State Farm landlord insurance coverage is a vital tool for any property owner who rents out their space. It provides crucial protection against financial losses that can arise from unexpected events, ensuring peace of mind and safeguarding your investment. This comprehensive coverage encompasses a range of scenarios, from property damage and liability claims to lost rental income, offering a robust safety net for landlords.

State Farm’s landlord insurance policies are designed to cater to diverse needs, offering flexible coverage options tailored to different property types and rental situations. With a variety of coverage components and add-ons, landlords can customize their policies to meet their specific requirements and budget.

Introduction to State Farm Landlord Insurance

Owning rental properties can be a rewarding investment, but it also comes with inherent risks. Landlord insurance is designed to protect property owners from financial losses due to unforeseen events. This type of insurance is essential for landlords, as it provides financial security and peace of mind.

Benefits of Landlord Insurance

Landlord insurance offers a range of benefits to protect your investment and safeguard your financial well-being.

- Property Damage Coverage: Landlord insurance provides coverage for damage to your rental property caused by various perils, including fire, theft, vandalism, and natural disasters. This coverage helps you rebuild or repair your property, minimizing financial strain in the event of an unexpected event.

- Liability Coverage: This insurance protects you from lawsuits filed by tenants or third parties due to injuries or property damage occurring on your property. For example, if a tenant slips and falls on an icy sidewalk, landlord insurance can cover legal costs and potential settlements.

- Loss of Rental Income: In the event your property becomes uninhabitable due to a covered event, landlord insurance can provide coverage for lost rental income. This helps ensure you continue receiving income while your property is being repaired or rebuilt.

- Personal Property Coverage: Some landlord insurance policies offer coverage for your personal property stored on the premises, such as tools, appliances, or furniture. This provides added protection for your belongings.

State Farm Landlord Insurance Offerings

State Farm offers a comprehensive range of landlord insurance policies tailored to meet the specific needs of property owners. Their policies typically include the following coverages:

- Dwelling Coverage: Protects your rental property against damage caused by various perils, including fire, theft, vandalism, and natural disasters.

- Liability Coverage: Provides protection against lawsuits filed by tenants or third parties due to injuries or property damage on your property.

- Loss of Rental Income: Covers lost rental income when your property is uninhabitable due to a covered event.

- Personal Property Coverage: Provides coverage for your personal property stored on the premises.

- Additional Coverages: State Farm also offers optional coverages, such as flood insurance, earthquake insurance, and identity theft protection, to further customize your policy to your specific needs.

Key Coverage Components: State Farm Landlord Insurance Coverage

State Farm’s landlord insurance policy provides comprehensive coverage designed to protect your investment and mitigate potential risks associated with owning and managing rental properties. This coverage typically includes protection for property damage, liability, and loss of rental income. The specific coverage options and their limits may vary depending on the type of rental property, its location, and the policyholder’s individual needs.

Property Damage Coverage

This coverage protects you against financial losses resulting from damage to your rental property caused by covered perils. Covered perils typically include:

- Fire

- Windstorm

- Hail

- Vandalism

- Theft

- Explosions

- Water damage

The coverage amount is usually determined by the replacement cost of the property, which is the cost to rebuild or repair it to its pre-loss condition. This amount can be adjusted based on factors such as the age and condition of the property.

State Farm’s landlord insurance policy provides protection for property damage caused by covered perils, ensuring that you can rebuild or repair your property to its pre-loss condition.

Liability Coverage

Liability coverage safeguards you from financial losses arising from lawsuits or claims filed against you for bodily injury or property damage caused by your negligence or the negligence of your tenants.

- For example, if a tenant falls on a slippery floor in your property and suffers injuries, they may file a claim against you.

- This coverage can also protect you from claims related to dog bites or other incidents involving pets.

Liability coverage typically includes legal defense costs, as well as the payment of damages awarded by a court or agreed upon in a settlement.

Loss of Rental Income Coverage

This coverage provides financial protection if you are unable to collect rent due to a covered peril that damages your rental property.

- For instance, if a fire renders your property uninhabitable, you may lose rental income while repairs are being made.

- Loss of rental income coverage helps you compensate for this loss and ensures you continue receiving income even during periods of property downtime.

The coverage amount typically depends on the rental income you receive from the property and the duration of the repair or rebuilding period.

Coverage Options for Different Rental Properties

State Farm offers various coverage options tailored to different types of rental properties, including:

- Single-family homes

- Multi-family dwellings

- Commercial properties

The specific coverage components and their limits may vary depending on the type of property and its associated risks.

State Farm’s landlord insurance provides customized coverage options for various types of rental properties, ensuring comprehensive protection for your investment.

Exclusions and Limitations

While State Farm’s landlord insurance offers comprehensive coverage, there are certain situations and events that are excluded from the policy. It’s crucial to understand these limitations to ensure you have the appropriate protection for your rental property.

Common Exclusions

This section explains the typical exclusions found in State Farm’s landlord insurance policy. Understanding these limitations will help you make informed decisions about your coverage.

- Acts of War or Terrorism: State Farm’s landlord insurance does not cover damage or loss resulting from acts of war or terrorism. These events are considered high-risk and are typically excluded from most insurance policies.

- Earthquakes and Floods: While State Farm offers optional coverage for earthquakes and floods, these events are typically excluded from the standard landlord policy. It’s important to consider these risks and purchase additional coverage if necessary.

- Negligence of the Insured: Landlord insurance generally doesn’t cover damages resulting from the insured’s negligence, such as failing to maintain the property or ignoring known safety hazards.

- Intentional Acts: The policy excludes damage caused by intentional acts, such as arson or vandalism by the insured or their family members.

- Business-Related Losses: Landlord insurance typically doesn’t cover business-related losses, such as lost income due to a tenant’s eviction or a property being uninhabitable.

Tenant Negligence

Landlord insurance typically does not cover damage caused by tenant negligence. For example, if a tenant accidentally starts a fire by leaving a stove unattended, the damage might not be covered. However, State Farm offers optional endorsements to cover tenant negligence, which can be a valuable addition to your policy.

Optional Add-ons and Endorsements

State Farm offers a variety of optional add-ons and endorsements to expand your coverage and address specific risks. These add-ons can provide additional protection for your rental property and your financial interests.

- Earthquake Coverage: This endorsement provides coverage for damage caused by earthquakes, a risk that is typically excluded from the standard policy.

- Flood Coverage: This endorsement protects your property from damage caused by floods, which are often excluded from standard landlord policies.

- Tenant Liability Coverage: This endorsement extends coverage to include liability for injuries sustained by tenants on the property, even if the injury is caused by the tenant’s own negligence.

- Personal Property Coverage: This endorsement provides coverage for your personal property stored on the rental property, such as furniture, appliances, and other valuables.

- Business Income Coverage: This endorsement protects your income if the property is damaged or uninhabitable, allowing you to cover expenses like mortgage payments and lost rental income.

Policy Requirements and Considerations

To secure State Farm landlord insurance, you’ll need to provide specific information about your property and rental operations. This helps State Farm assess your risk and determine the appropriate coverage and premiums for your needs.

Understanding the factors that influence your insurance premiums is crucial to managing your costs. State Farm considers various factors to calculate your premium, ensuring you pay a fair price for the protection you need.

Factors Influencing Premium Costs, State farm landlord insurance coverage

State Farm uses a variety of factors to determine your landlord insurance premiums. These factors help ensure that your premium reflects the level of risk associated with your property and rental operations.

- Property Location: The location of your rental property plays a significant role in premium calculations. Properties in high-crime areas or areas prone to natural disasters may have higher premiums due to the increased risk of claims.

- Rental History: Your history as a landlord is an important factor. State Farm may consider the number of years you’ve been a landlord, your tenant screening practices, and your claims history to assess your risk profile. A history of responsible renting and fewer claims can lead to lower premiums.

- Coverage Limits: The amount of coverage you choose for your policy directly impacts your premium. Higher coverage limits generally mean higher premiums. It’s essential to carefully consider the value of your property and potential liabilities to choose appropriate coverage limits.

- Property Type: The type of property you rent out can influence your premiums. For example, a single-family home may have a lower premium than a multi-unit apartment building due to the potential for more claims in larger properties.

- Safety Features: Installing safety features, such as smoke detectors, fire extinguishers, and security systems, can demonstrate your commitment to safety and reduce your risk profile. This may result in lower premiums.

Deductibles

The deductible is the amount you pay out of pocket before your insurance policy kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

- Standard Deductible: This is the most common deductible option and offers a balance between premium cost and out-of-pocket expenses. It’s typically a fixed amount, such as $500 or $1,000.

- High Deductible: Choosing a high deductible can significantly lower your premium. However, you’ll be responsible for a larger portion of the costs if you need to file a claim.

- Low Deductible: A low deductible means you’ll pay less out of pocket if you file a claim. However, your premium will be higher.

Choosing the right deductible depends on your financial situation and risk tolerance. If you have a strong financial cushion and are willing to absorb a larger portion of the costs in case of a claim, a high deductible may be a good option. However, if you prefer lower out-of-pocket expenses, a lower deductible may be more suitable.

Claims Process and Customer Support

State Farm understands that unexpected events can occur, and they are committed to making the claims process as smooth and efficient as possible for their landlord policyholders. The company offers a comprehensive approach to claims handling, ensuring prompt and fair resolution of covered incidents.

To ensure a timely and efficient claims process, State Farm encourages policyholders to report claims promptly. They provide multiple channels for reporting claims, including their website, mobile app, and phone. Once a claim is reported, a dedicated claims representative will be assigned to guide the policyholder through the process.

Steps Involved in Reporting a Claim

To initiate a claim, policyholders should follow these steps:

- Contact State Farm immediately after an incident occurs, either through their website, mobile app, or by calling their customer service line.

- Provide the claims representative with detailed information about the incident, including the date, time, location, and nature of the damage. This information will help them assess the claim and determine coverage.

- State Farm may request documentation to support the claim, such as photographs, repair estimates, and police reports. This documentation helps verify the incident and the extent of the damage.

- Once the claim is submitted, a claims adjuster will be assigned to investigate the incident and determine the extent of the coverage. They will review the policy, assess the damage, and determine the amount of compensation payable.

- The claims adjuster will work with the policyholder to arrange for repairs or replacements, ensuring that the process is handled efficiently and effectively.

Documentation Required for Claims

The specific documentation required for a claim will vary depending on the nature of the incident. However, common documents include:

- Police report: This is essential for claims involving theft, vandalism, or other criminal activity.

- Photographs: Clear and detailed photographs of the damaged property are crucial for documenting the extent of the damage.

- Repair estimates: Obtain estimates from qualified contractors for repairs or replacements.

- Rental agreement: The rental agreement provides essential information about the property and the terms of the lease.

- Proof of ownership: This could include a deed or other documentation demonstrating ownership of the property.

Customer Support During the Claims Process

State Farm prioritizes customer support throughout the claims process. Policyholders can expect:

- Dedicated claims representative: A dedicated claims representative will be assigned to each claim, serving as the primary point of contact for the policyholder. They will guide the policyholder through the process, answer questions, and provide updates.

- 24/7 customer support: State Farm offers 24/7 customer support, allowing policyholders to access assistance whenever needed. They can contact customer service by phone, email, or through their website.

- Online claim tracking: Policyholders can track the progress of their claim online, providing them with real-time updates and transparency into the process.

- Prompt communication: State Farm strives to communicate with policyholders regularly, providing updates on the status of their claim and addressing any concerns they may have.

Comparing State Farm with Other Providers

Choosing the right landlord insurance can be a daunting task, as many providers offer a range of coverage options and pricing structures. To help you make an informed decision, we’ll compare State Farm’s landlord insurance offerings with those of other prominent insurance providers.

Coverage Comparisons

This section will examine the key coverage differences between State Farm and other leading insurance providers.

- Property Coverage: State Farm typically provides standard coverage for building damage, including fire, vandalism, and natural disasters. However, some providers may offer additional coverage for specific perils, such as earthquake or flood, or may provide higher coverage limits.

- Liability Coverage: State Farm offers liability protection for claims arising from injuries or property damage caused by tenants or visitors. Some providers may offer higher liability limits or specialized coverage for specific risks, such as dog bites or swimming pool accidents.

- Loss of Rental Income: State Farm provides coverage for lost rental income if your property becomes uninhabitable due to a covered event. Some providers may offer extended coverage for situations like tenant abandonment or legal disputes.

- Additional Coverages: State Farm offers optional coverages such as personal property protection, replacement cost coverage, and liability for personal injuries. Other providers may offer additional coverages specific to landlord needs, such as coverage for damage caused by mold or sewer backups.

Pricing and Discounts

This section will compare the pricing structures and available discounts offered by State Farm and other providers.

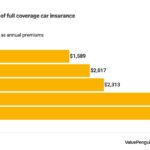

- Premium Rates: State Farm’s premium rates are generally competitive, but they can vary based on factors such as property location, age, value, and coverage limits. Other providers may offer lower rates for specific property types or risk profiles.

- Discounts: State Farm offers various discounts for landlords, such as multi-policy discounts, safety features, and security systems. Other providers may offer different discounts based on their specific programs.

Customer Service and Claims Process

This section will evaluate the customer service and claims process offered by State Farm compared to other providers.

- Customer Service: State Farm has a reputation for providing good customer service, with a network of agents and online resources. However, other providers may offer 24/7 customer support or specialized services tailored to landlord needs.

- Claims Process: State Farm’s claims process is generally straightforward, with online and phone options for reporting claims. Other providers may offer faster processing times or dedicated claims specialists for landlords.

Choosing the Right Provider

This section will provide insights into choosing the best landlord insurance provider based on individual needs.

- Property Type: Consider the type of property you own, as some providers specialize in specific types of rentals. For example, providers may have expertise in insuring multi-family properties, vacation rentals, or commercial properties.

- Risk Profile: Assess your property’s risk profile, including its location, age, and potential for claims. Some providers may offer more favorable rates for properties with low risk profiles.

- Budget: Determine your budget for landlord insurance, as premiums can vary significantly between providers. Compare quotes from multiple providers to find the best value.

- Coverage Needs: Identify your specific coverage needs based on your property type, risk profile, and personal preferences. Some providers offer specialized coverage options tailored to specific landlord needs.

- Customer Service and Claims Process: Evaluate the customer service and claims process offered by each provider. Consider factors such as accessibility, responsiveness, and claims processing time.

Final Conclusion

Navigating the complexities of landlord insurance can feel overwhelming, but understanding the nuances of State Farm’s offerings empowers you to make informed decisions. By carefully considering your individual needs and comparing options, you can find the right policy to protect your investment and navigate the challenges of property ownership with confidence. Whether you’re a seasoned landlord or just starting out, State Farm’s landlord insurance coverage provides a reliable foundation for success in the rental market.

Key Questions Answered

How much does State Farm landlord insurance cost?

The cost of State Farm landlord insurance varies depending on factors such as the location, size, and type of property, as well as the amount of coverage you choose.

What are the benefits of having landlord insurance?

Landlord insurance provides financial protection against a wide range of risks, including property damage, liability claims, and loss of rental income. It also offers peace of mind, knowing that you have insurance coverage in the event of an unexpected event.

What are some common exclusions from State Farm landlord insurance?

Common exclusions may include intentional acts of the insured, damage caused by wear and tear, and certain types of natural disasters.