State farm insurance homeowners insurance quote – State Farm homeowners insurance quotes provide a starting point for securing the right coverage for your home. Whether you’re a new homeowner or looking to review your existing policy, understanding the factors that influence your premium and the different coverage options available is crucial.

This guide explores the ins and outs of obtaining a State Farm homeowners insurance quote, including the different methods, required information, and factors that affect your rate. We’ll also delve into the features, benefits, and limitations of State Farm’s policies, helping you make an informed decision.

State Farm Homeowners Insurance Overview

State Farm is a leading provider of homeowners insurance, offering comprehensive coverage designed to protect your home and belongings from various risks. They offer a wide range of customizable coverage options to fit your specific needs and budget.

State Farm homeowners insurance is known for its competitive rates, excellent customer service, and strong financial stability. They have a long history of providing reliable insurance solutions to homeowners across the United States.

Key Features and Benefits

State Farm homeowners insurance provides numerous features and benefits to protect your investment and peace of mind.

- Comprehensive Coverage: State Farm offers a range of coverage options to protect your home and belongings from various perils, including fire, theft, vandalism, and natural disasters.

- Personal Liability Coverage: This coverage protects you from financial losses if someone is injured on your property or if you are found liable for property damage caused by you or a member of your household.

- Additional Living Expenses Coverage: If your home becomes uninhabitable due to a covered event, this coverage helps cover the cost of temporary housing and other essential expenses.

- Replacement Cost Coverage: This coverage option helps you rebuild or repair your home to its current market value, without deducting for depreciation.

- Discounts and Bundling Options: State Farm offers a variety of discounts for homeowners who take safety measures, such as installing security systems or smoke detectors. You can also bundle your homeowners insurance with other policies, such as auto insurance, to save money.

Types of Coverage Options

State Farm provides various homeowners insurance coverage options to meet diverse needs.

- Basic Coverage: This coverage protects your home and belongings from a limited number of perils, such as fire, theft, and vandalism. It is generally the most affordable option but provides less comprehensive protection.

- Broad Coverage: This coverage expands the protection offered by basic coverage to include a wider range of perils, such as windstorms, hail, and falling objects.

- Special Coverage: This coverage provides the most comprehensive protection, covering your home and belongings from almost all perils, including earthquakes, floods, and sinkholes.

Obtaining a Homeowners Insurance Quote from State Farm

Getting a homeowners insurance quote from State Farm is a straightforward process. You can choose from several convenient methods to receive a personalized quote based on your specific needs and property details.

Methods for Obtaining a Quote

There are various ways to obtain a homeowners insurance quote from State Farm.

- Online: State Farm’s website offers a user-friendly online quoting tool. You can input your property information and coverage preferences to receive an instant quote.

- Phone: You can call State Farm’s customer service line to speak with a representative who can guide you through the quoting process and answer any questions you may have.

- Agent: Visiting a local State Farm agent is another option. Agents can provide personalized advice and help you tailor your coverage to meet your specific needs.

Information Required for a Quote

To provide you with an accurate quote, State Farm will need certain information about your property and coverage preferences.

- Property Details: This includes the address, square footage, year built, type of construction (e.g., brick, wood), and any renovations or upgrades.

- Coverage Preferences: State Farm offers various coverage options, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. You’ll need to indicate the level of coverage you desire for each category.

- Personal Information: This may include your name, contact information, and any previous insurance claims.

Factors Influencing Homeowners Insurance Rates

Several factors influence homeowners insurance rates from State Farm.

- Location: The risk of natural disasters, crime rates, and other factors specific to your location can impact your premium.

- Property Value: The value of your home and its contents will affect the amount of coverage you need and, therefore, your premium.

- Coverage Options: Choosing higher coverage limits or additional coverage options will generally increase your premium.

- Deductible: A higher deductible, which is the amount you pay out-of-pocket before insurance kicks in, can lower your premium.

- Credit Score: In some states, your credit score can be a factor in determining your homeowners insurance rate.

- Safety Features: Having safety features like smoke detectors, burglar alarms, and fire sprinklers can lower your premium as they reduce the risk of claims.

- Claims History: Your past insurance claims history can impact your premium. A history of claims may indicate a higher risk, leading to higher rates.

Understanding State Farm’s Homeowners Insurance Policies: State Farm Insurance Homeowners Insurance Quote

State Farm offers a variety of homeowners insurance policies to meet the unique needs of its customers. These policies provide financial protection against covered perils, such as fire, theft, and natural disasters. Understanding the different coverage options, exclusions, and limitations is crucial for choosing the right policy and ensuring adequate protection for your home and belongings.

Coverage Options

State Farm’s homeowners insurance policies offer a range of coverage options to address different needs. These options typically include:

- Dwelling Coverage: This coverage protects your home’s structure, including the attached garage, against covered perils. It helps cover the cost of repairs or rebuilding in case of damage.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. It covers the cost of replacing or repairing damaged or stolen items.

- Liability Coverage: This coverage protects you from financial losses if someone is injured or their property is damaged on your property. It also covers legal defense costs in case of a lawsuit.

- Additional Living Expenses Coverage: This coverage helps pay for temporary living expenses if your home becomes uninhabitable due to a covered peril. It covers costs like hotel stays, meals, and other necessities.

Common Exclusions and Limitations

State Farm’s homeowners insurance policies typically exclude certain events and circumstances. Some common exclusions include:

- Earthquakes: Earthquakes are generally not covered by standard homeowners insurance policies. Separate earthquake insurance is often required for coverage.

- Flooding: Flood damage is also typically excluded from standard homeowners insurance policies. Flood insurance is available through the National Flood Insurance Program (NFIP).

- Acts of War: Damage caused by acts of war or terrorism is usually excluded from homeowners insurance policies.

- Neglect or Intentional Damage: Damage caused by negligence or intentional acts of the insured is typically excluded from coverage.

Scenarios Where State Farm Homeowners Insurance Might Apply or Not Apply, State farm insurance homeowners insurance quote

It’s important to understand how State Farm homeowners insurance policies apply to different scenarios. Here are a few examples:

- Scenario 1: Fire Damage: If your home is damaged by a fire, State Farm’s homeowners insurance policy would likely cover the cost of repairs or rebuilding. The policy would also cover the cost of replacing or repairing your personal property that was damaged in the fire.

- Scenario 2: Theft: If your belongings are stolen from your home, State Farm’s homeowners insurance policy would likely cover the cost of replacing the stolen items. However, there may be limits on the amount of coverage for certain items, such as jewelry or artwork.

- Scenario 3: Wind Damage: If your home is damaged by a strong windstorm, State Farm’s homeowners insurance policy would likely cover the cost of repairs. However, there may be deductibles and limits on the amount of coverage.

- Scenario 4: Flood Damage: If your home is damaged by a flood, State Farm’s homeowners insurance policy would not cover the damage. Flood insurance is required for coverage against flood damage.

State Farm’s Customer Service and Claims Process

State Farm is known for its strong customer service and claims handling capabilities. The company has a reputation for being responsive and helpful to policyholders, especially during challenging times like a home insurance claim.

State Farm’s Customer Service Reputation

State Farm consistently ranks high in customer satisfaction surveys for its home insurance services. This positive reputation is attributed to factors like:

- Accessibility: State Farm offers various communication channels, including phone, email, and online chat, making it easy for policyholders to reach out for assistance.

- Responsiveness: The company aims to address customer inquiries and concerns promptly, ensuring a timely resolution.

- Friendliness and Professionalism: State Farm’s customer service representatives are known for their courteous and helpful demeanor, providing clear explanations and support.

Filing a Homeowners Insurance Claim with State Farm

When filing a homeowners insurance claim with State Farm, policyholders can follow these steps:

- Report the Claim: Immediately contact State Farm to report the claim, providing details about the incident, date, and time.

- Document the Damage: Take photos and videos of the damage to your home, documenting the extent of the loss.

- Provide Necessary Information: State Farm will request specific information about the claim, such as the cause of damage, details of any involved parties, and relevant documentation.

- Schedule an Inspection: A State Farm adjuster will inspect the damage to assess the extent of the loss and determine the coverage amount.

- Receive Payment: Once the claim is approved, State Farm will issue payment for covered losses, which may be sent directly to you or to contractors involved in repairs.

State Farm’s Claims Handling Process

State Farm’s claims handling process is designed to be fair and transparent. The company employs a team of experienced adjusters who are trained to:

- Thoroughly Investigate Claims: Adjusters conduct detailed inspections and gather evidence to ensure accurate assessment of the damage and coverage.

- Communicate Clearly: They provide regular updates to policyholders throughout the claims process, keeping them informed about the progress and any decisions made.

- Resolve Disputes Fairly: State Farm has procedures in place for resolving disputes that may arise during the claims process, including options for mediation or arbitration.

Comparing State Farm Homeowners Insurance to Competitors

It’s crucial to compare quotes from multiple insurance companies to find the best coverage at the most competitive price. State Farm is a major player in the homeowners insurance market, but it’s essential to see how its policies and rates stack up against other reputable providers.

Comparing State Farm’s Homeowners Insurance Rates

When comparing homeowners insurance rates, it’s essential to consider the overall cost, including premiums, deductibles, and any additional fees. State Farm’s rates can vary depending on factors like your location, home value, coverage options, and your individual risk profile. To get a clear picture, you should obtain quotes from several competitors, including:

- Allstate: Known for its comprehensive coverage and strong financial stability.

- Liberty Mutual: Offers a wide range of discounts and customizable coverage options.

- Progressive: Provides competitive rates and a user-friendly online quoting process.

- USAA: A leading provider for military members and their families, offering competitive rates and excellent customer service.

Comparing State Farm’s Homeowners Insurance Coverage Options

While price is important, it’s equally crucial to consider the coverage options offered by each insurance company. State Farm provides a standard set of coverage options, but other companies may offer more specialized or unique features. Here’s a comparison of key coverage areas:

- Dwelling Coverage: This covers the physical structure of your home against perils like fire, windstorm, and hail. State Farm generally offers standard dwelling coverage, but some competitors may offer additional options like coverage for specific types of damage or higher limits.

- Personal Property Coverage: This protects your belongings inside your home, including furniture, electronics, and clothing. State Farm provides standard coverage, but some competitors may offer higher limits or specialized coverage for valuables like jewelry or art.

- Liability Coverage: This protects you financially if someone is injured on your property or you cause damage to someone else’s property. State Farm provides standard liability coverage, but some competitors offer higher limits or additional coverage for specific types of liability risks.

- Additional Living Expenses Coverage: This helps cover the cost of temporary housing and other living expenses if your home becomes uninhabitable due to a covered event. State Farm offers standard coverage, but some competitors may offer higher limits or additional coverage for specific types of expenses.

Pros and Cons of Choosing State Farm

- Pros:

- Strong financial stability and a long history of reliable service.

- Extensive network of agents and customer service representatives.

- Wide range of discounts and coverage options.

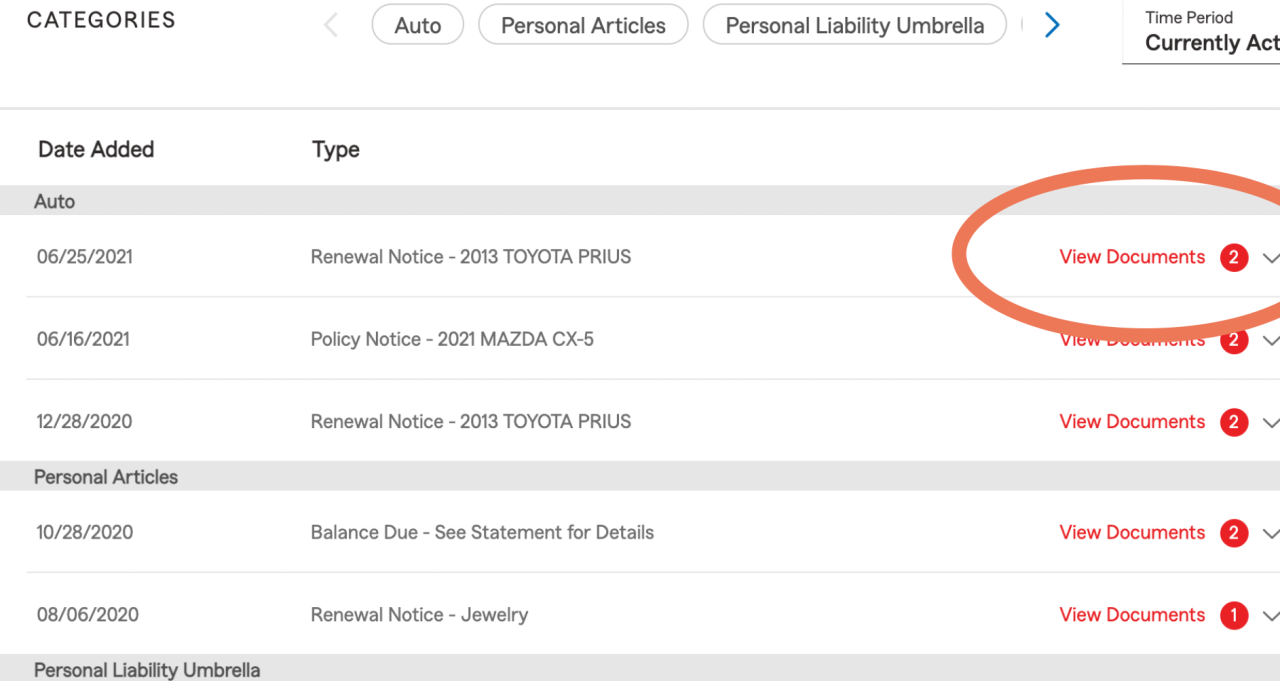

- User-friendly online quoting and policy management tools.

- Cons:

- Rates may not always be the most competitive, especially compared to some online-only insurers.

- Some customers have reported difficulties with the claims process.

Key Factors to Consider When Comparing Homeowners Insurance Quotes

When comparing homeowners insurance quotes, consider these factors:

- Price: Compare the overall cost, including premiums, deductibles, and any additional fees.

- Coverage: Ensure the coverage options meet your specific needs and risks.

- Customer Service: Research the insurer’s reputation for customer service and claims handling.

- Financial Stability: Choose an insurer with a strong financial rating to ensure they can pay out claims in the event of a major disaster.

Tips for Getting the Best Homeowners Insurance Quote from State Farm

Getting the best homeowners insurance quote from State Farm requires a strategic approach to maximize coverage while minimizing costs. This involves understanding your specific needs, exploring different policy options, and engaging in effective communication with State Farm representatives.

Negotiating for a Lower Rate

Negotiating with State Farm can potentially lead to a more favorable rate. Here are some strategies:

- Bundle your policies: Combining your homeowners insurance with other policies like auto insurance can often lead to significant discounts.

- Improve your home’s security: Installing security systems, smoke detectors, and other safety features can demonstrate a lower risk to State Farm and potentially result in a lower premium.

- Shop around and compare quotes: Having quotes from other insurance companies can provide leverage during negotiations. State Farm may be willing to match or even beat a competitor’s offer.

- Ask about discounts: State Farm offers various discounts, such as those for good credit, being a loyal customer, or belonging to certain organizations. Make sure to inquire about all applicable discounts.

Asking the Right Questions

Asking the right questions during the quote process ensures you understand the coverage and terms.

- What is included in the basic policy? This clarifies the standard coverage offered by State Farm and helps you determine if additional coverage is needed.

- What are the deductibles and coverage limits? Understanding these factors is crucial for determining the cost of your policy and the amount of financial protection you will have in case of a claim.

- What are the exclusions and limitations? This helps you identify potential gaps in coverage and ensure that your policy adequately protects your property and belongings.

- What are the payment options? Understanding payment options allows you to choose a plan that fits your budget and financial preferences.

- What is the claims process? Knowing the claims process helps you navigate any potential issues smoothly and efficiently.

Closing Summary

Armed with this knowledge, you can confidently navigate the process of getting a State Farm homeowners insurance quote and secure the best coverage for your needs. Remember, comparing quotes from multiple insurers is essential to finding the most competitive rates and coverage options. By taking the time to understand your options, you can ensure your home is protected with the right insurance policy.

User Queries

What factors influence State Farm homeowners insurance rates?

Several factors affect your rate, including your home’s location, age, and value, your credit score, the amount of coverage you choose, and your claims history.

How do I file a homeowners insurance claim with State Farm?

You can typically file a claim online, by phone, or through your State Farm agent. Be prepared to provide details about the incident, including the date, time, and location, as well as any relevant documentation.

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) coverage pays the depreciated value of your damaged property, while replacement cost coverage pays the cost to replace the property with a new, similar item, regardless of depreciation.

Can I get a discount on my State Farm homeowners insurance?

Yes, State Farm offers various discounts, such as those for bundling policies, having safety features in your home, or being a loyal customer.