State Farm Insurance homeowners quote is a vital step in securing financial protection for your home. Understanding the process, coverage options, and factors influencing your premium can help you make informed decisions about your homeowners insurance. This guide will provide a comprehensive overview of State Farm’s homeowners insurance offerings, including their various coverage options, pricing factors, and customer service experiences.

From obtaining a quote to analyzing its competitiveness, we’ll explore the key aspects of State Farm’s homeowners insurance and discuss how it stacks up against other major providers. We’ll also delve into their unique policy features, discounts, and customer service reputation to help you make a well-informed decision about whether State Farm is the right fit for your needs.

State Farm Homeowners Insurance Overview: State Farm Insurance Homeowners Quote

State Farm is a leading provider of homeowners insurance in the United States, offering a wide range of coverage options to protect your home and belongings. State Farm’s homeowners insurance policies are designed to provide financial protection against various risks, ensuring peace of mind for homeowners.

Coverage Options

State Farm homeowners insurance policies offer a variety of coverage options to meet the specific needs of each policyholder. The standard homeowners insurance policy typically includes the following types of coverage:

- Dwelling Coverage: This coverage protects the physical structure of your home, including the attached structures like garages and porches, against perils such as fire, windstorms, hail, and theft. The coverage amount is typically based on the estimated cost to rebuild or repair your home.

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, clothing, electronics, and jewelry, against the same perils covered under dwelling coverage. The coverage amount is usually a percentage of the dwelling coverage, typically 50% to 70%.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you are found liable for damages caused to someone else’s property. This coverage typically includes legal defense costs and medical expenses.

- Additional Living Expenses: This coverage helps pay for temporary housing and other living expenses if your home becomes uninhabitable due to a covered peril. This coverage can cover expenses such as hotel stays, meals, and transportation.

Factors Influencing Premiums, State farm insurance homeowners quote

Several factors influence the cost of State Farm homeowners insurance premiums. These factors include:

- Location: Homes located in areas with higher risks of natural disasters, such as hurricanes, earthquakes, or wildfires, tend to have higher premiums. The proximity to fire stations and other emergency services also plays a role in determining premiums.

- Property Value: The value of your home is a significant factor in determining premiums. Homes with higher values generally have higher premiums due to the greater potential loss in case of damage.

- Coverage Limits: The amount of coverage you choose for your dwelling, personal property, and liability will affect your premium. Higher coverage limits result in higher premiums.

- Risk Factors: Certain factors, such as the age of your home, the type of construction, and the presence of security systems, can influence your premium. Homes with older construction or lack of security features may have higher premiums.

Additional Coverage Options

State Farm offers various additional coverage options that can be added to your homeowners insurance policy to provide more comprehensive protection. These options include:

- Flood Insurance: This coverage protects your home from damage caused by flooding, which is typically not covered by standard homeowners insurance policies. It is essential for homeowners in areas prone to flooding.

- Earthquake Insurance: This coverage protects your home from damage caused by earthquakes, which are also typically not covered by standard homeowners insurance policies. It is crucial for homeowners in earthquake-prone regions.

- Personal Umbrella Liability Insurance: This coverage provides additional liability protection beyond the limits of your homeowners insurance policy. It can protect you against significant financial losses in case of a major liability claim.

Obtaining a Homeowners Insurance Quote from State Farm

Getting a homeowners insurance quote from State Farm is a straightforward process. You can choose from several convenient methods, each with its own advantages and disadvantages.

Methods for Obtaining a Quote

You can obtain a homeowners insurance quote from State Farm in the following ways:

- Online Platform: State Farm’s website offers a user-friendly online platform for obtaining quotes. This method is convenient and allows you to compare different coverage options at your own pace. You can access the platform 24/7, eliminating the need for phone calls or in-person visits. However, the online platform might not be suitable for complex situations requiring personalized guidance from an agent.

- Phone Call: State Farm has a dedicated customer service team available to assist you with obtaining a quote over the phone. This method allows you to receive personalized guidance from a representative who can answer your questions and address any concerns. However, it might be time-consuming, especially during peak hours, and requires you to provide information verbally.

- In-Person Consultation: You can schedule an appointment with a State Farm agent to discuss your homeowners insurance needs in person. This method offers the most personalized approach, allowing you to receive tailored advice and have your questions answered in detail. However, it requires scheduling an appointment and traveling to the agent’s office, which might not be convenient for everyone.

Information Required for a Quote

To obtain a homeowners insurance quote from State Farm, you will need to provide the following information:

- Property Details: This includes the address, square footage, year built, construction type, and any renovations or upgrades.

- Personal Information: This includes your name, address, phone number, and email address.

- Coverage Preferences: This includes the desired coverage amount, deductibles, and specific coverages, such as personal liability, dwelling coverage, and personal property coverage.

Benefits and Drawbacks of Each Method

| Method | Benefits | Drawbacks |

|---|---|---|

| Online Platform | Convenient, 24/7 access, allows for comparison of different options | May not be suitable for complex situations, lacks personalized guidance |

| Phone Call | Personalized guidance, allows for questions and concerns to be addressed | Time-consuming, requires verbal information, limited flexibility |

| In-Person Consultation | Most personalized approach, tailored advice, detailed answers to questions | Requires scheduling an appointment, travel time, limited availability |

Analyzing State Farm Homeowners Insurance Quotes

Once you’ve obtained a homeowners insurance quote from State Farm, it’s essential to analyze it thoroughly to ensure it meets your needs and fits within your budget. This analysis involves comparing State Farm’s quote with those from other major insurance providers and examining the factors that influence its competitiveness.

Comparing State Farm’s Quotes with Other Providers

When comparing State Farm’s homeowners insurance quotes with those from other major insurance providers, consider the following:

- Coverage Options: Compare the coverage options offered by each insurer. Ensure they provide adequate protection for your specific property and needs. Look for differences in coverage limits, deductibles, and optional endorsements.

- Premiums: Analyze the premiums quoted by each insurer, taking into account factors such as coverage levels, deductibles, and discounts. Consider the overall cost of the policy over the long term.

- Discounts: Compare the discounts offered by each insurer, such as those for home security systems, fire alarms, or bundling insurance policies. These discounts can significantly impact your final premium.

- Customer Service: Research the customer service reputation of each insurer. Read online reviews and consider the availability of 24/7 support, online tools, and mobile apps.

- Financial Stability: Evaluate the financial stability of each insurer. Check their ratings from independent agencies like AM Best or Moody’s to assess their ability to pay claims in the event of a major disaster.

Factors Influencing State Farm’s Quote Competitiveness

State Farm’s homeowners insurance quotes are influenced by several factors, including:

- Pricing Strategies: State Farm utilizes sophisticated pricing models that consider various factors, including property value, location, age, and construction type. They may offer competitive rates in specific areas or for certain types of homes.

- Discounts: State Farm offers a wide range of discounts, such as those for bundling insurance policies, installing security systems, or being a safe driver. These discounts can make their quotes more attractive to certain customers.

- Coverage Options: State Farm provides a comprehensive range of coverage options, allowing customers to tailor their policies to meet their specific needs. This flexibility can make their quotes more appealing to those seeking customized coverage.

Advantages and Disadvantages of Choosing State Farm

Based on the analysis of State Farm’s homeowners insurance quotes, here are some potential advantages and disadvantages of choosing them:

Advantages

- Strong Financial Stability: State Farm has a long history and a solid financial reputation, providing reassurance that they can pay claims in the event of a major disaster.

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options, allowing customers to tailor their policies to their specific needs.

- Extensive Discount Programs: State Farm offers a variety of discounts that can significantly reduce premiums, making their quotes more attractive to many customers.

- Strong Brand Recognition: State Farm is a well-known and trusted brand, which can provide peace of mind to some customers.

Disadvantages

- Potentially Higher Premiums: While State Farm offers discounts, their premiums may be higher than those of some competitors, especially for customers who don’t qualify for many discounts.

- Varying Customer Service Experiences: Customer service experiences can vary depending on the agent and location. It’s essential to research and choose an agent with a good reputation.

- Limited Online Tools: State Farm’s online tools and mobile app functionality may not be as robust as those offered by some competitors.

Understanding State Farm’s Customer Service and Claims Process

State Farm is known for its comprehensive homeowners insurance policies, but its customer service and claims process are equally important factors to consider. Understanding how State Farm handles customer inquiries and claims can help you make an informed decision about whether this insurer is the right fit for your needs.

State Farm’s Customer Service Channels

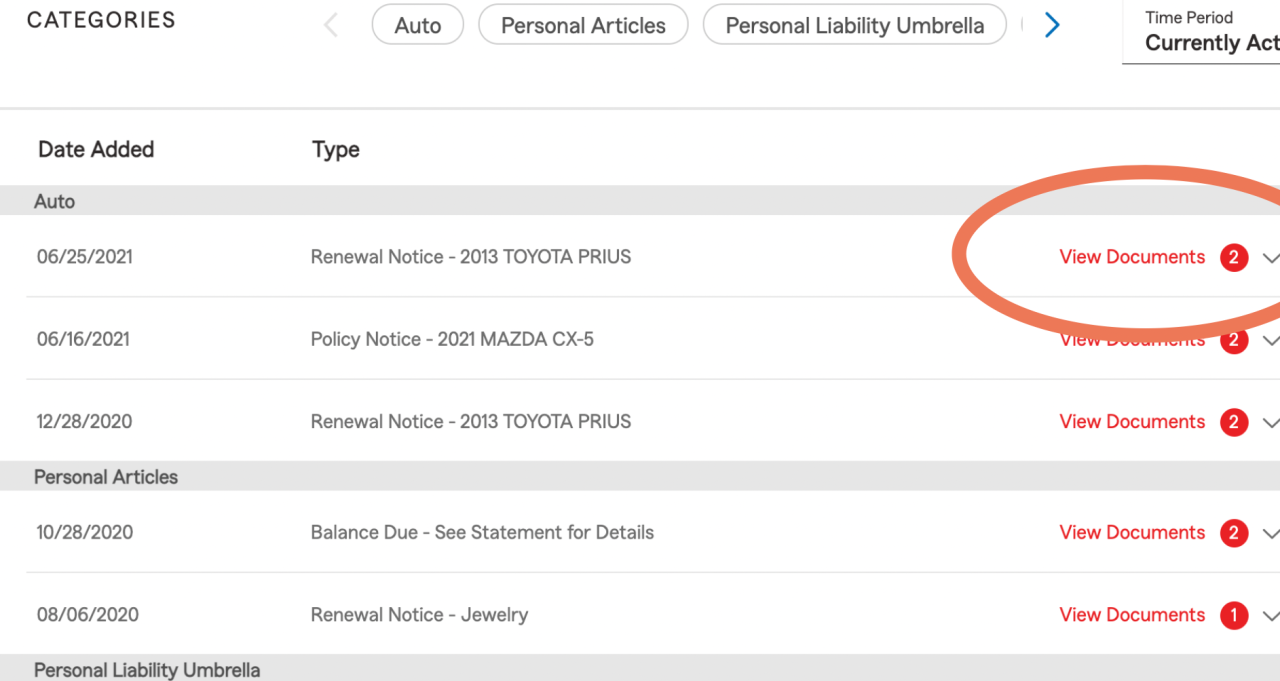

State Farm offers a variety of customer service channels to ensure convenient access to support.

- Phone Support: State Farm provides 24/7 phone support, allowing policyholders to reach a representative at any time, day or night. This is especially helpful for urgent situations or when you need immediate assistance.

- Online Resources: State Farm’s website offers a wealth of information, including policy details, claims procedures, and FAQs. You can also manage your policy online, make payments, and access other services.

- Mobile App: State Farm’s mobile app provides convenient access to policy information, claims reporting, and other features. The app is available for both Android and iOS devices, making it easy to stay connected on the go.

State Farm’s Claims Process

State Farm’s claims process is designed to be straightforward and efficient.

- Report the Claim: You can report a claim through one of the available channels, including phone, online, or the mobile app. Provide all necessary details about the incident, such as the date, time, and location.

- Initial Assessment: State Farm will assess the claim and determine if it is covered under your policy. They may request additional information or documentation.

- Claim Adjustment: Once the claim is approved, State Farm will assign an adjuster to handle the process. The adjuster will investigate the claim further and determine the amount of compensation.

- Compensation: State Farm will issue payment for covered damages, either directly to you or to the repair/replacement vendor. The payment will be based on the agreed-upon settlement amount.

State Farm’s Customer Satisfaction Ratings and Claims Handling Reputation

State Farm consistently ranks highly in customer satisfaction surveys. For example, in J.D. Power’s 2023 U.S. Home Insurance Satisfaction Study, State Farm received an above-average score for overall satisfaction. State Farm also has a strong reputation for handling claims effectively and fairly. The company has a dedicated team of claims professionals who are trained to provide prompt and efficient service.

Exploring State Farm’s Homeowners Insurance Discounts

State Farm, known for its comprehensive homeowners insurance coverage, also offers a range of discounts that can significantly reduce your premium. These discounts are designed to reward policyholders who take proactive steps to mitigate risks and demonstrate responsible behavior. By understanding the available discounts and their eligibility criteria, you can potentially save a substantial amount on your homeowners insurance.

Safety Features Discounts

State Farm recognizes that homes with enhanced safety features are less likely to experience claims. They offer discounts for installing various safety devices that can reduce the risk of accidents, theft, and other incidents.

- Smoke Detectors: Installing working smoke detectors throughout your home is a crucial safety measure that can save lives. State Farm rewards policyholders who have properly installed and maintained smoke detectors with a discount on their premiums.

- Fire Alarms: Similar to smoke detectors, having a functional fire alarm system in your home can help prevent significant damage from fires. State Farm offers discounts to homeowners who have installed and maintained fire alarms.

- Security Systems: Installing a security system, such as an alarm system or security cameras, can deter burglars and reduce the risk of theft. State Farm provides discounts to policyholders who have installed and maintain security systems.

- Deadbolt Locks: Installing deadbolt locks on all exterior doors is a simple yet effective way to enhance home security. State Farm offers discounts to homeowners who have installed deadbolt locks on all exterior doors.

Bundling Discounts

State Farm offers significant discounts to policyholders who bundle multiple insurance policies, such as homeowners, auto, renters, and life insurance.

- Bundling Home and Auto Insurance: This is one of the most common and substantial discounts offered by State Farm. By bundling your homeowners and auto insurance policies with State Farm, you can save significantly on both premiums.

- Bundling Additional Policies: State Farm also offers discounts for bundling other insurance policies, such as renters insurance, life insurance, or even motorcycle insurance.

Loyalty Discounts

State Farm rewards its loyal customers with discounts for maintaining their insurance policies for extended periods.

- Long-Term Policyholder Discounts: State Farm offers discounts to policyholders who have been continuously insured with them for a certain number of years. The longer you stay with State Farm, the larger the discount you may receive.

- Renewal Discounts: Some State Farm policies may qualify for a renewal discount for simply renewing your policy with them.

Other Discounts

State Farm offers a variety of other discounts to homeowners, based on their individual circumstances and characteristics.

- Good Credit Score Discounts: State Farm may offer discounts to policyholders who have good credit scores, as they are statistically less likely to file claims.

- Homeowner Association Discounts: Some homeowners associations may have partnerships with State Farm, offering discounts to residents.

- Green Home Discounts: State Farm may offer discounts to homeowners who have implemented energy-efficient upgrades, such as solar panels or energy-efficient appliances.

State Farm’s Homeowners Insurance Policy Features

State Farm offers a range of homeowners insurance policy features designed to provide comprehensive protection and peace of mind. These features include various coverage options, benefits, and discounts tailored to meet the unique needs of homeowners.

Replacement Cost Coverage

Replacement cost coverage is a valuable feature that ensures you receive the full cost of replacing your damaged or destroyed property, without deducting for depreciation. This means you’ll receive enough money to rebuild or repair your home to its pre-loss condition, using current materials and labor costs.

For example, if your roof is damaged in a storm and needs to be replaced, replacement cost coverage will cover the full cost of a new roof, even if the original roof was older and had depreciated in value.

Guaranteed Replacement Cost

Guaranteed replacement cost coverage is a more comprehensive version of replacement cost coverage, providing additional protection for your home. It guarantees that you’ll receive enough money to rebuild or repair your home, even if the cost exceeds your policy limits.

This feature is particularly beneficial in areas prone to natural disasters or where construction costs are high.

Extended Coverage Options

State Farm offers several extended coverage options that provide additional protection for your home and belongings. These options include:

- Water backup coverage: Protects against damage caused by sewer backups, sump pump failures, and other water-related issues.

- Personal property replacement cost coverage: Provides replacement cost coverage for your personal belongings, such as furniture, electronics, and clothing.

- Identity theft coverage: Helps cover expenses associated with identity theft, such as credit monitoring and legal fees.

Comparison with Competitors

State Farm’s homeowners insurance policy features are competitive with those offered by other major insurance providers. Some of the key differences include:

| Feature | State Farm | Competitor A | Competitor B |

|---|---|---|---|

| Replacement Cost Coverage | Offered as standard coverage | Offered as an optional add-on | Offered as standard coverage |

| Guaranteed Replacement Cost | Offered as an optional add-on | Not offered | Offered as an optional add-on |

| Extended Coverage Options | Wide range of options available | Limited options available | Extensive options available |

State Farm Homeowners Insurance Reviews and Ratings

Choosing the right homeowners insurance can be a significant decision, and it’s essential to consider various factors, including reviews and ratings. These insights can help you understand how a company performs in terms of customer satisfaction, claims handling, and financial stability.

Independent Reviews and Ratings

Several reputable organizations provide independent reviews and ratings for homeowners insurance companies, offering valuable information for consumers. These organizations evaluate various aspects of an insurer’s performance, including customer satisfaction, claims handling, financial stability, and overall value.

| Organization | Customer Satisfaction | Claims Handling | Financial Stability | Overall Value |

|---|---|---|---|---|

| J.D. Power | Above average | Above average | Excellent | Above average |

| AM Best | A+ (Superior) | A+ (Superior) | A+ (Superior) | A+ (Superior) |

| Moody’s | Aa2 (Very strong) | Aa2 (Very strong) | Aa2 (Very strong) | Aa2 (Very strong) |

Strengths and Weaknesses

Based on these reviews and ratings, State Farm homeowners insurance exhibits several strengths and weaknesses. Here’s a breakdown of key aspects:

- Strengths:

- Strong financial stability, indicating a lower risk of insolvency.

- Generally positive customer satisfaction ratings, highlighting a good experience for policyholders.

- Above-average claims handling, suggesting a smooth and efficient process for customers.

- Availability of various discounts, potentially lowering premiums for eligible policyholders.

- Weaknesses:

- Some customer complaints regarding the claims process, particularly in complex situations.

- Potential for higher premiums compared to some competitors, depending on individual factors.

- Limited availability in certain regions, which might restrict access for some potential customers.

Ending Remarks

Navigating the world of homeowners insurance can feel overwhelming, but understanding the basics and exploring your options can make the process smoother. State Farm offers a range of coverage options and features designed to protect your home and your financial well-being. By understanding the factors that influence your quote, the discounts available, and the company’s customer service track record, you can confidently choose the right homeowners insurance for your individual needs.

FAQ Section

What is the difference between dwelling coverage and personal property coverage?

Dwelling coverage protects the structure of your home, while personal property coverage protects your belongings inside the home.

What factors influence State Farm’s homeowners insurance premiums?

Factors like your location, property value, coverage limits, and risk factors can affect your premium.

Does State Farm offer discounts on homeowners insurance?

Yes, State Farm offers various discounts, including safety features, bundling policies, and loyalty programs.

How do I file a claim with State Farm?

You can file a claim online, through their mobile app, or by calling their customer service line.