State farms insurance quote – State Farm insurance quotes offer a personalized way to explore insurance options, ensuring you have the right coverage at a competitive price. State Farm, a leading insurance provider, has built a reputation for reliability and customer satisfaction. They offer a wide range of insurance products, including auto, home, life, and more, designed to meet diverse needs.

Understanding the factors that influence your quote is crucial to making informed decisions. State Farm considers your driving history, credit score, location, and chosen coverage levels when calculating your premium. Additionally, you can benefit from various discounts, including safe driver, multi-policy, and good student discounts, which can significantly impact your final quote.

State Farm Insurance Overview

State Farm is a renowned insurance company with a rich history and a strong commitment to customer satisfaction. Founded in 1922, the company has grown into one of the largest and most trusted insurance providers in the United States. State Farm’s mission is to help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.

History and Mission

State Farm was founded by George J. Mecherle in Bloomington, Illinois. Mecherle’s vision was to create an insurance company that provided affordable and reliable coverage to farmers and their families. State Farm’s mission statement reflects this commitment: “To help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.”

Core Values

State Farm’s core values guide the company’s operations and interactions with customers. These values include:

- Customer Focus: State Farm prioritizes understanding and meeting the needs of its customers.

- Integrity: The company operates with honesty and transparency in all its dealings.

- Financial Strength: State Farm maintains a strong financial position to ensure it can fulfill its obligations to policyholders.

- Innovation: The company continuously seeks ways to improve its products and services.

Financial Stability and Customer Satisfaction

State Farm is known for its financial stability and customer satisfaction. The company consistently receives high ratings from independent financial institutions, such as A.M. Best and Moody’s. In 2023, State Farm received an A+ rating from A.M. Best, signifying its strong financial position and ability to meet its policyholder obligations. State Farm also consistently ranks high in customer satisfaction surveys, demonstrating its commitment to providing exceptional service.

Insurance Products

State Farm offers a wide range of insurance products to meet the diverse needs of its customers. These products include:

- Auto Insurance: Provides coverage for damage to your vehicle and liability protection in case of an accident.

- Home Insurance: Protects your home and personal belongings from various risks, including fire, theft, and natural disasters.

- Life Insurance: Provides financial protection for your loved ones in the event of your death.

- Renters Insurance: Covers your personal belongings and provides liability protection if someone is injured in your rental unit.

- Business Insurance: Offers various coverage options for businesses, including property, liability, and workers’ compensation.

Obtaining a Quote: State Farms Insurance Quote

Getting a quote for State Farm insurance is straightforward and can be done in several ways to suit your preference. You can request a quote online, over the phone, or through a local State Farm agent.

Getting a Quote Online

Requesting a quote online through State Farm’s website is a quick and convenient option. Here’s a step-by-step guide:

- Visit the State Farm website and navigate to the “Get a Quote” section.

- Select the type of insurance you need, such as auto, home, or life insurance.

- Provide the necessary information, including your contact details, vehicle information, and home details (if applicable). For auto insurance, you’ll need to provide details about your vehicle, such as the year, make, model, and VIN. For home insurance, you’ll need to provide information about your home, such as the address, square footage, and type of construction.

- Review your quote and choose the coverage options that best suit your needs.

- Complete the online application process and submit your request.

Factors Influencing Quote Prices

Your insurance quote is a personalized reflection of your individual risk profile. State Farm considers several factors to ensure your premium accurately reflects the likelihood of you needing to file a claim.

Driving History

Your driving history is a significant factor in determining your insurance premium. A clean driving record with no accidents or violations generally results in lower premiums. Conversely, a history of accidents, traffic violations, or driving under the influence (DUI) can significantly increase your insurance costs.

- Accidents: Each accident, regardless of fault, is considered a risk factor. The severity of the accident, such as the number of vehicles involved or the extent of damage, can further impact your premium.

- Traffic Violations: Violations like speeding tickets, running red lights, or reckless driving can increase your premium. The severity of the violation and the number of violations on your record can influence the impact on your quote.

- DUI: A DUI conviction significantly increases your insurance costs. Insurance companies view DUI as a serious risk factor and often impose substantial rate increases for a period of time.

Credit Score

In many states, insurance companies can use your credit score as a factor in determining your premium. A higher credit score generally translates to lower premiums, while a lower credit score may lead to higher premiums.

- Credit Score and Risk: Insurance companies have found a correlation between credit score and claims behavior. Individuals with good credit scores tend to be more responsible financially, which can be indicative of responsible driving habits.

- Credit Score and Premiums: While credit score is not the only factor, it can have a significant impact on your premium. A good credit score can help you qualify for discounts, while a poor credit score may lead to higher premiums.

Location

Your location is another key factor that influences your insurance quote. Factors like the population density of your area, the rate of vehicle theft, and the frequency of accidents can all impact your premium.

- Urban vs. Rural: Generally, insurance premiums tend to be higher in urban areas compared to rural areas. This is due to higher traffic density, increased risk of accidents, and potentially higher repair costs in urban areas.

- Crime Rates: Areas with higher crime rates, particularly vehicle theft, often have higher insurance premiums. Insurance companies factor in the likelihood of claims based on the crime statistics of your location.

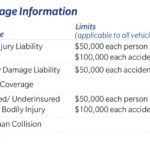

Coverage Levels

The level of coverage you choose directly impacts your insurance premium. Higher coverage limits, such as comprehensive and collision coverage, typically result in higher premiums.

- Liability Coverage: Liability coverage protects you financially if you are at fault in an accident. Higher liability limits provide greater financial protection, but also result in higher premiums.

- Collision and Comprehensive Coverage: Collision coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault. Comprehensive coverage protects you from damage caused by events like theft, vandalism, or natural disasters. Higher coverage limits for these options result in higher premiums.

Discounts

State Farm offers a wide range of discounts that can help you lower your premium. These discounts recognize your responsible driving habits, financial stability, and other positive factors.

- Safe Driver Discounts: Drivers with a clean driving record and no accidents or violations often qualify for safe driver discounts. These discounts reward you for your responsible driving behavior.

- Multi-Policy Discounts: Bundling multiple insurance policies, such as auto, home, and renters insurance, with State Farm can qualify you for significant discounts. This recognizes your loyalty to State Farm and your commitment to protecting your assets.

- Other Discounts: State Farm offers a variety of other discounts, including discounts for good students, vehicle safety features, and even for paying your premium in full.

Price Differences Between Providers

Insurance premiums can vary significantly between different providers. Factors like the provider’s risk assessment model, the types of discounts offered, and the specific coverage options available can all influence the final price.

- Risk Assessment Models: Each insurance company uses its own risk assessment model to determine premiums. These models may weigh certain factors, such as driving history or credit score, differently, leading to varying premiums.

- Discounts: The availability and types of discounts offered by different providers can also affect the final price. Some providers may offer more generous discounts for certain factors, such as good student discounts or multi-policy discounts.

- Coverage Options: The specific coverage options available and the coverage limits offered by different providers can also impact the premium. Some providers may offer more comprehensive coverage or higher coverage limits, which can lead to higher premiums.

Understanding Coverage Options

Choosing the right car insurance coverage is crucial for protecting yourself financially in case of an accident or other unforeseen events. State Farm offers a range of coverage options to meet diverse needs and budgets. Understanding these options and their benefits will help you make an informed decision.

Types of Coverage

State Farm provides various types of coverage, each designed to protect you in specific situations.

- Liability Coverage: This is the most basic type of car insurance and is required by law in most states. It covers damages to other people’s property or injuries to other people if you are at fault in an accident. Liability coverage typically includes two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages to people injured in an accident caused by you.

- Property Damage Liability: This covers repairs or replacement costs for damage to another person’s vehicle or property.

- Collision Coverage: This coverage pays for repairs or replacement costs to your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault. If you have a loan or lease on your car, your lender may require you to have collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. While not required by law, comprehensive coverage can be valuable if your vehicle is relatively new or has a high value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses. It can help cover medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident. PIP is often required in certain states, and it can help you access medical care and financial support quickly after an accident.

- Medical Payments Coverage (Med Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault in an accident. It is a supplemental coverage that can provide additional protection beyond your health insurance.

Choosing the Right Coverage Levels

The amount of coverage you need depends on several factors, including:

- Your financial situation: If you have a significant amount of assets, you may want to consider higher liability limits to protect yourself from potential lawsuits.

- The value of your vehicle: If your car is relatively new or has a high value, you may want to consider higher collision and comprehensive coverage limits.

- Your driving history: If you have a history of accidents or traffic violations, you may need higher liability limits to offset potential risks.

- Your state’s insurance requirements: Each state has minimum liability coverage requirements, which you must meet to legally operate a vehicle.

Coverage Options Comparison

| Coverage Type | Benefits | Potential Costs |

|---|---|---|

| Liability Coverage | Protects you financially if you cause damage to others’ property or injure others in an accident. | Lower than other coverage types, but may not cover all your losses if you are at fault. |

| Collision Coverage | Covers repairs or replacement costs to your vehicle if it’s damaged in a collision, regardless of who is at fault. | Higher than liability coverage, but can be crucial for protecting your vehicle’s value. |

| Comprehensive Coverage | Protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, or natural disasters. | Higher than liability coverage, but can be valuable for protecting your vehicle from unexpected events. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance. | Higher than liability coverage, but can be essential for covering your losses if you are involved in an accident with an uninsured driver. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages, regardless of who is at fault in an accident. | Higher than liability coverage, but can provide valuable financial support after an accident. |

| Medical Payments Coverage (Med Pay) | Helps pay for medical expenses for you and your passengers, regardless of who is at fault in an accident. | Lower than other coverage types, but can provide additional protection beyond your health insurance. |

Customer Service and Claims Process

State Farm is known for its strong customer service reputation, aiming to provide a positive and efficient experience for its policyholders. This commitment extends to the claims process, ensuring a smooth and supportive experience during challenging times.

Customer Service Reputation and Availability

State Farm is consistently ranked highly for customer satisfaction in the insurance industry. The company provides multiple avenues for customer service, including a 24/7 phone line, online chat, and mobile app support. This ensures that policyholders can reach a representative whenever they need assistance, whether it’s for a quote, policy change, or claim filing.

State Farm Claims Process

Filing a claim with State Farm is generally straightforward. The process involves the following steps:

- Contact State Farm: You can report a claim through the State Farm website, mobile app, or by calling their 24/7 claims line.

- Provide Claim Information: You’ll need to provide details about the incident, such as the date, time, and location, along with any relevant documentation, such as police reports or medical records.

- Claim Assessment: State Farm will assess the claim and determine the extent of coverage and potential payout.

- Claim Resolution: Once the claim is approved, State Farm will process the payment according to the terms of your policy.

Examples of Positive Customer Experiences, State farms insurance quote

Numerous online reviews and testimonials highlight positive experiences with State Farm’s claims process. Many customers praise the company’s responsiveness, transparency, and helpfulness in navigating the claims process. For example, one customer shared their experience of a car accident, where State Farm quickly processed their claim and provided ongoing support throughout the repair process. Another customer praised the company’s clear communication and timely updates, making the process stress-free.

Last Recap

Securing a State Farm insurance quote is a straightforward process. Whether you prefer to get a quote online, over the phone, or through an agent, State Farm provides multiple options for convenience. By carefully considering your insurance needs and comparing quotes from different providers, you can make an informed decision that best suits your financial situation and peace of mind.

FAQ Section

How do I get a State Farm insurance quote online?

You can easily get a quote online by visiting the State Farm website and providing the necessary information, such as your vehicle details, home information, and personal details. Follow the step-by-step instructions on their website to complete the process.

What are the different types of insurance coverage offered by State Farm?

State Farm offers a comprehensive range of insurance coverage options, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each type of coverage provides different protection, and it’s important to understand the benefits and costs associated with each.

What are the benefits of choosing State Farm insurance?

State Farm is known for its financial stability, excellent customer service, and a wide range of insurance products. They also offer various discounts and have a streamlined claims process, making them a reputable and reliable insurance provider.