State farm insurance colorado springs – State Farm Insurance in Colorado Springs is a well-established and respected provider of insurance solutions for individuals and businesses. With a long history in the community, State Farm has built a strong reputation for customer service and community involvement. They offer a comprehensive range of insurance products, including auto, home, life, and business insurance, tailored to meet the specific needs of Colorado Springs residents.

State Farm Insurance in Colorado Springs boasts a dedicated team of agents who are committed to providing personalized guidance and support. They are known for their accessibility and responsiveness, ensuring that customers have a positive experience when seeking insurance solutions. The company’s strong commitment to community engagement is evident through its involvement in local initiatives and charitable organizations.

State Farm Insurance in Colorado Springs

State Farm Insurance, a household name in the United States, has a strong presence in Colorado Springs. The company has been serving the community for decades, providing comprehensive insurance solutions to individuals and families. Its commitment to customer satisfaction and community involvement has made it a trusted and reliable insurance provider in the region.

State Farm Insurance’s Presence in Colorado Springs

State Farm Insurance boasts a significant presence in Colorado Springs, with a network of agents serving the local community. The company has a dedicated team of professionals who are committed to providing personalized insurance solutions to meet the diverse needs of their clients. The number of State Farm agents, policyholders, and claims processed annually reflects the company’s extensive reach and influence in the Colorado Springs market.

State Farm Insurance’s Reputation in Colorado Springs

State Farm Insurance enjoys a positive reputation in Colorado Springs, known for its customer-centric approach and commitment to excellence. The company consistently receives high customer satisfaction ratings, a testament to its dedication to providing exceptional service. State Farm Insurance has also been recognized for its community involvement, actively participating in local events and initiatives to support the well-being of the Colorado Springs community.

Products and Services Offered

State Farm Insurance in Colorado Springs provides a comprehensive range of insurance products and services designed to protect individuals, families, and businesses. These offerings cater to various needs and risk profiles, ensuring comprehensive coverage and peace of mind.

Auto Insurance

State Farm’s auto insurance in Colorado Springs offers a wide range of coverage options to suit different driving needs and budgets. This includes:

- Liability Coverage: This essential coverage protects you financially if you cause an accident that results in injury or property damage to others. It covers medical expenses, lost wages, and property repairs for the other party involved.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This is optional but recommended for newer or financed vehicles.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. This coverage helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage helps cover your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of fault.

Home Insurance

State Farm’s home insurance in Colorado Springs safeguards your home and belongings against various risks. This includes:

- Dwelling Coverage: This coverage protects the physical structure of your home from damage caused by perils like fire, windstorms, hail, and vandalism.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry, against damage or theft.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you cause property damage to others.

- Additional Living Expenses Coverage: This coverage helps cover the costs of temporary housing and other living expenses if your home becomes uninhabitable due to a covered event.

Life Insurance

State Farm’s life insurance in Colorado Springs provides financial security for your loved ones in the event of your death. This includes:

- Term Life Insurance: This type of life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It’s a cost-effective option for temporary needs, such as covering a mortgage or providing for young children.

- Whole Life Insurance: This type of life insurance provides permanent coverage for your entire life. It also builds cash value that you can borrow against or withdraw from.

- Universal Life Insurance: This type of life insurance offers flexibility in premium payments and death benefit amounts. It also allows you to accumulate cash value that you can use for various purposes.

Business Insurance

State Farm’s business insurance in Colorado Springs provides comprehensive protection for businesses of all sizes. This includes:

- General Liability Insurance: This coverage protects your business from financial losses due to claims of bodily injury, property damage, or personal injury caused by your business operations.

- Property Insurance: This coverage protects your business property, such as buildings, equipment, and inventory, from damage caused by fire, theft, vandalism, and other covered perils.

- Workers’ Compensation Insurance: This coverage protects your business from financial losses due to employee injuries or illnesses that occur on the job. It covers medical expenses, lost wages, and other related costs.

- Business Auto Insurance: This coverage protects your business vehicles from damage or theft, as well as provides liability coverage for accidents involving your vehicles.

Customer Experience and Service

State Farm Insurance in Colorado Springs prioritizes a positive customer experience, offering various communication channels, efficient response times, and streamlined claim processing procedures. The company aims to provide a seamless and supportive experience for its customers throughout their insurance journey.

Communication Channels and Response Times

State Farm offers multiple communication channels to ensure customers can connect with them conveniently. These include:

- Phone: Customers can reach a State Farm agent or representative by phone during business hours.

- Email: Email is another option for contacting State Farm, allowing customers to send inquiries and receive detailed responses.

- Online Chat: State Farm’s website features a live chat option, enabling customers to connect with an agent in real-time for immediate assistance.

- Mobile App: The State Farm mobile app allows customers to manage their policies, submit claims, and contact customer support directly from their smartphones.

State Farm strives to provide prompt responses to customer inquiries. The company aims to address phone calls within a reasonable timeframe and respond to emails and online chats within 24 hours.

Local Presence and Community Involvement

State Farm Insurance in Colorado Springs is deeply rooted in the community, demonstrating its commitment through its widespread presence and active participation in local initiatives. With a strong network of agents and offices strategically located throughout the city, State Farm ensures convenient access to its services for residents. Beyond its insurance offerings, State Farm actively contributes to the well-being of the community through various charitable endeavors and partnerships.

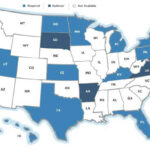

Geographic Reach and Agent Network, State farm insurance colorado springs

State Farm Insurance maintains a robust network of agents and offices across Colorado Springs, ensuring accessibility and convenience for residents seeking insurance solutions. Their agents are knowledgeable and dedicated to providing personalized service, catering to the specific needs of each customer. The strategic placement of these offices and agents ensures that residents can easily access State Farm’s services, whether they need to discuss a new policy, file a claim, or simply seek advice.

- State Farm agents are readily available throughout Colorado Springs, offering convenient access to insurance services for residents.

- The network of offices is strategically positioned across the city, ensuring proximity to various neighborhoods and communities.

- State Farm’s agent network prioritizes personalized service, with agents trained to understand and cater to individual customer needs.

Community Involvement and Charitable Contributions

State Farm Insurance in Colorado Springs is known for its active involvement in community initiatives and its commitment to supporting local organizations. The company believes in giving back to the community that supports it, and it demonstrates this belief through various charitable contributions and partnerships. These initiatives aim to address critical needs within the community, promote social well-being, and foster a sense of unity.

- State Farm actively supports local charities and non-profit organizations that focus on education, healthcare, and community development.

- The company regularly participates in fundraising events, volunteer programs, and sponsorships to support various community initiatives.

- State Farm’s contributions have a tangible impact on the lives of residents, helping to improve the quality of life in Colorado Springs.

Supporting Local Businesses and Residents

State Farm Insurance recognizes the importance of fostering a thriving local economy. They actively support local businesses by providing insurance solutions tailored to their specific needs and promoting their services within the community. The company also engages with residents through various programs and initiatives aimed at enhancing their well-being and enriching their lives.

- State Farm offers customized insurance packages designed to meet the unique requirements of local businesses, promoting their growth and success.

- The company participates in local events and festivals, showcasing its commitment to supporting community businesses and engaging with residents.

- State Farm actively promotes community involvement through programs that encourage residents to volunteer, participate in local events, and contribute to the well-being of their community.

Competition and Market Landscape: State Farm Insurance Colorado Springs

The insurance industry in Colorado Springs is highly competitive, with numerous national and regional players vying for market share. State Farm Insurance faces stiff competition from a variety of established insurers, as well as emerging disruptors leveraging technology and data analytics. Understanding the competitive landscape is crucial for State Farm to maintain its market position and attract new customers.

Key Competitors in the Colorado Springs Market

The Colorado Springs insurance market is characterized by a diverse range of competitors, each with its own strengths and weaknesses. Some of the key players in the market include:

- Progressive: Known for its aggressive marketing and online-focused approach, Progressive holds a significant market share in Colorado Springs. Its strengths include its user-friendly online platform and competitive pricing. However, some customers have criticized its customer service and claims processing.

- Geico: Geico is another major player in the market, with a strong brand recognition and a focus on affordability. It offers competitive rates and a streamlined online experience. However, it has faced criticism for its limited coverage options and complex policy terms.

- Allstate: Allstate is a well-established insurer with a strong presence in Colorado Springs. It offers a wide range of insurance products and services, including home, auto, and life insurance. However, its pricing can be higher than some of its competitors.

- Farmers Insurance: Farmers Insurance is a regional insurer with a strong focus on customer service. It offers personalized insurance solutions and a dedicated network of agents. However, it may not have the same brand recognition as some of the national players.

Competitive Landscape Analysis

The insurance industry in Colorado Springs is undergoing significant transformation driven by technological advancements, regulatory changes, and evolving customer preferences.

- Technological Advancements: Insurers are increasingly using technology to improve their operations and customer experience. This includes the use of artificial intelligence (AI) for claims processing, telematics for risk assessment, and online platforms for policy management.

- Regulatory Changes: The insurance industry is subject to ongoing regulatory changes, including updates to privacy laws and cybersecurity regulations. These changes can impact insurers’ operating costs and compliance requirements.

- Evolving Customer Preferences: Customers are increasingly demanding personalized insurance solutions, digital convenience, and transparent pricing. Insurers that can adapt to these evolving preferences will be well-positioned for success.

Challenges and Opportunities for State Farm

State Farm faces both challenges and opportunities in the competitive Colorado Springs market.

- Challenges:

- Maintaining Market Share: The competitive landscape is becoming increasingly crowded, making it challenging for State Farm to maintain its market share. It needs to continue to innovate and differentiate its offerings to stay ahead of the competition.

- Attracting Younger Customers: Younger generations are more tech-savvy and price-sensitive than previous generations. State Farm needs to adapt its marketing and product offerings to attract these customers.

- Responding to Industry Disruptions: The insurance industry is facing disruptions from emerging technologies and new business models. State Farm needs to be agile and responsive to these changes.

- Opportunities:

- Leveraging Technology: State Farm has a strong foundation in technology and can leverage its capabilities to improve its operations and customer experience. This includes investing in AI, telematics, and online platforms.

- Building Customer Loyalty: State Farm has a strong reputation for customer service and can leverage this to build customer loyalty. This includes providing personalized insurance solutions and proactive customer support.

- Expanding into New Markets: State Farm can expand into new markets and product lines to grow its business. This includes exploring opportunities in commercial insurance and insurance-related services.

Wrap-Up

State Farm Insurance in Colorado Springs stands as a reliable and trusted partner for residents seeking insurance coverage. Their dedication to customer satisfaction, coupled with their commitment to community engagement, has solidified their position as a leading insurance provider in the area. Whether you’re looking for auto insurance, home insurance, or other insurance solutions, State Farm is a name you can trust.

FAQ Corner

What types of insurance does State Farm offer in Colorado Springs?

State Farm in Colorado Springs offers a wide range of insurance products, including auto, home, life, health, business, and renters insurance. They also provide specialized coverage for specific needs, such as motorcycle, boat, and RV insurance.

How can I get a quote for insurance from State Farm in Colorado Springs?

You can get a free quote online through their website, by calling a local agent, or by visiting a State Farm office in Colorado Springs.

Does State Farm offer discounts in Colorado Springs?

Yes, State Farm offers a variety of discounts in Colorado Springs, such as good driver discounts, multi-policy discounts, and safety feature discounts. Contact a local agent to learn about available discounts.