State farm car insurance maryland – State Farm car insurance in Maryland is a popular choice for drivers seeking reliable and comprehensive coverage. State Farm, one of the largest insurance companies in the United States, has a long history in Maryland, offering a wide range of car insurance products and services tailored to the needs of Maryland residents.

This guide delves into the intricacies of State Farm car insurance in Maryland, exploring its coverage options, discounts, and customer experience. We’ll also examine Maryland’s car insurance regulations, including minimum liability coverage requirements and the claims filing process. By understanding the ins and outs of State Farm car insurance in Maryland, drivers can make informed decisions about their coverage and ensure they have the protection they need on the road.

State Farm Car Insurance in Maryland

State Farm is one of the largest and most well-known insurance companies in the United States, offering a wide range of insurance products, including car insurance, in Maryland. State Farm has a long history of providing insurance coverage and financial services to individuals and families across the country, including Maryland.

History of State Farm in Maryland

State Farm has been providing car insurance in Maryland for decades, serving the needs of drivers throughout the state. The company’s commitment to customer satisfaction and its comprehensive range of coverage options have made it a popular choice for Maryland residents seeking reliable car insurance.

Types of Car Insurance Coverage Offered by State Farm in Maryland

State Farm offers a comprehensive range of car insurance coverage options to meet the diverse needs of Maryland drivers. Here are the key types of coverage:

- Liability Coverage: This type of coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It covers collisions with other vehicles, objects, or even hitting a deer.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or no insurance at all. It helps cover your medical expenses and vehicle repairs.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” coverage, pays for your medical expenses and lost wages, regardless of who is at fault in an accident.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who is at fault, if you are injured in an accident.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

Car Insurance Discounts Available in Maryland

State Farm offers a variety of discounts to help Maryland drivers save money on their car insurance premiums. These discounts can be applied based on factors such as your driving record, vehicle safety features, and your overall insurance profile. Here are some of the most common car insurance discounts available in Maryland:

- Good Driver Discount: This discount is available to drivers with a clean driving record, free of accidents and traffic violations.

- Safe Driver Discount: This discount is offered to drivers who have completed a defensive driving course.

- Multi-Car Discount: This discount is available to customers who insure multiple vehicles with State Farm.

- Multi-Policy Discount: This discount is offered to customers who bundle their car insurance with other insurance policies from State Farm, such as homeowners or renters insurance.

- Anti-theft Device Discount: This discount is available to drivers who have anti-theft devices installed in their vehicles, such as alarms or tracking systems.

- Good Student Discount: This discount is available to students who maintain a certain grade point average.

- Defensive Driving Course Discount: This discount is available to drivers who complete a defensive driving course.

- Pay-in-Full Discount: This discount is offered to customers who pay their premiums in full.

- Paperless Discount: This discount is available to customers who opt for electronic communication and billing.

Obtaining a Car Insurance Quote from State Farm in Maryland

Getting a car insurance quote from State Farm in Maryland is a straightforward process. You can obtain a quote online, over the phone, or by visiting a local State Farm agent. To get an accurate quote, you will need to provide some basic information, such as:

- Your name, address, and contact information

- Your driving history, including any accidents or violations

- The make, model, and year of your vehicle

- Your desired coverage levels

Once you provide this information, State Farm will generate a personalized quote based on your specific needs and risk profile.

Maryland Car Insurance Regulations: State Farm Car Insurance Maryland

In Maryland, the Motor Vehicle Administration (MVA) mandates specific car insurance requirements to ensure financial responsibility and protect drivers and their property in case of accidents. These regulations Artikel minimum coverage amounts and establish a framework for handling claims.

Financial Responsibility Laws

Maryland’s financial responsibility laws require drivers to prove they can pay for damages caused by accidents. To comply, drivers must have a minimum amount of liability insurance coverage, which includes:

- Bodily Injury Liability: $30,000 per person/$60,000 per accident. This covers injuries to others in an accident caused by you.

- Property Damage Liability: $15,000 per accident. This covers damage to another person’s property, such as their vehicle or other belongings, caused by you.

Failing to meet these minimum requirements can result in fines, license suspension, and even vehicle impoundment.

Filing a Car Insurance Claim in Maryland

When filing a car insurance claim in Maryland, the process typically involves the following steps:

- Report the Accident: Immediately contact your insurance company and report the accident. Provide them with details such as the date, time, location, and any injuries or damages.

- File a Claim: Submit a formal claim with your insurance company, including all necessary documentation, such as a police report, photos of the damage, and witness statements.

- Investigate and Process: Your insurance company will investigate the claim, gather information, and assess the damages. This process can take some time.

- Negotiate and Settle: Once the investigation is complete, you and your insurance company will negotiate a settlement for the damages. This may involve a cash payment, repairs, or other arrangements.

Maryland Auto Insurance Rate Calculation Factors

Insurance companies in Maryland consider various factors when calculating your car insurance rates. These factors can influence the cost of your premium, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, plays a significant role in determining your rates.

- Vehicle Type and Age: The make, model, year, and safety features of your vehicle can impact your insurance premium. Newer vehicles with advanced safety features tend to be more expensive to insure.

- Location: Your residential address and the risk of accidents in your area can influence your rates. Areas with higher crime rates or more traffic congestion may have higher insurance premiums.

- Credit Score: In some states, insurance companies may consider your credit score as a factor in determining your rates. However, this practice is not allowed in Maryland.

- Coverage Options: The types and amounts of coverage you choose, such as comprehensive, collision, and uninsured motorist coverage, can affect your premium.

- Deductible: The amount you agree to pay out-of-pocket before your insurance coverage kicks in, known as the deductible, can also influence your rates. Higher deductibles generally result in lower premiums.

State Farm’s Customer Experience in Maryland

State Farm is a well-known and established insurance provider in Maryland, and its customer experience is a key factor in its success. The company aims to provide a positive and efficient experience for its policyholders, offering a range of services and resources to support their needs.

Customer Reviews and Testimonials

Customer feedback is crucial in understanding the effectiveness of a company’s services. Online platforms like Google Reviews, Trustpilot, and Yelp provide valuable insights into State Farm’s customer experience in Maryland. These platforms allow customers to share their experiences, both positive and negative, which can help potential customers make informed decisions.

- Many reviews praise State Farm’s friendly and helpful customer service representatives, highlighting their responsiveness and willingness to assist with policy-related inquiries.

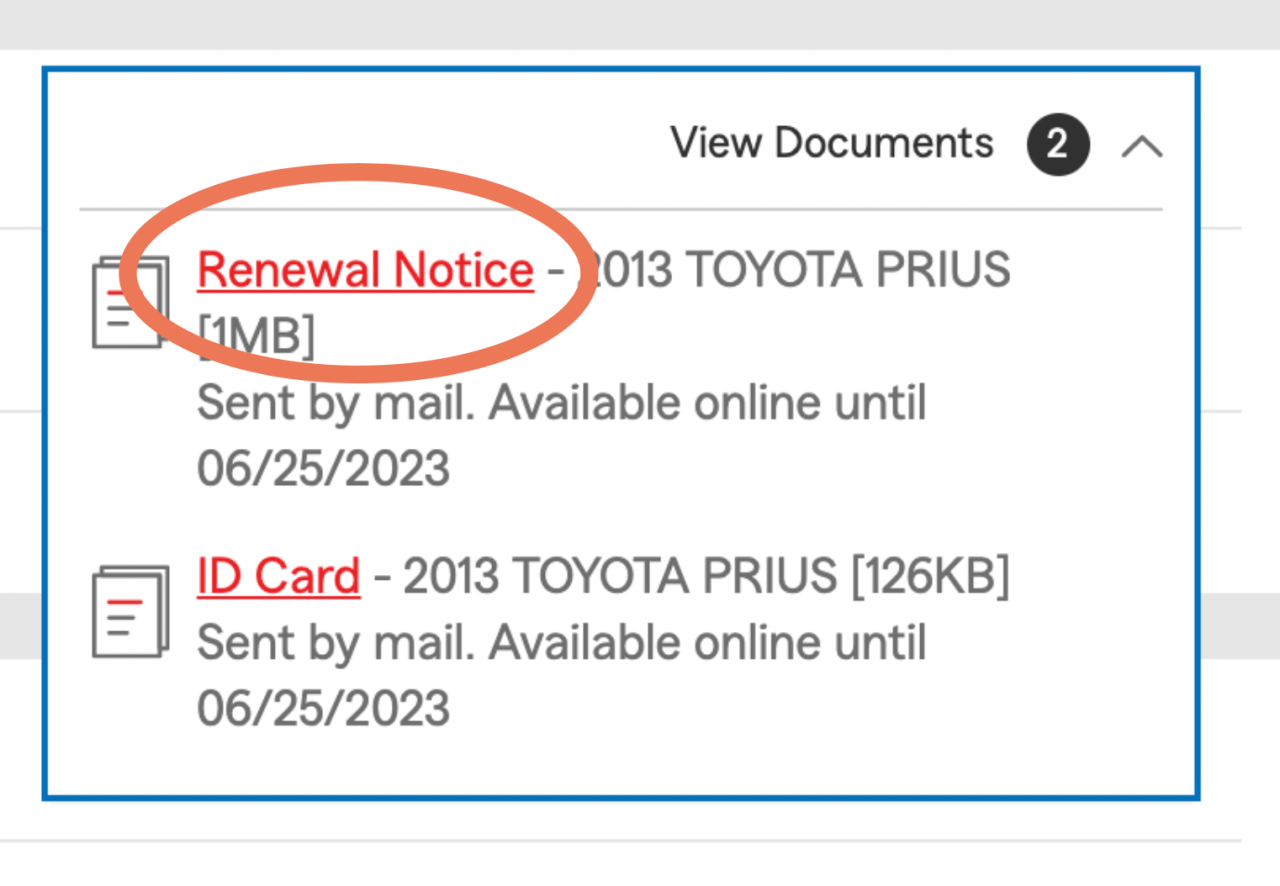

- Some customers appreciate the ease of filing claims online or through the mobile app, noting the streamlined process and prompt communication.

- However, some reviews mention occasional delays in claim processing or communication challenges, suggesting areas for improvement.

Accessibility and Responsiveness of Customer Service Channels

State Farm offers various customer service channels to ensure accessibility and responsiveness for its Maryland policyholders. These channels include:

- Phone Support: State Farm provides 24/7 phone support, allowing customers to reach a representative at any time, day or night. This is particularly beneficial for urgent matters or when immediate assistance is needed.

- Online Chat: The company’s website offers a live chat feature, allowing customers to connect with a representative online for quick inquiries or assistance. This option is convenient for those who prefer digital communication.

- Mobile App: State Farm’s mobile app offers a range of features, including policy management, claim filing, and communication with customer service representatives. This app provides a convenient and accessible platform for managing insurance needs on the go.

- Local Agents: State Farm has a network of local agents in Maryland, offering personalized support and guidance to policyholders. These agents can assist with policy selection, claims filing, and other insurance-related matters.

Comparison of Claims Handling Process

State Farm’s claims handling process in Maryland is generally regarded as efficient and transparent. The company aims to resolve claims promptly and fairly, offering a range of resources and support to guide policyholders through the process.

- State Farm provides a dedicated claims hotline for reporting accidents or incidents. The company also offers online claim filing options for added convenience.

- State Farm employs a team of claims adjusters who investigate claims and assess damages. These adjusters work to ensure fair and accurate compensation for policyholders.

- State Farm’s claims handling process is generally comparable to other major insurers in terms of efficiency and customer satisfaction. However, specific experiences may vary depending on the nature of the claim and individual circumstances.

Reputation Regarding Customer Satisfaction and Trust

State Farm enjoys a strong reputation in Maryland for customer satisfaction and trust. The company has consistently ranked highly in customer satisfaction surveys and industry reports, demonstrating its commitment to providing excellent service.

- State Farm’s focus on personalized service, prompt claims handling, and transparent communication has contributed to its positive reputation among Maryland policyholders.

- The company’s long history and strong financial stability also inspire trust among customers, assuring them of reliable coverage and support.

- State Farm’s commitment to community involvement and charitable initiatives further enhances its reputation and strengthens its ties with Maryland residents.

Car Insurance Rates in Maryland

Maryland car insurance rates are influenced by various factors, making it essential to understand the cost structure and compare options to find the best value. This section delves into car insurance rates in Maryland, analyzing factors that impact pricing and providing insights into potential cost savings.

Average Car Insurance Rates in Maryland

Maryland’s average annual car insurance premium is $1,262, slightly higher than the national average of $1,172. State Farm, a leading insurer in Maryland, offers competitive rates, typically falling within the average range. To get a precise estimate for your specific situation, it’s recommended to obtain personalized quotes from multiple insurers, including State Farm.

Factors Affecting Car Insurance Rates in Maryland

Several factors influence car insurance rates in Maryland. These include:

- Driving History: Drivers with a clean driving record, free from accidents and violations, generally receive lower rates. A history of accidents, traffic violations, or DUI convictions can significantly increase premiums.

- Vehicle Type: The type of vehicle you drive plays a significant role in determining insurance costs. High-performance cars, luxury vehicles, and SUVs tend to have higher insurance premiums due to their higher repair costs and greater risk of theft.

- Location: Car insurance rates vary based on the geographic location within Maryland. Urban areas with higher traffic density and accident rates often have higher premiums compared to rural areas.

- Age and Gender: Younger drivers, particularly those under 25, often face higher premiums due to their increased risk of accidents. Gender can also play a role, with male drivers typically paying slightly more than female drivers.

- Credit Score: In some states, including Maryland, insurance companies may consider your credit score when calculating your premium. A higher credit score generally indicates a lower risk and can lead to lower rates.

Car Insurance Rates for Different Demographics in Maryland

The following table illustrates estimated average annual car insurance premiums for various demographics in Maryland:

| Demographic | Average Annual Premium |

|---|---|

| Young Drivers (Under 25) | $1,800 – $2,500 |

| Experienced Drivers (Over 55) | $1,000 – $1,500 |

| Drivers with Clean Records | $1,000 – $1,600 |

| Drivers with Accidents or Violations | $1,500 – $2,200 |

Potential Cost Savings with State Farm Car Insurance in Maryland

State Farm offers various discounts and programs that can help Maryland residents save on their car insurance premiums. These include:

- Safe Driving Discounts: Drivers with clean driving records may qualify for discounts based on their accident-free history.

- Multi-Policy Discounts: Bundling multiple insurance policies, such as home and auto, with State Farm can lead to significant savings.

- Good Student Discounts: Students with good grades may be eligible for discounted premiums.

- Anti-theft Device Discounts: Vehicles equipped with anti-theft devices, such as alarms or tracking systems, can qualify for lower rates.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially lower your premiums.

Additional Features and Services

State Farm offers a range of optional car insurance add-ons in Maryland to enhance your coverage and provide peace of mind. These features cater to specific needs and can be customized to suit your driving habits and lifestyle.

Roadside Assistance and Rental Car Coverage

These optional add-ons provide valuable support in unexpected situations.

- Roadside Assistance: This service provides help with situations like flat tires, dead batteries, and lockouts. It can be especially helpful if you find yourself stranded on the side of the road.

- Rental Car Coverage: If your vehicle is damaged or stolen and you need transportation, rental car coverage can help cover the cost of a rental car while your vehicle is being repaired or replaced.

State Farm’s Mobile App and Online Portal, State farm car insurance maryland

State Farm’s mobile app and online portal provide convenient and accessible tools for managing your car insurance policy.

- Mobile App: The State Farm mobile app allows you to view your policy details, make payments, file claims, and access roadside assistance services directly from your smartphone.

- Online Portal: The online portal offers similar functionalities as the mobile app, allowing you to manage your policy from any computer or device with internet access.

Final Review

Choosing the right car insurance policy is crucial for Maryland drivers. State Farm offers a comprehensive range of coverage options, discounts, and customer service features that can meet diverse needs. By carefully considering the factors Artikeld in this guide, Maryland residents can confidently select a State Farm car insurance policy that provides adequate protection and financial security.

Question & Answer Hub

What are the minimum car insurance requirements in Maryland?

Maryland requires all drivers to carry at least $30,000 in bodily injury liability coverage per person, $60,000 per accident, and $15,000 in property damage liability coverage.

How can I get a car insurance quote from State Farm in Maryland?

You can obtain a quote online, by phone, or by visiting a State Farm agent in person. You’ll need to provide information about your vehicle, driving history, and desired coverage.

What are some common car insurance discounts offered by State Farm in Maryland?

State Farm offers various discounts, including good driver discounts, safe driver discounts, multi-car discounts, and discounts for bundling insurance policies.

How do I file a car insurance claim with State Farm in Maryland?

You can file a claim online, by phone, or through a State Farm agent. Be sure to have your policy information and details of the accident readily available.