State Farm car insurance Indiana offers comprehensive coverage options, tailoring policies to meet individual needs. With a strong presence in the state and a commitment to customer satisfaction, State Farm has earned its reputation as a trusted insurance provider. This guide delves into the various aspects of State Farm car insurance in Indiana, exploring coverage options, premium factors, customer service, and the benefits of online tools.

From understanding the minimum insurance requirements in Indiana to exploring discounts and bundling options, this guide aims to equip you with the knowledge necessary to make informed decisions about your car insurance needs.

State Farm Car Insurance in Indiana

State Farm is a prominent insurance provider in the United States, known for its comprehensive range of insurance products and services. With a strong national presence, State Farm has a long-standing history in Indiana, serving the insurance needs of Hoosiers for decades.

State Farm’s Presence in Indiana

State Farm has a significant presence in Indiana, with a vast network of agents and offices across the state. The company’s commitment to providing exceptional customer service and tailored insurance solutions has earned it the trust of many Indiana residents. State Farm’s dedication to the Indiana community is evident through its involvement in various local initiatives and partnerships.

Car Insurance Products Offered by State Farm in Indiana

State Farm offers a comprehensive range of car insurance products in Indiana, designed to meet the diverse needs of its customers. These products include:

- Liability Coverage: This coverage protects you financially if you are found liable for an accident that causes damage to another person’s property or injuries.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who does not have adequate insurance or is uninsured.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you are injured in an accident, regardless of fault.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers, regardless of fault.

State Farm also offers a variety of optional car insurance coverages, such as:

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged in an accident and is being repaired.

- Roadside Assistance: This coverage provides assistance with services such as jump starts, tire changes, and towing.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled.

Car Insurance Coverage Options

In Indiana, having car insurance is not just a good idea; it’s a legal requirement. The state mandates that all drivers carry a minimum level of coverage, and understanding the various types of car insurance can help you make informed decisions to protect yourself and your finances in case of an accident.

Indiana’s Minimum Car Insurance Requirements

Indiana law requires drivers to carry at least the following minimum liability insurance coverage:

- Bodily Injury Liability: This covers injuries to others in an accident you cause. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damage to another person’s property in an accident you cause. The minimum requirement is $10,000.

While these minimums are legally required, they may not be sufficient to cover all potential expenses in a serious accident. Consider increasing your coverage limits to provide greater financial protection.

State Farm’s Coverage Options in Indiana

State Farm offers a comprehensive range of car insurance coverage options, including:

- Liability Coverage: This is the most basic type of car insurance and covers damages to others in an accident you cause. It includes bodily injury liability and property damage liability, as described above.

- Collision Coverage: This covers damage to your own vehicle in an accident, regardless of who is at fault. It helps pay for repairs or replacement costs, minus your deductible.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, or natural disasters. It also helps pay for repairs or replacement costs, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It helps pay for your injuries and property damage.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): This covers medical expenses, lost wages, and other expenses for you and your passengers, regardless of who is at fault in an accident.

- Rental Reimbursement Coverage: This covers the cost of a rental car while your vehicle is being repaired after an accident.

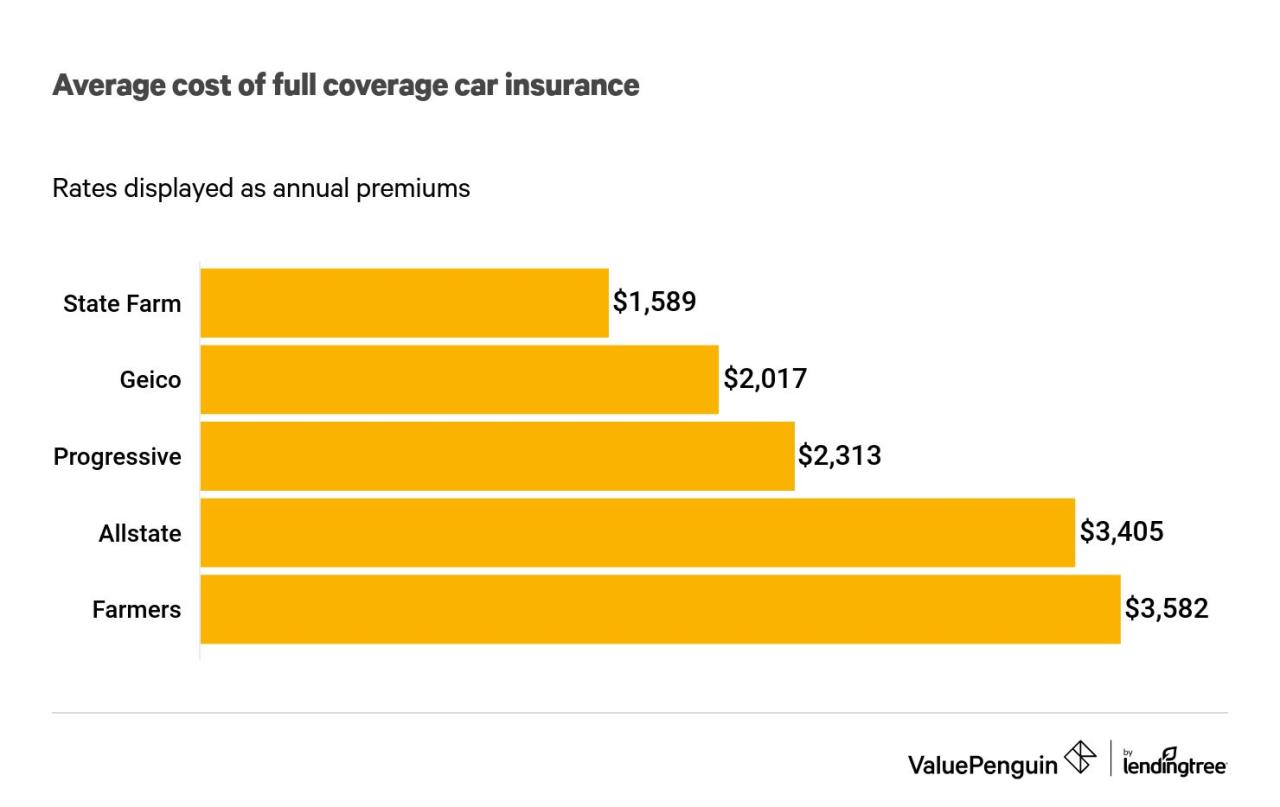

Comparison with Other Major Insurance Providers

State Farm is a leading car insurance provider in Indiana, but other major insurers also offer competitive coverage options. It’s essential to compare quotes from multiple insurers to find the best rates and coverage that meets your needs. Factors to consider when comparing insurance providers include:

- Coverage Options: Ensure the insurer offers the specific coverage you need, such as collision, comprehensive, and uninsured/underinsured motorist coverage.

- Price: Get quotes from several insurers to compare rates and find the most affordable option.

- Customer Service: Look for an insurer with a reputation for excellent customer service and responsiveness.

- Financial Stability: Choose an insurer with a strong financial rating, indicating their ability to pay claims.

Factors Affecting Car Insurance Premiums

Car insurance premiums in Indiana, like in other states, are influenced by a variety of factors that reflect your individual risk profile. State Farm, like other insurance companies, uses these factors to calculate your premiums, ensuring you pay a fair price for the coverage you need.

Driving History

Your driving history plays a significant role in determining your car insurance premium. A clean driving record with no accidents or violations will generally result in lower premiums. However, any incidents like speeding tickets, DUI/DWI, or accidents can lead to higher premiums. State Farm considers the severity and frequency of your past driving incidents to assess your risk.

Age

Age is another factor that impacts your car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher premiums. However, as you gain experience and reach a certain age, your premiums tend to decrease. This reflects the fact that older drivers are generally more experienced and cautious on the road.

Vehicle Type

The type of vehicle you drive significantly influences your car insurance premiums. Luxury cars, sports cars, and vehicles with powerful engines are generally more expensive to repair and replace, leading to higher insurance costs. Conversely, smaller, less expensive vehicles tend to have lower premiums. State Farm considers factors like the vehicle’s make, model, year, and safety features to determine its risk profile and adjust premiums accordingly.

Location

Where you live in Indiana can impact your car insurance premiums. Areas with higher crime rates, traffic congestion, and accident frequencies often have higher insurance premiums. State Farm considers the location’s risk profile, including factors like population density, traffic volume, and weather conditions, to adjust premiums accordingly.

State Farm’s Customer Service and Claims Process

State Farm is renowned for its customer service and claims handling, and its reputation in Indiana reflects this. Customers consistently praise State Farm’s responsiveness, helpfulness, and ease of interaction. To understand State Farm’s approach in Indiana, let’s delve into customer feedback and the detailed claims process.

Customer Service Reputation in Indiana

State Farm’s customer service in Indiana has garnered positive reviews and testimonials. Customers consistently highlight the following:

- Prompt and Efficient Response: State Farm agents in Indiana are known for their quick response times, whether it’s addressing inquiries, resolving issues, or providing guidance.

- Friendly and Knowledgeable Staff: Customers appreciate the friendly and helpful demeanor of State Farm agents and representatives in Indiana. They are also commended for their expertise in explaining insurance policies and addressing customer concerns.

- Personalized Service: State Farm agents in Indiana are known for taking a personalized approach, understanding individual needs and tailoring solutions accordingly.

The Claims Process in Indiana

The claims process for car insurance in Indiana with State Farm is designed to be straightforward and efficient. It involves the following steps:

- Report the Accident: The first step is to report the accident to State Farm as soon as possible. This can be done by phone, online, or through the State Farm mobile app.

- Provide Information: State Farm will request information about the accident, including details about the other driver, the location, and the extent of the damage.

- Claim Review and Assessment: State Farm will review the information provided and assess the claim. This may involve an inspection of the damaged vehicle.

- Negotiation and Settlement: Once the claim is assessed, State Farm will negotiate a settlement with the policyholder. This may involve repairing the damaged vehicle, covering medical expenses, or providing compensation for other losses.

- Payment: Once the settlement is agreed upon, State Farm will issue payment to the policyholder.

Unique Features and Benefits

State Farm offers several unique features and benefits to enhance customer service and claims handling in Indiana:

- 24/7 Claims Service: State Farm provides 24/7 claims service, allowing policyholders to report accidents and receive assistance anytime, anywhere.

- Mobile App: The State Farm mobile app provides a convenient platform for reporting accidents, tracking claim progress, and accessing other services.

- Direct Repair Network: State Farm has a network of preferred repair shops in Indiana, ensuring that policyholders have access to quality repairs at competitive prices.

- Ride Share: State Farm offers a ride share program that provides transportation to policyholders whose vehicles are damaged in an accident.

Discounts and Bundling Options

State Farm offers a variety of discounts to help Indiana drivers save money on their car insurance. These discounts can be applied to your policy based on your individual circumstances and driving habits. In addition to discounts, State Farm also allows you to bundle your car insurance with other insurance products, which can further reduce your overall insurance costs.

Discounts Available

State Farm offers a variety of discounts to help Indiana drivers save money on their car insurance. Here are some of the most common discounts:

| Discount Type | Description |

|---|---|

| Safe Driver Discount | This discount is available to drivers with a clean driving record, meaning they haven’t been involved in any accidents or received any traffic violations within a certain timeframe. |

| Good Student Discount | This discount is available to students who maintain a certain grade point average (GPA) or rank in their class. |

| Multi-Policy Discount | This discount is available to customers who bundle their car insurance with other insurance products from State Farm, such as home, renters, or life insurance. |

| Defensive Driving Course Discount | This discount is available to drivers who have completed a state-approved defensive driving course. |

| Anti-theft Device Discount | This discount is available to drivers who have installed anti-theft devices in their vehicles. |

Benefits of Bundling

Bundling your car insurance with other insurance products from State Farm can save you money on your premiums. When you bundle your insurance policies, State Farm often offers a significant discount on your combined premiums. This discount can be substantial, especially if you bundle multiple policies.

For example, if you bundle your car insurance with your homeowners insurance, you could save 10% or more on your combined premiums.

Bundling also simplifies your insurance management. You’ll only have one insurance provider to deal with for all your insurance needs, which can be convenient and less stressful.

Potential Savings

The discounts and bundling options offered by State Farm can save Indiana drivers a significant amount of money on their car insurance.

For example, a driver who qualifies for the Safe Driver, Good Student, and Multi-Policy discounts could save up to 25% or more on their car insurance premiums.

It’s important to note that the specific discounts and savings you qualify for will depend on your individual circumstances and the policies you choose. It’s always a good idea to contact State Farm directly to discuss your specific insurance needs and determine the best way to save money.

Online and Mobile Tools

State Farm offers a variety of online and mobile tools that make managing your car insurance policy in Indiana a breeze. These tools allow you to access your policy information, make payments, file claims, and even get a quote, all from the comfort of your own home or on the go.

Online Quote Generation

Getting a car insurance quote from State Farm is simple and convenient. You can obtain a quote online in just a few minutes by providing some basic information about yourself and your vehicle. The online quote tool allows you to compare different coverage options and see how they affect your premium. You can also get a personalized quote based on your specific needs and driving history.

Policy Management

State Farm’s online policy management tools give you 24/7 access to your policy information. You can view your policy details, make changes to your coverage, update your contact information, and even pay your premium online. This level of accessibility makes it easy to stay on top of your insurance needs and ensure that your coverage is always up-to-date.

Claims Reporting

State Farm’s mobile app makes it easy to report a claim, no matter where you are. The app allows you to submit photos and videos of the damage, provide details about the incident, and even track the progress of your claim. You can also communicate with your claims adjuster directly through the app, making the claims process faster and more efficient.

Advantages of Using Online and Mobile Tools

- Convenience: Online and mobile tools allow you to manage your car insurance policy from anywhere, anytime. You can access your policy information, make payments, file claims, and get quotes without having to visit a State Farm office.

- Time Savings: These tools save you time by eliminating the need to call or visit a State Farm office for simple tasks. You can complete many tasks online or through the app, freeing up your time for other things.

- Increased Transparency: Online and mobile tools provide you with access to your policy information, allowing you to see exactly what you’re paying for and how your coverage works.

- Improved Communication: You can communicate with State Farm directly through the app or online portal, making it easier to get the information you need and resolve any issues quickly.

Customer Testimonials and Reviews: State Farm Car Insurance Indiana

Understanding the experiences of actual State Farm customers in Indiana can provide valuable insights into the quality of their services. Analyzing customer testimonials and reviews can reveal both positive and negative aspects of their offerings.

Customer Testimonials and Reviews Analysis, State farm car insurance indiana

To gain a comprehensive understanding of customer sentiment towards State Farm car insurance in Indiana, we’ve compiled a table highlighting both positive and negative testimonials and reviews sourced from reputable platforms like Google Reviews, Trustpilot, and Yelp.

| Category | Positive Testimonials | Negative Testimonials |

|---|---|---|

| Customer Service | “The agents at State Farm are incredibly helpful and responsive. They always go the extra mile to ensure I understand my policy and answer any questions I have.” | “I had a terrible experience with State Farm’s customer service. I waited on hold for hours and couldn’t get through to a representative.” |

| Claims Process | “I was very satisfied with how quickly and efficiently State Farm handled my car accident claim. The process was smooth and hassle-free.” | “My claim was delayed for weeks, and I had to call multiple times to get updates. The communication from State Farm was poor.” |

| Pricing and Value | “State Farm offers competitive rates and a wide range of coverage options. I feel like I’m getting good value for my money.” | “I was surprised by how much my premium increased after only a year with State Farm. I feel like the rates are not transparent.” |

Analyzing these testimonials and reviews reveals several common themes and trends:

- Positive experiences with customer service: Many customers praise State Farm’s agents for their helpfulness, responsiveness, and willingness to go the extra mile.

- Efficient claims process: Customers generally appreciate the speed and efficiency of State Farm’s claims process, particularly in cases of accidents.

- Competitive pricing and value: State Farm’s competitive rates and comprehensive coverage options are often highlighted as positive aspects.

- Negative experiences with customer service: Some customers report difficulties reaching representatives and long wait times, leading to frustration.

- Communication issues: Certain customers express dissatisfaction with the communication from State Farm during the claims process, citing delays and lack of updates.

- Concerns about premium increases: Some customers have experienced unexpected premium increases, raising concerns about transparency and fairness.

Overall, customer sentiment towards State Farm car insurance in Indiana is generally positive, with many customers praising their customer service, claims process, and competitive pricing. However, there are also some negative experiences reported, primarily related to customer service responsiveness and communication during the claims process. These negative experiences highlight the importance of clear communication and timely responses from insurance providers.

Final Summary

Whether you’re a new driver or a seasoned motorist, State Farm car insurance Indiana offers a range of features and services designed to provide peace of mind. By understanding the various coverage options, premium factors, and customer service benefits, you can confidently choose a policy that meets your individual needs and budget.

FAQs

How do I get a quote for State Farm car insurance in Indiana?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

What are the minimum car insurance requirements in Indiana?

Indiana requires drivers to have liability coverage, including bodily injury liability, property damage liability, and uninsured motorist coverage.

What discounts are available for State Farm car insurance in Indiana?

State Farm offers various discounts, including safe driver, good student, multi-policy, and more.

How do I file a claim with State Farm car insurance in Indiana?

You can file a claim online, over the phone, or by visiting a local State Farm agent.