State minimum car insurance Georgia: Navigating the roads of Georgia requires understanding the state’s car insurance requirements. While driving without insurance is illegal and carries hefty penalties, knowing what coverage is legally mandated is crucial for every driver. This guide delves into the specifics of Georgia’s minimum car insurance requirements, outlining the types of coverage, minimum amounts, and potential consequences of driving without adequate protection.

Understanding the intricacies of Georgia’s insurance laws is essential for responsible driving. This information empowers drivers to make informed decisions about their coverage, ensuring they meet legal obligations while protecting themselves and others on the road.

Georgia’s Minimum Car Insurance Requirements

Driving in Georgia requires you to have a minimum amount of car insurance coverage. This ensures that you can cover the costs of damages or injuries caused by an accident you may be responsible for. Let’s delve into the specific requirements.

Types of Coverage Required

Georgia mandates specific types of car insurance coverage for all drivers. These coverages help protect you and others involved in accidents.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage.

- Property Damage Liability: This coverage specifically covers the cost of repairing or replacing the other driver’s vehicle or property damaged in an accident you caused.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses, lost wages, and other related costs, regardless of who caused the accident.

Minimum Coverage Amounts

Georgia sets minimum coverage amounts for each type of insurance. These amounts are the lowest limits allowed by the state.

| Coverage Type | Minimum Amount |

|---|---|

| Liability Coverage (per person) | $25,000 |

| Liability Coverage (per accident) | $50,000 |

| Property Damage Liability | $25,000 |

| Personal Injury Protection (PIP) | $5,000 |

Consequences of Driving Without Insurance

Driving without the required minimum car insurance in Georgia is illegal and can have serious consequences.

- Fines and Penalties: You can face hefty fines and penalties for driving without insurance. These fines can range from hundreds to thousands of dollars.

- License Suspension: Your driver’s license can be suspended if you’re caught driving without insurance. This can prevent you from legally driving until you obtain the required coverage.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Financial Responsibility: If you cause an accident without insurance, you are fully responsible for all costs, including medical bills, property damage, and legal fees.

Understanding Georgia’s Minimum Coverage

Georgia’s minimum car insurance requirements are designed to protect you and other drivers in case of an accident. While these requirements are the bare minimum, it’s important to understand what they cover and what they don’t.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other damages resulting from injuries caused by you to others. The minimum requirement in Georgia is $25,000 per person and $50,000 per accident.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s vehicle or property that you cause in an accident. The minimum requirement in Georgia is $25,000 per accident.

For example, if you rear-end another vehicle and cause $10,000 in damages to their car and $20,000 in medical bills for the driver, your PDL coverage would pay up to $25,000 for the damage to the other vehicle, and your BIL coverage would pay up to $25,000 for the driver’s medical bills.

Limitations: Liability coverage only protects others; it does not cover your own injuries or damages.

Factors Influencing Car Insurance Costs in Georgia: State Minimum Car Insurance Georgia

In Georgia, like many other states, several factors contribute to the cost of car insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history plays a significant role in determining your insurance premiums. Insurance companies consider your past driving record, including accidents, traffic violations, and driving under the influence (DUI) convictions. A clean driving record with no accidents or violations generally translates to lower premiums. Conversely, a history of accidents or violations can lead to higher premiums, as it indicates a higher risk to the insurance company.

Age

Age is another factor that significantly influences insurance costs. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk leads to higher premiums for younger drivers. As drivers gain experience and age, their premiums tend to decrease.

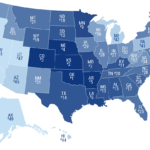

Location

The location where you live also plays a role in determining your car insurance costs. Insurance companies consider the risk of accidents in different areas. For instance, urban areas with high traffic density and more congestion tend to have higher insurance premiums compared to rural areas with lower traffic volumes.

Vehicle Type

The type of vehicle you drive is another important factor. Certain vehicle types, such as sports cars or luxury vehicles, are more expensive to repair or replace in case of an accident. These vehicles are also considered higher risk and, therefore, have higher insurance premiums. Conversely, vehicles with safety features like anti-lock brakes and airbags may qualify for discounts and lower premiums.

Credit Score

Your credit score may seem unrelated to car insurance, but it’s a factor that many insurance companies consider in Georgia. A good credit score often indicates responsible financial behavior, which can be a proxy for driving habits. Insurance companies may offer lower premiums to individuals with good credit scores, reflecting a lower risk of claims.

Other Factors

Besides the factors discussed above, other factors can also influence your car insurance costs. These include:

- Gender: Historically, men have been statistically more likely to be involved in accidents than women, which may lead to slightly higher premiums for men. However, this trend is changing, and some states have banned gender-based pricing.

- Marital Status: In some cases, married individuals may receive lower insurance premiums than single individuals, as they may be perceived as having a more stable lifestyle.

- Education Level: Studies have shown a correlation between education level and driving safety, potentially leading to lower premiums for individuals with higher education levels.

- Coverage Options: The type and amount of coverage you choose can significantly affect your premiums. Choosing higher coverage limits or adding additional coverage options will generally increase your premiums.

- Deductible: A higher deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lead to lower premiums. Conversely, a lower deductible will typically result in higher premiums.

- Discounts: Insurance companies offer various discounts that can reduce your premiums. These discounts may be based on factors such as good driving history, safety features in your vehicle, bundling multiple insurance policies, or being a member of certain organizations.

Finding Affordable Car Insurance in Georgia

Navigating the world of car insurance in Georgia can feel like a maze, especially when you’re seeking affordable options. Finding the right balance between coverage and cost is crucial, and it’s essential to understand the strategies that can help you secure competitive rates.

Comparing Quotes and Securing Competitive Rates

To find the best car insurance deal, you need to compare quotes from multiple insurers. This process involves providing your personal information and vehicle details to different companies. It’s recommended to use online comparison websites or contact insurance agents directly.

- Utilize Online Comparison Websites: Platforms like Policygenius, Insurify, and The Zebra allow you to enter your information once and receive quotes from various insurance companies. This streamlines the process and helps you quickly compare options.

- Contact Insurance Agents: While online tools are convenient, speaking with an insurance agent can provide personalized guidance. Agents can help you understand different coverage options and tailor a policy to your specific needs.

- Request Quotes from Multiple Insurers: Don’t limit yourself to just a few companies. Reach out to a variety of insurers, both large and small, to get a comprehensive view of available rates.

Benefits of Bundling Insurance Policies, State minimum car insurance georgia

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts. Insurance companies incentivize customers to bundle their policies, recognizing that you’re more likely to remain loyal if you have multiple policies with them.

- Reduced Premiums: Bundling can lead to lower premiums for both your car and other policies, as insurers offer discounts for combining coverage.

- Simplified Management: Having multiple policies with the same insurer simplifies managing your insurance needs. You’ll have a single point of contact for all your insurance-related inquiries.

Seeking Discounts

Many insurance companies offer discounts to policyholders who meet specific criteria. These discounts can significantly reduce your premiums, so it’s worth exploring the options available to you.

- Good Driving Record: Maintaining a clean driving record with no accidents or traffic violations is a major factor in securing lower premiums.

- Safety Features: Vehicles equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts.

- Payment in Full: Paying your insurance premium in full upfront can often result in a discount compared to paying monthly installments.

- Student Discounts: Students who maintain good grades and are enrolled full-time in college may be eligible for discounts.

- Military Discounts: Active-duty military personnel and veterans may qualify for special discounts.

Reputable Insurance Companies in Georgia

Several reputable insurance companies operate in Georgia, each with its own strengths and offerings.

- State Farm: Known for its extensive network of agents and customer service.

- GEICO: Often offers competitive rates and a user-friendly online experience.

- Progressive: Offers a wide range of coverage options and discounts, including its well-known “Name Your Price” tool.

- Allstate: Provides a variety of insurance products, including car insurance, and is known for its strong financial stability.

- Liberty Mutual: Offers personalized insurance solutions and a strong focus on customer satisfaction.

Additional Considerations for Georgia Drivers

Beyond the minimum requirements, understanding certain aspects of Georgia’s insurance landscape can significantly benefit drivers. This section delves into crucial considerations that go beyond the basic coverage, ensuring you’re well-equipped to navigate potential scenarios.

Georgia’s No-Fault Insurance System

Georgia operates under a “no-fault” insurance system, meaning that in the event of an accident, each driver involved files a claim with their own insurance company, regardless of who caused the accident. This system aims to expedite the claims process and reduce litigation.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you in situations where the other driver is either uninsured or doesn’t have enough insurance to cover your damages. This coverage is crucial because it helps you recover your losses when the at-fault driver cannot. In Georgia, UM/UIM coverage is not mandatory but is highly recommended.

Filing a Claim and Navigating the Insurance Process

Filing a claim with your insurance company can seem daunting, but following a structured approach can streamline the process:

- Report the Accident: Immediately contact your insurance company and report the accident, providing details about the incident, the other driver(s), and any injuries.

- Gather Information: Collect all relevant information, including the other driver’s insurance details, contact information, and police report number.

- Seek Medical Attention: If you’ve been injured, seek medical attention promptly and document all medical expenses.

- Document Damages: Take photographs of the damage to your vehicle and any property damage.

- Submit a Claim: File a claim with your insurance company within the specified timeframe, providing all necessary documentation.

- Cooperate with the Insurance Company: Respond to all inquiries promptly and provide any requested information.

- Review the Settlement Offer: Carefully review any settlement offer and consult with an attorney if you have concerns.

Dealing with Car Accidents in Georgia

Accidents can be stressful, but having a plan can help you navigate the situation effectively:

- Check for Injuries: Ensure the safety of yourself and any passengers. If necessary, call emergency services.

- Move to a Safe Location: If possible, move your vehicle to a safe location off the road to avoid further accidents.

- Exchange Information: Exchange contact and insurance information with the other driver(s) involved.

- Document the Accident: Take photographs of the accident scene, the damage to the vehicles, and any injuries.

- Report the Accident: Report the accident to the police and obtain a police report number.

- Contact Your Insurance Company: Report the accident to your insurance company as soon as possible.

- Seek Medical Attention: If you have been injured, seek medical attention promptly.

Closing Summary

Driving in Georgia comes with its own set of insurance regulations, and understanding the minimum requirements is a crucial step towards responsible driving. By adhering to these regulations, drivers can navigate the roads with confidence, knowing they are protected from potential financial and legal repercussions. Remember, driving without adequate insurance can lead to serious consequences, including fines, license suspension, and even imprisonment. This guide serves as a valuable resource for Georgia drivers, offering clarity on the state’s insurance requirements and fostering a safer driving environment for all.

Expert Answers

What are the penalties for driving without car insurance in Georgia?

Driving without the minimum required car insurance in Georgia can result in fines, license suspension, and even imprisonment. The specific penalties may vary depending on the circumstances.

Can I get a discount on my car insurance in Georgia?

Yes, several discounts are available for car insurance in Georgia, including good driver discounts, safe driving courses, and bundling multiple insurance policies.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least once a year, or whenever you experience significant life changes, such as a new vehicle purchase, marriage, or change in driving habits.