State insurance Texas is a complex and important topic for residents and businesses alike. Understanding the state’s insurance landscape, including the types of coverage available, regulatory environment, and consumer resources, is crucial for making informed decisions. This guide provides an overview of key aspects of state insurance in Texas, aiming to empower individuals with the knowledge they need to navigate the system effectively.

From exploring the different types of insurance offered in Texas to examining state-specific programs, this guide delves into the intricacies of the insurance market. We’ll also analyze factors that influence insurance costs, provide tips for obtaining affordable coverage, and offer valuable resources for consumers seeking assistance.

State Insurance Landscape in Texas

Texas boasts a diverse insurance market, catering to the needs of its vast and dynamic population. The state’s insurance industry is regulated by the Texas Department of Insurance (TDI), which ensures fair and competitive practices while protecting consumer interests.

Types of Insurance Offered in Texas

Texas residents have access to a wide range of insurance products, covering various aspects of their lives. Here are some of the key types of insurance offered in Texas:

- Auto Insurance: This is mandatory for all drivers in Texas and covers damages to vehicles and injuries to individuals in accidents.

- Homeowners Insurance: This protects homeowners against losses due to fire, theft, natural disasters, and other perils.

- Health Insurance: Texas offers a mix of public and private health insurance options, including Medicaid, CHIP, and individual and employer-sponsored plans.

- Life Insurance: This provides financial protection for beneficiaries in case of the policyholder’s death.

- Business Insurance: This covers various risks faced by businesses, including property damage, liability, and workers’ compensation.

- Workers’ Compensation Insurance: This is mandatory for most employers in Texas and covers medical expenses and lost wages for employees injured on the job.

- Flood Insurance: This is crucial for residents in flood-prone areas and covers damages caused by flooding.

- Windstorm Insurance: This is essential for coastal residents and protects against damages caused by hurricanes and other windstorms.

Regulatory Environment for Insurance Companies in Texas

The TDI plays a critical role in regulating the insurance industry in Texas. It sets standards for insurance companies, monitors their financial stability, and protects consumers from unfair or deceptive practices. The TDI also approves insurance rates and policies to ensure they are fair and reasonable.

The TDI’s mission is to protect Texas consumers by ensuring a fair and competitive insurance market.

Market Share of Different Insurance Providers in Texas

The Texas insurance market is highly competitive, with numerous national and regional insurance providers vying for market share. Some of the major players in the Texas insurance market include:

- State Farm: State Farm is a leading provider of auto, home, and life insurance in Texas, holding a significant market share.

- Allstate: Allstate is another major player in the Texas insurance market, offering a wide range of insurance products.

- Farmers Insurance: Farmers Insurance is a well-established provider of auto, home, and business insurance in Texas.

- USAA: USAA specializes in insurance for military personnel and their families and has a strong presence in Texas.

- Progressive: Progressive is known for its innovative insurance products and its direct-to-consumer sales model.

Texas State-Specific Insurance Programs

Texas offers several state-run insurance programs designed to address specific needs within the state. These programs aim to provide access to affordable insurance coverage for individuals and families who might otherwise struggle to obtain it.

Texas Health Steps

The Texas Health Steps program is a state-funded initiative that provides health insurance coverage to children from low-income families.

The program’s eligibility criteria are based on family income and household size. To qualify, a family’s income must fall below a certain threshold, which varies depending on the number of people in the household.

The Texas Health Steps program offers a wide range of benefits, including preventive care, immunizations, and treatment for common childhood illnesses. However, there are limitations. The program does not cover all medical expenses, and some services may require pre-authorization.

Texas Children’s Health Insurance Program (CHIP)

The Texas Children’s Health Insurance Program (CHIP) provides health insurance coverage to children from families who earn too much to qualify for Medicaid but cannot afford private health insurance.

Eligibility for CHIP is determined by income and family size. Families must meet specific income guidelines to qualify.

CHIP offers comprehensive health coverage, including preventive care, immunizations, and treatment for a wide range of medical conditions. The program also provides dental and vision coverage.

Texas Women’s Health Program (WHP)

The Texas Women’s Health Program (WHP) provides health insurance coverage to low-income women who are not eligible for Medicaid.

Eligibility for the WHP is based on income and residency. Women must be residents of Texas and have an income below a certain level to qualify.

The WHP offers a wide range of health services, including preventive care, screenings, and treatment for various health conditions. It also covers some reproductive health services, such as family planning and prenatal care.

Texas Medicaid Program

The Texas Medicaid program is a federal-state partnership that provides health insurance coverage to low-income individuals and families, pregnant women, children, seniors, and people with disabilities.

Eligibility for Medicaid is based on income, household size, and other factors. The program’s income guidelines vary depending on the individual’s circumstances.

Medicaid offers a comprehensive range of health benefits, including preventive care, hospitalizations, prescription drugs, and long-term care.

Texas Workers’ Compensation Program

The Texas Workers’ Compensation program is a state-run insurance program that provides benefits to employees who are injured or become ill on the job.

Eligibility for workers’ compensation is determined by the nature of the injury or illness and the employee’s employment status.

The program provides medical care, lost wages, and other benefits to injured workers. The amount of benefits received depends on the severity of the injury or illness and the employee’s wages.

Insurance Requirements in Texas

Texas law mandates that all drivers carry specific types of insurance to protect themselves and others on the road. This ensures financial responsibility in case of accidents and helps to cover potential costs associated with injuries, property damage, and legal liabilities.

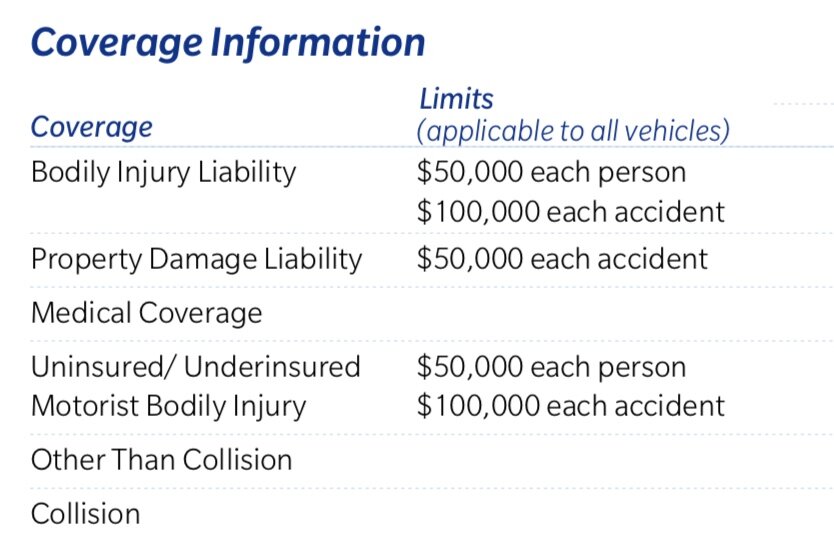

Minimum Insurance Requirements in Texas

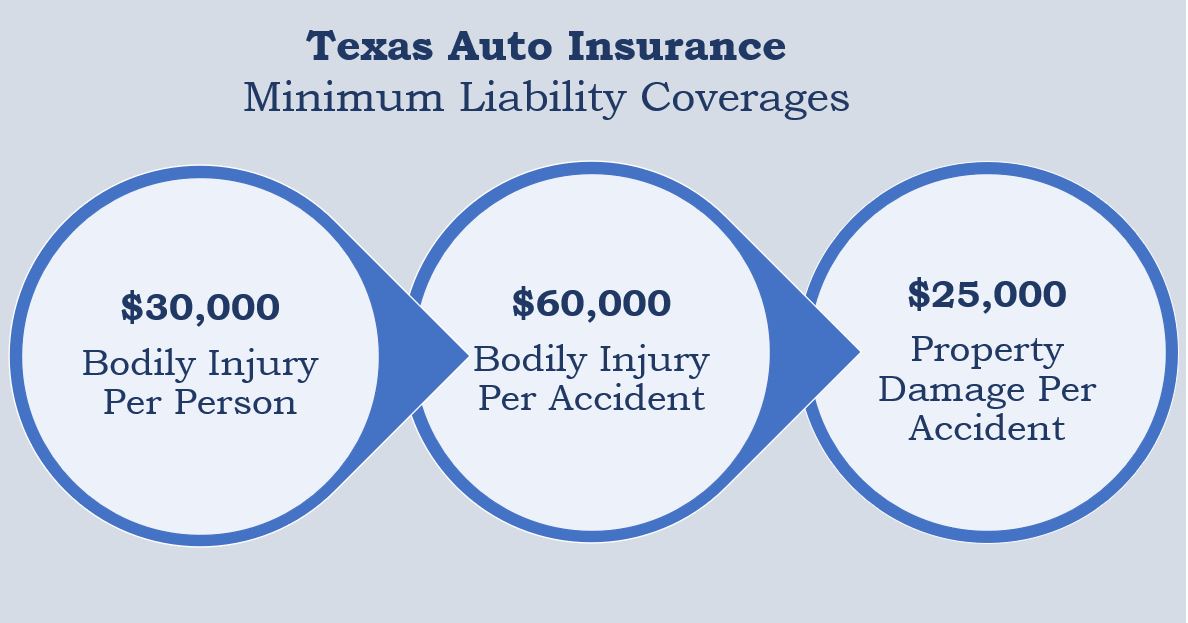

Texas requires all drivers to have the following minimum liability insurance coverage:

- Bodily Injury Liability: This coverage protects you financially if you injure someone else in an accident. It covers medical expenses, lost wages, and pain and suffering. The minimum requirement is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This coverage pays for damages to another person’s property if you are at fault in an accident. The minimum requirement is $25,000 per accident.

In addition to the minimum liability coverage, Texas law also requires drivers to carry:

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. The minimum requirement is $30,000 per person and $60,000 per accident. You can choose to have UM/UIM coverage equal to your bodily injury liability limits, or you can choose higher limits.

Consequences of Driving Without Insurance

Driving without the required minimum insurance in Texas is illegal and can result in severe consequences.

- Fines and Penalties: You could face a fine of up to $350 for driving without insurance. If you are caught driving without insurance multiple times, the fines and penalties can increase.

- License Suspension: If you are caught driving without insurance, your driver’s license could be suspended. This can make it difficult to drive legally and can also affect your ability to obtain insurance in the future.

- Financial Responsibility: If you are involved in an accident without insurance, you will be personally responsible for all costs associated with the accident, including medical expenses, property damage, and legal fees. This could lead to significant financial hardship.

Minimum Insurance Requirements for Different Vehicle Types

| Vehicle Type | Bodily Injury Liability | Property Damage Liability | Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|

| Passenger Vehicles | $30,000 per person / $60,000 per accident | $25,000 per accident | $30,000 per person / $60,000 per accident |

| Commercial Vehicles | $30,000 per person / $60,000 per accident | $25,000 per accident | $30,000 per person / $60,000 per accident |

| Motorcycles | $30,000 per person / $60,000 per accident | $25,000 per accident | $30,000 per person / $60,000 per accident |

Insurance Costs in Texas

Understanding the factors that influence insurance premiums in Texas is crucial for making informed decisions about your coverage. Factors like your driving history, the type of vehicle you own, and the location where you live all play a role in determining your insurance costs.

Factors Influencing Insurance Premiums in Texas, State insurance texas

Several factors influence insurance premiums in Texas. These factors are considered by insurance companies to assess risk and determine your individual rate.

- Driving History: Your driving record is a significant factor in determining your insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums.

- Vehicle Type: The type of vehicle you own also impacts your insurance costs. Luxury cars, sports cars, and vehicles with advanced safety features tend to be more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Location: Your location in Texas can influence your insurance premiums. Areas with higher crime rates or more frequent accidents may have higher insurance rates due to the increased risk of claims.

- Age and Gender: While age and gender are factors considered by insurance companies, it’s important to note that these factors are subject to state regulations. In Texas, insurance companies are prohibited from using gender as a factor in determining premiums. However, age can still be a factor, as younger drivers may be considered more risky due to their lack of experience.

- Credit Score: In some states, insurance companies may consider your credit score as a factor in determining your insurance premiums. While this practice is controversial, it is legal in Texas. A good credit score can potentially lead to lower premiums.

- Coverage Levels: The amount of coverage you choose will also affect your premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will generally result in higher premiums.

Average Insurance Costs in Texas

Comparing average insurance costs in Texas to other states can provide valuable insights into the insurance market landscape. According to a recent study by the National Association of Insurance Commissioners (NAIC), the average annual cost of car insurance in Texas was $1,537 in 2023. This places Texas among the states with higher average insurance costs.

Tips for Obtaining Affordable Insurance Coverage in Texas

While insurance costs can be a concern, there are several strategies you can employ to obtain affordable coverage in Texas.

- Shop Around: Comparing quotes from multiple insurance companies is crucial to finding the best rates. Online insurance comparison websites can streamline this process, allowing you to get quotes from several insurers in a matter of minutes.

- Improve Your Driving Record: Maintaining a clean driving record is essential for lowering your insurance premiums. Avoid traffic violations and accidents, and consider taking a defensive driving course to improve your driving skills and potentially earn discounts.

- Consider Increasing Your Deductible: A higher deductible means you pay more out-of-pocket in the event of an accident, but it can also lead to lower premiums. Carefully evaluate your financial situation and determine a deductible amount that is comfortable for you.

- Bundle Your Policies: If you have multiple insurance policies, such as auto and homeowners insurance, bundling them with the same insurer can often result in significant discounts. Bundling your policies demonstrates loyalty and can lead to lower overall costs.

- Ask About Discounts: Many insurance companies offer discounts for various factors, such as good student discounts, safe driver discounts, and multi-car discounts. Inquire about available discounts and see if you qualify for any of them.

Consumer Resources for Texas Insurance

Navigating the world of insurance can be complex, especially in a state as diverse as Texas. Luckily, there are numerous resources available to help Texas residents understand their insurance options, file complaints, and resolve disputes. These resources provide valuable information, support, and guidance to ensure consumers are protected and empowered.

Reputable Organizations Providing Insurance Consumer Resources in Texas

Texas residents have access to various organizations that offer resources and assistance related to insurance. These organizations play a crucial role in educating consumers, resolving disputes, and advocating for fair insurance practices.

- Texas Department of Insurance (TDI): The TDI is the primary regulatory body for the insurance industry in Texas. It offers a wide range of services, including:

- Consumer education materials: The TDI provides informative brochures, articles, and online resources to educate consumers about various insurance products, rights, and responsibilities.

- Complaint resolution: Consumers can file complaints against insurance companies for unfair or deceptive practices. The TDI investigates complaints and works to resolve disputes.

- Market regulation: The TDI oversees the insurance market in Texas, ensuring that companies operate fairly and comply with state regulations.

- Texas Insurance Commissioner: The Texas Insurance Commissioner is the head of the TDI and is responsible for overseeing the insurance industry and protecting consumers.

- Texas Association of Insurance Agents (TAIA): The TAIA is a professional organization representing independent insurance agents in Texas. It offers resources and support to its members and provides information to consumers about insurance products and services.

- Texas Department of Banking: While primarily focused on banking, the Department of Banking also oversees the activities of insurance companies that offer financial products, such as annuities and life insurance.

- Better Business Bureau (BBB): The BBB is a non-profit organization that promotes ethical business practices. It provides consumer reviews, ratings, and complaint resolution services for insurance companies.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to standardize insurance regulations and consumer protection laws across the United States. It provides resources and information for consumers on various insurance topics.

Services Offered by Reputable Organizations

The following table summarizes the services offered by these organizations:

| Organization | Services Offered |

|---|---|

| Texas Department of Insurance (TDI) | Consumer education, complaint resolution, market regulation, licensing and enforcement |

| Texas Insurance Commissioner | Oversight of the insurance industry, consumer protection advocacy |

| Texas Association of Insurance Agents (TAIA) | Professional development for insurance agents, consumer information and resources |

| Texas Department of Banking | Regulation of insurance companies offering financial products |

| Better Business Bureau (BBB) | Consumer reviews, ratings, and complaint resolution services |

| National Association of Insurance Commissioners (NAIC) | Standardization of insurance regulations, consumer protection resources and information |

Filing Complaints Regarding Insurance Practices in Texas

Consumers can file complaints against insurance companies with the Texas Department of Insurance (TDI) if they believe they have been treated unfairly or have experienced deceptive practices. Complaints can be filed online, by phone, or by mail. The TDI investigates complaints and works to resolve disputes between consumers and insurance companies.

Ending Remarks: State Insurance Texas

Navigating the world of insurance in Texas can be daunting, but with the right information and resources, it can be a manageable process. This guide has provided a comprehensive overview of state insurance in Texas, covering key aspects from types of coverage to consumer resources. By understanding the landscape and utilizing available tools, Texans can make informed decisions about their insurance needs and ensure adequate protection for themselves and their families.

Question Bank

What are the main types of insurance offered in Texas?

Texas offers a wide range of insurance products, including auto, health, home, life, business, and workers’ compensation insurance.

How can I file a complaint about an insurance company in Texas?

You can file a complaint with the Texas Department of Insurance (TDI) online, by phone, or by mail. The TDI investigates complaints and works to resolve issues between consumers and insurance companies.

What are some tips for finding affordable insurance coverage in Texas?

To find affordable insurance, shop around and compare quotes from multiple insurers. Consider increasing your deductible, improving your credit score, and bundling your policies.