State General Insurance stands as a prominent player in the insurance landscape, offering a diverse range of products and services to meet the needs of its diverse customer base. Founded with a commitment to providing reliable and comprehensive insurance solutions, State General Insurance has earned a reputation for its customer-centric approach and unwavering dedication to financial stability.

The company’s success can be attributed to its strategic focus on understanding the evolving needs of its target market. By offering tailored insurance products, competitive pricing, and exceptional customer service, State General Insurance has cultivated a loyal customer base and established itself as a trusted partner in managing risk.

What is State General Insurance?

State General Insurance is a leading provider of insurance solutions in [Country/Region]. Established with a commitment to [briefly state the company’s core purpose], State General Insurance has become a trusted name in the insurance industry.

History and Origin

State General Insurance traces its roots back to [year of establishment] when it was founded as [original company name]. The company initially focused on [initial products/services]. Over the years, State General Insurance has expanded its product portfolio and geographic reach, evolving into the comprehensive insurance provider it is today.

Mission, Vision, and Core Values

State General Insurance is driven by a clear mission to [state the company’s mission statement]. This mission is guided by the vision to [state the company’s vision statement]. To achieve its goals, State General Insurance operates according to the following core values:

- [Core Value 1]: This value translates into [brief explanation of how the value is manifested in the company’s operations].

- [Core Value 2]: This value is reflected in [brief explanation of how the value is manifested in the company’s operations].

- [Core Value 3]: This value is exemplified by [brief explanation of how the value is manifested in the company’s operations].

Company Structure and Organizational Hierarchy

State General Insurance has a well-defined organizational structure that ensures efficient operations and effective decision-making. The company’s hierarchy is as follows:

- Board of Directors: The Board of Directors provides strategic direction and oversight to the company.

- Executive Management: The Executive Management team is responsible for implementing the Board’s strategies and managing the day-to-day operations of the company.

- Department Heads: Department Heads lead their respective departments, ensuring the efficient delivery of products and services.

- Employees: State General Insurance’s success relies on its dedicated team of employees who work collaboratively to provide excellent customer service and innovative solutions.

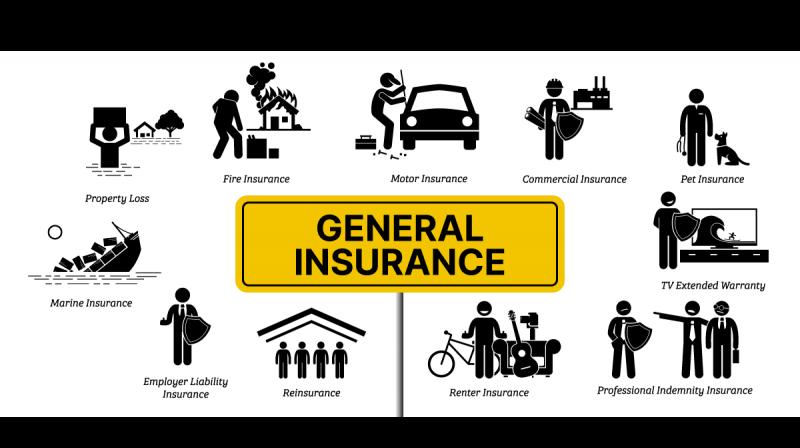

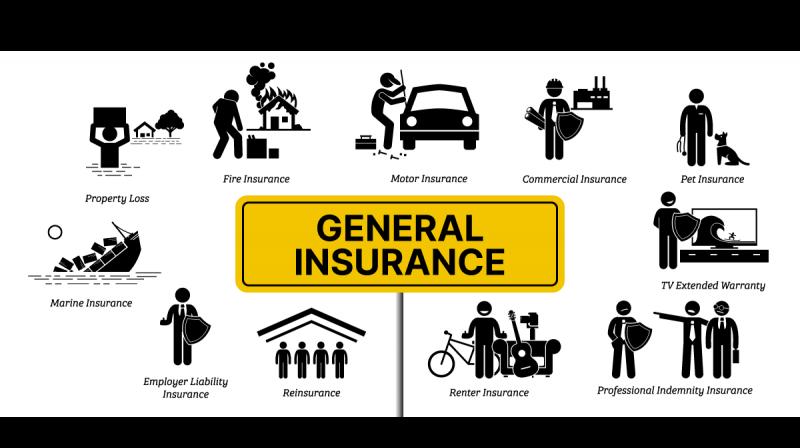

Key Products and Services

State General Insurance offers a comprehensive range of insurance products and services to meet the diverse needs of its customers. These products and services include:

- [Product/Service 1]: [Brief description of the product/service and its key features].

- [Product/Service 2]: [Brief description of the product/service and its key features].

- [Product/Service 3]: [Brief description of the product/service and its key features].

State General Insurance’s Target Market

State General Insurance caters to a diverse range of individuals and businesses, targeting specific demographics and psychographics. The company’s target market is carefully chosen to ensure a strong understanding of their insurance needs and preferences, allowing State General to provide tailored solutions that meet their unique requirements.

The company’s target market is primarily influenced by factors such as age, income, lifestyle, and risk tolerance. These factors shape their insurance needs and preferences, leading them to seek out specific types of coverage and features.

Demographics and Psychographics

State General Insurance’s target market encompasses individuals and businesses with varying demographics and psychographics. This diverse group includes:

- Age: State General targets individuals across different age groups, including young adults, families, and retirees. The company offers a variety of products that cater to the specific needs of each age group, such as life insurance for young families, health insurance for retirees, and auto insurance for young drivers.

- Income: State General’s target market includes individuals and businesses with a wide range of income levels. The company offers flexible payment options and coverage levels to accommodate different financial situations.

- Lifestyle: State General understands that lifestyle plays a significant role in insurance needs. The company caters to individuals with diverse lifestyles, including those who are active, adventurous, and risk-takers, as well as those who prefer a more traditional and conservative lifestyle.

- Risk Tolerance: State General recognizes that individuals have different levels of risk tolerance. The company offers a variety of products with varying coverage levels to meet the specific risk tolerance of each individual or business.

Factors Influencing Insurance Needs and Preferences

Several factors influence the insurance needs and preferences of State General’s target market, including:

- Age: Younger individuals typically have different insurance needs than older individuals. For example, young adults may prioritize auto insurance and life insurance, while retirees may focus on health insurance and long-term care insurance.

- Income: Individuals with higher incomes may have more complex insurance needs and may be willing to pay for more comprehensive coverage. Individuals with lower incomes may need to prioritize affordability and may opt for more basic coverage.

- Lifestyle: An individual’s lifestyle can also impact their insurance needs. For example, individuals who are active and adventurous may require more comprehensive travel insurance, while individuals who are more sedentary may prioritize health insurance.

- Risk Tolerance: Individuals with a higher risk tolerance may be willing to accept higher deductibles and lower coverage limits in exchange for lower premiums. Individuals with a lower risk tolerance may prefer higher coverage limits and lower deductibles, even if it means paying higher premiums.

Competitive Landscape

The insurance industry is highly competitive, with a wide range of companies vying for customers. State General Insurance faces competition from both large national insurers and smaller regional insurers. Some of the key competitors include:

- National Insurers: These companies have a large market share and offer a wide range of products and services. They often have a strong brand reputation and extensive distribution networks. Examples include Progressive, Geico, and Allstate.

- Regional Insurers: These companies focus on specific geographic areas and often have a deeper understanding of the local market. They may offer more personalized service and competitive pricing. Examples include State Farm, Farmers Insurance, and Nationwide.

- Specialty Insurers: These companies specialize in specific types of insurance, such as auto insurance, health insurance, or life insurance. They often have a deep understanding of their niche market and can offer highly tailored products and services.

Comparison of Offerings

State General Insurance differentiates itself from its competitors by offering a unique combination of products, services, and pricing. Here are some key differentiators:

- Product Variety: State General offers a comprehensive range of insurance products to meet the diverse needs of its target market. This includes auto insurance, home insurance, life insurance, health insurance, and business insurance.

- Customer Service: State General is known for its exceptional customer service. The company has a dedicated team of customer service representatives who are available to answer questions, resolve issues, and provide personalized support.

- Pricing: State General offers competitive pricing and flexible payment options to make insurance affordable for its target market. The company also offers discounts for good driving records, multiple policyholders, and other factors.

- Technology: State General leverages technology to streamline its operations and provide a seamless customer experience. The company offers online quoting, policy management, and claims reporting.

State General Insurance’s Products and Services

State General Insurance offers a comprehensive range of insurance products designed to protect individuals and businesses from various risks. These products are categorized based on their specific purpose and target audience.

Personal Insurance

Personal insurance products cater to the individual needs of customers, providing coverage for their personal assets, health, and well-being.

- Life Insurance: Provides financial protection for your loved ones in the event of your death. This includes term life insurance, which offers coverage for a specific period, and whole life insurance, which provides lifetime coverage with a savings component.

- Health Insurance: Covers medical expenses incurred due to illness or injury. This can include hospitalization, surgery, and critical illness coverage. State General Insurance offers various health insurance plans to suit different needs and budgets.

- Home Insurance: Protects your home and its contents from damage caused by fire, theft, natural disasters, and other unforeseen events. State General Insurance offers comprehensive home insurance plans with customizable coverage options.

- Motor Insurance: Provides financial protection in case of accidents involving your vehicle. This includes third-party liability coverage, which covers damages caused to other vehicles or property, and comprehensive coverage, which also protects your own vehicle from damage.

- Travel Insurance: Offers coverage for medical expenses, trip cancellation, and lost baggage while traveling abroad. State General Insurance provides various travel insurance plans, including those specifically designed for families, students, and business travelers.

Business Insurance

Business insurance products are designed to protect businesses from various risks associated with their operations.

- Commercial Property Insurance: Covers damage to your business property, including buildings, equipment, and inventory. State General Insurance offers flexible coverage options to meet the specific needs of different businesses.

- Business Liability Insurance: Protects your business from financial losses arising from lawsuits or claims filed by third parties due to injuries or property damage caused by your business operations.

- Workers’ Compensation Insurance: Provides benefits to employees who suffer injuries or illnesses while on the job. State General Insurance offers workers’ compensation insurance plans that comply with local regulations.

- Professional Indemnity Insurance: Protects professionals, such as doctors, lawyers, and accountants, from claims arising from negligence or errors in their professional services.

- Cyber Liability Insurance: Covers financial losses resulting from cyberattacks, data breaches, and other cyber-related incidents.

How to Obtain a Quote and Purchase a Policy, State general insurance

To obtain a quote for any of State General Insurance’s products, you can visit their website, contact their customer service team, or visit a local agent. You will need to provide some basic information about yourself or your business, including your age, health, location, and the type of coverage you require. Once you have provided this information, State General Insurance will provide you with a personalized quote.

To purchase a policy, you can do so online, over the phone, or through a local agent. You will need to pay a premium, which is the cost of your insurance coverage. State General Insurance offers various payment options, including online payments, credit card payments, and bank transfers.

State General Insurance’s Claims Process

Filing a claim with State General Insurance is a straightforward process designed to help you get back on your feet as quickly as possible. The company understands that dealing with unexpected events can be stressful, and they aim to make the claims process as smooth and efficient as possible.

Types of Claims

State General Insurance offers coverage for a variety of situations, including:

- Property Damage: This covers damage to your property caused by events like fire, theft, vandalism, or natural disasters.

- Liability: This covers legal and financial responsibility for injuries or damages you cause to others. For example, if you are involved in a car accident and are found at fault, liability insurance will help cover the costs of the other driver’s injuries and vehicle repairs.

- Medical Claims: These cover medical expenses resulting from accidents or injuries covered by your policy.

Claim Filing Process

- Report the Claim: Contact State General Insurance immediately after an incident. You can report the claim online, over the phone, or through a mobile app.

- Provide Necessary Information: State General Insurance will ask for details about the incident, including the date, time, location, and any witnesses. You will also need to provide your policy information and any relevant documentation.

- Claim Investigation: State General Insurance will investigate your claim to determine the validity of your claim and the extent of the damages or injuries. This may involve interviewing witnesses, reviewing evidence, and conducting an inspection of the property.

- Claim Settlement: Once the investigation is complete, State General Insurance will determine the amount of the claim and issue a settlement offer. You have the right to negotiate the settlement offer if you feel it is not fair.

Claim Settlement Process

Several factors can influence the claim settlement process, including:

- Policy Terms: The specific terms and conditions of your policy will determine the coverage you have and the amount of compensation you are eligible to receive.

- Evidence: The evidence you provide to support your claim, such as photographs, witness statements, and medical records, can significantly impact the outcome of the settlement.

- Legal Requirements: State General Insurance must comply with all applicable laws and regulations when processing claims.

State General Insurance’s Financial Performance

State General Insurance’s financial performance is a crucial indicator of its overall health and ability to meet its obligations to policyholders and stakeholders. Analyzing the company’s financial statements, including revenue, expenses, and profitability, provides valuable insights into its strengths, weaknesses, and future prospects.

Revenue and Expenses

The primary source of revenue for State General Insurance is the premiums collected from its policyholders. These premiums represent the fees paid by individuals and businesses to secure insurance coverage against various risks. The company’s expenses include claims payouts, operating costs, and administrative expenses. Claims payouts represent the largest expense for insurance companies, as they cover the costs associated with insured events. Operating costs encompass expenses related to running the business, such as salaries, rent, and utilities. Administrative expenses include costs associated with managing the company’s operations, such as marketing, legal, and regulatory compliance.

Profitability

Profitability is a key metric for assessing the financial performance of State General Insurance. It is calculated by subtracting expenses from revenue. A profitable insurance company indicates that it is effectively managing its operations and generating a return on its investments. Factors that influence profitability include the level of premiums collected, the frequency and severity of claims, and the efficiency of the company’s operations.

Trends and Patterns

Analyzing trends and patterns in State General Insurance’s financial data can provide valuable insights into its performance over time. For example, an increasing trend in revenue may indicate growth in the company’s customer base or an increase in premium rates. A decreasing trend in profitability may indicate rising claims costs or inefficiencies in operations. Identifying these trends and patterns allows the company to make informed decisions regarding its future strategies.

Comparison to Competitors

Comparing State General Insurance’s financial performance to that of its competitors provides valuable insights into its relative position within the industry. Metrics such as revenue, profitability, and market share can be used to assess the company’s competitive advantage. This comparison can help State General Insurance identify areas where it excels and areas where it needs to improve to maintain its competitive edge.

State General Insurance’s Social Responsibility

State General Insurance is committed to operating responsibly and ethically, recognizing its impact on society and the environment. The company believes that sustainability and social responsibility are integral to its long-term success and are reflected in its business practices, community engagement, and employee policies.

Commitment to Social and Environmental Responsibility

State General Insurance’s commitment to social and environmental responsibility is rooted in its belief that businesses have a responsibility to contribute to the well-being of society and the environment. The company actively promotes sustainable practices within its operations and supports initiatives that address social issues.

Community Initiatives

State General Insurance actively engages with communities through various initiatives. These initiatives are designed to address local needs and contribute to the well-being of communities.

- State General Insurance partners with local organizations to provide financial support for community projects, such as education, healthcare, and disaster relief.

- The company also sponsors community events and activities that promote social cohesion and cultural development.

- State General Insurance encourages its employees to volunteer their time and skills to support local charities and community initiatives.

Sustainability Efforts

State General Insurance is committed to reducing its environmental footprint and promoting sustainable practices across its operations.

- The company has implemented energy-efficient measures in its offices and buildings, reducing energy consumption and carbon emissions.

- State General Insurance promotes the use of recycled materials and sustainable products in its operations.

- The company encourages its employees to adopt sustainable practices in their personal lives and supports initiatives that promote environmental awareness.

Ethical Business Practices

State General Insurance adheres to the highest ethical standards in all its business dealings.

- The company has a strong code of ethics that guides its employees in their interactions with customers, partners, and the public.

- State General Insurance is committed to transparency and accountability in its financial reporting and business practices.

- The company has established a whistleblower program to encourage employees to report any unethical or illegal activities.

Employee Diversity

State General Insurance values diversity and inclusion in its workforce.

- The company actively recruits and promotes individuals from diverse backgrounds and fosters a workplace culture that embraces inclusivity.

- State General Insurance provides training and development opportunities to its employees to enhance their skills and promote diversity and inclusion.

- The company has implemented policies to ensure equal opportunities for all employees, regardless of their background or identity.

State General Insurance’s Future Outlook

State General Insurance is well-positioned to navigate the evolving landscape of the insurance industry. The company’s commitment to innovation, customer-centricity, and financial stability lays a solid foundation for future success.

Industry Trends and Their Impact

The insurance industry is undergoing a period of significant transformation driven by technological advancements, changing customer expectations, and evolving regulatory landscapes. State General Insurance is actively monitoring these trends and adapting its strategies to remain competitive.

- Digitalization and Insurtech: The rise of Insurtech companies and the increasing adoption of digital technologies are transforming the way insurance is bought and sold. State General Insurance is embracing digitalization by investing in its online platforms, mobile apps, and data analytics capabilities. This allows the company to provide customers with a seamless and personalized experience, while also streamlining internal processes and improving efficiency.

- Customer Expectations: Customers are demanding more personalized and convenient insurance solutions. State General Insurance is responding by developing customized insurance products and services tailored to individual needs. The company is also leveraging data analytics to provide personalized recommendations and proactively identify potential risks.

- Regulatory Changes: The insurance industry is subject to ongoing regulatory changes. State General Insurance is proactively monitoring these developments and ensuring compliance with all relevant regulations. The company is also engaging with industry stakeholders to advocate for policies that promote innovation and consumer protection.

Strategic Goals and Plans for the Future

State General Insurance has Artikeld a clear vision for its future growth and development. The company’s strategic goals are focused on:

- Expanding Product and Service Offerings: State General Insurance plans to expand its product and service portfolio to meet the evolving needs of its customers. The company is exploring new insurance lines, such as cyber insurance and travel insurance, as well as innovative solutions for existing products.

- Strengthening Customer Relationships: State General Insurance is committed to building strong and lasting relationships with its customers. The company is investing in customer service excellence, personalized communication, and loyalty programs to enhance customer satisfaction.

- Leveraging Technology: State General Insurance recognizes the importance of technology in driving innovation and efficiency. The company plans to continue investing in digital technologies, such as artificial intelligence (AI) and machine learning (ML), to improve its operations and enhance customer experiences.

- Expanding Geographic Reach: State General Insurance aims to expand its geographic reach to new markets. The company is exploring opportunities to enter new regions and serve a wider customer base.

Challenges and Opportunities

State General Insurance faces a number of challenges and opportunities in the years to come.

- Competition: The insurance industry is highly competitive, with both established players and new entrants vying for market share. State General Insurance must continue to innovate and differentiate itself to remain competitive.

- Economic Uncertainty: Global economic conditions can impact the insurance industry. State General Insurance must be prepared to navigate economic volatility and adapt its strategies to changing market conditions.

- Cybersecurity Threats: Cybersecurity threats are a growing concern for insurance companies. State General Insurance must invest in robust cybersecurity measures to protect its data and systems from attacks.

- Talent Acquisition: Attracting and retaining skilled talent is essential for the success of any insurance company. State General Insurance must offer competitive salaries and benefits, as well as opportunities for professional development, to attract and retain top talent.

Overall Assessment of Future Prospects

State General Insurance is well-positioned for continued growth and success in the future. The company’s strong financial performance, commitment to innovation, and focus on customer satisfaction provide a solid foundation for future success. By embracing industry trends, adapting to changing market conditions, and staying ahead of the competition, State General Insurance can continue to provide its customers with exceptional insurance solutions.

Concluding Remarks

State General Insurance’s commitment to innovation, customer satisfaction, and financial stability positions it for continued success in the dynamic insurance market. As the company navigates the evolving landscape, it remains dedicated to providing its customers with the security and peace of mind they deserve, ensuring that they are well-protected against life’s uncertainties.

Questions and Answers

What types of insurance does State General Insurance offer?

State General Insurance offers a comprehensive range of insurance products, including auto, home, health, life, and business insurance.

How can I file a claim with State General Insurance?

You can file a claim with State General Insurance online, by phone, or by mail. The company provides detailed instructions on its website and through its customer service representatives.

What is State General Insurance’s customer service phone number?

You can find State General Insurance’s customer service phone number on their website or by searching online.

Is State General Insurance financially stable?

State General Insurance has a strong financial rating, indicating its financial stability and ability to meet its obligations to policyholders.