The State Farm car insurance estimator is a valuable tool that empowers you to get a personalized quote for your car insurance needs. This online estimator simplifies the process, allowing you to quickly understand your potential coverage options and costs. By inputting basic information about yourself and your vehicle, you can receive an estimated quote within minutes, providing a starting point for your insurance journey.

The estimator is designed to be user-friendly, guiding you through each step with clear instructions. It allows you to explore different coverage options and adjust them to fit your specific requirements. This flexibility ensures that you can find a policy that meets your needs and budget. Whether you’re a new driver, seasoned motorist, or looking to compare quotes, the State Farm car insurance estimator is a convenient and informative resource.

Understanding State Farm Car Insurance Estimator

The State Farm Car Insurance Estimator is a user-friendly online tool that helps potential customers get a personalized estimate of their car insurance premiums. It simplifies the process of understanding potential costs and allows individuals to compare different coverage options.

Key Features and Benefits

The estimator provides a quick and convenient way to explore car insurance options without the need for a formal quote request. It allows users to see how different factors, such as their driving history, vehicle details, and coverage choices, impact their potential premiums. The tool offers several benefits:

- Instant Estimate: Get a preliminary idea of your insurance costs within minutes, without needing to contact an agent.

- Personalized Results: The estimator considers individual circumstances and provides a customized estimate based on the information provided.

- Comparison Tool: Allows users to compare different coverage options and see how their choices affect the premium.

- Transparency: The estimator provides clear and concise information about the factors influencing the estimated premium.

Information Required

The State Farm Car Insurance Estimator requires users to provide certain information to generate a personalized estimate. This information typically includes:

- Personal Information: Name, address, date of birth, and contact details.

- Vehicle Information: Year, make, model, and vehicle identification number (VIN).

- Driving History: Driving record, including any accidents or violations.

- Coverage Preferences: Desired coverage levels, such as liability, collision, and comprehensive coverage.

- Location: Zip code or address to determine location-based factors influencing premiums.

Accessing and Using the Estimator

The State Farm car insurance estimator is a user-friendly online tool that allows you to get a personalized estimate of your potential car insurance premiums. It’s a convenient way to explore different coverage options and compare prices without having to contact an agent directly.

Accessing the Estimator

To access the State Farm car insurance estimator, you can follow these steps:

- Visit the State Farm website. You can easily find it by searching for “State Farm” on your preferred search engine.

- Navigate to the “Car Insurance” section. This is usually found under the “Insurance” or “Products” tab on the website.

- Look for the “Get a Quote” or “Estimate Your Rate” button. It’s often prominently displayed on the car insurance page.

- Click on the button. This will redirect you to the car insurance estimator page.

Providing User Information

Once you’re on the estimator page, you’ll need to provide some basic information about yourself and your vehicle. This information helps State Farm to generate an accurate estimate. Here’s what you’ll typically be asked to provide:

- Your zip code: This helps State Farm determine the location and risk factors associated with your area.

- Your driving history: This includes details about your age, driving experience, and any past accidents or violations.

- Your vehicle information: This includes the make, model, year, and estimated value of your car.

- Your coverage preferences: This includes the type of coverage you’re interested in, such as liability, collision, comprehensive, and uninsured motorist coverage.

Customizing Your Quote

After you’ve provided your information, the estimator will generate an initial quote. You can then customize this quote by adjusting your coverage options. Here are some common ways to adjust your coverage:

- Deductibles: You can choose a higher deductible, which will lower your premium but increase your out-of-pocket expenses in case of an accident.

- Coverage limits: You can adjust the coverage limits for different types of insurance, such as liability or collision coverage. Higher limits will provide more protection but may result in a higher premium.

- Optional coverage: You can add or remove optional coverage, such as roadside assistance, rental car reimbursement, or gap insurance. These options can enhance your protection but will increase your premium.

Factors Influencing Car Insurance Estimates

Several factors play a significant role in determining your car insurance premium. These factors help insurance companies assess your risk and determine how much you’ll pay for coverage.

Driving History

Your driving history is a crucial factor in calculating your insurance premium. This includes your past driving record, which reflects your driving habits and potential risk. A clean driving record with no accidents or traffic violations generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely increase your insurance costs. For example, if you’ve been involved in multiple accidents, insurance companies might perceive you as a higher risk driver, leading to higher premiums.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premium. Insurance companies consider factors like the vehicle’s make, model, year, safety features, and overall value when determining your rate. Luxury cars, sports cars, and vehicles with high repair costs tend to have higher premiums due to their potential for more expensive repairs in case of an accident. Conversely, older, less expensive vehicles with basic safety features often have lower premiums.

Location

Your location, specifically your zip code, is a significant factor in your car insurance rates. Insurance companies consider factors like the density of traffic, crime rates, and the frequency of accidents in your area. Areas with high traffic density and higher crime rates generally have higher insurance premiums. This is because the risk of accidents and theft is higher in such areas.

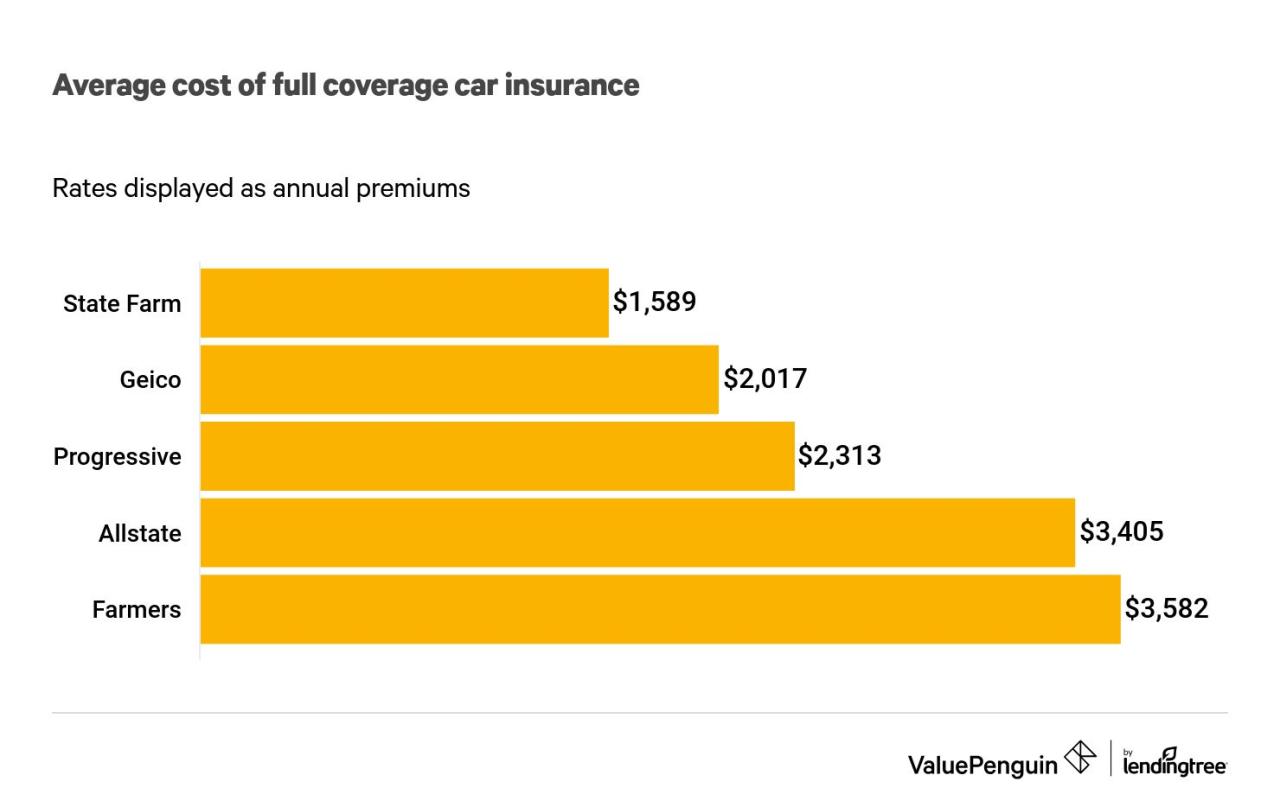

State Farm Car Insurance Estimator vs. Competitors

Getting an accurate car insurance quote can be time-consuming and tedious, especially when you need to contact multiple insurance companies. Thankfully, many insurers offer online car insurance estimators to streamline the process. While State Farm’s estimator is a popular choice, it’s essential to compare it with similar tools offered by competitors to make an informed decision.

Comparison of Car Insurance Estimators

The State Farm car insurance estimator is a valuable tool, but it’s not the only option available. Comparing it with similar tools from competitors can help you determine which one best suits your needs. Here’s a breakdown of key features, strengths, and weaknesses of some popular estimators:

- State Farm: State Farm’s estimator is user-friendly and provides a quick quote based on basic information. It allows you to customize your coverage options and see how they affect your premium. However, it may not be as detailed as some competitors, and it doesn’t offer as many customization options.

- Geico: Geico’s estimator is known for its simplicity and speed. It provides a quick quote based on basic information and allows you to compare different coverage options. However, it may not be as comprehensive as some other estimators, and it doesn’t offer as many customization options.

- Progressive: Progressive’s estimator is known for its comprehensive nature. It allows you to customize your coverage options and get a personalized quote. It also offers features like a “Name Your Price” tool, which lets you set your desired premium and see what coverage options are available. However, it can be more complex to use than some other estimators.

- Allstate: Allstate’s estimator is a good option for those who want a detailed quote. It allows you to customize your coverage options and see how they affect your premium. It also offers features like a “Drive Safe & Save” discount calculator, which can help you estimate potential savings based on your driving habits. However, it may not be as user-friendly as some other estimators.

Accuracy and User Experience

The accuracy of car insurance estimators can vary depending on the information you provide and the algorithms used by the insurer. In general, most estimators provide a reasonably accurate estimate of your premium, but it’s essential to note that these are just estimates and not guaranteed quotes.

- Accuracy: Most car insurance estimators use algorithms to provide a quick and reasonably accurate estimate of your premium based on the information you provide. However, it’s important to remember that these are just estimates, and your actual premium may vary based on factors that the estimator cannot account for. For example, the estimator may not consider your driving history or credit score, which can significantly impact your premium.

- User Experience: The user experience of car insurance estimators can vary significantly. Some estimators are simple and easy to use, while others are more complex and require more information. The best estimator for you will depend on your individual needs and preferences. If you’re looking for a quick and easy way to get an estimate, a simple estimator may be sufficient. However, if you want a more detailed and personalized quote, you may need to use a more complex estimator.

Key Differences in Features

While all car insurance estimators offer a basic quote, they differ in the features they offer. Some estimators offer more customization options, while others focus on speed and simplicity. Here are some key differences in features:

- Coverage Options: Most estimators allow you to customize your coverage options, such as liability limits, collision coverage, and comprehensive coverage. However, the specific coverage options available may vary depending on the insurer.

- Discounts: Some estimators offer discounts based on factors such as good driving history, safe driving features, and multiple policies. It’s essential to check if the estimator considers these discounts when providing your quote.

- Additional Features: Some estimators offer additional features, such as a “Name Your Price” tool or a “Drive Safe & Save” discount calculator. These features can help you personalize your quote and estimate potential savings based on your driving habits.

Strengths and Weaknesses of Each Tool, State farm car insurance estimator

Each car insurance estimator has its strengths and weaknesses. Understanding these can help you choose the best tool for your needs.

- State Farm:

- Strengths: User-friendly interface, quick quote generation, customization options for coverage.

- Weaknesses: May not be as detailed as competitors, limited customization options compared to some.

- Geico:

- Strengths: Simple and fast, easy to compare coverage options.

- Weaknesses: May not be as comprehensive as other estimators, limited customization options.

- Progressive:

- Strengths: Comprehensive features, personalized quotes, “Name Your Price” tool.

- Weaknesses: Can be more complex to use than other estimators, may require more information.

- Allstate:

- Strengths: Detailed quotes, customization options, “Drive Safe & Save” discount calculator.

- Weaknesses: May not be as user-friendly as other estimators, can be time-consuming.

Tips for Obtaining the Best Car Insurance Quote

Finding the best car insurance quote involves a combination of research, strategy, and negotiation. It’s not just about finding the cheapest option; it’s about finding the right coverage at the best price.

Strategies for Getting the Most Accurate and Competitive Car Insurance Quote

To get the most accurate and competitive car insurance quote, it’s essential to be proactive and prepared.

- Provide Accurate Information: When filling out the quote request form, be sure to provide accurate information about your vehicle, driving history, and any other relevant details. Inaccurate information can lead to inaccurate quotes and potential problems later on.

- Compare Quotes from Multiple Insurers: Don’t settle for the first quote you receive. Get quotes from several different insurance companies to compare prices and coverage options. Online comparison tools can make this process easier.

- Consider Bundling Policies: If you have multiple insurance needs, such as homeowners or renters insurance, consider bundling your policies with the same insurer. Bundling can often lead to discounts.

- Shop Around Regularly: Car insurance rates can fluctuate, so it’s a good idea to shop around for new quotes every year or two, even if you’re happy with your current insurer.

- Ask About Discounts: Many insurance companies offer discounts for things like good driving records, safety features in your car, and even being a member of certain organizations. Be sure to ask about any available discounts.

Negotiating with Insurance Agents

While negotiating car insurance rates might seem daunting, it’s a valid approach to potentially save money.

- Be Prepared: Before you call an insurance agent, have a clear understanding of your needs and budget. Research different coverage options and compare quotes from other insurers. This will give you leverage during negotiations.

- Highlight Your Good Driving Record: If you have a clean driving history, emphasize this point to the agent. A good driving record is a major factor in determining insurance rates.

- Ask About Bundling Discounts: If you’re considering bundling your car insurance with other policies, inquire about potential discounts and how they would impact your overall premium.

- Don’t Be Afraid to Walk Away: If you’re not satisfied with the offered rate, don’t be afraid to politely decline and consider other options. Insurance companies are often willing to negotiate to retain customers.

The Importance of Reviewing and Comparing Multiple Quotes

Comparing multiple quotes is crucial for finding the best car insurance deal.

- Different Coverage Levels: Insurance companies offer different coverage levels and options. Comparing quotes ensures you’re getting the coverage you need at a competitive price.

- Hidden Fees and Charges: Some insurance companies may have hidden fees or charges that aren’t immediately apparent in the initial quote. Comparing quotes helps you identify these potential costs.

- Finding the Best Value: Comparing quotes allows you to assess the value of different insurance policies. You can determine which company offers the best combination of coverage and price for your specific needs.

Outcome Summary: State Farm Car Insurance Estimator

Using the State Farm car insurance estimator can be a game-changer when it comes to finding the right coverage for your vehicle. By taking advantage of this online tool, you gain control over the process, allowing you to explore various options and compare quotes efficiently. Remember, obtaining multiple quotes and reviewing your coverage needs regularly is crucial for securing the best possible insurance protection.

Essential Questionnaire

What information do I need to use the State Farm car insurance estimator?

You’ll typically need information about your vehicle, driving history, and desired coverage options. This may include your vehicle’s year, make, model, and VIN, as well as your driving record and any previous insurance claims.

Is the estimate provided by the State Farm car insurance estimator guaranteed?

No, the estimate is not guaranteed. It’s a starting point based on the information you provide. A final quote will be determined after a more comprehensive review of your individual circumstances.

Can I adjust the coverage options in the State Farm car insurance estimator?

Yes, the estimator allows you to customize your coverage options by adding or removing different types of coverage. You can adjust the deductible amounts and explore various levels of protection to find the best fit for your needs.