State Farm life insurance reddit is a hub for discussions about one of America’s largest insurance providers. Here, users share their experiences, concerns, and insights about State Farm’s life insurance policies, customer service, and claims handling processes. From detailed reviews of specific policy types to comparisons with other insurance providers, Reddit offers a valuable platform for understanding the real-world perspectives on State Farm life insurance.

This article delves into the key themes and trends emerging from Reddit discussions, examining the pros and cons of State Farm’s life insurance offerings, and providing valuable insights for potential customers. We explore the different policy types, analyze the cost and value for money, and discuss the experiences of individuals with State Farm’s customer service and claims handling procedures.

State Farm Life Insurance Overview

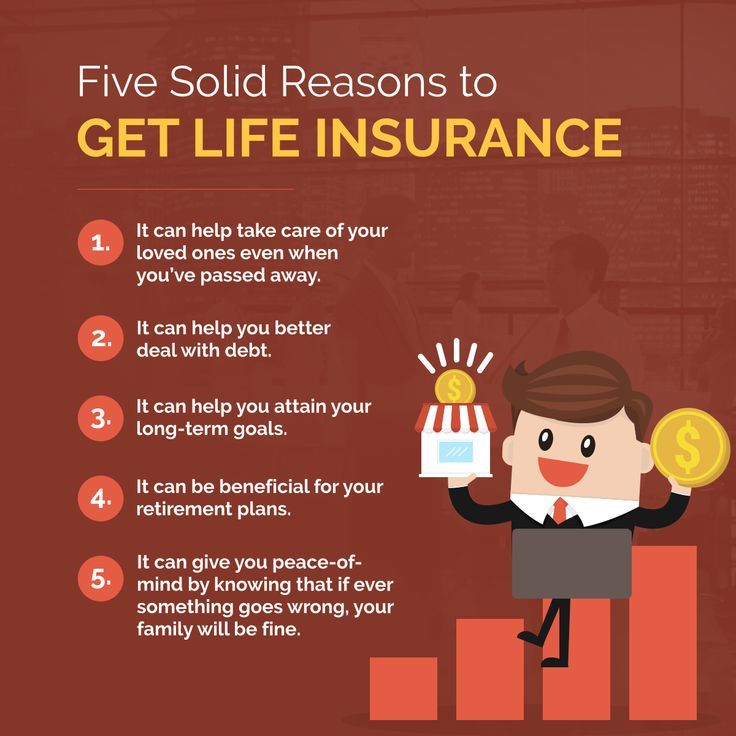

State Farm is a well-known and trusted name in the insurance industry, offering a wide range of life insurance products to meet diverse needs. These policies can provide financial security for loved ones in the event of your passing, helping to cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Term Life Insurance, State farm life insurance reddit

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and no death benefit is paid.

- Affordability: Term life insurance is generally the most affordable type of life insurance, making it a good option for those on a budget.

- Simplicity: Term life insurance policies are relatively straightforward and easy to understand.

- Flexibility: Some term life insurance policies offer the option to convert to a permanent life insurance policy at the end of the term.

Whole Life Insurance

Whole life insurance provides lifelong coverage, meaning your beneficiaries will receive a death benefit regardless of when you pass away. It also has a cash value component that grows over time.

- Guaranteed Death Benefit: Whole life insurance policies guarantee a death benefit, providing peace of mind knowing your beneficiaries will be financially protected.

- Cash Value Accumulation: The cash value component of whole life insurance can be borrowed against or withdrawn, providing access to funds during your lifetime.

- Investment Potential: Whole life insurance policies offer potential investment growth, but returns are typically lower than other investment options.

Universal Life Insurance

Universal life insurance offers flexible premiums and death benefit options. It also has a cash value component that earns interest, similar to whole life insurance.

- Flexibility: Universal life insurance policies allow you to adjust your premiums and death benefit to meet your changing needs.

- Cash Value Growth: The cash value component of universal life insurance can grow at a rate that is linked to current interest rates.

- Potential for Higher Returns: Universal life insurance policies can potentially earn higher returns than whole life insurance, but they also carry more risk.

Variable Life Insurance

Variable life insurance allows you to invest your premium payments in sub-accounts that are linked to the performance of the stock market.

- Potential for Higher Returns: Variable life insurance policies offer the potential for higher returns than traditional life insurance policies, but they also carry more risk.

- Investment Flexibility: You can choose from a variety of investment options within your variable life insurance policy.

- Death Benefit Protection: Your death benefit is guaranteed, but the amount may fluctuate based on the performance of your investment sub-accounts.

Reddit Discussions on State Farm Life Insurance: State Farm Life Insurance Reddit

Reddit serves as a valuable platform for gathering insights into consumer experiences and opinions about various products and services, including life insurance. Analyzing discussions on Reddit about State Farm life insurance provides a nuanced understanding of how users perceive the company’s offerings and customer service.

Common Themes and Concerns

Reddit users often express a range of concerns and opinions regarding State Farm life insurance. Some common themes that emerge from these discussions include:

- Pricing and Value: Users frequently discuss the pricing of State Farm life insurance policies, comparing them to other providers and expressing concerns about perceived high costs or lack of value for the premium paid. For example, some users may mention that they found better rates with other insurers after comparing quotes, leading to discussions about State Farm’s competitive pricing.

- Customer Service: Another recurring theme is customer service experiences, with some users sharing positive experiences, while others highlight negative interactions, including difficulties reaching representatives, long wait times, or issues with claim processing. These experiences can significantly influence users’ overall perception of State Farm.

- Policy Transparency and Complexity: Reddit discussions often touch upon the complexity of life insurance policies, with users expressing concerns about the clarity and transparency of State Farm’s policy language and terms. Some users may find it challenging to understand the specifics of their policy or the coverage they are receiving.

- Limited Options: While State Farm offers various life insurance products, some users may express a desire for more diverse options, particularly in terms of coverage features or specific needs, such as those related to terminal illness or critical illness coverage.

Specific Experiences

Individual experiences shared by Reddit users provide valuable insights into the real-world interactions with State Farm life insurance. Some common narratives include:

- Positive Experiences: Some users share positive experiences with State Farm, highlighting efficient claim processing, responsive customer service, or competitive pricing. These positive narratives can contribute to a favorable perception of the company.

- Negative Experiences: Conversely, other users share negative experiences, such as difficulties obtaining quotes, lengthy wait times for claim approvals, or frustrating interactions with customer service representatives. These negative experiences can lead to dissatisfaction and negative sentiment towards State Farm.

- Comparison with Other Providers: Many Reddit discussions involve comparing State Farm life insurance with offerings from other providers. Users may share their experiences with different insurers, comparing pricing, coverage, and customer service, influencing their overall perception of State Farm’s competitiveness.

Sentiment Analysis

Analyzing the sentiment expressed by Reddit users towards State Farm life insurance reveals a mixed picture. While some users express positive sentiments, highlighting good experiences and competitive pricing, others express negative sentiments, citing concerns about pricing, customer service, or policy complexity.

- Positive Sentiment: Users who have had positive experiences with State Farm life insurance, particularly in terms of claim processing or customer service, often express positive sentiment, recommending the company to others.

- Negative Sentiment: Conversely, users who have encountered negative experiences, such as difficulties obtaining quotes, long wait times for claim approvals, or frustrating interactions with customer service representatives, often express negative sentiment, cautioning others against choosing State Farm.

- Neutral Sentiment: Many Reddit discussions express neutral sentiment, with users simply sharing their experiences and observations without strong positive or negative opinions. These neutral discussions can provide valuable insights into the general perception of State Farm life insurance.

Customer Service and Claims Handling

State Farm is known for its extensive network and its reputation for providing reliable insurance services. However, customer experiences with State Farm’s customer service and claims handling can vary. Reddit users have shared their experiences, highlighting both positive and negative aspects.

Customer Service Experiences

Reddit discussions offer a platform for customers to share their experiences with State Farm’s customer service. While some users report positive interactions with friendly and helpful representatives, others have encountered challenges with responsiveness, communication, and resolution of issues.

- Positive Experiences: Some Reddit users have praised State Farm’s customer service for its promptness, helpfulness, and efficiency. They have found representatives to be knowledgeable, patient, and willing to go the extra mile to assist them.

- Negative Experiences: Other Reddit users have expressed frustration with long wait times, difficulty reaching a representative, and inconsistent responses. They have reported instances where their concerns were not adequately addressed, and they felt their issues were not taken seriously.

Claims Handling Process

Filing a claim with State Farm can be a complex process, and the experiences of Reddit users highlight the varying levels of satisfaction with the claims handling process.

- Speed and Efficiency: Some users have reported positive experiences with the speed and efficiency of State Farm’s claims handling process. They have found that claims were processed promptly, and they received timely updates on the status of their claim.

- Transparency and Communication: Other users have expressed concerns about the lack of transparency and communication during the claims process. They have reported difficulty obtaining clear information about the status of their claim, and they felt that they were not kept informed about the process.

- Outcomes: The outcomes of claims filed with State Farm vary. Some users have reported satisfactory resolutions, while others have expressed dissatisfaction with the settlement offered or the handling of their claim.

Insights on Claims Handling Procedures

Based on Reddit discussions, several insights can be drawn about State Farm’s claims handling procedures.

- Importance of Clear Communication: Effective communication is crucial for a positive claims experience. Users have emphasized the importance of receiving clear and timely updates on the status of their claim, and they have expressed frustration when communication was lacking or inconsistent.

- Need for Transparency: Transparency in the claims handling process is essential for building trust between State Farm and its customers. Users have called for more transparency regarding the criteria used to assess claims and the process for making decisions.

- Impact of Individual Experiences: It is important to note that individual experiences with State Farm’s claims handling process can vary. Factors such as the type of claim, the complexity of the situation, and the individual representative assigned can all influence the outcome.

Cost and Value for Money

State Farm life insurance is known for its affordability and wide range of coverage options. However, determining if it’s the best value for your money depends on your individual needs and financial situation. This section will explore the pricing of State Farm life insurance policies compared to competitors, analyze its overall value proposition, and discuss factors influencing pricing.

Pricing Comparison with Competitors

Comparing State Farm’s life insurance pricing to competitors is crucial to understanding its competitiveness. While State Farm offers competitive rates, it’s essential to consider factors like coverage, benefits, and policy features when making a comparison. Several online life insurance comparison tools allow you to get quotes from multiple providers, including State Farm, side-by-side.

Value Proposition Analysis

State Farm life insurance offers a comprehensive value proposition that includes coverage, benefits, and customer service.

Coverage and Benefits

- State Farm offers various life insurance policies, including term life, whole life, universal life, and variable life. This diverse selection caters to different needs and budgets.

- Term life insurance is a cost-effective option for temporary coverage, typically for a specific period, such as a mortgage term or until children are financially independent.

- Whole life insurance provides permanent coverage with a cash value component that can be borrowed against or withdrawn.

- Universal life insurance offers flexibility in premium payments and death benefit options.

- Variable life insurance links the death benefit and cash value to the performance of underlying investment accounts.

Cost and Affordability

- State Farm’s life insurance premiums are generally competitive, but pricing can vary depending on factors such as age, health, coverage amount, and policy type.

- State Farm offers discounts for non-smokers, healthy lifestyle choices, and bundling insurance policies.

Factors Influencing Pricing

Several factors influence the pricing of State Farm life insurance policies.

- Age: Younger individuals generally pay lower premiums than older individuals, as they have a lower risk of mortality.

- Health: Individuals with pre-existing health conditions may pay higher premiums due to an increased risk of early death.

- Coverage Amount: Higher coverage amounts generally lead to higher premiums, as the insurer assumes a greater financial risk.

- Policy Type: Different policy types have varying premiums, with term life insurance typically being the most affordable and whole life insurance being more expensive due to its cash value component.

- Lifestyle: Factors such as smoking, alcohol consumption, and risky hobbies can impact premium pricing.

Alternatives to State Farm Life Insurance

While State Farm is a well-known and trusted name in the insurance industry, it’s essential to explore other options to ensure you’re getting the best coverage and value for your needs. Several reputable life insurance providers offer competitive rates, comprehensive coverage, and excellent customer service.

Comparing different providers allows you to make an informed decision based on your individual circumstances and financial goals. This can lead to significant savings in the long run and ensure you have the right protection for your loved ones.

Alternative Life Insurance Providers

Several alternative life insurance providers are available in the market, each with its unique features, benefits, and pricing structure. Here are some prominent players worth considering:

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically 10 to 30 years. It’s generally more affordable than permanent life insurance, making it a suitable option for younger individuals or those with a short-term need for coverage.

- Whole Life Insurance: Whole life insurance provides lifelong coverage and builds cash value that you can borrow against or withdraw. It’s a more expensive option than term life insurance but offers long-term financial security and investment potential.

- Universal Life Insurance: Universal life insurance offers flexible premiums and death benefits, allowing you to adjust your coverage and investment options as your needs change. It provides more control over your policy but can be more complex than other life insurance types.

- Indexed Universal Life Insurance: Indexed universal life insurance links its cash value growth to the performance of a specific market index, such as the S&P 500. This option provides potential for higher returns but also carries some market risk.

- Variable Universal Life Insurance: Variable universal life insurance allows you to invest your cash value in a range of mutual funds, offering greater investment flexibility but also higher risk. It’s suitable for individuals seeking potential growth but willing to accept potential losses.

Comparison with State Farm

When comparing alternative life insurance providers to State Farm, it’s crucial to consider the following factors:

- Coverage Options: Compare the different types of life insurance policies offered by each provider, including term life, whole life, and universal life. Evaluate the coverage limits, benefits, and exclusions to determine the best fit for your needs.

- Pricing: Obtain quotes from multiple providers to compare premiums and determine the most affordable option. Consider factors like age, health, and coverage amount, as they significantly impact pricing.

- Customer Service: Research each provider’s customer service reputation by reading online reviews and testimonials. Look for companies known for their responsiveness, helpfulness, and problem-solving abilities.

- Financial Stability: Assess the financial strength and stability of each provider by checking their ratings from reputable agencies like A.M. Best and Standard & Poor’s. Choose a provider with a strong track record of financial soundness to ensure your policy remains secure.

Advantages and Disadvantages

Choosing an alternative life insurance provider over State Farm offers potential advantages and disadvantages. Here’s a breakdown of key considerations:

Advantages

- Lower Premiums: Some alternative providers may offer more competitive premiums than State Farm, especially for term life insurance. Shopping around can lead to significant savings.

- Greater Flexibility: Certain alternative providers may offer more flexible policy options, allowing you to customize your coverage and investment choices to meet your specific needs.

- Specialized Expertise: Some alternative providers specialize in specific types of life insurance, such as term life or whole life, and may have greater expertise in those areas.

Disadvantages

- Limited Availability: Some alternative providers may not be available in all states or may have limited coverage options compared to State Farm.

- Less Brand Recognition: Smaller alternative providers may not have the same level of brand recognition as State Farm, which could be a concern for some individuals.

- Potential for Higher Risk: Some alternative providers may offer more complex or risky investment options, such as variable universal life insurance, which could lead to potential losses.

Tips for Choosing Life Insurance

Choosing the right life insurance policy can be a complex process, but it’s an important decision for protecting your loved ones financially. Here’s a step-by-step guide to help you navigate the process.

Determine Your Needs

Before you start shopping for life insurance, it’s crucial to assess your individual needs. Consider your financial obligations, such as outstanding debts, mortgage payments, and potential future expenses like college tuition. Also, factor in your dependents’ financial needs, such as income replacement, living expenses, and outstanding debts. Once you understand your financial obligations and your dependents’ needs, you can determine the amount of coverage you require.

Types of Life Insurance

There are two main types of life insurance: term life insurance and permanent life insurance.

- Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It’s generally more affordable than permanent life insurance, making it a good option for those who need coverage for a limited time, such as while raising children or paying off a mortgage.

- Permanent life insurance provides coverage for your entire life, as long as you continue to pay the premiums. It’s typically more expensive than term life insurance but also offers a cash value component that can be borrowed against or withdrawn.

Choosing a Life Insurance Provider

Once you understand your needs and have chosen the type of life insurance that’s right for you, it’s time to start shopping for a provider. Consider the following factors when making your decision:

- Financial strength: Look for a provider with a strong financial rating, as this indicates their ability to pay out claims in the future. You can check the ratings of life insurance companies with independent agencies like A.M. Best, Moody’s, and Standard & Poor’s.

- Reputation: Research the provider’s reputation for customer service and claims handling. Read online reviews and ask for referrals from friends and family.

- Policy features: Compare the features of different policies, such as the coverage amount, premium payment options, and the availability of riders (additional benefits).

- Cost: Get quotes from multiple providers and compare the premiums for similar policies. Don’t just focus on the lowest premium, as this could mean you’re sacrificing coverage or features.

Negotiating Premiums

While you can’t always negotiate the base premium for a life insurance policy, there are some things you can do to potentially lower your costs:

- Shop around: Get quotes from multiple providers to compare premiums.

- Consider a higher deductible: If you’re willing to pay a higher deductible in the event of a claim, you may be able to get a lower premium.

- Ask about discounts: Many providers offer discounts for things like non-smoking status, good health, and group membership.

Ensuring Your Policy Meets Your Needs

Once you’ve chosen a provider and a policy, it’s essential to review the policy carefully to ensure it meets your needs. Consider the following:

- Coverage amount: Make sure the coverage amount is sufficient to meet your financial obligations and your dependents’ needs.

- Premium payment options: Choose a premium payment option that fits your budget and financial situation.

- Riders: Consider adding riders to your policy, such as accidental death benefits or long-term care benefits, to provide additional protection.

- Exclusions: Review the policy exclusions to understand what situations are not covered.

Last Word

Navigating the world of life insurance can be daunting, and Reddit provides a valuable resource for understanding the nuances of State Farm’s offerings. By examining the experiences and opinions shared on the platform, potential customers can gain a deeper understanding of the pros and cons of choosing State Farm life insurance. Ultimately, the decision of whether or not to choose State Farm comes down to individual needs and priorities. However, the insights gleaned from Reddit discussions can help individuals make more informed choices and ensure they select a life insurance policy that aligns with their specific circumstances.

Common Queries

Is State Farm life insurance a good option?

The suitability of State Farm life insurance depends on individual needs and preferences. It’s essential to compare policies, pricing, and customer service experiences before making a decision.

What are the most common complaints about State Farm life insurance on Reddit?

Common complaints include issues with customer service, lengthy claims processing times, and concerns about policy transparency.

How does State Farm’s life insurance compare to competitors?

State Farm’s life insurance policies are generally competitive in terms of pricing and coverage. However, it’s crucial to compare options from other providers to ensure you’re getting the best value for your needs.