State Farm car insurance rates are a topic that many drivers are curious about. This well-established insurance company has a reputation for reliable coverage, but how do their rates compare to the competition? Understanding the factors that influence State Farm’s pricing can help you make informed decisions about your car insurance needs.

State Farm’s car insurance rates are calculated based on a variety of factors, including your driving history, the type of vehicle you drive, your location, and the coverage levels you choose. For example, drivers with a clean driving record and newer, safer vehicles may qualify for lower rates than those with a history of accidents or who drive older cars. Your location also plays a role, as rates can vary significantly depending on the risk of accidents in your area. It’s important to remember that State Farm offers a range of discounts, such as safe driver discounts, good student discounts, and multi-policy discounts, that can help you save money on your premiums.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, known for its comprehensive coverage options, competitive rates, and excellent customer service. Founded in 1922, State Farm has a long history of serving millions of policyholders nationwide. The company’s commitment to providing affordable and reliable insurance solutions has earned it a strong reputation for financial stability and customer satisfaction.

Key Features and Benefits

State Farm car insurance policies offer a range of features and benefits designed to protect you and your vehicle in case of an accident or other covered event.

- Comprehensive Coverage: State Farm offers comprehensive coverage that protects against damage to your vehicle caused by events like theft, vandalism, fire, and natural disasters.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision, regardless of who is at fault.

- Liability Coverage: State Farm’s liability coverage protects you financially if you are responsible for an accident that causes injury or damage to another person or property.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): PIP coverage helps pay for medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of fault.

- Rental Car Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: State Farm offers roadside assistance services, including towing, jump starts, flat tire changes, and lockout assistance.

- Discounts: State Farm offers a variety of discounts to help you save on your car insurance premiums, such as good driver discounts, multi-policy discounts, and safe driver discounts.

Factors Influencing Rates

State Farm, like other insurance companies, uses a complex system to calculate car insurance rates. This system considers various factors to determine the likelihood of you filing a claim, ultimately affecting your premium.

Driving History

Your driving history is a significant factor in determining your car insurance rates. State Farm considers your past driving record, including accidents, traffic violations, and driving experience. A clean driving record with no accidents or violations will likely result in lower rates. Conversely, having multiple accidents or traffic violations can significantly increase your premium. For example, a DUI conviction could lead to a substantial rate increase.

Vehicle Type

The type of vehicle you drive also plays a role in your car insurance rates. Some vehicles are more expensive to repair or replace, making them riskier to insure. For example, a luxury sports car with advanced features and expensive parts will typically have higher insurance rates than a basic sedan. Additionally, the safety features of your vehicle, such as airbags and anti-lock brakes, can influence your rates.

Location

Your location is a crucial factor in determining your car insurance rates. Areas with higher crime rates, more traffic congestion, or a higher frequency of accidents tend to have higher insurance premiums. For example, living in a densely populated city with a high volume of traffic may result in higher rates compared to living in a rural area with fewer cars on the road.

Coverage Levels

The amount of coverage you choose for your car insurance policy also affects your rates. Higher coverage levels, such as comprehensive and collision coverage, provide more protection but come at a higher cost. If you opt for a higher deductible, you will pay less in premiums but will have to pay more out of pocket if you file a claim. For instance, choosing a higher deductible for your collision coverage will result in lower monthly premiums, but you will be responsible for paying a larger portion of the repair costs if you are involved in an accident.

Rate Comparison with Competitors

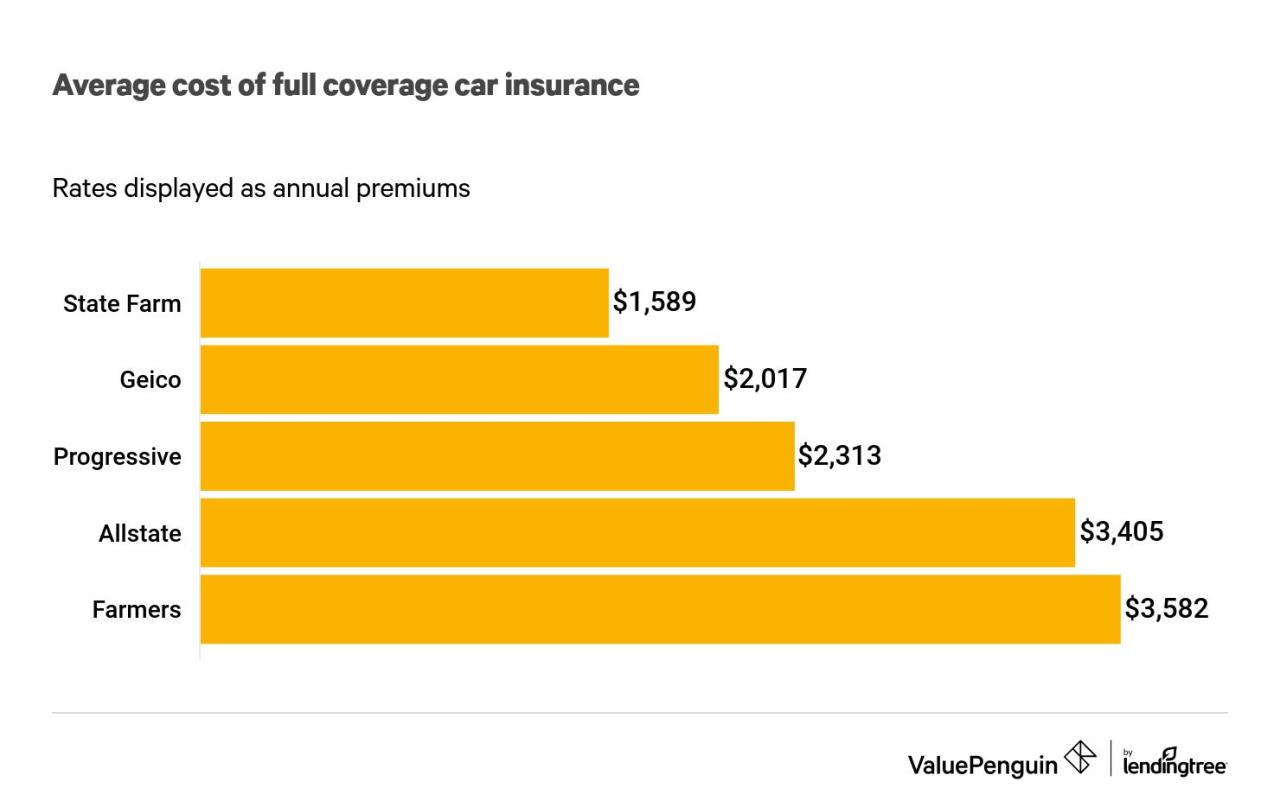

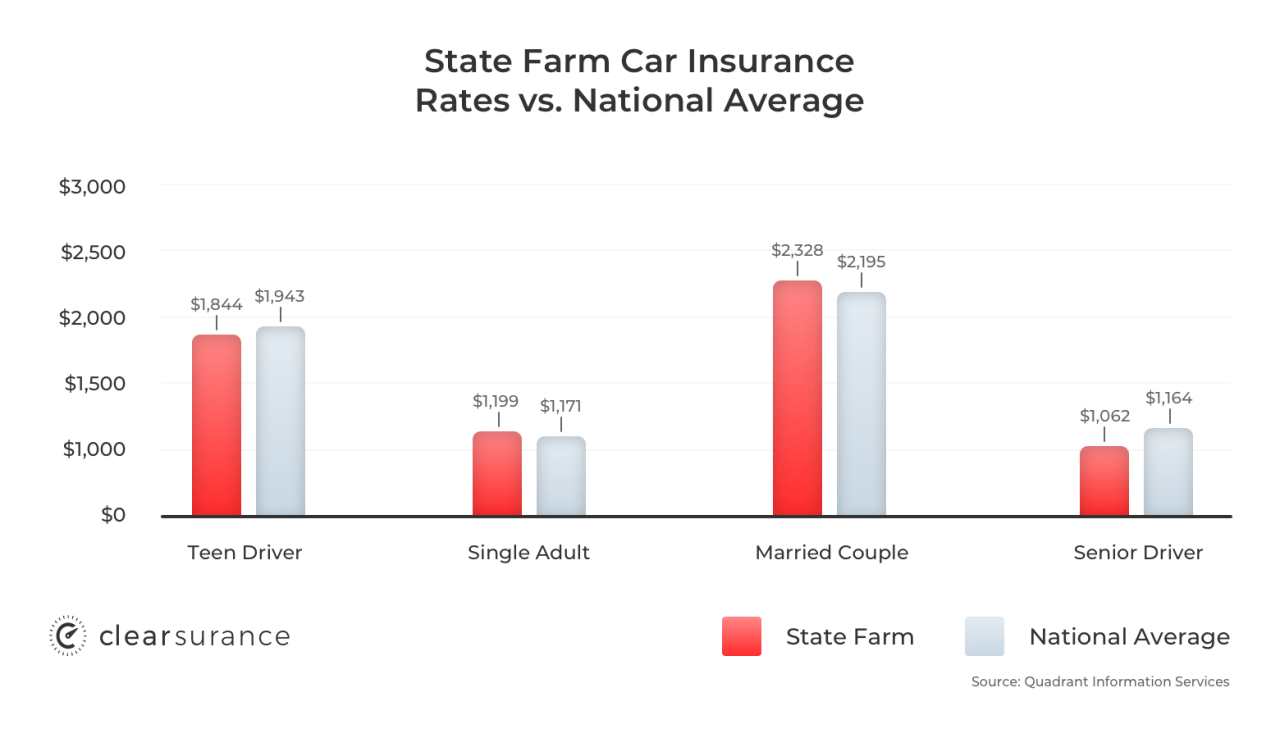

It is essential to compare State Farm car insurance rates with those of its major competitors to understand how its pricing strategies stack up. This comparison helps identify the most competitive options available in the market and determine the best value for your specific needs.

Comparison of Average Rates

The following table showcases the average annual car insurance premiums for specific car models and driver profiles across different insurance providers, including State Farm. These rates are based on national averages and may vary depending on factors like location, driving history, and coverage options.

| Insurance Provider | Car Model | Driver Profile | Average Annual Premium |

|---|---|---|---|

| State Farm | Toyota Camry | 35-year-old male with clean driving record | $1,200 |

| Geico | Toyota Camry | 35-year-old male with clean driving record | $1,100 |

| Progressive | Toyota Camry | 35-year-old male with clean driving record | $1,300 |

| Allstate | Toyota Camry | 35-year-old male with clean driving record | $1,400 |

| State Farm | Honda Civic | 25-year-old female with one speeding ticket | $1,500 |

| Geico | Honda Civic | 25-year-old female with one speeding ticket | $1,400 |

| Progressive | Honda Civic | 25-year-old female with one speeding ticket | $1,600 |

| Allstate | Honda Civic | 25-year-old female with one speeding ticket | $1,700 |

Pricing Strategies of Different Insurance Companies

Different insurance companies employ various pricing strategies to attract customers and remain competitive.

- State Farm: Known for its comprehensive coverage options and customer service, State Farm often positions itself as a reliable and trustworthy provider. Its pricing strategy focuses on offering competitive rates for a wide range of drivers, including those with good driving records and those with more complex needs.

- Geico: Geico is renowned for its aggressive pricing strategy, often offering lower rates than its competitors. Its focus on online and digital channels allows for more efficient operations, which translates to lower costs and more competitive pricing.

- Progressive: Progressive is known for its personalized pricing model, which considers various factors, including driving history, location, and car features. Its “Name Your Price” tool allows customers to set a budget and find coverage options that fit their needs and financial situation.

- Allstate: Allstate offers a variety of discounts and programs, including safe driving discounts and accident forgiveness. Its pricing strategy aims to attract customers by providing value-added services and competitive rates.

Discounts and Bundling Options

State Farm offers a variety of discounts to help you save money on your car insurance. These discounts can be applied to your policy based on factors such as your driving record, vehicle safety features, and your home insurance. In addition to discounts, State Farm also allows you to bundle your car insurance with other insurance products, such as homeowners or renters insurance, to potentially save even more.

Discounts

Discounts can significantly reduce your car insurance premiums. Here are some common discounts offered by State Farm:

- Good Driver Discount: This discount is available to drivers with a clean driving record, meaning no accidents or traffic violations. It can significantly reduce your premiums.

- Safe Driver Discount: This discount is offered to drivers who complete a defensive driving course, demonstrating their commitment to safe driving practices.

- Multi-Car Discount: If you insure multiple vehicles with State Farm, you may qualify for a discount on each policy.

- Multi-Policy Discount: Bundling your car insurance with other insurance products, such as homeowners or renters insurance, can result in significant savings.

- Anti-theft Device Discount: If your car is equipped with anti-theft devices, such as an alarm system or immobilizer, you may be eligible for a discount.

- Good Student Discount: Students with good grades may be eligible for a discount, reflecting their responsible behavior.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and may qualify you for a discount.

Bundling Options, State farm car insurance rates

Bundling your car insurance with other insurance products from State Farm, such as homeowners or renters insurance, can lead to substantial savings. This strategy combines your policies under a single umbrella, often resulting in discounted premiums.

- Homeowners or Renters Insurance: Bundling your car insurance with homeowners or renters insurance can significantly reduce your overall premiums. This strategy allows State Farm to offer a discounted rate for both policies, recognizing the combined risk profile.

- Life Insurance: Bundling your car insurance with life insurance can also lead to savings. By combining these policies, State Farm can offer a discounted rate for both, reflecting the potential benefits of having both types of insurance.

- Other Insurance Products: State Farm offers a variety of other insurance products, such as health insurance and business insurance. Bundling your car insurance with any of these products can potentially lead to significant savings.

Customer Reviews and Experiences: State Farm Car Insurance Rates

Customer reviews and testimonials provide valuable insights into the overall satisfaction with State Farm’s car insurance services. By analyzing these reviews, we can gain a comprehensive understanding of customer experiences, including their perspectives on the claims process, customer support, and overall value proposition.

Customer Satisfaction with State Farm

Customer satisfaction with State Farm car insurance is generally positive, with a high number of positive reviews highlighting the company’s reliable service, competitive rates, and responsive customer support.

- State Farm consistently ranks high in customer satisfaction surveys, such as the J.D. Power U.S. Auto Insurance Satisfaction Study.

- Many customers praise State Farm’s agents for their professionalism, helpfulness, and personalized attention.

- Customers appreciate the company’s wide range of discounts and bundling options, which can significantly reduce insurance costs.

State Farm’s Claims Process

State Farm’s claims process is generally well-regarded by customers, with many praising the company’s efficiency, transparency, and ease of filing claims.

- State Farm offers multiple convenient channels for filing claims, including online, phone, and mobile app.

- Customers often appreciate the company’s prompt response times and clear communication throughout the claims process.

- State Farm’s commitment to fair and timely settlements contributes to customer satisfaction with the claims process.

State Farm’s Customer Support

State Farm’s customer support is widely recognized for its responsiveness, helpfulness, and accessibility.

- Customers can reach State Farm’s customer support team through various channels, including phone, email, and online chat.

- Many customers praise the company’s knowledgeable and friendly customer service representatives who are readily available to assist with inquiries and resolve issues.

- State Farm’s commitment to providing excellent customer support contributes to its positive reputation and high customer satisfaction ratings.

State Farm’s Digital Platform

State Farm has invested heavily in developing a robust digital platform to cater to the evolving needs of its customers. Their online portal and mobile app offer a wide range of features designed to streamline policy management and provide 24/7 access to insurance-related services.

Online Portal Features

State Farm’s online portal is a comprehensive platform that allows policyholders to manage their insurance policies, make payments, and access various resources.

- Policy Management: Policyholders can view their policy details, make changes to their coverage, and update their personal information online. This eliminates the need for phone calls or in-person visits to an agent.

- Payment Options: The portal allows for convenient online payments, ensuring timely premium payments and avoiding late fees. Policyholders can set up automatic payments or make one-time payments through a secure system.

- Claims Reporting: In the event of an accident, policyholders can file claims online, providing details of the incident and uploading relevant documents. This simplifies the claims process and expedites claim processing.

- Digital Documents: State Farm provides access to digital copies of policy documents, eliminating the need for physical paperwork. Policyholders can easily download and store their insurance information electronically.

- Customer Support: The online portal offers access to various resources, including frequently asked questions (FAQs), online chat support, and contact information for agents and customer service representatives.

Mobile App Features

State Farm’s mobile app extends the convenience of its online portal to smartphones and tablets. The app offers a user-friendly interface and provides access to key insurance management features.

- Policy Access: The app allows policyholders to view their policy details, including coverage limits, deductibles, and payment history, anytime and anywhere.

- Payment Management: Policyholders can make payments, view payment history, and set up automatic payments through the app.

- Claims Reporting: The app allows for easy claims reporting, enabling policyholders to submit photos, videos, and other relevant information directly from their mobile devices.

- Roadside Assistance: State Farm’s mobile app offers roadside assistance features, allowing policyholders to request towing, jump-starts, and other services directly through the app.

- Digital ID Cards: The app provides access to digital ID cards, eliminating the need to carry physical cards. Policyholders can easily show their digital ID cards to law enforcement officers or other individuals.

Ease of Use and Functionality

State Farm’s digital platforms are designed with user-friendliness in mind. The online portal and mobile app feature intuitive navigation, clear menus, and helpful tooltips.

- Simple Interface: The platforms are easy to navigate, with clear menus and straightforward instructions. This ensures that policyholders can easily find the information they need and complete tasks efficiently.

- Responsive Design: The mobile app is optimized for various screen sizes and devices, ensuring a seamless user experience across different platforms. This allows policyholders to access their insurance information from any device.

- Secure Transactions: State Farm employs robust security measures to protect policyholder information. Secure login credentials, encryption protocols, and fraud detection systems ensure the safety of personal data.

- Multilingual Support: State Farm’s digital platforms offer support in multiple languages, catering to a diverse customer base. This ensures that policyholders can access information and manage their policies in their preferred language.

Benefits of Using State Farm’s Digital Tools

Utilizing State Farm’s digital platforms offers several benefits to policyholders, enhancing convenience, efficiency, and accessibility.

- 24/7 Access: Policyholders can access their insurance information, manage their policies, and file claims anytime, anywhere, eliminating the need to wait for business hours.

- Time Savings: The digital platforms streamline policy management, reducing the time and effort required to handle insurance-related tasks.

- Improved Communication: The platforms facilitate seamless communication between policyholders and State Farm, providing quick and efficient access to support and information.

- Personalized Experience: State Farm’s digital tools offer personalized features, tailoring information and services to individual policyholders’ needs.

- Paperless Transactions: The digital platforms promote paperless transactions, reducing environmental impact and promoting sustainability.

Conclusive Thoughts

In conclusion, State Farm car insurance rates are determined by a variety of factors, including your driving history, vehicle type, location, and coverage levels. By understanding these factors and taking advantage of available discounts, you can potentially find a competitive rate for your car insurance needs. However, it’s essential to compare rates from multiple insurance providers to ensure you’re getting the best value for your money. Remember, finding the right car insurance is about more than just the price. It’s about finding a provider that offers the coverage and customer service you need to feel confident and secure.

Question & Answer Hub

What is State Farm’s average car insurance rate?

Average rates vary depending on location, driving history, and other factors. It’s best to get a personalized quote from State Farm.

Does State Farm offer discounts for good drivers?

Yes, State Farm offers a variety of discounts, including safe driver discounts, good student discounts, and multi-policy discounts.

How can I get a quote for State Farm car insurance?

You can get a quote online, over the phone, or by visiting a local State Farm agent.