State Farm quote insurance is a valuable tool for anyone looking to secure their financial future. State Farm, a renowned insurance provider with a rich history, offers a wide array of insurance products designed to meet diverse customer needs. Whether you’re seeking auto, home, life, or other types of insurance, State Farm provides comprehensive coverage options tailored to your specific requirements. Obtaining a quote from State Farm is a straightforward process, allowing you to explore different insurance plans and compare prices.

By providing basic information about yourself and your desired coverage, you can receive a personalized quote that reflects your individual circumstances. State Farm’s transparent pricing and detailed explanations ensure you understand the costs associated with your chosen insurance plan. With its commitment to customer satisfaction, State Farm offers a seamless and informative experience, guiding you through the insurance process with ease.

State Farm Overview

State Farm Insurance is a leading provider of insurance and financial services in the United States. It has a long and storied history, known for its commitment to customer satisfaction and financial stability.

History of State Farm

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. Initially, the company focused on providing auto insurance to farmers in the Midwest. Over the years, State Farm expanded its product offerings to include a wide range of insurance products, such as homeowners, renters, life, health, and business insurance.

Core Values and Mission Statement

State Farm’s core values are centered around customer service, integrity, and financial strength. The company’s mission statement reflects these values: “To be the leading provider of insurance and financial services products and solutions for our customers, while upholding the highest standards of ethical business practices.”

Financial Stability and Reputation

State Farm is known for its strong financial position and excellent reputation. It has consistently been rated highly by independent rating agencies, such as A.M. Best and Moody’s. This financial stability provides customers with confidence that State Farm will be there to meet their insurance needs.

State Farm Insurance Products: State Farm Quote Insurance

State Farm offers a wide range of insurance products designed to protect individuals and families from various risks. These products cater to different needs, providing financial security and peace of mind in case of unexpected events.

Auto Insurance

State Farm’s auto insurance provides coverage for damages to your vehicle and liability protection in case of accidents. Key features include:

- Collision Coverage: Covers damages to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision damages, such as theft, vandalism, or natural disasters.

- Liability Coverage: Covers damages to other vehicles or property and injuries to others in an accident that you are at fault for.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault.

Home Insurance

State Farm’s home insurance protects your dwelling and belongings from various perils, such as fire, theft, and natural disasters. Key features include:

- Dwelling Coverage: Covers damages to your home’s structure, including the roof, walls, and foundation.

- Personal Property Coverage: Protects your belongings inside your home, such as furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection if someone is injured on your property or if you are held liable for damages caused by you or your family members.

- Additional Living Expenses Coverage: Covers temporary housing and other expenses if you are unable to live in your home due to a covered event.

Life Insurance

State Farm’s life insurance provides financial security for your loved ones in the event of your death. Key features include:

- Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years.

- Whole Life Insurance: Offers permanent coverage with a cash value component that grows over time.

- Universal Life Insurance: Provides flexible coverage options with adjustable premiums and death benefits.

Renters Insurance

State Farm’s renters insurance protects your belongings and provides liability coverage while renting. Key features include:

- Personal Property Coverage: Protects your belongings inside your rental unit, such as furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection if someone is injured on your property or if you are held liable for damages caused by you or your family members.

- Additional Living Expenses Coverage: Covers temporary housing and other expenses if you are unable to live in your rental unit due to a covered event.

Business Insurance

State Farm’s business insurance provides protection for small businesses from various risks, including property damage, liability, and employee-related issues. Key features include:

- Property Coverage: Protects your business property, such as buildings, equipment, and inventory.

- Liability Coverage: Provides financial protection if someone is injured on your business property or if you are held liable for damages caused by you or your employees.

- Business Income Coverage: Covers lost income if your business is forced to close due to a covered event.

Other Insurance Products

State Farm also offers a range of other insurance products, including:

- Health Insurance: Provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Motorcycle Insurance: Protects your motorcycle and provides liability coverage in case of accidents.

- Boat Insurance: Covers damages to your boat and provides liability protection in case of accidents.

- Umbrella Insurance: Provides additional liability coverage above your existing policies.

Tailored Insurance Solutions

State Farm understands that every customer has unique needs. Their agents work closely with customers to develop customized insurance solutions that meet their specific requirements. Whether you are a young adult just starting out or a family with growing needs, State Farm has the right insurance products to protect you and your loved ones.

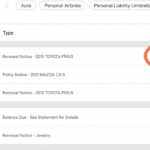

Obtaining a State Farm Quote

Getting a quote for State Farm insurance is a straightforward process. You can choose from various methods, each offering its own advantages. The information required for a quote is generally the same, but the specific details might vary based on the type of insurance you are seeking.

Ways to Obtain a Quote

State Farm provides several convenient options for obtaining a quote. These include:

- Online Quote: This method allows you to get a quick and easy quote directly from State Farm’s website. You can enter your details, including your personal information, vehicle information (for auto insurance), and desired coverage details. The website then provides you with a personalized quote based on your specific needs.

- Phone Quote: You can also obtain a quote by calling State Farm’s customer service line. A representative will guide you through the process, asking for the necessary information to provide you with a quote. This option allows you to get personalized assistance and clarification on any questions you may have.

- Agent Quote: If you prefer a more personal approach, you can schedule an appointment with a local State Farm agent. This allows you to discuss your insurance needs in detail and get a customized quote tailored to your specific situation. The agent can also answer any questions you may have about State Farm’s policies and services.

Information Required for a Quote

To get a quote from State Farm, you will generally need to provide the following information:

- Personal Information: This includes your name, address, date of birth, and contact information.

- Vehicle Information (for auto insurance): This includes the make, model, year, and VIN of your vehicle.

- Driving History: You will need to provide information about your driving record, including any accidents or violations.

- Coverage Details: This includes the type of coverage you are seeking (e.g., liability, collision, comprehensive) and the desired coverage limits.

- Other Information: Depending on the type of insurance you are seeking, you may need to provide additional information, such as your home address (for homeowners insurance) or your business information (for commercial insurance).

Factors Influencing State Farm Insurance Premiums

Several factors can influence your State Farm insurance premiums. These include:

- Driving Record: A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents or violations will likely increase your premiums.

- Age and Gender: Younger drivers typically pay higher premiums than older drivers, as they are statistically more likely to be involved in accidents. Gender can also play a role in premium calculations, with some studies suggesting that men pay higher premiums than women.

- Vehicle Type: The type of vehicle you drive can also impact your premiums. Higher-performance vehicles or vehicles with expensive parts are more likely to result in higher premiums.

- Location: Your location can also affect your premiums. Areas with higher crime rates or more traffic congestion may have higher premiums.

- Coverage Levels: The amount of coverage you choose will also influence your premiums. Higher coverage limits will generally result in higher premiums.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles will generally result in lower premiums.

- Discounts: State Farm offers various discounts that can lower your premiums. These discounts can include safe driver discounts, multi-policy discounts, and good student discounts.

State Farm Customer Experience

State Farm is known for its commitment to providing exceptional customer service. The company has a long history of prioritizing customer satisfaction and strives to make insurance simple and easy to understand. This dedication is reflected in numerous positive customer reviews and testimonials, a variety of customer service channels, and a streamlined claims process.

Customer Reviews and Testimonials

Customer reviews and testimonials offer valuable insights into the customer experience with State Farm. These reviews highlight the company’s strengths and areas for improvement.

- Many customers praise State Farm for its friendly and helpful agents, who are knowledgeable and responsive to their needs.

- Customers also appreciate the company’s commitment to fair and transparent pricing, as well as its competitive rates.

- State Farm’s claims process is often lauded for its efficiency and ease of use, with customers reporting positive experiences navigating the process.

State Farm’s Customer Service Channels

State Farm provides a range of customer service channels to ensure accessibility and convenience for its policyholders.

- Customers can reach State Farm through phone, email, or online chat, allowing them to choose the method that best suits their needs.

- State Farm also offers a mobile app that allows customers to manage their policies, file claims, and access other services on the go.

- The company’s website provides a wealth of information and resources, including FAQs, policy documents, and claims forms.

State Farm’s Claims Process

State Farm’s claims process is designed to be efficient and customer-centric.

- Customers can file claims online, through the mobile app, or by phone.

- State Farm provides 24/7 claims support, ensuring assistance is available whenever needed.

- The company aims to process claims quickly and fairly, with a focus on resolving issues promptly and to the customer’s satisfaction.

Comparing State Farm to Competitors

When deciding on an insurance provider, it’s essential to compare different companies and their offerings to find the best fit for your needs. State Farm is a well-known and reputable insurer, but it’s important to understand how it stacks up against its competitors.

State Farm’s Rates and Coverage Compared to Competitors

To determine whether State Farm offers competitive rates and coverage, it’s essential to compare its offerings with those of other major insurance providers. This analysis should consider factors like:

- Premium costs: Comparing premiums for similar coverage levels across different insurers allows you to assess whether State Farm’s pricing is competitive.

- Coverage options: Examining the types and limits of coverage offered by each insurer helps you understand the extent of protection they provide.

- Discounts: Understanding the discounts available from each insurer, such as those for good driving records, safety features, or multiple policies, is crucial for finding the best value.

It’s essential to remember that insurance rates vary based on factors like location, driving history, vehicle type, and coverage levels. Therefore, a direct comparison of premiums between companies might not always be accurate. Instead, focusing on the overall value proposition, including coverage options, discounts, and customer service, provides a more comprehensive understanding.

State Farm’s Strengths and Weaknesses Compared to Competitors

State Farm’s strengths and weaknesses can be analyzed by comparing it to other major insurers.

- Strengths:

- Strong financial stability: State Farm is a financially sound company with a high credit rating, ensuring the ability to meet its obligations.

- Extensive network: State Farm has a vast network of agents and offices across the country, offering convenient access to services and support.

- Customer satisfaction: State Farm consistently ranks highly in customer satisfaction surveys, indicating a positive customer experience.

- Weaknesses:

- Rates can be higher: In some cases, State Farm’s premiums may be higher than those offered by other insurers, especially for certain types of coverage or risk profiles.

- Limited online services: Compared to some competitors, State Farm’s online platform for managing policies and making payments may be less comprehensive.

- Agent-focused model: While having a strong agent network can be beneficial, some customers prefer a more digital-centric experience.

By comparing State Farm’s strengths and weaknesses to those of its competitors, you can gain a better understanding of its overall value proposition and determine whether it aligns with your individual needs and preferences.

Factors Influencing State Farm’s Suitability for Individuals

State Farm’s suitability for specific individuals depends on a range of factors, including:

- Location: State Farm’s availability and pricing may vary depending on your location.

- Driving history: Drivers with good driving records may find State Farm’s discounts attractive, while those with a history of accidents or violations might face higher premiums.

- Coverage needs: If you require specific types of coverage or high limits, State Farm’s offerings may or may not meet your needs.

- Preference for agent interaction: If you prefer a more personal and hands-on approach, State Farm’s agent network could be a significant advantage.

- Budget: State Farm’s rates should be compared to those of other insurers to ensure they fit within your budget.

Considering these factors allows you to assess whether State Farm is a suitable option for your individual circumstances.

State Farm’s Digital Presence

State Farm has made a significant investment in its digital presence, recognizing the importance of online engagement and accessibility in today’s tech-savvy world. The company’s website and mobile app are designed to provide a user-friendly experience for policyholders and potential customers, while its social media presence and online marketing strategies aim to reach a wider audience and strengthen brand loyalty.

State Farm Website and Mobile App Features

State Farm’s website and mobile app are designed to offer a comprehensive range of services, including:

- Policy Management: Users can access, manage, and make changes to their insurance policies online. This includes viewing policy details, making payments, reporting claims, and updating contact information.

- Quote Generation: The website allows users to obtain personalized quotes for various insurance products, such as auto, home, renters, and life insurance. The quote process is streamlined and user-friendly, enabling customers to compare different coverage options and choose the best fit for their needs.

- Claim Reporting: Customers can report claims online or through the mobile app, providing convenient access to assistance during an emergency. The app also includes features for tracking claim progress and communicating with State Farm representatives.

- Customer Support: The website and mobile app provide access to a variety of customer support resources, including FAQs, contact information, and online chat features. This allows users to find answers to common questions and connect with State Farm representatives for personalized assistance.

State Farm’s Social Media Presence and Engagement

State Farm has a strong presence on various social media platforms, including Facebook, Twitter, Instagram, and YouTube. These platforms are used to:

- Engage with Customers: State Farm utilizes social media to interact with customers, respond to inquiries, and address concerns. They also use these platforms to share helpful information, such as safety tips and insurance-related advice.

- Promote Products and Services: Social media campaigns are used to promote State Farm’s insurance products and services, highlighting their benefits and value propositions. The company also uses these platforms to announce new products and updates.

- Build Brand Awareness: State Farm’s social media presence helps to increase brand awareness and visibility. They use engaging content, including videos, images, and interactive posts, to connect with a wider audience and build brand loyalty.

State Farm’s Online Marketing Strategies

State Farm employs a variety of online marketing strategies to reach potential customers and promote its products and services. These strategies include:

- Search Engine Optimization (): State Farm optimizes its website and content to rank higher in search engine results pages (SERPs). This ensures that its website appears prominently when potential customers search for insurance-related s.

- Pay-Per-Click (PPC) Advertising: State Farm uses PPC advertising platforms, such as Google Ads, to reach a targeted audience through search engine results pages and other online channels. This allows them to drive traffic to their website and generate leads.

- Social Media Marketing: State Farm utilizes social media platforms to engage with potential customers, promote its products and services, and build brand awareness. They create targeted content, run contests and giveaways, and collaborate with influencers to reach a wider audience.

- Email Marketing: State Farm uses email marketing to stay connected with existing customers and promote its products and services. They send out newsletters, special offers, and other relevant information to keep customers engaged.

State Farm’s Community Involvement

State Farm is not just an insurance company; it’s a company deeply rooted in the communities it serves. This commitment extends beyond providing financial protection and embraces a genuine desire to contribute to the well-being of its policyholders and the wider community.

State Farm’s community involvement is a cornerstone of its corporate philosophy, demonstrating a strong sense of social responsibility and a commitment to making a positive impact.

Community Outreach Programs and Initiatives, State farm quote insurance

State Farm actively engages in various community outreach programs and initiatives that address diverse needs. These programs are designed to empower individuals, families, and communities, fostering positive change and strengthening local ties.

State Farm’s commitment to community outreach is evident in its numerous initiatives, including:

- Neighborhood Grants Program: This program provides grants to local organizations that address critical community needs, such as education, safety, and environmental sustainability. These grants empower local communities to address their unique challenges and build a brighter future.

- State Farm Neighborhood Assist: This program allows individuals to nominate deserving community projects for funding. This initiative empowers individuals to become active participants in shaping their communities and supporting causes they care about.

- State Farm Youth Advisory Councils: These councils provide opportunities for young people to voice their concerns, develop leadership skills, and contribute to positive change in their communities.

- Disaster Relief Efforts: State Farm provides significant financial support and resources to communities affected by natural disasters, helping them rebuild and recover.

State Farm’s Commitment to Social Responsibility

State Farm’s commitment to social responsibility goes beyond charitable giving. It encompasses a proactive approach to ethical business practices, environmental stewardship, and promoting diversity and inclusion within its workforce.

State Farm’s commitment to social responsibility is reflected in its:

- Sustainability Initiatives: State Farm actively promotes sustainable practices across its operations, minimizing its environmental footprint and contributing to a greener future. This includes initiatives like reducing energy consumption, promoting paperless transactions, and supporting renewable energy sources.

- Diversity and Inclusion Programs: State Farm fosters a diverse and inclusive workplace, valuing the unique perspectives and contributions of its employees. This commitment creates a more equitable and welcoming environment for all.

- Ethical Business Practices: State Farm operates with a strong ethical code, ensuring fair and transparent dealings with its customers, employees, and stakeholders.

Impact of State Farm’s Community Involvement

State Farm’s community involvement has a significant impact on individuals, families, and communities across the country.

State Farm’s community involvement has a positive impact on:

- Strengthening Local Communities: State Farm’s investments in community initiatives help strengthen local economies, promote social cohesion, and address critical issues facing communities.

- Empowering Individuals: State Farm’s programs empower individuals to become active participants in their communities, fostering a sense of ownership and responsibility.

- Improving Lives: State Farm’s community involvement directly improves the lives of individuals and families by providing access to essential resources, supporting education, and promoting safety and well-being.

Closing Summary

In conclusion, State Farm quote insurance offers a comprehensive and user-friendly way to explore insurance options and find the right coverage for your needs. By understanding the factors that influence insurance premiums, you can make informed decisions about your insurance plan. State Farm’s reputation for financial stability, customer service excellence, and community involvement further solidifies its position as a trusted and reliable insurance provider. Whether you’re a new customer or an existing policyholder, State Farm provides a comprehensive insurance solution that meets your evolving needs and protects your future.

FAQ Overview

How do I get a State Farm quote online?

You can get a quote online by visiting the State Farm website and entering your information into the quote form. The process is quick and easy, and you will receive a personalized quote within minutes.

What factors influence my State Farm insurance premiums?

Your insurance premiums are determined by several factors, including your driving history, age, location, vehicle type, and coverage options. State Farm uses these factors to assess your risk and determine your premium.

Does State Farm offer discounts on insurance premiums?

Yes, State Farm offers a variety of discounts to its policyholders. These discounts may be based on factors such as good driving records, safety features in your vehicle, and bundling multiple insurance policies with State Farm.