State farm quotes auto insurance – State Farm quotes for auto insurance are a crucial step in finding the right coverage for your needs. State Farm, a well-established name in the insurance industry, offers a variety of policies designed to protect you and your vehicle. From liability to collision coverage, State Farm provides a comprehensive range of options. Understanding the factors that influence your quote, like your driving history, vehicle type, and location, can help you make informed decisions about your auto insurance.

This guide will delve into the intricacies of obtaining State Farm auto insurance quotes, exploring the different methods available and the factors that affect the final price. We’ll also discuss State Farm’s customer service, claims process, and the various discounts they offer. By understanding these key aspects, you can confidently navigate the process of securing a State Farm auto insurance quote that meets your specific requirements.

State Farm Auto Insurance Overview

State Farm is a leading provider of auto insurance in the United States, known for its comprehensive coverage options, competitive rates, and excellent customer service. Founded in 1922, State Farm has a long history of providing reliable and affordable insurance solutions to millions of Americans.

Key Features and Benefits

State Farm’s auto insurance policies offer a range of features and benefits designed to meet the diverse needs of its customers. Some key features include:

- Comprehensive Coverage Options: State Farm provides a wide array of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage, allowing customers to customize their policies to meet their specific requirements.

- Competitive Rates: State Farm strives to offer competitive rates by leveraging its extensive network of agents, efficient claims processing, and risk management expertise.

- Excellent Customer Service: State Farm is known for its commitment to providing exceptional customer service, with a network of agents available to assist customers with policy inquiries, claims filing, and other needs.

- Discounts and Rewards: State Farm offers a variety of discounts and rewards programs, including safe driving discounts, multi-policy discounts, and good student discounts, helping customers save on their premiums.

- 24/7 Claims Service: State Farm provides 24/7 claims service, ensuring that customers can access assistance whenever they need it, regardless of the time or day.

Coverage Options

State Farm offers a variety of coverage options to protect customers from financial losses arising from accidents or other incidents involving their vehicles. These coverage options include:

- Liability Coverage: This coverage protects customers from financial responsibility for damages caused to other vehicles or property in an accident for which they are at fault. It typically covers bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of fault. It covers damages resulting from collisions with other vehicles, objects, or even single-vehicle accidents.

- Comprehensive Coverage: This coverage protects the insured vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It also covers damages caused by falling objects, animals, or other unforeseen circumstances.

- Uninsured/Underinsured Motorist Coverage: This coverage protects customers in the event of an accident with an uninsured or underinsured driver. It covers damages to the insured vehicle and medical expenses incurred by the insured driver and passengers.

Obtaining State Farm Auto Insurance Quotes: State Farm Quotes Auto Insurance

Getting a quote for State Farm auto insurance is a straightforward process. You can choose from several convenient methods to obtain a quote, each with its own advantages and disadvantages.

Methods for Obtaining a Quote

There are three main ways to get a State Farm auto insurance quote: online, by phone, and in person.

- Online: This method is the most convenient and accessible, allowing you to get a quote anytime, anywhere. You can visit the State Farm website, enter your details, and receive an instant quote. The online quote system is designed to be user-friendly, guiding you through the necessary steps.

- By Phone: You can also get a quote by calling State Farm directly. This method allows you to speak to a representative who can answer your questions and guide you through the quote process. This can be helpful if you have complex insurance needs or prefer personalized assistance.

- In Person: Visiting a local State Farm agent is another option. This method allows for face-to-face interaction, enabling you to discuss your insurance needs in detail and receive personalized advice. You can also ask questions and get clarification on any aspects of the policy.

Advantages and Disadvantages of Each Method

Each method of obtaining a quote has its own advantages and disadvantages.

- Online:

- Advantages: Convenient, accessible, instant quotes, user-friendly.

- Disadvantages: Limited opportunity for personalized assistance, may not be suitable for complex insurance needs.

- By Phone:

- Advantages: Personalized assistance, opportunity to ask questions, helpful for complex insurance needs.

- Disadvantages: Less convenient than online, may require waiting on hold.

- In Person:

- Advantages: Face-to-face interaction, personalized advice, opportunity to ask questions and get clarification.

- Disadvantages: Least convenient, may require scheduling an appointment.

Information Required for a Quote

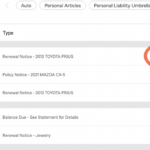

To get an accurate quote, State Farm will require specific information about you, your vehicle, and your driving history.

- Vehicle Details: This includes the year, make, model, and VIN (Vehicle Identification Number) of your vehicle.

- Driving History: This includes your driving record, including any accidents, tickets, or violations.

- Location: Your address is required to determine your location and the associated risk factors, such as traffic density and crime rates.

- Other Factors: Additional factors that may influence your quote include your age, gender, marital status, credit score, and coverage options.

Factors Influencing State Farm Auto Insurance Quotes

State Farm, like other insurance companies, uses various factors to determine your auto insurance premium. Understanding these factors can help you make informed decisions that might lead to lower premiums.

Driving Record

Your driving record is a significant factor in determining your State Farm auto insurance quote. A clean driving record with no accidents, violations, or DUI convictions will result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will increase your premium.

For example, a driver with a DUI conviction could see their premium increase by 50% or more.

Age

Your age plays a role in your State Farm auto insurance quote. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk leads to higher premiums for younger drivers. As drivers age, their risk profile generally decreases, leading to lower premiums.

For instance, a 20-year-old driver might pay significantly more than a 40-year-old driver with a similar driving record.

Gender

While gender used to be a factor in auto insurance premiums, it is no longer a factor in many states due to regulations. State Farm, like many other insurers, now bases its pricing on individual risk profiles rather than gender.

Vehicle Type

The type of vehicle you drive is a key factor in determining your State Farm auto insurance quote. Certain vehicles are considered more expensive to repair or replace, leading to higher premiums. For example, sports cars, luxury vehicles, and high-performance trucks tend to have higher insurance premiums compared to standard sedans or hatchbacks.

Location

Your location can significantly impact your State Farm auto insurance quote. Areas with higher crime rates, traffic congestion, and accident frequencies generally have higher insurance premiums.

Coverage Options

The type and amount of coverage you choose will also influence your State Farm auto insurance quote. Higher coverage limits, such as comprehensive and collision coverage, will lead to higher premiums. Conversely, choosing lower coverage limits or opting for only liability coverage will generally result in lower premiums.

Table Comparing Impact of Different Factors

| Factor | Impact on Premium |

|---|---|

| Clean Driving Record | Lower Premium |

| Accidents, Violations, or DUI | Higher Premium |

| Younger Drivers (Under 25) | Higher Premium |

| Older Drivers | Lower Premium |

| Sports Cars, Luxury Vehicles, High-Performance Trucks | Higher Premium |

| Standard Sedans or Hatchbacks | Lower Premium |

| Areas with Higher Crime Rates, Traffic Congestion, and Accident Frequencies | Higher Premium |

| Higher Coverage Limits (Comprehensive and Collision) | Higher Premium |

| Lower Coverage Limits or Liability Coverage Only | Lower Premium |

State Farm’s Customer Service and Claims Process

State Farm prides itself on providing exceptional customer service and a streamlined claims process. Their commitment to customer satisfaction is reflected in their various communication channels, efficient claims handling procedures, and a strong reputation in the industry.

Customer Service Channels

State Farm offers a variety of ways for customers to connect with them, ensuring accessibility and convenience.

- Phone: State Farm has a dedicated customer service phone line available 24/7, allowing policyholders to reach a representative at any time.

- Email: Customers can also contact State Farm via email for inquiries and requests. They have a designated email address for customer service, ensuring prompt responses.

- Online Resources: State Farm’s website provides a comprehensive online portal where customers can access their policy information, manage payments, file claims, and find answers to frequently asked questions.

Claims Process

State Farm’s claims process is designed to be straightforward and efficient. Here’s a step-by-step breakdown:

- Reporting an Accident: Policyholders can report an accident through various channels, including phone, email, or the online portal.

- Initial Assessment: State Farm will gather information about the accident, including details of the incident, involved parties, and potential damages.

- Damage Inspection: If necessary, State Farm will arrange for an independent inspection of the damaged vehicle to assess the extent of repairs.

- Claim Processing: State Farm will review the claim and process it based on the policy coverage and applicable laws.

- Payment: Once the claim is approved, State Farm will issue payment directly to the policyholder or the repair facility, depending on the circumstances.

Reputation for Customer Service and Claims Handling

State Farm consistently ranks high in customer satisfaction surveys, demonstrating their commitment to providing excellent service. Their claims process is known for its speed and efficiency, with a focus on resolving claims fairly and promptly.

- J.D. Power: State Farm consistently receives high rankings in J.D. Power’s annual customer satisfaction surveys for auto insurance. This recognition reflects their commitment to providing a positive customer experience.

- Better Business Bureau: State Farm maintains an A+ rating with the Better Business Bureau, indicating a strong track record of customer satisfaction and ethical business practices.

State Farm’s Discounts and Programs

State Farm, known for its comprehensive auto insurance policies, also offers a variety of discounts and programs designed to reward safe driving habits, responsible behavior, and loyalty. These benefits can significantly reduce your insurance premiums, making State Farm a more attractive option for many drivers.

Discounts Offered by State Farm

State Farm provides numerous discounts to help you save money on your auto insurance. These discounts can be categorized into various groups, including:

- Safe Driving Discounts:

- Good Driver Discount: This discount is typically awarded to drivers with a clean driving record, demonstrating responsible driving habits. It can be a significant savings for those who haven’t been involved in accidents or received traffic violations.

- Defensive Driving Course Discount: Completing a defensive driving course, focusing on safe driving techniques and traffic laws, can qualify you for this discount. This shows your commitment to safe driving practices and can lead to a reduction in your premium.

- Vehicle-Related Discounts:

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can deter theft and lower your insurance risk. State Farm recognizes these efforts and offers a discount for having these devices installed.

- New Car Discount: Purchasing a brand-new car often comes with safety features and technology that reduce the risk of accidents. State Farm may offer a discount for driving a newer vehicle.

- Policy-Related Discounts:

- Multi-policy Discount: Bundling multiple insurance policies, such as auto, home, and life insurance, with State Farm can lead to significant savings. This discount is a reward for consolidating your insurance needs with a single provider.

- Paid-in-Full Discount: Paying your entire auto insurance premium upfront, rather than in installments, can often earn you a discount. This demonstrates your financial responsibility and commitment to paying your insurance on time.

- Other Discounts:

- Good Student Discount: This discount is typically available to students who maintain a certain GPA, demonstrating academic achievement and responsible behavior. It can be a significant savings for young drivers.

- Homeowner Discount: If you own your home and have a State Farm homeowners insurance policy, you may be eligible for a discount on your auto insurance. This demonstrates your financial stability and responsible homeownership.

State Farm’s Unique Programs

State Farm offers several unique programs and initiatives that go beyond traditional discounts, providing additional benefits and peace of mind for their policyholders.

- Accident Forgiveness: This program allows you to avoid a premium increase after your first at-fault accident. It provides a safety net, ensuring your rates don’t skyrocket after a single mishap. This can be especially beneficial for new drivers or those with limited driving experience.

- Drive Safe & Save: This program uses telematics technology, typically a device plugged into your vehicle’s diagnostic port or a mobile app, to track your driving habits. By demonstrating safe driving practices, such as avoiding speeding or hard braking, you can earn discounts on your insurance premium. This program allows you to be rewarded for your responsible driving behavior in real-time.

- State Farm Drive Safe & Save: This program allows you to earn discounts based on your driving habits. By using a device or mobile app to track your driving, you can earn discounts for safe driving practices such as avoiding speeding or hard braking. This program encourages responsible driving and rewards you for your safe behavior.

- State Farm’s Steer Clear Program: This program is designed to help teen drivers develop safe driving habits. It provides resources and support to parents and teens, including online tools, driving simulations, and educational materials. This program can help reduce the risk of accidents and promote safe driving among young drivers.

Comparing State Farm to Competitors

State Farm is a major player in the auto insurance market, but it’s not the only option. To make an informed decision about your insurance needs, it’s essential to compare State Farm to its competitors. This section will analyze State Farm’s policies, pricing, and customer service against those of its main rivals.

Key Competitors

State Farm’s main competitors in the auto insurance market include:

- Geico: Known for its competitive pricing and extensive advertising campaigns, Geico offers a wide range of coverage options and discounts.

- Progressive: Progressive is another popular choice, offering customizable policies and a user-friendly online experience. They’re known for their “Name Your Price” tool, which allows customers to set their desired premium and see which coverage options fit their budget.

- Allstate: Allstate provides a comprehensive suite of insurance products, including auto insurance. They offer various discounts and have a strong reputation for customer service.

- USAA: USAA is a military-focused insurer that offers competitive rates and excellent customer service to active-duty military personnel, veterans, and their families.

Comparing Policies and Pricing, State farm quotes auto insurance

State Farm, Geico, Progressive, Allstate, and USAA offer a range of coverage options, including:

- Liability coverage: This covers damages to other people’s property or injuries caused by an accident.

- Collision coverage: This covers damage to your vehicle in a collision, regardless of fault.

- Comprehensive coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance.

While the core coverage options are similar, there are variations in specific features and discounts offered by each insurer.

Customer Service and Claims Process

Each insurer has its own approach to customer service and claims processing. State Farm is known for its extensive network of agents, providing personalized service and local support. Geico emphasizes convenience and efficiency, offering online and mobile tools for managing policies and filing claims. Progressive is recognized for its innovative features, such as its “Snapshot” program that rewards safe driving habits with discounts. Allstate is known for its focus on customer satisfaction and its “Good Hands” brand promise. USAA has a strong reputation for providing exceptional service to its military members and their families.

Comparison Table

The following table summarizes key features of State Farm and its competitors:

| Feature | State Farm | Geico | Progressive | Allstate | USAA |

|---|---|---|---|---|---|

| Pricing | Competitive, varies by location and driving record | Often among the most affordable | Flexible, with “Name Your Price” tool | Competitive, with discounts for safe driving | Competitive, with discounts for military members |

| Customer Service | Extensive agent network, personalized service | Convenience-focused, online and mobile tools | Innovative, with “Snapshot” program | Strong focus on customer satisfaction | Exceptional service for military members and families |

| Discounts | Multiple discounts available, including safe driving, good student, and multi-policy | Wide range of discounts, including good driver, multi-car, and military | Numerous discounts, including safe driver, good student, and multi-policy | Various discounts, including good driver, multi-car, and defensive driving | Exclusive discounts for military members |

| Claims Process | Streamlined process, with options for online, phone, or agent assistance | Easy online and mobile claims filing | Fast and efficient claims processing | Comprehensive claims support | Dedicated claims service for military members |

Final Summary

Getting a State Farm auto insurance quote is an essential step in securing the right coverage for your vehicle. By considering the various factors that influence your quote, exploring the different methods for obtaining a quote, and understanding State Farm’s customer service and claims process, you can make an informed decision that protects your interests. Remember, comparing quotes from different insurance providers is crucial in finding the best value for your needs.

Detailed FAQs

How do I get a State Farm auto insurance quote?

You can get a quote online, over the phone, or in person at a State Farm agent’s office. Each method has its own advantages and disadvantages.

What factors affect my State Farm auto insurance quote?

Several factors influence your quote, including your driving record, age, gender, vehicle type, location, and coverage options.

What discounts does State Farm offer?

State Farm offers a variety of discounts, such as safe driver, good student, multi-policy, and more. Check with your local agent for specific details.

How do I file a claim with State Farm?

You can file a claim online, over the phone, or through your State Farm agent. Follow the instructions provided by State Farm to ensure a smooth process.