State Farm car insurance prices are a topic of interest for many drivers seeking affordable and reliable coverage. State Farm, a leading insurance provider, offers a wide range of policies and discounts, making it a popular choice for car insurance. This guide delves into the factors that influence State Farm car insurance prices, providing insights into how to obtain the best rates and navigate the complexities of car insurance.

From understanding the various coverage options to exploring discounts and comparing prices, this comprehensive overview aims to equip you with the knowledge you need to make informed decisions about your car insurance needs. Whether you’re a new driver or a seasoned veteran, this guide offers valuable information to help you secure the most suitable and cost-effective coverage for your vehicle.

State Farm Car Insurance Overview

State Farm is one of the largest and most well-known car insurance providers in the United States. Founded in 1922, the company has a long history of providing reliable and affordable car insurance to millions of customers. State Farm’s commitment to customer satisfaction and its comprehensive range of insurance products have made it a trusted name in the industry.

Key Features and Benefits

State Farm car insurance offers a wide range of features and benefits designed to meet the diverse needs of its customers. Some of the key features include:

- Competitive Prices: State Farm is known for offering competitive car insurance rates, often lower than many of its competitors. This is achieved through efficient operations, a strong financial position, and a focus on risk management.

- Comprehensive Coverage Options: State Farm offers a variety of coverage options to suit different needs and budgets. These include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and more.

- Excellent Customer Service: State Farm prides itself on providing exceptional customer service. The company has a large network of agents who are available to answer questions, provide personalized advice, and assist with claims.

- Digital Convenience: State Farm offers a user-friendly mobile app and online portal that allows customers to manage their policies, pay their premiums, and file claims easily.

- Discounts and Rewards: State Farm offers a variety of discounts and rewards programs to help customers save money on their premiums. These include discounts for good driving records, multiple policies, safety features, and more.

Types of Car Insurance Coverage

State Farm offers a comprehensive range of car insurance coverage options to protect you and your vehicle in various situations. Here are some of the most common types of coverage:

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes injury or damage to others. It covers medical expenses, property damage, and legal defense costs.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It covers damages caused by collisions with other vehicles, objects, or even hitting a pothole.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, hail, or floods. It covers the cost of repairs or replacement, minus any deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, available in some states, helps pay for your medical expenses, lost wages, and other expenses if you are injured in an accident, regardless of fault.

Factors Influencing State Farm Car Insurance Prices

State Farm, like other insurance companies, considers various factors when calculating your car insurance premiums. These factors aim to assess the risk associated with insuring you and your vehicle. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your State Farm car insurance price. A clean driving record with no accidents or violations typically translates to lower premiums.

- Accidents: Each accident, regardless of fault, can increase your premiums. The severity of the accident, the number of accidents, and the time elapsed since the last accident all play a role.

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions significantly raise your insurance costs. These violations indicate a higher risk of future accidents.

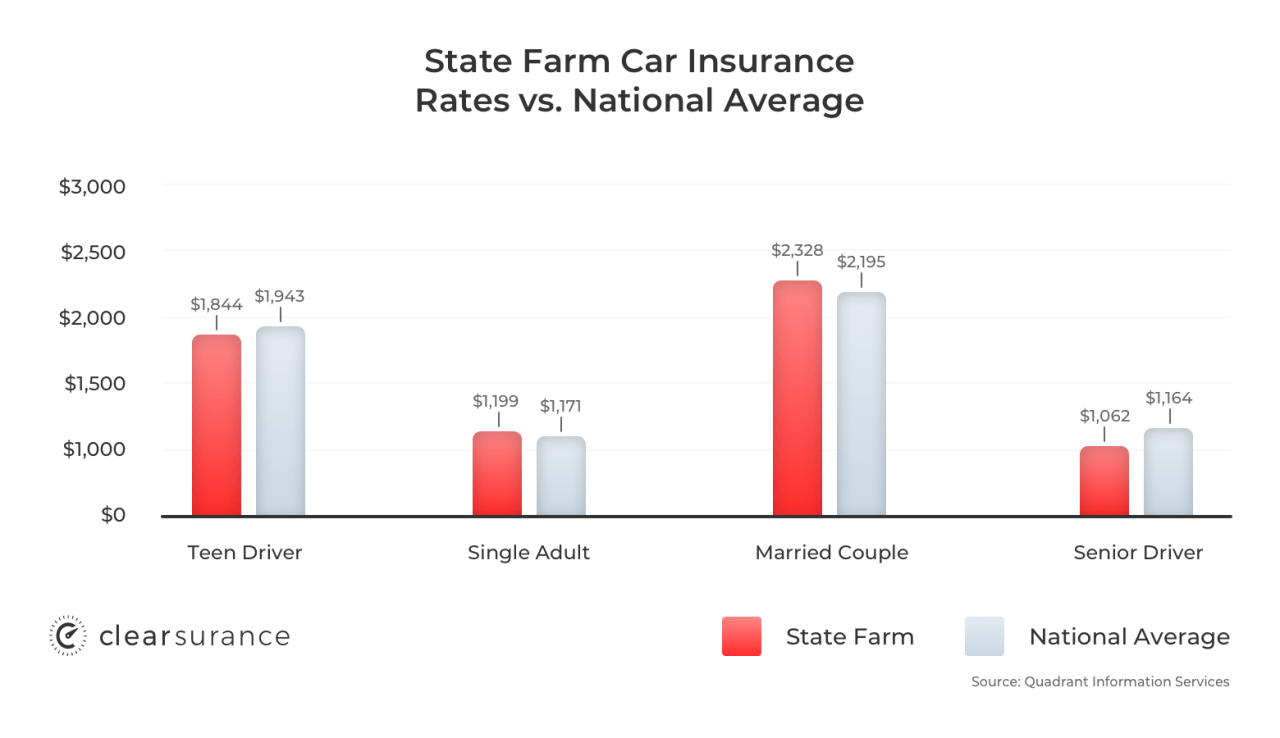

Age

Age is another crucial factor that State Farm considers. Generally, younger drivers (under 25) tend to have higher premiums due to their lack of experience and higher risk of accidents. Conversely, older drivers (over 65) often see lower premiums as they have more experience and may be more cautious on the road.

Location

The location where you live significantly impacts your State Farm car insurance premiums. Areas with higher crime rates, more traffic congestion, or a greater frequency of accidents tend to have higher insurance rates.

- Urban vs. Rural: Urban areas often have higher insurance premiums due to increased traffic density, higher risk of theft, and more frequent accidents. Rural areas may have lower premiums due to less traffic and lower accident rates.

- Climate: Areas prone to severe weather events, such as hurricanes, tornadoes, or hailstorms, can have higher premiums as the risk of vehicle damage increases.

Vehicle Type

The type of vehicle you drive is a key factor influencing your State Farm car insurance price.

- Vehicle Value: More expensive vehicles, especially luxury or sports cars, tend to have higher premiums because they are more costly to repair or replace.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts and lower premiums. These features can reduce the risk of accidents and injuries.

- Vehicle Age: Newer vehicles generally have higher premiums as they are more expensive to repair. Older vehicles may have lower premiums, but they might also have less comprehensive coverage.

Credit Score

Your credit score, surprisingly, can influence your State Farm car insurance premiums. While this might seem unrelated, insurance companies often use credit score as a proxy for financial responsibility. Individuals with good credit scores tend to be considered more responsible and less likely to file claims, leading to lower premiums.

Comparing State Farm Car Insurance Prices

It’s essential to compare State Farm car insurance prices with other major insurance providers to ensure you’re getting the best deal. This involves considering various factors like coverage levels, demographics, and individual circumstances.

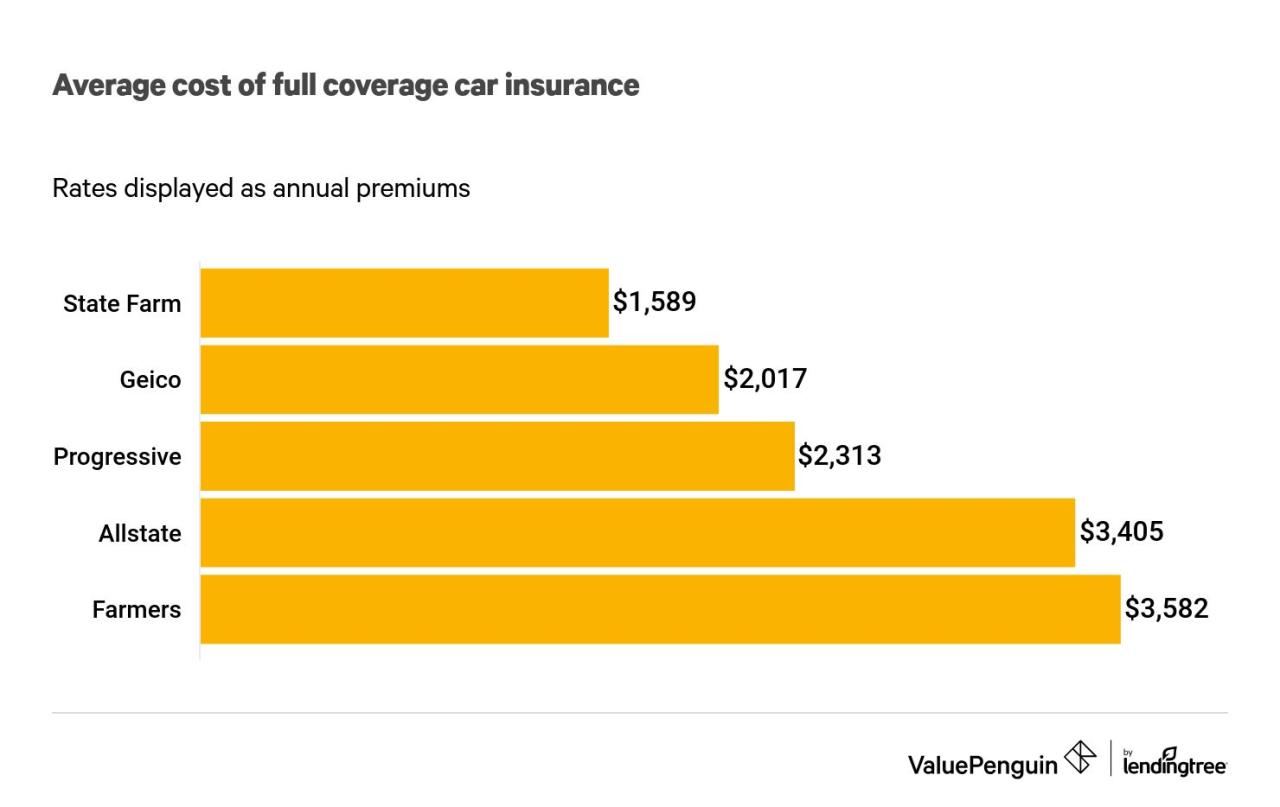

Comparison with Other Insurance Providers

To make an informed decision, it’s crucial to compare State Farm’s rates with those of other major insurance providers. Some popular competitors include Geico, Progressive, Allstate, and USAA. While State Farm is known for its customer service and comprehensive coverage options, other providers might offer more competitive rates depending on your specific needs and location.

Average Premiums for Different Coverage Levels and Demographics

Here’s a table outlining average premiums for different coverage levels and demographics, based on data from various sources:

| Coverage Level | Age Group | Average Premium |

|—|—|—|

| Liability Only | 18-25 | $500 – $700 |

| Comprehensive and Collision | 26-35 | $1,000 – $1,500 |

| Full Coverage | 36-45 | $1,500 – $2,000 |

| Liability Only | 46-55 | $400 – $600 |

| Comprehensive and Collision | 56-65 | $800 – $1,200 |

| Full Coverage | 66+ | $1,200 – $1,800 |

It’s important to note that these are just average premiums and your actual rates may vary based on your individual circumstances.

Tips for Getting the Best Possible Rates from State Farm

Here are some tips to help you secure the best possible rates from State Farm:

* Maintain a Good Driving Record: A clean driving record with no accidents or violations will significantly reduce your premiums.

* Bundle Your Insurance: Bundling your car insurance with other policies like homeowners or renters insurance can often lead to discounts.

* Increase Your Deductible: Choosing a higher deductible can lower your monthly premiums.

* Shop Around Regularly: It’s recommended to compare rates from different providers regularly, as prices can fluctuate.

* Take Advantage of Discounts: State Farm offers various discounts, including good student, safe driver, and multi-car discounts. Make sure to inquire about all available discounts.

* Consider a Telematics Program: Participating in a telematics program that tracks your driving habits can potentially earn you discounts.

Remember, it’s crucial to compare rates from different providers and explore all available discounts to secure the most competitive car insurance policy for your needs.

State Farm Car Insurance Discounts and Promotions

State Farm offers a wide range of discounts to help you save money on your car insurance premiums. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other positive factors. By taking advantage of these discounts, you can significantly reduce your overall insurance costs.

Discounts Offered by State Farm, State farm car insurance prices

State Farm provides a variety of discounts to its policyholders. Here are some of the most common discounts:

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating their responsible driving habits. It typically requires a certain period without accidents or traffic violations.

- Good Student Discount: This discount is available to students who maintain a high GPA. It encourages academic excellence and responsible behavior.

- Multi-Policy Discount: This discount is offered to customers who bundle multiple insurance policies with State Farm, such as home, auto, life, or renters insurance. Bundling your policies can lead to substantial savings.

- Defensive Driving Course Discount: Completing a certified defensive driving course can qualify you for this discount. These courses teach safe driving techniques and can help reduce your risk of accidents.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can make it less attractive to thieves, leading to a discount on your insurance premiums.

- Vehicle Safety Features Discount: Vehicles equipped with advanced safety features, such as airbags, anti-lock brakes, and electronic stability control, are generally considered safer and may qualify for a discount.

- Homeowner Discount: This discount is available to homeowners who insure their homes with State Farm. It reflects the stability and responsibility associated with homeownership.

- Paid-in-Full Discount: Paying your car insurance premium in full upfront can sometimes qualify you for a discount. This demonstrates financial responsibility and eliminates the need for installment payments.

- Driver Training Discount: Completing a driver training program, particularly for young drivers, can qualify you for this discount. These programs teach safe driving practices and may reduce your risk of accidents.

- Military Discount: Active military personnel and veterans may be eligible for a discount. This recognizes the service and sacrifices made by our armed forces.

Eligibility Criteria for Discounts

To qualify for these discounts, you must meet specific criteria, which may vary depending on your state and policy.

It’s important to contact your State Farm agent or review your policy documents to understand the specific eligibility requirements for each discount in your area.

Current Promotions and Special Offers

State Farm often runs special promotions and offers to attract new customers and reward existing ones. These promotions can include:

- New Customer Discounts: State Farm may offer discounts for new customers who switch their insurance from another company.

- Referral Bonuses: You may receive a bonus or discount for referring friends or family members to State Farm.

- Seasonal Promotions: State Farm might offer special discounts during certain times of the year, such as holiday periods or during specific insurance-related events.

Keep an eye out for email notifications, advertisements, and communication from your State Farm agent to stay informed about current promotions and special offers.

Customer Experience and Reviews

State Farm is one of the largest and most well-known insurance companies in the United States. With a vast customer base, it’s crucial to understand the experiences of those who have interacted with the company. Customer reviews and ratings provide valuable insights into State Farm’s strengths and weaknesses, offering a comprehensive view of its customer service, claims handling, and overall satisfaction.

Customer Reviews and Ratings

Customer reviews and ratings are a crucial indicator of customer satisfaction. They offer valuable insights into the overall experience with State Farm, encompassing factors like ease of claims filing, customer service responsiveness, and overall satisfaction with the insurance coverage. These reviews are available on various platforms, including independent review websites, social media platforms, and customer forums. Analyzing these reviews allows us to gain a holistic understanding of State Farm’s customer experience.

Common Strengths and Weaknesses

Analyzing customer reviews and ratings reveals common strengths and weaknesses reported by customers. State Farm consistently receives positive feedback for its extensive network of agents, providing personalized service and local expertise. Customers often praise the company’s financial stability and reputation for reliability. However, some customers express concerns about the claims process, citing delays and difficulties in navigating the system. Additionally, certain customers have reported challenges in reaching customer service representatives or resolving issues promptly.

Ease of Filing Claims and Customer Service Experience

The ease of filing claims and the quality of customer service are critical aspects of the insurance experience. State Farm generally receives positive feedback for its claims process, with customers appreciating the availability of multiple channels for filing claims, including online portals and mobile apps. However, some customers have reported challenges with claim processing times, particularly in cases involving complex claims. The customer service experience varies depending on the individual’s interaction with agents and representatives. While many customers commend State Farm’s agents for their responsiveness and helpfulness, others have encountered difficulties reaching customer service representatives or resolving issues promptly.

Conclusion

State Farm car insurance prices are influenced by a variety of factors, including driving history, vehicle type, location, and coverage options. It’s important to consider all of these factors when comparing prices from different insurers, including State Farm.

State Farm Car Insurance Prices: Key Findings

State Farm offers competitive prices for car insurance, but it’s crucial to shop around and compare quotes from multiple insurers to find the best deal. State Farm’s discounts and promotions can help lower your premiums, and its customer service is generally well-regarded. However, keep in mind that prices can vary significantly depending on your individual circumstances.

Last Recap: State Farm Car Insurance Prices

In conclusion, State Farm car insurance prices are influenced by a variety of factors, including driving history, location, vehicle type, and credit score. By understanding these factors and exploring available discounts, you can optimize your premiums and secure affordable coverage. Remember to shop around, compare quotes, and consider your individual needs to find the best car insurance plan for you.

Questions and Answers

What is the average cost of State Farm car insurance?

The average cost of State Farm car insurance varies depending on factors such as your location, driving history, vehicle type, and coverage level. It’s best to get a personalized quote from State Farm to determine the exact cost for your specific situation.

How can I lower my State Farm car insurance premiums?

You can lower your premiums by taking advantage of discounts offered by State Farm, such as safe driving discounts, good student discounts, and multi-policy discounts. Additionally, consider increasing your deductible or choosing a higher coverage level to potentially reduce your monthly payments.

What are the different types of coverage offered by State Farm?

State Farm offers various coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection. The specific coverage options you choose will depend on your individual needs and state requirements.

How do I file a claim with State Farm?

You can file a claim with State Farm by contacting their customer service line or visiting their website. They offer various methods for reporting accidents and initiating the claims process.