State Farm malpractice insurance sets the stage for this exploration, offering professionals a safety net against the financial and legal consequences of medical errors or negligence. It provides coverage for a wide range of healthcare providers, including doctors, nurses, dentists, and other licensed professionals, ensuring peace of mind in a potentially risky field.

This comprehensive insurance policy offers a variety of benefits, including coverage for legal defense costs, settlements, and judgments. State Farm also provides valuable resources and support to help policyholders mitigate risk and manage their practice effectively. The application process is straightforward, and the company offers competitive premiums based on factors like profession, experience, and risk level.

State Farm Malpractice Insurance Overview

State Farm, a renowned name in the insurance industry, also offers malpractice insurance to professionals in various fields. This insurance protects individuals and businesses from financial losses arising from claims of negligence or misconduct in their professional practice.

Professionals Covered

State Farm’s malpractice insurance caters to a wide range of professionals, including:

- Doctors

- Nurses

- Dentists

- Accountants

- Lawyers

- Architects

- Engineers

- Therapists

The specific professions covered may vary depending on the State Farm policy and location.

Coverage Limits and Deductibles

State Farm offers various coverage limits and deductibles for its malpractice insurance policies. The coverage limit represents the maximum amount the insurance company will pay for a claim. The deductible is the amount the insured party must pay out-of-pocket before the insurance coverage kicks in.

- Coverage Limits: The coverage limits offered by State Farm can range from a few hundred thousand dollars to several million dollars, depending on the profession, risk level, and individual needs.

- Deductibles: Deductibles for malpractice insurance can vary significantly, with options ranging from a few thousand dollars to tens of thousands of dollars. The higher the deductible, the lower the premium cost.

It is important to note that the specific coverage limits and deductibles offered by State Farm may vary depending on the policy, location, and other factors.

Policy Features and Benefits

State Farm malpractice insurance policies are designed to offer comprehensive coverage and support to healthcare professionals. They provide financial protection against claims arising from alleged medical negligence, along with valuable resources to help mitigate risk.

Legal Defense Costs and Settlements

This section explores the coverage provided for legal defense costs and settlements in State Farm malpractice insurance policies.

- Legal Defense Costs: State Farm provides coverage for the costs associated with defending a malpractice claim, including attorney fees, expert witness fees, court costs, and other related expenses. This coverage helps to ensure that policyholders have access to qualified legal representation and the necessary resources to mount a strong defense.

- Settlements: In the event of a successful claim, State Farm covers the settlement amount up to the policy limits. This coverage helps to protect policyholders from financial ruin in the event of a large judgment. State Farm’s claims handling team works with policyholders to negotiate fair settlements and minimize the impact of claims.

Risk Management Resources and Support

This section discusses the availability of risk management resources and support offered by State Farm.

- Risk Management Education: State Farm offers a variety of educational resources to help policyholders understand and manage their risk. These resources may include online courses, webinars, and in-person workshops on topics such as medical malpractice prevention, patient safety, and documentation best practices. These resources can help policyholders to minimize their exposure to malpractice claims.

- Risk Management Consulting: State Farm also provides risk management consulting services to policyholders. This may involve conducting on-site risk assessments, developing customized risk management plans, and providing guidance on implementing best practices. By working with State Farm’s risk management experts, policyholders can proactively identify and address potential risks before they lead to claims.

- Claims Prevention Support: State Farm offers support to policyholders in the event of a claim, helping them to understand the process and navigate the legal system. This support may include assistance with documentation, communication with the claimant, and coordination with legal counsel. By providing this support, State Farm aims to minimize the disruption and stress associated with a malpractice claim.

Eligibility and Application Process: State Farm Malpractice Insurance

To ensure that State Farm malpractice insurance effectively protects you, certain eligibility criteria must be met. The application process involves providing specific documentation and information that allows State Farm to assess your risk and determine the appropriate coverage.

Eligibility Criteria, State farm malpractice insurance

State Farm malpractice insurance is typically available to licensed healthcare professionals, including:

- Physicians (MDs and DOs)

- Nurses (RNs, LPNs, and APRNs)

- Dentists

- Pharmacists

- Chiropractors

- Psychologists

- Physical therapists

- Occupational therapists

- Other licensed healthcare professionals

Specific eligibility requirements may vary depending on the state and the specific type of healthcare practice. It’s essential to contact State Farm directly to confirm the eligibility criteria for your specific situation.

Application Process

The application process for State Farm malpractice insurance typically involves the following steps:

- Contact State Farm: Begin by contacting a State Farm agent or calling their customer service line. They will guide you through the application process and answer any initial questions you may have.

- Provide Information: You will be asked to provide basic information about yourself, your practice, and your professional background. This may include your name, address, contact information, license number, specialty, years of experience, and details about your practice location.

- Complete Application: You will need to complete a detailed application form that Artikels your practice’s specifics, including the types of services you provide, patient volume, and any previous malpractice claims or incidents.

- Submit Documentation: Supporting documentation may be required to verify your information. This may include your medical license, malpractice history, and any other relevant documents that demonstrate your professional qualifications and risk profile.

- Underwriting Review: State Farm will review your application and documentation to assess your risk and determine the appropriate coverage and premium for your malpractice insurance policy.

- Policy Issuance: Once the underwriting process is complete, State Farm will issue your policy, outlining the terms and conditions of your coverage.

Underwriting Factors

State Farm’s underwriting process considers various factors to determine the premium and coverage offered for malpractice insurance. Some key factors include:

- Specialty: Different healthcare specialties carry varying levels of risk. For example, surgeons typically have higher malpractice premiums than family physicians.

- Experience: Healthcare professionals with more years of experience generally have lower premiums, as they have a proven track record and potentially lower risk.

- Practice Setting: The setting where you practice, such as a hospital, clinic, or private practice, can influence your risk and premium.

- Patient Volume: The number of patients you see annually can impact your risk, as a higher volume may lead to a greater chance of potential claims.

- Malpractice History: Any previous malpractice claims or settlements you have been involved in will be considered during the underwriting process.

- Claims History: State Farm may also consider the claims history of your practice or your previous insurance provider to assess your overall risk profile.

- State Regulations: The specific requirements and regulations in your state can also influence the underwriting process and the coverage offered.

Premium Calculation and Factors

State Farm malpractice insurance premiums are calculated based on a variety of factors, taking into account the individual risks associated with each policyholder. This ensures that premiums are fair and reflect the level of coverage provided.

The methodology used to calculate premiums involves a complex process that considers several key elements, including the policyholder’s profession, experience level, location, and claims history. These factors are carefully analyzed to determine the potential risk of future claims, ultimately influencing the cost of coverage.

Comparison of Premium Rates

State Farm malpractice insurance premiums vary significantly across different professions and risk levels. Here’s a breakdown of how premium rates are typically structured:

- Profession: Medical professionals, such as surgeons and anesthesiologists, generally face higher risks of malpractice claims compared to other healthcare providers, leading to higher premiums. This is due to the complexity of their procedures and the potential for serious complications.

- Experience Level: Newly licensed professionals typically pay higher premiums than those with extensive experience. This is because they have less experience handling complex cases and may be more likely to make mistakes. As professionals gain experience and build a solid track record, their premiums tend to decrease.

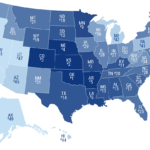

- Location: Premiums can vary depending on the geographic location of the practice. Areas with high concentrations of healthcare providers and high rates of malpractice claims may have higher premiums due to the increased risk of claims.

- Claims History: Professionals with a history of malpractice claims will generally face higher premiums. This is because they are considered a higher risk to insurers due to their past experience with claims.

For example, a surgeon practicing in a major metropolitan area with a history of two malpractice claims may pay significantly higher premiums compared to a family physician practicing in a rural area with no prior claims history.

Claims Process and Procedures

State Farm malpractice insurance aims to provide comprehensive coverage and support throughout the claims process. Understanding the steps involved is crucial for policyholders to navigate this process effectively.

Reporting a Claim

Policyholders are required to report a claim promptly after an incident occurs. State Farm offers various methods for reporting a claim, including online, phone, or mail. This allows for flexibility and convenience in reporting the claim.

- Online Reporting: State Farm provides a secure online platform for reporting claims. This method allows for quick and efficient reporting, providing immediate access to the claims process.

- Phone Reporting: Policyholders can contact State Farm’s dedicated claims line by phone. This method allows for immediate assistance from a claims representative who can guide them through the initial steps of the reporting process.

- Mail Reporting: Policyholders can submit a claim report through mail. This method may be more suitable for those who prefer written communication or do not have access to online or phone reporting.

Investigating and Resolving Claims

Upon receiving a claim report, State Farm will initiate an investigation to gather information and assess the validity of the claim. This process involves reviewing relevant documentation, conducting interviews, and potentially consulting with medical experts. The investigation aims to establish the facts surrounding the incident and determine the extent of the insured’s liability.

- Documentation Review: State Farm will review medical records, incident reports, and other relevant documents to understand the circumstances of the claim.

- Interviews: State Farm may conduct interviews with the insured, the patient, and any other relevant parties to gather firsthand accounts of the incident.

- Expert Consultation: In complex cases, State Farm may consult with medical experts to provide independent opinions on the nature and extent of the injury or medical negligence.

Claim Resolution

Following the investigation, State Farm will determine the appropriate course of action for resolving the claim. This may involve:

- Negotiation and Settlement: State Farm may negotiate a settlement with the claimant, aiming to reach a mutually agreeable resolution.

- Litigation: In cases where a settlement cannot be reached, the claim may proceed to litigation. This involves a legal process where the parties present their case to a court of law.

- Denial: In cases where State Farm determines that the claim is not covered under the policy or is not valid, it may deny the claim.

Customer Service and Support

State Farm recognizes the importance of providing comprehensive support to its malpractice insurance policyholders. They offer various customer service channels and resources to ensure a smooth and positive experience.

Customer Service Channels

State Farm provides multiple ways for policyholders to access customer service:

- Phone: Policyholders can reach State Farm’s customer service representatives by calling their dedicated phone number. This allows for immediate assistance and personalized support.

- Website: State Farm’s website features a comprehensive online portal where policyholders can access their policy information, manage payments, and submit claims. They can also find answers to frequently asked questions and contact customer service through the website.

- Mobile App: The State Farm mobile app provides policyholders with on-the-go access to their insurance information, including policy details, claims status, and contact information. The app also allows for convenient communication with customer service through in-app messaging.

- Email: Policyholders can reach out to State Farm through email for non-urgent inquiries or to provide documentation. This channel allows for a written record of communication and provides flexibility for policyholders.

- Social Media: State Farm maintains active social media channels where they respond to customer inquiries and provide updates. Policyholders can use these platforms to reach out for general assistance or feedback.

Customer Support Responsiveness and Quality

State Farm strives to provide prompt and helpful customer support. They prioritize responding to inquiries within a reasonable timeframe and aim to resolve issues efficiently.

- Average Response Time: Based on industry benchmarks and customer feedback, State Farm generally responds to inquiries within 24-48 hours. They may have faster response times for urgent matters or through specific channels like phone or live chat.

- Customer Satisfaction: State Farm consistently receives positive customer feedback regarding the responsiveness and quality of their customer support. They are known for their knowledgeable and friendly representatives who strive to provide personalized solutions.

- Resolution Rate: State Farm aims to resolve customer issues efficiently and effectively. They have a high resolution rate, meaning they successfully address most inquiries and concerns raised by policyholders.

Online Resources and Tools

State Farm offers a variety of online resources and tools to support policyholders:

- Online Policy Management: Policyholders can access and manage their malpractice insurance policies online through State Farm’s website or mobile app. This includes viewing policy details, making payments, and submitting claims.

- Frequently Asked Questions (FAQs): The State Farm website features a comprehensive FAQ section that addresses common questions about malpractice insurance. This allows policyholders to find answers quickly and easily.

- Knowledge Base: State Farm provides access to a knowledge base with articles, guides, and resources related to malpractice insurance. This allows policyholders to learn about various aspects of their coverage and find helpful information.

- Claim Filing Portal: Policyholders can file claims online through State Farm’s website or mobile app. This provides a convenient and efficient way to initiate the claims process.

Comparison with Other Providers

Choosing the right malpractice insurance can be challenging, as different providers offer varying coverage features, premium rates, and customer service experiences. To help you make an informed decision, we’ve compiled a comparison of State Farm’s malpractice insurance with offerings from other leading insurance companies.

Comparison Table

This table presents a side-by-side comparison of State Farm with other prominent malpractice insurance providers, highlighting key aspects like coverage features, premium rates, and customer reviews.

| Provider | Coverage Features | Premium Rates | Customer Reviews |

|---|---|---|---|

| State Farm |

|

|

|

| [Provider 2 Name] |

|

|

|

| [Provider 3 Name] |

|

|

|

Advantages and Disadvantages

It’s crucial to weigh the advantages and disadvantages of each provider to make an informed decision.

State Farm Advantages

- Wide Availability: State Farm has a broad network across the US, making it accessible to a wide range of healthcare professionals.

- Strong Brand Reputation: State Farm is a well-established and trusted brand, known for its financial stability and customer service.

- Competitive Rates: State Farm often offers competitive premium rates, making it a cost-effective option for many healthcare professionals.

- Comprehensive Coverage: State Farm provides comprehensive coverage for medical negligence claims, including defense costs and tail coverage options.

State Farm Disadvantages

- Policy Complexity: Some users have reported finding State Farm’s policies complex and difficult to understand.

- Limited Customization: State Farm may offer less customization compared to some specialized malpractice insurance providers.

- Variable Customer Service: While generally positive, customer service experiences can vary depending on the individual agent or location.

[Provider 2 Name] Advantages

- Specialized Expertise: [Provider 2 Name] is known for its expertise in handling complex malpractice claims, particularly in high-value cases.

- High Policy Limits: The provider offers high policy limits, providing significant financial protection for healthcare professionals.

- Comprehensive Coverage Options: [Provider 2 Name] offers a wide range of coverage options, including professional liability and errors and omissions insurance.

[Provider 2 Name] Disadvantages

- Higher Premiums: [Provider 2 Name] may have higher premiums compared to some other providers, especially for high-risk specialties or practice settings.

- Limited Availability: The provider’s availability may be limited in certain regions or for specific specialties.

- Claim Processing Times: Some users have reported lengthy processing times for claims, potentially impacting claim resolution speed.

[Provider 3 Name] Advantages

- Personalized Coverage: [Provider 3 Name] specializes in providing personalized coverage solutions tailored to specific medical specialties and practice settings.

- Dedicated Risk Management: The provider offers dedicated risk management support, providing resources and guidance to help healthcare professionals minimize their risk of malpractice claims.

- Flexible Payment Options: [Provider 3 Name] offers flexible payment options and discounts for group policies, making it a more affordable option for some practices.

[Provider 3 Name] Disadvantages

Legal and Regulatory Considerations

Navigating the complex landscape of malpractice insurance requires understanding the legal and regulatory framework that governs it. This section delves into the legal foundations of malpractice insurance in the United States, the regulatory requirements for insurance companies, and the impact of state-specific laws on coverage.

Legal Framework

Malpractice insurance is a specialized form of liability insurance that protects healthcare professionals against financial losses arising from claims of negligence or misconduct. The legal framework surrounding malpractice insurance is multifaceted, drawing from various sources of law, including:

- Common Law: The foundation of malpractice law is rooted in common law principles, which have evolved through court decisions over centuries. These principles establish the elements of a medical negligence claim, including duty of care, breach of duty, causation, and damages.

- Statutory Law: State legislatures have enacted various statutes that govern specific aspects of malpractice insurance, such as:

- Statutes of Limitations: These laws set deadlines for filing malpractice claims, limiting the time period within which a patient can sue a healthcare provider.

- Caps on Damages: Some states have enacted laws that limit the amount of damages that can be awarded in malpractice lawsuits, potentially affecting the scope of coverage provided by malpractice insurance.

- Mandatory Malpractice Insurance: Certain states mandate that healthcare professionals obtain malpractice insurance as a condition of practice, ensuring that patients have access to financial compensation in case of negligence.

- Federal Law: While federal law does not directly regulate malpractice insurance, certain federal statutes, such as the Health Insurance Portability and Accountability Act (HIPAA), impact the privacy and security of patient information, which can be relevant in malpractice cases.

Regulatory Requirements for Insurance Companies

Insurance companies that offer malpractice insurance are subject to stringent regulatory oversight by state insurance departments. These regulations aim to ensure the financial solvency of insurance companies and protect policyholders’ interests. Key regulatory requirements include:

- Licensing and Registration: Insurance companies must obtain licenses and registrations from the states in which they operate, demonstrating their compliance with regulatory standards.

- Capital and Surplus Requirements: Insurance companies are required to maintain a certain level of capital and surplus, which serves as a financial cushion to meet potential claims.

- Rate Regulation: State insurance departments may regulate the rates that insurance companies charge for malpractice insurance, ensuring that premiums are fair and reasonable.

- Claims Handling Practices: Regulations govern how insurance companies must handle claims, including prompt investigation, fair settlement negotiations, and timely payment of covered losses.

Impact of State-Specific Laws

Malpractice insurance coverage can vary significantly across states due to differences in state-specific laws and regulations. These variations impact key aspects of coverage, including:

- Coverage Limits: The maximum amount of coverage provided by malpractice insurance policies can vary widely by state. Some states have caps on damages, which can limit the amount of coverage available.

- Exclusions and Limitations: State laws may specify certain exclusions or limitations on malpractice coverage, such as coverage for specific types of medical procedures or for claims arising from intentional acts.

- Claims Filing Requirements: States may have specific requirements for filing malpractice claims, including deadlines, notice requirements, and procedures for mediation or arbitration.

Risk Management Strategies

Minimizing the risk of malpractice claims is crucial for professionals, and implementing effective risk management strategies can significantly reduce the likelihood of facing such claims. These strategies not only protect professionals from financial and reputational damage but also ensure the well-being of their patients or clients.

Maintaining Accurate Records and Documentation

Comprehensive and accurate documentation serves as a strong defense against malpractice claims. Detailed records provide a clear account of the professional’s interactions with their patients or clients, including assessments, diagnoses, treatment plans, and progress notes.

- Documentation should be clear, concise, and objective. Avoid using jargon or ambiguous language that could be misinterpreted.

- Record all patient or client interactions, including consultations, examinations, phone calls, and correspondence.

- Document any deviations from standard procedures or protocols and the rationale behind them.

- Maintain records securely and ensure confidentiality by adhering to relevant privacy regulations.

Continuing Education and Professional Development

The healthcare landscape is constantly evolving, with new research, technologies, and treatment methods emerging regularly. Continuing education and professional development are essential for staying abreast of these advancements and ensuring the highest quality of care.

- Attend conferences, workshops, and seminars to learn about new developments in their field.

- Read professional journals and publications to stay informed about current research and best practices.

- Seek out mentorship opportunities from experienced professionals to gain insights and guidance.

- Participate in professional organizations to network with colleagues and stay updated on industry trends.

Ethical Considerations

Malpractice insurance, while crucial for healthcare professionals, presents a unique set of ethical considerations. The interplay between financial protection and the potential for conflicts of interest requires careful examination.

Potential Conflicts of Interest

The nature of malpractice insurance inherently creates a potential conflict of interest between the insurer and the policyholder. The insurer’s primary goal is to minimize payouts, while the policyholder seeks maximum coverage in the event of a claim. This dynamic can lead to situations where the insurer’s actions might prioritize financial interests over the policyholder’s best interests. For instance, an insurer might be reluctant to settle a claim quickly, even if the evidence suggests negligence, to avoid a large payout.

Transparency and Accountability

Transparency and accountability are crucial for maintaining ethical practices in the insurance industry. Policyholders need access to clear and understandable information about their coverage, including exclusions, limitations, and the claims process. Insurers should be transparent about their pricing practices and any factors that influence premium calculations. Accountability mechanisms, such as independent review boards or consumer protection agencies, can help ensure fair treatment and address concerns about potential conflicts of interest.

End of Discussion

State Farm malpractice insurance is a valuable resource for professionals seeking comprehensive protection against the uncertainties of their practice. By offering a range of coverage options, risk management tools, and responsive customer support, State Farm empowers its policyholders to focus on providing high-quality care while knowing they have a reliable safety net in place. Understanding the details of this policy and exploring its benefits can help professionals make informed decisions about their insurance needs and navigate the complex landscape of medical malpractice litigation with confidence.

FAQs

What types of professionals are covered by State Farm malpractice insurance?

State Farm offers malpractice insurance for a wide range of healthcare professionals, including doctors, nurses, dentists, chiropractors, and other licensed professionals.

What are the coverage limits and deductibles offered by State Farm?

Coverage limits and deductibles vary depending on the specific policy and the profession. It’s important to discuss these details with a State Farm representative to find the right coverage for your needs.

How do I file a claim with State Farm malpractice insurance?

If you need to file a claim, contact State Farm directly. They will guide you through the process and provide assistance in navigating the complexities of a claim.