State insurance company – State insurance companies play a crucial role in the insurance market, offering a diverse range of products and services to individuals and businesses. These companies are typically established and regulated by state governments, providing a sense of security and stability to policyholders. From auto and home insurance to health and life coverage, state insurance companies cater to a wide array of needs, often with a focus on serving the specific requirements of their state’s residents.

This exploration delves into the intricacies of state insurance companies, examining their structure, governance, product offerings, customer experiences, competitive landscape, and impact on consumers. By shedding light on these aspects, we aim to provide a comprehensive understanding of how these companies operate within the broader insurance ecosystem.

State Insurance Company Overview

State insurance companies are government-owned and operated insurance providers that play a crucial role in the insurance market, particularly in providing coverage for individuals and businesses that may not be served by private insurers.

State insurance companies are often established to fulfill specific social and economic objectives, such as ensuring access to essential insurance products, mitigating risks associated with natural disasters, or promoting financial stability in the insurance sector. These companies operate under government oversight and are subject to regulations designed to protect policyholders and ensure financial soundness.

Types of Insurance Products Offered

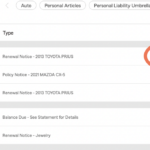

State insurance companies typically offer a range of insurance products to cater to diverse needs. These products can include:

- Auto insurance: Covers financial losses arising from accidents involving motor vehicles, including liability for injuries, property damage, and medical expenses.

- Home insurance: Provides coverage for damage to residential properties caused by perils such as fire, theft, vandalism, and natural disasters.

- Health insurance: Offers protection against medical expenses, including hospitalization, surgery, and prescription drugs. This can be provided through public health insurance programs or through private health insurance plans offered by state insurance companies.

- Life insurance: Provides financial security to beneficiaries upon the death of the insured individual. This can include term life insurance, whole life insurance, and universal life insurance.

Structure and Governance: State Insurance Company

State insurance companies operate within a distinct organizational framework and regulatory environment, designed to ensure their financial stability and accountability to policyholders. This section delves into the key aspects of their structure, governance, and the regulatory landscape they navigate.

Organizational Structure

The organizational structure of a state insurance company typically reflects a hierarchical model, with a board of directors at the apex, followed by a management team responsible for day-to-day operations, and various departments dedicated to specific functions.

- Board of Directors: The board of directors is the governing body of a state insurance company, responsible for setting strategic direction, overseeing financial performance, and ensuring compliance with regulations. Board members are typically appointed by the state government and represent diverse interests, including policyholders, consumers, and the insurance industry.

- Management Team: The management team, led by the Chief Executive Officer (CEO), implements the board’s strategic decisions and manages the company’s day-to-day operations. Key management roles include the Chief Financial Officer (CFO), Chief Operating Officer (COO), and Chief Underwriting Officer (CUO), each responsible for their respective areas of expertise.

- Key Departments: State insurance companies typically have departments dedicated to underwriting, claims processing, actuarial analysis, investments, and marketing. These departments work together to ensure the company’s financial stability, efficient operations, and customer satisfaction.

Regulatory Framework

State insurance companies operate within a comprehensive regulatory framework designed to protect policyholders and ensure the financial soundness of the industry. State insurance commissioners, appointed by the governor or elected by the people, play a crucial role in overseeing the activities of state insurance companies.

- State Insurance Commissioners: State insurance commissioners are responsible for licensing and regulating insurance companies, enforcing insurance laws, and protecting consumers from unfair or deceptive practices. They conduct regular examinations of insurance companies to assess their financial stability and compliance with regulations.

- Insurance Laws and Regulations: State insurance laws and regulations cover a wide range of aspects, including licensing requirements, capital adequacy standards, rate regulation, and consumer protection. These laws and regulations are designed to ensure that insurance companies operate in a fair and transparent manner and are able to meet their obligations to policyholders.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents state insurance regulators. It develops model laws and regulations that states can adopt to ensure consistency and uniformity in the insurance industry.

Financial Stability and Solvency Requirements

Maintaining financial stability and solvency is paramount for state insurance companies, as they are obligated to meet their financial commitments to policyholders. State insurance regulators enforce stringent financial requirements to ensure that companies can withstand unexpected losses and continue to operate.

- Capital Adequacy Standards: State insurance companies are required to maintain a certain level of capital, known as surplus, to cover potential losses and provide a cushion against financial shocks. These capital adequacy standards are determined by state regulators and are based on factors such as the company’s risk profile and the size of its insurance portfolio.

- Risk-Based Capital (RBC): The RBC system is a framework used by state regulators to assess the financial health of insurance companies. It considers factors such as the company’s assets, liabilities, and underwriting risks to determine its capital adequacy. Companies with inadequate capital are subject to regulatory intervention, such as restrictions on writing new business or increased capital requirements.

- Financial Examinations: State insurance commissioners conduct regular financial examinations of insurance companies to assess their financial stability and compliance with regulations. These examinations include reviews of the company’s accounting practices, investment portfolio, and claims reserves.

Products and Services

State insurance companies offer a wide range of insurance products designed to meet the diverse needs of their residents. These products provide financial protection against various risks, ensuring peace of mind and financial stability in the face of unforeseen events.

Comparison of Insurance Products

State insurance companies often offer similar insurance products, but there can be variations in coverage options, pricing, and customer service features. The following table compares some common insurance products offered by state insurance companies:

| Product | Coverage Options | Pricing | Customer Service Features |

|---|---|---|---|

| Auto Insurance | Liability, collision, comprehensive, uninsured/underinsured motorist | Varies based on factors like driving record, vehicle type, and location | 24/7 claims reporting, online account management, roadside assistance |

| Homeowners Insurance | Dwelling, personal property, liability, additional living expenses | Varies based on factors like home value, location, and coverage amount | Claims assistance, home safety inspections, discounts for security systems |

| Renters Insurance | Personal property, liability, additional living expenses | Generally more affordable than homeowners insurance | Online policy management, claims reporting app, renter’s legal liability coverage |

| Health Insurance | Individual, family, employer-sponsored, Medicare, Medicaid | Varies based on plan type, coverage level, and individual health status | Network of healthcare providers, telehealth services, wellness programs |

| Life Insurance | Term, whole, universal, variable | Varies based on coverage amount, age, health, and policy type | Death benefit payout, cash value accumulation (for certain policies), beneficiary management |

Key Features and Benefits of Popular Insurance Products

State insurance companies often emphasize certain features and benefits to make their products more attractive to consumers. Here are some key features and benefits of popular insurance products:

| Product | Key Features | Benefits |

|---|---|---|

| Auto Insurance | Accident forgiveness, usage-based discounts, rental car reimbursement | Reduced premiums, financial protection in case of accidents, peace of mind while driving |

| Homeowners Insurance | Replacement cost coverage, personal liability protection, flood insurance options | Full replacement of damaged property, financial protection against lawsuits, coverage for natural disasters |

| Renters Insurance | Personal property coverage, liability protection, identity theft coverage | Protection against loss or damage to personal belongings, financial security in case of accidents, peace of mind while renting |

| Health Insurance | Preventive care coverage, prescription drug coverage, mental health benefits | Access to quality healthcare, financial protection against medical expenses, peace of mind knowing health needs are covered |

| Life Insurance | Death benefit payout, cash value accumulation (for certain policies), beneficiary management | Financial security for loved ones, legacy planning, tax advantages (for certain policies) |

Tailoring Products and Services to Specific Customer Segments

State insurance companies often tailor their products and services to meet the specific needs of different customer segments. For example:

* Young adults: May offer discounts for good driving records, accident forgiveness programs, and renters insurance packages with additional liability coverage.

* Families: May offer bundled insurance packages with discounts for multiple policies, family health insurance plans with comprehensive coverage, and life insurance options with beneficiary management features.

* Seniors: May offer discounts for senior citizens, specialized health insurance plans for Medicare recipients, and long-term care insurance options.

* Business owners: May offer commercial insurance packages tailored to specific industries, risk management services, and business interruption insurance.

By understanding the unique needs of their customer segments, state insurance companies can provide more relevant and valuable products and services, fostering stronger customer relationships and loyalty.

Customer Experience

State insurance companies strive to provide a positive and seamless customer experience. They understand that satisfied customers are more likely to remain loyal and recommend their services to others. To achieve this, they offer various customer service channels and resources, prioritize key factors contributing to a positive experience, and actively seek feedback to improve their services.

Customer Service Channels and Resources

State insurance companies typically provide a wide range of customer service channels to ensure accessibility and convenience for their policyholders. These channels may include:

- Phone Support: This is often the most common and immediate way for customers to connect with an agent or representative. State insurance companies often have dedicated phone lines for specific departments, such as claims or customer service.

- Online Portals: Many state insurance companies offer secure online portals where customers can access their policy information, make payments, submit claims, and manage their accounts. These portals provide 24/7 access and allow customers to handle tasks at their convenience.

- Mobile Apps: State insurance companies are increasingly adopting mobile apps to enhance customer convenience. These apps allow customers to access their policy information, manage payments, report claims, and receive personalized notifications on their smartphones or tablets.

- Email Support: State insurance companies often provide email addresses for customers to submit inquiries or concerns. This channel offers a more formal and detailed communication method compared to phone or chat.

- Live Chat: Some state insurance companies offer live chat support on their websites, allowing customers to connect with an agent in real-time for immediate assistance. This channel is particularly helpful for quick questions or troubleshooting.

- Social Media: Many state insurance companies maintain active social media profiles, using platforms like Facebook, Twitter, and Instagram to interact with customers, answer questions, and address concerns. This channel provides a more informal and accessible platform for customer engagement.

Key Factors Contributing to a Positive Customer Experience

Several key factors contribute to a positive customer experience with state insurance companies:

- Responsiveness: Prompt and efficient responses to inquiries, claims, and policy changes are crucial for customer satisfaction. Customers appreciate being kept informed and receiving timely updates.

- Accessibility: Offering a variety of customer service channels, including phone, online portals, mobile apps, email, and social media, ensures that customers can reach out and receive assistance in the way that is most convenient for them.

- Personalization: State insurance companies can leverage customer data to provide personalized recommendations, tailored communication, and customized solutions. This shows that they understand their customers’ individual needs and preferences.

- Transparency: Providing clear and concise information about policies, coverage, claims processes, and customer rights fosters trust and confidence in the insurance company. Customers appreciate knowing exactly what to expect.

- Friendliness and Empathy: Customers value interacting with agents and representatives who are friendly, helpful, and understanding. A compassionate approach can go a long way in resolving issues and building positive relationships.

Customer Satisfaction Ratings

Customer satisfaction ratings can provide insights into the overall performance of state insurance companies. These ratings are often based on surveys, reviews, and feedback from customers. While specific ratings may vary depending on the source and methodology, some state insurance companies consistently receive high customer satisfaction scores.

For example, [insert example of a specific state insurance company with high customer satisfaction ratings and a brief explanation of why they consistently receive high ratings].

Competitive Landscape

The insurance industry is a dynamic and competitive landscape, with state insurance companies navigating a complex ecosystem alongside private insurance companies. Understanding the competitive dynamics and the unique challenges and opportunities faced by state insurance companies is crucial for their success.

Comparison of Offerings and Strategies

State and private insurance companies often offer similar insurance products, including auto, home, health, and life insurance. However, their strategies and approaches can differ significantly.

- State Insurance Companies typically prioritize affordability and accessibility, often serving as a safety net for individuals who may not have access to private insurance options. They may have a broader focus on social responsibility, supporting community development and economic growth.

- Private Insurance Companies tend to focus on profitability and market share, often offering a wider range of specialized products and services catering to diverse customer segments. They may emphasize innovation and technological advancements to gain a competitive edge.

Challenges and Opportunities in the Evolving Insurance Landscape

The insurance industry is undergoing significant transformations driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. State insurance companies face both challenges and opportunities in this evolving environment.

- Challenges:

- Competition: Increasing competition from private insurance companies and new entrants like fintech companies, especially in the online and digital insurance space.

- Financial constraints: State insurance companies often face budgetary constraints, limiting their ability to invest in innovation and technological advancements.

- Regulatory changes: Adapting to evolving regulatory frameworks, including cybersecurity requirements and data privacy regulations.

- Opportunities:

- Leveraging technology: Embracing digital technologies to improve efficiency, enhance customer experience, and develop innovative products and services.

- Data analytics: Utilizing data analytics to gain insights into customer behavior, optimize risk assessment, and personalize insurance offerings.

- Partnerships and collaborations: Collaborating with private companies, fintech startups, and other stakeholders to leverage their expertise and resources.

Role of Technology and Innovation

Technology is playing an increasingly critical role in the operations of state insurance companies, enabling them to streamline processes, improve efficiency, and enhance customer experience.

- Digitalization: Implementing digital platforms for online policy purchasing, claims processing, and customer service interactions.

- Artificial intelligence (AI): Utilizing AI-powered tools for risk assessment, fraud detection, and personalized recommendations.

- Internet of Things (IoT): Leveraging IoT devices to collect real-time data on policyholders’ behavior and assets, enabling more accurate risk assessment and personalized pricing.

- Blockchain: Exploring the potential of blockchain technology to improve transparency, security, and efficiency in insurance transactions.

Impact on Consumers

State insurance companies, often established by governments, offer a unique approach to the insurance market. They aim to provide coverage to a broader population, including those who might not have access to private insurance options. However, it’s essential to understand the potential benefits and drawbacks associated with purchasing insurance from a state-run entity.

Impact on Affordability and Accessibility

State insurance companies can play a significant role in making insurance more affordable and accessible for consumers. Their primary goal is often to serve the public good, leading to lower premiums and more inclusive coverage policies. For example, some state-run insurance programs offer subsidies or discounts to low-income individuals or families.

- Reduced Premiums: State insurance companies often operate with a lower profit motive compared to private insurers. This allows them to offer premiums that are more competitive and accessible to a wider range of consumers.

- Expanded Coverage: State insurance companies may offer coverage for risks that private insurers might consider too risky or unprofitable. This can be particularly beneficial for individuals in high-risk areas or those with pre-existing conditions.

- Increased Accessibility: State-run insurance programs can reach communities that are underserved by private insurers. This is particularly relevant in rural areas or low-income neighborhoods where access to insurance can be limited.

Addressing Consumer Needs and Concerns, State insurance company

State insurance companies are often responsive to consumer needs and concerns. They are typically subject to greater public scrutiny and accountability, which can lead to improvements in customer service and product offerings.

- Transparency and Accountability: State insurance companies are often subject to more stringent regulations and oversight than private insurers. This can lead to greater transparency in pricing, coverage, and claims processing.

- Consumer Protection: State insurance companies may have stronger consumer protection measures in place, such as stricter rules regarding unfair claims practices or more robust complaint resolution processes.

- Targeted Programs: State insurance companies can tailor their products and services to address specific needs within their jurisdictions. For example, they might offer specialized insurance programs for farmers, small businesses, or vulnerable populations.

Final Conclusion

State insurance companies represent a significant force in the insurance industry, offering a unique blend of public and private sector characteristics. Their commitment to serving their state’s residents, combined with their regulatory oversight, ensures a level of accountability and stability. As the insurance landscape continues to evolve, state insurance companies are adapting to meet the changing needs of consumers and businesses, leveraging technology and innovation to enhance their offerings and customer experiences. Understanding the role and impact of these companies is crucial for navigating the complexities of the insurance market and making informed decisions about coverage and protection.

Question & Answer Hub

What are the advantages of purchasing insurance from a state insurance company?

State insurance companies often offer competitive rates and a focus on serving the specific needs of their state’s residents. They also benefit from regulatory oversight, which can provide additional protection for policyholders.

How do state insurance companies differ from private insurance companies?

State insurance companies are typically owned and operated by state governments, while private insurance companies are owned by private entities. State insurance companies often have a broader focus on public service, while private insurance companies may prioritize profitability.

Are state insurance companies financially stable?

State insurance companies are subject to strict financial regulations and oversight to ensure their solvency. This helps to protect policyholders from potential financial risks.

How can I find a state insurance company in my area?

You can typically find a list of state insurance companies on your state’s insurance department website or by searching online for “state insurance companies” followed by your state’s name.