State minimum car insurance Texas is a crucial aspect of driving in the Lone Star State. It’s not just a legal requirement but also a safety net for you and others on the road. Understanding these minimums helps ensure you’re adequately covered in case of an accident.

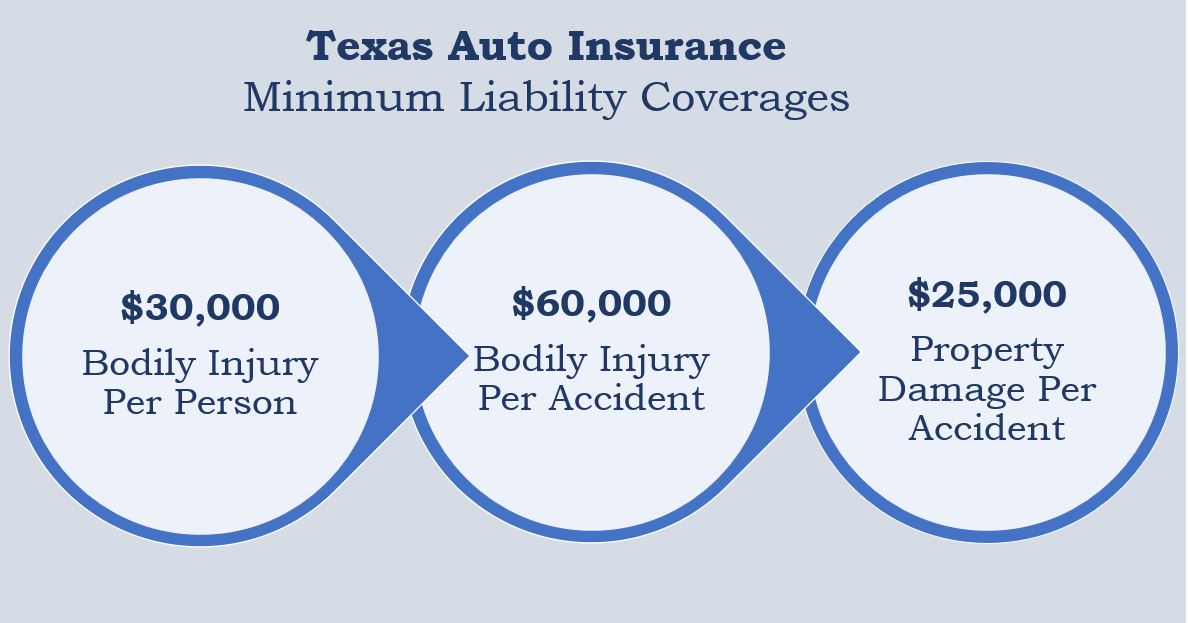

Texas law mandates specific minimum coverage amounts for liability, medical payments, uninsured/underinsured motorist, and property damage. These coverages protect you financially if you cause an accident, and also offer protection if you’re hit by an uninsured driver.

Texas Minimum Car Insurance Requirements

Driving a vehicle in Texas without the required minimum car insurance coverage can have serious consequences, including fines, license suspension, and even jail time. To avoid these penalties, it’s crucial to understand the state’s minimum insurance requirements and ensure your policy meets these standards.

Financial Responsibility Laws in Texas

Texas law mandates that all drivers carry a minimum amount of liability insurance to cover damages they may cause to others in an accident. These laws, known as financial responsibility laws, aim to protect victims of accidents by ensuring that responsible drivers are financially prepared to cover the costs of injuries and property damage.

Types of Car Insurance Coverage in Texas

Texas law requires drivers to have certain types of car insurance to protect themselves and others on the road. While the state minimum covers only the basics, many drivers choose to purchase additional coverage to ensure they’re fully protected in case of an accident. Understanding the different types of car insurance coverage available in Texas can help you make informed decisions about your policy and ensure you have the right protection.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. It covers damage caused by collisions with other vehicles, objects, or even hitting a pothole. If you have a car loan or lease, your lender will likely require you to carry collision coverage. This coverage can be expensive, but it’s crucial if you want to protect your investment in your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than accidents. This includes damage from theft, vandalism, fire, natural disasters, and animal collisions. It also covers damage caused by falling objects, such as tree branches or hail. Like collision coverage, comprehensive coverage can be expensive, but it’s essential for protecting your vehicle from unexpected events.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages if you’re injured in an accident, regardless of who’s at fault. This coverage can be helpful if you’re injured in an accident and need to cover medical bills or lost income. Texas law requires drivers to carry at least $2,500 in PIP coverage, but you can choose to purchase higher limits.

Rental Reimbursement Coverage, State minimum car insurance texas

Rental reimbursement coverage helps cover the cost of renting a car while your vehicle is being repaired after an accident. This coverage can be helpful if you rely on your vehicle for work or other essential activities and need to rent a car while your own is out of commission. The amount of coverage you have will determine how much the insurance company will pay towards your rental car expenses.

Factors Influencing Car Insurance Premiums in Texas

Several factors influence the cost of car insurance in Texas. These factors help insurance companies assess the risk of insuring a particular driver and vehicle. By understanding these factors, you can better manage your car insurance costs.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your insurance costs. Insurance companies view drivers with a history of accidents or violations as higher risk, leading to higher premiums.

Age

Age is another crucial factor in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies perceive them as higher risk and charge higher premiums. As drivers age and gain experience, their risk profile decreases, leading to lower premiums.

Gender

While gender-based pricing is controversial, it is still a factor in some states, including Texas. Historically, men have been statistically more likely to be involved in accidents than women. As a result, men may face higher premiums than women. However, this trend is changing, and insurance companies are increasingly considering other factors like driving history and driving habits.

Vehicle Type

The type of vehicle you drive also impacts your insurance premiums. Sports cars, luxury vehicles, and high-performance vehicles are generally more expensive to repair or replace. Insurance companies consider these vehicles higher risk and charge higher premiums. Conversely, smaller, less expensive vehicles typically have lower insurance premiums.

Location

Your location, specifically your zip code, can significantly affect your car insurance premiums. Insurance companies analyze accident rates and crime statistics in different areas. Areas with higher accident rates or higher crime rates tend to have higher insurance premiums.

Credit Score

Your credit score may seem unrelated to car insurance, but it can play a role in determining your premiums in Texas. Some insurance companies believe that people with good credit are more financially responsible and less likely to file claims. Therefore, they may offer lower premiums to drivers with good credit scores. However, this practice is controversial, and some states have banned the use of credit scores for insurance pricing.

Finding Affordable Car Insurance in Texas

Finding affordable car insurance in Texas can be a challenging task, but with some research and strategic planning, you can find a policy that meets your needs and fits your budget.

Comparing Quotes from Multiple Insurers

It is crucial to compare quotes from multiple insurers before settling on a policy. Different insurers use various factors to calculate premiums, so getting quotes from several companies will give you a better understanding of the market and help you find the most competitive rates.

Considering Discounts

Many insurers offer discounts to policyholders who meet certain criteria. These discounts can significantly reduce your premium, so it’s essential to inquire about them when getting quotes. Common discounts include:

- Good driver discounts

- Safe driver discounts

- Multi-car discounts

- Bundling discounts

- Loyalty discounts

Reviewing Coverage Needs

Before you start comparing quotes, take some time to assess your coverage needs. Determine the minimum coverage required by law in Texas and consider whether you need additional coverage, such as comprehensive or collision insurance.

Benefits of Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings. This is because insurers typically offer discounts to customers who bundle multiple policies with them.

Understanding Insurance Policies and Their Terms

It is essential to carefully read and understand the terms and conditions of your insurance policy before you sign it. Pay attention to the following:

- Deductibles

- Coverage limits

- Exclusions

It’s crucial to understand what your policy covers and what it doesn’t, as well as the financial implications of different coverage levels and deductibles.

Consequences of Driving Without Insurance in Texas

Driving without car insurance in Texas is not only illegal but also carries significant financial and legal risks. If you are caught driving without insurance, you could face fines, license suspension, and even vehicle impoundment. Moreover, you could be held personally liable for any damages or injuries caused in an accident, leaving you financially vulnerable.

Fines and License Suspension

Driving without car insurance in Texas is a serious offense that can result in hefty fines and license suspension.

- The minimum fine for driving without insurance in Texas is $175.

- The fine can increase to $350 if you are caught driving without insurance again within three years.

- Your driver’s license can be suspended for up to six months if you are caught driving without insurance multiple times.

Vehicle Impoundment

In addition to fines and license suspension, your vehicle may be impounded if you are caught driving without insurance.

- The vehicle impoundment fee can be substantial, adding to the financial burden of driving without insurance.

- You may also have to pay daily storage fees for the duration of the impoundment.

- To reclaim your vehicle, you will need to provide proof of insurance and pay all outstanding fines and fees.

Financial Burden of Uninsured Accidents

If you are involved in an accident without car insurance, you could be held personally liable for all damages and injuries, even if the accident was not your fault.

- This could include medical bills, property damage, lost wages, and pain and suffering.

- The financial burden of an uninsured accident can be overwhelming, potentially leading to bankruptcy or significant debt.

- If you are sued by the other party, you could face a judgment against you, forcing you to pay damages even if you cannot afford to do so.

Legal Action

If you are caught driving without insurance in Texas, you could face criminal charges.

- The penalties for driving without insurance can vary depending on the circumstances of the offense and the driver’s prior record.

- In some cases, you may be required to appear in court and pay a fine or serve jail time.

- If you are involved in an accident without insurance, you could be subject to both civil and criminal penalties.

Ending Remarks: State Minimum Car Insurance Texas

Navigating the world of car insurance in Texas can feel overwhelming, but knowing your state’s minimum requirements is a great starting point. By understanding these essentials, you can make informed decisions about your coverage and ensure you’re protected on the road. Remember, comparing quotes, considering discounts, and understanding your policy terms are all important steps to finding affordable and adequate car insurance in Texas.

FAQ Section

What happens if I get into an accident and don’t have the required minimum insurance?

You could face serious consequences, including fines, license suspension, and even vehicle impoundment. You’ll also be financially responsible for any damages or injuries caused, which can be significant.

Can I choose to have more coverage than the minimum requirements?

Absolutely! While the minimums are legally required, they might not be enough to cover all potential expenses in an accident. You can choose additional coverage like collision and comprehensive, which offer more protection.

How often do I need to renew my car insurance policy?

Car insurance policies are typically renewed annually. You’ll receive a renewal notice from your insurer before your current policy expires.