State Farm Home and Auto Insurance stands as a leading force in the insurance industry, offering comprehensive protection for your most valuable assets. With a rich history and a commitment to customer satisfaction, State Farm has become a trusted name in the world of insurance. This guide delves into the various facets of State Farm’s offerings, from their comprehensive coverage options to their digital tools and community involvement.

State Farm’s reputation for reliability and financial stability is solidified by its strong market presence and customer-centric approach. Whether you’re seeking coverage for your home, your car, or both, State Farm provides a range of policies tailored to meet your individual needs. This guide will explore the key features of State Farm’s home and auto insurance, including their coverage options, pricing strategies, customer service, and digital resources. We’ll also examine State Farm’s commitment to social responsibility and their role in the communities they serve.

State Farm

State Farm is a leading insurance provider in the United States, known for its comprehensive range of insurance products and services. Founded in 1922, the company has grown into a household name, synonymous with reliability and customer satisfaction.

State Farm’s History and Founding Principles

State Farm was established in 1922 by George J. Mecherle in Bloomington, Illinois. Mecherle, a former teacher and insurance agent, believed in providing affordable and accessible insurance to the average American. He focused on building a company with strong ethical principles, emphasizing fairness, honesty, and customer service. This philosophy has remained central to State Farm’s identity throughout its history.

State Farm’s Market Presence

State Farm’s geographical reach is extensive, with operations across the United States and its territories. The company holds a significant market share in the home and auto insurance sectors, consistently ranking among the top providers. Its widespread presence is a testament to its strong brand recognition and customer loyalty.

State Farm’s Reputation and Brand Image, State farm home and auto insurance

State Farm has cultivated a reputation for reliability, customer service, and financial stability. Its brand image is often associated with trustworthiness, community involvement, and a commitment to customer satisfaction. The company’s long history, strong financial performance, and positive customer reviews have contributed to its positive brand perception.

Home Insurance Coverage Offered by State Farm

State Farm offers a variety of home insurance coverage options to protect your most valuable asset: your home. They offer a range of plans to fit your specific needs and budget, including standard, enhanced, and customized coverage plans.

Dwelling Coverage

Dwelling coverage protects your home’s structure, including the attached garage, from various perils such as fire, windstorm, hail, and vandalism. This coverage pays for repairs or replacement of the damaged structure, up to the policy’s limit.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry, against covered perils. This coverage typically pays for the actual cash value or replacement cost of the damaged or stolen items, depending on your policy’s terms.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. This coverage covers legal defense costs and any financial settlements or judgments awarded against you.

Additional Living Expenses

Additional living expenses coverage helps cover the costs of temporary housing, food, and other essential expenses if you’re unable to live in your home due to a covered peril. This coverage helps you maintain a comfortable standard of living while your home is being repaired or rebuilt.

Policy Options

State Farm offers several policy options to tailor your coverage to your specific needs. These options include:

- Standard Coverage: This basic coverage provides protection against common perils like fire, windstorm, and hail. It’s often the most affordable option but may not cover all potential risks.

- Enhanced Coverage: This option provides broader protection than standard coverage, covering additional perils like earthquakes, floods, and sewer backups. It offers greater peace of mind but comes at a higher premium.

- Customized Coverage: This option allows you to choose specific coverage limits and deductibles for different aspects of your home insurance policy. This allows you to create a policy that perfectly meets your individual needs and budget.

Coverage Scenarios

Here are some examples of how State Farm’s home insurance policies address specific coverage scenarios:

- Fire Damage: If your home is damaged by fire, dwelling coverage would pay for repairs or replacement of the damaged structure, while personal property coverage would reimburse you for lost or damaged belongings.

- Theft: If your home is burglarized and belongings are stolen, personal property coverage would help replace the stolen items.

- Natural Disasters: State Farm offers coverage for various natural disasters, including hurricanes, tornadoes, earthquakes, and floods (with optional coverage). This coverage can help you rebuild your home and replace your belongings after a disaster.

Auto Insurance Coverage Offered by State Farm: State Farm Home And Auto Insurance

State Farm offers comprehensive auto insurance coverage designed to protect you and your vehicle in various situations. This coverage includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage. These coverages provide financial protection in case of accidents, theft, vandalism, and other unforeseen events.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes injury or damage to others. This coverage pays for the other driver’s medical expenses, property damage, and legal fees. The amount of liability coverage you need depends on your individual circumstances, such as your assets and the risk of being involved in an accident.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is essential if you want to protect your investment in your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. This coverage is also optional, but it can be valuable if you live in an area prone to these events.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. This coverage pays for your medical expenses, lost wages, and property damage.

Policy Options

State Farm offers various policy options to meet your individual needs and budget. These options include:

- Standard Coverage: This is the basic level of coverage that meets the minimum requirements in most states. It includes liability, collision, and comprehensive coverage.

- Enhanced Coverage: This option provides additional coverage, such as higher liability limits, uninsured/underinsured motorist coverage, and roadside assistance.

- Customized Coverage: This option allows you to tailor your coverage to your specific needs and budget. You can choose the coverage you need and exclude the coverage you don’t.

Coverage Scenarios

Here are some examples of how State Farm’s auto insurance policies address specific coverage scenarios:

- Accident: If you are involved in an accident, your liability coverage will pay for the other driver’s medical expenses, property damage, and legal fees. Your collision coverage will pay for repairs to your vehicle, regardless of who is at fault.

- Theft: If your vehicle is stolen, your comprehensive coverage will pay for the replacement value of your vehicle, subject to a deductible.

- Vandalism: If your vehicle is vandalized, your comprehensive coverage will pay for repairs or replacement, subject to a deductible.

State Farm’s Customer Service and Claims Process

State Farm, a leading insurance provider in the United States, is known for its comprehensive coverage options and commitment to customer satisfaction. The company offers a range of customer service channels and a streamlined claims process designed to provide a positive experience for policyholders.

State Farm’s Customer Service Channels

State Farm provides various customer service channels to cater to the diverse needs of its policyholders. These channels ensure accessibility and convenience, allowing customers to connect with State Farm representatives whenever and however they prefer.

- Online Platforms: State Farm offers a user-friendly website and mobile app, allowing customers to manage their policies, pay premiums, access documents, and submit claims online. The online platform provides a convenient and efficient way for customers to interact with State Farm, offering 24/7 access to account information and resources.

- Mobile Apps: State Farm’s mobile app offers a range of features, including policy management, claim reporting, roadside assistance requests, and access to digital ID cards. The app provides a convenient and on-the-go solution for policyholders, allowing them to manage their insurance needs from their smartphones.

- Phone Support: State Farm offers dedicated phone lines for customer service, claims reporting, and specific departments, such as roadside assistance. Customers can reach a representative through these phone lines for assistance with a wide range of inquiries, including policy changes, billing issues, and claim guidance.

State Farm’s Claims Process

State Farm’s claims process is designed to be straightforward and efficient, aiming to provide a seamless experience for policyholders who need to file a claim. The process involves several steps, ensuring transparency and timely resolution.

- Reporting a Claim: Policyholders can report a claim through various channels, including online platforms, mobile apps, or phone calls. State Farm provides clear instructions and guidance on how to report a claim, ensuring that all necessary information is collected.

- Handling the Investigation: Once a claim is reported, State Farm initiates an investigation to gather information and assess the validity of the claim. This may involve contacting witnesses, reviewing documentation, and inspecting the damaged property. The investigation process aims to ensure fairness and accuracy in determining the extent of the damage and the amount of compensation due.

- Receiving Compensation: Upon completion of the investigation, State Farm determines the amount of compensation due to the policyholder based on the terms of their policy and the assessed damage. Compensation can be provided in various forms, including direct payments, repair services, or replacement of damaged property. State Farm aims to resolve claims promptly and fairly, ensuring that policyholders receive the compensation they are entitled to.

Comparison with Other Insurance Providers

State Farm’s customer service and claims process is generally considered to be competitive with other major insurance providers. The company’s strong reputation for customer satisfaction, coupled with its comprehensive online and mobile resources, provides a positive experience for many policyholders.

- Strengths: State Farm’s customer service is often praised for its accessibility, responsiveness, and personalized approach. The company’s commitment to resolving claims promptly and fairly is also a significant strength, contributing to its positive reputation in the industry.

- Weaknesses: While State Farm generally receives positive feedback, some customers have reported occasional delays in claim processing or difficulties navigating the online platform. However, these issues are typically isolated and do not detract from State Farm’s overall reputation for customer service and claims handling.

State Farm’s Pricing and Discounts

State Farm, a leading insurance provider, employs a comprehensive pricing strategy for its home and auto insurance policies, taking into account various factors to ensure fair and competitive rates. This approach involves assessing individual risk profiles, considering coverage levels, and factoring in location-specific considerations. Additionally, State Farm offers a wide array of discounts to reward safe driving practices, loyalty, and other positive behaviors.

State Farm’s Pricing Strategy

State Farm’s pricing strategy is designed to be fair and transparent, reflecting the individual risk profile of each policyholder. This means that factors like the age, driving history, and location of the insured individual are considered when determining premiums.

- Coverage Levels: State Farm offers various coverage levels for both home and auto insurance, ranging from basic to comprehensive. Choosing higher coverage levels naturally leads to higher premiums, as you are essentially paying for greater financial protection in case of an incident.

- Risk Assessments: State Farm employs sophisticated risk assessment models to evaluate the likelihood of claims for each policyholder. These models consider factors such as driving history, credit score, and even the location of the insured property. Individuals with a lower risk profile, such as those with a clean driving record and a well-maintained home, are often eligible for lower premiums.

- Location-Specific Considerations: Location plays a crucial role in determining insurance premiums, as it influences factors such as the frequency and severity of claims. Areas with higher crime rates, natural disaster risks, or denser traffic may have higher insurance premiums.

Discounts Offered by State Farm

State Farm offers a variety of discounts to its policyholders, rewarding safe driving practices, loyalty, and other positive behaviors. These discounts can significantly reduce premiums and make insurance more affordable.

- Safe Driving Discounts: State Farm offers discounts for drivers with clean driving records, such as those who have not been involved in accidents or received traffic violations. These discounts can be substantial, especially for drivers with a long history of safe driving.

- Multi-Policy Discounts: State Farm offers discounts to policyholders who bundle their home and auto insurance policies. This is a significant benefit, as it allows you to save money by insuring multiple vehicles or properties with the same provider.

- Good Student Discounts: State Farm offers discounts to students who maintain a certain GPA. This discount is designed to encourage academic achievement and reward responsible behavior.

- Other Discounts: State Farm also offers a range of other discounts, including those for homeowners who install security systems, those who pay their premiums in full, and those who are members of certain organizations.

Comparison with Other Insurance Providers

State Farm’s pricing and discounts are generally competitive with other major insurance providers. The company’s focus on risk assessment and its wide range of discounts help to make its insurance policies affordable for a wide range of individuals. However, it’s important to compare quotes from multiple insurers to ensure you’re getting the best possible rate.

- Competitive Advantages: State Farm’s competitive advantages include its strong financial stability, its wide range of discounts, and its commitment to customer service.

- Competitive Disadvantages: Some potential disadvantages of State Farm include its pricing, which can sometimes be higher than other providers, and its limited availability in certain regions.

State Farm’s Digital Tools and Resources

State Farm offers a suite of digital tools and resources to enhance the customer experience, making it easier to manage policies, report claims, and access support. These digital tools are designed to provide convenience, efficiency, and 24/7 accessibility.

State Farm Website

State Farm’s website serves as a central hub for information and services. It provides comprehensive information about State Farm’s products and services, including home and auto insurance, life insurance, and financial products. Customers can access their policy information, make payments, manage their accounts, and find local agents.

State Farm Mobile App

The State Farm mobile app is a powerful tool that allows customers to manage their insurance needs on the go. The app offers a wide range of functionalities, including:

- Policy Management: View policy details, make payments, update contact information, and access digital ID cards.

- Claims Reporting: Report claims, track their status, and submit supporting documentation.

- Roadside Assistance: Request roadside assistance services, such as towing or jump starts.

- Customer Support: Contact customer service representatives through chat or phone.

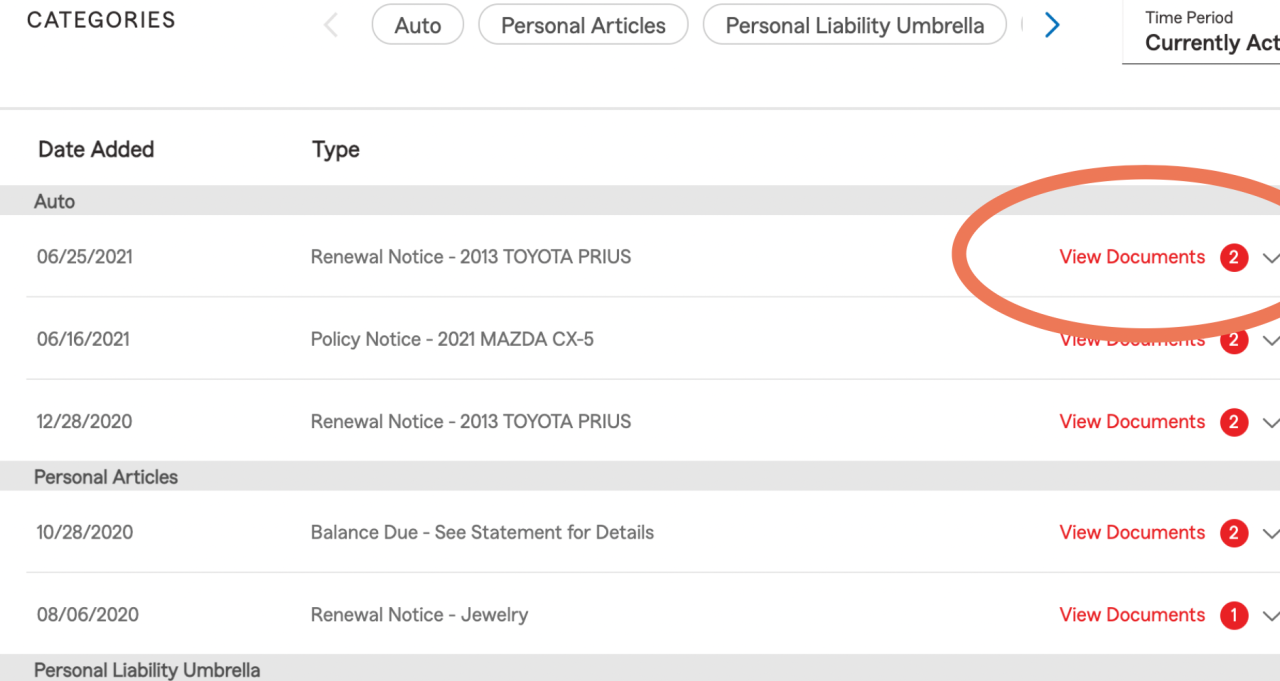

- Digital Documents: Access digital copies of policy documents and claim reports.

State Farm Online Portal

The State Farm online portal provides a secure platform for managing policies and accessing account information. Customers can:

- View Policy Details: Access policy summaries, coverage details, and payment history.

- Make Payments: Pay premiums online through various payment methods.

- Manage Auto Coverage: Update vehicle information, add or remove drivers, and make changes to coverage.

- Review Claims: Track the progress of claims, submit documentation, and communicate with adjusters.

Benefits of Using State Farm’s Digital Tools

State Farm’s digital tools offer numerous benefits, including:

- Convenience: Access services anytime, anywhere, without the need for phone calls or visits to physical offices.

- Efficiency: Streamline processes, such as policy management, claims reporting, and payment, saving time and effort.

- Accessibility: 24/7 access to information and services, regardless of location or time of day.

- Security: Secure online portal and mobile app with encryption and multi-factor authentication to protect sensitive information.

- Personalized Experience: Tailored information and services based on individual policy needs and preferences.

Limitations of Using State Farm’s Digital Tools

While State Farm’s digital tools offer significant advantages, there are some limitations to consider:

- Technical Requirements: Access to a computer or mobile device with internet connectivity is required.

- Digital Literacy: Users need basic digital literacy skills to navigate the website and mobile app.

- Limited Personal Interaction: Digital tools may not be suitable for complex situations that require personal interaction with an agent.

- Potential Security Risks: Despite security measures, there is always a risk of cyberattacks or data breaches.

State Farm’s Community Involvement and Social Responsibility

State Farm is known for its commitment to giving back to the communities it serves. Beyond providing insurance products, the company actively participates in various initiatives that aim to improve the well-being of its customers and the broader society.

State Farm’s Community Involvement Initiatives

State Farm’s community involvement initiatives are diverse and impactful. They reflect the company’s desire to make a positive difference in the lives of its customers and the communities where they live.

- Sponsoring Local Events: State Farm sponsors a wide range of local events, including sporting events, festivals, and community gatherings. This support helps to foster a sense of community and provides opportunities for State Farm to connect with its customers in a meaningful way. For example, State Farm is a long-time sponsor of the National Football League (NFL), showcasing its commitment to supporting sports and entertainment events that resonate with its customer base.

- Supporting Charities: State Farm contributes significantly to charitable organizations that focus on various causes, such as education, disaster relief, and social justice. This support demonstrates State Farm’s commitment to addressing societal issues and improving the lives of those in need. For example, State Farm partners with the American Red Cross to provide financial assistance and support to individuals and families affected by natural disasters.

- Promoting Safety Programs: State Farm actively promotes safety programs in communities across the country. These programs aim to educate individuals about various safety hazards and provide resources to help them stay safe. For example, State Farm’s “Drive Safe, Drive Smart” program educates drivers about safe driving practices and encourages responsible driving habits.

State Farm’s Commitment to Social Responsibility

State Farm’s commitment to social responsibility extends beyond its community involvement initiatives. The company strives to operate in an ethical and sustainable manner, demonstrating its dedication to environmental protection and responsible business practices.

- Environmental Sustainability Practices: State Farm is committed to reducing its environmental footprint through various sustainability initiatives. The company has implemented energy-efficient practices in its offices and operations, reducing its energy consumption and carbon emissions. For example, State Farm has invested in renewable energy sources, such as solar panels, to power its facilities.

- Ethical Business Conduct: State Farm adheres to a high standard of ethical business conduct, prioritizing transparency, integrity, and fairness in its dealings with customers, employees, and stakeholders. The company has implemented policies and procedures to ensure ethical decision-making and prevent unethical practices. For example, State Farm has a strong code of ethics that guides its employees in their daily interactions and decision-making.

Final Conclusion

State Farm Home and Auto Insurance offers a comprehensive suite of products and services designed to protect your most valuable assets. Their commitment to customer satisfaction, coupled with their strong financial standing and wide range of coverage options, makes State Farm a compelling choice for individuals and families seeking reliable insurance protection. By understanding the nuances of State Farm’s offerings, you can make informed decisions about your insurance needs and ensure that you have the right coverage to safeguard your future.

Questions and Answers

What are the different types of home insurance coverage offered by State Farm?

State Farm offers a variety of home insurance coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses. These coverages can be customized to meet your specific needs and budget.

How can I get a quote for State Farm home and auto insurance?

You can get a quote for State Farm home and auto insurance online, over the phone, or by visiting a local State Farm agent. The quote process is quick and easy, and you’ll receive a personalized quote based on your individual circumstances.

What are the benefits of bundling my home and auto insurance with State Farm?

Bundling your home and auto insurance with State Farm can save you money on your premiums. You may also be eligible for additional discounts, such as multi-policy discounts and safe driver discounts.

How do I file a claim with State Farm?

You can file a claim with State Farm online, over the phone, or by visiting a local State Farm agent. State Farm has a streamlined claims process, and their representatives are available to assist you every step of the way.