State Farm insurance claims numbers are essential for managing and tracking your insurance claims. Whether you’re dealing with an auto accident, a home repair, or a life insurance claim, understanding how these numbers work is crucial for a smooth and efficient process. These unique identifiers serve as a key to accessing information, communicating with State Farm, and ensuring your claim progresses smoothly.

State Farm assigns specific claims numbers to each type of claim you file, helping to organize and track your individual cases. You’ll receive a claims number once you report a claim, and it’s vital to keep this number safe and readily available. This number acts as your personal identifier for your claim, allowing you to access information about its status, communicate with your assigned adjuster, and manage the process effectively.

Understanding State Farm Insurance Claims Numbers

State Farm insurance claims numbers are unique identifiers assigned to each claim filed with the company. These numbers are crucial for tracking and managing claims efficiently, ensuring that all relevant information is readily accessible and organized. They serve as a central point of reference for communication and coordination between policyholders, agents, adjusters, and other stakeholders involved in the claims process.

Types of State Farm Claims Numbers, State farm insurance claims number

State Farm uses different claims numbers for various types of insurance policies, including auto, home, and life insurance. The specific format and structure of the claims number may vary depending on the type of policy and the claim itself.

- Auto Insurance Claims Numbers: Auto insurance claims numbers are typically assigned to claims related to vehicle accidents, damage, theft, or other incidents involving a covered vehicle. These numbers often consist of a combination of letters and numbers, which may include information about the policyholder, the type of claim, and the date of the incident.

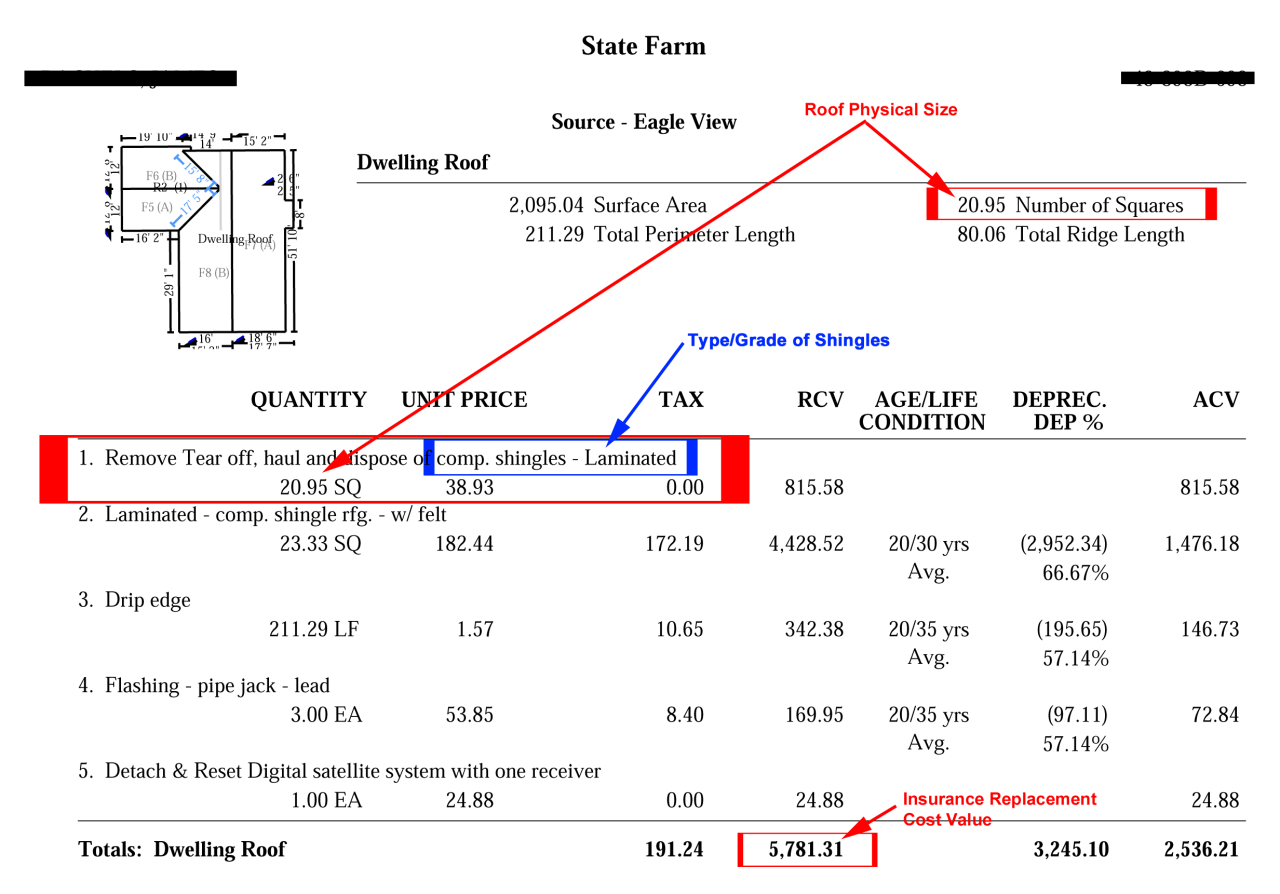

- Home Insurance Claims Numbers: Home insurance claims numbers are assigned to claims related to damage or loss to a covered property, such as fire, water damage, theft, or vandalism. These numbers may also include information about the policyholder, the location of the property, and the type of claim.

- Life Insurance Claims Numbers: Life insurance claims numbers are assigned to claims related to the death of a covered individual. These numbers may include information about the policyholder, the deceased individual, and the type of policy.

Examples of State Farm Claims Numbers

State Farm claims numbers are formatted in a specific way, which can vary depending on the type of claim. Here are some examples of how State Farm claims numbers might be structured:

Auto insurance claims number: SF-123456789-01

Home insurance claims number: SFH-987654321-02

Life insurance claims number: SFL-012345678-03

In these examples, “SF” represents State Farm, followed by a series of numbers that may represent the policyholder’s information, the type of claim, or the date of the incident. The last two digits could represent the specific claim number within a policy.

Obtaining a State Farm Insurance Claims Number

You’ll need a State Farm Insurance Claims Number to report a claim and begin the process of getting your claim settled. This number is a unique identifier that allows State Farm to track your claim and provide you with updates on its progress.

Ways to Contact State Farm to Report a Claim

State Farm offers various ways to report a claim, making it convenient for you to contact them. Here are the primary methods:

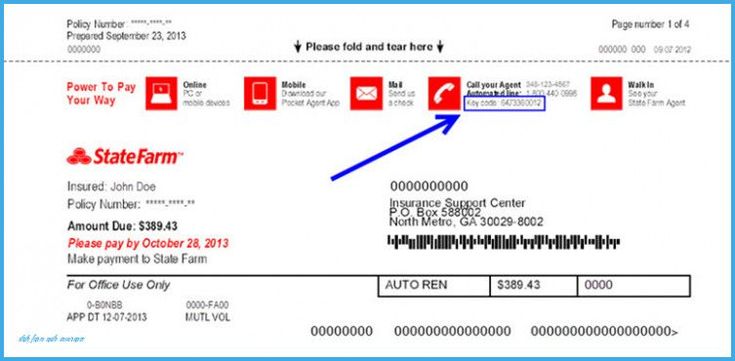

- Phone: You can call State Farm’s customer service line, which is available 24/7. You can find the number on your insurance policy or on the State Farm website.

- Online: State Farm has a secure online portal where you can report a claim. This option is available on their website and allows you to submit your claim information at your convenience.

- Mobile App: The State Farm mobile app provides a user-friendly interface to report a claim. You can access the app on your smartphone or tablet and submit your claim details quickly.

Information Required When Filing a Claim

When reporting a claim, State Farm will require specific information to process it efficiently. The information you’ll need to provide typically includes:

- Your policy number: This is your unique identifier for your insurance policy.

- Your contact information: State Farm will need your name, phone number, and email address to communicate with you about your claim.

- Details of the incident: This includes the date, time, and location of the incident, as well as a description of what happened.

- Information about any other parties involved: This includes the names, addresses, and insurance information of any other individuals or entities involved in the incident.

- Details of the damage: You’ll need to provide a description of the damage, including the type and extent of the damage. You may also be asked to provide photographs or videos of the damage.

Important Note: It’s crucial to be as accurate and detailed as possible when providing information about your claim. This will help State Farm process your claim efficiently and ensure you receive the appropriate benefits.

Using a State Farm Insurance Claims Number

Once you have a State Farm insurance claims number, you can use it to track the progress of your claim. This number serves as a unique identifier for your claim, connecting you to all related information and communication.

Tracking Claim Progress

Your claims number is your key to staying informed about your claim’s progress. State Farm provides several ways to track your claim using your claims number:

- Online Account: Access your State Farm online account, where you can view the status of your claim, see any updates, and communicate with your adjuster.

- Mobile App: The State Farm mobile app allows you to track your claim, submit photos and documents, and receive real-time updates.

- Phone: You can call State Farm’s customer service line and provide your claims number to get updates on your claim.

Importance of Keeping Your State Farm Insurance Claims Number Secure

Your State Farm insurance claims number is a sensitive piece of information that should be treated with care. It can be used to access your claim details, track the progress of your claim, and even make changes to your policy. Therefore, protecting this number from unauthorized access is crucial.

Risks of Sharing Your Claims Number

Sharing your State Farm insurance claims number with unauthorized individuals can put your personal information at risk. This can lead to identity theft, fraud, and other serious consequences.

- Identity Theft: Sharing your claims number with someone who isn’t authorized to access it could allow them to use your information to open credit cards, take out loans, or even access your bank accounts.

- Fraudulent Claims: Someone could use your claims number to file a fraudulent claim, potentially impacting your insurance premiums and coverage.

- Policy Changes: Unauthorized individuals could use your claims number to make changes to your policy without your knowledge, potentially jeopardizing your coverage.

Protecting Your Claims Number

Protecting your State Farm insurance claims number is crucial to prevent these risks. Here are some tips to keep your claims number safe:

- Memorize Your Claims Number: If possible, try to memorize your claims number to avoid having to write it down. This minimizes the risk of it falling into the wrong hands.

- Keep Your Claims Number in a Safe Place: If you need to write down your claims number, store it in a secure location, such as a locked drawer or safe. Avoid storing it in easily accessible places, such as your wallet or purse.

- Be Cautious When Sharing Your Claims Number: Only share your claims number with authorized individuals, such as State Farm representatives or your insurance agent. Be wary of anyone who requests your claims number without a legitimate reason.

- Report Suspicious Activity: If you suspect that your claims number has been compromised, contact State Farm immediately to report the incident. They can help you secure your account and prevent further damage.

Last Point

In the world of insurance, having a clear understanding of State Farm insurance claims numbers can empower you to navigate the process with confidence. By knowing how to obtain, use, and protect your claims number, you can ensure a smoother and more efficient experience when dealing with any insurance claim. Remember, keeping your claims number secure is paramount, as it acts as a gateway to sensitive information. By taking steps to safeguard this number, you can protect yourself from potential fraud and misuse.

Quick FAQs

How do I find my State Farm insurance claims number?

You can usually find your State Farm insurance claims number on your claim confirmation email, or by contacting your State Farm agent or customer service.

What should I do if I lose my State Farm insurance claims number?

Don’t worry! You can contact State Farm customer service to retrieve your claims number. They will likely ask you for your policy information or other identifying details to verify your identity.

Can I use my State Farm insurance claims number to check the status of my claim online?

Yes, many insurance companies, including State Farm, offer online portals where you can track the progress of your claim using your claims number.