State Farm Home Renters Insurance provides crucial financial protection for renters, safeguarding their personal belongings against unforeseen events like fire, theft, or natural disasters. This comprehensive coverage extends beyond basic protection, offering a range of valuable benefits and customization options to meet individual needs.

Whether you’re a seasoned renter or just starting out, understanding the nuances of renters insurance is essential. This guide explores the intricacies of State Farm’s offerings, delving into coverage options, cost factors, claims processes, and customer experiences. We’ll also compare State Farm’s policies with those offered by other reputable providers, empowering you to make informed decisions about your renters insurance needs.

State Farm Home Renters Insurance Overview

State Farm Home Renters Insurance is a type of insurance that protects your personal belongings in your rental property from various covered perils. This insurance policy safeguards you against financial losses due to damage or theft of your possessions, providing peace of mind and financial security.

Key Features and Benefits

State Farm Home Renters Insurance offers a comprehensive range of features and benefits designed to protect your belongings and financial well-being. These features include:

- Personal Property Coverage: This covers your personal belongings, such as furniture, electronics, clothing, and other valuable items, against damage or theft. Coverage amounts are typically based on the actual cash value or replacement cost of your belongings.

- Liability Coverage: This protects you from financial responsibility for injuries or property damage that you or a member of your household may cause to others while residing in your rental property. This coverage can help cover legal fees, medical expenses, and property damage costs.

- Additional Living Expenses Coverage: If your rental property becomes uninhabitable due to a covered event, this coverage can help pay for temporary housing, food, and other essential expenses while your home is being repaired or rebuilt.

- Personal Injury Coverage: This coverage can help protect you from financial losses resulting from personal injuries caused by covered events, such as slander or libel.

- Loss of Use Coverage: This coverage can help cover the cost of additional expenses you incur due to a covered event that makes your rental property uninhabitable. This can include things like hotel accommodations, meals, and other essential expenses.

- Other Coverage Options: State Farm also offers a variety of optional coverage options, such as coverage for valuable items, water backup, and identity theft protection, that can be tailored to meet your specific needs and budget.

Target Audience

State Farm Home Renters Insurance is designed for individuals who rent their homes or apartments. This insurance is ideal for:

- Individuals: Anyone who rents a home or apartment can benefit from the protection offered by renters insurance.

- Families: Families living in rental properties can safeguard their belongings and financial well-being with this insurance.

- Students: Renters insurance can provide crucial protection for students living in off-campus apartments or houses.

- Anyone with Valuable Possessions: Individuals with valuable belongings, such as electronics, jewelry, or artwork, should consider renters insurance to ensure they are adequately protected.

Coverage Options

State Farm Home Renters Insurance offers a range of coverage options to cater to your specific needs and budget. Understanding the different coverage options available is crucial for choosing the right policy that provides adequate protection for your belongings.

Coverage Options Explained

The coverage options offered by State Farm can be categorized into two main groups:

- Basic Coverage: This provides the fundamental protection for your personal property against various perils. It includes coverage for losses caused by fire, theft, vandalism, and certain natural disasters.

- Additional Coverage: This group offers supplementary protection for specific situations or items, allowing you to customize your policy to meet your individual needs. It includes coverage for things like personal liability, medical payments, and valuable items.

Detailed Coverage Options

Below is a table outlining the various coverage options offered by State Farm, their descriptions, and limitations:

| Coverage Option | Description | Limitations |

|---|---|---|

| Personal Property Coverage | Protects your belongings against damage or loss from covered perils. | Coverage is typically limited to the actual cash value of your belongings, which means you will receive the replacement cost minus depreciation. You can choose to purchase replacement cost coverage, which provides the full replacement cost of your belongings, but this will increase your premium. |

| Liability Coverage | Protects you against legal claims from others who are injured or whose property is damaged due to your negligence. | Coverage is typically limited to a certain amount, and you may have to pay a deductible. |

| Medical Payments Coverage | Covers medical expenses for injuries to others who are injured on your property, regardless of fault. | Coverage is typically limited to a certain amount per person and per incident. |

| Loss of Use Coverage | Provides financial assistance if your dwelling is uninhabitable due to a covered peril. | Coverage is typically limited to a certain amount and duration. |

| Additional Living Expenses Coverage | Covers the additional costs you incur while your dwelling is being repaired or rebuilt, such as temporary housing, food, and transportation. | Coverage is typically limited to a certain amount and duration. |

| Personal Property Replacement Cost Coverage | Provides the full replacement cost of your belongings, without depreciation. | This coverage is optional and will increase your premium. |

| Valuable Items Coverage | Provides additional coverage for high-value items, such as jewelry, art, and antiques. | You may need to provide proof of ownership and value for these items. |

Coverage Options Comparison

The following table compares State Farm’s coverage options with those offered by other major insurance providers:

| Coverage Option | State Farm | Other Major Providers |

|---|---|---|

| Personal Property Coverage | Offers actual cash value and replacement cost coverage options. | Similar coverage options are generally available. |

| Liability Coverage | Offers various liability limits to choose from. | Similar liability limits are generally available. |

| Medical Payments Coverage | Offers medical payments coverage with different limits. | Similar medical payments coverage is generally available. |

| Loss of Use Coverage | Offers loss of use coverage with different limits and durations. | Similar loss of use coverage is generally available. |

| Additional Living Expenses Coverage | Offers additional living expenses coverage with different limits and durations. | Similar additional living expenses coverage is generally available. |

| Personal Property Replacement Cost Coverage | Offers optional replacement cost coverage. | Similar replacement cost coverage is generally available. |

| Valuable Items Coverage | Offers valuable items coverage with different limits. | Similar valuable items coverage is generally available. |

Policy Costs and Factors

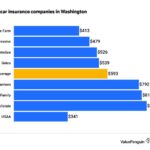

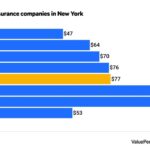

The cost of State Farm Home Renters Insurance is determined by a variety of factors, including your location, the value of your belongings, and your chosen coverage options. Understanding these factors can help you get the best possible price for your policy.

Factors Influencing Policy Costs

Several factors can influence the cost of your State Farm Home Renters Insurance. These include:

- Location: The cost of insurance is often higher in areas with higher crime rates or natural disaster risks. For example, if you live in a coastal area, you may pay more for coverage due to the risk of hurricanes.

- Value of Your Belongings: The amount of coverage you need will depend on the value of your personal property. If you have expensive items, such as jewelry or electronics, you will likely pay more for insurance.

- Coverage Options: The specific coverage options you choose will also affect your premium. For example, if you choose to add coverage for personal liability or flood damage, you will pay more.

- Your Credit Score: In some states, insurers can use your credit score to determine your insurance rates. A higher credit score can generally lead to lower insurance premiums.

- Claims History: If you have a history of filing claims, you may pay more for insurance. This is because insurers consider past claims as an indicator of future risk.

- Security Features: Having security features in your rental unit, such as an alarm system or deadbolt locks, can sometimes lower your insurance premiums.

- Deductible: The deductible is the amount you pay out of pocket for a claim before your insurance coverage kicks in. A higher deductible generally leads to lower premiums.

Obtaining a Quote

To obtain a quote for State Farm Home Renters Insurance, you can:

- Visit a State Farm Agent: You can schedule an appointment with a local State Farm agent to discuss your insurance needs and receive a personalized quote.

- Get a Quote Online: State Farm offers an online quote tool on its website. You can provide your information and receive a preliminary quote within minutes.

- Call State Farm: You can contact State Farm directly by phone to request a quote.

Typical Costs

The cost of State Farm Home Renters Insurance can vary significantly depending on the factors mentioned above. However, you can expect to pay somewhere between $15 and $50 per month for basic coverage. This is just an estimate, and your actual premium will be determined based on your specific circumstances.

Claims Process: State Farm Home Renters Insurance

Filing a claim with State Farm for renters insurance is a straightforward process designed to help you get back on your feet after a covered loss. State Farm has a dedicated claims team available 24/7 to assist you through every step.

The claims process is typically handled efficiently and with a focus on providing prompt assistance. Here’s what you can expect:

Steps Involved in Filing a Claim

The first step is to report your claim to State Farm as soon as possible after the loss occurs. You can do this by calling their claims hotline or submitting a claim online. Once you’ve reported the claim, a State Farm representative will guide you through the following steps:

- Provide details about the loss: You’ll need to provide information about the date, time, and circumstances of the loss, as well as a description of the damaged property.

- File a formal claim: State Farm will provide you with a formal claim form that you’ll need to complete and submit. This form will require you to provide detailed information about your belongings and their estimated value.

- Schedule an inspection: A State Farm adjuster will be assigned to your claim and will schedule an inspection of the damaged property. This inspection is necessary to assess the extent of the damage and determine the value of your losses.

- Negotiate a settlement: Once the adjuster has completed their assessment, they will work with you to negotiate a settlement amount. This amount will be based on the value of your damaged belongings, the coverage limits of your policy, and any applicable deductibles.

- Receive payment: Once the settlement has been agreed upon, State Farm will issue payment to you. This payment may be sent directly to you or to the party responsible for repairing or replacing your damaged property.

Claims Handling Process

State Farm strives to process claims efficiently and fairly. The claims handling process typically involves:

- Prompt response: State Farm aims to respond to your claim within 24 hours of receiving it.

- Expert assessment: Experienced adjusters are assigned to claims to provide accurate assessments of damage and ensure fair settlements.

- Clear communication: State Farm representatives will keep you informed throughout the claims process and answer any questions you may have.

- Fast resolution: State Farm strives to resolve claims as quickly as possible. However, the timeframe for claim resolution can vary depending on the complexity of the claim and the availability of necessary information.

Policyholder’s Role in the Claims Process, State farm home renters insurance

As the policyholder, you play a crucial role in ensuring a smooth and efficient claims process. Here’s how you can contribute:

- Report claims promptly: The sooner you report your claim, the sooner State Farm can start working on resolving it.

- Provide accurate information: Be sure to provide accurate and complete information to the adjuster, including details about the loss, the value of your damaged property, and any relevant documentation.

- Cooperate with the adjuster: Schedule the inspection promptly and provide the adjuster with access to the damaged property.

- Maintain communication: Stay in contact with your adjuster and respond to their requests promptly.

Customer Service and Reviews

State Farm’s reputation for customer service is a crucial factor when considering their home renters insurance. Understanding how they handle customer interactions and what past experiences have been like can help you make an informed decision.

Customer Service Channels

State Farm offers various channels for customers to access their services and address inquiries. Here are some of the primary ways to connect with State Farm:

- Phone: State Farm has a dedicated customer service phone number for renters insurance inquiries. You can reach them at 1-800-STATE FARM (1-800-782-8332).

- Website: State Farm’s website provides a comprehensive online platform for managing your policy, making payments, and accessing resources. You can find contact information for specific departments, including claims, through their website.

- Mobile App: The State Farm mobile app allows you to manage your policy, submit claims, and access other services directly from your smartphone or tablet.

- Local Agent: State Farm has a network of local agents across the country. You can find an agent in your area through their website or by calling the customer service number.

Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the experiences of others with State Farm Home Renters Insurance. Many websites and platforms aggregate customer feedback, offering a diverse perspective on State Farm’s performance.

- J.D. Power: J.D. Power is a reputable organization that conducts surveys and provides ratings for various industries, including insurance. State Farm has consistently received above-average ratings for customer satisfaction in home insurance.

- Consumer Reports: Consumer Reports is another respected source for product and service reviews. Their ratings for State Farm Home Renters Insurance are generally positive, highlighting their strengths in claims handling and customer service.

- Online Review Platforms: Websites like Trustpilot, Google Reviews, and Yelp offer a platform for customers to share their experiences with State Farm. Reviews on these platforms can provide a more detailed and nuanced understanding of customer sentiment, covering aspects like policy clarity, claims processing, and overall customer support.

Common Themes in Customer Reviews

Examining customer reviews across different platforms reveals common themes and feedback regarding State Farm Home Renters Insurance. These themes can provide valuable insights into customer expectations and perceptions of the company.

- Positive Feedback:

- Responsive and helpful customer service: Many customers praise State Farm for their responsiveness and helpfulness in addressing inquiries and resolving issues.

- Smooth claims process: Customers often highlight the ease and efficiency of the claims process, with prompt communication and fair settlements.

- Competitive pricing: State Farm’s rates are generally considered competitive, making their insurance policies attractive to renters.

- Areas for Improvement:

- Long wait times: Some customers have reported long wait times when contacting customer service by phone.

- Limited online options: While State Farm offers online services, some customers have expressed a desire for more comprehensive online capabilities, such as policy customization or real-time claim updates.

- Varying agent experiences: Customer experiences with local agents can vary, with some reporting positive interactions while others have encountered less helpful or responsive agents.

Alternative Renters Insurance Options

While State Farm is a reputable choice for renters insurance, it’s wise to explore other providers to find the best fit for your needs and budget. Several other insurance companies offer competitive renters insurance policies with unique features and pricing.

Other Reputable Renters Insurance Providers

Several other reputable insurance companies offer competitive renters insurance policies. These providers often cater to specific needs and offer unique features and pricing. Some of the most well-known and highly-rated renters insurance companies include:

- Allstate: Known for its comprehensive coverage options and customer-friendly features, Allstate offers various customization options to tailor your policy to your specific needs. They are also known for their strong financial stability and excellent customer service.

- Liberty Mutual: Liberty Mutual is a well-established insurance company offering renters insurance with competitive rates and comprehensive coverage. They offer a variety of discounts, including multi-policy discounts and safety features discounts, which can significantly reduce your premiums.

- USAA: If you are a member of the military or a family member of a military member, USAA is an excellent option. USAA offers highly competitive rates and excellent customer service, specifically tailored to the needs of military families. They are known for their commitment to customer satisfaction and financial stability.

- Nationwide: Nationwide is another large insurance company offering a wide range of insurance products, including renters insurance. They offer competitive rates and comprehensive coverage, with various discounts available to help lower your premiums. Nationwide also offers a convenient online quoting and policy management system.

- Travelers: Travelers is a well-established insurance company with a strong reputation for financial stability and customer service. They offer comprehensive renters insurance coverage with various customization options and discounts.

Comparison of Key Features, Benefits, and Costs

When comparing renters insurance providers, consider factors such as coverage options, policy limits, deductibles, discounts, and customer service. Each company has its unique strengths and weaknesses, so it’s essential to carefully evaluate your needs and priorities.

- Coverage Options: Each insurance provider offers a different range of coverage options. Some companies offer more comprehensive coverage, while others may focus on specific areas. Consider your individual needs and determine which provider offers the best coverage for your situation.

- Policy Limits: The policy limit is the maximum amount your insurance company will pay for a covered loss. This amount varies depending on the provider and the type of coverage you choose. Choose a policy limit that adequately protects your belongings and meets your individual needs.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums. Consider your financial situation and risk tolerance when choosing your deductible.

- Discounts: Many insurance companies offer discounts to lower your premiums. Some common discounts include multi-policy discounts, safety feature discounts, and good driver discounts. Explore the available discounts and see if you qualify for any savings.

- Customer Service: Customer service is crucial, especially during a claim. Consider the provider’s reputation for customer service and their claims process. Read reviews and compare customer satisfaction ratings to get a sense of their responsiveness and helpfulness.

Advantages and Disadvantages of Choosing a Different Provider

Choosing a different provider over State Farm can offer several advantages, including:

- Lower Premiums: Some providers may offer lower premiums than State Farm, depending on your specific circumstances and location. Comparing quotes from multiple providers can help you find the most affordable option.

- More Comprehensive Coverage: Certain providers may offer more comprehensive coverage than State Farm, including additional benefits or specific coverage options tailored to your needs. Carefully compare coverage options and policy limits to ensure you are adequately protected.

- Better Customer Service: Some providers may have a better reputation for customer service and claims handling than State Farm. Reading reviews and comparing customer satisfaction ratings can help you choose a provider known for its responsiveness and helpfulness.

However, switching providers can also have some disadvantages:

- Potential for Higher Premiums: While some providers may offer lower premiums, others may have higher premiums than State Farm, depending on your risk profile and location. Comparing quotes from multiple providers is crucial to find the most competitive rates.

- Unfamiliarity with the Provider: Choosing a new provider may mean dealing with a company you are unfamiliar with. This could involve navigating a new website, learning a new claims process, and building a new relationship with the company.

- Potential for Reduced Coverage: Some providers may offer less comprehensive coverage than State Farm, meaning you might not be fully protected in certain situations. Carefully review coverage options and policy limits to ensure you are adequately protected.

Tips for Choosing Renters Insurance

Finding the right renters insurance policy can be overwhelming, but with careful planning, you can ensure you’re adequately protected. By considering your individual needs, comparing quotes, and understanding the coverage options, you can make an informed decision that suits your budget and circumstances.

Assess Your Needs and Risks

It’s crucial to evaluate your belongings and potential risks before choosing a policy. This involves considering the value of your possessions, the likelihood of damage or theft, and your personal risk tolerance.

- Inventory your belongings: Create a detailed list of your possessions, including their estimated value. This will help you determine the amount of coverage you need.

- Consider your location: High-crime areas or areas prone to natural disasters may require higher coverage limits.

- Evaluate your risk tolerance: Determine how much risk you’re willing to take. If you’re comfortable with a higher deductible, you can potentially lower your premium.

Compare Quotes and Coverage Options

Once you have a good understanding of your needs, you can start comparing quotes from different insurance providers. Don’t just focus on price; pay attention to the coverage options and policy details.

- Get multiple quotes: Request quotes from several insurance companies to compare prices and coverage.

- Review coverage options: Understand the different types of coverage offered, such as personal property, liability, and additional living expenses.

- Compare deductibles: A higher deductible will generally result in a lower premium, but you’ll have to pay more out of pocket in case of a claim.

Negotiate Coverage and Price

Don’t be afraid to negotiate with insurance providers to get the best possible price and coverage.

- Ask about discounts: Inquire about potential discounts, such as multi-policy discounts, safety features, or good driving records.

- Bundle policies: Combining renters insurance with other insurance policies, such as auto insurance, can often lead to lower premiums.

- Shop around: Don’t settle for the first quote you receive. Continue comparing quotes and exploring different options.

Conclusive Thoughts

Navigating the world of renters insurance can feel overwhelming, but armed with knowledge and a clear understanding of your individual needs, you can confidently choose a policy that provides adequate protection for your belongings. By comparing options, evaluating coverage levels, and considering your risk profile, you can secure peace of mind knowing that your assets are safeguarded against life’s unexpected turns. Whether you opt for State Farm or another provider, ensuring your renters insurance is tailored to your unique circumstances is a crucial step in safeguarding your financial well-being.

FAQ Compilation

What are the most common exclusions in State Farm Home Renters Insurance?

State Farm’s renters insurance typically excludes coverage for certain events like earthquakes, floods, and intentional acts of the policyholder. It’s crucial to review your policy carefully to understand these limitations and consider additional coverage options if needed.

How can I lower my State Farm Home Renters Insurance premium?

You can potentially lower your premium by implementing safety measures like installing smoke detectors, burglar alarms, and deadbolt locks. Additionally, bundling your renters insurance with other State Farm policies like auto insurance can often lead to discounts.

What are the benefits of choosing State Farm Home Renters Insurance?

State Farm offers a range of benefits, including comprehensive coverage options, competitive pricing, a well-established reputation for customer service, and a vast network of agents for personalized support. Their policies are known for their clarity and ease of understanding, making it simpler to navigate the insurance process.