State minimum insurance, a requirement in most states, plays a crucial role in ensuring financial protection for drivers involved in accidents. It sets the minimum coverage levels drivers must carry to cover potential liabilities and damages. Understanding these requirements is vital, as driving without proper insurance can lead to severe legal and financial consequences.

This guide explores the intricacies of state minimum insurance, delving into its purpose, key components, variations across states, and the impact it has on drivers. We’ll also examine additional considerations like understanding policy terms, finding competitive quotes, and the role of insurance professionals in guiding you towards appropriate coverage.

Understanding State Minimum Insurance Requirements

Every state in the United States requires drivers to carry a minimum amount of auto insurance. These requirements are designed to protect drivers and their passengers from financial ruin in the event of an accident. State minimum insurance requirements ensure that drivers are financially responsible for any damages or injuries they cause to others.

Types of Insurance

State minimum insurance requirements typically cover three main types of insurance:

- Liability Insurance: This type of insurance protects you from financial losses if you cause an accident that results in injury or damage to another person or their property. Liability insurance covers both bodily injury liability and property damage liability. It is the most common type of auto insurance.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. It covers your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. PIP coverage is not required in all states, but it is often a good idea to purchase it.

Consequences of Driving Without Insurance

Driving without the required minimum insurance coverage can have serious consequences. These consequences vary from state to state, but they can include:

- Fines and Penalties: Drivers caught driving without insurance will face fines and penalties. The amount of the fine can vary depending on the state and the number of offenses. For example, in some states, drivers who are caught driving without insurance for the first time may be required to pay a fine of $500 or more. Subsequent offenses may result in higher fines and even jail time.

- License Suspension: If you are caught driving without insurance, your driver’s license may be suspended. This means you will not be able to drive legally until you obtain the required insurance coverage. This can make it difficult to get to work, school, or other important appointments. It can also make it more difficult to find a job or rent an apartment.

- Vehicle Impoundment: In some states, your vehicle may be impounded if you are caught driving without insurance. This means that your vehicle will be towed and stored at a local impound lot until you pay the required fees and obtain insurance. You will also be responsible for the cost of towing and storage.

- Financial Ruin: If you are involved in an accident and do not have insurance, you could be held personally liable for all damages and injuries. This could result in significant financial losses, including medical bills, lost wages, and property damage.

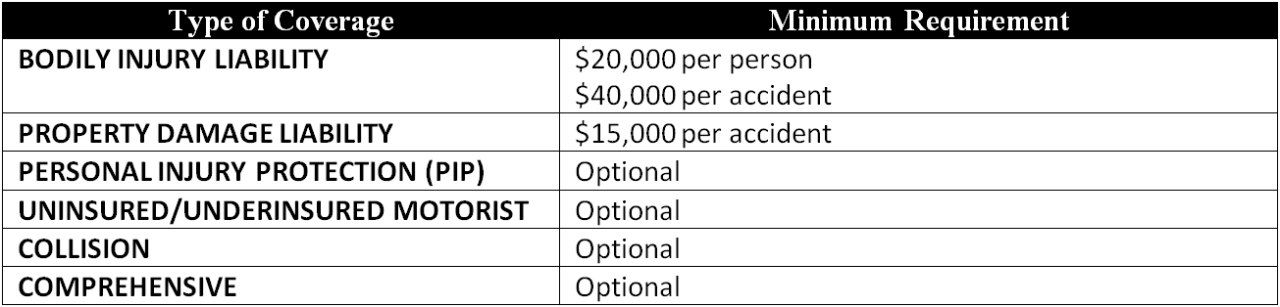

Key Components of State Minimum Insurance

State minimum insurance requirements are the bare minimum coverage levels mandated by each state to ensure basic financial protection in case of an accident. Understanding these components is crucial for drivers to ensure they meet legal obligations and have sufficient coverage to address potential liabilities.

Types of Coverage

State minimum insurance requirements typically include several types of coverage. These coverages address different aspects of potential losses arising from an accident.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident and cause injury or damage to others. It covers both bodily injury liability and property damage liability.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, helps pay for your medical expenses and lost wages, regardless of who is at fault in an accident. It is often required in states that have “no-fault” insurance systems.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

Coverage Limits

Each type of coverage has specific limits, which represent the maximum amount the insurance company will pay for a claim. Coverage limits are typically expressed as a combination of per-person and per-accident limits.

- Liability Coverage: For example, a typical state minimum liability coverage might be $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

- PIP Coverage: PIP coverage limits vary significantly by state, but common minimums include $5,000 or $10,000 per person.

- Uninsured/Underinsured Motorist Coverage: Similar to liability coverage, this coverage often has per-person and per-accident limits.

Situations Where Minimum Coverage May Be Insufficient, State minimum insurance

While state minimum insurance requirements fulfill legal obligations, they might not be sufficient to cover all potential expenses in certain situations.

- Serious Injuries: If an accident results in severe injuries, medical expenses can quickly exceed the minimum coverage limits. This could leave you responsible for significant out-of-pocket costs.

- Multiple Vehicles Involved: In accidents involving multiple vehicles, the total damage and injury costs can exceed the per-accident limits of your insurance.

- High-Value Property Damage: If you are involved in an accident that damages a high-value vehicle or property, the minimum property damage liability coverage may not be enough to cover the repairs or replacement costs.

- Lost Wages: PIP coverage limits may not cover the full extent of your lost wages if you are unable to work due to injuries.

Variations in State Minimum Insurance Laws

State minimum insurance requirements can vary significantly across the United States. These variations reflect a complex interplay of factors, including population density, traffic volume, cost of living, and the historical prevalence of accidents.

Factors Contributing to Variations

Several key factors contribute to the differences in state minimum insurance requirements. These include:

- Population Density: States with higher population densities tend to have stricter minimum insurance requirements. This is because increased traffic congestion and pedestrian activity can lead to a higher risk of accidents.

- Traffic Volume: States with high traffic volume, particularly on major highways, often have stricter minimum insurance requirements. This is due to the increased risk of accidents on heavily traveled roads.

- Cost of Living: States with higher costs of living, particularly for medical care, may have higher minimum insurance requirements. This is to ensure that individuals can afford to cover medical expenses in the event of an accident.

- Historical Accident Rates: States with a history of high accident rates, or those with a higher frequency of serious accidents, often have stricter minimum insurance requirements. This is to protect victims from financial hardship.

Comparing State Minimum Insurance Requirements

To illustrate the variations in state minimum insurance requirements, we can compare the requirements of several states. For example:

- New York: New York has some of the most stringent minimum insurance requirements in the United States. Drivers are required to carry a minimum of $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per accident, and $10,000 for property damage liability.

- California: California also has relatively high minimum insurance requirements. Drivers must carry a minimum of $15,000 for bodily injury liability per person, $30,000 for bodily injury liability per accident, and $5,000 for property damage liability.

- Texas: Texas has some of the lowest minimum insurance requirements in the country. Drivers are only required to carry a minimum of $30,000 for bodily injury liability per person, $60,000 for bodily injury liability per accident, and $25,000 for property damage liability.

State Minimum Insurance Requirements: A Table Comparison

The following table provides a summary of the key differences in coverage limits and types of insurance required in various states:

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability | Other Required Coverage |

|---|---|---|---|---|

| New York | $25,000 | $50,000 | $10,000 | Uninsured/Underinsured Motorist Coverage (UM/UIM) |

| California | $15,000 | $30,000 | $5,000 | Uninsured/Underinsured Motorist Coverage (UM/UIM) |

| Texas | $30,000 | $60,000 | $25,000 | None |

| Florida | $10,000 | $20,000 | $10,000 | Personal Injury Protection (PIP) |

| Pennsylvania | $15,000 | $30,000 | $5,000 | Uninsured/Underinsured Motorist Coverage (UM/UIM) |

Impact of State Minimum Insurance on Drivers

State minimum insurance requirements are designed to ensure that drivers have some financial protection in the event of an accident. However, these minimums are often inadequate to cover the full costs of damages and injuries, potentially leaving drivers facing significant financial burdens.

Financial Burden on Drivers

Drivers who only carry minimum insurance coverage may face significant financial risks in the event of an accident. Here are some potential financial burdens they might encounter:

- High Out-of-Pocket Expenses: If the damages exceed the minimum coverage limits, drivers may be responsible for paying the difference out of pocket. This could include medical bills, vehicle repairs, lost wages, and other expenses.

- Legal Fees and Court Costs: In the case of a lawsuit, drivers with minimum insurance coverage may face high legal fees and court costs, further adding to their financial burden.

- Financial Ruin: In severe accidents with significant damages, drivers with minimum insurance coverage could face financial ruin if their out-of-pocket expenses exceed their financial resources.

Benefits of Higher Coverage

Carrying insurance coverage that exceeds the state minimum requirements can provide significant benefits for drivers:

- Greater Financial Protection: Higher coverage limits provide more financial protection in the event of an accident, reducing the risk of out-of-pocket expenses and financial hardship.

- Peace of Mind: Knowing that you have adequate insurance coverage can provide peace of mind and reduce stress in the event of an accident.

- Enhanced Legal Protection: Higher coverage limits may give drivers greater leverage in legal negotiations and settlements, potentially reducing their legal costs.

Scenario: Accident with Minimum Insurance

Imagine a driver with minimum insurance coverage who is involved in a car accident causing significant damage to another vehicle and injuries to the other driver.

- Potential Consequences: The driver’s minimum insurance coverage might not be sufficient to cover the full costs of the other driver’s medical bills and vehicle repairs.

- Financial Hardship: The driver could face substantial out-of-pocket expenses, potentially leading to financial hardship and difficulty paying for essential needs.

- Legal Action: The other driver could sue the driver for damages exceeding the minimum coverage limits, potentially leading to a lengthy legal battle and significant financial burdens.

Additional Considerations for State Minimum Insurance

While understanding state minimum insurance requirements is essential, it’s equally important to go beyond the bare minimum and consider additional factors that can enhance your protection and peace of mind.

Understanding Policy Terms and Conditions

Carefully reviewing the terms and conditions of your insurance policy is crucial to fully grasp the coverage you’re receiving. Pay close attention to the following aspects:

- Deductibles: The amount you pay out-of-pocket before your insurance kicks in. Higher deductibles usually result in lower premiums, but you’ll bear more financial responsibility in the event of an accident.

- Coverage Limits: The maximum amount your insurance company will pay for specific types of claims, such as bodily injury or property damage. Ensure the limits are sufficient to cover potential liabilities.

- Exclusions: Certain situations or events that are not covered by your policy. Understanding these exclusions can help you avoid unexpected financial burdens.

- Conditions: Specific requirements you must meet to be eligible for coverage or to file a claim. For instance, your policy might require you to report an accident within a certain timeframe.

Comparing Insurance Quotes

Finding the best insurance coverage at an affordable price often involves comparing quotes from multiple providers.

- Online Comparison Websites: Websites like Insurify, Policygenius, and The Zebra allow you to input your information and receive quotes from various insurance companies simultaneously. This provides a convenient way to compare prices and coverage options.

- Direct Contact with Insurance Companies: Contacting insurance companies directly allows you to ask specific questions and receive personalized quotes based on your unique needs.

- Working with an Insurance Agent or Broker: These professionals can help you navigate the insurance market, understand different policy options, and find the best coverage for your situation.

Role of Insurance Agents and Brokers

Insurance agents and brokers act as intermediaries between you and insurance companies. They can provide valuable assistance in the insurance selection process:

- Expert Advice: Agents and brokers have a deep understanding of the insurance market and can offer tailored recommendations based on your individual circumstances.

- Negotiation: They can negotiate better rates and coverage terms on your behalf.

- Claims Assistance: They can guide you through the claims process, ensuring you receive the proper compensation for your losses.

Concluding Remarks

Navigating the world of state minimum insurance can seem complex, but armed with knowledge, drivers can make informed decisions about their coverage. By understanding the requirements, exploring available options, and seeking professional advice, you can ensure you’re adequately protected on the road and prepared for unforeseen events. Remember, while state minimum insurance provides a baseline, considering higher coverage levels may offer greater peace of mind and financial security in the event of an accident.

Quick FAQs

What happens if I get into an accident and only have state minimum insurance?

If your minimum coverage is insufficient to cover the damages or injuries, you may be personally liable for the remaining costs. This could include medical expenses, property repairs, and legal fees.

How do I find out the state minimum insurance requirements in my area?

You can typically find this information on your state’s Department of Motor Vehicles (DMV) website or by contacting your insurance agent.

Can I get a discount on my car insurance if I have a good driving record?

Yes, many insurance companies offer discounts for drivers with clean driving records. These discounts can vary depending on the insurer and your specific driving history.