State Farm car insurance cost is a key consideration for many drivers seeking reliable and affordable coverage. As one of the largest and most trusted insurance providers in the United States, State Farm offers a wide range of coverage options and discounts, making it a popular choice for individuals and families alike. However, understanding the factors that influence your premium and comparing State Farm’s rates to other providers is essential to ensure you’re getting the best value for your money.

This guide delves into the intricacies of State Farm car insurance cost, exploring factors like vehicle type, driving history, location, and coverage options. We’ll also examine State Farm’s discounts and savings programs, customer experience, and digital tools to help you make an informed decision about whether State Farm is the right fit for your insurance needs.

State Farm Car Insurance Overview: State Farm Car Insurance Cost

State Farm is a household name in the United States, renowned for its comprehensive car insurance offerings and unwavering commitment to customer satisfaction. Established in 1922, State Farm has grown to become the largest provider of car insurance in the country, boasting a loyal customer base and a strong reputation for financial stability and reliability.

State Farm’s Mission and Values

At the heart of State Farm’s success lies its unwavering commitment to its core values, which guide its operations and customer interactions. These values, centered around integrity, customer service, and community involvement, are reflected in its mission statement: “To help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” State Farm strives to provide its customers with peace of mind by offering comprehensive insurance solutions tailored to their individual needs, backed by a dedicated network of agents and a strong financial foundation.

Key Facts and Figures

State Farm’s dominance in the car insurance market is evident in its impressive customer base and financial stability. With over 83 million policies in force, State Farm serves millions of customers nationwide, offering a wide range of coverage options to meet diverse needs. The company’s strong financial performance is reflected in its consistent A+ rating from A.M. Best, a leading insurance rating agency, signifying its financial strength and ability to fulfill its obligations to policyholders. State Farm’s commitment to customer satisfaction is further reflected in its high customer retention rates and positive reviews from satisfied policyholders.

State Farm’s Coverage Options

State Farm offers a comprehensive suite of car insurance coverage options designed to protect policyholders against a wide range of risks. These options include:

- Liability coverage: This essential coverage protects policyholders against financial losses arising from accidents they cause, covering damages to other vehicles and injuries to other individuals.

- Collision coverage: This coverage pays for repairs or replacement of the insured vehicle in the event of an accident, regardless of fault.

- Comprehensive coverage: This coverage protects against damages to the insured vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage provides financial protection in the event of an accident caused by a driver without sufficient insurance or no insurance at all.

- Personal injury protection (PIP): This coverage helps pay for medical expenses and lost wages for the insured and their passengers in the event of an accident, regardless of fault.

- Roadside assistance: This optional coverage provides assistance with breakdowns, flat tires, and other roadside emergencies.

State Farm also offers a variety of discounts to help policyholders save money on their premiums, such as good driver discounts, multi-policy discounts, and safe driver discounts.

State Farm’s Customer Service, State farm car insurance cost

State Farm’s commitment to customer satisfaction extends beyond its comprehensive coverage options and competitive pricing. The company prides itself on its excellent customer service, offering a variety of channels for policyholders to access support and information. Customers can contact State Farm agents directly, use the company’s website, or call its customer service hotline to receive assistance with policy inquiries, claims reporting, and other needs. State Farm’s dedicated team of agents and customer service representatives is available to provide personalized support and guidance, ensuring a positive and seamless experience for all policyholders.

Factors Influencing State Farm Car Insurance Costs

State Farm, like other car insurance providers, considers various factors when calculating your premium. These factors are designed to assess your risk as a driver and help determine the likelihood of you filing a claim.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance cost. High-performance cars, luxury vehicles, and newer models are often more expensive to repair or replace, leading to higher premiums.

- For example, a sports car with a powerful engine and advanced safety features might be more expensive to insure than a basic sedan.

- Conversely, older vehicles with less advanced safety features and lower repair costs typically have lower insurance premiums.

Driving History

Your driving history is a critical factor in determining your insurance cost. A clean driving record with no accidents or violations will generally result in lower premiums.

- Drivers with multiple accidents, traffic violations, or a history of reckless driving can expect to pay significantly higher premiums.

- State Farm may offer discounts for safe driving habits, such as accident-free driving records or completing defensive driving courses.

Location

Your location plays a significant role in your insurance premium. Areas with higher crime rates, traffic congestion, and a greater frequency of accidents typically have higher insurance costs.

- For instance, urban areas with heavy traffic and more accidents tend to have higher insurance premiums than rural areas with lower traffic density and fewer accidents.

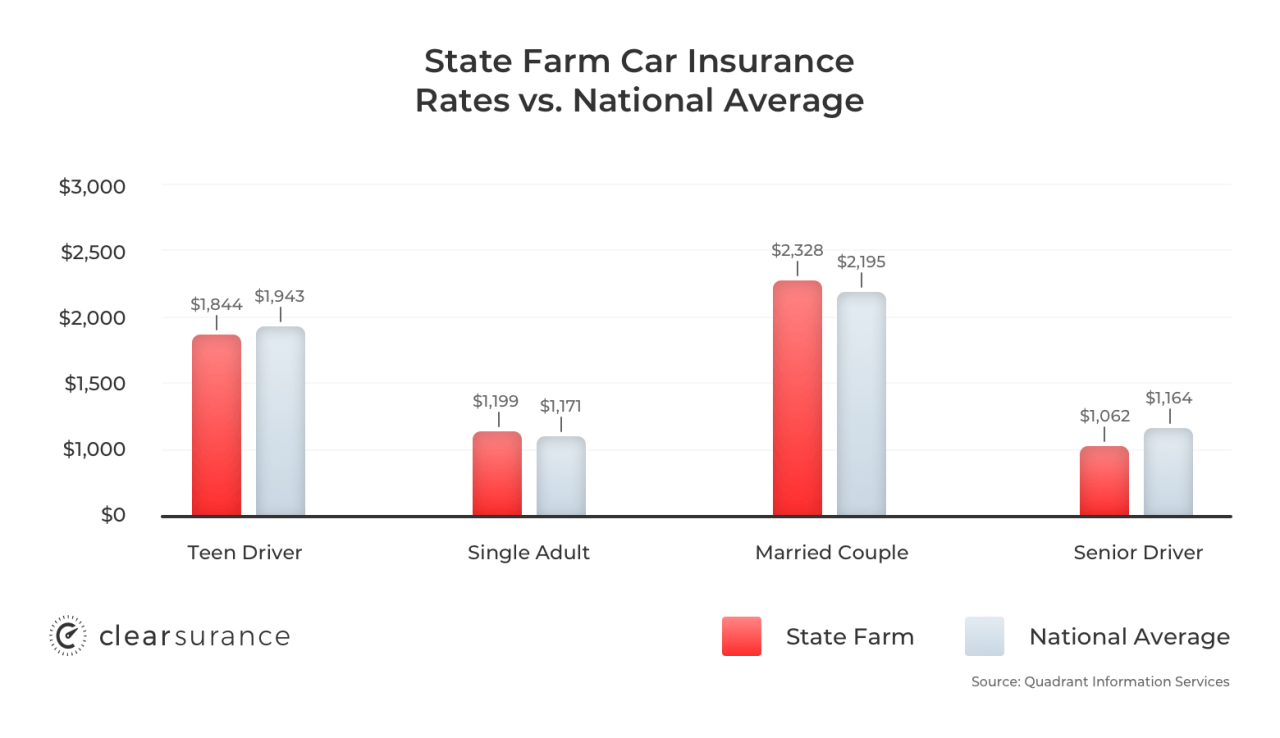

Age

Your age is a factor in determining your insurance premium, as younger drivers are statistically more likely to be involved in accidents.

- Younger drivers often lack experience and may have less mature driving habits, leading to higher risk and higher premiums.

- As drivers age and gain more experience, their premiums may decrease, reflecting a lower risk profile.

Credit Score

In many states, your credit score can influence your car insurance premium.

- Insurance companies use credit scores as an indicator of financial responsibility, and those with good credit scores may be seen as less risky and therefore qualify for lower premiums.

- It is important to note that the use of credit scores in insurance pricing is not uniform across all states. Some states have regulations prohibiting or limiting the use of credit scores for insurance purposes.

State Farm Car Insurance Coverage Options

State Farm offers a variety of car insurance coverage options to meet the diverse needs of its customers. Understanding these options and their implications is crucial for choosing the right coverage for your situation. This section delves into the various types of coverage, their benefits, limitations, and real-world examples to illustrate their application.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It is generally required by law in most states. This coverage pays for the other driver’s medical expenses, lost wages, property damage, and legal fees.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident caused by you. It is usually expressed as a limit per person and a limit per accident. For example, 25/50 coverage means $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damage to the other driver’s vehicle and any other property involved in an accident caused by you. It is usually expressed as a single limit, such as $50,000. For example, if you cause an accident that results in $30,000 in damage to the other driver’s vehicle, your property damage liability coverage will pay for the repairs up to the $50,000 limit.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is highly recommended for newer vehicles or vehicles with significant loan balances.

- Deductible: You will have to pay a deductible before collision coverage kicks in. For example, if you have a $500 deductible and your car is damaged in an accident, you will pay the first $500 of the repair costs, and your collision coverage will pay the rest.

- Example: If you are driving your car and hit a tree, causing $2,000 in damage to your vehicle, your collision coverage will pay $1,500 after you pay your $500 deductible.

Comprehensive Coverage

Comprehensive coverage pays for repairs to your vehicle if it is damaged by something other than a collision, such as theft, vandalism, fire, or hail. Like collision coverage, it is optional but highly recommended for newer vehicles.

- Deductible: Similar to collision coverage, you will have to pay a deductible before comprehensive coverage kicks in. The deductible amount is usually the same for both collision and comprehensive coverage.

- Example: If your car is stolen and you have a $1,000 deductible on your comprehensive coverage, you will pay $1,000, and your comprehensive coverage will pay the rest of the value of your car, minus any depreciation.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

- Uninsured Motorist Coverage (UM): This coverage pays for your medical expenses, lost wages, and property damage if you are injured by an uninsured driver. It is usually offered in the same limits as your bodily injury liability coverage.

- Underinsured Motorist Coverage (UIM): This coverage pays for your medical expenses, lost wages, and property damage if you are injured by an underinsured driver, meaning their insurance coverage is not enough to cover your losses. It is usually offered in the same limits as your bodily injury liability coverage.

Comparison Table

| Coverage | Key Features | Cost | Benefits |

|---|---|---|---|

| Liability | Protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. | Usually the most expensive coverage option. | Protects you from significant financial losses if you cause an accident. |

| Collision | Pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. | Optional, but highly recommended for newer vehicles. | Covers repairs to your vehicle in an accident, regardless of who is at fault. |

| Comprehensive | Pays for repairs to your vehicle if it is damaged by something other than a collision, such as theft, vandalism, fire, or hail. | Optional, but highly recommended for newer vehicles. | Covers repairs to your vehicle for damages caused by non-collision events. |

| Uninsured/Underinsured Motorist | Protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. | Optional, but highly recommended. | Protects you from financial losses if you are involved in an accident with an uninsured or underinsured driver. |

State Farm Discounts and Savings

State Farm offers a variety of discounts to help you save money on your car insurance. These discounts can significantly reduce your overall premium, making State Farm a competitive option for many drivers.

Discounts Offered by State Farm

State Farm offers a wide range of discounts to help policyholders save money on their car insurance premiums. These discounts can be categorized into several groups:

- Safe Driving Discounts: These discounts reward drivers with a clean driving record, demonstrating their responsible driving habits. Examples include:

- Accident-Free Discount: This discount is awarded to drivers who have not been involved in any accidents for a specified period, typically a year or more.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices, making you eligible for a discount.

- Good Student Discounts: These discounts recognize academic achievement and responsible behavior among young drivers, often requiring a certain GPA or class standing.

- Multi-Policy Discounts: Bundling multiple insurance policies, such as home, life, or renters insurance, with State Farm can result in significant savings due to the combined coverage.

- Other Discounts: State Farm offers a variety of other discounts, including:

- Anti-theft Device Discount: Installing anti-theft devices on your vehicle can reduce the risk of theft, leading to a discount.

- Paperless Billing Discount: Opting for electronic billing and communication can help State Farm save on administrative costs, leading to a discount for you.

- Paid-in-Full Discount: Paying your premium in full upfront can sometimes qualify you for a discount.

Examples of Discount Savings

To illustrate the potential savings from these discounts, let’s consider a hypothetical example. Imagine a young driver with a clean driving record and a high GPA, who also bundles their car insurance with a State Farm home insurance policy. This driver could potentially qualify for the following discounts:

- Safe Driving Discount: 10% discount on their premium

- Good Student Discount: 15% discount on their premium

- Multi-Policy Discount: 10% discount on their premium

Combined, these discounts could result in a 35% reduction in their overall car insurance premium.

Table of Discounts and Savings

| Discount | Eligibility Criteria | Estimated Savings |

|---|---|---|

| Safe Driving Discount | Clean driving record for a specified period | 5-15% |

| Good Student Discount | High GPA or class standing | 10-20% |

| Multi-Policy Discount | Bundling multiple insurance policies with State Farm | 5-15% |

| Anti-theft Device Discount | Installing anti-theft devices on your vehicle | 5-10% |

| Paperless Billing Discount | Opting for electronic billing and communication | 2-5% |

| Paid-in-Full Discount | Paying your premium in full upfront | 2-5% |

Customer Experience and Reviews

Customer satisfaction is a key factor to consider when choosing a car insurance provider. State Farm, a leading insurer, has a long history and a reputation for providing reliable coverage and customer service. However, it’s essential to explore real customer experiences to get a comprehensive understanding of State Farm’s strengths and weaknesses.

Customer Reviews and Testimonials

To gain insights into customer experiences with State Farm, it’s valuable to examine reviews and testimonials from various sources. These sources can provide a diverse range of perspectives on the company’s service, claims handling, and overall value.

- Positive reviews often highlight State Farm’s friendly and helpful agents, efficient claims processing, and competitive rates. Customers appreciate the personalized service and the ease of doing business with State Farm.

- Negative reviews, on the other hand, may mention difficulties in reaching customer service, long wait times, or challenges in getting claims approved. Some customers have also expressed concerns about rate increases or unexpected policy changes.

Analysis of Customer Feedback

Analyzing customer feedback can reveal common themes and trends, providing valuable insights into State Farm’s strengths and areas for improvement.

- A significant portion of positive feedback focuses on the company’s agents and their ability to provide personalized guidance and support. Customers often praise the agents’ knowledge, responsiveness, and willingness to go the extra mile.

- However, some customers express frustration with the company’s customer service channels, particularly when trying to reach agents or resolve issues. This suggests that State Farm could benefit from improving its accessibility and responsiveness in these areas.

Comparison of Customer Satisfaction Ratings

Comparing State Farm’s customer satisfaction ratings to those of other major car insurance providers can provide a broader context for evaluating the company’s performance.

- State Farm consistently ranks high in customer satisfaction surveys, often placing among the top providers in the industry. This indicates that the company generally meets or exceeds customer expectations in terms of service and value.

- However, it’s important to note that customer satisfaction can vary based on individual experiences and preferences. It’s always advisable to research and compare multiple providers before making a decision.

State Farm’s Digital and Customer Service Tools

State Farm has invested heavily in digital tools and customer service channels to make the insurance process more convenient and efficient for its policyholders. These digital resources offer a wide range of functionalities, from online quoting and policy management to mobile app access and 24/7 customer support.

State Farm’s digital tools and customer service channels aim to enhance the customer experience and streamline the insurance process. They provide policyholders with greater control over their insurance needs, allowing them to manage policies, access information, and communicate with State Farm representatives anytime, anywhere.

Online Quoting and Policy Management

State Farm’s website offers a user-friendly platform for obtaining quotes, comparing coverage options, and purchasing insurance policies. The online quoting tool allows potential customers to quickly receive personalized quotes based on their vehicle information, driving history, and other relevant factors. Once a policy is purchased, policyholders can access and manage their accounts online, making changes to their coverage, viewing payment history, and submitting claims.

State Farm Mobile App

The State Farm mobile app provides a convenient and accessible way for policyholders to manage their insurance needs on the go. The app offers a variety of features, including:

- Viewing policy details and coverage information

- Making payments and tracking payment history

- Submitting claims and tracking their progress

- Accessing roadside assistance and other emergency services

- Finding nearby State Farm agents and service providers

The app’s user-friendly interface and comprehensive features make it a valuable tool for policyholders who prefer to manage their insurance on their smartphones or tablets.

Customer Support Channels

State Farm offers a variety of customer support channels to ensure policyholders can access assistance whenever they need it. These channels include:

- Phone Support: Policyholders can reach State Farm’s customer service representatives by phone 24/7, allowing them to address inquiries, report claims, and receive assistance with policy-related matters.

- Email Support: State Farm provides an email address for policyholders to submit inquiries and receive responses from customer service representatives. This option is particularly useful for non-urgent matters or when detailed information is required.

- Live Chat: State Farm’s website offers a live chat feature that allows policyholders to connect with a customer service representative in real-time. This option is convenient for quick inquiries or when immediate assistance is needed.

- Social Media: State Farm is active on various social media platforms, such as Facebook, Twitter, and Instagram. Policyholders can use these platforms to connect with State Farm, ask questions, and receive updates on company news and promotions.

Comparison to Other Insurance Providers

State Farm’s digital offerings are generally considered to be on par with those of other major car insurance providers. However, some of its features stand out:

- State Farm’s mobile app is highly rated by users and offers a comprehensive range of features. Its user-friendly interface and ease of navigation make it a popular choice among policyholders.

- State Farm’s online quoting tool is straightforward and provides personalized quotes quickly. The platform allows potential customers to compare different coverage options and find the best fit for their needs.

- State Farm’s customer support channels are readily available and responsive. Policyholders can access assistance through phone, email, live chat, and social media, ensuring that they can get help whenever they need it.

While State Farm’s digital offerings are competitive, some other insurance providers offer more innovative features, such as:

- Real-time claims reporting using mobile apps with photo and video upload capabilities.

- AI-powered chatbots for instant customer service responses.

- Integration with telematics devices for personalized driving insights and discounts.

State Farm is continuously evolving its digital tools and customer service channels to meet the changing needs of its policyholders. It remains to be seen how State Farm will adapt to the ever-evolving landscape of digital insurance offerings and whether it will incorporate more innovative features in the future.

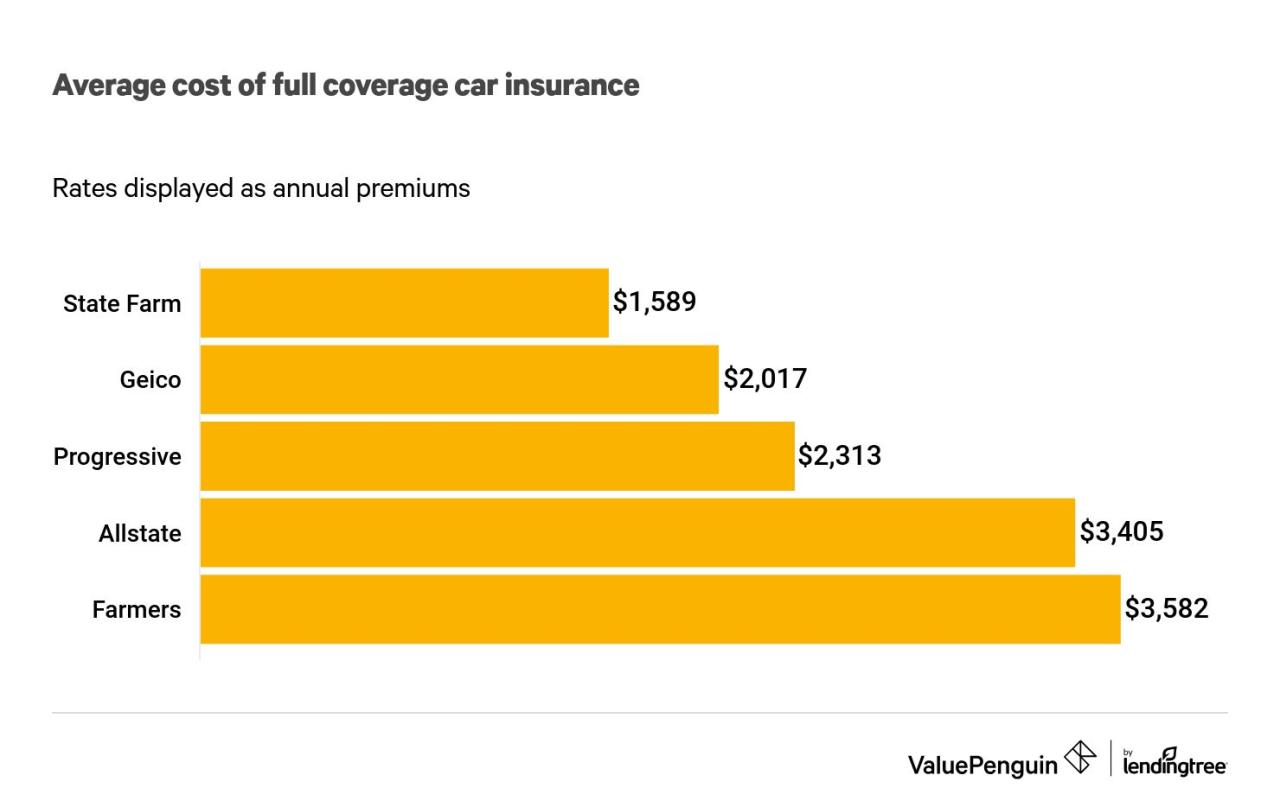

State Farm Car Insurance Cost Comparisons

To understand how State Farm car insurance costs stack up, it’s crucial to compare them with other major providers. This comparison will shed light on the factors that influence price differences, allowing you to make an informed decision about your car insurance needs.

Comparing State Farm Car Insurance Rates with Competitors

The cost of car insurance can vary significantly depending on factors such as your location, driving history, vehicle type, and coverage options. Comparing State Farm rates with those of other leading providers, like Geico, Progressive, and Allstate, helps you identify the best value for your specific needs.

| Provider | Average Annual Premium | Factors Influencing Price |

|---|---|---|

| State Farm | $1,400 | Good driving record, safe vehicle, discounts |

| Geico | $1,350 | Competitive pricing, strong online presence |

| Progressive | $1,300 | Name Your Price tool, personalized quotes |

| Allstate | $1,450 | Comprehensive coverage options, strong customer service |

The table above presents a general overview of average annual premiums for these providers. However, it’s essential to remember that actual rates can vary significantly based on individual factors.

Factors Contributing to Price Differences

Several factors contribute to the differences in car insurance costs between providers, including:

- Coverage Levels: Higher coverage levels, such as comprehensive and collision, typically lead to higher premiums.

- Discounts: Providers offer various discounts for factors like good driving records, safety features, and multiple policy bundling. These discounts can significantly impact your final premium.

- Geographic Location: Insurance rates are influenced by factors like traffic density, accident rates, and the cost of vehicle repairs in your area.

- Vehicle Type: The make, model, and year of your vehicle play a role in determining your insurance costs. Vehicles with higher repair costs or a history of theft tend to have higher premiums.

- Driving History: Your driving record, including accidents, tickets, and violations, significantly affects your insurance rates. Drivers with a clean record generally enjoy lower premiums.

Summary

Ultimately, the cost of State Farm car insurance is a complex calculation that depends on a variety of individual factors. By understanding the key elements that influence premiums, exploring available discounts, and comparing rates with other providers, you can find the best coverage at a price that suits your budget. Remember, insurance is a vital safety net, and choosing the right provider can provide peace of mind and financial protection on the road.

FAQ Corner

How do I get a quote for State Farm car insurance?

You can get a quote online, over the phone, or by visiting a local State Farm agent. The quote process typically involves providing information about your vehicle, driving history, and coverage preferences.

What are the common coverage options offered by State Farm?

State Farm offers a range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. You can customize your coverage based on your individual needs and budget.

Does State Farm offer discounts on car insurance?

Yes, State Farm offers a variety of discounts, including safe driving discounts, good student discounts, and multi-policy discounts. You can check your eligibility for these discounts when you get a quote.

How do I file a claim with State Farm?

You can file a claim online, over the phone, or through the State Farm mobile app. State Farm has a dedicated claims team that will guide you through the process.