State minimum car insurance Florida sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Florida, known for its sunny beaches and vibrant culture, also has specific requirements for car insurance. Understanding these requirements is crucial for drivers in the Sunshine State, ensuring they are protected financially and legally. This guide explores Florida’s minimum car insurance requirements, providing a comprehensive overview of coverage types, factors influencing costs, and the importance of maintaining financial responsibility.

Florida’s Minimum Car Insurance Requirements: State Minimum Car Insurance Florida

Driving in Florida legally requires you to have car insurance. The state mandates specific coverage types to protect drivers, passengers, and others involved in accidents.

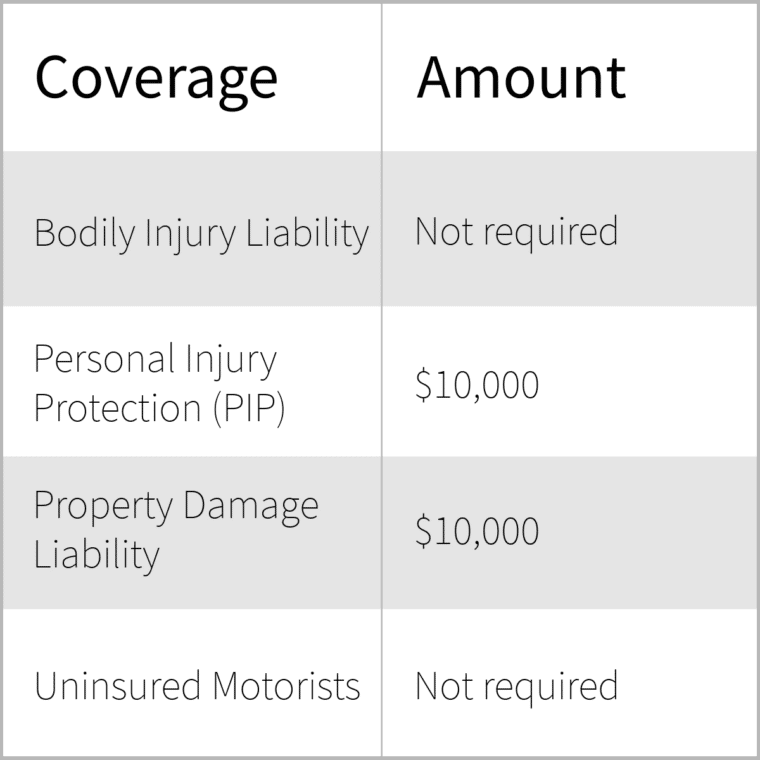

Florida’s Minimum Car Insurance Requirements

Florida’s financial responsibility law dictates that all drivers must have a minimum amount of liability coverage to compensate others for damages caused by an accident. These coverages include:

- Property Damage Liability: This covers damage to another person’s vehicle or property, up to a minimum of $10,000. This coverage applies to situations where you are at fault in an accident.

- Bodily Injury Liability: This coverage protects you from financial liability for injuries caused to another person in an accident. The minimum requirement is $10,000 per person and $20,000 per accident. For example, if you cause an accident that results in injuries to two people, this coverage would pay up to $10,000 for each individual, totaling $20,000.

It’s important to note that these minimum requirements are the bare minimum and may not be sufficient to cover all potential damages. Many insurance companies offer additional coverage options, such as collision, comprehensive, and personal injury protection (PIP), which can provide more comprehensive protection.

Financial Responsibility Law

Florida’s Financial Responsibility Law ensures that drivers are financially responsible for the damages they cause in an accident. If you are found at fault for an accident and do not have the required minimum insurance coverage, you could face serious consequences. These consequences include:

- Suspension of your driver’s license: If you fail to provide proof of insurance or cannot pay for damages caused in an accident, your driver’s license will be suspended.

- Vehicle registration suspension: Similar to license suspension, your vehicle registration can be suspended if you do not meet the financial responsibility requirements.

- Fines and penalties: In addition to license and registration suspension, you may face significant fines and penalties for violating the Financial Responsibility Law.

- Potential legal action: If you cause an accident and do not have sufficient insurance, the injured party can sue you directly for damages. This could result in a substantial financial burden, including court costs, legal fees, and compensation for injuries and property damage.

It is crucial to understand the implications of Florida’s Financial Responsibility Law and to ensure you have adequate insurance coverage to protect yourself and others from financial hardship in the event of an accident.

Understanding Florida’s Coverage Types

Florida’s minimum car insurance requirements are designed to protect you and others in the event of an accident. However, these minimums might not be enough for your specific needs. Understanding the different coverage types available can help you choose the right insurance for your situation.

Personal Injury Protection (PIP)

PIP is a type of coverage that pays for your medical expenses and lost wages if you are injured in a car accident, regardless of who was at fault. This coverage is mandatory in Florida and must be at least $10,000.

- Medical Expenses: PIP covers medical expenses such as doctor visits, hospital stays, surgery, and rehabilitation.

- Lost Wages: PIP can also help compensate for lost wages if you are unable to work due to your injuries.

- Death Benefits: PIP can also provide death benefits to your beneficiaries if you are killed in a car accident.

For example, if you are involved in a car accident and suffer a broken leg, your PIP coverage would pay for your medical bills and lost wages while you are recovering.

Property Damage Liability (PDL)

PDL covers the cost of damage to another person’s property if you are at fault in an accident. In Florida, the minimum PDL coverage required is $10,000.

- Other Vehicles: PDL can cover damage to another vehicle, including the cost of repairs or replacement.

- Other Property: PDL can also cover damage to other property, such as fences, mailboxes, or buildings.

For instance, if you hit another car while backing out of your driveway, your PDL coverage would pay for the repairs to the other vehicle.

Bodily Injury Liability (BIL)

BIL covers the cost of injuries to other people if you are at fault in an accident. In Florida, the minimum BIL coverage required is $10,000 per person and $20,000 per accident.

- Medical Expenses: BIL can cover the medical expenses of the other driver and any passengers in their vehicle.

- Lost Wages: BIL can also cover the lost wages of the other driver and passengers if they are unable to work due to their injuries.

- Pain and Suffering: In some cases, BIL can also cover pain and suffering, although this is not always guaranteed.

For instance, if you cause an accident that results in the other driver sustaining a serious back injury, your BIL coverage would pay for their medical expenses, lost wages, and potentially pain and suffering.

Factors Affecting Florida’s Minimum Car Insurance Costs

While Florida mandates minimum car insurance coverage, the actual cost of this coverage can vary significantly. Several factors influence how much you’ll pay for your minimum car insurance policy. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Driver Age

Your age plays a significant role in determining your car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies often consider young drivers to be higher risks and charge them higher premiums. As you gain experience and age, your premiums generally decrease.

Driving History

Your driving record is a major factor in calculating your car insurance costs. A clean driving record with no accidents or traffic violations will typically result in lower premiums. However, if you have a history of accidents, speeding tickets, or DUI convictions, your insurance rates will likely increase. Insurance companies view these incidents as indicators of higher risk, leading to higher premiums.

Vehicle Type

The type of vehicle you drive also influences your insurance costs. Sports cars, luxury vehicles, and high-performance cars are often more expensive to repair or replace, making them riskier for insurance companies. As a result, these vehicles often have higher insurance premiums. Conversely, less expensive and more common vehicles typically have lower insurance rates.

Geographic Location

The location where you live can also impact your car insurance costs. Areas with higher crime rates, traffic congestion, or a greater number of accidents tend to have higher insurance premiums. Insurance companies consider these factors when calculating premiums as they represent a higher risk of claims.

Insurance Company Choice

Different insurance companies use varying methods to calculate premiums. They also offer different discounts and benefits. It’s essential to compare quotes from multiple insurance companies to find the best rates that fit your needs and budget.

Choosing the Right Car Insurance in Florida

While Florida’s minimum car insurance requirements are designed to provide basic financial protection, they might not be enough for everyone. It’s crucial to understand that going beyond the minimum can provide greater peace of mind and financial security in the event of an accident.

Understanding Your Individual Needs and Risks

Your individual needs and risk tolerance play a significant role in determining the right level of car insurance coverage for you. Several factors can influence your decision, including:

- Your driving history: A clean driving record with no accidents or violations typically results in lower insurance premiums. Conversely, a history of accidents or traffic violations could lead to higher premiums.

- Your vehicle’s value: If you drive a newer or more expensive vehicle, comprehensive and collision coverage might be more important to ensure you’re adequately compensated for repairs or replacement in the event of an accident.

- Your financial situation: Consider your financial resources and ability to cover potential expenses in case of an accident. If you have limited savings, higher coverage levels might provide greater financial protection.

- Your lifestyle: If you frequently drive long distances or in high-traffic areas, you might consider higher coverage limits.

Comparing Insurance Quotes from Different Providers

Once you’ve assessed your individual needs and risks, it’s time to compare insurance quotes from different providers. This allows you to find the best value for your money. Here are some tips for comparing quotes:

- Use online comparison tools: Several websites allow you to enter your information and receive quotes from multiple insurers simultaneously, making the comparison process efficient.

- Contact insurers directly: Don’t hesitate to call insurance companies directly to discuss your specific needs and get personalized quotes.

- Compare coverage options: Pay close attention to the coverage limits, deductibles, and other terms and conditions offered by each insurer.

- Consider discounts: Many insurers offer discounts for safe driving, good student records, multiple vehicle insurance, and other factors.

- Read reviews: Research the reputation and customer satisfaction ratings of each insurer before making a decision.

Optional Coverage Options Available in Florida

Beyond the minimum requirements, Florida offers several optional coverage options that can provide additional protection:

- Collision coverage: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive coverage: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage (UM/UIM): This protects you if you’re involved in an accident with a driver who doesn’t have enough insurance or no insurance at all.

- Personal injury protection (PIP): This covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Rental reimbursement: This covers the cost of renting a vehicle while yours is being repaired after an accident.

- Roadside assistance: This provides assistance for situations like flat tires, jump starts, and towing.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, which means that after a car accident, each driver involved is primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system is designed to expedite the claims process and reduce the number of lawsuits arising from minor accidents.

Filing Claims Under PIP Coverage

In Florida, all drivers are required to carry Personal Injury Protection (PIP) coverage, which is a part of your car insurance policy that pays for your medical expenses and lost wages after an accident, regardless of who was at fault.

To file a PIP claim, you must notify your insurance company within 14 days of the accident. You will need to provide them with information about the accident, including the date, time, and location, as well as details about your injuries. Your insurance company will then review your claim and decide whether to approve it.

You will need to provide your insurance company with the following information:

- Date, time, and location of the accident

- Details of your injuries

- Medical bills

- Lost wages

- Police report (if available)

Your insurance company will then review your claim and decide whether to approve it. If your claim is approved, they will pay for your medical expenses and lost wages up to the limits of your PIP coverage.

Limitations of PIP Coverage, State minimum car insurance florida

While PIP coverage can help cover your medical expenses and lost wages, it does have limitations. For example, PIP coverage typically has a maximum benefit limit, which is the total amount of money that your insurance company will pay for your injuries. The standard PIP coverage limit in Florida is $10,000.

Additionally, PIP coverage may not cover all of your medical expenses. For example, it may not cover expenses for:

- Cosmetic surgery

- Experimental treatments

- Services that are not medically necessary

Exceptions to the No-Fault System

While Florida’s no-fault system generally requires drivers to cover their own expenses, there are some exceptions. For example, if you are injured in an accident caused by another driver’s negligence, you may be able to file a claim against that driver’s insurance company for additional damages, such as pain and suffering.

The no-fault system also does not apply to certain types of accidents, such as those involving hit-and-run drivers or uninsured motorists. In these cases, you may be able to file a claim with your own insurance company for uninsured motorist coverage.

Examples of Situations Where the No-Fault System Applies

Here are some examples of situations where Florida’s no-fault system would apply:

- You are driving down the road when another driver runs a red light and hits your car. You are injured in the accident.

- You are stopped at a traffic light when another driver rear-ends your car. You are injured in the accident.

- You are driving down the road when a driver pulls out in front of you, causing you to swerve to avoid an accident. You are injured in the accident.

The Importance of Maintaining Financial Responsibility

In Florida, driving without the minimum required car insurance is not only illegal but can also have severe consequences. Failure to maintain financial responsibility can lead to hefty fines, license suspension, and even imprisonment. It’s crucial to understand the potential penalties and the situations where financial responsibility becomes paramount.

Consequences of Driving Without Minimum Insurance

Driving without minimum insurance in Florida can result in various penalties. These penalties are designed to discourage uninsured driving and ensure that victims of accidents have access to compensation.

- Fines: You can be fined up to $500 for the first offense and $1,000 for subsequent offenses.

- License Suspension: Your driver’s license can be suspended for up to three years.

- Imprisonment: In some cases, you may even face jail time, especially if you’re involved in an accident without insurance.

- Financial Responsibility: You will be held personally liable for all damages and injuries caused in an accident, even if you are not at fault. This could mean paying for medical bills, property damage, and other expenses.

Penalties for Violating Florida’s Insurance Laws

Florida’s insurance laws are designed to protect both drivers and victims of accidents. Violating these laws can lead to a range of penalties, including:

- Fines: You can be fined for driving without insurance, driving with expired insurance, or failing to provide proof of insurance upon request.

- License Suspension: Your driver’s license can be suspended if you fail to comply with insurance requirements.

- Vehicle Impoundment: Your vehicle may be impounded if you are caught driving without insurance.

- Insurance Rate Increases: If you are involved in an accident and are found to be uninsured, you may face significantly higher insurance premiums in the future.

Situations Where Financial Responsibility Is Crucial

Financial responsibility is essential in several situations, particularly when involved in a car accident.

- Personal Injury: If you cause an accident that results in injuries to another person, you could be held financially responsible for their medical bills, lost wages, and pain and suffering.

- Property Damage: If you cause an accident that damages another person’s property, you will be responsible for the cost of repairs or replacement.

- Legal Fees: If you are sued as a result of an accident, you will need to pay for legal representation.

Tips for Ensuring Compliance with Florida’s Insurance Requirements

It is essential to maintain compliance with Florida’s insurance requirements to avoid penalties and protect yourself financially.

- Obtain Minimum Insurance: Ensure you have the minimum required coverage for your vehicle.

- Renew Your Policy: Keep track of your insurance policy expiration date and renew it on time.

- Carry Proof of Insurance: Always carry proof of insurance in your vehicle and be prepared to present it to law enforcement officers if requested.

- Shop Around for Rates: Compare quotes from different insurance companies to find the best rates for your needs.

Ending Remarks

Navigating Florida’s car insurance landscape can be complex, but understanding the minimum requirements and considering additional coverage options is essential for responsible drivers. By staying informed and making informed decisions, Floridians can ensure they are adequately protected on the road, safeguarding themselves and their families from potential financial hardship.

Frequently Asked Questions

What happens if I get into an accident and don’t have the minimum required car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. Additionally, you would be responsible for covering all costs associated with the accident, which could be significant.

Can I choose to have more coverage than the state minimum?

Absolutely! It’s highly recommended to consider additional coverage, especially if you have a family or valuable assets to protect. This can provide greater financial security in the event of an accident.

How often should I review my car insurance policy?

It’s wise to review your policy at least annually, or even more frequently if you experience any significant life changes, such as a new car purchase, marriage, or the addition of a new driver to your household.