State Farm car insurance quote online offers a convenient way to explore your car insurance options. This platform allows you to quickly and easily compare different coverage plans and receive personalized quotes tailored to your needs. Whether you’re a new driver or looking to switch providers, State Farm’s online quoting tool empowers you to make informed decisions about your car insurance.

Navigating the world of car insurance can be overwhelming, but State Farm’s user-friendly interface simplifies the process. With a few key pieces of information, you can generate a quote within minutes. This transparency and ease of use make State Farm a popular choice for those seeking affordable and reliable car insurance.

Understanding State Farm Car Insurance

State Farm is one of the largest and most well-known insurance providers in the United States, offering a comprehensive range of car insurance products designed to protect drivers and their vehicles. This guide explores the key features and benefits of State Farm car insurance, providing insights into the coverage options, reputation, and customer satisfaction associated with this renowned insurer.

Coverage Options

State Farm offers a variety of car insurance coverage options to suit different needs and budgets. These options can be customized to create a policy that provides the right level of protection for each individual.

- Liability Coverage: This is the most basic type of car insurance, providing financial protection for damages or injuries you cause to others in an accident. It covers medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It can be beneficial if your car is relatively new or if you have a loan on it.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. It is often required in some states.

- Medical Payments Coverage (Med Pay): This coverage provides supplemental medical payments for you and your passengers, regardless of who is at fault. It is a less comprehensive option compared to PIP.

- Rental Car Coverage: This coverage helps pay for a rental car if your vehicle is damaged in an accident and is being repaired.

- Roadside Assistance: This coverage provides assistance with services such as towing, flat tire changes, and battery jump starts.

Reputation and Customer Satisfaction

State Farm has a strong reputation for its financial stability, customer service, and commitment to customer satisfaction. It consistently ranks high in industry surveys and has received numerous awards for its performance.

“State Farm has been recognized as one of the most trusted and reliable insurance companies in the United States, consistently receiving high ratings for its financial strength and customer satisfaction.”

State Farm is known for its extensive network of agents and claims representatives, providing personalized service and support to its customers. The company also offers a variety of online and mobile resources to make managing your insurance easier, including online quote tools, policy management options, and claims reporting services.

Online Quoting Process

Getting a car insurance quote from State Farm online is quick and easy. You can do it from the comfort of your own home, anytime, day or night. The process is straightforward, and you can get a personalized quote in just a few minutes.

Information Required for a Quote

Before you start, gather the following information to ensure a smooth and accurate quote:

- Your driving history, including any accidents or violations.

- Your vehicle information, such as make, model, year, and VIN (Vehicle Identification Number).

- Your personal information, including your name, address, and date of birth.

- Your desired coverage options, including liability limits, collision and comprehensive coverage, and other optional features.

Online Quoting Platform Features

State Farm’s online quoting platform is designed to be user-friendly and efficient. Here are some key features:

- Easy-to-use interface: The platform is designed to be intuitive and simple to navigate, making it easy for users to find the information they need.

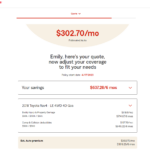

- Personalized quotes: The platform takes into account your specific needs and preferences to provide personalized quotes tailored to your individual situation.

- Multiple quote options: You can explore different coverage options and see how they affect your quote, allowing you to find the best coverage at the most affordable price.

- Real-time quote updates: As you enter information, the platform updates your quote in real time, giving you an immediate sense of how your choices impact the price.

- Secure online payment: You can pay for your policy online securely through the platform, eliminating the need for paper forms or phone calls.

- 24/7 access: You can access the platform and get a quote at any time, day or night, from any device with an internet connection.

Factors Influencing Quotes

Getting a car insurance quote is the first step in finding the right coverage for your needs. However, several factors can influence the price you pay. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Driving History

Your driving history is one of the most significant factors that influence your car insurance quote. Insurance companies use your driving record to assess your risk of accidents. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions can significantly increase your quote.

Vehicle Type, State farm car insurance quote online

The type of vehicle you drive also plays a role in determining your insurance quote. Some vehicles are considered more expensive to repair or replace than others, making them riskier for insurance companies. For example, luxury cars, sports cars, and high-performance vehicles often have higher insurance premiums due to their higher repair costs and the potential for more severe accidents.

Location

Your location is another crucial factor that affects your car insurance quote. Insurance companies consider the risk of accidents in different areas. Areas with higher crime rates, traffic congestion, and weather hazards typically have higher insurance premiums. For example, if you live in a city with a high rate of car theft, your insurance quote might be higher than someone living in a rural area with lower crime rates.

Discounts and Promotions

Many car insurance companies offer discounts and promotions to reduce your premium. These discounts can vary depending on the insurer and your specific circumstances. Some common discounts include:

- Good Student Discount: This discount is available to students who maintain good grades. It reflects the assumption that good students are more responsible drivers.

- Safe Driver Discount: This discount is offered to drivers with a clean driving record and no accidents or violations. It rewards safe driving habits.

- Multi-Policy Discount: If you bundle your car insurance with other policies, such as homeowners or renters insurance, you may qualify for a multi-policy discount. This discount incentivizes customers to buy multiple policies from the same insurer.

- Anti-theft Device Discount: Installing anti-theft devices in your car can reduce your premium. Insurance companies recognize that these devices make your car less attractive to thieves, reducing the risk of theft.

Comparison with Other Providers

It’s always a good idea to compare quotes from multiple insurance providers before choosing a policy. While State Farm is a well-known and reputable insurer, other companies might offer more competitive rates depending on your specific circumstances. Online comparison tools can help you quickly and easily compare quotes from different insurers.

Advantages of Online Quoting

Getting a car insurance quote online is incredibly convenient and efficient. It saves you time and effort compared to traditional methods like visiting an agent in person or calling on the phone. You can quickly get an estimate without leaving your home or interrupting your day.

Speed and Convenience

Online quoting platforms are designed for speed and ease of use. You can typically get a quote within minutes, by simply entering your information and answering a few questions. This contrasts with traditional methods, which might require scheduling an appointment, visiting an office, and waiting for an agent to be available.

Comparing Quotes

One of the biggest advantages of online quoting is the ability to compare quotes from multiple insurers. You can quickly and easily get quotes from several companies, allowing you to find the best coverage at the most competitive price. This comparison process is often more time-consuming and challenging when using traditional methods.

Potential for Savings

By comparing quotes online, you can potentially save money on your car insurance. Insurance companies often offer different rates and discounts depending on factors like your driving history, vehicle type, and location. Online quoting tools allow you to easily see these variations and identify the most affordable option.

Additional Considerations

While obtaining a car insurance quote online is quick and convenient, there are additional factors to consider to ensure you have the right coverage and the best possible price. Understanding your specific needs and exploring all available options can help you make informed decisions.

State Farm Car Insurance Coverage Options

State Farm offers a comprehensive range of car insurance coverage options to meet diverse needs. Understanding these options is crucial when deciding which coverage is best for you.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damage or injuries to others in an accident caused by you. |

| Collision Coverage | Covers damage to your car in an accident, regardless of fault. |

| Comprehensive Coverage | Covers damage to your car from events like theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are hit by a driver without insurance or insufficient coverage. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers, regardless of fault, but has a lower limit than PIP. |

State Farm Car Insurance Resources

State Farm provides various resources on their website to help you understand car insurance and make informed decisions. These resources can be accessed directly from the State Farm website.

- Car Insurance Guide: This comprehensive guide explains different coverage options, factors influencing premiums, and tips for saving money.

- Frequently Asked Questions (FAQs): This section addresses common questions about car insurance, providing clear and concise answers.

- Glossary of Terms: This glossary defines key car insurance terms, helping you understand the language used in policies and quotes.

- Online Tools and Calculators: State Farm offers online tools, such as a premium calculator, to estimate your potential insurance costs and compare different coverage options.

- Contact Information: You can contact State Farm directly through their website or phone number for personalized assistance and answers to specific questions.

Factors to Consider When Comparing Car Insurance Quotes

Comparing quotes from different insurance providers is essential to finding the best value. Consider these factors when evaluating quotes and choosing the right coverage for your needs.

- Coverage Options: Compare the types and limits of coverage offered by each insurer to ensure you have adequate protection.

- Deductibles: Understand the deductible amount for each coverage type and choose a level you can comfortably afford.

- Premium Costs: Compare the annual or monthly premium costs from different insurers to find the most affordable option.

- Discounts: Explore available discounts, such as safe driver discounts, multi-car discounts, and good student discounts, to reduce your premium.

- Customer Service: Consider the insurer’s reputation for customer service, claims handling, and overall satisfaction.

- Financial Stability: Research the insurer’s financial strength and stability to ensure they can pay claims in the event of an accident.

Ultimate Conclusion

Getting a State Farm car insurance quote online is a valuable first step in securing the right coverage for your needs. By utilizing this tool, you gain access to a wide range of options, empowering you to compare prices and coverage features. Remember to consider your individual driving history, vehicle type, and location to ensure you’re receiving the most appropriate and cost-effective policy.

Q&A: State Farm Car Insurance Quote Online

What information do I need to get a quote?

To get a quote, you’ll typically need your driver’s license information, vehicle details (make, model, year), address, and driving history. You may also be asked about your coverage preferences, such as liability limits and deductibles.

Can I get a quote without providing my personal information?

While some websites allow you to get a general idea of rates without personal details, obtaining a personalized quote requires providing your information for accurate calculations.

Is the online quote binding?

No, an online quote is not binding. It provides an estimate based on the information you provided, but the final price may vary depending on factors that cannot be determined online, such as a full driving record review.

Can I adjust my quote after receiving it?

Yes, you can adjust your quote by changing your coverage preferences, such as increasing your deductible or adding additional coverage. You can also explore different discount options.