State Farm home insurance online quote provides a convenient and efficient way to explore your insurance options. State Farm, a well-established name in the insurance industry, offers a user-friendly online platform to get a personalized quote tailored to your needs. Whether you’re a homeowner seeking comprehensive coverage or a first-time buyer exploring your options, State Farm’s online quote tool can help you navigate the process effortlessly.

The online quote process is straightforward and requires basic information about your property, location, and desired coverage. By inputting this information, you can quickly receive an estimated quote for your home insurance, allowing you to compare different plans and make an informed decision. This digital tool empowers you to take control of your insurance journey, providing you with valuable insights and flexibility.

State Farm Home Insurance Overview

State Farm is a leading provider of home insurance in the United States, with a long history of serving customers and protecting their homes. Founded in 1922, State Farm has grown into a trusted and reliable name in the insurance industry. The company’s commitment to customer satisfaction and its extensive network of agents have contributed to its enduring success.

History and Role in the Home Insurance Market, State farm home insurance online quote

State Farm’s origins can be traced back to 1922 when George J. Mecherle, a farmer from Bloomington, Illinois, established the company to provide affordable automobile insurance to his fellow farmers. Over the years, State Farm expanded its offerings to include home insurance, life insurance, and other financial products.

State Farm’s dedication to providing comprehensive home insurance coverage has solidified its position as a major player in the market. The company offers a wide range of insurance policies designed to meet the diverse needs of homeowners.

Core Values and Mission Statement

State Farm’s core values are deeply rooted in its commitment to customer service, integrity, and financial strength. These values are reflected in its mission statement: “To help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.”

In the context of home insurance, State Farm strives to provide homeowners with peace of mind by offering comprehensive coverage, competitive pricing, and exceptional customer service. The company’s commitment to these values has earned it a reputation for reliability and trustworthiness.

Target Audience and Needs

State Farm home insurance is designed to cater to a wide range of homeowners, from first-time buyers to seasoned investors. The company recognizes that different homeowners have different needs and priorities, and it tailors its insurance policies accordingly.

For example, first-time homebuyers may be looking for affordable coverage that protects their investment, while seasoned investors may require more comprehensive coverage to safeguard their assets. State Farm offers a variety of options to meet the specific needs of each customer, including:

- Standard coverage: This provides basic protection against common perils such as fire, theft, and vandalism.

- Comprehensive coverage: This offers more extensive protection, including coverage for natural disasters, floods, and earthquakes.

- Customized coverage: This allows homeowners to tailor their policies to meet their specific needs and budget.

State Farm also offers a range of additional features and benefits, such as:

- Discounts: Homeowners can save money on their premiums by taking advantage of various discounts, such as those for home security systems, smoke detectors, and multiple policies.

- Claims service: State Farm has a reputation for providing prompt and efficient claims service, ensuring that homeowners can recover from unexpected events quickly and easily.

- Agent support: State Farm has a vast network of agents who are available to provide personalized advice and support to homeowners.

Online Quote Process: State Farm Home Insurance Online Quote

Getting a quote for State Farm home insurance online is a simple and straightforward process. You can easily obtain a personalized estimate by providing some basic information about your property and coverage needs.

Information Required

The online quote process requires you to provide information about your property and coverage preferences. This includes:

- Property Address: This is crucial for determining the risk factors associated with your location, such as the prevalence of natural disasters and crime rates.

- Property Type: Whether it’s a single-family home, condo, townhouse, or other dwelling type, this information helps assess the structure’s characteristics and potential risks.

- Year Built: The age of your home influences its overall condition and potential maintenance needs, which impact insurance costs.

- Square Footage: This determines the size of your home and the potential value of your belongings.

- Number of Bedrooms and Bathrooms: These details provide insights into the home’s size and potential living arrangements, which may influence insurance premiums.

- Construction Materials: The type of materials used in your home’s construction, such as brick, wood, or concrete, affects its resilience to various hazards.

- Coverage Preferences: You can choose from various coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Your preferences influence the overall premium.

- Deductible: Choosing a higher deductible typically leads to lower premiums. This represents the amount you pay out of pocket before insurance kicks in.

Factors Influencing the Quote

The final quote for your State Farm home insurance policy is determined by a combination of factors, including:

- Coverage Options: The level of coverage you choose, such as dwelling coverage, personal property coverage, and liability coverage, directly impacts the premium. More comprehensive coverage generally results in higher premiums.

- Location: Your property’s location plays a significant role in determining your insurance premium. Factors like crime rates, natural disaster risk, and proximity to fire hydrants all influence the risk assessment.

- Property Details: The characteristics of your home, such as its age, size, construction materials, and safety features, affect the likelihood of potential claims and, consequently, your premium.

- Credit Score: In some states, insurance companies may consider your credit score as a factor in determining your premium. This is because credit history can be an indicator of financial responsibility.

- Safety Features: Installing safety features, such as smoke detectors, burglar alarms, and fire sprinklers, can reduce your insurance premium by demonstrating a lower risk of potential claims.

- Previous Claims History: If you have a history of filing claims, it can increase your premium. However, maintaining a clean claims history can lead to discounts.

Available Coverage Options

State Farm offers a comprehensive range of home insurance coverage options to protect your property and belongings from various risks. Understanding the different coverage options and their benefits is crucial in choosing the right policy for your needs.

Coverage Options

Here is a breakdown of the most common coverage options offered by State Farm home insurance:

| Coverage | Description | Key Features |

|---|---|---|

| Dwelling Coverage | This coverage protects your home’s structure, including the walls, roof, foundation, and attached structures like garages and porches, against damage caused by covered perils. | Covers damage from fire, lightning, windstorms, hail, vandalism, and other specified perils. The amount of coverage you choose determines the maximum payout for dwelling damage. |

| Other Structures Coverage | This coverage protects detached structures on your property, such as sheds, fences, and detached garages, from covered perils. | Similar to dwelling coverage, it provides financial protection for damage to these structures. |

| Personal Property Coverage | This coverage protects your belongings inside your home, such as furniture, appliances, clothing, and electronics, from covered perils. | Covers damage or loss of personal property due to covered perils, up to a specified limit. |

| Loss of Use Coverage | This coverage provides financial assistance if you are unable to live in your home due to a covered loss. | Covers additional living expenses, such as hotel stays or temporary housing, while your home is being repaired or rebuilt. |

| Personal Liability Coverage | This coverage protects you from financial liability if someone is injured on your property or if you accidentally damage someone else’s property. | Covers legal defense costs and settlements for claims arising from personal liability incidents. |

| Medical Payments Coverage | This coverage pays for medical expenses for injuries sustained by guests on your property, regardless of fault. | Provides immediate financial assistance for medical bills, even if you are not legally responsible for the injury. |

Advantages of State Farm Home Insurance

Choosing the right home insurance can be a significant decision, and State Farm offers a range of advantages that make it a strong contender for protecting your most valuable asset. With its reputation for reliability, comprehensive coverage options, and customer-centric approach, State Farm has become a trusted name in the insurance industry. Let’s delve into the key advantages that set State Farm apart.

Convenience and Speed of Online Quoting

The online quoting process offered by State Farm is a testament to its commitment to providing a seamless and efficient customer experience. By utilizing the online platform, you can obtain a personalized quote quickly and conveniently, without the need for lengthy phone calls or in-person visits. This streamlined approach allows you to compare different coverage options and find the best fit for your needs within minutes. The online quoting tool guides you through a series of simple questions, gathering the necessary information to generate an accurate and tailored quote. This eliminates the hassle of traditional methods, saving you valuable time and effort.

Customer Service and Claims Handling Experience

State Farm prioritizes its customers’ satisfaction and has built a reputation for exceptional customer service. Their dedicated team of agents is available to answer your questions, provide guidance, and address any concerns you may have throughout the insurance process. When it comes to claims handling, State Farm strives to make the experience as smooth and hassle-free as possible. They have a well-established claims process that is designed to be efficient and transparent. From the initial reporting of the claim to the final settlement, State Farm’s claims professionals are committed to supporting you every step of the way. They offer a variety of communication channels, including phone, email, and online platforms, to ensure that you can reach them conveniently and receive prompt assistance. State Farm’s commitment to customer satisfaction is reflected in its consistently high customer ratings and its dedication to resolving claims fairly and promptly.

Considerations and Comparisons

Choosing the right home insurance provider is an important decision, as it can significantly impact your financial security in case of unforeseen events. While State Farm is a reputable and well-known insurer, it’s essential to compare it with other major providers and understand its potential drawbacks to make an informed choice.

Comparing State Farm with Other Providers

When comparing State Farm with other major providers, consider factors such as:

- Coverage options: Compare the types of coverage offered by different providers, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. For example, State Farm offers a wide range of coverage options, but you should compare these options with other providers to ensure they meet your specific needs.

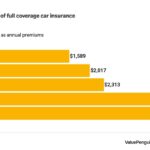

- Premiums: Get quotes from multiple insurers to compare premium rates. Factors such as your location, home value, coverage amount, and deductibles can influence premium costs. You can use online comparison tools to quickly get quotes from different insurers and compare rates.

- Customer service: Read customer reviews and ratings to assess the quality of customer service provided by different insurers. State Farm has a strong reputation for customer service, but it’s essential to consider other providers’ feedback to ensure you choose an insurer with a responsive and helpful customer support team.

- Financial stability: Check the financial strength ratings of potential insurers to ensure they are financially sound and capable of meeting claims obligations. State Farm has consistently received high financial strength ratings, indicating its stability and ability to pay claims. However, it’s always advisable to verify the financial stability of other providers you’re considering.

Potential Drawbacks of State Farm Home Insurance

While State Farm offers competitive home insurance policies, it’s important to be aware of potential drawbacks:

- Premium rates: While State Farm generally offers competitive rates, they can vary depending on your location and risk profile. In some cases, other providers may offer lower premiums, so it’s essential to compare rates before making a decision.

- Claims handling: While State Farm has a reputation for efficient claims handling, there have been instances of delays or difficulties in processing claims. It’s essential to review customer reviews and complaints to assess the insurer’s claims handling practices.

- Availability: State Farm’s availability can vary depending on your location. In some areas, it may not offer coverage or may have limited coverage options.

Factors to Consider When Choosing a Home Insurance Provider

When selecting a home insurance provider, consider these factors:

- Your individual needs: Determine the specific coverage you require based on your home’s value, personal belongings, and potential risks. For example, if you have valuable artwork or jewelry, you may need additional coverage for these items.

- Your budget: Set a budget for your home insurance premiums and compare quotes from different providers to find the best value for your money.

- Customer service and claims handling: Look for an insurer with a strong reputation for customer service and efficient claims handling. Read customer reviews and ratings to assess the insurer’s track record.

- Financial stability: Choose a financially sound insurer with a strong financial rating to ensure they can meet their obligations in case of a claim.

- Discounts and benefits: Explore available discounts and benefits offered by different insurers, such as discounts for home security systems, fire alarms, or bundling policies.

Tips for Obtaining the Best Quote

Getting the most competitive home insurance quote from State Farm involves understanding your needs, utilizing available discounts, and carefully reviewing the policy details. By taking these steps, you can ensure you’re getting the best value for your money.

Leveraging Discounts and Special Offers

State Farm offers various discounts that can significantly reduce your premium. These discounts are designed to reward policyholders for responsible behavior and risk mitigation.

- Bundle Discounts: Combining your home insurance with other State Farm policies, such as auto or renters insurance, can lead to substantial savings.

- Safety Features: Installing security systems, smoke detectors, and other safety features in your home can qualify you for discounts. These features demonstrate a lower risk profile, making your home more appealing to insurers.

- Loyalty Discounts: Being a long-time State Farm customer can result in a discount, rewarding your continued business and trust in the company.

- Payment Discounts: Paying your premium annually or semi-annually often leads to a discount compared to monthly payments.

- Good Driving Record: If you have a clean driving record, you might qualify for a discount on your home insurance, as State Farm sees this as an indicator of responsible behavior.

Understanding Policy Details

Before finalizing your quote, it’s crucial to review the policy details carefully. Understanding the coverage limits, deductibles, and exclusions will ensure you’re getting the protection you need.

“It’s important to ensure your policy covers the specific risks you face, such as natural disasters or theft, and that the coverage limits are sufficient to cover your property’s value.”

- Coverage Limits: This refers to the maximum amount State Farm will pay for a covered loss. It’s essential to choose coverage limits that reflect the full replacement value of your home and possessions.

- Deductibles: The deductible is the amount you pay out-of-pocket before State Farm starts covering your claim. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

- Exclusions: These are specific events or situations that are not covered by your policy. It’s crucial to understand these exclusions to avoid surprises during a claim.

Seeking Professional Guidance

If you’re unsure about which coverage options or discounts apply to you, don’t hesitate to reach out to a State Farm agent. They can provide personalized guidance and help you find the best policy for your needs.

Last Point

Getting a State Farm home insurance online quote is a valuable step in securing the right protection for your home. By understanding the process, exploring coverage options, and comparing prices, you can confidently choose a policy that aligns with your needs and budget. Remember to review the policy details carefully and contact State Farm directly if you have any questions or require further clarification. With the convenience of online quoting and the expertise of State Farm, you can navigate the home insurance landscape with ease and peace of mind.

Popular Questions

How long does it take to get an online quote?

The online quote process is usually quick, often taking just a few minutes to complete. However, the time may vary depending on the complexity of your request and the information provided.

Can I get a quote without providing personal information?

To receive a personalized quote, you will need to provide some basic information about yourself and your property. This helps State Farm tailor the quote to your specific needs.

What happens after I get an online quote?

After receiving your online quote, you can review it carefully and compare it to other options. If you decide to proceed, you can contact State Farm to discuss the details and finalize the policy.