State Farm insurance cars is a household name in the United States, known for its comprehensive coverage and reliable customer service. Founded in 1922, State Farm has grown to become one of the largest insurance companies in the country, offering a wide range of car insurance products and services to meet the diverse needs of its policyholders.

From basic liability coverage to comprehensive protection against accidents and theft, State Farm provides a range of options to ensure drivers are financially secure in the event of an unforeseen incident. The company’s commitment to customer satisfaction is evident in its user-friendly digital platforms, accessible claims process, and extensive network of agents. State Farm also actively promotes road safety through educational programs and community initiatives, reinforcing its dedication to protecting both drivers and their vehicles.

State Farm Insurance Overview

State Farm is a leading provider of insurance and financial services in the United States. Founded in 1922, the company has a rich history of serving individuals and families with a wide range of insurance products and services.

State Farm’s History and Growth, State farm insurance cars

State Farm was established in Bloomington, Illinois, by George J. Mecherle. The company’s initial focus was on providing affordable automobile insurance to farmers. Over the years, State Farm has expanded its product offerings to include a wide range of insurance products, such as homeowners, renters, life, health, and business insurance. The company’s growth has been fueled by its commitment to customer satisfaction, its strong financial position, and its innovative approach to insurance.

State Farm’s Size and Market Position

State Farm is one of the largest insurance companies in the world. As of 2023, State Farm is the largest provider of auto insurance in the United States, holding a significant market share of over 20%. The company has a vast network of agents and employees who provide personalized insurance solutions to millions of customers nationwide.

State Farm’s Core Values and Mission Statement

State Farm’s core values are centered around customer satisfaction, integrity, and community involvement. The company’s mission statement emphasizes its commitment to providing “good neighbor” service and helping customers protect their dreams. State Farm strives to build long-term relationships with its customers and to be a trusted partner in their financial well-being.

Car Insurance Products and Services

State Farm offers a comprehensive range of car insurance products designed to meet the diverse needs and risk profiles of its customers. From basic liability coverage to comprehensive protection, State Farm provides a customizable approach to ensure you have the right coverage for your specific situation.

Types of Car Insurance Policies

State Farm offers a variety of car insurance policies, each designed to cover different aspects of potential risks associated with owning and operating a vehicle.

- Liability Coverage: This is the most basic type of car insurance, and it’s typically required by law. Liability coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers medical expenses, property damage, and legal defense costs.

- Collision Coverage: Collision coverage protects your vehicle from damage caused by a collision with another vehicle or object, regardless of who is at fault. This coverage helps pay for repairs or replacement of your vehicle after an accident.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage helps pay for repairs or replacement of your vehicle after an incident not involving a collision.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage helps pay for your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. This coverage can be especially beneficial if you’re injured in an accident with a driver who is uninsured or underinsured.

- Medical Payments Coverage: Medical payments coverage, similar to PIP, provides coverage for medical expenses incurred by you or your passengers, regardless of who is at fault. This coverage typically has a lower limit than PIP and is often included as part of a comprehensive car insurance policy.

Key Features and Benefits of Car Insurance Policies

Each type of car insurance policy offered by State Farm comes with specific features and benefits that cater to different customer needs and risk profiles.

- Customizable Coverage: State Farm allows you to customize your car insurance policy to meet your specific needs. You can choose the coverage levels that best fit your budget and risk tolerance.

- Discounts: State Farm offers a variety of discounts that can help you save money on your car insurance premiums. These discounts can include good driver discounts, multi-car discounts, and safe driver discounts.

- 24/7 Customer Support: State Farm provides 24/7 customer support to assist you with any questions or concerns you may have about your car insurance policy.

- Claims Process: State Farm has a streamlined claims process to ensure a smooth and efficient experience. You can file a claim online, by phone, or through the State Farm mobile app.

- Financial Stability: State Farm is a financially strong company with a long history of providing reliable car insurance coverage.

Catering to Different Customer Needs and Risk Profiles

State Farm’s car insurance policies are designed to cater to the diverse needs and risk profiles of its customers. For example, a driver with a clean driving record and a newer vehicle may choose a policy with lower liability coverage and higher collision and comprehensive coverage. On the other hand, a driver with a history of accidents or traffic violations may need a policy with higher liability coverage to protect them from potential lawsuits.

State Farm’s approach to car insurance is to provide personalized coverage options that meet the specific needs of each customer.

Pricing and Discounts

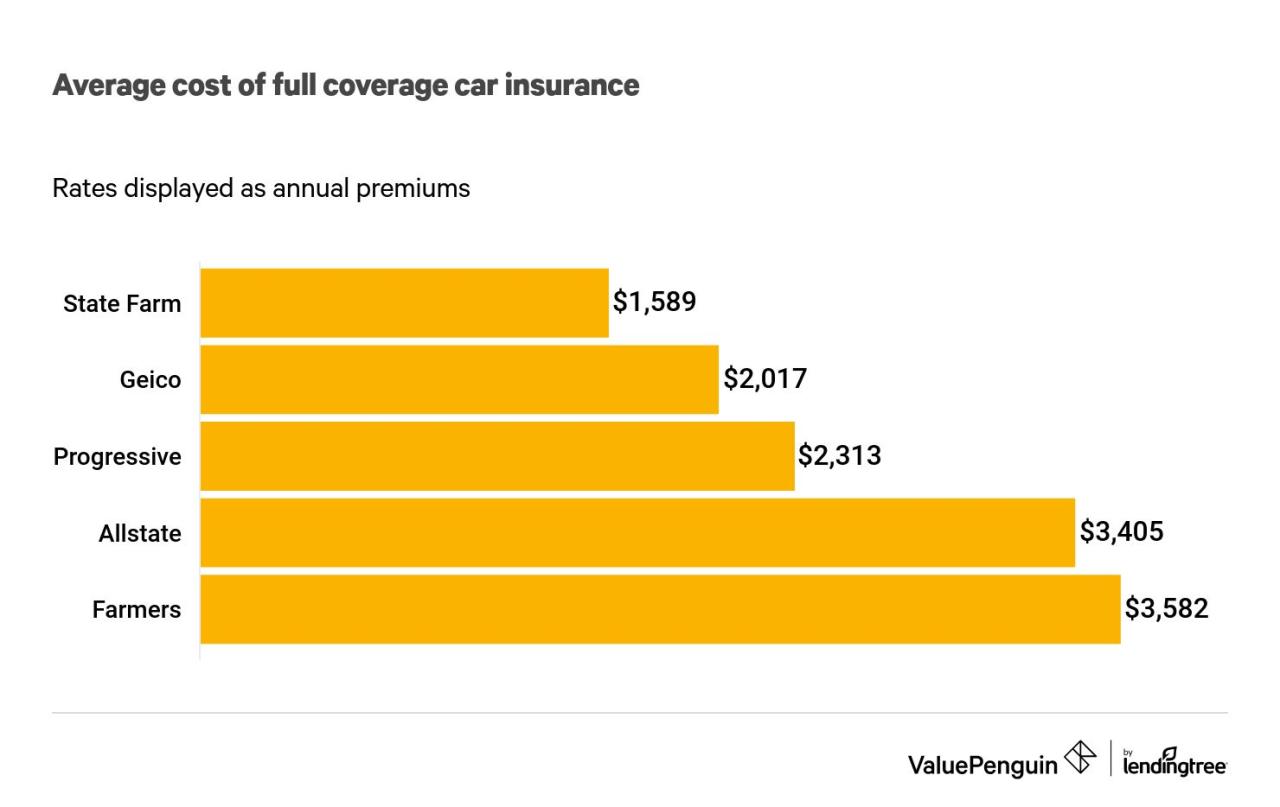

State Farm is known for its competitive car insurance rates, and its pricing is influenced by various factors, including your driving history, vehicle type, location, and coverage options. However, it’s always a good idea to compare quotes from multiple insurance companies to find the best deal for your individual needs.

Comparison with Other Insurance Companies

State Farm’s car insurance rates are generally considered competitive within the industry. To compare rates effectively, you can use online comparison tools or contact insurance agents directly. Remember that rates can vary significantly depending on your specific circumstances and location.

Factors Influencing State Farm Car Insurance Premiums

Several factors influence State Farm’s car insurance premiums, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, plays a significant role in determining your premium. A clean driving record typically results in lower premiums.

- Vehicle Type: The make, model, and year of your vehicle affect your premium. Vehicles with high repair costs or a history of theft or accidents tend to have higher insurance premiums.

- Location: Your location, including your state, city, and neighborhood, influences premiums. Areas with higher crime rates or more frequent accidents generally have higher insurance rates.

- Coverage Options: The amount of coverage you choose, including liability, collision, and comprehensive coverage, will impact your premium. Higher coverage levels typically mean higher premiums.

- Credit Score: In some states, your credit score can be used to determine your insurance premium. Individuals with higher credit scores may qualify for lower premiums.

- Age and Gender: Your age and gender can also play a role in your premium. Younger drivers and males typically pay higher premiums due to their higher risk profiles.

- Driving Habits: Your driving habits, such as mileage, driving patterns, and parking location, can also impact your premium. Drivers who drive fewer miles or park their vehicles in secure locations may qualify for discounts.

Discounts Available for State Farm Car Insurance

State Farm offers a wide range of discounts to help you save money on your car insurance. Some common discounts include:

- Good Driver Discount: This discount is available to drivers with a clean driving record, typically for a period of several years without accidents or violations.

- Safe Driver Discount: This discount is similar to the good driver discount and rewards drivers with a history of safe driving.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for a discount.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in a significant discount.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can help deter theft and may qualify you for a discount.

- Vehicle Safety Features Discount: Vehicles equipped with safety features, such as airbags, anti-lock brakes, and electronic stability control, may qualify for a discount.

- Good Student Discount: Students with good grades may qualify for a discount on their car insurance. This discount is typically available to high school and college students.

- Driver Training Discount: Completing a driver training course, especially for young drivers, can demonstrate your commitment to safe driving and may qualify you for a discount.

- Paperless Discount: Choosing to receive your insurance documents electronically can help reduce administrative costs and may qualify you for a discount.

- Paid-in-Full Discount: Paying your car insurance premium in full may qualify you for a discount.

- Loyalty Discount: State Farm may offer discounts to customers who have been with the company for a long time.

Customer Service and Claims Process: State Farm Insurance Cars

State Farm is known for its commitment to providing excellent customer service and a smooth claims process. They offer a variety of channels for customers to connect with them, and their claims process is designed to be efficient and straightforward.

Accessibility of Customer Service Channels

State Farm provides various ways for customers to connect with them, ensuring accessibility and convenience. These channels include:

- Phone: State Farm has a dedicated customer service line available 24/7. This allows customers to reach a representative at any time, regardless of the time or day.

- Website: State Farm’s website offers a comprehensive online portal where customers can manage their policies, file claims, and access other services. This provides a convenient option for customers who prefer self-service.

- Mobile App: The State Farm mobile app allows customers to access their insurance information, file claims, and manage their policies on the go. This provides a convenient and accessible option for customers who are constantly on the move.

- Local Agents: State Farm has a vast network of local agents across the country. Customers can visit their local agent’s office for personalized assistance with their insurance needs.

Steps Involved in Filing a Car Insurance Claim

The process of filing a car insurance claim with State Farm is straightforward and efficient. Here are the general steps involved:

- Report the Accident: The first step is to report the accident to State Farm as soon as possible. This can be done by calling their customer service line or using their online portal.

- Gather Information: Once the accident has been reported, it is important to gather all relevant information, such as the names and contact details of the other parties involved, the location of the accident, and any witness statements.

- File the Claim: Customers can file their claim online, over the phone, or through their local agent. State Farm will then review the claim and start the processing procedure.

- Assessment and Investigation: State Farm will investigate the claim and assess the damage to the vehicle. This may involve a third-party inspection or an assessment by a State Farm representative.

- Claim Approval and Payment: Once the claim has been approved, State Farm will notify the customer and arrange for the payment of the claim. The payment may be made directly to the customer or to the repair shop, depending on the circumstances.

Customer Testimonials and Reviews

State Farm consistently receives positive feedback from customers regarding their claims handling process. Customers often praise the company’s prompt response times, clear communication, and helpfulness. Many customers have shared their experiences online, highlighting their satisfaction with the overall claim process.

“I was really impressed with how quickly State Farm responded to my claim. They were very professional and helpful throughout the entire process. I would definitely recommend them to anyone.” – John Doe, satisfied customer.

“I was involved in a minor accident and was worried about the claims process. But State Farm made it so easy. They took care of everything and kept me informed every step of the way. I am so grateful for their excellent customer service.” – Jane Smith, satisfied customer.

State Farm’s Digital and Mobile Capabilities

State Farm recognizes the importance of providing a seamless and convenient digital experience for its customers. The company has invested heavily in developing robust online and mobile platforms that allow policyholders to manage their insurance needs efficiently.

State Farm Mobile App Features

State Farm’s mobile app is a comprehensive tool designed to simplify car insurance management. The app offers a wide range of features that enhance the customer experience.

- Policy Management: View and manage policy details, make payments, and update personal information.

- Claims Reporting: Submit claims quickly and easily with photo and video uploads, track claim status, and communicate with adjusters.

- Roadside Assistance: Request roadside assistance, such as towing or jump starts, directly through the app.

- Digital ID Cards: Access digital copies of insurance cards for easy sharing.

- Personalized Recommendations: Receive tailored recommendations for coverage, discounts, and other services based on individual needs.

- Digital Documents: View and download policy documents, such as declarations pages and endorsements.

- 24/7 Customer Support: Connect with a State Farm agent or representative via chat, phone, or email.

Managing Car Insurance Policies Online

State Farm’s website provides a user-friendly platform for managing car insurance policies online. Policyholders can access and manage their accounts, make payments, view policy documents, and request quotes for new or additional coverage. The online platform allows customers to:

- Review and Update Policy Details: Modify coverage options, adjust deductibles, and update contact information.

- Access Digital Documents: Download policy documents, such as declarations pages, endorsements, and proof of insurance.

- Pay Premiums Online: Make payments securely and conveniently through various methods, including credit cards, debit cards, and bank accounts.

- Request Quotes: Obtain personalized quotes for new or additional coverage, such as collision, comprehensive, or rental car coverage.

- Manage Claims: Report claims, track their progress, and communicate with adjusters.

- Contact Customer Support: Reach out to State Farm agents or representatives through online forms, email, or phone.

Technology-Enabled Services

State Farm leverages advanced technology to provide efficient and convenient services. The company utilizes:

- Artificial Intelligence (AI): AI-powered chatbots and virtual assistants are available to answer customer inquiries and provide support 24/7.

- Data Analytics: State Farm analyzes data to identify trends, personalize recommendations, and optimize pricing strategies.

- Mobile Technology: The company’s mobile app and website are designed to be responsive and accessible across multiple devices.

- Cloud Computing: State Farm utilizes cloud-based platforms to ensure secure and reliable data storage and processing.

- Telematics: State Farm offers telematics programs that track driving behavior and provide insights into safe driving practices.

State Farm’s Community Involvement and Social Responsibility

State Farm is deeply committed to giving back to the communities it serves. This commitment goes beyond providing insurance; it extends to fostering a safer and more prosperous society through various initiatives and programs.

Road Safety and Driver Education

State Farm actively promotes road safety and driver education through a variety of programs aimed at reducing accidents and fatalities.

- State Farm Drive Safe & Save: This program rewards safe driving habits with discounts on insurance premiums, encouraging policyholders to adopt safer driving practices.

- State Farm Teen Driver: This program offers resources and tools for parents and teens to learn about safe driving practices and responsible vehicle ownership.

- State Farm Good Neighbor Citizenship Program: This program provides funding for organizations and initiatives that promote traffic safety and driver education.

Philanthropic Efforts and Community Support

State Farm’s commitment to social responsibility is evident in its extensive philanthropic efforts and community support.

- State Farm Neighborhood Assist Program: This program provides grants to non-profit organizations that address critical community needs.

- State Farm Youth Advisory Councils: These councils engage young people in community service projects and promote leadership development.

- State Farm’s Support for Disaster Relief: State Farm provides financial assistance and resources to communities affected by natural disasters, demonstrating its commitment to helping people in times of need.

Impact on Brand Image

State Farm’s commitment to social responsibility enhances its brand image, fostering trust and loyalty among customers.

- Positive Brand Perception: By actively supporting communities and promoting social causes, State Farm builds a positive brand image, associating itself with values like integrity, compassion, and responsibility.

- Increased Customer Loyalty: Customers are more likely to choose companies that align with their values. State Farm’s social responsibility initiatives resonate with customers who appreciate a company that gives back.

- Stronger Community Relationships: By actively engaging in communities, State Farm strengthens its relationships with local residents, creating a sense of shared purpose and mutual respect.

Conclusive Thoughts

Whether you’re a seasoned driver or a new car owner, State Farm offers a comprehensive suite of car insurance solutions designed to provide peace of mind on the road. With its strong financial standing, extensive network, and commitment to customer service, State Farm continues to be a trusted name in the car insurance industry, ensuring drivers have the protection they need to navigate the roads with confidence.

Expert Answers

What are the different types of car insurance policies offered by State Farm?

State Farm offers a variety of car insurance policies, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each policy provides different levels of protection depending on your needs and risk tolerance.

How do I file a claim with State Farm?

You can file a claim with State Farm online, through their mobile app, or by calling their customer service line. The claims process is designed to be straightforward and efficient, with dedicated claims adjusters to assist you every step of the way.

Does State Farm offer discounts on car insurance?

Yes, State Farm offers a variety of discounts on car insurance, including safe driving discounts, good student discounts, multi-car discounts, and more. These discounts can help you save money on your premiums.