State Farm car insurance Texas has been a trusted name in the Lone Star State for decades, providing drivers with a range of coverage options and competitive rates. Whether you’re a seasoned driver or just getting behind the wheel, understanding your insurance needs is crucial, and State Farm offers a comprehensive approach to protecting you and your vehicle.

This guide will delve into the ins and outs of State Farm car insurance in Texas, exploring its history, policy types, pricing factors, customer service, discounts, community involvement, and digital resources. We’ll also provide valuable tips for choosing the right policy and saving money on your premiums.

State Farm Car Insurance in Texas

State Farm is one of the largest and most well-known car insurance providers in the United States, including Texas. The company has a long history in the state, having established its presence there decades ago.

History of State Farm in Texas

State Farm entered the Texas market in 1936, offering car insurance to residents. Over the years, the company has grown significantly, becoming a major player in the state’s insurance industry. State Farm’s success in Texas can be attributed to its commitment to providing affordable and comprehensive car insurance coverage, along with its strong customer service reputation.

Types of Car Insurance Policies Offered by State Farm in Texas

State Farm offers a variety of car insurance policies in Texas, designed to meet the diverse needs of its customers. These policies include:

- Liability insurance: This is the most basic type of car insurance, and it covers damages to other people’s property or injuries caused by an accident. It also covers legal expenses if you are sued for negligence. Texas law requires all drivers to carry a minimum amount of liability coverage.

- Collision insurance: This type of coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is recommended if you have a loan or lease on your vehicle.

- Comprehensive insurance: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. This coverage is also optional.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. This coverage is optional, but it is highly recommended.

Factors Influencing Car Insurance Premiums in Texas

Several factors can influence the cost of car insurance premiums in Texas, including:

- Age: Younger drivers, especially those under 25, generally pay higher premiums due to their higher risk of accidents.

- Driving history: Drivers with a history of accidents, traffic violations, or DUI convictions will likely face higher premiums. A clean driving record can lead to lower premiums.

- Vehicle type: The type of vehicle you drive can impact your premiums. Higher-performance or luxury vehicles tend to have higher insurance costs due to their higher repair costs and greater risk of theft.

- Location: Your location can influence premiums, as some areas have higher rates of accidents or theft than others. Urban areas often have higher premiums than rural areas.

Comparison of State Farm Car Insurance Rates in Texas

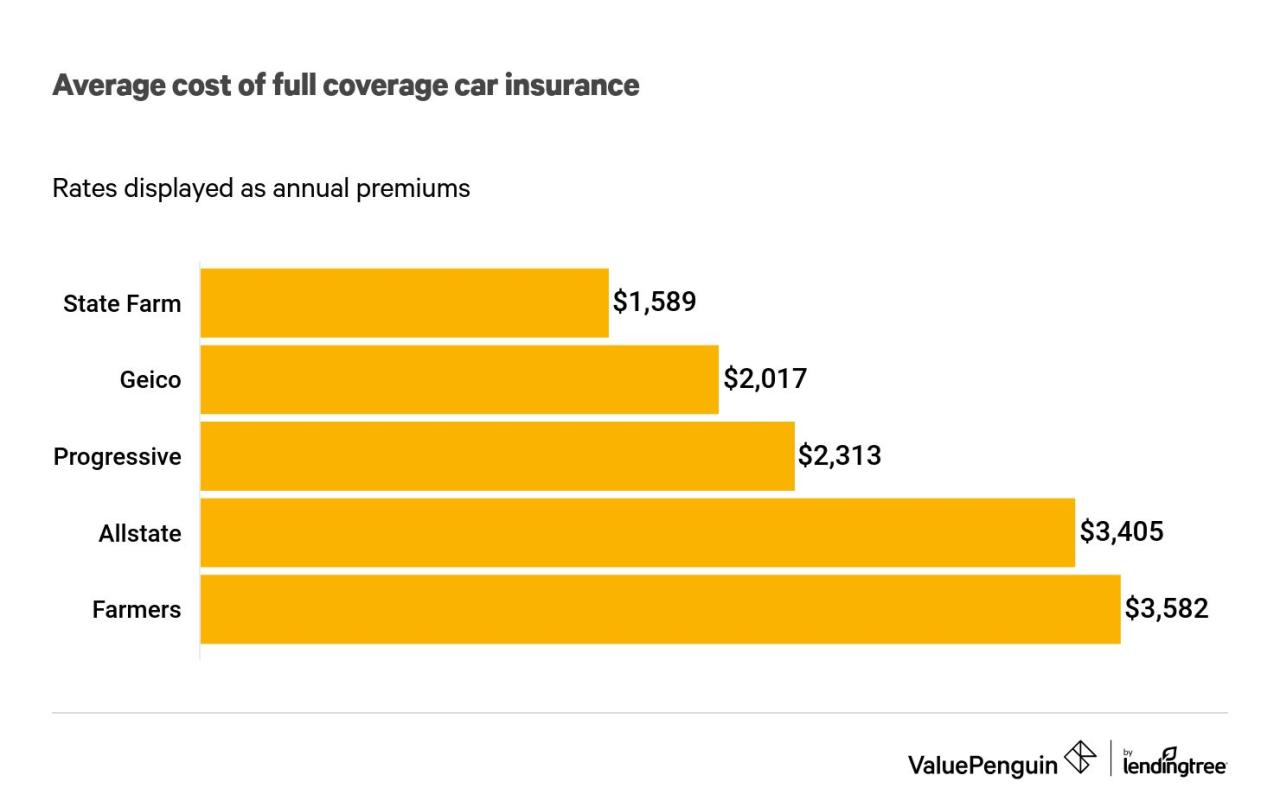

It is difficult to provide a definitive comparison of State Farm’s car insurance rates in Texas to those of other major insurance providers without specific details about your individual situation, such as your age, driving history, vehicle type, and location. However, you can use online comparison tools to get quotes from multiple insurers and compare rates side-by-side.

State Farm’s Customer Service and Claims Process in Texas

State Farm, a leading car insurance provider in Texas, strives to provide its policyholders with efficient and responsive customer service and claims handling. They offer a variety of channels for customers to reach them, and their claims process is designed to be straightforward and transparent.

Customer Service Channels

State Farm offers multiple channels for policyholders in Texas to access customer service. These channels provide convenient and accessible options for addressing inquiries, reporting claims, and managing policy details.

- Phone: State Farm maintains a dedicated customer service line for policyholders in Texas. This provides a direct and immediate way to connect with a representative for assistance with various needs, such as policy inquiries, claim reporting, and general support.

- Email: State Farm offers an email address for policyholders to reach their customer service team. This allows for written communication and detailed inquiries, providing a convenient option for those who prefer asynchronous communication.

- Online Chat: State Farm provides an online chat feature on its website for policyholders in Texas. This allows for real-time communication with a customer service representative, offering immediate assistance for inquiries and basic requests.

- Mobile App: State Farm has a mobile app that allows policyholders in Texas to manage their policies, report claims, and access other services. This app provides a convenient and readily accessible platform for managing insurance needs on the go.

Filing a Car Insurance Claim

State Farm in Texas provides a straightforward process for filing a car insurance claim. Policyholders can report a claim through various channels, including phone, email, or the mobile app.

- Reporting the Claim: When reporting a claim, policyholders need to provide basic information, such as their policy number, the date and time of the accident, and the location of the incident. They should also describe the details of the accident and any injuries involved.

- Necessary Documentation: State Farm may request specific documentation to support the claim, such as a police report, photos of the damage, and medical records if applicable. This documentation helps verify the details of the claim and expedite the processing.

- Claim Assessment: Once the claim is filed, State Farm will assess the damages and determine the coverage applicable to the claim. This assessment involves reviewing the policy details and the information provided by the policyholder.

Claim Settlement Process

State Farm in Texas aims to process claims efficiently and fairly. The claim settlement process involves several steps, including reviewing the claim, determining coverage, and making payments.

- Claim Review: State Farm’s claims adjusters review the information provided by the policyholder and assess the damage. They may conduct an inspection of the vehicle or property to verify the extent of the damage.

- Coverage Determination: Based on the policy details and the assessment of the damage, State Farm determines the coverage applicable to the claim. This involves identifying the specific coverage provisions that apply to the situation and calculating the amount of coverage available.

- Payment Options: Once the claim is approved, State Farm offers various payment options to policyholders. These options may include direct payments to repair shops, reimbursement for out-of-pocket expenses, or direct payments to the policyholder.

- Timeframe: The timeframe for processing claims varies depending on the complexity of the claim and the availability of necessary information. However, State Farm strives to resolve claims within a reasonable timeframe.

Customer Feedback

- Positive Feedback: Many State Farm customers in Texas have praised their customer service and claims handling. They appreciate the responsiveness of the representatives, the clear communication throughout the process, and the timely resolution of claims.

- Negative Feedback: Some customers have reported occasional delays in processing claims or difficulties reaching customer service representatives. These instances are often attributed to high claim volumes or specific circumstances.

State Farm’s Discounts and Benefits for Texas Drivers

State Farm, a leading car insurance provider in Texas, offers a range of discounts and benefits designed to help drivers save money and get the most out of their insurance policies. These perks can make a significant difference in your overall insurance costs, providing financial relief and peace of mind.

Discounts Offered by State Farm in Texas

State Farm offers a variety of discounts to its Texas policyholders, aiming to reward safe driving practices, responsible financial behavior, and loyalty. These discounts can significantly reduce your insurance premiums.

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating their responsible driving habits. The discount amount typically increases with each year of accident-free driving.

- Good Student Discount: This discount is available to students who maintain a certain grade point average (GPA) in school, highlighting their academic achievements and responsible nature.

- Multi-Policy Discount: This discount applies to policyholders who bundle multiple insurance policies, such as car insurance, homeowners insurance, or renters insurance, with State Farm. This demonstrates loyalty and provides a cost-effective solution for comprehensive insurance needs.

- Defensive Driving Course Discount: This discount is offered to drivers who complete a state-approved defensive driving course, demonstrating their commitment to safe driving practices and knowledge of traffic laws.

- Anti-theft Device Discount: This discount is available to policyholders who install anti-theft devices in their vehicles, reducing the risk of theft and demonstrating proactive security measures.

- Driver Training Discount: This discount is offered to drivers who have completed a driver training course, highlighting their commitment to safe driving practices and knowledge of traffic laws.

- Pay in Full Discount: This discount is awarded to policyholders who pay their premiums in full upfront, eliminating the need for installment payments and simplifying the payment process.

- Paperless Discount: This discount is offered to policyholders who opt for electronic communication and billing, reducing paper waste and promoting environmentally friendly practices.

- Loyalty Discount: This discount is offered to policyholders who have been with State Farm for a certain period, rewarding their long-term commitment and trust in the company.

Benefits Included in State Farm Car Insurance Policies in Texas

State Farm offers various benefits as part of its car insurance policies in Texas, providing comprehensive coverage and support beyond just financial compensation in case of an accident.

- Roadside Assistance: This benefit provides assistance in case of a breakdown, flat tire, or other roadside emergencies, including towing, jump-starts, and tire changes. This service ensures that you are not stranded on the side of the road and can access necessary help quickly and efficiently.

- Rental Car Coverage: This benefit covers the cost of a rental car if your vehicle is damaged or stolen, ensuring that you have transportation while your car is being repaired or replaced. This eliminates the inconvenience of being without a car and allows you to maintain your daily routines.

- Accident Forgiveness: This benefit waives your first accident, preventing a potential increase in your insurance premium due to a single incident. This offers peace of mind and protects your insurance rates, even in the event of an unexpected accident.

- 24/7 Customer Support: State Farm provides 24/7 customer support, ensuring that you have access to assistance and information whenever you need it. This includes support for claims, policy changes, and general inquiries, providing a convenient and reliable resource for all your insurance needs.

- Online and Mobile Services: State Farm offers convenient online and mobile services, allowing you to manage your policy, pay your premiums, and access information from anywhere with an internet connection. This provides a flexible and accessible platform for managing your insurance needs.

Comparison of State Farm Discounts and Benefits to Other Insurance Providers in Texas

State Farm’s discounts and benefits are competitive compared to other major insurance providers in Texas. However, the specific offerings and their eligibility criteria can vary between companies. It is essential to compare quotes from multiple providers to find the best deal tailored to your individual needs and circumstances.

- Progressive: Progressive offers discounts for safe driving, good student, and multi-policy, similar to State Farm. However, they also offer discounts for bundling home and auto insurance, even if the home insurance is not with Progressive. Additionally, Progressive has a unique “Name Your Price” tool that allows you to set your desired premium and see which coverage options fit within your budget.

- Geico: Geico offers discounts for safe driving, good student, and multi-policy, similar to State Farm. They also offer discounts for military personnel, federal employees, and members of certain organizations. Geico’s “Rate Guarantee” promises that your rate will not increase for 12 months if you maintain a clean driving record.

- USAA: USAA, a company that primarily serves military members and their families, offers discounts for safe driving, good student, and multi-policy, similar to State Farm. However, USAA also offers discounts for military affiliation, deployment, and military training. They also have a strong reputation for customer service and claims handling.

Eligibility Criteria for State Farm Discounts and Benefits in Texas

To be eligible for State Farm’s discounts and benefits in Texas, you must meet specific criteria. These criteria vary depending on the discount or benefit you are seeking.

- Safe Driver Discount: To be eligible for the Safe Driver Discount, you must have a clean driving record for a specified period, typically a year or more, without any accidents or traffic violations. This demonstrates your responsible driving habits and minimizes the risk of future claims.

- Good Student Discount: To be eligible for the Good Student Discount, you must be a student who maintains a certain GPA, typically a 3.0 or higher. This demonstrates your academic achievements and responsible nature, indicating a lower risk of accidents.

- Multi-Policy Discount: To be eligible for the Multi-Policy Discount, you must bundle multiple insurance policies with State Farm, such as car insurance, homeowners insurance, or renters insurance. This demonstrates your loyalty and provides a cost-effective solution for comprehensive insurance needs.

- Defensive Driving Course Discount: To be eligible for the Defensive Driving Course Discount, you must complete a state-approved defensive driving course. This demonstrates your commitment to safe driving practices and knowledge of traffic laws, reducing the risk of accidents.

- Anti-theft Device Discount: To be eligible for the Anti-theft Device Discount, you must install an anti-theft device in your vehicle, such as an alarm system or immobilizer. This reduces the risk of theft and demonstrates proactive security measures.

- Driver Training Discount: To be eligible for the Driver Training Discount, you must have completed a driver training course. This highlights your commitment to safe driving practices and knowledge of traffic laws, reducing the risk of accidents.

- Pay in Full Discount: To be eligible for the Pay in Full Discount, you must pay your premiums in full upfront, eliminating the need for installment payments. This simplifies the payment process and demonstrates your financial responsibility.

- Paperless Discount: To be eligible for the Paperless Discount, you must opt for electronic communication and billing, reducing paper waste and promoting environmentally friendly practices. This demonstrates your commitment to sustainability and efficiency.

- Loyalty Discount: To be eligible for the Loyalty Discount, you must have been a State Farm policyholder for a specified period, typically a year or more. This rewards your long-term commitment and trust in the company.

State Farm’s Community Involvement in Texas

State Farm is deeply committed to giving back to the communities it serves. Beyond providing insurance, the company actively engages in philanthropic activities and community outreach programs throughout Texas.

State Farm’s Philanthropic Activities and Community Outreach Programs

State Farm’s community involvement in Texas encompasses a wide range of initiatives. The company actively supports various local organizations and initiatives, demonstrating its commitment to improving the lives of Texans.

State Farm’s Support for Local Organizations and Initiatives

State Farm’s support for local organizations and initiatives in Texas is a testament to its dedication to community well-being.

- Education: State Farm has a strong commitment to education, partnering with organizations like the Texas Education Agency to promote financial literacy among students. They also support local schools through grants and volunteer programs.

- Disaster Relief: State Farm plays a crucial role in disaster relief efforts in Texas, providing financial assistance and resources to communities affected by natural disasters. They also mobilize their agents and employees to assist with recovery efforts.

- Community Safety: State Farm promotes community safety by supporting organizations like the Texas Department of Transportation that work to reduce traffic accidents and injuries. They also offer programs and resources to educate Texans about safe driving practices.

- Arts and Culture: State Farm actively supports the arts and culture scene in Texas, partnering with organizations like the Texas Commission on the Arts to promote artistic expression and cultural preservation.

- Health and Wellness: State Farm recognizes the importance of health and wellness, supporting organizations like the American Heart Association that work to improve the health of Texans. They also offer programs and resources to promote healthy lifestyles.

How State Farm’s Community Involvement Contributes to the Well-being of Texans

State Farm’s community involvement in Texas directly contributes to the well-being of Texans by:

- Promoting Education and Financial Literacy: By supporting education initiatives and promoting financial literacy, State Farm helps Texans develop essential skills for success in life and career.

- Enhancing Community Safety: Through their support for community safety programs, State Farm helps create safer environments for Texans to live, work, and play.

- Supporting Disaster Relief Efforts: State Farm’s commitment to disaster relief ensures that Texans receive timely assistance and support during times of crisis.

- Promoting Arts and Culture: By supporting arts and culture organizations, State Farm helps enrich the lives of Texans and foster a vibrant cultural landscape.

- Improving Health and Wellness: Through their support for health and wellness initiatives, State Farm helps Texans live healthier and more fulfilling lives.

State Farm’s Key Community Partnerships and Initiatives in Texas

State Farm’s commitment to community involvement is evident in their partnerships and initiatives.

| Partner Organization | Initiative | Impact |

|---|---|---|

| Texas Education Agency | Financial Literacy Program | Empowers students with financial knowledge and skills. |

| Texas Department of Transportation | Traffic Safety Campaign | Promotes safe driving practices and reduces accidents. |

| American Heart Association | Heart Health Awareness Campaign | Raises awareness about heart disease and promotes healthy lifestyles. |

| Texas Commission on the Arts | Arts and Culture Grants | Supports artistic expression and cultural preservation. |

| Local School Districts | Education Grants and Volunteer Programs | Provides financial support and volunteer assistance to schools. |

State Farm’s Digital Tools and Resources for Texas Drivers

State Farm, a leading car insurance provider in Texas, offers a wide array of digital tools and resources to help its policyholders manage their insurance needs conveniently and efficiently. These digital tools are designed to simplify the insurance experience, empowering Texas drivers to access their policies, make payments, file claims, and get support all from the comfort of their homes or on the go.

Benefits of Using State Farm’s Digital Tools

State Farm’s digital tools and resources provide numerous benefits for Texas drivers, including:

- Convenience: Accessing your insurance information, managing your policy, and contacting customer service is made easy with State Farm’s digital platforms. You can do it anytime, anywhere, without having to wait on hold or visit a physical office.

- Time-Saving: State Farm’s digital tools streamline various insurance tasks, saving you time and effort. You can easily pay your premiums, file claims, and track the progress of your claims online or through the mobile app.

- Efficiency: State Farm’s digital tools are designed to be user-friendly and intuitive, allowing you to quickly and easily find the information you need. This helps you manage your insurance needs efficiently, saving you time and reducing stress.

- Security: State Farm prioritizes the security of your personal information. Their digital platforms use advanced security measures to protect your data from unauthorized access.

- Personalized Experience: State Farm’s digital tools offer personalized experiences, tailoring information and features to your specific needs. For example, you can set up customized alerts for policy renewal reminders or claim updates.

Comparison of State Farm’s Digital Tools to Other Providers

State Farm’s digital tools and resources are highly competitive compared to other insurance providers in Texas. Their mobile app, online portal, and digital payment options are considered user-friendly and comprehensive.

- Mobile App: State Farm’s mobile app is a comprehensive platform for managing your insurance needs. It offers features like policy management, claims filing, roadside assistance, and 24/7 customer support. It’s available on both iOS and Android devices.

- Online Portal: State Farm’s online portal provides access to a wide range of services, including policy information, payment options, claim status updates, and customer service support. It’s accessible from any computer or mobile device.

- Digital Payment Options: State Farm offers multiple digital payment options, including online payments, mobile payments, and automatic payments. This allows you to choose the most convenient method for managing your premiums.

List of State Farm’s Digital Tools and Resources in Texas

State Farm provides a variety of digital tools and resources to help Texas drivers manage their car insurance needs:

- State Farm Mobile App: The State Farm mobile app is a powerful tool for managing your car insurance policy. You can use the app to:

- View your policy details and coverage information

- Make payments and track your payment history

- File claims and track their progress

- Access roadside assistance services

- Contact customer support

- Get personalized insurance recommendations

- State Farm Online Portal: The State Farm online portal offers a comprehensive suite of tools for managing your car insurance. You can use the portal to:

- View and manage your policy information

- Make payments and track your payment history

- File claims and track their progress

- Request policy changes and updates

- Access customer support and FAQs

- State Farm Digital Payment Options: State Farm offers various digital payment options for your convenience:

- Online Payments: Make secure payments directly from your bank account or credit card through the State Farm website or mobile app.

- Mobile Payments: Use your mobile wallet to make quick and easy payments through the State Farm mobile app.

- Automatic Payments: Set up automatic payments to ensure your premiums are paid on time, eliminating the need for manual reminders.

- State Farm Drive Safe & Save Program: This program uses telematics technology to track your driving habits and reward you for safe driving. By using a smartphone app or a device plugged into your car’s diagnostic port, you can earn discounts on your car insurance based on your driving behavior.

Tips for Choosing Car Insurance in Texas: State Farm Car Insurance Texas

Choosing the right car insurance policy in Texas is crucial for protecting yourself financially in case of an accident. With so many different options available, it can be overwhelming to decide which policy is best for you. Here are some tips to help you make an informed decision:

Understanding Your Coverage Needs

It’s important to understand your coverage needs based on your individual circumstances. Consider factors such as the value of your vehicle, your driving history, and your financial situation. For example, if you have a newer car with a high value, you may want to consider comprehensive and collision coverage. If you have a history of accidents or traffic violations, you may need to pay higher premiums for liability coverage.

Setting a Budget

Before you start shopping for car insurance, it’s essential to set a budget for your premiums. Consider how much you can afford to pay each month. Remember that higher coverage limits usually come with higher premiums. It’s a good idea to balance your coverage needs with your budget to find a policy that works for you.

Comparing Quotes

Comparing quotes from multiple insurance providers is crucial for finding the best possible rate. You can use online comparison tools or contact insurance agents directly to get quotes. Make sure to compare quotes for similar coverage levels to ensure you’re getting a fair comparison.

Negotiating Car Insurance Rates, State farm car insurance texas

Once you have a few quotes, you can try to negotiate lower rates. Here are some tips for negotiating:

- Ask about discounts: Many insurance providers offer discounts for things like good driving records, safety features in your car, and bundling multiple policies.

- Consider increasing your deductible: A higher deductible means you’ll pay more out of pocket if you have an accident, but it can lower your premium.

- Shop around regularly: It’s a good idea to compare quotes from different providers every year or two to ensure you’re still getting the best rate.

Key Factors to Consider When Choosing Car Insurance in Texas

| Factor | Description |

|---|---|

| Coverage Needs | Determine the type and amount of coverage you need based on your vehicle, driving history, and financial situation. |

| Budget | Set a realistic budget for your premiums and consider how much you can afford to pay each month. |

| Driving History | Your driving history, including accidents, violations, and years of driving experience, significantly impacts your premiums. |

| Vehicle Type | The make, model, and year of your vehicle influence your premiums, as some cars are considered more expensive to insure. |

| Location | Your location in Texas can affect your premiums due to factors like traffic density, crime rates, and weather conditions. |

| Insurance Provider | Compare quotes from multiple insurance providers to find the best rates and coverage options. |

Last Recap

With its strong reputation, extensive coverage options, and commitment to customer satisfaction, State Farm car insurance Texas stands out as a reliable choice for drivers seeking comprehensive protection. By understanding the various factors that influence your rates, taking advantage of available discounts, and utilizing State Farm’s digital tools, you can ensure you’re getting the best possible value for your insurance needs.

FAQs

How do I get a quote for State Farm car insurance in Texas?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

What are the common discounts offered by State Farm in Texas?

Common discounts include safe driver, good student, multi-policy, and defensive driving.

How do I file a claim with State Farm in Texas?

You can file a claim online, over the phone, or through the State Farm mobile app.