State Farm homeowners insurance quotes are a valuable tool for understanding the cost of protecting your biggest investment. Whether you’re a first-time homeowner or a seasoned property owner, obtaining an accurate quote is crucial for making informed decisions about your insurance coverage.

State Farm, a renowned insurance provider with a long history, offers a range of homeowners insurance products designed to meet diverse needs. From basic coverage to comprehensive protection, State Farm provides options tailored to individual circumstances. By understanding the factors that influence quotes, you can optimize your coverage and potentially save on premiums.

State Farm Homeowners Insurance Overview

State Farm is a leading provider of homeowners insurance in the United States, known for its comprehensive coverage options, competitive rates, and exceptional customer service. The company has a rich history spanning over a century, built on a foundation of reliability and customer-centric values.

History and Background of State Farm

State Farm was founded in 1922 by George J. Mecherle, a farmer in Bloomington, Illinois. Mecherle recognized the need for affordable and reliable auto insurance for farmers, and he established State Farm Mutual Automobile Insurance Company to address this need. The company quickly gained popularity and expanded its offerings to include other types of insurance, including homeowners insurance. Today, State Farm is one of the largest insurance providers in the United States, with millions of policyholders nationwide.

Range of Homeowners Insurance Products

State Farm offers a wide range of homeowners insurance products designed to meet the unique needs of its policyholders. Some of the key products include:

- Standard Homeowners Insurance: This is the most common type of homeowners insurance, providing coverage for damage to your home and personal property from various perils, such as fire, theft, and windstorms.

- Condo Insurance: Specifically designed for condo owners, this policy provides coverage for the interior of your unit and personal belongings. It also includes liability coverage for injuries or damages that occur within your unit.

- Renters Insurance: This policy protects your personal belongings from damage or theft, regardless of whether the damage is caused by a covered peril or an accident. It also provides liability coverage for injuries or damages that occur within your rental unit.

- High-Value Home Insurance: This policy is tailored for homeowners with homes of significant value, offering higher coverage limits and specialized protection for valuable possessions.

Key Features and Benefits of State Farm Homeowners Insurance

State Farm homeowners insurance is known for its comprehensive coverage options, competitive rates, and exceptional customer service. Some of the key features and benefits include:

- Comprehensive Coverage: State Farm homeowners insurance policies offer coverage for a wide range of perils, including fire, theft, windstorms, hail, and vandalism.

- Personal Property Coverage: Your belongings are covered against damage or theft, with options for additional coverage for valuable items like jewelry and art.

- Liability Coverage: This protects you financially if someone is injured on your property or if you cause damage to someone else’s property.

- Additional Living Expenses Coverage: If your home is uninhabitable due to a covered peril, State Farm will cover your additional living expenses, such as hotel stays or temporary housing.

- Discounts: State Farm offers various discounts to policyholders, such as discounts for safety features, multiple policy discounts, and good driving records.

- Excellent Customer Service: State Farm is known for its responsive and helpful customer service, available 24/7 through phone, email, and online chat.

Obtaining a Quote

Getting a quote for State Farm homeowners insurance is straightforward. Whether you’re a new homeowner or looking to review your current coverage, State Farm offers several ways to obtain a quote.

Essential Information for a Quote

State Farm requires certain information to provide you with an accurate and personalized quote. This information helps them assess your risk and determine the appropriate coverage and premium for your needs. Here’s a list of the key information you’ll need:

- Property Details: This includes your home’s address, square footage, year built, type of construction (brick, wood, etc.), and any renovations or additions.

- Coverage Preferences: State Farm offers various coverage options, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses. You’ll need to indicate your preferred coverage levels and any specific needs, such as valuable possessions or high-risk activities.

- Personal Information: This includes your name, contact information, and any relevant insurance history.

Methods for Obtaining a Quote

State Farm offers multiple ways to obtain a quote, allowing you to choose the method that best suits your preferences:

- Online: The State Farm website offers a user-friendly online quoting tool. You can input your information and receive an instant quote. This method is convenient and allows you to explore different coverage options at your own pace.

- Phone: You can call a State Farm agent directly to request a quote. This allows for a more personalized experience and the opportunity to ask questions about your coverage options.

- Agent: You can visit a local State Farm agent in person to discuss your insurance needs and receive a quote. This method provides the most personalized service and allows you to build a relationship with your agent.

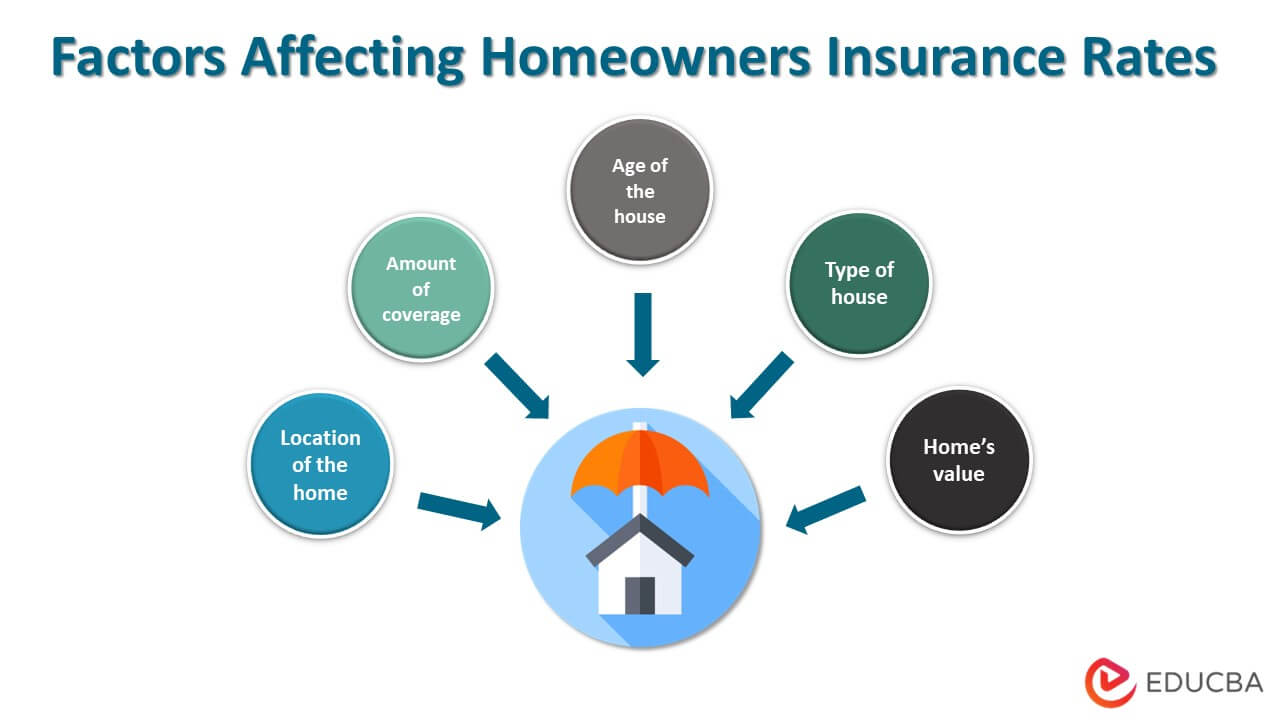

Factors Influencing Quotes: State Farm Homeowners Insurance Quotes

Your homeowners insurance premium is calculated based on a variety of factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Location

Your home’s location plays a significant role in determining your homeowners insurance premium. Factors such as the crime rate, the frequency of natural disasters, and the cost of construction materials in your area can all influence your quote. For example, homes located in areas prone to earthquakes or hurricanes will generally have higher premiums than homes in areas with lower risks.

Property Value, State farm homeowners insurance quotes

The value of your home is another key factor that affects your insurance premium. The higher the value of your home, the more it will cost to rebuild or repair it in the event of damage. Insurance companies use a variety of methods to assess the value of your home, including considering its size, age, materials, and location.

Coverage Levels

The amount of coverage you choose for your homeowners insurance policy will also influence your premium. Higher coverage levels, such as higher limits for dwelling coverage or personal property coverage, will generally result in higher premiums. It’s important to choose coverage levels that meet your specific needs and budget.

Risk Factors

Various risk factors can affect your homeowners insurance premium. These factors can include:

- Your credit score: Insurance companies may use your credit score as an indicator of your financial responsibility. Individuals with lower credit scores may be considered higher risk and therefore pay higher premiums.

- The age of your home: Older homes may have outdated wiring or plumbing, which can increase the risk of fire or other damage. This can lead to higher premiums.

- The presence of a swimming pool or trampoline: These features can increase the risk of accidents and injuries, leading to higher premiums.

- The type of roof: Some roof types, such as asphalt shingles, are more prone to damage than others. Homes with these types of roofs may have higher premiums.

- The presence of security systems: Homes with security systems, such as burglar alarms or smoke detectors, are considered lower risk and may qualify for discounts.

Comparison to Other Providers

While State Farm is a well-known and reputable insurance provider, it’s always a good idea to compare quotes from multiple insurance companies to ensure you’re getting the best rate. You can use online comparison tools or contact insurance agents directly to obtain quotes from various providers. Comparing quotes allows you to see which company offers the most comprehensive coverage at the most competitive price.

Coverage Options and Customization

State Farm homeowners insurance offers a comprehensive range of coverage options designed to protect your home and belongings from various risks. Understanding these options and customizing them to fit your specific needs is crucial to ensure you have the right protection in place.

Coverage Options

State Farm homeowners insurance policies typically include several standard coverage options, providing protection for different aspects of your home and belongings.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Covers the physical structure of your home, including the attached structures like garages and decks, against perils like fire, windstorm, and hail. |

| Personal Property Coverage | Protects your belongings inside your home, such as furniture, clothing, electronics, and other personal items, against covered perils. |

| Liability Coverage | Provides financial protection if someone is injured on your property or if you are held liable for damages caused to someone else’s property. |

| Additional Living Expenses Coverage | Covers the costs of temporary housing, meals, and other expenses if your home becomes uninhabitable due to a covered event. |

Customization Options

State Farm offers various customization options to tailor your homeowners insurance policy to your specific needs. These options allow you to add additional coverage or adjust existing coverage limits to better suit your situation.

- Endorsements: These are add-ons that extend your coverage to include specific risks or situations not covered by the standard policy. Examples include:

- Flood Insurance: Protects against damages caused by flooding, a peril not typically covered by standard homeowners insurance.

- Earthquake Insurance: Provides coverage for damages caused by earthquakes, especially important in areas prone to seismic activity.

- Scheduled Personal Property Coverage: Offers higher coverage limits for specific valuable items, such as jewelry, artwork, or antiques.

- Coverage Limits: You can adjust the coverage limits for different aspects of your policy, such as dwelling coverage, personal property coverage, and liability coverage, based on the value of your home and belongings.

- Deductibles: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but you will have to pay more in the event of a claim.

Understanding Coverage Limits and Deductibles

Understanding the coverage limits and deductibles in your homeowners insurance policy is crucial for making informed decisions about your coverage.

Coverage Limits: The maximum amount your insurance company will pay for a covered loss.

Deductible: The amount you pay out-of-pocket for a covered loss before your insurance coverage kicks in.

For example, if your dwelling coverage limit is $250,000 and your deductible is $1,000, your insurance company will pay up to $249,000 for damages to your home, but you will be responsible for the first $1,000.

Claims Process and Customer Service

When facing a covered event, State Farm’s claims process is designed to provide support and a smooth experience for policyholders. The company aims to help you recover from losses and get back on your feet as quickly as possible.

Filing a Claim

The first step in the claims process is to report the event to State Farm. You can do this through various channels, including:

- Online: Through State Farm’s website, you can file a claim 24/7, providing details about the event and uploading relevant documents.

- Mobile App: The State Farm mobile app allows you to file a claim, track its progress, and communicate with your claims representative.

- Phone: Calling State Farm’s customer service hotline connects you directly with a claims representative who can guide you through the process.

Once you have filed a claim, State Farm will assign a claims representative who will work with you throughout the process. Your representative will gather information about the event, assess the damage, and determine the extent of coverage.

Claim Processing and Settlement

State Farm’s goal is to process claims efficiently and fairly. The time it takes to process a claim can vary depending on the complexity of the event and the amount of damage. However, the company aims to resolve claims promptly.

“State Farm strives to provide a fair and efficient claims process, aiming to resolve claims within a reasonable timeframe.”

Customer Service Channels and Reputation

State Farm offers various customer service channels to address your inquiries and concerns. You can reach out to them through:

- Phone: State Farm’s customer service hotline is available 24/7 to assist you with your insurance needs.

- Website: State Farm’s website provides a wealth of information about its products and services, including FAQs, claim filing instructions, and contact details.

- Mobile App: The State Farm mobile app allows you to manage your policy, file claims, and communicate with customer service representatives.

- Social Media: State Farm is active on various social media platforms, providing customer support and responding to inquiries.

State Farm has consistently ranked highly in customer satisfaction surveys. The company is known for its commitment to providing excellent customer service and its responsiveness to policyholder needs.

Discounts and Incentives

State Farm offers a variety of discounts that can significantly reduce your homeowners insurance premiums. These discounts are designed to reward policyholders for taking steps to mitigate risk and manage their properties responsibly. By understanding the eligibility criteria and application process for these discounts, you can maximize your savings and secure the most affordable homeowners insurance coverage.

Discounts Offered by State Farm

State Farm offers a wide range of discounts to help homeowners save money on their insurance premiums. Some of the most common discounts include:

- Safety Features: Installing safety features in your home, such as smoke detectors, burglar alarms, and fire sprinklers, can significantly reduce the risk of property damage and loss. State Farm recognizes these efforts by offering discounts to policyholders who have implemented these safety measures.

- Bundling Policies: Combining your homeowners insurance with other policies, such as auto insurance, can lead to substantial savings. State Farm rewards policyholders who bundle their insurance by offering a discount on their combined premiums.

- Loyalty Programs: State Farm offers loyalty programs that reward long-term policyholders with discounts and other benefits. These programs acknowledge the value of customer loyalty and incentivize policyholders to maintain their coverage with State Farm.

- Homeowners Association Membership: Being a member of a homeowners association can indicate a commitment to property maintenance and community safety. State Farm may offer discounts to policyholders who are members of homeowners associations.

- Home Improvement Discounts: Certain home improvements, such as replacing your roof with impact-resistant materials or installing energy-efficient windows, can enhance your home’s safety and reduce energy consumption. State Farm may offer discounts for these improvements.

- Good Credit Score: Maintaining a good credit score can be beneficial for obtaining lower insurance premiums. State Farm, like many insurance companies, may offer discounts to policyholders with good credit histories.

- Protective Devices: Installing security systems, such as video surveillance or motion sensors, can deter crime and reduce the risk of property theft. State Farm may offer discounts to policyholders who have these protective devices installed.

- Claim-Free Discount: Policyholders who maintain a claim-free history are often eligible for discounts. This incentivizes responsible property ownership and reduces the risk of claims for insurance companies.

- Multi-Line Discount: Combining multiple insurance policies with State Farm, such as auto, life, and renters insurance, can qualify you for a multi-line discount, further reducing your overall premiums.

- Paid in Full Discount: Paying your homeowners insurance premium in full upfront may qualify you for a discount, as it simplifies billing and reduces administrative costs for insurance companies.

Eligibility Criteria and Application Process

To qualify for discounts, you typically need to meet specific criteria, such as:

- Safety Features: You must have the safety features installed and operational, and you may need to provide proof of installation.

- Bundling Policies: You must have multiple insurance policies with State Farm.

- Loyalty Programs: You must have maintained your policy with State Farm for a certain period.

- Homeowners Association Membership: You must be an active member of a homeowners association.

- Home Improvement Discounts: You must have completed the home improvements and have documentation or receipts for the work.

- Good Credit Score: You must have a credit score that meets State Farm’s criteria.

- Protective Devices: You must have the protective devices installed and operational.

- Claim-Free Discount: You must have a claim-free history for a specified period.

- Multi-Line Discount: You must have multiple insurance policies with State Farm.

- Paid in Full Discount: You must pay your premium in full upfront.

The application process for discounts typically involves providing State Farm with the necessary documentation, such as receipts for safety features or proof of membership in a homeowners association. State Farm will then verify the information and apply the applicable discounts to your premium.

Potential Savings Associated with Discounts

The potential savings associated with State Farm discounts can vary depending on the specific discounts you qualify for and your individual insurance needs. However, many policyholders can save hundreds of dollars per year by taking advantage of these discounts. For example, bundling your homeowners and auto insurance policies could save you 10% or more on your premiums. Similarly, installing safety features in your home, such as smoke detectors and burglar alarms, could qualify you for discounts that reduce your premium by 5% or more.

Remember: The more discounts you qualify for, the greater your potential savings. It’s essential to inquire about available discounts and ensure you are taking full advantage of the opportunities to reduce your homeowners insurance premiums.

Ultimate Conclusion

Navigating the world of homeowners insurance can seem overwhelming, but with State Farm, the process is streamlined and transparent. By obtaining a personalized quote, you gain valuable insights into your insurance options and can confidently choose the coverage that best suits your needs and budget. Remember to explore the available discounts and incentives to potentially reduce your premiums further.

FAQ Section

What factors affect my State Farm homeowners insurance quote?

Your quote is determined by factors such as your location, property value, coverage levels, and risk factors. Things like your home’s age, security features, and your personal history also play a role.

How do I compare State Farm’s quotes to other providers?

It’s recommended to obtain quotes from multiple insurers to compare coverage and pricing. You can use online comparison tools or contact insurance agents directly.

What discounts are available for State Farm homeowners insurance?

State Farm offers various discounts, including those for safety features, bundling policies, loyalty programs, and being a good driver.