State farm insurance quite – State Farm Insurance: Quite the Reliable Choice. A household name synonymous with dependable insurance, State Farm has been a pillar of the industry for over a century. With a strong commitment to customer satisfaction and a wide range of insurance products, State Farm has earned its reputation as a trusted provider for individuals and families alike.

From its humble beginnings in 1922, State Farm has grown into a massive insurance company, offering a comprehensive suite of insurance products, including auto, home, life, health, and business insurance. Their dedication to innovation and customer-centricity has propelled them to the forefront of the industry, consistently ranking among the top insurance providers in the United States.

State Farm Insurance

State Farm Insurance is one of the largest and most recognizable insurance companies in the United States. Founded in 1922, the company has a long history of providing insurance products and financial services to individuals and families.

State Farm is known for its strong commitment to customer service, financial stability, and community involvement. The company has consistently ranked high in customer satisfaction surveys and is recognized as a leader in the insurance industry.

Overview of State Farm’s Operations

State Farm’s core services include:

- Auto Insurance: State Farm is the largest provider of auto insurance in the United States, offering comprehensive coverage options to protect drivers and their vehicles.

- Home Insurance: State Farm provides homeowners insurance to protect properties from damage caused by fire, theft, natural disasters, and other risks.

- Life Insurance: State Farm offers various life insurance policies, including term life, whole life, and universal life, to help individuals and families plan for the future.

- Health Insurance: State Farm provides health insurance plans through its partnerships with other insurance companies.

- Other Insurance Products: State Farm also offers insurance for renters, businesses, motorcycles, boats, and other assets.

State Farm’s Size and Market Share

State Farm is a massive company with a significant presence in the insurance industry. Key facts and figures about its size and market share include:

- Largest Auto Insurer: State Farm is the largest auto insurer in the United States, with a market share of over 18% in 2022.

- Top 10 Property and Casualty Insurer: State Farm is consistently ranked among the top 10 property and casualty insurance companies in the United States.

- Significant Financial Resources: State Farm has a strong financial position, with billions of dollars in assets and a history of profitability.

- National Network: State Farm operates in all 50 states, the District of Columbia, and several territories.

State Farm’s Customer Base and Reputation

State Farm has a large and loyal customer base. The company is known for its:

- Strong Customer Service: State Farm has consistently ranked high in customer satisfaction surveys, with a reputation for providing friendly and responsive service.

- Wide Range of Products and Services: State Farm offers a comprehensive suite of insurance products and financial services to meet the needs of its diverse customer base.

- Community Involvement: State Farm is actively involved in supporting communities through charitable donations, sponsorships, and volunteer programs.

State Farm’s Financial Performance, State farm insurance quite

State Farm has a long history of financial stability and profitability. Key financial performance indicators include:

- Strong Revenue: State Farm generates billions of dollars in revenue annually from its insurance operations.

- Profitability: State Farm has consistently generated profits over the years, reflecting its efficient operations and strong financial management.

- High Credit Ratings: State Farm receives high credit ratings from major rating agencies, indicating its financial strength and stability.

State Farm’s Geographic Reach

State Farm has a national presence, operating in all 50 states, the District of Columbia, and several territories. The company has a network of agents and offices throughout the country, providing convenient access to its products and services.

State Farm Insurance Products and Services

State Farm Insurance is a leading provider of insurance products and services, catering to a wide range of individual and business needs. The company offers a comprehensive suite of insurance solutions, including auto, home, life, health, and business insurance, all designed to provide financial protection and peace of mind.

Auto Insurance

State Farm’s auto insurance policies are designed to protect you financially in the event of an accident, theft, or other damage to your vehicle.

- Liability Coverage: This coverage protects you from financial responsibility for injuries or damages caused to others in an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you are injured in an accident, regardless of fault.

State Farm also offers a variety of optional coverage options, such as roadside assistance, rental car reimbursement, and accident forgiveness.

Home Insurance

State Farm’s home insurance policies are designed to protect your home and belongings from damage caused by various perils, such as fire, theft, windstorms, and hail.

- Dwelling Coverage: This coverage pays for repairs or replacement of your home’s structure in the event of a covered loss.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, and clothing, from damage or loss.

- Liability Coverage: This coverage protects you from financial responsibility for injuries or damages caused to others on your property.

- Additional Living Expenses Coverage: This coverage helps pay for temporary housing and other expenses if you are unable to live in your home due to a covered loss.

State Farm offers various coverage options and discounts, such as earthquake coverage, flood insurance, and discounts for safety features, security systems, and smoke detectors.

Life Insurance

State Farm’s life insurance policies are designed to provide financial protection for your loved ones in the event of your death.

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10 to 30 years. It is generally more affordable than permanent life insurance but does not build cash value.

- Whole Life Insurance: This type of insurance provides lifetime coverage and builds cash value that you can borrow against or withdraw. It is generally more expensive than term life insurance.

- Universal Life Insurance: This type of insurance offers flexible premiums and death benefits. It also allows you to build cash value, but the growth rate is not guaranteed.

State Farm offers a variety of life insurance options to meet your specific needs and budget.

Health Insurance

State Farm offers health insurance plans through the Affordable Care Act (ACA) Marketplace. These plans provide coverage for essential health benefits, such as preventive care, hospitalization, and prescription drugs.

- Bronze Plans: These plans have the lowest monthly premiums but have the highest out-of-pocket costs.

- Silver Plans: These plans have moderate monthly premiums and out-of-pocket costs.

- Gold Plans: These plans have higher monthly premiums but lower out-of-pocket costs.

- Platinum Plans: These plans have the highest monthly premiums but the lowest out-of-pocket costs.

State Farm’s health insurance plans offer a variety of coverage options and benefits, including coverage for preventive care, prescription drugs, and mental health services.

Business Insurance

State Farm offers a variety of business insurance policies to protect your business from financial losses.

- Property Insurance: This coverage protects your business property, such as buildings, equipment, and inventory, from damage or loss.

- Liability Insurance: This coverage protects your business from financial responsibility for injuries or damages caused to others.

- Workers’ Compensation Insurance: This coverage provides benefits to employees who are injured or become ill on the job.

- Business Interruption Insurance: This coverage helps pay for lost income and expenses if your business is forced to close due to a covered loss.

State Farm also offers a variety of other business insurance products, such as commercial auto insurance, professional liability insurance, and cyber liability insurance.

Pricing, Coverage Options, and Customer Service

State Farm’s pricing for its insurance products is competitive and varies based on factors such as your location, driving history, credit score, and the coverage you choose. The company offers a variety of coverage options to meet your specific needs and budget. State Farm is known for its excellent customer service, with a network of agents and representatives available to answer your questions and provide personalized advice.

State Farm Insurance Customer Experience

State Farm Insurance is a leading provider of insurance products and services in the United States. The company has a long history of providing excellent customer service and has a strong reputation for its commitment to customer satisfaction.

Customer Testimonials and Reviews

Customer testimonials and reviews offer valuable insights into the experiences of State Farm policyholders. A review on Trustpilot states, “I’ve been with State Farm for over 10 years and have always been happy with their service. They’re always there to help when I need them, and their rates are competitive.” Another customer, writing on Google Reviews, praises the company’s “friendly and helpful staff” and “efficient claims process.” These positive testimonials demonstrate the company’s ability to meet the needs of its customers and build lasting relationships.

State Farm Insurance Customer Service Channels

State Farm offers a variety of customer service channels to meet the diverse needs of its policyholders.

- Online Platforms: State Farm’s website and mobile app provide customers with 24/7 access to their policy information, make payments, file claims, and contact customer support. The website features a comprehensive FAQ section and a user-friendly interface for navigating policy details. The mobile app offers similar features and allows for convenient on-the-go access.

- Phone Support: State Farm provides 24/7 phone support, allowing customers to speak with a representative at any time. The company’s phone lines are known for their quick response times and helpful agents. Customers can reach a representative by dialing the toll-free number on their policy documents.

- Physical Locations: State Farm has a network of physical locations across the United States. Customers can visit a local agent to discuss their insurance needs, file claims in person, or receive personalized assistance. The company’s physical locations offer a more personal touch and provide a face-to-face interaction for customers who prefer this type of service.

Ease of Filing Claims

State Farm aims to make the claims process as simple and straightforward as possible. Customers can file claims online, through the mobile app, or by phone. The company’s website provides clear instructions and guides customers through each step of the process. State Farm’s claims adjusters are available to assist customers with their claims and provide support throughout the process.

Processing Payments and Accessing Policy Information

State Farm offers multiple payment options for policy premiums, including online payments, automatic deductions from bank accounts, and mail-in payments. The company’s website and mobile app allow customers to view their policy information, track payments, and make changes to their coverage. State Farm’s online portal provides a secure and convenient way for customers to manage their insurance policies.

State Farm Insurance in the Market

State Farm Insurance is a prominent player in the insurance market, boasting a vast customer base and a wide range of products. To understand its position in the market, it’s essential to compare it to its major competitors and analyze its strengths and weaknesses. This analysis will also explore how industry trends and technological advancements impact State Farm’s operations and customer experience.

Comparison with Major Competitors

State Farm faces stiff competition from other insurance giants like Geico, Progressive, and Allstate. While all these companies offer similar products, there are key differences in their strategies and offerings.

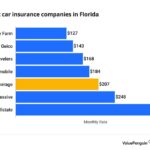

- Pricing: State Farm is known for its competitive pricing, often offering discounts for good driving records and bundling multiple insurance policies. Geico, on the other hand, has gained popularity for its aggressive advertising and low-cost offerings. Progressive has also made a name for itself with its personalized pricing model, using data analytics to tailor rates to individual customers. Allstate has positioned itself as a provider of comprehensive coverage with a focus on customer service.

- Product Range: State Farm offers a wide range of insurance products, including auto, home, life, health, and business insurance. Geico and Progressive primarily focus on auto insurance, while Allstate also offers a diverse range of products.

- Customer Service: State Farm has a strong reputation for its customer service, with a network of agents available to assist customers in person. Geico and Progressive rely heavily on online and phone-based channels, while Allstate offers a blend of both.

- Brand Image: State Farm has cultivated a strong brand image built on trust, reliability, and community involvement. Geico has leveraged humor and memorable advertising to create a distinct brand identity. Progressive has focused on innovation and technology, while Allstate has emphasized its commitment to customer satisfaction.

Strengths and Weaknesses

State Farm possesses several strengths that have contributed to its success, including:

- Strong Brand Recognition: State Farm has built a strong brand over decades, fostering trust and loyalty among customers.

- Extensive Agent Network: Its vast network of agents provides a personalized touch and local expertise, offering convenience and accessibility to customers.

- Wide Range of Products: State Farm offers a diverse range of insurance products, catering to various customer needs.

- Financial Stability: As a mutual company, State Farm is owned by its policyholders, providing financial stability and a long-term perspective.

However, State Farm also faces some weaknesses, such as:

- Digital Transformation: State Farm has been slower to embrace digital technologies compared to some competitors, leading to potential challenges in attracting younger generations who prefer online interactions.

- Customer Service Efficiency: While State Farm is known for its customer service, some customers have reported long wait times and complex processes, especially when dealing with claims.

- Innovation: State Farm has not been as aggressive as some competitors in developing innovative products and services, such as telematics-based insurance programs.

Impact of Industry Trends and Technological Advancements

The insurance industry is constantly evolving, driven by factors such as:

- Digitalization: The rise of online insurance platforms and mobile apps is transforming how customers purchase and manage insurance. State Farm has recognized this trend and invested in its digital capabilities, but it still has room for improvement in terms of user experience and functionality.

- Data Analytics: Insurance companies are increasingly using data analytics to personalize pricing, detect fraud, and improve risk management. State Farm is leveraging data to enhance its underwriting processes and provide more tailored offerings to customers.

- Artificial Intelligence (AI): AI is revolutionizing customer service and claims processing, enabling faster and more efficient interactions. State Farm is exploring AI-powered chatbots and virtual assistants to enhance customer support and streamline claims handling.

- Internet of Things (IoT): The proliferation of connected devices is creating new opportunities for insurance companies to monitor risks and offer innovative products. State Farm is exploring telematics-based insurance programs that use data from connected cars to assess driving behavior and provide personalized discounts.

State Farm Insurance

State Farm Insurance, a leading provider of insurance and financial services, has a long history of adapting to changing market conditions and customer needs. The company’s commitment to innovation and customer-centricity has positioned it well for continued success in the future.

Future Outlook and Growth Strategies

State Farm’s future outlook is positive, driven by its strong brand recognition, robust financial position, and commitment to innovation. The company is well-positioned to capitalize on emerging trends in the insurance industry, including:

- Digital Transformation: State Farm is actively investing in digital technologies to enhance the customer experience. This includes online quoting, mobile apps, and AI-powered chatbots for personalized customer service. These digital initiatives will allow State Farm to reach a wider audience, improve efficiency, and offer a more seamless customer journey.

- Data Analytics: State Farm is leveraging data analytics to better understand customer needs and market trends. By analyzing vast amounts of data, the company can develop more targeted products and services, improve risk assessment, and optimize pricing strategies. This data-driven approach will enable State Farm to remain competitive and offer tailored solutions to its customers.

- Expansion into New Markets: State Farm is exploring new markets and product lines to expand its reach and diversify its revenue streams. This includes expanding into new geographic regions, offering new insurance products like cyber security insurance, and exploring opportunities in the financial services sector.

Adapting to Evolving Customer Needs

State Farm is committed to meeting the evolving needs of its customers, recognizing that consumer expectations are constantly changing. The company is focusing on providing:

- Personalized Experiences: State Farm is leveraging technology to offer personalized experiences to its customers. This includes customized insurance quotes, tailored communication channels, and personalized recommendations based on individual needs and preferences. By providing a more personalized experience, State Farm aims to build stronger customer relationships and enhance customer satisfaction.

- Seamless Digital Interactions: State Farm is making it easier for customers to interact with the company through digital channels. This includes online policy management, mobile app features for claims reporting and policy updates, and 24/7 online support. These digital interactions are designed to provide customers with a more convenient and efficient experience.

- Proactive Customer Service: State Farm is shifting from a reactive to a proactive approach to customer service. This includes using data analytics to identify potential issues and proactively reaching out to customers to address concerns. By taking a proactive approach, State Farm aims to prevent problems before they arise and enhance customer satisfaction.

Adapting to Changes in the Insurance Landscape

The insurance landscape is rapidly changing, driven by technological advancements, regulatory changes, and evolving consumer expectations. State Farm is adapting to these changes by:

- Embracing Digital Transformation: State Farm is actively investing in digital technologies to improve efficiency, enhance customer experience, and remain competitive. This includes adopting cloud computing, implementing automation, and leveraging data analytics. These digital initiatives are enabling State Farm to operate more efficiently and respond to changing market conditions.

- Developing Innovative Products and Services: State Farm is developing new products and services to meet the evolving needs of its customers. This includes offering new insurance products like cyber security insurance, expanding into the financial services sector, and developing innovative solutions for emerging risks. By developing innovative offerings, State Farm aims to remain at the forefront of the insurance industry and provide value to its customers.

- Partnering with Insurtech Companies: State Farm is collaborating with insurtech companies to leverage their expertise in technology and innovation. These partnerships allow State Farm to access new technologies, develop innovative products, and enhance customer experiences. By embracing collaboration, State Farm is able to stay ahead of the curve and remain competitive in the rapidly evolving insurance landscape.

Last Point: State Farm Insurance Quite

State Farm Insurance stands out as a beacon of reliability and stability in the insurance market. Their unwavering commitment to customer satisfaction, combined with their extensive product offerings and innovative approach, makes them a compelling choice for individuals and families seeking comprehensive and dependable insurance coverage. As State Farm continues to adapt to the ever-evolving insurance landscape, their focus on providing exceptional customer experiences and innovative solutions ensures their continued success in the years to come.

Helpful Answers

What is State Farm’s claim process like?

State Farm offers multiple channels for filing claims, including online, phone, and mobile app. They have a reputation for efficient claim processing and a dedicated team of claims adjusters who work to ensure a smooth and hassle-free experience.

Does State Farm offer discounts on insurance?

Yes, State Farm offers a wide range of discounts, including safe driving discounts, bundling discounts, and good student discounts. Their website and customer service representatives can provide details on available discounts.

How can I get a quote from State Farm?

You can easily obtain a quote online through their website or by contacting their customer service team. They will ask for basic information about your needs and preferences to provide you with a personalized quote.