State Farm homeowners insurance quotes are a crucial step in securing the right coverage for your home. Whether you’re a first-time buyer or a seasoned homeowner, understanding the factors that influence your quote and comparing options from different providers is essential.

This guide explores the process of obtaining a State Farm homeowners insurance quote, covering everything from the initial request to analyzing the final price. We’ll delve into the various coverage options, the impact of factors like location and home value, and the importance of comparing quotes from other insurers. By the end, you’ll be equipped to make an informed decision about your homeowners insurance.

Understanding State Farm Homeowners Insurance

State Farm is a well-known and reputable insurance company that offers a variety of homeowners insurance policies. These policies are designed to protect your home and belongings from various risks, providing financial security in the event of an unexpected event.

Coverage Options

State Farm offers a comprehensive range of coverage options to cater to the specific needs of homeowners. These options can be customized to create a policy that best suits your individual situation and budget.

- Dwelling Coverage: This covers the structure of your home, including the attached structures like garages and porches, against damage caused by perils like fire, windstorms, hail, and vandalism.

- Other Structures Coverage: This extends coverage to detached structures on your property, such as sheds, fences, and detached garages.

- Personal Property Coverage: This protects your belongings inside your home, including furniture, electronics, clothing, and other personal items, against damage or loss due to covered perils.

- Liability Coverage: This provides financial protection if you are held legally responsible for injuries or property damage to others on your property.

- Medical Payments Coverage: This covers medical expenses for guests who are injured on your property, regardless of who is at fault.

- Loss of Use Coverage: This provides financial assistance if you are unable to live in your home due to a covered loss, covering expenses like temporary housing and additional living expenses.

- Additional Living Expenses Coverage: This helps cover the costs of temporary housing, meals, and other expenses if you are unable to live in your home due to a covered loss.

Benefits of Choosing State Farm

State Farm offers several benefits to homeowners, making it an attractive choice for insurance coverage:

- Financial Strength: State Farm is a financially stable company with a strong reputation for paying claims promptly and fairly. This provides peace of mind knowing your insurance company will be there when you need them most.

- Wide Network of Agents: State Farm has a vast network of local agents who can provide personalized advice and assistance throughout the insurance process. They can help you understand your coverage options, choose the right policy, and file claims efficiently.

- Competitive Pricing: State Farm offers competitive rates on homeowners insurance, making it a value-for-money option for many homeowners. They often provide discounts for various factors, such as safety features, bundling multiple policies, and being a loyal customer.

- Customer Service: State Farm is known for its excellent customer service, with a dedicated team available to answer questions, resolve issues, and provide support. They offer multiple channels for communication, including phone, email, and online chat.

Drawbacks of Choosing State Farm, State farm homeowners insurance quote

While State Farm offers many benefits, there are also some potential drawbacks to consider:

- Limited Coverage Options: While State Farm offers a wide range of coverage options, they may not have as many specialized or niche coverage options compared to some other insurance companies.

- Varying Claim Handling Experiences: While State Farm generally has a good reputation for claim handling, individual experiences can vary depending on the specific claim and the agent involved. It’s important to research and understand the claims process before choosing State Farm.

- Potential for Rate Increases: Like all insurance companies, State Farm can adjust rates based on factors like claims history, risk assessments, and market conditions. This means your premiums may increase over time, even if you have no claims.

Obtaining a Quote from State Farm

Getting a homeowners insurance quote from State Farm is a straightforward process. You can choose from several convenient methods to obtain an estimate tailored to your specific needs.

Methods for Obtaining a Quote

State Farm offers various ways to obtain a homeowners insurance quote, making it easy to get the information you need.

- Online Quote Request: This is the most convenient and fastest option. You can access State Farm’s website and fill out a simple online form with your basic information and property details. The system will then provide you with a preliminary quote within minutes.

- Phone Call: If you prefer a more personalized approach, you can call State Farm’s customer service line. A representative will guide you through the process, ask you the necessary questions, and provide you with a quote.

- Local Agent: You can visit a local State Farm agent’s office in person. This allows for a face-to-face consultation where you can discuss your specific insurance needs and receive a personalized quote.

Information Required for a Quote

To obtain an accurate homeowners insurance quote, State Farm will need some key information about you and your property. This information helps them assess your risk and determine the appropriate coverage and price.

- Personal Information: Your name, address, contact details, and date of birth are necessary to identify you and establish your policy.

- Property Details: State Farm will require information about your home, including its address, square footage, year built, type of construction (brick, wood, etc.), and any renovations or additions.

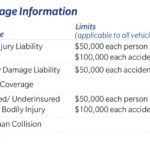

- Coverage Preferences: You’ll need to specify the level of coverage you desire for different aspects of your home, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Risk Factors: State Farm will also consider factors that influence your risk, such as your credit score, claims history, and the location of your home (e.g., proximity to fire hazards or flood zones).

Factors Influencing Quote Amount

The final quote amount for your homeowners insurance will depend on several factors, including:

- Location: Your home’s location significantly impacts the cost of insurance. Areas with higher crime rates, natural disaster risks (earthquakes, hurricanes), or more frequent severe weather events will generally have higher premiums.

- Property Value: The value of your home is a primary factor in determining your premium. A higher value home will typically require higher coverage, resulting in a higher premium.

- Coverage Amount: The amount of coverage you choose will directly affect your premium. Higher coverage levels will generally lead to higher premiums.

- Deductible: Your deductible is the amount you agree to pay out of pocket for covered losses before your insurance kicks in. A higher deductible will usually result in a lower premium.

- Risk Factors: As mentioned earlier, factors like your credit score, claims history, and the presence of safety features (e.g., smoke detectors, burglar alarms) can influence your quote.

Analyzing the Quote

After obtaining a quote from State Farm, it’s crucial to carefully analyze it and compare it with quotes from other major insurance providers. This comparison helps you understand the strengths and weaknesses of State Farm’s offer and make an informed decision about your homeowners insurance.

Comparing State Farm Quotes with Other Providers

Comparing quotes from different insurers is essential for finding the best value. Consider factors like coverage, deductibles, premiums, discounts, and customer service when comparing.

- Coverage: Compare the types of coverage offered by State Farm and other providers. For instance, check if they cover specific perils, such as floods or earthquakes, or if they offer additional coverage options like identity theft protection or replacement cost coverage for personal belongings.

- Deductibles: Examine the deductibles offered by each insurer. A higher deductible generally translates to lower premiums, but you’ll have to pay more out of pocket in case of a claim. Consider your risk tolerance and financial situation when choosing a deductible.

- Premiums: Compare the premium costs from State Farm and other insurers. Ensure you’re comparing quotes for similar coverage levels and deductibles to make a fair comparison.

- Discounts: Explore the discounts offered by each insurer. State Farm might provide discounts for things like home security systems, fire alarms, or bundling your insurance policies.

- Customer Service: Read online reviews and testimonials to assess the customer service experience of each insurer. Factors like claim processing speed, communication, and responsiveness are crucial considerations.

Strengths and Weaknesses of the State Farm Quote

Once you’ve compared quotes, analyze the State Farm quote specifically to identify its strengths and weaknesses.

- Strengths: These could include competitive premiums, comprehensive coverage options, favorable discounts, or a strong reputation for customer service.

- Weaknesses: These might include higher deductibles, limited coverage options, lack of specific discounts, or negative customer reviews.

Key Aspects of the State Farm Quote

Summarizing the key aspects of the State Farm quote in a table helps you visualize the important details and compare them easily.

| Aspect | State Farm Quote |

|---|---|

| Coverage | [Specify the type of coverage offered, including any additional options] |

| Deductible | [Specify the deductible amount for different types of coverage] |

| Premium | [Specify the annual or monthly premium amount] |

| Discounts | [List the discounts applicable to your policy] |

| Other Features | [Highlight any additional features or benefits, such as customer service options, claim handling process, or mobile app features] |

Factors Influencing the Quote

Your State Farm homeowners insurance quote is tailored to your unique circumstances, and several factors contribute to its final price. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premium.

Property Location

The location of your home significantly impacts your homeowners insurance quote. Factors like the risk of natural disasters, crime rates, and proximity to fire stations and other emergency services are considered. For example, homes in areas prone to earthquakes, hurricanes, or wildfires will generally have higher premiums due to the increased risk of damage. Similarly, homes located in high-crime areas may also face higher premiums due to the potential for theft or vandalism.

State Farm’s Reputation and Customer Service

State Farm is one of the largest and most well-known insurance providers in the United States, boasting a long history and a vast customer base. Their reputation for customer service is a key factor for many homeowners considering their insurance policies. This section explores State Farm’s reputation and customer service, providing insights into their strengths and areas for improvement.

Customer Service Pros and Cons

Understanding the advantages and disadvantages of State Farm’s customer service can help homeowners make informed decisions. Here’s a breakdown of the pros and cons:

- Pros:

- Wide Availability: State Farm has a large network of agents across the country, making it easy for policyholders to find local representatives for assistance.

- Strong Financial Stability: State Farm is a financially strong company with a long history of paying claims, providing policyholders with confidence in their financial security.

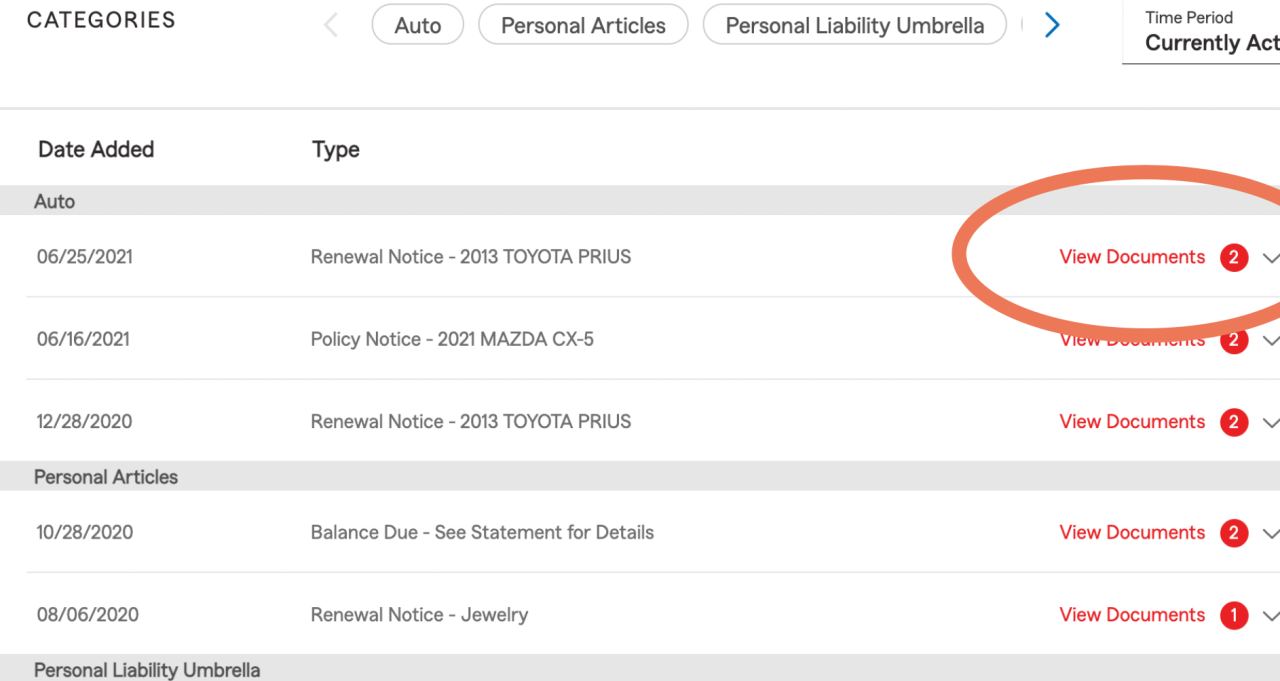

- User-Friendly Online Tools: State Farm offers online tools for managing policies, submitting claims, and accessing account information, providing convenience and accessibility.

- 24/7 Customer Support: State Farm provides 24/7 customer support through phone, email, and online chat, ensuring assistance whenever needed.

- Cons:

- Varying Agent Experiences: While State Farm has a strong network of agents, the quality of service can vary depending on the individual agent.

- Potential for Long Wait Times: During peak periods or for complex issues, customers may experience longer wait times on phone or online.

- Limited Customization Options: Some customers may find State Farm’s policies less customizable compared to other providers, limiting their ability to tailor coverage to specific needs.

Customer Reviews and Testimonials

To gain further insight into State Farm’s customer service, it’s valuable to explore reviews and testimonials from actual policyholders. Online platforms like Trustpilot, Yelp, and Google Reviews provide a wealth of customer experiences.

“I’ve been with State Farm for over 10 years and have always been happy with their service. They’ve been responsive and helpful whenever I’ve needed them.” – John Smith, Trustpilot

“I recently filed a claim after a storm damaged my roof. The process was smooth and straightforward, and the adjuster was very professional.” – Sarah Jones, Yelp

Comparison of Customer Satisfaction Ratings

While customer reviews provide individual perspectives, independent surveys and ratings offer a broader view of customer satisfaction. J.D. Power, a reputable market research firm, conducts annual surveys on customer satisfaction in various industries, including insurance. Comparing State Farm’s customer satisfaction ratings with other providers can offer valuable insights.

According to the J.D. Power 2023 U.S. Home Insurance Study, State Farm ranked [insert State Farm’s ranking here] in customer satisfaction, [insert comparison with other providers’ rankings here]. These rankings can be a helpful indicator of overall customer experience.

Additional Considerations

Before purchasing State Farm homeowners insurance, it is crucial to carefully evaluate various factors that may influence your decision and ensure the policy aligns with your specific needs.

Understanding Policy Exclusions and Limitations

It is essential to understand what your policy covers and what it does not. Every insurance policy has limitations and exclusions, which are specific events or circumstances not covered by the policy. These exclusions and limitations are typically Artikeld in the policy’s terms and conditions. For instance, many homeowners insurance policies exclude coverage for damage caused by natural disasters such as earthquakes or floods, unless you have purchased additional coverage.

Checklist for Important Considerations

Before purchasing State Farm homeowners insurance, consider these important factors:

- Coverage Limits: Determine the appropriate coverage limits for your property and belongings. Coverage limits refer to the maximum amount your insurance company will pay for a covered loss. You should consider the value of your home, its contents, and any potential liabilities.

- Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums. Choose a deductible you can comfortably afford in case of a claim.

- Additional Coverage: Consider purchasing additional coverage for specific risks, such as flood insurance, earthquake insurance, or personal liability coverage. These additional coverages may provide protection for events not covered by your standard homeowners insurance policy.

- Discounts: Inquire about available discounts, such as those for home security systems, fire alarms, or multiple policy discounts. Discounts can significantly reduce your premium costs.

- Claims Process: Familiarize yourself with State Farm’s claims process, including how to report a claim, what documentation is required, and the timeline for claim resolution.

Filing a Claim with State Farm

When you need to file a claim with State Farm, the process is straightforward. You can typically report a claim online, over the phone, or through a mobile app. State Farm will provide you with a claim number and instructions on how to proceed. You will need to provide details about the incident, including the date, time, and location of the event, as well as any supporting documentation, such as photographs or videos. State Farm will then investigate the claim and determine whether it is covered under your policy. If your claim is approved, State Farm will provide you with compensation for your covered losses.

Wrap-Up: State Farm Homeowners Insurance Quote

Navigating the world of homeowners insurance can feel overwhelming, but understanding the basics and comparing quotes from different providers can empower you to make the right choice for your needs. State Farm offers a competitive range of options, but it’s essential to consider all aspects of their coverage and compare it to other insurers. Remember, the right homeowners insurance provides peace of mind and financial protection in case of unforeseen events.

Common Queries

How long does it take to get a State Farm homeowners insurance quote?

The time it takes to receive a quote varies depending on the method you use. Online quotes are often generated instantly, while phone or in-person quotes may take a few days.

Can I get a quote without providing personal information?

While some websites offer general estimates, getting an accurate quote requires providing personal and property information. This helps insurers assess your risk and tailor the quote to your specific circumstances.

What happens if my quote changes after I accept it?

Once you accept a quote, it is generally locked in for a specific period. However, if there are significant changes to your property or risk factors, your insurer may need to adjust the quote.