State insurance house insurance – State insurance and house insurance are two crucial aspects of homeownership that often go hand in hand. Understanding the intricacies of these insurance programs is essential for homeowners seeking peace of mind and financial security. This guide delves into the world of state insurance, exploring its role in safeguarding homeowners, and examining the various types of programs available. We will then delve into the essential components of house insurance, including dwelling, personal property, and liability coverage, while highlighting common exclusions and limitations.

Throughout this exploration, we will examine factors that influence insurance premiums, such as location, property value, and risk factors, and provide insights into how specific features can impact costs. We will also guide you through the process of choosing the right insurance provider, emphasizing the importance of carefully reviewing policy terms and conditions. Finally, we will equip you with practical advice on filing claims and navigating the process, along with preventative measures to minimize risks and potential claims.

State Insurance

State insurance plays a vital role in protecting homeowners from financial losses due to unforeseen events. It provides a safety net, ensuring that individuals can rebuild their lives after a disaster. State insurance programs are designed to address specific needs and risks within each region.

Types of State-Level Insurance Programs

State-level insurance programs offer a range of coverage options for homeowners, catering to diverse needs and situations. These programs are typically designed to address specific risks prevalent in a particular region.

- Flood Insurance: This program provides coverage for damage caused by flooding, a common risk in coastal areas and regions prone to heavy rainfall. It is often offered through the National Flood Insurance Program (NFIP) and is a requirement for homeowners in high-risk flood zones.

- Earthquake Insurance: This program is essential for homeowners residing in earthquake-prone areas, providing coverage for damage caused by seismic activity. It is typically offered as an optional add-on to standard homeowner’s insurance policies.

- Windstorm Insurance: This program protects homeowners from damage caused by high winds, particularly in regions prone to hurricanes and tornadoes. It may be available as a separate policy or as an add-on to standard homeowner’s insurance.

- Hail Insurance: This program covers damage caused by hailstorms, a common risk in areas with severe weather patterns. It is often included as part of standard homeowner’s insurance policies.

State Insurance Regulations Across Different Regions

State insurance regulations vary significantly across different regions, reflecting the unique risks and needs of each area.

- California: California has strict regulations regarding earthquake insurance, requiring insurers to offer coverage to homeowners in high-risk zones. The state also has a robust program for managing wildfire risks.

- Florida: Florida has comprehensive regulations for windstorm insurance, requiring insurers to offer coverage to homeowners in hurricane-prone areas. The state also has a dedicated hurricane catastrophe fund.

- Texas: Texas has regulations regarding hail insurance, requiring insurers to offer coverage to homeowners in areas with frequent hailstorms. The state also has a program for managing flood risks.

House Insurance: State Insurance House Insurance

Protecting your home is a crucial aspect of financial security. House insurance, also known as homeowners insurance, safeguards your dwelling and its contents against various perils. It provides financial protection in case of unexpected events that could damage your property or cause liability issues.

Essential Coverage Types

A standard house insurance policy encompasses various coverage types to address different risks. These coverages are designed to provide financial protection in case of specific events.

- Dwelling Coverage: This component covers the physical structure of your house, including the attached structures like garages, decks, and porches. It provides financial assistance for repairs or rebuilding in case of damage due to covered perils like fire, windstorms, hail, or vandalism. The coverage amount is typically based on the estimated cost to rebuild or repair the house, considering factors like the size, materials, and location.

- Personal Property Coverage: This coverage protects your belongings inside the house, including furniture, electronics, clothing, and other personal items. It provides financial assistance to replace or repair damaged or stolen property. The coverage amount is usually a percentage of the dwelling coverage, with limits for specific items like jewelry or artwork. It’s essential to review your policy to understand the specific coverage limits and exclusions.

- Liability Coverage: This coverage protects you against financial claims from third parties due to accidents or injuries that occur on your property. For instance, if someone gets injured while visiting your home, this coverage can help cover medical expenses, legal fees, and other related costs. It also covers liability for personal injuries or property damage caused by you or your family members off your property. Liability coverage limits are typically defined in your policy.

Common Exclusions and Limitations

While house insurance policies offer comprehensive protection, they often have exclusions and limitations that restrict coverage for specific events or circumstances.

- Acts of War: Damage caused by war or military action is typically excluded from coverage. This exclusion reflects the high risk and unpredictability associated with such events. It’s important to note that this exclusion might vary depending on the specific policy and insurer.

- Earthquakes: Earthquake damage is often excluded from standard house insurance policies. However, you can purchase additional coverage, known as earthquake insurance, to protect your home from this specific peril. The availability and cost of earthquake insurance vary based on your location and the risk of earthquakes in your area.

- Flood: Flood damage is typically not covered by standard house insurance policies. Flood insurance is a separate policy offered by the National Flood Insurance Program (NFIP) or private insurers. It’s essential to check your policy and determine whether you need flood insurance, especially if your home is located in a flood-prone area.

- Neglect or Maintenance Issues: Coverage may be limited or excluded for damage caused by neglect or failure to maintain your property. For example, damage resulting from a leaky roof due to a lack of regular maintenance might not be covered. It’s crucial to maintain your home properly to ensure coverage in case of unexpected events.

Factors Affecting Insurance Premiums

Your house insurance premium is influenced by several factors, each contributing to the overall cost of your policy. Understanding these factors can help you make informed decisions and potentially lower your premiums.

Location, State insurance house insurance

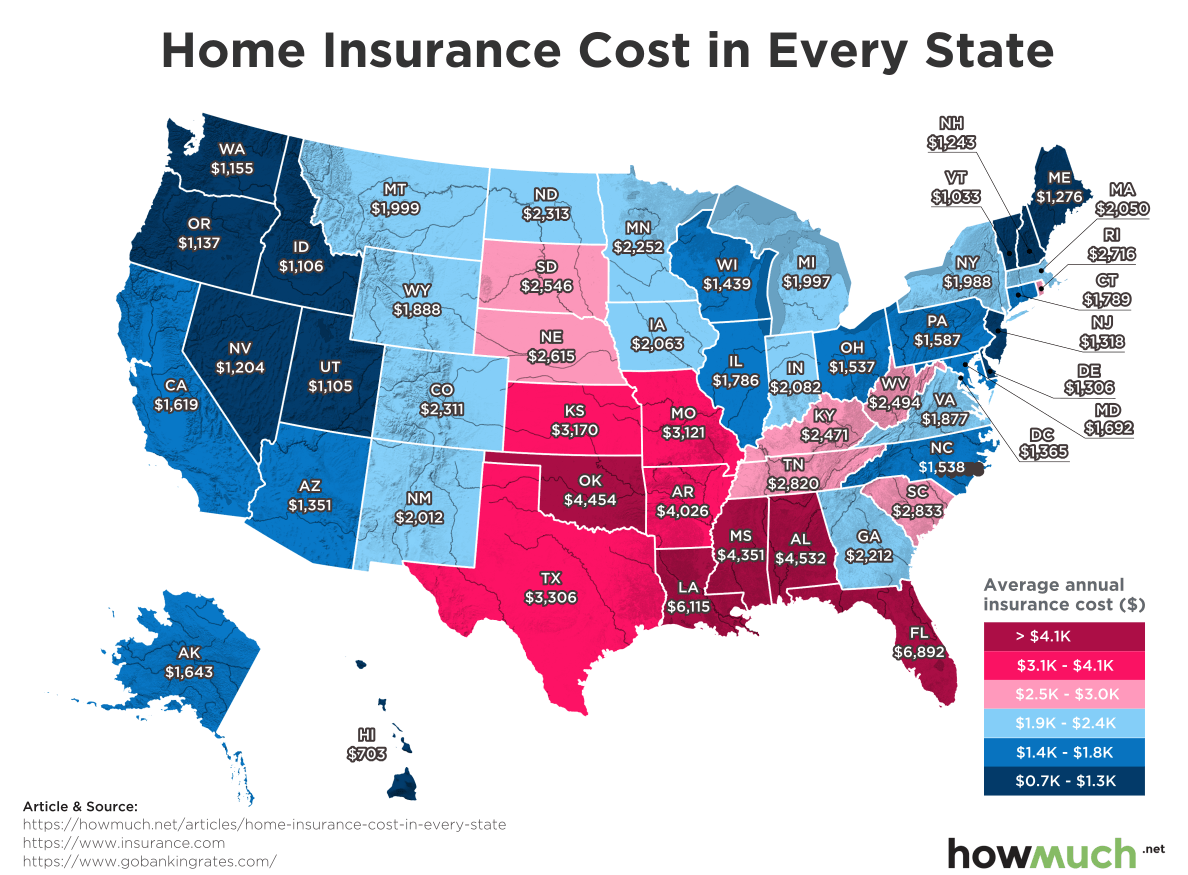

The location of your home significantly impacts your insurance premiums. Areas with higher crime rates, natural disaster risks, or proximity to fire hazards are generally associated with higher premiums. For example, homes located in coastal areas prone to hurricanes or in regions with frequent earthquakes will likely have higher premiums than homes in less risky areas.

Property Value

The value of your home is directly proportional to your insurance premiums. A higher property value means a higher potential payout for the insurance company in case of damage or loss. Therefore, homes with higher market values will generally have higher insurance premiums.

Risk Factors

Several risk factors can influence your premiums. These include:

- Age of the home: Older homes may have outdated electrical systems or plumbing, increasing the risk of fire or water damage. This can lead to higher premiums.

- Roof condition: A well-maintained roof is crucial for protecting your home from weather damage. Homes with aging or damaged roofs may have higher premiums.

- Security systems: Homes with security systems, such as burglar alarms or monitored security cameras, are considered less risky. Installing such systems can lead to lower premiums.

- Fire sprinklers: Homes with fire sprinklers are less likely to suffer significant damage in the event of a fire. This can result in lower premiums.

- Claim history: Your past insurance claims can influence your current premiums. Frequent claims can indicate a higher risk profile, leading to increased premiums.

Average Premiums for Different Types of Homes

The following table shows average house insurance premiums for different types of homes in various states. These are estimates and can vary based on individual factors.

| State | Single-Family Home | Condominium | Townhouse |

|---|---|---|---|

| California | $1,500 | $800 | $1,000 |

| Florida | $2,000 | $1,200 | $1,500 |

| Texas | $1,200 | $700 | $900 |

Choosing the Right Insurance Provider

Selecting the right house insurance provider is crucial to ensure you have adequate coverage and peace of mind. This decision involves comparing different insurers, understanding policy terms, and considering various factors to make an informed choice.

Comparing Insurance Companies

Different insurance companies offer a range of services and benefits, so comparing them is essential.

- Coverage Options: Compare the types of coverage offered, such as building damage, contents insurance, and liability coverage. Look for policies that meet your specific needs and consider the value of your property.

- Premiums and Deductibles: Compare premiums and deductibles to find a balance between affordability and coverage. Lower premiums may come with higher deductibles, and vice versa.

- Customer Service: Research the reputation of each insurer’s customer service, including their response time, claims handling process, and overall customer satisfaction.

- Financial Stability: Check the financial stability of the insurer by looking at their ratings from independent agencies like A.M. Best. A strong financial rating indicates the insurer’s ability to pay claims.

- Discounts: Inquire about available discounts, such as those for safety features, security systems, or loyalty programs.

Reviewing Policy Terms and Conditions

Carefully reviewing the policy terms and conditions is crucial to understand the scope of coverage, exclusions, and limitations.

- Coverage Limits: Pay close attention to the coverage limits for different aspects of your insurance, such as the maximum amount payable for building damage or contents loss.

- Exclusions: Identify any specific events or circumstances not covered by the policy, such as natural disasters, intentional acts, or specific types of damage.

- Deductibles: Understand the deductible amount you’ll need to pay before the insurer covers any losses. A higher deductible typically results in lower premiums.

- Claims Process: Review the procedures for filing claims, including required documentation, timeframes, and any specific requirements.

- Renewal Terms: Understand the terms for renewing your policy, including any potential premium increases or changes in coverage.

Key Considerations When Selecting a Provider

- Your Needs: Consider your specific needs and the value of your property. Do you need comprehensive coverage for your entire house, or just basic protection for building damage?

- Budget: Set a budget for your insurance premiums and factor in any potential deductibles. Balance affordability with the level of coverage you require.

- Reputation and Experience: Research the insurer’s reputation and experience in handling claims. Look for companies with a track record of fair and efficient claim settlements.

- Customer Service: Consider the insurer’s customer service reputation, including their responsiveness, communication, and overall customer satisfaction.

- Financial Stability: Check the insurer’s financial stability by looking at their ratings from independent agencies. A strong financial rating indicates the insurer’s ability to pay claims.

Filing a Claim and Navigating the Process

Filing a claim after an insured event can be a stressful experience, but understanding the process and gathering the necessary information can make it smoother.

Steps Involved in Filing a Claim

Filing a claim typically involves the following steps:

- Contact your insurance provider: Inform your insurance company about the incident as soon as possible, either by phone or online.

- Provide initial details: You will need to provide basic information about the incident, such as the date, time, location, and nature of the damage.

- File a claim: Your insurance provider will guide you through the formal claim filing process, which may involve completing online forms or providing specific documentation.

- Schedule an inspection: An insurance adjuster will be assigned to assess the damage and determine the extent of the coverage.

- Negotiate the settlement: Once the adjuster completes their assessment, they will present you with a settlement offer. You can negotiate this offer if you believe it is insufficient.

- Receive payment: After reaching a settlement, your insurance company will process the payment for the covered damages.

Documentation Required for a Claim

To ensure a successful claim, it’s essential to gather and provide the following documentation:

- Proof of ownership: Provide evidence of your ownership of the property, such as a deed or mortgage statement.

- Policy details: Present your insurance policy, including the policy number and coverage details.

- Incident report: If applicable, obtain a police report or incident report from the relevant authorities.

- Photographs and videos: Document the damage with clear photographs and videos from multiple angles.

- Estimates: Obtain estimates from contractors or repair professionals for the cost of repairs or replacement.

- Receipts: Keep receipts for any expenses incurred related to the incident, such as temporary housing or repairs.

Challenges and Complications in the Claims Process

The claims process can sometimes present challenges and complications:

- Delayed responses: Insurance companies may take time to process claims, especially during busy periods.

- Disputes over coverage: Disagreements may arise regarding the extent of coverage or the amount of the settlement.

- Communication issues: Clear communication between you and your insurance provider is crucial to avoid misunderstandings.

- Fraudulent claims: Submitting false information or exaggerating the damage can lead to claim denial or legal repercussions.

Protecting Your Home

Taking preventative measures is crucial to safeguarding your home and minimizing potential insurance claims. By implementing proactive steps, you can significantly reduce the risk of damage, protect your investment, and potentially lower your insurance premiums.

Home Maintenance and Safety Practices

Regular maintenance and adherence to safety practices are essential for preserving your home’s integrity and reducing the likelihood of accidents.

- Regular Inspections: Conduct routine inspections of your home’s exterior and interior, including roof, foundation, plumbing, electrical wiring, and appliances. Addressing any potential issues early can prevent costly repairs later.

- Roof Maintenance: Ensure your roof is in good condition by cleaning gutters, removing debris, and inspecting for leaks or damage. A well-maintained roof can protect your home from water damage and reduce the risk of roof collapses.

- Plumbing and Electrical Checks: Regularly check for leaks, drips, or faulty wiring. Address any issues promptly to prevent potential fires or water damage.

- Smoke and Carbon Monoxide Detectors: Install and maintain working smoke and carbon monoxide detectors throughout your home. These devices provide early warning in case of fire or gas leaks, potentially saving lives.

- Fire Safety: Develop and practice a fire escape plan with your family, ensuring everyone knows the designated exits and meeting point. Regularly check and maintain fire extinguishers.

Innovative Technologies and Security Systems

Technological advancements offer innovative solutions for enhancing home protection and security.

- Smart Home Security Systems: Install a smart home security system that includes motion sensors, door and window sensors, and video surveillance. These systems can deter potential intruders and provide real-time alerts in case of an intrusion.

- Smart Locks: Consider upgrading to smart locks that can be controlled remotely via a smartphone app. These locks enhance security by allowing you to monitor and control access to your home from anywhere.

- Water Leak Detectors: Install water leak detectors in areas prone to leaks, such as basements and bathrooms. These devices can alert you to leaks before they cause significant damage.

- Security Cameras: Invest in security cameras that provide live video streaming and recording capabilities. These cameras can deter crime and assist in identifying potential suspects in case of an incident.

Ultimate Conclusion

Navigating the complex world of state and house insurance can seem daunting, but by understanding the fundamentals, exploring your options, and taking proactive steps to protect your home, you can gain a greater sense of security and peace of mind. Remember to carefully review policy terms and conditions, compare quotes from reputable providers, and stay informed about any changes in regulations or coverage options. By taking a proactive approach, you can ensure that your home is adequately protected against unforeseen events.

FAQ Section

What is the difference between state insurance and house insurance?

State insurance refers to government-backed programs that provide coverage for specific risks, while house insurance is a private insurance policy that protects your home and belongings from various perils.

How do I know if I need state insurance?

The need for state insurance depends on your location and the specific risks you face. Contact your state insurance department or a licensed insurance agent to determine your eligibility.

What are some common exclusions in house insurance policies?

Common exclusions include damage caused by floods, earthquakes, and acts of war. It’s essential to review your policy carefully to understand what is and is not covered.

How often should I review my house insurance policy?

It’s recommended to review your policy annually, or whenever you make significant changes to your home or belongings, to ensure adequate coverage.