State Farm insurance car is a household name synonymous with reliable and comprehensive car insurance. State Farm, founded in 1922, has a rich history of providing peace of mind to millions of drivers across the United States. The company’s mission is to help people manage the risks of everyday life, and their core values are centered around integrity, customer service, and community involvement. State Farm offers a wide range of car insurance products, including liability, collision, comprehensive, and uninsured motorist coverage, all designed to protect you financially in the event of an accident.

Beyond basic coverage, State Farm provides additional features like roadside assistance, rental car coverage, and accident forgiveness, making it a truly comprehensive car insurance provider. They also offer a variety of digital tools and services, including a mobile app and online portal, making it easy for customers to manage their policies and access information anytime, anywhere.

State Farm Insurance Overview

State Farm is a leading insurance company in the United States, known for its comprehensive insurance products and services. Founded in 1922, State Farm has grown into a household name, providing financial protection and peace of mind to millions of customers across the country.

History of State Farm

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. The company began by offering automobile insurance to farmers in the state. Mecherle’s vision was to provide affordable and accessible insurance to all, regardless of their background or location. This philosophy has remained at the core of State Farm’s mission throughout its history.

Mission and Core Values

State Farm’s mission is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” This mission statement reflects the company’s commitment to customer service and providing a wide range of insurance products and services to meet the needs of individuals and families. State Farm’s core values include integrity, customer focus, respect, responsibility, and excellence. These values guide the company’s operations and its interactions with customers, agents, and employees.

Key Services Offered by State Farm

State Farm offers a wide range of insurance products and services, including:

- Auto insurance

- Homeowners insurance

- Renters insurance

- Life insurance

- Health insurance

- Business insurance

- Financial services, such as banking and investments

State Farm’s car insurance is one of its most popular products. The company offers a variety of coverage options to meet the needs of different drivers, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. State Farm also provides discounts for safe driving, good student records, and other factors.

State Farm Car Insurance Features

State Farm offers a variety of car insurance coverage options to cater to the specific needs of its customers. Understanding these options and their benefits can help you choose the right coverage for your situation.

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and other damages to the other driver and passengers involved in the accident.

- Property Damage Liability: Covers repairs or replacement costs for the other driver’s vehicle and any other property damaged in the accident.

Liability coverage is usually required by law, and the minimum amount required varies by state. It is important to have sufficient liability coverage to protect yourself from significant financial losses in case of an accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional but can be beneficial if you have a newer vehicle or a loan on your car.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional but can be important if you live in an area prone to these types of events.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. This coverage can help pay for your medical expenses, lost wages, and property damage.

Additional Features

State Farm also offers a variety of additional features that can enhance your car insurance policy, such as:

- Roadside Assistance: Provides help with flat tires, jump starts, towing, and other roadside emergencies.

- Rental Car Coverage: Covers the cost of a rental car if your vehicle is damaged in an accident or is being repaired.

- Accident Forgiveness: Waives your first at-fault accident and prevents your insurance premiums from increasing.

State Farm Car Insurance Pricing: State Farm Insurance Car

State Farm, being one of the largest insurance providers in the US, offers competitive car insurance rates. However, the price you pay will depend on various factors. Understanding these factors can help you obtain the best possible rate.

Factors Influencing State Farm Car Insurance Premiums

Several factors contribute to the cost of car insurance premiums, including:

- Driving History: Your driving record is a significant factor. Accidents, speeding tickets, and other violations can increase your premium. A clean driving record can help you get lower rates.

- Age and Gender: Younger drivers, particularly males, often pay higher premiums due to their higher risk of accidents. As drivers mature and gain experience, their premiums generally decrease.

- Location: Your location influences your premium because of the frequency and severity of accidents in the area. High-risk areas with more traffic or crime tend to have higher premiums.

- Vehicle Type: The type of vehicle you drive, including its make, model, and safety features, plays a role. High-performance cars or expensive vehicles are often associated with higher premiums due to their higher repair costs.

- Coverage Levels: The amount of coverage you choose affects your premium. Higher coverage limits, such as comprehensive and collision coverage, will generally result in higher premiums. However, it’s essential to have adequate coverage to protect yourself financially in case of an accident.

- Credit Score: In some states, your credit score can influence your premium. A good credit score may be associated with responsible behavior, which can translate to lower premiums.

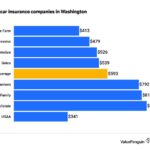

Comparison with Other Major Insurance Providers

State Farm is a major insurance provider, and its rates are generally competitive. However, it’s essential to compare quotes from several providers to find the best deal. Some other major insurance providers include:

- Geico: Known for its affordable rates and extensive online services.

- Progressive: Offers a wide range of discounts and customization options.

- Allstate: Offers a variety of coverage options and customer service.

- USAA: Primarily serves military members and their families, known for its strong customer satisfaction ratings.

Tips for Obtaining Competitive Car Insurance Rates

- Shop Around: Compare quotes from multiple insurance providers to find the best deal. Online comparison tools can make this process easier.

- Review Your Coverage: Ensure you have adequate coverage but avoid unnecessary extras. Consider raising your deductible to lower your premium, but make sure you can afford the deductible if you need to file a claim.

- Bundle Policies: Combine your car insurance with other policies, such as homeowners or renters insurance, to potentially get a discount.

- Ask About Discounts: Many insurance providers offer discounts for good driving records, safety features, and other factors. Ask about available discounts and ensure you qualify for them.

- Maintain a Good Driving Record: A clean driving record is the best way to keep your premiums low. Avoid speeding tickets, accidents, and other violations.

State Farm Customer Experience

State Farm, a leading insurance provider, has garnered a reputation for its customer-centric approach. This section explores the customer experience offered by State Farm, focusing on reviews, ease of service, and customer support channels.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the overall customer experience. State Farm boasts a strong online presence, with numerous reviews and testimonials available on various platforms. These reviews highlight the positive experiences of many State Farm customers, emphasizing aspects like prompt claim processing, excellent customer service, and competitive pricing.

“I have been with State Farm for over 10 years and have always been satisfied with their service. They are always there to help when I need them, and their rates are very competitive.” – John Smith, a satisfied State Farm customer

Ease of Obtaining Quotes and Filing Claims

State Farm offers a convenient online platform and mobile app that allow customers to obtain quotes and file claims with ease. The online quoting process is straightforward and provides instant results, allowing customers to compare different coverage options and find the best fit for their needs.

Filing claims is also streamlined through the State Farm app or website. Customers can submit claim information, upload supporting documents, and track the status of their claim online.

Customer Service Channels and Effectiveness

State Farm provides multiple customer service channels to cater to diverse customer preferences. Customers can reach out to State Farm through phone, email, live chat, or social media. The company is known for its responsive and helpful customer service agents who are available 24/7 to address customer queries and concerns.

“I recently had a minor accident and was impressed with the prompt and professional service I received from State Farm. The claims process was smooth and hassle-free.” – Jane Doe, a satisfied State Farm customer

State Farm Digital Tools and Services

State Farm understands the importance of convenience in today’s digital world. They offer a range of online and mobile tools designed to simplify insurance management and provide customers with easy access to their policy information and services.

State Farm Mobile App Features

The State Farm mobile app is a powerful tool that allows policyholders to manage their insurance needs on the go. The app provides a user-friendly interface for accessing a variety of features:

- View Policy Details: Easily access and review policy information, including coverage details, deductibles, and payment history.

- Make Payments: Manage payments securely and conveniently, with options for setting up automatic payments or making one-time payments.

- File Claims: Submit claims directly through the app, complete with photo uploads and real-time status updates.

- Roadside Assistance: Request roadside assistance, such as towing or jump starts, directly through the app.

- Find Agents: Locate nearby State Farm agents and schedule appointments.

- Manage Documents: Access and manage important insurance documents, such as policy documents and claim reports.

- Get Quotes: Obtain quotes for new insurance policies, including auto, home, and life insurance.

State Farm Online Portal Features

The State Farm online portal complements the mobile app, offering a comprehensive platform for managing insurance policies:

- Policy Management: Make changes to existing policies, including adding or removing drivers, updating vehicle information, or modifying coverage.

- Claim Management: Track the progress of claims, upload supporting documents, and communicate with adjusters.

- Payment History: Review payment history, download statements, and set up payment reminders.

- Digital Documents: Access and manage important policy documents electronically.

- Customer Support: Contact State Farm customer support through online chat, email, or phone.

Benefits of Digital Insurance Management

State Farm’s digital tools offer numerous benefits for policyholders:

- Convenience: Manage insurance needs anytime, anywhere, without the need for phone calls or visits to an agent’s office.

- Time Savings: Streamline tasks such as making payments, filing claims, and accessing policy information.

- Improved Communication: Receive real-time updates and notifications regarding claims, policy changes, and other important information.

- Enhanced Security: Securely manage sensitive information and transactions through encrypted online platforms.

- Accessibility: Access insurance services and information 24/7, regardless of location or time of day.

State Farm’s Impact on the Car Insurance Industry

State Farm, a household name in the United States, has significantly shaped the car insurance landscape. As one of the largest and most recognized insurers, the company’s influence extends beyond its vast customer base, impacting industry practices, technological advancements, and consumer expectations.

State Farm’s Role as a Major Player

State Farm’s position as a major player in the car insurance market has allowed it to exert a considerable influence on industry trends. With a vast network of agents and a wide range of insurance products, the company has consistently ranked among the top insurers in the US, demonstrating its strong market presence and financial stability. This prominent position allows State Farm to drive innovation and set standards that other insurers often follow.

State Farm’s Innovations and Contributions

State Farm has consistently been at the forefront of innovation, introducing new products and services that have revolutionized the car insurance industry. Some notable contributions include:

- Telematics Programs: State Farm’s Drive Safe & Save program utilizes telematics technology to track driving behavior and reward safe drivers with discounts. This program, launched in 2010, paved the way for other insurers to adopt similar programs, ultimately promoting safer driving practices and rewarding responsible drivers.

- Digital Transformation: State Farm has embraced digital technologies, making it easier for customers to manage their policies online, access claims information, and communicate with agents. The company’s user-friendly website and mobile app have set a benchmark for online customer service in the insurance industry.

- Customer-Centric Approach: State Farm has consistently focused on providing exceptional customer service. This commitment has led to the development of various programs and initiatives designed to enhance customer satisfaction, such as personalized insurance recommendations and proactive communication during claims processes.

State Farm’s Commitment to Safety and Accident Prevention, State farm insurance car

Beyond its insurance products, State Farm has been a strong advocate for road safety and accident prevention. The company actively participates in public awareness campaigns, educational programs, and community initiatives aimed at reducing accidents and promoting responsible driving habits. These efforts have included:

- Partnerships with Safety Organizations: State Farm has partnered with organizations like the National Highway Traffic Safety Administration (NHTSA) to promote safe driving practices and raise awareness about traffic safety issues.

- Community Outreach Programs: State Farm has supported local community initiatives focused on promoting pedestrian safety, distracted driving prevention, and responsible alcohol consumption.

- Driver Education Programs: State Farm offers a variety of driver education programs for young drivers, focusing on safe driving techniques and risk awareness. These programs aim to instill responsible driving habits from an early age, reducing the likelihood of accidents.

Outcome Summary

State Farm’s commitment to customer satisfaction, combined with its comprehensive coverage options, innovative digital tools, and dedication to safety, has made it a leading player in the car insurance industry. Whether you’re a new driver or a seasoned veteran, State Farm offers a range of options to suit your needs and budget. By understanding the factors that influence premiums, comparing quotes from different providers, and taking advantage of State Farm’s digital services, you can find the best car insurance policy to protect yourself and your vehicle.

FAQ Overview

What are the discounts offered by State Farm car insurance?

State Farm offers a wide range of discounts, including safe driver discounts, good student discounts, multi-car discounts, and more. These discounts can significantly reduce your premium.

How do I file a claim with State Farm car insurance?

You can file a claim online, through the State Farm mobile app, or by calling their customer service line. State Farm has a streamlined claims process designed for convenience.

What are the different types of car insurance coverage offered by State Farm?

State Farm offers a variety of coverage options, including liability, collision, comprehensive, uninsured motorist, and more. You can customize your policy to fit your specific needs and budget.

Is State Farm car insurance available in all states?

Yes, State Farm operates in all 50 states and the District of Columbia.