State Farm renters insurance cost is a crucial factor to consider when protecting your belongings and financial well-being. Renters insurance, provided by State Farm, offers essential coverage against unexpected events like theft, fire, and natural disasters. Understanding the cost of this insurance and the factors that influence it is vital for making informed decisions about your financial security.

This guide delves into the intricacies of State Farm renters insurance, providing insights into coverage options, premium calculations, and strategies for maximizing savings. By exploring key aspects like coverage limits, discounts, and claim procedures, you can gain a comprehensive understanding of how State Farm renters insurance can safeguard your assets and provide peace of mind.

State Farm Renters Insurance Overview

State Farm Renters Insurance is designed to protect your personal belongings and financial well-being in case of unforeseen events that damage your rented property. This insurance policy provides coverage for losses due to fire, theft, vandalism, and other covered perils, ensuring you can recover from unexpected situations and rebuild your life.

Benefits of State Farm Renters Insurance

Having renters insurance with State Farm offers several benefits, including financial protection, peace of mind, and legal support.

- Financial Protection: Renters insurance provides financial compensation for losses to your personal belongings, including furniture, electronics, clothing, and other valuables. This coverage helps you replace or repair damaged items, minimizing financial strain in the event of a covered incident.

- Peace of Mind: Knowing that your belongings are insured against unexpected events gives you peace of mind. You can focus on recovering from the incident without worrying about the financial burden of replacing lost or damaged items.

- Legal Support: Renters insurance can provide legal support if you are sued by a third party for an incident occurring in your rented property. This coverage protects you from financial losses and legal complications.

Key Features and Options

State Farm Renters Insurance offers various features and options to tailor your coverage to your specific needs.

- Personal Property Coverage: This coverage protects your belongings against covered perils, including fire, theft, vandalism, and natural disasters. You can choose the coverage amount based on the value of your possessions.

- Liability Coverage: This coverage protects you against lawsuits filed by third parties for injuries or property damage that occur on your rented property. You can choose the coverage amount based on your risk tolerance and the potential liability exposure.

- Additional Living Expenses Coverage: This coverage provides financial assistance for temporary housing and other expenses if you are unable to live in your rented property due to a covered incident. This helps you maintain a comfortable living standard during the recovery period.

- Personal Injury Coverage: This coverage protects you against claims of slander, libel, or invasion of privacy. It can help you cover legal expenses and settlements in case of such incidents.

Factors Influencing Renters Insurance Cost

Several factors contribute to the cost of State Farm renters insurance. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

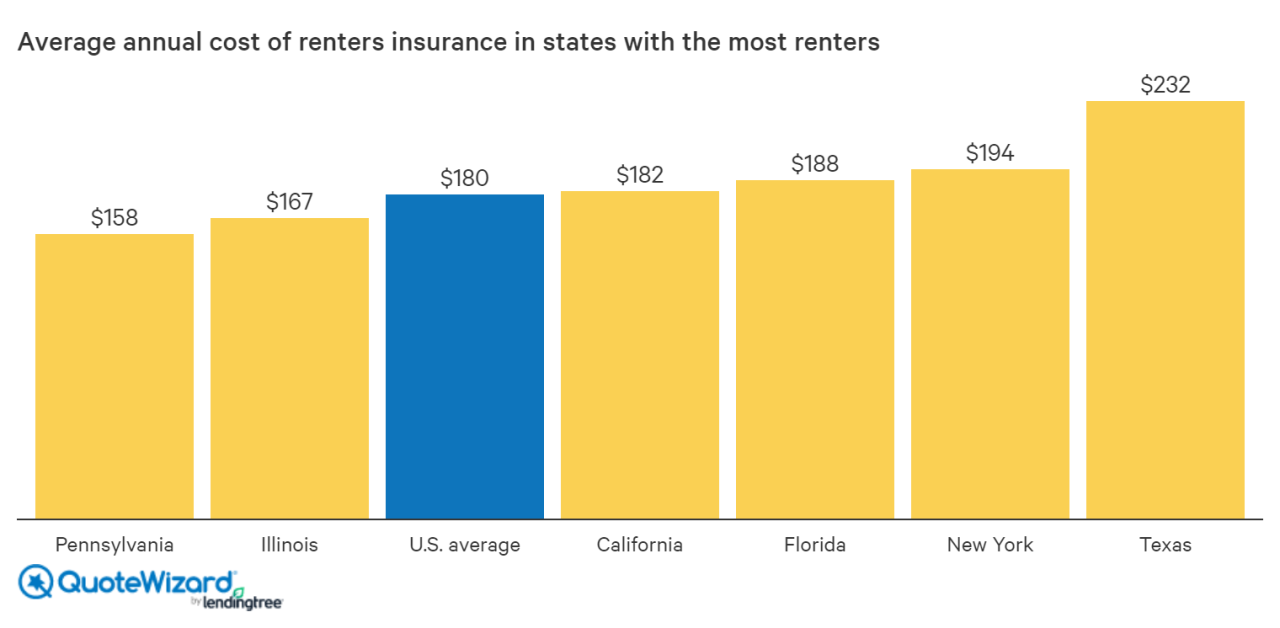

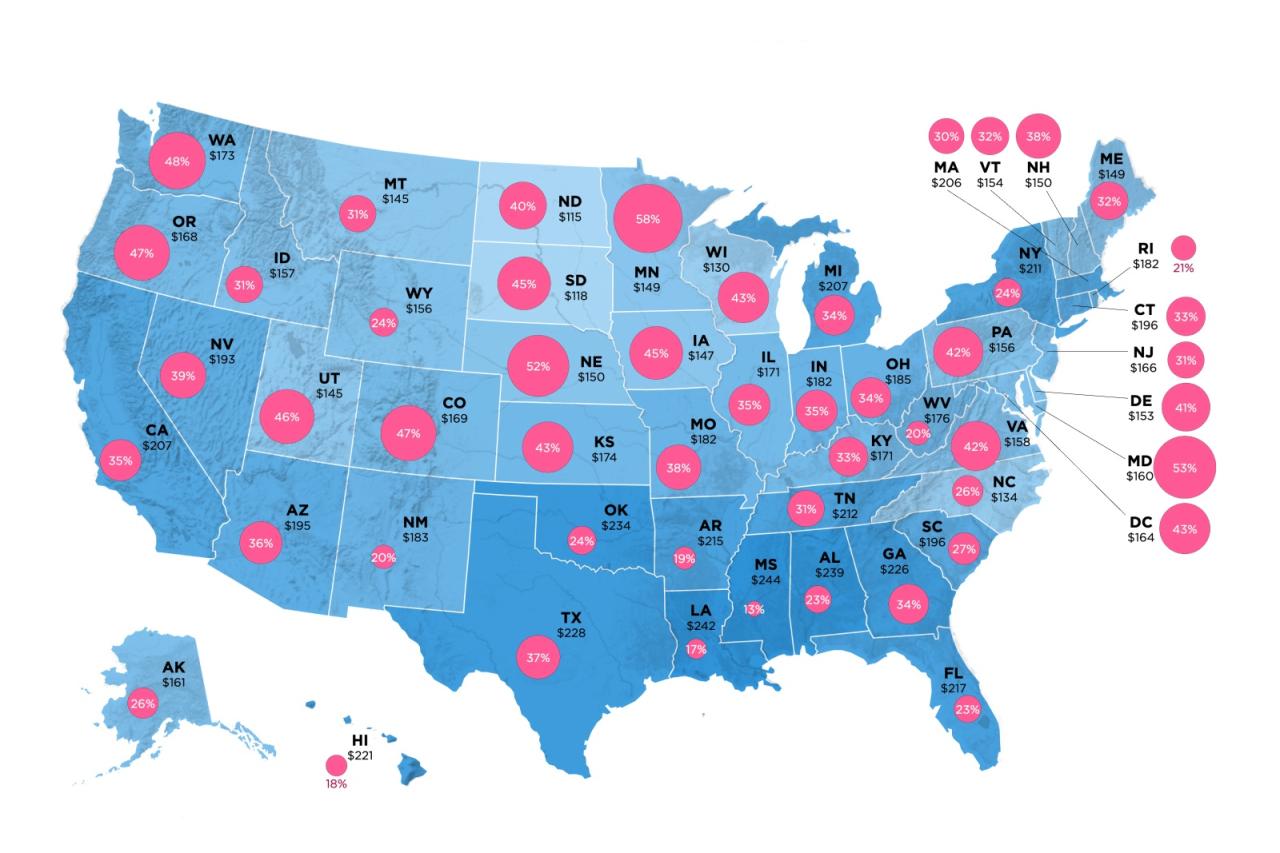

Location

Your location plays a significant role in determining your renters insurance cost. Areas with higher crime rates, natural disaster risks, or a higher cost of living generally have higher premiums. For instance, a renter in a city with frequent burglaries may pay more than someone in a rural area with a lower crime rate.

Coverage Amount

The amount of coverage you choose directly impacts your premium. The more coverage you need, the higher your premium will be. This is because you’re essentially paying for a higher level of financial protection in case of a covered loss.

Deductible

Your deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. A higher deductible means you pay less in premiums but more in the event of a claim. Conversely, a lower deductible means higher premiums but lower out-of-pocket expenses.

For example, if you choose a $500 deductible, you’ll pay a lower premium than if you choose a $1000 deductible. However, if you have a claim, you’ll need to pay the first $500 out of pocket.

Personal Risk Factors

Your personal risk factors can also affect your premiums. For example, if you have a history of claims or a poor credit score, you may pay more for insurance.

Table of Factors Affecting Premium Calculations

| Factor | Example | Impact on Premium |

|---|---|---|

| Location | City with high crime rate vs. rural area | Higher premium in the city |

| Coverage Amount | $50,000 coverage vs. $100,000 coverage | Higher premium for $100,000 coverage |

| Deductible | $500 deductible vs. $1000 deductible | Lower premium for $1000 deductible |

| Personal Risk Factors | Previous claims or poor credit score | Higher premium |

Obtaining a Quote and Policy

Getting a quote for State Farm renters insurance is a straightforward process. You can easily obtain a quote online, over the phone, or by visiting a local State Farm agent.

Obtaining a Quote

You can obtain a quote for State Farm renters insurance in a few easy steps.

- Gather your information: Before you start, you’ll need to gather some basic information about your rental property and belongings. This includes your address, the value of your belongings, and any security features you have in place.

- Visit the State Farm website: Navigate to the State Farm website and select “Renters Insurance” from the menu.

- Enter your information: Enter the requested information about your rental property and belongings.

- Get your quote: State Farm will provide you with a personalized quote based on the information you provided.

Applying for a Policy

Once you have received a quote and are satisfied with the coverage options and price, you can apply for a policy.

- Review the policy details: Carefully review the policy details, including the coverage limits, deductibles, and exclusions.

- Provide required documentation: State Farm may require you to provide certain documentation, such as proof of residency or a list of your belongings.

- Make your payment: Once you have reviewed the policy and provided the necessary documentation, you can make your first premium payment.

- Receive your policy: State Farm will issue your policy once your payment is processed.

Comparing Quotes

Comparing quotes from different insurers is crucial to ensure you are getting the best possible rate for your renters insurance.

- Use online comparison tools: Several online comparison tools can help you quickly compare quotes from multiple insurers.

- Contact multiple insurers directly: You can also contact multiple insurers directly to get quotes.

- Consider coverage options: When comparing quotes, make sure to compare the coverage options offered by each insurer.

- Read the fine print: Always carefully review the policy details before making a decision.

Coverage Options and Limits: State Farm Renters Insurance Cost

State Farm offers a variety of coverage options for renters insurance, allowing you to customize your policy to meet your specific needs and budget. The coverage options include personal property, liability, and additional living expenses, each with its own limits and features.

Personal Property Coverage

Personal property coverage protects your belongings against covered perils such as fire, theft, and vandalism. This coverage reimburses you for the actual cash value (ACV) or replacement cost value (RCV) of your belongings, depending on your chosen coverage.

The actual cash value (ACV) is the replacement cost of your belongings minus depreciation, while the replacement cost value (RCV) covers the full cost of replacing your belongings without deducting depreciation.

The limit of your personal property coverage is the maximum amount State Farm will pay for your belongings in the event of a covered loss. You can choose a coverage limit that aligns with the value of your belongings.

Liability Coverage

Liability coverage protects you financially if you are found legally responsible for causing injury or damage to another person or their property. This coverage covers legal defense costs, medical expenses, and property damage up to your chosen limit.

For example, if a guest in your apartment is injured due to a slip and fall, your liability coverage can help pay for their medical expenses and legal costs.

Additional Living Expenses

Additional living expenses coverage helps pay for temporary housing, food, and other essential expenses if you are unable to live in your apartment due to a covered loss. This coverage can help you maintain your standard of living while your apartment is being repaired or rebuilt.

For example, if a fire forces you to evacuate your apartment, this coverage can help you pay for a hotel stay and meals until you can return home.

Coverage Limits

The following table summarizes the coverage options and limits available with State Farm renters insurance:

| Coverage Option | Description | Typical Coverage Limits |

|—|—|—|

| Personal Property | Protects your belongings against covered perils | $10,000 – $100,000 |

| Liability | Protects you financially if you are found legally responsible for causing injury or damage | $100,000 – $300,000 |

| Additional Living Expenses | Helps pay for temporary housing and other essential expenses | 20% – 50% of your personal property coverage |

Choosing the Right Coverage Limits

It is important to select coverage limits that are adequate for your needs and the value of your belongings. You should consider the following factors:

* The value of your belongings: Determine the replacement cost of your belongings, taking into account factors such as age, condition, and market value.

* Your risk tolerance: Consider your willingness to bear the financial burden of a significant loss.

* Your budget: Factor in the cost of your premiums and the coverage limits you need.

Discounts and Savings

State Farm offers a variety of discounts to help renters save money on their insurance premiums. These discounts can significantly reduce your overall cost, making renters insurance more affordable.

Discounts Offered by State Farm

Here are some of the common discounts that State Farm offers to renters:

- Multi-policy Discount: This is one of the most popular discounts offered by State Farm. If you bundle your renters insurance with other State Farm policies, such as auto insurance, you can save a significant amount on your premiums. For example, if you have both auto and renters insurance with State Farm, you could save up to 15% on your premiums.

- Safety Features Discount: If your rental property has certain safety features, such as smoke detectors, burglar alarms, or fire sprinklers, you may be eligible for a discount on your renters insurance. These safety features help reduce the risk of damage or loss, which in turn lowers the insurer’s liability.

- Claim-Free Discount: If you have a history of not filing claims on your insurance, you may qualify for a claim-free discount. This discount rewards renters who have a good driving record and have not made any claims in the past.

- Homeowner Association Discount: Some homeowner associations have agreements with State Farm, which may qualify renters for a discount. This discount is often based on the association’s safety measures and security features.

- Early Payment Discount: If you pay your premiums in full or opt for a recurring payment schedule, you may be eligible for an early payment discount. This discount incentivizes timely payments and reduces administrative costs for State Farm.

- Other Discounts: State Farm may offer other discounts based on your individual circumstances. These discounts could include things like being a good student, being a member of a certain organization, or being a military member.

Tips for Maximizing Savings

Here are some tips for maximizing your savings on State Farm renters insurance:

- Compare Quotes: Get quotes from multiple insurance companies, including State Farm, to compare rates and coverage options. This allows you to identify the best deal based on your needs and budget.

- Bundle Policies: Consider bundling your renters insurance with other State Farm policies, such as auto insurance, to take advantage of multi-policy discounts. This can lead to significant savings on your premiums.

- Improve Safety Features: Install safety features in your rental property, such as smoke detectors, burglar alarms, or fire sprinklers, to qualify for potential discounts. These features can also help protect your belongings and reduce the risk of claims.

- Maintain a Good Claim History: Avoid filing claims unless absolutely necessary, as a good claim history can lead to claim-free discounts. This helps demonstrate your responsible insurance behavior and lowers your premiums.

- Negotiate: Don’t hesitate to negotiate with your State Farm agent to see if they can offer you any additional discounts or lower your premiums. Be prepared to explain your circumstances and why you deserve a better rate.

Benefits of Bundling

Bundling your renters insurance with other State Farm policies, such as auto insurance, offers several benefits:

- Discounts: Bundling policies can significantly reduce your premiums by providing multi-policy discounts. This can save you money on your overall insurance costs.

- Convenience: Having multiple policies with the same insurer simplifies your insurance management. You can easily manage all your policies through one provider, making it convenient to pay premiums, file claims, and access information.

- Streamlined Customer Service: Bundling policies with State Farm allows you to interact with a single customer service team for all your insurance needs. This simplifies the process of resolving issues, making it easier to get the support you need.

- Loyalty Rewards: State Farm often offers loyalty programs and rewards to customers who bundle their policies. These programs can provide additional discounts and benefits for your insurance coverage.

Claim Filing and Process

Filing a claim with State Farm renters insurance is a straightforward process designed to help you recover from covered losses. The process typically involves reporting the incident, providing necessary documentation, and cooperating with the claims adjuster to assess and settle your claim.

Claim Reporting

To initiate a claim, you can contact State Farm through their website, mobile app, or by calling their customer service hotline. When reporting your claim, provide details about the incident, including the date, time, location, and nature of the loss. It’s important to be accurate and thorough in your description to ensure your claim is processed efficiently.

Documentation and Information

To support your claim, State Farm will require specific documentation and information. This may include:

- Proof of loss: This could include photographs, videos, receipts, or other evidence that demonstrates the extent of the damage or loss.

- Police report: If the loss is due to theft or vandalism, a police report is usually required.

- Rental agreement: This document confirms your status as a renter and the address of your property.

- Inventory list: Maintaining an inventory of your belongings with descriptions and estimated values can expedite the claims process.

- Proof of ownership: If you are claiming for specific items, you may need to provide receipts or other documentation to verify ownership.

Claim Resolution

Once your claim is filed and the necessary documentation is submitted, State Farm will assign a claims adjuster to assess the damage and determine the extent of coverage. The adjuster will inspect the property, review the documentation, and communicate with you throughout the process.

Claim Timeline

The timeline for claim resolution can vary depending on the complexity of the claim and the availability of information. However, State Farm aims to process claims efficiently and keep you informed throughout the process.

“State Farm’s goal is to provide prompt and fair claim settlement, ensuring you receive the benefits you’re entitled to under your policy.”

Customer Service and Support

State Farm is renowned for its commitment to customer service and providing comprehensive support throughout the renters insurance policy lifecycle. They offer multiple channels for communication and assistance, and their customer service representatives are known for their helpfulness and responsiveness.

Customer Service Channels

State Farm provides multiple avenues for policyholders to reach out for assistance. These include:

- Phone: Policyholders can call State Farm’s customer service hotline, available 24/7, to speak with a representative. This is a convenient option for immediate assistance and resolving urgent issues.

- Online: State Farm offers a user-friendly online portal where policyholders can access their account, manage their policy, file claims, and contact customer support. This digital platform provides a convenient and accessible way to interact with State Farm.

- Mobile App: The State Farm mobile app allows policyholders to access their account, manage their policy, and file claims on the go. This app provides a convenient and efficient way to interact with State Farm from any location.

- Social Media: State Farm actively engages with customers on social media platforms like Facebook and Twitter, offering customer support and addressing inquiries. This platform provides an additional avenue for communication and resolving issues.

Claim Handling and Resolution

State Farm has a reputation for handling claims efficiently and fairly. The company has a dedicated claims team that works to ensure a smooth and hassle-free experience for policyholders.

- Prompt Response: State Farm aims to respond to claims promptly and provide updates throughout the process. The company understands the inconvenience of unexpected events and strives to resolve claims efficiently.

- Transparent Communication: State Farm keeps policyholders informed about the status of their claims and provides clear explanations of the process. They ensure transparency and open communication to build trust and alleviate any concerns.

- Fair Settlement: State Farm aims to provide fair and reasonable settlements for covered losses. They strive to ensure policyholders receive the compensation they deserve for their losses, within the terms of their policy.

Policyholder Resources

State Farm provides various resources to support policyholders in understanding their coverage and navigating the insurance process. These resources include:

- Online Policy Documents: Policyholders can access their policy documents online, providing them with clear information about their coverage and terms. This digital access ensures easy reference and eliminates the need for physical copies.

- Frequently Asked Questions (FAQs): State Farm’s website features a comprehensive FAQ section addressing common questions related to renters insurance, policy coverage, and claims procedures. This resource provides quick and accessible answers to common inquiries.

- Customer Support Articles: State Farm provides articles and guides on various aspects of renters insurance, including tips for preventing losses, understanding coverage, and filing claims. These resources offer valuable information and insights to enhance policyholder knowledge.

- Agent Support: Policyholders can contact their local State Farm agent for personalized assistance and guidance. Agents are knowledgeable about renters insurance and can provide tailored support to address specific needs.

Comparison with Other Insurers

Choosing the right renters insurance policy can be a daunting task, especially when you’re faced with a multitude of insurers offering varying coverage options and premiums. While State Farm is a reputable and well-known provider, it’s essential to compare its offerings with other leading insurers in the market to ensure you’re getting the best value for your money. This section will delve into a comparative analysis of State Farm renters insurance costs and coverage options against other prominent insurers, highlighting the advantages and disadvantages of choosing State Farm over its competitors. Additionally, we’ll provide insights on how to determine the most suitable renters insurance option for your individual needs.

Comparison of Costs and Coverage Options

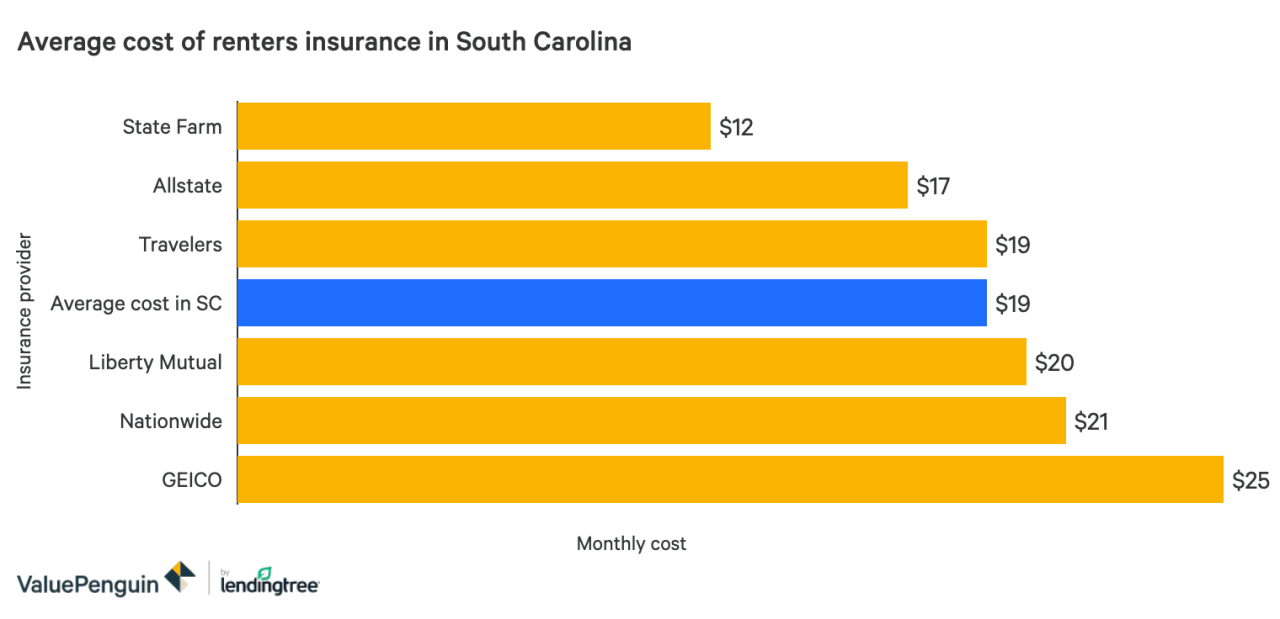

State Farm is known for its competitive pricing and comprehensive coverage options. However, it’s essential to compare its offerings with other leading insurers to identify the best fit for your specific requirements. Here’s a comparison of State Farm’s renters insurance costs and coverage options against other prominent insurers:

| Insurer | Average Monthly Premium | Coverage Options | Pros | Cons |

|---|---|---|---|---|

| State Farm | $15 – $30 | Personal property, liability, additional living expenses, medical payments, and more. | Wide coverage options, competitive pricing, excellent customer service, and a strong reputation. | May not offer the most affordable rates for all individuals, especially those with a high-risk profile. |

| Allstate | $12 – $25 | Similar coverage options to State Farm, including personal property, liability, and additional living expenses. | Offers competitive pricing and a wide range of coverage options. | May have higher deductibles than other insurers, and its customer service may not be as consistently high as State Farm’s. |

| Liberty Mutual | $18 – $35 | Offers a variety of coverage options, including personal property, liability, and additional living expenses. | Known for its strong financial stability and excellent customer service. | May have higher premiums than other insurers, particularly for individuals with a high-risk profile. |

| USAA | $10 – $20 | Offers comprehensive coverage options and competitive pricing, but is only available to active military personnel, veterans, and their families. | Offers highly competitive pricing and excellent customer service. | Limited availability to only active military personnel, veterans, and their families. |

Pros and Cons of Choosing State Farm, State farm renters insurance cost

Choosing State Farm for your renters insurance has its advantages and disadvantages. Understanding these pros and cons can help you make an informed decision:

Pros

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options, including personal property, liability, additional living expenses, medical payments, and more. This ensures that you’re adequately protected against various risks associated with renting.

- Competitive Pricing: State Farm is known for its competitive pricing, offering affordable rates for renters insurance policies. This makes it an attractive option for budget-conscious individuals.

- Excellent Customer Service: State Farm has a reputation for providing excellent customer service. Its agents are knowledgeable and responsive, ensuring that you receive prompt assistance with any queries or claims.

- Strong Reputation: State Farm is a well-established and reputable insurer with a long history of financial stability and reliability. This provides renters with confidence in their coverage and the insurer’s ability to fulfill its obligations.

Cons

- May Not Offer the Most Affordable Rates for All Individuals: While State Farm offers competitive pricing, it may not be the most affordable option for all individuals, particularly those with a high-risk profile. This could be due to factors like your location, credit score, or claim history.

Determining the Best Renters Insurance Option

The best renters insurance option for you depends on your individual needs and circumstances. Here are some factors to consider:

- Coverage Options: Determine the coverage options you require based on the value of your belongings and your risk tolerance. Consider factors like personal property coverage, liability limits, and additional living expenses.

- Pricing: Obtain quotes from multiple insurers to compare premiums and identify the most affordable option for your needs. Consider factors like deductibles and coverage limits to ensure you’re getting the best value for your money.

- Customer Service: Research the insurer’s reputation for customer service. Look for reviews and ratings to gauge their responsiveness, helpfulness, and overall customer satisfaction.

- Financial Stability: Choose an insurer with a strong financial history and a solid track record of paying claims. This ensures that you’ll be covered in the event of a disaster or loss.

Epilogue

Navigating the world of renters insurance can be daunting, but with a clear understanding of State Farm’s offerings and the factors influencing costs, you can make informed choices that align with your individual needs. By considering your specific requirements, comparing quotes from different insurers, and exploring available discounts, you can secure the best renters insurance coverage at a price that fits your budget. Remember, renters insurance is an essential investment in protecting your belongings and financial security, offering peace of mind in the face of unforeseen circumstances.

Helpful Answers

What factors influence State Farm renters insurance cost?

Several factors affect your premium, including your location, coverage amount, deductible, credit score, and claims history.

How can I get a quote for State Farm renters insurance?

You can obtain a quote online, over the phone, or by visiting a local State Farm agent.

What are some common discounts offered by State Farm?

State Farm offers discounts for bundling policies, having a good credit score, and installing safety features in your rental property.

What is the process for filing a claim with State Farm renters insurance?

You can file a claim online, over the phone, or by visiting a local State Farm agent. You will need to provide information about the incident and any relevant documentation.