State farms auto insurance – State Farm Auto Insurance, a household name in the insurance industry, has been providing reliable coverage and peace of mind to drivers for decades. This guide delves into the intricacies of State Farm’s auto insurance offerings, exploring their history, product range, customer experience, pricing, and commitment to social responsibility.

From their humble beginnings to becoming one of the largest insurance providers in the United States, State Farm has built a reputation for customer-centric service and financial stability. This guide aims to provide a comprehensive overview of State Farm’s auto insurance products and services, helping you make informed decisions about your insurance needs.

State Farm Overview

State Farm Insurance is a leading provider of auto insurance and other financial products in the United States. Founded in 1922, the company has grown into a household name, synonymous with reliability and customer service.

State Farm’s History and Growth

State Farm was founded in 1922 by George J. Mecherle, a farmer from Bloomington, Illinois. The company initially focused on providing auto insurance to farmers in the Midwest. Mecherle’s vision was to create a company that offered affordable and accessible insurance to all Americans.

Over the years, State Farm has expanded its product offerings to include a wide range of insurance products, including homeowners, life, health, and business insurance. The company has also grown its presence internationally, operating in several countries around the world.

State Farm’s Size and Market Share

State Farm is one of the largest insurance companies in the world, with a strong presence in the U.S. auto insurance market. As of 2023, State Farm holds the largest market share in the U.S. auto insurance market, according to data from the National Association of Insurance Commissioners (NAIC).

State Farm’s Reputation and Core Values

State Farm has earned a reputation for its commitment to customer service, financial stability, and community involvement. The company’s core values include:

- Customer Focus: State Farm is dedicated to providing its customers with exceptional service and value.

- Integrity: State Farm operates with honesty and transparency.

- Financial Strength: State Farm maintains a strong financial position to ensure it can meet its obligations to its customers.

- Community Involvement: State Farm is actively involved in supporting communities across the country.

State Farm’s Mission Statement

State Farm’s mission statement is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” This statement reflects the company’s commitment to providing its customers with the financial security they need to achieve their goals.

Auto Insurance Products and Services: State Farms Auto Insurance

State Farm offers a comprehensive suite of auto insurance products and services designed to meet the diverse needs of its customers. These policies provide financial protection against various risks associated with owning and operating a vehicle.

Coverage Options

State Farm provides a range of coverage options to protect you and your vehicle in case of an accident or other covered event.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. It covers medical expenses, property damage, and legal fees. State Farm offers various liability limits to choose from, based on your individual needs and risk tolerance.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object, regardless of fault. Collision coverage is typically optional, but it is often required if you have a car loan or lease.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than a collision, such as theft, vandalism, fire, hail, or a falling object. Like collision coverage, it is typically optional.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured by a driver who does not have insurance or has insufficient insurance. It helps cover medical expenses, lost wages, and other damages.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other expenses for you and your passengers, regardless of fault. PIP coverage is required in some states.

- Medical Payments Coverage (Med Pay): This coverage provides medical expense coverage for you and your passengers, regardless of fault, up to a certain limit. Med Pay coverage is often a good option for those who want additional medical expense protection beyond their health insurance.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident. This can be helpful if you rely on your vehicle for transportation to work, school, or other essential activities.

- Roadside Assistance Coverage: This coverage provides assistance with services such as jump starts, flat tire changes, towing, and lockout assistance. This can be a valuable benefit for those who want peace of mind knowing that help is available if they experience a roadside emergency.

Key Features and Benefits, State farms auto insurance

State Farm’s auto insurance policies offer a range of features and benefits that can help you save money and protect your vehicle.

- Discounts: State Farm offers a variety of discounts to help you lower your premiums, including discounts for good driving records, safe driving courses, multiple policies, and safety features on your vehicle.

- 24/7 Customer Service: State Farm provides 24/7 customer service by phone, email, and online chat. This means you can get help with your insurance needs whenever you need it.

- Online and Mobile Access: State Farm offers online and mobile access to your policy information, allowing you to manage your insurance needs from the comfort of your home or on the go. This includes making payments, filing claims, and accessing your policy documents.

- Claims Process: State Farm has a streamlined claims process that makes it easy to file a claim and receive compensation for covered damages. The company has a strong reputation for prompt and fair claims handling.

- Financial Strength: State Farm is a financially strong company with a long history of stability. This means you can have confidence that your insurance needs will be met even in the event of a major catastrophe.

Comparison with Competitors

State Farm is one of the largest and most well-known auto insurance companies in the United States. It competes with other major insurers, such as Geico, Progressive, Allstate, and Nationwide. While all of these companies offer similar coverage options, there are some key differences in terms of pricing, features, and customer service.

- Pricing: State Farm’s premiums are generally competitive with those of other major insurers. However, the actual price you pay will depend on a variety of factors, such as your driving record, age, location, and the type of vehicle you drive. It is important to compare quotes from multiple insurers to find the best rate for your needs.

- Features: State Farm offers a wide range of features and benefits, including discounts, 24/7 customer service, and online and mobile access. Some of its competitors may offer unique features, such as ride-sharing coverage or telematics programs that can track your driving behavior and provide discounts based on safe driving. It is important to compare the features of different insurers to determine which ones are most important to you.

- Customer Service: State Farm has a strong reputation for customer service. However, customer satisfaction can vary depending on individual experiences. It is important to research customer reviews and ratings to get a sense of the overall customer service experience with different insurers.

Customer Experience and Reviews

State Farm, being one of the largest insurance providers in the US, boasts a substantial customer base. Understanding their experiences and feedback is crucial to assess the company’s performance and identify areas for improvement. This section delves into the analysis of customer reviews and ratings, exploring common themes and comparing State Farm’s performance with competitors.

Customer Reviews Analysis

Customer reviews provide valuable insights into the overall customer experience with State Farm’s auto insurance services. Analyzing these reviews reveals recurring themes and sentiments that shed light on the strengths and weaknesses of the company.

- Positive Reviews: Many customers commend State Farm for its excellent customer service, prompt claim processing, and competitive pricing. They appreciate the personalized attention they receive from their agents and the ease of managing their policies online.

- Negative Reviews: Some customers express dissatisfaction with State Farm’s claim handling process, citing delays and difficulties in resolving issues. Others complain about unexpected rate increases or limited coverage options.

Customer Satisfaction Ratings

Customer satisfaction ratings provide a quantitative measure of customer experience. While State Farm generally enjoys positive ratings, its performance varies across different metrics and compared to competitors.

- J.D. Power: State Farm has consistently received above-average ratings in J.D. Power’s annual Auto Insurance Satisfaction Study. In the 2022 study, State Farm ranked third overall, demonstrating its strong performance in customer satisfaction.

- Consumer Reports: Consumer Reports’ ratings for State Farm are mixed, with the company scoring above average in terms of policyholder satisfaction but receiving lower scores for claims handling and pricing.

- Other Sources: Reviews on websites like Trustpilot and Yelp provide a broader perspective on customer experiences. These platforms often showcase both positive and negative feedback, offering a more balanced view of State Farm’s performance.

Pricing and Discounts

State Farm’s auto insurance pricing is determined by a variety of factors, including your driving history, vehicle type, location, and coverage options. The company uses a complex algorithm to calculate your individual premium, ensuring that you pay a fair price for the level of protection you need.

Factors Influencing Auto Insurance Premiums

State Farm considers several factors when determining your auto insurance premium. These factors are designed to assess your risk profile and ensure that you pay a fair price for the coverage you receive.

- Driving History: Your driving record, including accidents, traffic violations, and driving history, plays a significant role in your premium. A clean driving record generally results in lower premiums.

- Vehicle Type: The type of vehicle you drive, including its make, model, year, and safety features, influences your premium. Higher-value vehicles or those with a history of theft or accidents may cost more to insure.

- Location: Your location, including the state and zip code, impacts your premium due to factors like population density, traffic congestion, and the frequency of accidents in your area.

- Coverage Options: The level of coverage you choose, such as liability, collision, and comprehensive, directly affects your premium. More comprehensive coverage generally leads to higher premiums.

- Age and Gender: Younger and less experienced drivers often pay higher premiums due to their higher risk profile. Gender can also play a role, as some studies suggest that men tend to have higher accident rates.

- Credit Score: In some states, your credit score can influence your auto insurance premium. This is because credit score can be a proxy for risk, and individuals with lower credit scores may be perceived as higher-risk drivers.

Discounts Offered by State Farm

State Farm offers a wide range of discounts to help policyholders save money on their auto insurance premiums. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other factors that contribute to lower risk.

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record and no accidents or traffic violations.

- Good Student Discount: Students who maintain a certain grade point average (GPA) can qualify for this discount.

- Multi-Car Discount: Insuring multiple vehicles with State Farm can result in a significant discount.

- Multi-Policy Discount: Combining auto insurance with other State Farm insurance policies, such as home or renter’s insurance, can lead to a discount.

- Defensive Driving Course Discount: Completing a certified defensive driving course can qualify you for a discount.

- Anti-Theft Device Discount: Installing anti-theft devices, such as alarms or GPS trackers, can lower your premium.

- Pay-in-Full Discount: Paying your premium in full upfront can often result in a discount.

- Paperless Billing Discount: Opting for electronic billing and communication can qualify you for a discount.

- Automatic Payment Discount: Setting up automatic payments for your premium can lead to a discount.

Note: Discount availability and eligibility criteria may vary by state and individual policy. It’s always advisable to contact State Farm directly to confirm the specific discounts you qualify for.

Claims Process and Customer Support

State Farm’s claims process is designed to be straightforward and convenient for policyholders. The company aims to provide a seamless experience for customers facing auto accidents, from reporting the incident to receiving compensation.

Claims Process

State Farm offers multiple channels for reporting an auto accident. Policyholders can file a claim online, through the State Farm mobile app, or by contacting a local agent or customer service representative. The company’s claims process typically involves the following steps:

- Report the Accident: Policyholders should report the accident as soon as possible, providing details about the incident, including the date, time, location, and parties involved.

- Gather Information: Policyholders should gather necessary information, such as the names, addresses, and insurance information of all parties involved, as well as details about the vehicles and any witnesses.

- Provide Documentation: Policyholders may need to provide documentation, such as a police report, photos of the damage, and medical records.

- Claim Review and Assessment: State Farm will review the claim and assess the damages.

- Claim Resolution: State Farm will work with the policyholder to resolve the claim, which may involve paying for repairs, medical expenses, or other related costs.

Customer Support Channels

State Farm provides a variety of customer support channels to assist policyholders with their claims and other insurance needs. These channels include:

- Online Services: Policyholders can access their account information, file claims, and manage their policies online through the State Farm website.

- Mobile App: The State Farm mobile app allows policyholders to file claims, track their claim status, and access other features on their mobile devices.

- Phone Support: Policyholders can reach State Farm’s customer service representatives by phone 24/7.

- Local Agents: Policyholders can contact their local State Farm agent for personalized assistance and support.

Claims Handling Efficiency and Responsiveness

State Farm is known for its efficient and responsive claims handling. The company has a strong track record of resolving claims promptly and fairly. State Farm strives to provide timely communication and updates to policyholders throughout the claims process.

Digital Tools and Technology

State Farm is committed to providing its customers with a seamless and convenient insurance experience. This commitment extends to its digital tools and technology, which empower policyholders to manage their insurance needs efficiently and effectively.

Digital Tools and Technology Offered by State Farm

State Farm offers a comprehensive suite of digital tools and technology designed to enhance the customer experience. These tools are available through the State Farm website, mobile app, and other digital platforms. Here’s a closer look at some of the key features:

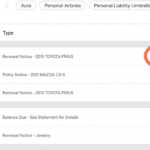

- State Farm Mobile App: The State Farm mobile app is a versatile tool that allows customers to manage their insurance policies, pay bills, view policy documents, file claims, and access roadside assistance. The app also provides real-time notifications and updates, keeping customers informed about important policy changes or claims updates.

- Online Policy Management: Customers can easily manage their insurance policies online, including making changes to coverage, adding or removing drivers, and updating personal information. This online platform provides a convenient and secure way to access and manage policy details.

- Digital Claims Filing: State Farm’s digital claims filing process allows customers to file claims online or through the mobile app. This process streamlines the claims process, making it faster and more efficient for both the customer and the insurer.

- Virtual Assistance: State Farm offers virtual assistance through its website and mobile app, providing customers with instant access to information and support. Virtual assistants can answer frequently asked questions, provide policy details, and guide customers through various tasks.

- Telematics Programs: State Farm offers telematics programs like Drive Safe & Save, which utilize mobile technology to track driving behavior. By analyzing driving data, these programs can provide feedback and potentially offer discounts based on safe driving habits.

Benefits of Using State Farm’s Digital Tools

State Farm’s digital tools offer several benefits to customers, including:

- Convenience: Digital tools allow customers to manage their insurance needs from the comfort of their homes or on the go, eliminating the need for physical visits or phone calls.

- Efficiency: Digital tools streamline various insurance processes, such as policy management, claims filing, and communication, making them faster and more efficient.

- Transparency: Digital tools provide customers with access to their policy information, claims history, and other relevant data, promoting transparency and accountability.

- Personalized Experience: State Farm’s digital tools leverage data and technology to personalize the customer experience, offering tailored recommendations and support based on individual needs.

Comparison of State Farm’s Digital Capabilities with Competitors

State Farm’s digital capabilities are comparable to those offered by other major insurance providers. Many insurers offer mobile apps, online policy management platforms, and digital claims filing processes. However, State Farm’s commitment to innovation and customer experience sets it apart.

- User-Friendly Interface: State Farm’s digital tools are designed with user-friendliness in mind, making them easy to navigate and use, even for those unfamiliar with technology.

- Comprehensive Functionality: State Farm’s digital tools offer a wide range of features, covering various insurance needs, from policy management to claims handling.

- Proactive Communication: State Farm utilizes digital channels to proactively communicate with customers, providing updates and reminders, ensuring they stay informed about their insurance needs.

Financial Strength and Stability

State Farm’s financial strength and stability are crucial considerations for potential customers. It’s essential to understand how the company performs financially and its ability to meet its obligations to policyholders.

Financial Performance and Stability

State Farm’s financial performance is consistently strong, demonstrating its stability and ability to meet its commitments to policyholders. The company’s financial performance is reflected in its consistent profitability, strong capital reserves, and favorable credit ratings.

Credit Ratings and Risk Management Practices

State Farm’s credit ratings are a testament to its strong financial standing. Major credit rating agencies like A.M. Best and Standard & Poor’s consistently assign high ratings to State Farm, reflecting its low risk profile and robust financial position. These ratings provide confidence to policyholders that State Farm is financially sound and capable of fulfilling its obligations.

State Farm’s credit ratings are a strong indicator of its financial health and ability to pay claims.

State Farm’s risk management practices are integral to its financial strength. The company employs a comprehensive approach to risk management, including careful underwriting, proactive loss prevention efforts, and efficient claims handling processes. These practices help mitigate potential risks and contribute to State Farm’s financial stability.

Comparison with Competitors

State Farm’s financial strength compares favorably to its competitors in the insurance industry. Its consistent profitability, strong capital reserves, and high credit ratings position it as a financially sound and reliable insurance provider.

Social Responsibility and Community Involvement

State Farm, a leading insurance provider, goes beyond providing financial protection and demonstrates a strong commitment to social responsibility and community involvement. This dedication is reflected in various initiatives that aim to make a positive impact on the lives of individuals and communities across the nation.

Community Grants and Support

State Farm’s commitment to community involvement is evident through its generous grant programs and support for local organizations. The company recognizes the importance of supporting initiatives that address critical community needs, such as education, safety, and disaster relief.

- State Farm provides grants to non-profit organizations through its “State Farm Neighborhood Assist” program, which empowers communities to identify and address local issues.

- State Farm supports organizations focused on youth development, such as the Boys & Girls Clubs of America, by providing financial assistance and volunteer opportunities.

- In the wake of natural disasters, State Farm actively participates in relief efforts by providing financial aid, supplies, and support to affected communities.

Disaster Relief and Preparedness

State Farm plays a significant role in disaster relief and preparedness efforts, recognizing the importance of supporting communities during times of crisis.

- State Farm’s “Catastrophe Response Team” is deployed to disaster-affected areas to provide immediate assistance and support to policyholders.

- The company offers resources and information to help individuals and communities prepare for potential disasters, including tips on creating emergency plans and securing property.

- State Farm partners with organizations like the American Red Cross to promote disaster preparedness and provide educational resources to the public.

Final Conclusion

Navigating the world of auto insurance can be complex, but State Farm’s commitment to providing comprehensive coverage, competitive pricing, and excellent customer service sets them apart. Whether you’re a seasoned driver or just starting out, understanding the nuances of State Farm’s offerings can help you find the right protection for your needs. By exploring their various policies, digital tools, and commitment to community involvement, you can gain valuable insights into this trusted insurance provider.

FAQs

What are the main types of auto insurance coverage offered by State Farm?

State Farm offers a variety of auto insurance coverages, including liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), and medical payments coverage (MedPay).

How do I get a quote for State Farm auto insurance?

You can get a quote for State Farm auto insurance online, over the phone, or through a local State Farm agent. You will need to provide some basic information about yourself and your vehicle.

Does State Farm offer discounts on auto insurance?

Yes, State Farm offers a variety of discounts on auto insurance, including discounts for good driving records, multiple policies, safety features, and more. You can learn more about these discounts on their website or by contacting an agent.