State Farm car insurance price is a crucial factor for many drivers, and understanding how it’s determined can help you save money. State Farm considers various factors, including your driving history, vehicle type, location, and chosen coverage, to calculate your premium. This comprehensive guide delves into the intricacies of State Farm’s pricing model, offering insights into how your individual circumstances impact your insurance costs.

By exploring the factors that influence State Farm car insurance prices, comparing them to competitors, and uncovering available discounts, you can gain valuable knowledge to make informed decisions about your insurance coverage. This guide aims to empower you with the information you need to secure the best possible car insurance rates from State Farm.

Understanding State Farm Car Insurance Pricing

Getting a car insurance quote from State Farm can seem like a complex process, but it’s based on a number of factors that help determine your individual risk. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Factors Influencing State Farm Car Insurance Prices

State Farm, like other insurance companies, considers various factors to determine your car insurance premiums. These factors can be broadly categorized into driver demographics, vehicle details, location, and coverage options.

- Driver Demographics: Your age, driving history, credit score, and even your occupation can influence your premium. For example, young drivers with limited driving experience or a history of accidents may pay higher premiums compared to older, experienced drivers with a clean record. Similarly, drivers with good credit scores might receive discounts, as they are statistically less likely to file claims.

- Vehicle Details: The make, model, year, and safety features of your vehicle play a significant role. Vehicles with advanced safety features like anti-lock brakes and airbags are often considered safer and can lead to lower premiums. On the other hand, high-performance cars or luxury vehicles are generally more expensive to repair and might result in higher premiums.

- Location: The area where you live impacts your premium due to factors like the frequency of accidents, theft rates, and the cost of repairs in your region. For instance, urban areas with high traffic density might have higher accident rates, leading to higher premiums compared to rural areas.

- Coverage Options: The level of coverage you choose also affects your premium. Comprehensive and collision coverage, which protect against damage from incidents like theft or accidents, are generally more expensive than liability coverage, which covers damages you cause to others. Choosing a higher deductible can also lower your premium, as you agree to pay more out of pocket in case of an accident.

State Farm’s Pricing Model

State Farm utilizes a sophisticated pricing model that takes into account all the factors mentioned above. They employ statistical analysis and historical data to assess risk and determine premiums.

State Farm’s pricing model aims to ensure that premiums reflect the individual risk associated with each policyholder.

Examples of Price Adjustments

Here are some real-life examples of how State Farm might adjust prices based on different factors:

- Driver with a clean record: A 35-year-old driver with a clean driving record for 10 years might receive a lower premium compared to a 20-year-old driver with a recent speeding ticket.

- Vehicle safety features: A car equipped with advanced safety features like lane departure warning and automatic emergency braking might qualify for a discount compared to a similar model without these features.

- Location: A driver living in a rural area with a low accident rate might receive a lower premium compared to a driver living in a major city with high traffic density.

- Coverage options: A driver opting for a higher deductible on their comprehensive and collision coverage might receive a lower premium compared to a driver with a lower deductible.

Comparing State Farm Car Insurance Prices

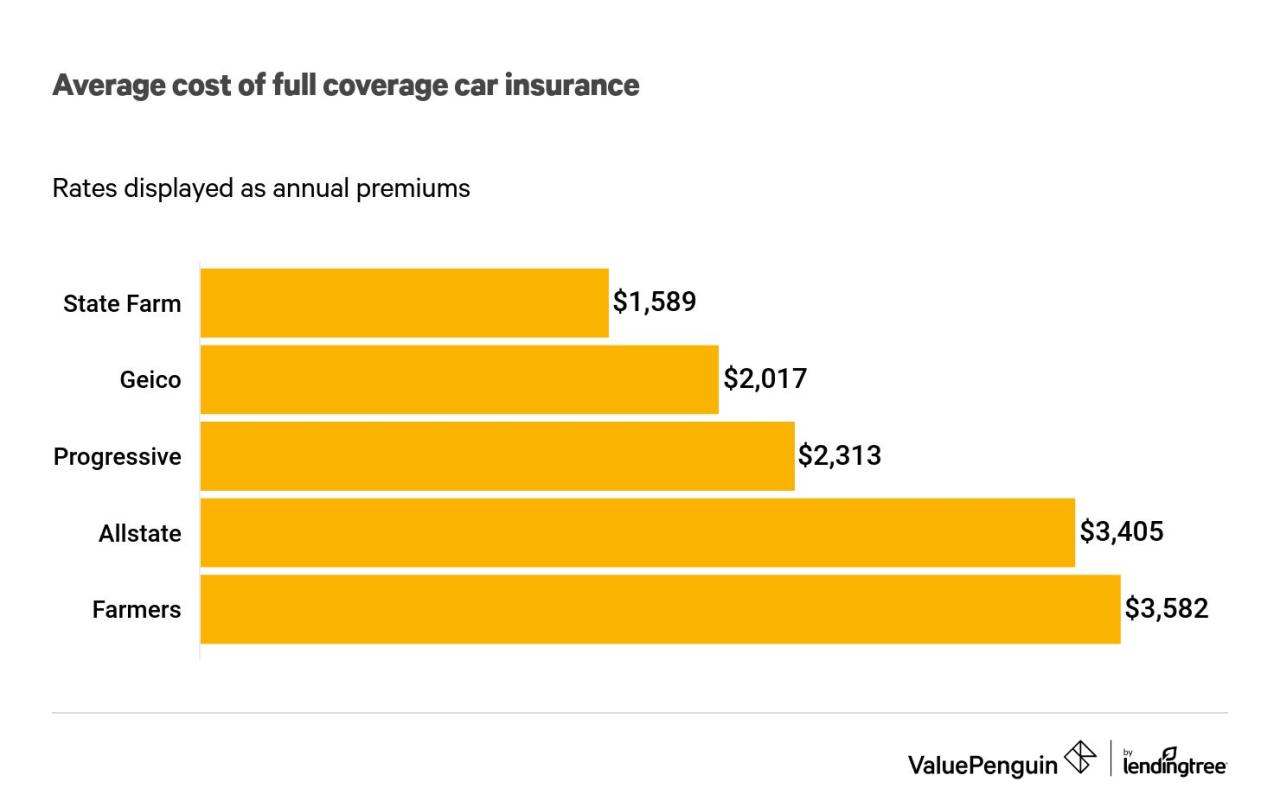

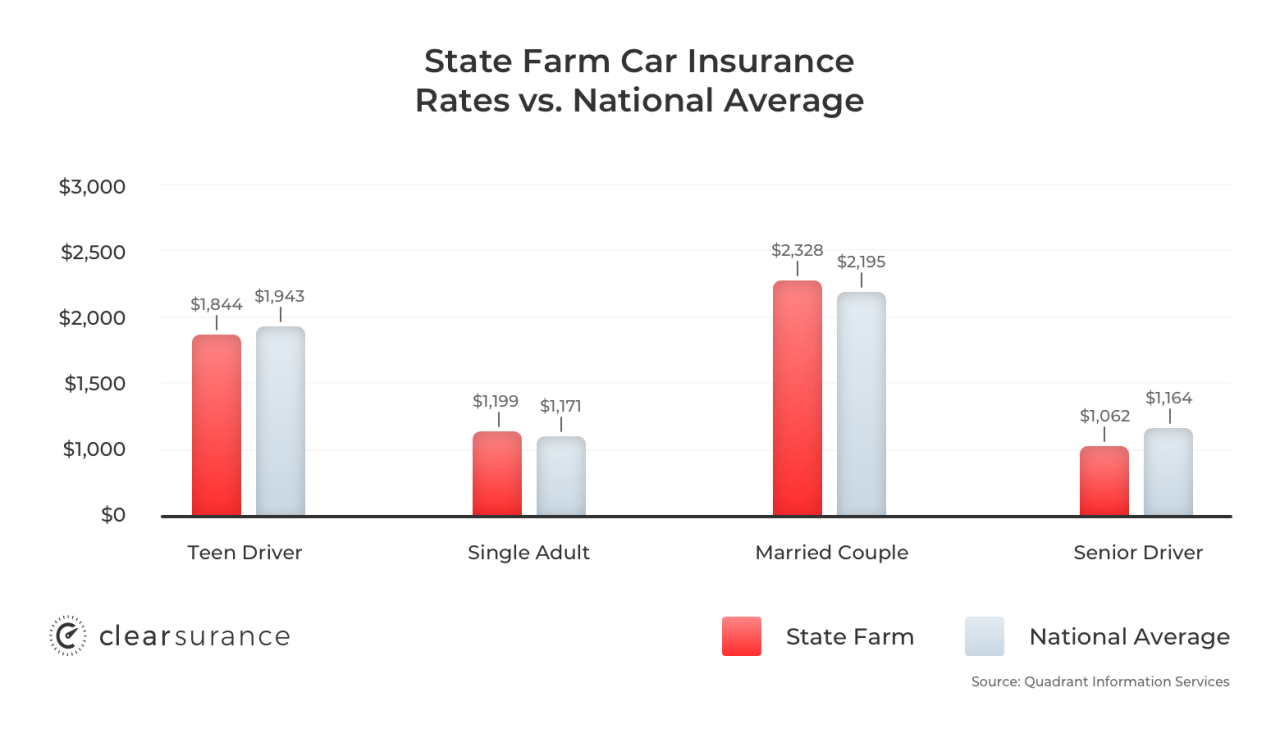

Now that you have a general understanding of how State Farm calculates your car insurance premiums, it’s essential to compare their pricing with other major insurance providers. This comparison will help you determine if State Farm offers competitive rates or if you might find better deals elsewhere.

Comparing State Farm’s Pricing to Competitors

State Farm is a well-established and reputable insurance provider, but it’s not always the cheapest option. Several other major insurance companies offer competitive rates, and it’s worth comparing quotes from multiple providers before making a decision.

Here’s a brief overview of some of State Farm’s key competitors and their general pricing strategies:

- Geico: Geico is known for its aggressive advertising and often offers very competitive rates, particularly for drivers with good driving records.

- Progressive: Progressive is another popular choice, offering various discounts and personalized pricing options. They often use a “name your price” approach, allowing you to set a desired premium and then finding coverage options that fit within your budget.

- Allstate: Allstate is a well-known insurance provider offering various discounts and coverage options. They are known for their strong customer service and financial stability.

- USAA: USAA is a military-focused insurance provider offering excellent rates and customer service to active-duty military personnel, veterans, and their families. They are often considered one of the best insurance providers overall.

It’s important to note that these are general observations, and actual premiums can vary significantly depending on individual factors such as your driving history, location, vehicle type, and coverage needs. It’s always best to get personalized quotes from multiple insurance providers to find the best deal.

Factors Affecting Price Differences, State farm car insurance price

Several factors can contribute to differences in car insurance premiums between State Farm and other providers. Understanding these factors can help you better understand why you might receive varying quotes from different companies.

- Risk Assessment: Each insurance company uses its own proprietary algorithms and data to assess the risk associated with insuring a particular driver. These algorithms consider factors like driving history, age, location, vehicle type, and credit score. If one company assesses you as a higher risk than another, you might receive a higher premium.

- Coverage Options: The specific coverage options you choose can significantly impact your premium. For example, choosing a higher deductible or opting for a less comprehensive coverage package can generally lower your premium.

- Discounts: Different insurance companies offer various discounts, and the availability and value of these discounts can vary significantly. For example, some companies offer discounts for good driving records, safe driving courses, bundling multiple insurance policies, or being a member of certain organizations.

- Market Conditions: Insurance premiums are also influenced by market conditions, such as the cost of repairs, the frequency of accidents, and overall competition in a particular area. These factors can fluctuate over time and can lead to price differences between providers.

Examples of Price Differences

Let’s look at some examples of how different insurance providers might offer varying premiums for similar coverage:

| Scenario | State Farm | Geico | Progressive |

|---|---|---|---|

| 30-year-old driver with a clean driving record, driving a 2018 Honda Accord in Chicago, IL, with minimum liability coverage | $1,200/year | $1,000/year | $1,150/year |

| 55-year-old driver with a few minor accidents, driving a 2015 Toyota Camry in Los Angeles, CA, with full coverage | $2,500/year | $2,300/year | $2,600/year |

These are just hypothetical examples, and actual premiums will vary based on the specific circumstances of each driver. However, they illustrate how different insurance providers can offer different rates for similar coverage, even for drivers with similar profiles.

State Farm Car Insurance Discounts

State Farm offers a wide range of discounts to help you save money on your car insurance premiums. These discounts can significantly reduce your overall costs, making State Farm a more affordable option for many drivers.

Types of Discounts

State Farm provides discounts for various factors, including your driving history, vehicle features, and lifestyle choices. Understanding these discounts and how to qualify for them can help you save on your car insurance.

Driving History Discounts

- Safe Driver Discount: This discount is offered to drivers with a clean driving record, typically for those who haven’t been involved in any accidents or received traffic violations for a certain period. The discount percentage can vary depending on your specific driving history.

- Defensive Driving Course Discount: Taking a defensive driving course can demonstrate your commitment to safe driving practices. State Farm offers a discount to policyholders who complete an approved defensive driving course, which can help you learn valuable skills and potentially lower your premiums.

- Good Student Discount: This discount is available to students who maintain a certain GPA or academic standing. State Farm recognizes that good students are often more responsible drivers, and this discount reflects that.

Vehicle Features Discounts

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can significantly reduce the risk of theft, and State Farm rewards you for taking this proactive step. By installing features like alarms, immobilizers, or tracking systems, you can qualify for a discount.

- Airbag Discount: Vehicles equipped with airbags offer increased safety for drivers and passengers. State Farm recognizes this enhanced safety feature by offering a discount to policyholders who drive cars with airbags.

- Anti-lock Brake Discount: Anti-lock brakes (ABS) improve vehicle control and can help prevent accidents. State Farm offers a discount for vehicles equipped with ABS, as it demonstrates a commitment to safety.

Lifestyle and Other Discounts

- Multi-policy Discount: Bundling your car insurance with other insurance policies, such as home or renters insurance, can result in significant savings. State Farm offers a multi-policy discount to customers who insure multiple vehicles or properties with them.

- Paperless Discount: Choosing to receive your policy documents electronically can help State Farm reduce administrative costs. They reward this eco-friendly choice with a discount.

- Pay-in-Full Discount: Paying your car insurance premium in full upfront can often result in a discount. This demonstrates a commitment to financial responsibility and can save you money on your premiums.

Customer Reviews and Experiences

Understanding how State Farm car insurance pricing is perceived by customers is crucial. Examining customer reviews and experiences provides valuable insights into their satisfaction with the company’s pricing practices. By analyzing common themes and patterns, we can identify areas where State Farm excels or faces challenges in customer perception.

Positive Feedback on Pricing

Positive customer reviews often highlight State Farm’s competitive pricing and value for money. Customers appreciate the company’s transparent pricing structure, making it easy to understand and compare quotes.

- Many customers find State Farm’s rates to be competitive, especially when considering the company’s reputation for excellent customer service and comprehensive coverage options.

- State Farm’s focus on personalized pricing based on individual risk factors is often commended by customers. This allows for fair and accurate pricing tailored to each customer’s specific needs.

- The availability of various discounts, such as safe driving, good student, and multi-policy discounts, is widely appreciated by customers. These discounts can significantly reduce the overall cost of insurance, making State Farm an attractive option for cost-conscious drivers.

Negative Feedback on Pricing

While State Farm generally receives positive feedback on pricing, some customers have expressed concerns about higher-than-expected rates. These concerns often stem from factors such as:

- Unexpected Rate Increases: Some customers have experienced significant rate increases after renewing their policies, even without any changes in their driving record or coverage. This can lead to frustration and a sense of unfairness.

- Limited Negotiation Options: Some customers have found it difficult to negotiate their rates with State Farm, even when presenting a clean driving record or seeking discounts. This can be frustrating for customers who feel they are not being offered the best possible price.

- Geographic Variations: Pricing discrepancies based on geographic location can lead to customer dissatisfaction. Customers living in areas with higher insurance costs may feel they are being unfairly penalized for factors outside their control.

State Farm’s Customer Service and Support

State Farm’s customer service and support play a significant role in shaping the overall customer experience and, in turn, influencing their perception of pricing. A responsive and helpful customer service team can build trust and loyalty, potentially leading to a more positive view of State Farm’s insurance pricing.

Customer Service Resources and Tools

State Farm offers a comprehensive range of resources and tools to help customers manage their insurance policies and access price information. These resources are designed to streamline the customer experience and provide convenient access to information:

- Online Account Management: Customers can easily access their policy details, make payments, and manage their coverage through State Farm’s user-friendly online platform. This online portal allows customers to compare different coverage options and understand the impact of various factors on their insurance pricing.

- Mobile App: The State Farm mobile app provides on-the-go access to policy information, claims assistance, and other features. This convenience allows customers to quickly access information and make informed decisions about their insurance coverage, contributing to their understanding of pricing.

- 24/7 Customer Service: State Farm provides round-the-clock customer support through phone, email, and live chat. This accessibility ensures that customers can get assistance with their insurance needs whenever they require it, fostering a sense of security and confidence in their insurance provider.

Tips for Saving Money on State Farm Car Insurance

It’s natural to want to keep your car insurance costs as low as possible. State Farm offers various ways to potentially reduce your premiums. By understanding these strategies and implementing them, you can save money on your insurance while maintaining adequate coverage.

Comparing Quotes and Negotiating Rates

Comparing quotes from different insurance providers, including State Farm, is a crucial first step in finding the best price. State Farm’s online quote tool allows you to quickly get an estimate based on your specific information. However, it’s also recommended to contact a State Farm agent directly for personalized guidance and potential discounts. You can also use independent comparison websites that gather quotes from multiple insurers.

Once you have quotes from different providers, you can compare coverage options and prices to identify the most competitive offer.

Remember, you can negotiate your rates with State Farm. If you find a better quote elsewhere, you can use this information as leverage to request a lower price from State Farm.

Taking Advantage of Available Discounts

State Farm offers a wide range of discounts that can significantly reduce your premium. Here’s a list of common discounts:

- Good Driver Discount: This is a significant discount for drivers with a clean driving record and no accidents or violations.

- Multi-Policy Discount: Bundle your car insurance with other policies like homeowners, renters, or life insurance to save money on your combined premiums.

- Safe Driver Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can deter theft and earn you a discount.

- Vehicle Safety Features Discount: Cars with advanced safety features like anti-lock brakes, airbags, and stability control often qualify for discounts.

- Payment Discount: Paying your premium annually or semi-annually can often result in a lower overall cost compared to monthly payments.

- Student Discount: If you’re a good student with a high GPA, you may qualify for a discount.

- Military Discount: Active duty military personnel or veterans may be eligible for discounts.

- Group Discount: If you belong to a specific group or organization, such as an alumni association or professional group, you may qualify for a discount.

It’s important to note that discount availability and eligibility criteria can vary by state and policy. Contact your State Farm agent to determine which discounts you qualify for.

Optimizing Your Insurance Costs

Here’s a step-by-step guide to help you optimize your State Farm car insurance costs:

- Gather Your Information: Before you start comparing quotes, have your driver’s license, vehicle information, and details of any accidents or violations readily available.

- Compare Quotes: Get quotes from multiple insurance providers, including State Farm, to compare prices and coverage options.

- Review Your Coverage: Carefully examine your current coverage and determine if you need any adjustments. For example, if you have a very old car with low value, you may not need full collision and comprehensive coverage.

- Negotiate Rates: If you find a better quote elsewhere, use it as leverage to negotiate a lower rate with State Farm.

- Take Advantage of Discounts: Review the list of available discounts and make sure you’re taking advantage of all eligible options.

- Consider Payment Options: Explore different payment options, such as annual or semi-annual payments, to potentially reduce your overall cost.

- Review Your Policy Regularly: It’s a good practice to review your policy annually to ensure you have the right coverage and that you’re still taking advantage of all available discounts.

Final Wrap-Up: State Farm Car Insurance Price

Ultimately, the cost of State Farm car insurance is a personalized equation based on your individual circumstances. By understanding the factors that influence pricing, exploring available discounts, and comparing quotes, you can optimize your insurance costs and secure the best possible coverage for your needs. Remember to review your policy regularly and consider adjusting your coverage as your needs evolve.

Popular Questions

How can I get a quote for State Farm car insurance?

You can get a quote online, over the phone, or by visiting a State Farm agent.

What are some common discounts offered by State Farm?

State Farm offers discounts for good drivers, safe vehicles, multiple policies, and more.

How often should I review my State Farm car insurance policy?

It’s recommended to review your policy at least annually to ensure it still meets your needs and to see if you qualify for any new discounts.