State Farm life insurance quotes are a valuable tool for anyone seeking financial security for their loved ones. Whether you’re a young professional starting a family or an experienced individual looking to protect your legacy, understanding the costs and benefits of life insurance is essential. This guide will delve into the intricacies of State Farm life insurance quotes, providing you with the knowledge you need to make informed decisions about your financial future.

State Farm, a renowned name in the insurance industry, offers a variety of life insurance products designed to meet diverse needs and budgets. From term life insurance to whole life insurance, State Farm provides flexible options to ensure your loved ones are financially protected in the event of your passing. This guide will explore the key factors that influence life insurance quotes, including age, health, coverage amount, and policy term. Additionally, we’ll compare State Farm’s offerings with those of other leading insurance providers, giving you a comprehensive understanding of the competitive landscape.

State Farm Life Insurance Overview: State Farm Life Insurance Quote

State Farm Life Insurance, a subsidiary of State Farm Mutual Automobile Insurance Company, is a well-established and reputable provider of life insurance products in the United States. With a rich history spanning over a century, State Farm has earned the trust of millions of customers through its commitment to financial stability, reliable customer service, and diverse product offerings.

History and Background

State Farm was founded in 1922 by George J. Mecherle, a farmer in Bloomington, Illinois. Initially focusing on automobile insurance, the company quickly expanded its offerings to include other types of insurance, including life insurance. Today, State Farm is one of the largest insurance providers in the U.S., with a vast network of agents and a wide range of financial products.

Types of Life Insurance Products, State farm life insurance quote

State Farm Life Insurance offers a comprehensive suite of life insurance products to meet the diverse needs of its customers. Here are some of the key types of life insurance policies offered by State Farm:

- Term Life Insurance: This type of life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is generally the most affordable option and is ideal for individuals who need coverage for a specific time period, such as during the years their children are young or while they are paying off a mortgage.

- Whole Life Insurance: This type of life insurance provides permanent coverage for your entire life, as long as you continue to pay the premiums. Whole life insurance also builds cash value that you can borrow against or withdraw from, making it a potential investment vehicle.

- Universal Life Insurance: This type of life insurance provides flexible premiums and death benefits. You can adjust your premium payments and death benefit amount to suit your changing needs.

- Variable Life Insurance: This type of life insurance allows you to invest a portion of your premiums in sub-accounts that offer the potential for growth. However, it also carries the risk of losing your investment.

- Indexed Universal Life Insurance: This type of life insurance offers a combination of guaranteed death benefits and potential growth linked to a specific market index, such as the S&P 500.

Financial Stability and Customer Service

State Farm Life Insurance is known for its strong financial stability and excellent customer service. The company consistently receives high ratings from independent financial institutions, such as A.M. Best and Moody’s, indicating its robust financial position.

State Farm Life Insurance has an A+ (Superior) rating from A.M. Best, a leading credit rating agency specializing in the insurance industry.

Furthermore, State Farm consistently ranks high in customer satisfaction surveys. The company has a long history of providing responsive and helpful customer service, ensuring that its policyholders have a positive experience.

Getting a Life Insurance Quote from State Farm

Getting a life insurance quote from State Farm is a straightforward process that can be completed online, over the phone, or by working with a local State Farm agent.

Factors Influencing the Cost of a Life Insurance Quote

Several factors influence the cost of a life insurance quote, and understanding these factors can help you get the best possible price.

- Age: Younger individuals generally pay lower premiums than older individuals because they have a lower risk of death.

- Health: Your health history plays a significant role in determining your life insurance premium. Individuals with pre-existing health conditions or a history of risky behavior may be charged higher premiums.

- Lifestyle: Your lifestyle, including your hobbies and occupation, can impact your life insurance quote. Individuals who engage in high-risk activities or work in dangerous professions may face higher premiums.

- Policy Type: The type of life insurance policy you choose will also affect the cost. Term life insurance policies, which provide coverage for a specific period, typically have lower premiums than permanent life insurance policies, which offer lifelong coverage.

- Coverage Amount: The amount of coverage you need will also influence the cost of your life insurance quote. The higher the coverage amount, the higher the premium.

Comparison of State Farm’s Life Insurance Quotes with Other Providers

Here is a table comparing State Farm’s life insurance quotes with those of other major insurance providers, based on a hypothetical 35-year-old male in good health seeking $250,000 in coverage:

| Insurance Provider | Monthly Premium |

|---|---|

| State Farm | $35 |

| AIG | $40 |

| MetLife | $30 |

| Prudential | $38 |

Please note: These are hypothetical examples, and actual quotes may vary based on individual factors. It is essential to obtain quotes from multiple insurance providers to compare rates and coverage options.

Key Considerations for State Farm Life Insurance

Before diving into the specifics of State Farm life insurance, it’s crucial to weigh the advantages and disadvantages of purchasing a policy through this company. Understanding the pros and cons can help you make an informed decision about whether State Farm is the right fit for your life insurance needs.

Pros and Cons of State Farm Life Insurance

State Farm, a well-known name in the insurance industry, offers life insurance as part of its comprehensive suite of financial products. Here’s a breakdown of the key benefits and drawbacks associated with choosing State Farm for your life insurance:

Pros

- Established Reputation: State Farm boasts a long-standing reputation for reliability and customer service, which can be reassuring for those seeking a trusted provider.

- Wide Range of Products: State Farm offers various life insurance policies, catering to diverse needs and budgets, including term life, whole life, and universal life insurance.

- Convenience: State Farm agents are readily available in many communities, making it convenient to obtain quotes, discuss policy options, and manage your coverage.

- Financial Strength: State Farm has a strong financial standing, which translates to a high level of stability and the ability to meet its policy obligations.

Cons

- Potentially Higher Premiums: State Farm’s premiums might be higher compared to some other life insurance providers, particularly for certain policy types or individuals with specific health conditions.

- Limited Customization: While State Farm offers a range of policies, the level of customization available might be less extensive than some competitors, potentially limiting flexibility in tailoring coverage to specific needs.

- Agent Dependence: The process of obtaining quotes and managing your policy can be heavily reliant on the availability and expertise of your local State Farm agent, which may vary depending on the agent’s experience and responsiveness.

Types of Life Insurance Riders Available Through State Farm

Life insurance riders are additional features that can be added to your base policy, enhancing its coverage and providing more comprehensive protection. State Farm offers a variety of riders to address specific needs, including:

Common Riders

- Accidental Death Benefit Rider: This rider provides an additional death benefit if the insured dies due to an accident, offering financial support for unexpected situations.

- Waiver of Premium Rider: This rider waives future premium payments if the insured becomes disabled, ensuring coverage remains in effect even if they can no longer afford premiums.

- Living Benefits Rider: This rider allows the insured to access a portion of their death benefit while they are still alive, providing financial assistance for critical illnesses or long-term care needs.

Benefits and Drawbacks of State Farm Life Insurance Policies

State Farm offers a variety of life insurance policies, each with its own advantages and disadvantages. Here’s a look at some of the key benefits and drawbacks of the most common types of policies:

Term Life Insurance

- Lower Premiums: Term life insurance offers lower premiums compared to permanent life insurance policies, making it an affordable option for temporary coverage needs, such as protecting a mortgage or providing income replacement for a specific period.

- Limited Coverage: Term life insurance provides coverage for a specific term, typically 10 to 30 years. If the insured dies after the term expires, no death benefit is paid.

Whole Life Insurance

- Permanent Coverage: Whole life insurance provides lifelong coverage, ensuring a death benefit will be paid regardless of when the insured passes away. It also builds cash value that can be borrowed against or withdrawn.

- Higher Premiums: Whole life insurance premiums are typically higher than term life insurance due to the lifelong coverage and cash value accumulation feature.

Universal Life Insurance

- Flexibility: Universal life insurance offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage based on changing needs and financial situations.

- Potential for Higher Costs: Universal life insurance premiums can fluctuate depending on interest rates and investment performance, potentially leading to higher costs than expected.

Alternatives to State Farm Life Insurance

While State Farm is a reputable insurance provider, it’s essential to explore other options to ensure you’re getting the best coverage and value for your needs. Comparing different life insurance providers can help you find a policy that aligns with your specific circumstances and budget.

Comparison of Life Insurance Products

Exploring the features and benefits of alternative life insurance providers can help you make an informed decision. Let’s delve into some of the key differences between State Farm and its competitors:

| Feature | State Farm | Competitors (e.g., Northwestern Mutual, Prudential) |

|---|---|---|

| Policy Types | Term life, whole life, universal life, variable life | Similar policy types, often with variations in coverage and features |

| Premiums | Generally competitive, but can vary depending on factors like age, health, and coverage amount | Wide range of premiums, with some companies offering lower rates for specific demographics |

| Coverage Options | Flexible coverage options, including accidental death benefit and living benefits | Diverse coverage options, potentially including riders for specific needs like critical illness or long-term care |

| Customer Service | Known for its strong customer service network | Varying levels of customer service, with some companies offering dedicated support channels |

| Financial Strength | Rated highly by financial institutions for its financial stability | Financial strength ratings vary across companies, so it’s crucial to research their financial stability |

Key Features of Alternative Life Insurance Providers

Here are some examples of features and benefits offered by other life insurance providers:

* Northwestern Mutual: Known for its strong financial stability and personalized financial planning services.

* Prudential: Offers a wide range of life insurance products, including term life, whole life, and universal life.

* MassMutual: Provides comprehensive life insurance coverage and financial planning resources.

* New York Life: Known for its financial strength and commitment to customer service.

Considerations for Choosing an Alternative Provider

When exploring alternatives to State Farm, consider these factors:

* Your individual needs: Determine your specific life insurance needs, such as coverage amount, policy type, and desired features.

* Financial stability: Research the financial strength of potential providers to ensure their long-term viability.

* Customer service: Explore the reputation and accessibility of the provider’s customer service channels.

* Policy features and benefits: Compare coverage options, riders, and additional benefits offered by different companies.

* Cost: Evaluate the premiums and overall cost of the policy to ensure it fits within your budget.

Tips for Choosing the Right Life Insurance Policy

Finding the right life insurance policy can feel overwhelming. With so many options available, it’s essential to understand your needs and consider factors like your budget, coverage amount, and policy term.

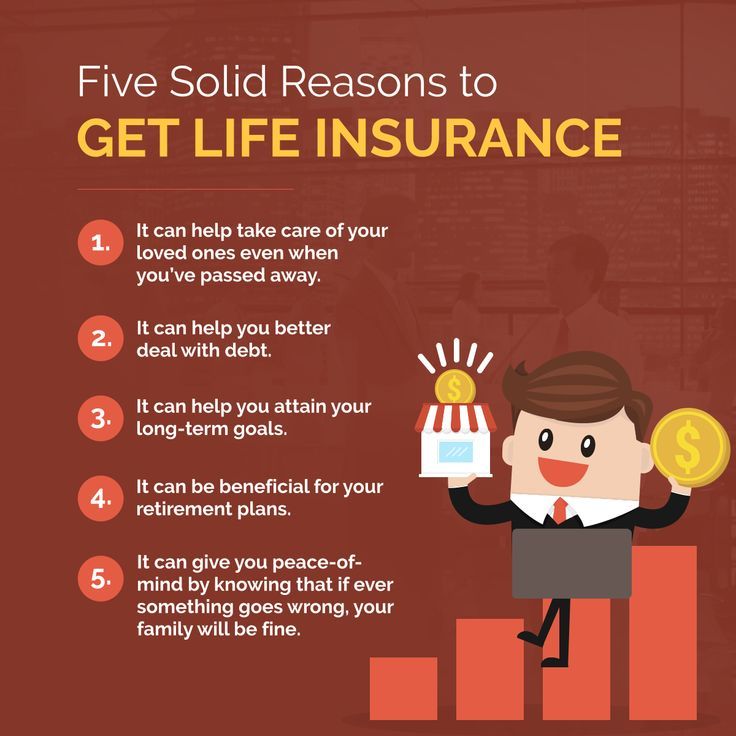

Determining the Right Coverage Amount

The coverage amount you need depends on your financial obligations and the people you want to protect. A good starting point is to consider your outstanding debts, such as mortgages, loans, and credit card balances. You should also factor in the cost of living expenses for your dependents, including housing, food, transportation, and education.

A common rule of thumb is to aim for a coverage amount that is 10 to 15 times your annual income. However, this is just a general guideline, and you may need more or less coverage depending on your individual circumstances.

Choosing the Right Policy Term

The policy term refers to the length of time the policy will be in effect. You can choose a term life insurance policy, which provides coverage for a specific period, or a permanent life insurance policy, which provides coverage for your entire life.

- Term life insurance is typically more affordable than permanent life insurance, making it a good option for individuals with limited budgets or specific coverage needs. For example, if you have a young family and want to ensure their financial security if you pass away before they are financially independent, a term life insurance policy could be a good choice.

- Permanent life insurance offers lifelong coverage, but it is more expensive than term life insurance. This type of policy can be a good option for individuals who want to ensure their loved ones are financially protected regardless of when they pass away. It can also be used as a wealth-building tool, as it allows you to accumulate cash value over time.

Considering Your Budget

Life insurance premiums can vary significantly depending on factors such as your age, health, and coverage amount. It’s important to consider your budget and choose a policy that you can afford.

Before you purchase a policy, it’s a good idea to get quotes from several different insurance companies to compare premiums and coverage options. You can also use an online life insurance calculator to estimate the premiums you would pay for different coverage amounts and policy terms.

Understanding Different Policy Types

There are several different types of life insurance policies available, each with its own benefits and drawbacks. It’s important to understand the different types of policies and choose one that best suits your needs.

- Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is generally the most affordable type of life insurance.

- Whole life insurance provides lifelong coverage and accumulates cash value, which you can borrow against or withdraw. It is more expensive than term life insurance.

- Universal life insurance provides lifelong coverage and allows you to adjust your premiums and death benefit. It offers more flexibility than whole life insurance but can be more complex.

- Variable life insurance provides lifelong coverage and allows you to invest the cash value in a variety of sub-accounts. The death benefit and cash value can fluctuate depending on the performance of the sub-accounts.

Essential Factors to Consider

Before purchasing a life insurance policy, it’s important to consider several essential factors, including:

- Your health: Your health status can affect your premium rates. If you have pre-existing health conditions, you may have to pay higher premiums.

- Your age: Younger individuals generally pay lower premiums than older individuals.

- Your lifestyle: Your lifestyle habits, such as smoking or engaging in risky activities, can also affect your premium rates.

- Your financial situation: Consider your budget and the amount of coverage you can afford.

- Your beneficiaries: Determine who you want to receive the death benefit and how you want the proceeds to be distributed.

- The policy’s terms and conditions: Carefully review the policy’s terms and conditions, including the coverage amount, premiums, and exclusions.

Epilogue

In conclusion, obtaining a State Farm life insurance quote is a crucial step towards securing your family’s financial well-being. By understanding the various factors that influence quote costs, comparing options from different providers, and carefully considering your individual needs, you can make a confident decision that aligns with your financial goals. Remember, life insurance is an investment in your loved ones’ future, and taking the time to research and compare quotes can ensure you find the right policy for your unique circumstances.

General Inquiries

What factors influence the cost of a State Farm life insurance quote?

The cost of your life insurance quote is influenced by factors such as your age, health, coverage amount, policy term, and smoking status.

How can I get a life insurance quote from State Farm?

You can obtain a quote online, by phone, or by contacting a State Farm agent. You will need to provide basic information about yourself, such as your age, health, and desired coverage amount.

What are the benefits of purchasing life insurance from State Farm?

State Farm offers a wide range of life insurance products, competitive rates, and excellent customer service. They also have a strong financial reputation and a long history of providing reliable insurance solutions.