State Farm UTV insurance stands ready to safeguard your off-road adventures, offering comprehensive coverage for a wide range of utility vehicles. Whether you’re navigating rugged trails, exploring scenic landscapes, or simply enjoying a leisurely ride, State Farm provides peace of mind knowing you’re protected against potential risks.

State Farm’s UTV insurance policies are designed to cater to the unique needs of off-road enthusiasts, providing coverage options for liability, collision, comprehensive, and medical payments. These policies offer customizable features to ensure you have the right protection for your specific UTV and riding style.

State Farm UTV Insurance Overview

State Farm offers comprehensive insurance coverage for a wide range of UTVs, providing peace of mind for enthusiasts and recreational riders. Their policies are designed to protect you and your investment, ensuring you can enjoy your adventures with confidence.

Types of UTVs Covered

State Farm UTV insurance policies cover a diverse range of UTVs, including side-by-sides, ATVs, and other off-road vehicles. This includes:

- Side-by-Sides: These vehicles are designed for two or more passengers and are typically used for recreational activities, work, and utility purposes. They feature a spacious cabin with a roll cage for added safety.

- ATVs (All-Terrain Vehicles): These single-rider vehicles are popular for off-road adventures, farming, and other recreational activities. They are known for their maneuverability and versatility.

- Other Off-Road Vehicles: State Farm also covers a range of other off-road vehicles, including dune buggies, rock crawlers, and utility task vehicles (UTVs). These vehicles are designed for specific off-road terrains and activities.

Key Features and Benefits

State Farm UTV insurance offers a comprehensive set of features and benefits to protect you and your vehicle. These include:

- Liability Coverage: This protects you financially if you are involved in an accident that causes damage to another person’s property or injuries. It covers legal expenses and medical costs associated with the accident.

- Collision Coverage: This covers damage to your UTV if it is involved in an accident, regardless of fault. It helps pay for repairs or replacement costs, depending on the extent of the damage.

- Comprehensive Coverage: This protects your UTV from damage caused by events other than accidents, such as theft, vandalism, fire, and natural disasters. It helps cover repairs or replacement costs for these situations.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and vehicle damage costs.

- Medical Payments Coverage: This covers your medical expenses, regardless of fault, if you are injured in an accident. It helps pay for medical bills, regardless of who is at fault.

- Custom Parts and Equipment Coverage: State Farm offers coverage for aftermarket parts and equipment installed on your UTV, such as custom wheels, tires, and accessories. This ensures your investment is protected.

- Towing and Roadside Assistance: This provides assistance in case your UTV breaks down or gets stuck. It includes towing services, flat tire changes, and other roadside assistance.

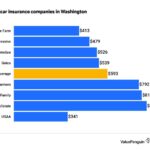

Comparison with Other Insurance Providers

State Farm UTV insurance offers competitive rates and comprehensive coverage compared to other insurance providers. They have a strong reputation for customer service and claim handling. When comparing State Farm UTV insurance to other providers, consider the following factors:

- Coverage Options: Compare the coverage options offered by different providers, including liability, collision, comprehensive, and other specialized coverages.

- Premiums: Obtain quotes from multiple providers to compare premiums and find the best value for your needs.

- Discounts: Inquire about discounts offered by each provider, such as safe driving discounts, multi-policy discounts, and good student discounts.

- Customer Service: Read reviews and testimonials from other customers to gauge the quality of customer service provided by each provider.

- Claim Handling: Research the claim handling process and reputation of each provider to ensure they have a smooth and efficient process.

Coverage Options for State Farm UTV Insurance

State Farm offers a variety of coverage options for your UTV, designed to provide you with the protection you need in case of an accident or other unforeseen event. These coverage options can be tailored to your specific needs and budget, ensuring you have the right amount of protection for your vehicle.

Liability Coverage

Liability coverage is a crucial part of any UTV insurance policy, as it protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to another person. State Farm offers several liability coverage options, including:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages if you injure someone in an accident. State Farm offers various limits for bodily injury liability coverage, such as $25,000 per person, $50,000 per accident, or $100,000 per accident.

- Property Damage Liability: This coverage pays for damages to another person’s property if you are at fault in an accident. Like bodily injury liability, you can choose different limits for property damage liability coverage.

Collision Coverage

Collision coverage pays for repairs or replacement of your UTV if it is damaged in an accident with another vehicle or object. This coverage is optional and can be purchased with a deductible, which is the amount you pay out of pocket before your insurance coverage kicks in.

Comprehensive Coverage

Comprehensive coverage protects your UTV from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or falling objects. This coverage is also optional and can be purchased with a deductible.

Medical Payments Coverage

Medical payments coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. This coverage is optional and can be purchased with a limit, which is the maximum amount your insurance company will pay.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. This coverage can help pay for your medical expenses and property damage, even if the other driver is at fault.

Table Comparing Coverage Options and Costs

| Coverage Option | Description | Cost |

|---|---|---|

| Liability Coverage | Protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to another person. | Varies based on factors such as your driving record, location, and the amount of coverage you choose. |

| Collision Coverage | Pays for repairs or replacement of your UTV if it is damaged in an accident with another vehicle or object. | Varies based on factors such as the value of your UTV, your driving record, and your deductible. |

| Comprehensive Coverage | Protects your UTV from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or falling objects. | Varies based on factors such as the value of your UTV, your driving record, and your deductible. |

| Medical Payments Coverage | Pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. | Varies based on factors such as the amount of coverage you choose and your driving record. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who is uninsured or underinsured. | Varies based on factors such as your driving record and the amount of coverage you choose. |

Factors Affecting State Farm UTV Insurance Premiums

The cost of your State Farm UTV insurance premium is influenced by several factors. Understanding these factors can help you make informed decisions about your UTV and insurance coverage.

Type of UTV

The type of UTV you own plays a significant role in determining your insurance premium. State Farm considers factors like the UTV’s make, model, year, and engine size to assess its value and potential risk. Higher-performance UTVs with powerful engines may be considered riskier and therefore carry higher premiums. Similarly, UTVs with advanced safety features, such as anti-lock brakes or airbags, may receive a discount.

Driver’s Age and Experience

Your age and driving experience are also important factors in determining your premium. Younger and less experienced drivers are statistically more likely to be involved in accidents. As a result, they may face higher premiums compared to older, more experienced drivers with a clean driving record.

Location

The location where you primarily use your UTV can significantly impact your insurance premium. Areas with high rates of UTV accidents or theft may have higher insurance premiums. State Farm assesses the risk of your location based on factors like traffic density, crime rates, and the prevalence of off-road trails.

Usage

The frequency and type of use of your UTV also influence your insurance premium. UTVs used primarily for recreational purposes on private property may have lower premiums than those used for work or in demanding off-road environments. For example, a UTV used for farming or construction work may be subject to higher premiums due to the increased risk of accidents or damage.

Hypothetical Scenario

Imagine two individuals, both with clean driving records, seeking insurance for their UTVs. Person A owns a new, high-performance UTV and uses it for off-road racing on weekends. Person B owns an older, less powerful UTV and primarily uses it for recreational riding on their private property. Person A lives in an urban area with a high density of UTV traffic, while Person B lives in a rural area with limited off-road trails. In this scenario, Person A is likely to face a higher insurance premium due to the higher risk associated with their UTV, its usage, and their location. Person B, on the other hand, is likely to receive a lower premium due to the lower risk associated with their UTV, its usage, and their location.

State Farm UTV Insurance Claims Process

Navigating a UTV accident can be stressful, but State Farm makes the claims process straightforward. Whether it’s a collision, theft, or damage from a natural disaster, understanding the steps involved can ease the burden.

Filing a Claim

The first step is to report the accident to State Farm as soon as possible. This can be done by phone, online, or through the State Farm mobile app. Provide details of the incident, including the date, time, location, and any injuries.

Documentation and Procedures

To ensure a smooth claims process, gather the following documentation:

- Police report (if applicable)

- Photos and videos of the damaged UTV and the accident scene

- Information about any witnesses

- Your UTV insurance policy details

- Proof of ownership

State Farm may also request additional documentation, depending on the nature of the claim.

Claim Processing and Settlement

Once you file a claim, State Farm will assign a claims adjuster to your case. The adjuster will review the documentation, investigate the accident, and assess the damages. They will then provide you with an estimate of the repair or replacement costs.

State Farm aims to process claims efficiently. The typical timeframe for claim processing and settlement can vary depending on the complexity of the claim and the availability of necessary information.

For example, a simple claim for minor damage might be settled within a few weeks, while a more complex claim involving significant damage or legal issues could take longer.

State Farm offers various payment options, including direct payment to repair shops or reimbursement to you.

Safety Tips for UTV Operators

Operating a UTV can be a fun and exciting experience, but it’s crucial to prioritize safety to prevent accidents and injuries. By following these safety tips, you can enjoy your UTV adventures while minimizing risks.

Proper Gear

Wearing appropriate gear can significantly reduce the severity of injuries in case of an accident.

- Helmets: Always wear a DOT-approved helmet specifically designed for off-road use. Helmets protect your head from impact and provide crucial safety in case of a rollover or collision.

- Eye Protection: Goggles or safety glasses are essential to shield your eyes from debris, dust, and wind. They also help prevent eye injuries caused by flying objects or branches.

- Gloves: Gloves protect your hands from abrasion, burns, and blisters. They also improve grip and control, particularly in challenging terrain.

- Boots: Wear sturdy, closed-toe boots that provide ankle support. This helps prevent foot injuries and provides stability while driving.

- Protective Clothing: Long pants, long-sleeved shirts, and jackets offer protection from the elements and abrasion. Consider wearing brightly colored clothing for increased visibility.

Driving Practices

Safe driving practices are crucial for preventing accidents and ensuring a safe UTV experience.

- Speed Limits: Always adhere to posted speed limits and adjust your speed based on terrain and visibility conditions. Excessive speed can lead to loss of control and rollovers.

- Terrain Awareness: Be mindful of the terrain and obstacles you encounter. Avoid driving over steep slopes, rough terrain, or areas with hidden hazards. Familiarize yourself with the area before driving.

- Defensive Driving: Always be aware of your surroundings and anticipate potential hazards. Maintain a safe following distance and be prepared to react quickly to unexpected situations.

- Passenger Safety: Ensure all passengers are wearing appropriate safety gear and are seated securely. Never exceed the UTV’s maximum passenger capacity.

- Alcohol and Drugs: Never operate a UTV under the influence of alcohol or drugs. Impairment can significantly impact your judgment and reaction time, increasing the risk of accidents.

Maintenance, State farm utv insurance

Regular maintenance is essential for ensuring your UTV operates safely and reliably.

- Regular Inspections: Perform regular inspections of your UTV’s brakes, tires, lights, steering, and other essential components. Ensure all fluids are at the proper levels.

- Tire Pressure: Maintain proper tire pressure according to the manufacturer’s recommendations. Under-inflated tires can lead to blowouts, while over-inflated tires can reduce traction and handling.

- Brakes: Check your brakes regularly for wear and tear. Replace brake pads or shoes as needed. Ensure the brake fluid is at the correct level.

- Lights: Verify that all headlights, taillights, and turn signals are functioning correctly. Ensure the headlights are properly aligned.

- Safety Equipment: Inspect safety equipment such as seat belts, roll cages, and fire extinguishers to ensure they are in good working order.

Resources and Contact Information

This section provides a comprehensive list of valuable resources for UTV owners, including safety organizations, regulatory agencies, and repair shops. Additionally, you’ll find the contact information for State Farm’s UTV insurance department, ensuring you have the support you need.

Safety Organizations and Regulatory Agencies

Safety organizations and regulatory agencies play a crucial role in promoting safe UTV operation and setting industry standards. These organizations offer valuable resources, including safety guidelines, training materials, and accident statistics.

- The National Highway Traffic Safety Administration (NHTSA): NHTSA is the U.S. government agency responsible for setting safety standards for vehicles, including UTVs. They offer a wealth of information on UTV safety, including accident data, safety tips, and recalls. Contact: 1-888-327-4236. Website: https://www.nhtsa.gov

- The Association of American Railroads (AAR): The AAR is a trade association that represents the North American freight rail industry. They offer resources and information on safe rail crossings, which are particularly relevant for UTV owners who may encounter them on their adventures. Contact: 1-202-639-2100. Website: https://www.aar.org

- The National Off-Highway Vehicle Conservation Council (NOHVCC): NOHVCC is a non-profit organization dedicated to promoting responsible off-highway vehicle use. They offer a variety of resources, including trail maps, safety tips, and advocacy for responsible OHV use. Contact: 1-701-223-4644. Website: https://www.nohvcc.org

UTV Repair Shops

UTV repair shops specialize in maintaining and repairing these vehicles, ensuring they are in top condition for safe operation. They offer a range of services, including routine maintenance, repairs, and customization.

- Local UTV Dealerships: Most UTV manufacturers have authorized dealerships that offer repair services for their specific models. These dealerships often have trained technicians familiar with the latest technologies and parts. Contact: Refer to your UTV manufacturer’s website for a list of authorized dealerships in your area.

- Independent UTV Repair Shops: There are also independent repair shops that specialize in UTVs. These shops may offer more competitive pricing and flexible scheduling. Contact: Search online directories or ask for recommendations from other UTV owners in your area.

State Farm UTV Insurance Department

For any questions or inquiries regarding State Farm’s UTV insurance coverage, you can reach out to their dedicated department. They are available to provide information, answer questions, and assist you with any insurance needs.

| Contact Information | Details |

|---|---|

| Phone Number | 1-800-STATE-FARM (1-800-782-8332) |

| Website | https://www.statefarm.com |

Wrap-Up

When it comes to protecting your investment and ensuring a safe and enjoyable off-road experience, State Farm UTV insurance emerges as a reliable partner. With its comprehensive coverage options, competitive pricing, and commitment to customer satisfaction, State Farm empowers you to confidently explore the great outdoors, knowing you have a trusted ally by your side.

FAQ Insights

What types of UTVs are covered by State Farm insurance?

State Farm typically covers a wide range of UTVs, including side-by-sides, ATVs, and other utility vehicles. It’s best to contact your local State Farm agent to confirm coverage for your specific UTV model.

How do I get a quote for State Farm UTV insurance?

You can easily obtain a quote online through State Farm’s website or by contacting your local agent. They will ask for details about your UTV, driving history, and other relevant information to provide you with an accurate quote.

What are the typical deductibles for State Farm UTV insurance?

Deductibles for State Farm UTV insurance can vary depending on your coverage options and chosen plan. It’s recommended to discuss deductible options with your agent to determine the best fit for your needs and budget.

What are some common exclusions in State Farm UTV insurance policies?

Common exclusions may include coverage for racing, commercial use, or modifications that significantly alter the vehicle’s safety or performance. It’s important to carefully review your policy to understand the specific exclusions.