State Farm tractor insurance is a vital investment for farmers and agricultural businesses, offering comprehensive protection for their valuable equipment. Whether you’re a seasoned farmer or just starting out, understanding the coverage options and factors influencing insurance costs is essential.

State Farm provides various insurance policies tailored to meet the specific needs of tractor owners, including coverage for accidents, theft, fire, and other unforeseen events. By choosing the right coverage, you can ensure peace of mind knowing your investment is protected.

State Farm Tractor Insurance Overview

State Farm offers a comprehensive tractor insurance policy designed to protect your investment and provide peace of mind. Whether you use your tractor for farming, landscaping, or other purposes, State Farm’s insurance can help you recover from unexpected events.

State Farm’s tractor insurance provides financial protection against various risks, including accidents, theft, fire, and natural disasters. It also offers additional coverage options to customize your policy based on your specific needs and the value of your tractor.

Types of Coverage

State Farm offers a range of coverage options for your tractor, including:

- Liability Coverage: This coverage protects you financially if you are found liable for an accident that causes damage to another person’s property or injuries to others.

- Collision Coverage: This coverage helps pay for repairs or replacement of your tractor if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your tractor from damage caused by events other than accidents, such as theft, fire, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault.

- Towing and Labor Coverage: This coverage helps pay for towing and labor costs if your tractor breaks down or needs repairs.

Situations Where State Farm Tractor Insurance is Beneficial

State Farm tractor insurance can be beneficial in various situations, such as:

- Accidents: If you are involved in an accident with your tractor, State Farm’s insurance can help cover the costs of repairs or replacement, as well as any liability claims.

- Theft: If your tractor is stolen, State Farm’s comprehensive coverage can help replace it or reimburse you for its value.

- Fire: If your tractor is damaged or destroyed by fire, State Farm’s comprehensive coverage can help cover the costs of repairs or replacement.

- Natural Disasters: If your tractor is damaged or destroyed by a natural disaster, such as a flood, hurricane, or tornado, State Farm’s comprehensive coverage can help cover the costs of repairs or replacement.

- Liability Claims: If you are sued for damages caused by your tractor, State Farm’s liability coverage can help defend you in court and pay any judgments or settlements.

Tractor Insurance Coverage Options

State Farm offers a variety of tractor insurance coverage options to protect your investment and ensure peace of mind. These options can be tailored to your specific needs and budget, providing you with the right amount of protection for your valuable tractor.

Coverage Levels and Costs

State Farm’s tractor insurance coverage options are designed to offer different levels of protection, with varying costs reflecting the scope of coverage.

- Basic Coverage: This level provides the most fundamental protection, covering your tractor against damages resulting from specific perils like fire, theft, and certain weather events. It typically has lower premiums compared to more comprehensive options.

- Comprehensive Coverage: This level offers broader protection, encompassing the perils covered by basic coverage and expanding to include damages from collisions, rollovers, and other incidents. Comprehensive coverage comes with higher premiums due to its wider range of protection.

- Collision Coverage: This level focuses on covering damages caused by collisions with other vehicles or objects. While it doesn’t cover all perils, it can be particularly beneficial for tractors that are frequently used on public roads.

- Liability Coverage: This level protects you against financial responsibility for injuries or damages caused to others while operating your tractor. It’s crucial for ensuring financial protection in case of accidents involving third parties.

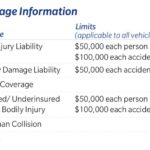

Deductibles and Limits

Deductibles and limits play a crucial role in determining the cost of your tractor insurance.

- Deductibles: This is the amount you pay out of pocket for each claim before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums.

- Limits: This refers to the maximum amount your insurance policy will pay for a specific type of claim. Higher limits typically mean higher premiums, while lower limits result in lower premiums.

Exclusions

While State Farm’s tractor insurance policies offer comprehensive protection, there are certain exclusions that are not covered.

- Wear and Tear: Normal wear and tear on your tractor is generally not covered by insurance.

- Mechanical Breakdown: Mechanical failures not caused by covered perils are typically excluded.

- Negligence: Damages resulting from your negligence, such as failing to maintain your tractor properly, may not be covered.

Table of Coverage Options

Here’s a table summarizing the key features of State Farm’s tractor insurance coverage options:

| Coverage Option | Deductible | Limit | Exclusions |

|---|---|---|---|

| Basic Coverage | $500 – $1,000 | $25,000 – $50,000 | Wear and tear, mechanical breakdown, negligence |

| Comprehensive Coverage | $500 – $1,000 | $50,000 – $100,000 | Wear and tear, mechanical breakdown, negligence |

| Collision Coverage | $500 – $1,000 | $25,000 – $50,000 | Wear and tear, mechanical breakdown, negligence |

| Liability Coverage | N/A | $100,000 – $300,000 | Intentional acts, criminal activity |

Factors Affecting Tractor Insurance Costs

Your State Farm tractor insurance premium is determined by a variety of factors, ensuring that you pay a fair price for the coverage you need. Several key elements come into play when calculating your premium.

Tractor Type

The type of tractor you own significantly influences your insurance cost. Different tractor types carry varying levels of risk. For example, a high-horsepower tractor used for heavy-duty farming operations will likely have a higher premium than a smaller, utility tractor used for light tasks.

- Horsepower: Tractors with higher horsepower ratings are generally considered more expensive to repair or replace, resulting in higher premiums.

- Features: Tractors equipped with advanced features, such as GPS guidance systems or automated controls, may be subject to higher premiums due to their greater complexity and repair costs.

- Usage: The type of work your tractor performs also impacts your premium. Tractors used for intensive agricultural activities, such as plowing or harvesting, are typically associated with a higher risk of damage or accidents, leading to higher premiums.

Tractor Age

The age of your tractor is another critical factor in determining your insurance premium. Newer tractors generally have lower premiums than older models.

- Depreciation: As tractors age, their value decreases, resulting in lower premiums.

- Maintenance: Older tractors may require more frequent maintenance and repairs, potentially increasing the risk of breakdowns and accidents.

- Safety Features: Older tractors may lack modern safety features found in newer models, which could increase the likelihood of accidents and injuries.

Tractor Usage

The frequency and intensity of your tractor’s use directly impact your insurance premium. Tractors used more frequently and in demanding environments are subject to higher premiums.

- Hours of Operation: Tractors used for extended periods or in high-demand situations have a greater risk of damage or accidents, leading to higher premiums.

- Operating Conditions: Tractors operating in harsh environments, such as mountainous terrain or heavy construction sites, may be subject to higher premiums due to increased risks.

Location, State farm tractor insurance

The location where your tractor is stored and operated can influence your insurance premium.

- Rural vs. Urban: Tractors stored in rural areas, where theft and vandalism are less common, may have lower premiums than those stored in urban areas.

- Climate: Tractors operating in areas with extreme weather conditions, such as hurricanes or tornadoes, may be subject to higher premiums due to increased risk of damage.

Safety Features

Tractors equipped with safety features, such as roll-over protection structures (ROPS), seat belts, and emergency brakes, can help lower your insurance premium. These features reduce the risk of accidents and injuries, making your tractor a safer investment.

Driver Experience

The experience level of the tractor operator can also influence your insurance premium. Experienced operators with a good driving record may qualify for lower premiums than inexperienced operators.

State Farm Tractor Insurance Claims Process

Filing a tractor insurance claim with State Farm is a straightforward process designed to help you get back on track quickly. Here’s a step-by-step guide to help you navigate the process.

Reporting a Claim

After an accident or damage to your tractor, it’s important to report the claim to State Farm as soon as possible. This will help initiate the claims process and ensure a timely resolution.

- Contact State Farm: Call State Farm’s customer service line or visit their website to report the claim. Provide the necessary information about the incident, including the date, time, location, and details of the damage.

- Gather Information: Be prepared to provide the following information to State Farm:

- Your policy number

- Your tractor’s identification number (VIN)

- Details of the accident or damage

- Contact information for any other parties involved

- Any witnesses to the incident

- Take Photographs: Take clear photographs of the damage to your tractor, the accident scene, and any other relevant details. These photos will serve as valuable evidence for your claim.

- File a Police Report: If the accident involves another vehicle or property damage, it’s essential to file a police report. This report will document the incident and provide official documentation for your claim.

Claim Review and Settlement

Once you’ve reported your claim, State Farm will begin the review process. This typically involves the following steps:

- Claim Assessment: A State Farm representative will review the details of your claim, including your policy coverage, the incident report, and any supporting documentation you provide.

- Damage Inspection: A qualified inspector may be assigned to assess the damage to your tractor. They will determine the extent of the damage and provide an estimate of the repair costs.

- Claim Settlement: Based on the assessment and inspection, State Farm will determine the amount of your claim settlement. This amount will be based on your policy coverage and the estimated repair costs. You can choose to receive the settlement as a direct payment to the repair shop or as a lump sum payment to cover the repairs yourself.

Comparing State Farm Tractor Insurance with Competitors

Choosing the right tractor insurance can be a significant decision for any farmer or agricultural business owner. While State Farm is a well-known name in the insurance industry, it’s essential to compare their offerings with those of other major competitors to find the best fit for your needs. This comparison will delve into the strengths and weaknesses of each provider, focusing on coverage options, pricing, and customer service.

Coverage Options

To understand the differences between State Farm and its competitors, it’s crucial to examine the coverage options they offer. While most providers offer standard coverage like liability, collision, and comprehensive, some may have specialized options tailored to specific agricultural needs.

- State Farm offers a comprehensive range of tractor insurance coverage, including liability, collision, comprehensive, and optional coverage like uninsured/underinsured motorist, personal injury protection, and medical payments. They also offer coverage for attachments and implements.

- Progressive provides similar coverage options to State Farm, including liability, collision, comprehensive, and optional coverage like uninsured/underinsured motorist, personal injury protection, and medical payments. They also offer specialized coverage for agricultural equipment and machinery.

- Farmers Insurance offers comprehensive tractor insurance, including liability, collision, comprehensive, and optional coverage like uninsured/underinsured motorist, personal injury protection, and medical payments. They also provide specialized coverage for farm property and livestock.

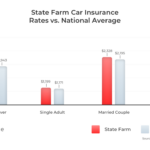

Pricing

Pricing is a critical factor for any insurance policy. While coverage options are important, the cost of the policy directly impacts the budget. Here’s a breakdown of pricing considerations:

- State Farm generally offers competitive pricing for tractor insurance. However, their rates can vary based on factors like the tractor’s age, value, usage, and the insured’s location.

- Progressive is known for its competitive pricing and often offers discounts for various factors, including safety features, multiple policies, and good driving records. They also have a strong online presence and use technology to streamline the quoting process.

- Farmers Insurance offers competitive pricing for tractor insurance, often with discounts for bundling policies and good driving records. They also have a strong reputation for personalized service and local agents.

Customer Service

Customer service is an essential aspect of any insurance provider. A positive customer experience can be crucial during a claim or when seeking information.

- State Farm has a long history of providing excellent customer service. They have a network of local agents and a strong online presence, making it easy for customers to access information and file claims.

- Progressive offers a variety of customer service channels, including online chat, phone support, and a network of local agents. They have a reputation for responsiveness and efficiency.

- Farmers Insurance emphasizes personalized service and local agents who can provide tailored advice and support. They have a strong reputation for handling claims efficiently and fairly.

Key Differences in Tractor Insurance

| Feature | State Farm | Progressive | Farmers Insurance |

|---|---|---|---|

| Coverage Options | Comprehensive, including liability, collision, comprehensive, and optional coverage like uninsured/underinsured motorist, personal injury protection, and medical payments. Coverage for attachments and implements. | Comprehensive, including liability, collision, comprehensive, and optional coverage like uninsured/underinsured motorist, personal injury protection, and medical payments. Specialized coverage for agricultural equipment and machinery. | Comprehensive, including liability, collision, comprehensive, and optional coverage like uninsured/underinsured motorist, personal injury protection, and medical payments. Specialized coverage for farm property and livestock. |

| Pricing | Generally competitive, with rates varying based on factors like the tractor’s age, value, usage, and the insured’s location. | Known for competitive pricing and discounts for various factors, including safety features, multiple policies, and good driving records. | Offers competitive pricing with discounts for bundling policies and good driving records. |

| Customer Service | Long history of providing excellent customer service with a network of local agents and a strong online presence. | Offers a variety of customer service channels, including online chat, phone support, and a network of local agents. Known for responsiveness and efficiency. | Emphasizes personalized service and local agents who can provide tailored advice and support. Strong reputation for handling claims efficiently and fairly. |

Tips for Saving on Tractor Insurance

Saving money on tractor insurance is a smart move for any farmer or landowner. By taking a few proactive steps, you can potentially lower your premiums and keep more money in your pocket.

Benefits of Bundling Insurance Policies

Bundling your tractor insurance with other State Farm policies, like auto, home, or renters insurance, can lead to significant savings. State Farm often offers discounts for bundling multiple policies, rewarding you for consolidating your insurance needs with them. This strategy allows you to enjoy a lower overall premium while still benefiting from comprehensive coverage for all your assets.

Ultimate Conclusion

In conclusion, State Farm tractor insurance offers a comprehensive solution for safeguarding your agricultural equipment. By understanding the various coverage options, factors affecting premiums, and claim process, you can make informed decisions to protect your investment and minimize financial risks. Remember to compare State Farm’s offerings with competitors and utilize available resources to find the best insurance policy for your needs.

Clarifying Questions

What types of tractors are covered by State Farm insurance?

State Farm covers a wide range of tractors, including farm tractors, utility tractors, and compact tractors. The specific types of tractors covered may vary depending on the policy.

How do I get a quote for State Farm tractor insurance?

You can obtain a quote online, over the phone, or by visiting a State Farm agent. You will need to provide information about your tractor, usage, and other relevant details.

What are some tips for reducing my State Farm tractor insurance premiums?

Some tips include maintaining a good driving record, implementing safety measures, and bundling your tractor insurance with other policies.