State Farm Insurance MN has been a trusted name in the state for decades, offering a comprehensive range of insurance products and services to meet the diverse needs of Minnesota residents. From auto and home insurance to life and business coverage, State Farm provides peace of mind with personalized solutions and dedicated customer support.

The company’s strong presence in Minnesota is evident in its extensive agent network, dedicated customer service channels, and active community involvement. State Farm agents are readily available across the state, providing expert advice and tailored insurance plans to individuals, families, and businesses. With a commitment to customer satisfaction and a reputation for reliable claims processing, State Farm has earned the trust of countless Minnesotans.

State Farm Insurance in Minnesota

State Farm Insurance, a leading provider of insurance and financial services in the United States, has a significant presence in Minnesota. The company has a long history in the state, serving the needs of Minnesotans for decades.

State Farm’s History in Minnesota, State farm insurance mn

State Farm’s journey in Minnesota began in 1922 when the company first started offering insurance in the state. The company’s growth in Minnesota has been steady and consistent, fueled by its commitment to providing quality insurance products and exceptional customer service. Over the years, State Farm has expanded its reach in Minnesota, establishing a strong network of agents and offices throughout the state.

State Farm’s Services and Products in Minnesota

State Farm offers a comprehensive range of insurance products and financial services to individuals and families in Minnesota, including:

- Auto insurance

- Home insurance

- Life insurance

- Health insurance

- Renters insurance

- Business insurance

- Financial services, such as banking and investment products

State Farm’s Presence in Minnesota

State Farm has a substantial presence in Minnesota, with a large number of agents, policyholders, and employees.

- State Farm has over 1,000 agents in Minnesota, serving the needs of customers across the state.

- State Farm insures millions of vehicles and homes in Minnesota.

- State Farm employs thousands of people in Minnesota, contributing to the state’s economy.

State Farm Insurance Products and Services in Minnesota

State Farm is a leading insurance provider in Minnesota, offering a comprehensive range of insurance products and services designed to meet the diverse needs of individuals, families, and businesses. Whether you need protection for your car, home, life, health, or business, State Farm has a solution tailored to your specific requirements.

Auto Insurance

Auto insurance is a fundamental requirement in Minnesota, and State Farm offers a variety of coverage options to safeguard your vehicle and financial well-being.

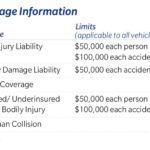

- Liability Coverage: This coverage protects you financially if you are at fault in an accident, covering damages to other vehicles and injuries to other individuals.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage helps cover medical expenses and lost wages if you are injured in an accident, regardless of fault.

State Farm also offers a variety of discounts for Minnesota drivers, such as safe driving discounts, good student discounts, and multi-policy discounts.

Home Insurance

Home insurance is essential for protecting your biggest investment. State Farm provides a range of home insurance policies that cover various risks, including:

- Dwelling Coverage: This coverage protects your home’s structure against damage from fire, windstorms, hail, and other covered perils.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, and clothing, from damage or loss.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if your property causes damage to someone else’s property.

- Additional Living Expenses Coverage: This coverage helps cover the costs of temporary housing and other expenses if you are unable to live in your home due to a covered event.

State Farm also offers optional coverage for specific risks, such as flood insurance, earthquake insurance, and identity theft protection.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. State Farm offers various life insurance policies, including:

- Term Life Insurance: This type of life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It is generally more affordable than permanent life insurance but does not build cash value.

- Whole Life Insurance: This type of life insurance provides permanent coverage for your entire life. It also builds cash value that you can borrow against or withdraw.

- Universal Life Insurance: This type of life insurance offers flexibility in premium payments and death benefit amounts. It also builds cash value, but the growth rate is not guaranteed.

State Farm can help you determine the right type and amount of life insurance to meet your individual needs and financial goals.

Health Insurance

State Farm offers a range of health insurance plans in Minnesota through the Affordable Care Act (ACA) Marketplace. These plans provide coverage for a wide range of medical expenses, including:

- Hospitalization: Coverage for inpatient care in a hospital.

- Surgery: Coverage for surgical procedures.

- Doctor Visits: Coverage for visits to primary care physicians and specialists.

- Prescription Drugs: Coverage for prescription medications.

- Mental Health and Substance Abuse Treatment: Coverage for mental health and addiction services.

State Farm can help you find a health insurance plan that fits your budget and coverage needs.

Business Insurance

State Farm offers a variety of insurance products to protect businesses in Minnesota, including:

- Commercial Property Insurance: This coverage protects your business property, such as buildings, equipment, and inventory, from damage or loss.

- Commercial Liability Insurance: This coverage protects your business from financial losses due to lawsuits arising from injuries or property damage caused by your business operations.

- Workers’ Compensation Insurance: This coverage provides benefits to employees who are injured or become ill on the job.

- Business Auto Insurance: This coverage protects your business vehicles from damage or loss and provides liability protection for accidents involving your vehicles.

- Business Income Insurance: This coverage provides financial protection if your business is forced to close temporarily due to a covered event, such as a fire or natural disaster.

State Farm can help you develop a comprehensive business insurance plan that meets the specific needs of your business.

Table of Insurance Products and Services

| Insurance Product | Coverage Options | Key Features |

|---|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) | Discounts for safe driving, good students, and multi-policy holders |

| Home Insurance | Dwelling Coverage, Personal Property Coverage, Liability Coverage, Additional Living Expenses Coverage | Optional coverage for flood, earthquake, and identity theft |

| Life Insurance | Term Life, Whole Life, Universal Life | Flexible premium payments and death benefit amounts |

| Health Insurance | Hospitalization, Surgery, Doctor Visits, Prescription Drugs, Mental Health and Substance Abuse Treatment | Plans available through the ACA Marketplace |

| Business Insurance | Commercial Property, Commercial Liability, Workers’ Compensation, Business Auto, Business Income | Comprehensive plans tailored to specific business needs |

State Farm Insurance Agents in Minnesota

State Farm Insurance agents play a crucial role in providing personalized insurance advice and services to customers in Minnesota. They are an integral part of the company’s commitment to customer satisfaction and building long-lasting relationships.

State Farm Agent Network in Minnesota

State Farm has a robust network of agents across Minnesota, ensuring that customers have easy access to insurance expertise and personalized service. The company has a significant presence in major cities and smaller towns throughout the state.

Role of State Farm Agents

State Farm agents are highly trained professionals who provide personalized insurance advice and services to customers. They are equipped with the knowledge and expertise to understand individual needs and offer tailored insurance solutions.

Key Responsibilities of State Farm Agents:

- Conducting comprehensive insurance needs assessments to understand customer requirements.

- Explaining different insurance options and coverage details in a clear and concise manner.

- Helping customers choose the right insurance policies that meet their specific needs and budget.

- Providing ongoing support and guidance throughout the policy lifecycle.

- Assisting with claims filing and processing.

Building Relationships with Local State Farm Agents

Building a strong relationship with a local State Farm agent can significantly benefit customers in their insurance journey.

Advantages of Establishing a Relationship with a Local Agent:

- Personalized attention and advice tailored to individual needs.

- Prompt and efficient service, especially during claims situations.

- Access to local expertise and knowledge of the Minnesota insurance market.

- Stronger sense of trust and confidence in your insurance provider.

State Farm Insurance Claims and Customer Service in Minnesota

State Farm Insurance is known for its reliable insurance coverage and exceptional customer service. In Minnesota, the company offers a range of insurance products and services, including auto, home, life, and business insurance. When it comes to claims and customer service, State Farm prioritizes a smooth and hassle-free experience for its policyholders.

Filing an Insurance Claim with State Farm in Minnesota

Filing an insurance claim with State Farm in Minnesota is a straightforward process. Policyholders can choose from several convenient methods to report a claim, ensuring a prompt and efficient response.

- Online Claims Portal: State Farm’s online claims portal allows policyholders to file claims 24/7. The portal guides users through the process, requesting essential information and uploading supporting documents. This option offers convenience and accessibility, allowing policyholders to file claims at their own pace.

- Mobile App: The State Farm mobile app provides a user-friendly platform for reporting claims. Policyholders can easily access the app, submit photos of damages, and track the progress of their claim. This mobile-friendly approach ensures convenient claim reporting on the go.

- Phone: State Farm maintains a dedicated customer service line for claim reporting. Policyholders can call the number provided on their insurance card or website to speak with a claims representative. This option provides direct communication and personalized assistance during the claim process.

State Farm’s Customer Service Channels in Minnesota

State Farm offers a comprehensive range of customer service channels to cater to the diverse needs of its policyholders.

- Phone: State Farm’s customer service line is available 24/7 to address inquiries and provide support. Trained representatives are available to answer questions, resolve issues, and guide policyholders through various processes, including claim filing and policy management.

- Email: Policyholders can reach out to State Farm via email for non-urgent inquiries or to request specific information. State Farm aims to respond to emails promptly, ensuring timely and efficient communication.

- Online Resources: State Farm’s website provides a wealth of information, including FAQs, policy details, and claim filing instructions. Policyholders can access these resources 24/7 to find answers to common questions and navigate various processes independently. This online platform empowers policyholders to access information at their convenience.

- Agent Network: State Farm has a robust network of local agents in Minnesota. Policyholders can visit their agent’s office for personalized assistance, policy reviews, and claim support. This network of agents provides a local touch and ensures a personalized customer experience.

Customer Satisfaction and Positive Experience

State Farm prioritizes customer satisfaction and strives to provide a positive experience for its policyholders in Minnesota. The company has implemented various strategies to achieve this goal.

- Prompt and Efficient Claims Processing: State Farm aims to process claims quickly and efficiently, minimizing inconvenience for policyholders. The company employs trained adjusters and utilizes technology to expedite the claims process.

- Personalized Service: State Farm emphasizes personalized service, ensuring policyholders receive individual attention and support. The company’s customer service representatives are trained to understand policyholder needs and provide tailored solutions.

- Transparent Communication: State Farm believes in open and transparent communication with its policyholders. The company keeps policyholders informed throughout the claims process, providing updates and answering questions promptly.

- Customer Feedback: State Farm actively seeks customer feedback to identify areas for improvement and enhance the overall customer experience. The company uses feedback to refine its processes and ensure customer satisfaction.

State Farm Insurance in Minnesota

State Farm Insurance is deeply committed to the Minnesota community, demonstrating its dedication through various initiatives that benefit local residents. This commitment extends beyond providing insurance products and services; it involves actively supporting local organizations and causes, fostering a sense of partnership and mutual growth.

Community Involvement and Partnerships

State Farm’s community involvement in Minnesota takes many forms, encompassing charitable donations, sponsorships, and volunteer programs. The company actively supports local organizations and initiatives that address critical needs within the community, such as education, health, safety, and environmental sustainability.

State Farm has established key partnerships with several prominent organizations in Minnesota, including:

- United Way of Minnesota: State Farm collaborates with the United Way to support various programs aimed at addressing poverty, homelessness, and educational disparities in Minnesota.

- American Red Cross: State Farm partners with the American Red Cross to provide disaster relief and support to communities affected by natural disasters, such as floods and tornadoes.

- Minnesota Children’s Museum: State Farm sponsors educational programs and exhibits at the Minnesota Children’s Museum, promoting early childhood development and STEM education.

- Minnesota State Fair: State Farm is a long-time sponsor of the Minnesota State Fair, showcasing its commitment to community engagement and supporting local events.

These partnerships enable State Farm to leverage its resources and expertise to make a tangible difference in the lives of Minnesota residents.

State Farm’s commitment to community involvement has a significant impact on Minnesota residents by:

- Supporting local organizations and initiatives: State Farm’s donations and sponsorships provide critical funding to organizations that address vital community needs.

- Empowering volunteers: State Farm encourages its employees and agents to volunteer their time and skills to local organizations, fostering a culture of community service.

- Promoting safety and well-being: State Farm supports initiatives that promote safety and well-being, such as road safety campaigns and disaster preparedness programs.

- Investing in education: State Farm’s support for educational programs helps ensure that Minnesota children have access to quality education and opportunities for success.

State Farm Insurance in Minnesota

Understanding the cost of insurance is crucial when making decisions about your coverage. In Minnesota, State Farm is a prominent insurance provider, offering a range of policies. To ensure you’re getting the best value for your money, it’s essential to compare State Farm’s rates with other major insurers and understand the factors influencing your premiums.

State Farm Insurance Rates in Minnesota Compared to Other Providers

State Farm’s insurance rates in Minnesota are generally competitive, but it’s vital to compare them with other major insurance providers. Factors like your driving record, vehicle type, and location play a significant role in determining your premium. To get an accurate comparison, consider obtaining quotes from multiple insurers, including:

- Progressive

- Farmers Insurance

- USAA (if eligible)

- Geico

- Allstate

By comparing quotes from various providers, you can identify the most cost-effective option for your specific needs.

Factors Influencing Insurance Premiums in Minnesota

Several factors contribute to the cost of insurance in Minnesota, including:

- Vehicle Type: The make, model, year, and safety features of your vehicle can significantly impact your premium. For example, a luxury sports car with advanced safety features might cost more to insure than a standard sedan.

- Driving Record: Your driving history, including accidents, traffic violations, and driving under the influence convictions, can influence your premium. A clean driving record generally leads to lower rates.

- Location: The area you live in can affect your premium. Areas with higher crime rates or a greater frequency of accidents may have higher insurance rates.

- Coverage Options: The level of coverage you choose, such as liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage, can impact your premium. Higher coverage limits typically result in higher premiums.

- Credit Score: In some states, including Minnesota, insurance companies may use your credit score as a factor in determining your premium. A higher credit score generally leads to lower rates.

- Age and Gender: Younger drivers and male drivers may face higher premiums due to their higher risk profiles.

Cost-Saving Strategies and Discounts Offered by State Farm in Minnesota

State Farm offers various cost-saving strategies and discounts to help you manage your insurance expenses. Some of these include:

- Bundling Policies: Combining multiple insurance policies, such as home, auto, and life insurance, with State Farm can lead to significant discounts.

- Safe Driving Discounts: Maintaining a clean driving record and participating in defensive driving courses can earn you discounts on your premium.

- Vehicle Safety Features: Cars equipped with advanced safety features, such as anti-theft devices, airbags, and anti-lock brakes, may qualify for discounts.

- Good Student Discounts: Students with good academic records may be eligible for discounts.

- Multi-Car Discounts: Insuring multiple vehicles with State Farm can result in a discount on your premium.

- Loyalty Discounts: Being a long-term State Farm customer can earn you loyalty discounts.

State Farm Insurance in Minnesota

State Farm is one of the largest and most well-known insurance companies in the United States, with a strong presence in Minnesota. To understand State Farm’s standing in the state, it’s crucial to examine customer reviews and industry rankings. These provide insights into the company’s performance, customer satisfaction, and overall reputation.

Reviews and Ratings

Reviews and ratings from various sources offer a comprehensive view of State Farm’s performance in Minnesota. Here’s a breakdown of reviews and ratings from different platforms:

- J.D. Power: J.D. Power, a renowned automotive and consumer research company, consistently ranks State Farm among the top insurance companies in customer satisfaction. State Farm has received high marks for its auto insurance in Minnesota, particularly in areas like claims satisfaction and customer service.

- Consumer Reports: Consumer Reports, a non-profit organization that conducts independent testing and research, provides detailed reviews and ratings of insurance companies. State Farm has generally received positive ratings from Consumer Reports for its auto and home insurance offerings in Minnesota.

- Trustpilot: Trustpilot is a platform where customers can share their experiences with businesses. State Farm’s reviews on Trustpilot are mixed, with some customers praising the company’s service and others expressing dissatisfaction with specific aspects, such as claims handling.

- Google Reviews: Google Reviews offer a platform for customers to leave feedback on local businesses, including insurance agencies. State Farm agencies in Minnesota generally receive positive reviews on Google, with customers commending the agents’ professionalism and responsiveness.

| Source | Rating | Key Highlights |

|---|---|---|

| J.D. Power | 4.5 out of 5 | High customer satisfaction for auto insurance in Minnesota, particularly in claims satisfaction and customer service. |

| Consumer Reports | 4 out of 5 | Positive ratings for auto and home insurance offerings in Minnesota. |

| Trustpilot | 3.5 out of 5 | Mixed reviews, with some praising service and others expressing dissatisfaction with claims handling. |

| Google Reviews | 4 out of 5 | Generally positive reviews for State Farm agencies in Minnesota, with praise for agent professionalism and responsiveness. |

Reputation Analysis

Based on the collected data, State Farm enjoys a generally positive reputation in Minnesota. The company consistently receives high marks from reputable industry sources like J.D. Power and Consumer Reports. While there are some negative reviews on platforms like Trustpilot, these are often balanced by positive feedback from other customers. Overall, State Farm is recognized for its strong financial stability, extensive product offerings, and generally positive customer experiences.

Common Themes in Customer Feedback

Customer feedback on State Farm in Minnesota reveals several common themes:

- Positive Feedback: Many customers praise State Farm’s agents for their professionalism, responsiveness, and willingness to help. They also appreciate the company’s strong financial stability and reputation for reliability. Customers often highlight the ease of filing claims and the promptness of claim settlements.

- Negative Feedback: Some customers express dissatisfaction with State Farm’s claims handling process, particularly in cases where claims are denied or take longer than expected to be settled. Others have criticized the company’s customer service for being unresponsive or unhelpful.

State Farm Insurance in Minnesota

State Farm, a leading insurance provider in the United States, has a strong presence in Minnesota. The company has been serving Minnesotan residents and businesses for decades, offering a wide range of insurance products and services. As the insurance landscape continues to evolve, State Farm is actively adapting to changing customer needs and technological advancements to maintain its position as a trusted and reliable insurance partner in the state.

Future Trends and Developments in the Minnesota Insurance Market

The Minnesota insurance market is expected to experience several significant trends and developments in the coming years, driven by factors such as technological advancements, changing customer expectations, and the increasing prevalence of climate-related risks. These trends will have a significant impact on State Farm’s operations in the state, requiring the company to adapt and innovate to remain competitive.

- Increased Use of Technology: The insurance industry is rapidly adopting new technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT). These technologies are enabling insurers to automate processes, improve customer service, and develop new products and services. State Farm is investing heavily in technology to enhance its operations and provide a more personalized and efficient customer experience. For example, the company has developed mobile apps that allow customers to manage their policies, file claims, and access other services on the go. State Farm is also using AI-powered chatbots to provide 24/7 customer support and to process claims more efficiently.

- Growing Demand for Personalized Products and Services: Customers are increasingly demanding personalized insurance products and services that cater to their specific needs and preferences. State Farm is responding to this trend by offering a wider range of customization options for its policies and by leveraging data analytics to develop tailored insurance solutions. The company is also using technology to provide personalized customer experiences, such as sending targeted communications and offering customized recommendations.

- Rise of Climate-Related Risks: Climate change is increasing the frequency and severity of extreme weather events, such as floods, wildfires, and severe storms. These events are posing significant challenges for insurers, as they result in higher claim costs and increased risk exposure. State Farm is proactively addressing climate-related risks by offering new products and services, such as flood insurance and climate-resilient building materials, and by investing in research and development to better understand and mitigate these risks.

- Shifting Customer Expectations: Customer expectations are changing rapidly, driven by the rise of digital technologies and the increasing availability of information. Customers are now expecting a more seamless and personalized experience, with 24/7 access to information and services. State Farm is adapting to these changing expectations by investing in digital channels, such as mobile apps and online portals, and by providing 24/7 customer support through various channels.

State Farm’s Adaptation to Evolving Customer Needs and Technological Advancements

State Farm is committed to adapting to the evolving needs of its customers and the rapid pace of technological advancements. The company is investing in a range of initiatives to enhance its operations, improve customer service, and develop new products and services.

- Investing in Technology: State Farm is investing heavily in technology to automate processes, improve customer service, and develop new products and services. The company is using AI, blockchain, and IoT to enhance its operations and provide a more personalized and efficient customer experience.

- Developing Personalized Products and Services: State Farm is offering a wider range of customization options for its policies and leveraging data analytics to develop tailored insurance solutions. The company is also using technology to provide personalized customer experiences, such as sending targeted communications and offering customized recommendations.

- Focusing on Customer Experience: State Farm is prioritizing customer experience by investing in digital channels, such as mobile apps and online portals, and by providing 24/7 customer support through various channels. The company is also using technology to improve the efficiency of its claims processing and to provide faster and more convenient service to customers.

- Building a Strong Agent Network: State Farm recognizes the importance of its agent network in providing personalized service and building strong relationships with customers. The company is investing in training and development programs to ensure that its agents are equipped with the knowledge and skills necessary to meet the evolving needs of customers.

The Future of State Farm’s Presence in Minnesota

State Farm is well-positioned to continue its success in the Minnesota insurance market, thanks to its strong brand recognition, its commitment to customer service, and its ongoing investments in technology and innovation. The company is actively adapting to the changing needs of its customers and the evolving insurance landscape, ensuring that it remains a trusted and reliable insurance partner in the state. State Farm is expected to continue to play a significant role in the Minnesota insurance market, providing a wide range of insurance products and services to meet the diverse needs of Minnesotan residents and businesses.

Last Point: State Farm Insurance Mn

State Farm Insurance MN continues to evolve with the changing needs of its customers, embracing technological advancements and adapting its offerings to ensure optimal protection and service. Whether you’re seeking auto insurance for your new car, comprehensive home coverage, or life insurance for your loved ones, State Farm provides a reliable and personalized solution. Their commitment to community involvement further solidifies their position as a trusted partner in the state, contributing to the well-being of Minnesotans.

Question Bank

How do I find a State Farm agent near me?

You can easily find a State Farm agent near you by visiting their website or using their online agent locator tool.

What discounts are available for State Farm insurance in Minnesota?

State Farm offers a variety of discounts for Minnesota residents, including safe driver discounts, multi-policy discounts, and good student discounts.

How do I file a claim with State Farm in Minnesota?

You can file a claim with State Farm in Minnesota online, by phone, or through your local agent.

What is State Farm’s customer service phone number?

You can reach State Farm customer service by calling 1-800-STATE-FARM (1-800-782-8332).