State Farm online quote auto insurance offers a convenient way to get a personalized insurance quote. The online platform allows you to compare different coverage options and see how much you could save on your premiums. You can tailor your policy to fit your needs, whether you’re looking for basic liability coverage or comprehensive protection.

With State Farm’s user-friendly interface, you can easily enter your information, select your desired coverage, and receive an instant quote. This process eliminates the need for phone calls or in-person appointments, saving you valuable time and effort.

State Farm’s Online Quote Process

Getting an auto insurance quote online with State Farm is a convenient and straightforward process. You can obtain a quote in just a few minutes, without needing to speak to an agent.

Information Required for an Online Quote, State farm online quote auto insurance

State Farm’s online quote system requires you to provide basic information about yourself and your vehicle. This information helps State Farm calculate your insurance rates. Here is a list of the information you will typically need to provide:

- Your name, address, and contact information.

- Your date of birth and driver’s license number.

- Your vehicle’s year, make, model, and VIN.

- Your driving history, including any accidents or traffic violations.

- The coverage levels you desire.

Benefits of Using State Farm’s Online Quote System

There are several benefits to using State Farm’s online quote system:

- Convenience: You can get a quote anytime, anywhere, without needing to schedule an appointment or speak to an agent.

- Speed: The online quote process is quick and efficient, allowing you to get a quote in just a few minutes.

- Transparency: The online quote system provides a clear and concise breakdown of the factors influencing your insurance rate.

- Privacy: You can provide your information securely online without having to share it with anyone in person.

Comparison of Online Quotes vs. Agent Quotes

While obtaining an online quote offers numerous advantages, it’s important to consider the differences between online and agent quotes.

- Customization: An agent can provide more personalized advice and tailor your policy to your specific needs, while an online quote system may not offer the same level of customization.

- Personalization: An agent can answer questions and address concerns, while an online quote system may not offer the same level of personal interaction.

- Complexity: For complex insurance needs, an agent may be able to provide more comprehensive guidance and support.

Features of State Farm Auto Insurance

State Farm offers a comprehensive suite of auto insurance policies designed to protect you and your vehicle in various situations. Their policies are tailored to meet individual needs and offer a range of coverage options and discounts to ensure you get the best value for your money.

Coverage Options

State Farm provides various coverage options to cater to your specific requirements. These options protect you financially in case of an accident or other incidents involving your vehicle. Here’s a breakdown of the key coverage options:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers medical expenses, lost wages, and property repairs for the other party involved.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault. It’s optional and often comes with a deductible, which you pay before the insurance company covers the remaining costs.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-collision events such as theft, vandalism, fire, hail, or other natural disasters. It also comes with a deductible, and you can choose the level of coverage that best suits your needs.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. It covers your medical expenses, lost wages, and property damage, up to the limits of your policy.

Discounts

State Farm offers various discounts to help you save on your auto insurance premiums. These discounts are designed to reward safe driving habits, responsible actions, and loyalty to the company. Here are some examples of discounts you might be eligible for:

- Safe Driving Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits and minimizing risk on the road.

- Good Student Discount: Students with good academic standing can benefit from this discount, reflecting their responsible behavior and commitment to education.

- Multi-Policy Discount: If you bundle your auto insurance with other State Farm policies, such as homeowners or renters insurance, you can qualify for a multi-policy discount, offering significant savings on your premiums.

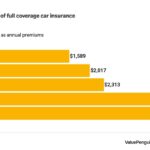

Coverage Levels and Costs

The cost of your auto insurance policy depends on several factors, including your driving record, vehicle type, location, and coverage options selected. Here’s a table outlining different coverage levels and their associated costs, providing a general idea of pricing:

| Coverage Level | Estimated Annual Premium |

|---|---|

| Basic Liability | $500 – $1,000 |

| Liability with Collision and Comprehensive | $1,000 – $2,000 |

| Full Coverage with Uninsured/Underinsured Motorist | $1,500 – $3,000 |

Customer Experience with State Farm

State Farm, a prominent name in the insurance industry, boasts a large customer base and a reputation for providing comprehensive insurance solutions. However, understanding the customer experience with State Farm’s online quote process and customer service is crucial to assess its effectiveness and identify areas for improvement.

Customer Reviews and Feedback

Customer reviews and feedback offer valuable insights into the overall customer experience with State Farm. Analyzing these reviews helps identify common themes, positive and negative experiences, and areas where State Farm excels or needs improvement.

- Positive Experiences: Many customers praise State Farm for its user-friendly online platform, quick and efficient quote generation, and responsive customer service. They appreciate the clear and concise information provided on the website, making it easy to understand policy options and compare quotes.

- Negative Experiences: Some customers report challenges with navigating the website, particularly when trying to access specific information or complete certain tasks. Others have expressed frustration with long wait times for customer service representatives or difficulties resolving complex issues.

Ease of Use and User-Friendliness

State Farm’s online platform aims to provide a seamless and user-friendly experience for customers seeking auto insurance quotes. The platform’s design and features are crucial factors in determining its ease of use.

- Positive Aspects: State Farm’s online quote process is generally considered straightforward and intuitive. The platform’s clear layout and easy-to-follow instructions guide customers through the quote process, making it accessible even for those unfamiliar with online insurance platforms.

- Areas for Improvement: Some customers have suggested improvements to the website’s navigation, making it easier to find specific information or access certain features. Additionally, streamlining the quote process by reducing the number of required steps or simplifying the data entry process could enhance user experience.

Potential Areas for Improvement

While State Farm’s online quote experience is generally positive, there are areas where improvements could enhance customer satisfaction and optimize the process.

- Enhanced Customer Support: Expanding customer support options, such as live chat or 24/7 phone availability, could improve accessibility and responsiveness.

- Personalized Recommendations: Utilizing data analytics to personalize quote recommendations based on individual customer needs and preferences could enhance the customer experience.

- Streamlined Payment Process: Simplifying the payment process, offering more payment options, and providing real-time payment status updates could improve customer convenience.

State Farm’s Online Presence and Marketing

State Farm, a leading insurance provider, has a robust online presence that plays a crucial role in attracting and retaining customers. Their online marketing efforts encompass a comprehensive strategy that leverages their website, social media platforms, and online advertising campaigns to reach a wide audience.

State Farm’s Website

State Farm’s website is a central hub for customers to access various services, including obtaining auto insurance quotes. The website is user-friendly, with a clear layout and intuitive navigation. Visitors can easily find information about different insurance plans, compare quotes, and manage their policies online. The website also features interactive tools, such as a car payment calculator and a claims reporting system, enhancing the customer experience.

State Farm’s Social Media Presence

State Farm maintains an active presence on popular social media platforms like Facebook, Twitter, Instagram, and YouTube. They use these platforms to engage with customers, share helpful tips, and promote their products and services. State Farm’s social media strategy focuses on building a strong brand image and fostering a sense of community among its followers. They also utilize social media advertising to target specific demographics and interests.

State Farm’s Online Advertising Campaigns

State Farm invests heavily in online advertising campaigns, including search engine marketing (SEM), display advertising, and social media advertising. These campaigns aim to reach potential customers who are actively searching for auto insurance or browsing websites related to the automotive industry. State Farm’s online ads are often tailored to specific demographics and interests, making them more effective in attracting relevant leads.

State Farm’s Search Engine Optimization () Strategy

plays a critical role in driving traffic to State Farm’s online quote platform. The company employs various strategies to improve its website’s ranking in search engine results pages (SERPs). These strategies include optimizing website content for relevant s, building high-quality backlinks, and ensuring website accessibility. State Farm’s efforts ensure that their website appears prominently in search results when potential customers search for auto insurance quotes online.

Comparison of State Farm’s Online Marketing Strategies with Competitors

| Feature | State Farm | Competitor A | Competitor B |

|---|---|---|---|

| Website Usability | User-friendly, intuitive navigation | Limited features, complex navigation | Modern design, seamless user experience |

| Social Media Presence | Active engagement, strong brand image | Limited social media activity | Engaging content, strong community building |

| Online Advertising Campaigns | Targeted campaigns, high investment | Limited online advertising presence | Innovative ad formats, strong ROI |

| Strategy | Comprehensive efforts, high ranking | Limited optimization | Strong foundation, high organic traffic |

Industry Trends and State Farm’s Position

The auto insurance industry is constantly evolving, driven by technological advancements and changing consumer preferences. Key trends include the increasing adoption of telematics, digital insurance platforms, and personalized pricing models. These trends are shaping the competitive landscape and influencing how insurance providers like State Farm operate and interact with customers.

State Farm’s Response to Industry Trends

State Farm has recognized the significance of these trends and has taken steps to adapt its business model and offerings. The company has invested in developing its digital capabilities, including its online quote platform and mobile app, to provide customers with a seamless and convenient experience. State Farm has also embraced telematics, offering its Drive Safe & Save program, which uses telematics devices to track driving behavior and reward safe drivers with discounts.

Comparison with Other Providers

State Farm’s online quote process and offerings are comparable to those of other major auto insurance providers. Many companies now offer online quote tools, mobile apps, and telematics programs. However, State Farm’s long-standing reputation for customer service and its extensive agent network differentiate it from some competitors.

Potential Future Impact on State Farm’s Online Presence

The continued adoption of telematics and digital insurance platforms is likely to have a significant impact on State Farm’s online presence in the future.

- State Farm will need to continue investing in its digital infrastructure to ensure its online platform remains competitive and user-friendly.

- The company may also need to explore new ways to leverage data collected from telematics devices to personalize pricing and offer customized insurance products.

- State Farm’s online presence will play an increasingly important role in attracting and retaining customers in a digital-first environment.

Ultimate Conclusion

Whether you’re a seasoned driver or a new car owner, State Farm online quote auto insurance offers a hassle-free way to explore your options and find the right coverage for you. By leveraging technology, State Farm streamlines the insurance process, allowing you to focus on what matters most: driving safely and confidently on the road.

FAQ: State Farm Online Quote Auto Insurance

Is it safe to provide my personal information online?

State Farm uses industry-standard security measures to protect your information. Their website is encrypted to ensure the privacy of your data.

What if I need help with the online quote process?

You can contact State Farm’s customer service team for assistance. They are available by phone, email, or chat.

Can I get a quote for multiple vehicles?

Yes, State Farm’s online platform allows you to get quotes for multiple vehicles at once.

What happens after I get a quote?

Once you receive a quote, you can choose to accept it or decline it. If you accept, you can purchase your policy online or through a State Farm agent.