State Farm Liability Car Insurance provides essential protection for drivers, covering financial responsibility in the event of an accident. It’s a vital component of a comprehensive insurance plan, safeguarding you from potential legal and financial repercussions. State Farm offers a range of coverage options, customizable to individual needs, ensuring drivers have the right level of protection for their specific circumstances.

Understanding the intricacies of liability car insurance is crucial for informed decision-making. This guide delves into the key features and benefits of State Farm’s offerings, exploring factors that influence premium calculations, and providing insights into the claims process and customer support. By comparing State Farm’s liability car insurance with other leading providers, we aim to shed light on its strengths and weaknesses, empowering you to make an informed choice.

State Farm Liability Car Insurance Overview

State Farm Liability Car Insurance is a crucial aspect of protecting yourself financially in case of an accident. It covers damages to other people’s property and injuries to other individuals if you are found at fault in an accident. This coverage is legally required in most states, and it’s essential to have sufficient coverage to avoid significant financial burdens.

Key Features and Benefits of State Farm Liability Car Insurance

State Farm Liability Car Insurance provides various features and benefits that make it a valuable choice for drivers. These include:

- Financial Protection: State Farm’s liability insurance safeguards you from significant financial losses in case of an accident. It covers expenses related to the other party’s injuries, medical bills, lost wages, and property damage.

- Legal Representation: If you’re involved in an accident, State Farm provides legal representation to defend you against claims. This is particularly helpful if you’re facing a lawsuit, ensuring you have expert legal counsel to protect your interests.

- Peace of Mind: Knowing you have adequate liability coverage provides peace of mind, allowing you to focus on recovering from an accident without worrying about overwhelming financial burdens.

- Competitive Pricing: State Farm strives to offer competitive pricing on its liability insurance policies. This ensures you receive the necessary coverage at a reasonable cost.

Coverage Options within State Farm Liability Car Insurance

State Farm offers various coverage options within its liability insurance policies, allowing you to tailor your coverage to your specific needs and risk profile. These options include:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by individuals injured in an accident caused by you.

- Property Damage Liability: This coverage covers damages to the other party’s vehicle or property caused by your negligence.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your injuries and property damage, even if the other driver cannot afford to pay.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who is at fault in an accident. It’s particularly useful for covering minor injuries or when the other driver is uninsured or underinsured.

Coverage Components and Limits

State Farm’s liability car insurance offers various coverage components designed to protect you financially in the event of an accident. These components cover your legal responsibility for damages caused to others, including their injuries and property.

Bodily Injury Liability

Bodily injury liability coverage protects you against financial losses arising from injuries sustained by other people in an accident caused by you. It covers medical expenses, lost wages, and pain and suffering. This coverage is typically expressed as a per-person limit and a per-accident limit. For example, a 25/50 limit means you are covered for up to $25,000 for injuries to a single person and up to $50,000 for all injuries in a single accident.

Property Damage Liability

Property damage liability coverage protects you against financial losses arising from damage to other people’s property caused by you in an accident. This coverage typically has a per-accident limit, covering damages to vehicles, buildings, or other property. For example, a $50,000 limit means you are covered for up to $50,000 in property damage caused in a single accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you against financial losses arising from accidents caused by drivers who are uninsured or underinsured. It covers medical expenses, lost wages, and pain and suffering. This coverage is typically expressed as a per-person limit and a per-accident limit, similar to bodily injury liability coverage.

Standard Coverage Limits

State Farm offers standard coverage limits for liability car insurance. These limits are based on the minimum requirements set by each state. However, you can customize these limits based on your individual needs and risk tolerance.

Customizing Coverage Limits

You can increase or decrease the coverage limits for bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage to suit your specific needs. Increasing the coverage limits provides greater financial protection in case of a severe accident, but it will also increase your premium. Decreasing the coverage limits can lower your premium but reduces your financial protection.

Comparison with Other Providers

State Farm’s coverage limits are generally comparable to those offered by other major car insurance providers. However, it’s crucial to compare quotes from multiple providers to find the best coverage and price for your specific needs. Consider factors such as coverage limits, deductibles, and discounts when comparing quotes.

Factors Affecting Premiums

State Farm, like most insurance providers, uses a complex system to determine car insurance premiums. Several factors influence the cost of your policy, and understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a crucial role in calculating your premium. State Farm considers your past driving record, including accidents, traffic violations, and even your driving experience.

- Accidents: A history of accidents, especially at-fault accidents, will significantly increase your premium. This is because insurers view drivers with accident records as higher risks.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations also contribute to higher premiums. Each violation adds points to your driving record, reflecting a higher risk profile.

- Driving Experience: New drivers, especially teenagers, are considered higher risks due to their lack of experience. As you gain more experience and a clean driving record, your premiums may decrease.

Vehicle Type

The type of vehicle you drive is another significant factor in determining your insurance premiums.

- Vehicle Value: Expensive vehicles, such as luxury cars or high-performance sports cars, are more costly to repair or replace. As a result, their insurance premiums tend to be higher.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts.

- Theft Risk: Certain vehicle models are more prone to theft. Insurers consider theft risk when calculating premiums, and vehicles with higher theft rates may have higher premiums.

Location

Your location, specifically your zip code, plays a role in determining your premium.

- Crime Rates: Areas with higher crime rates, including car theft and vandalism, tend to have higher insurance premiums.

- Traffic Density: Areas with heavy traffic congestion can increase the risk of accidents, which can influence premiums.

- Weather Conditions: Areas prone to severe weather events, such as hurricanes, hailstorms, or earthquakes, may have higher premiums due to the increased risk of damage.

Age

Your age is a factor that influences your car insurance premiums.

- Young Drivers: As mentioned earlier, young drivers, especially teenagers, are considered higher risks due to their lack of experience.

- Mature Drivers: Drivers over a certain age, often 65 or 70, may also face higher premiums due to potential health concerns or age-related driving limitations.

Premium Ranges for Different Driver Profiles

| Driver Profile | Age | Driving History | Vehicle Type | Location | Estimated Premium Range |

|---|---|---|---|---|---|

| New Driver | 18 | Clean Record | Mid-size Sedan | Urban Area | $1,500 – $2,500 per year |

| Experienced Driver | 35 | Minor Accident 5 years ago | SUV | Suburban Area | $1,000 – $1,800 per year |

| Mature Driver | 68 | Clean Record | Compact Car | Rural Area | $800 – $1,400 per year |

Claims Process and Customer Support

State Farm offers a comprehensive claims process designed to ensure a smooth and efficient experience for its policyholders. The process involves a series of steps, each aimed at resolving your claim promptly and fairly.

Filing a Liability Car Insurance Claim

State Farm provides multiple convenient channels for filing a liability car insurance claim. You can initiate the process by:

- Contacting State Farm’s 24/7 customer service line: This is the fastest and most direct way to file a claim, as you can speak to a representative immediately.

- Using the State Farm mobile app: The app allows you to file a claim, track its progress, and access important documents, all from the convenience of your smartphone.

- Submitting a claim online through the State Farm website: This option is ideal for those who prefer a self-service approach and have all the necessary information readily available.

Handling Claims

Once you’ve filed a claim, State Farm will assign an adjuster to your case. The adjuster will:

- Investigate the incident: This involves gathering information about the accident, including witness statements, police reports, and vehicle damage assessments.

- Evaluate the claim: The adjuster will determine the extent of your coverage, assess the damages, and evaluate the liability of all parties involved.

- Negotiate a settlement: Once the investigation is complete, the adjuster will work with you to reach a fair settlement for your claim.

Required Documentation

To ensure a smooth claims process, it’s essential to have the following documentation readily available:

- Your insurance policy details: This includes your policy number, coverage details, and contact information.

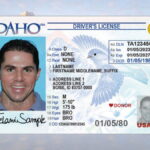

- Driver’s license and vehicle registration: These documents provide proof of ownership and identification.

- Police report: If the accident involved a police report, having a copy is crucial.

- Photos and videos of the damage: This documentation helps the adjuster assess the extent of the damage.

- Witness statements: If anyone witnessed the accident, their contact information and statements can be valuable.

Customer Support Channels

State Farm prioritizes providing exceptional customer support, offering various channels to assist you:

- Phone lines: State Farm’s 24/7 customer service line is available to answer your questions and address your concerns.

- Online portal: The State Farm website provides access to account information, policy details, claim status updates, and other resources.

- Mobile app: The State Farm mobile app offers a convenient way to manage your policy, file claims, and contact customer support.

- Social media: State Farm is active on various social media platforms, providing a channel for communication and customer support.

State Farm’s customer support team is known for its responsiveness and commitment to resolving issues promptly and effectively. They are dedicated to ensuring a positive experience for all policyholders, from the initial claim filing to the final settlement.

Comparison with Other Insurance Providers

Choosing the right car insurance provider can be a daunting task, especially when considering the numerous options available. While State Farm is a well-established and reputable provider, it’s essential to compare its offerings with those of other major insurance providers to determine the best fit for your individual needs. This section will analyze the strengths and weaknesses of State Farm, Geico, Progressive, and Allstate, highlighting key differences in coverage, pricing, and customer service.

Coverage Comparison

Understanding the different types of coverage offered by each provider is crucial in making an informed decision. While basic liability coverage is mandatory in most states, additional coverage options like collision, comprehensive, and uninsured/underinsured motorist coverage can provide greater protection.

| Provider | Liability Coverage | Collision Coverage | Comprehensive Coverage | Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|---|

| State Farm | Yes | Yes | Yes | Yes |

| Geico | Yes | Yes | Yes | Yes |

| Progressive | Yes | Yes | Yes | Yes |

| Allstate | Yes | Yes | Yes | Yes |

Pricing Comparison

Insurance premiums can vary significantly depending on factors such as driving history, vehicle type, location, and coverage options. While comparing prices across providers is essential, it’s equally important to consider the value and comprehensiveness of the coverage offered.

“The cheapest insurance isn’t always the best deal.”

- State Farm: State Farm is known for its competitive pricing, especially for drivers with good driving records and safe vehicles.

- Geico: Geico often advertises its low rates and has a strong online presence, making it easy to obtain quotes.

- Progressive: Progressive offers a variety of discounts and personalized pricing options, including its “Name Your Price” tool, which allows drivers to set their desired premium and see which coverage options fit within their budget.

- Allstate: Allstate is known for its comprehensive coverage options and strong customer service, but its premiums may be higher than other providers.

Customer Service Comparison, State farm liability car insurance

Excellent customer service is essential when dealing with insurance claims or policy changes. Each provider offers different customer support channels, including phone, email, and online chat.

- State Farm: State Farm has a strong reputation for its friendly and responsive customer service.

- Geico: Geico is known for its efficient claims processing and online tools that make it easy to manage policies.

- Progressive: Progressive offers a variety of customer service options, including its “Snapshot” program, which uses telematics to track driving behavior and offer discounts based on safe driving habits.

- Allstate: Allstate has a dedicated customer service team that is available 24/7.

Advantages and Disadvantages

Choosing the right car insurance provider is a crucial decision, and State Farm is a prominent name in the industry. To help you weigh your options, this section delves into the advantages and disadvantages of choosing State Farm for your liability car insurance needs.

Advantages of Choosing State Farm

State Farm boasts several advantages that make it an attractive option for car insurance. These advantages stem from its financial stability, strong reputation, and commitment to customer satisfaction.

- Financial Stability: State Farm is a financially strong company with a long history of stability. This financial strength translates into greater security for policyholders, as it ensures the company’s ability to fulfill its obligations even in challenging economic times. For example, during the 2008 financial crisis, State Farm remained financially sound, unlike some other insurance companies, demonstrating its resilience.

- Reputation: State Farm enjoys a positive reputation for its customer service and claims handling. It consistently ranks high in customer satisfaction surveys and has received numerous awards for its service. This reputation is built on a foundation of providing fair and prompt claim settlements, making the claims process smoother for policyholders.

- Customer Satisfaction: State Farm prioritizes customer satisfaction and invests in building strong relationships with its policyholders. This commitment is evident in its extensive network of agents, who provide personalized service and support throughout the policy lifecycle. For example, State Farm agents are readily available to answer questions, assist with policy adjustments, and guide customers through the claims process.

Disadvantages of Choosing State Farm

While State Farm offers several advantages, there are also potential drawbacks to consider. These disadvantages include premium pricing, coverage limitations, and occasional customer service issues.

- Premium Pricing: State Farm’s premiums can sometimes be higher compared to other insurance providers, particularly for high-risk drivers or those with a history of accidents. This pricing strategy reflects State Farm’s focus on financial stability and its commitment to providing comprehensive coverage. However, it can be a disadvantage for price-sensitive customers.

- Coverage Limitations: Like most insurance companies, State Farm has limitations on its coverage. For example, certain types of vehicles or driving situations may not be fully covered under standard policies. This is a common practice across the industry, but it’s important to carefully review the policy details and understand the specific limitations.

- Customer Service Issues: While State Farm generally has a positive reputation for customer service, there have been occasional reports of delays in claims processing or difficulties reaching customer support. These issues are often isolated and can vary depending on the location and individual circumstances.

Closure

Ultimately, choosing the right liability car insurance policy depends on your individual needs and financial situation. State Farm offers a comprehensive and customizable solution, but it’s essential to compare options and consider your driving history, vehicle type, and location to ensure you have the right coverage at the best possible price. By understanding the intricacies of liability car insurance, you can make an informed decision that provides peace of mind and financial protection on the road.

Commonly Asked Questions

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your own vehicle, regardless of who is at fault.

How do I file a claim with State Farm?

You can file a claim online, through their mobile app, or by calling their customer service line. You’ll need to provide information about the accident, including the date, time, location, and any injuries or damages.

What factors affect my car insurance premiums?

Your driving history, vehicle type, location, age, and credit score can all impact your premiums. State Farm offers discounts for good drivers, safe vehicles, and certain safety features.

What happens if I’m involved in an accident with an uninsured driver?

Uninsured/underinsured motorist coverage helps protect you in the event of an accident with a driver who doesn’t have enough insurance or no insurance at all.