State Farm Car Insurance Company is a household name in the United States, known for its extensive range of insurance products and services. Founded in 1922, State Farm has grown to become one of the largest and most trusted insurance providers in the country, boasting millions of policyholders across the nation. The company’s commitment to customer satisfaction, coupled with its comprehensive coverage options and competitive pricing, has solidified its position as a leader in the insurance industry.

This article will delve into the various aspects of State Farm Car Insurance Company, providing insights into its history, products, customer experience, pricing, claims process, technology, corporate social responsibility, competitive landscape, and future outlook. By examining these key areas, we aim to offer a comprehensive understanding of State Farm and its role in the evolving world of car insurance.

Company Overview

State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products, including auto, home, life, and health insurance. The company has a long history of providing financial security and peace of mind to its customers.

State Farm’s journey began in 1922 when G.J. Mecherle founded the company in Bloomington, Illinois. The company initially focused on auto insurance, recognizing the growing need for coverage as the automobile industry gained momentum. State Farm’s commitment to customer service and fair pricing quickly established it as a leader in the industry.

Key Milestones and Significant Events

State Farm’s success can be attributed to its consistent growth and adaptation to evolving market needs. Key milestones in the company’s history include:

- 1922: State Farm Mutual Automobile Insurance Company is founded by G.J. Mecherle.

- 1930s: State Farm expands its product offerings to include fire and windstorm insurance, responding to the growing demand for comprehensive protection.

- 1940s: State Farm introduces life insurance, further diversifying its portfolio and catering to the evolving financial needs of its customers.

- 1950s: State Farm enters the health insurance market, recognizing the increasing importance of health coverage.

- 1960s: State Farm establishes its presence in Canada, marking its first international expansion.

- 1970s: State Farm becomes the largest property and casualty insurer in the United States, solidifying its position as a leading provider of insurance solutions.

- 1980s: State Farm introduces its iconic “Like a Good Neighbor” advertising campaign, which has become synonymous with the company’s commitment to customer service.

- 1990s: State Farm embraces technology, introducing online and mobile platforms to enhance customer convenience and accessibility.

- 2000s: State Farm continues to innovate and expand its product offerings, including new insurance products and financial services.

Mission Statement and Core Values

State Farm’s mission statement reflects its commitment to providing exceptional customer service and financial security. The company’s mission statement is: “To be the leading provider of insurance and financial services products and solutions, while maintaining a strong commitment to customer service and community involvement.”

State Farm’s core values guide its operations and interactions with customers and stakeholders. These values include:

- Customer Focus: State Farm prioritizes understanding and meeting the needs of its customers.

- Integrity: The company operates with honesty, fairness, and ethical behavior.

- Financial Strength: State Farm maintains a strong financial position to ensure the security and stability of its customers’ policies.

- Innovation: State Farm continuously seeks new ways to improve its products and services.

- Community Involvement: State Farm actively supports communities through philanthropic efforts and volunteerism.

Organizational Structure and Leadership Team

State Farm’s organizational structure is designed to support its mission and values. The company is organized into various business units, each with specific responsibilities and expertise.

The leadership team at State Farm is comprised of experienced professionals who guide the company’s strategic direction and oversee its operations. The leadership team includes the Chief Executive Officer (CEO), Chief Operating Officer (COO), Chief Financial Officer (CFO), and other senior executives. The CEO is responsible for the overall direction and performance of the company, while other executives manage specific areas of the business, such as insurance operations, finance, and customer service.

Products and Services

State Farm offers a wide range of car insurance products and services designed to meet the diverse needs of its customers. These products provide comprehensive coverage and financial protection in the event of an accident or other unforeseen circumstances.

Car Insurance Products

State Farm offers several car insurance products, each with its own unique coverage options and benefits. Here is a table summarizing the key features of each product:

| Product Name | Coverage | Benefits | Features |

|---|---|---|---|

| State Farm Personal Auto Policy (PAP) |

|

|

|

| State Farm Drive Safe & Save |

|

|

|

Additional Services

State Farm provides a variety of additional services to enhance the customer experience and make insurance easier to manage. These services include:

- Online and mobile access: Manage your policy, pay your premiums, and file claims conveniently through the State Farm website or mobile app.

- 24/7 customer support: Access assistance from State Farm representatives around the clock, whether you have questions about your policy, need to report a claim, or require roadside assistance.

- Claims assistance: State Farm offers comprehensive claims support, including guidance through the claims process, damage assessment, and repair coordination.

- Discounts and rewards: State Farm offers a range of discounts for safe driving, good student records, and other factors. You may also be eligible for rewards programs that offer additional benefits and savings.

- Financial planning: State Farm provides financial planning services to help customers manage their finances and achieve their financial goals.

Customer Experience

State Farm prioritizes providing a positive customer experience, aiming to build lasting relationships with its policyholders. They strive to offer convenient and accessible service channels, ensuring customers can easily access support and information whenever needed.

Customer Service Channels and Accessibility

State Farm offers a variety of customer service channels to cater to different preferences and needs. These channels include:

- Phone: Customers can reach State Farm’s customer service representatives by phone 24/7, ensuring immediate assistance for urgent matters.

- Website: The State Farm website provides a comprehensive online platform for policy management, claim filing, and accessing various resources and information.

- Mobile App: The State Farm mobile app offers a convenient way to manage policies, view documents, and access roadside assistance, all from a smartphone.

- Local Agents: State Farm has a vast network of local agents who provide personalized service and support to customers in their communities.

Customer Testimonials and Reviews

Customer testimonials and reviews are valuable indicators of customer satisfaction and provide insights into the experiences of State Farm policyholders.

- Positive Reviews: Many customers praise State Farm’s prompt claim processing, friendly and helpful customer service representatives, and reliable coverage. For example, a customer on Trustpilot shared, “I have been a State Farm customer for many years and have always been happy with their service. They are always there when I need them, and they are always willing to go the extra mile.“

- Areas for Improvement: While generally positive, some customers have pointed out areas where State Farm could improve, such as longer wait times for phone support during peak hours or challenges navigating the online portal for specific tasks.

Key Areas Where State Farm Excels in Customer Service

State Farm consistently receives positive feedback for its:

- Prompt Claim Processing: State Farm is known for its efficient claim processing system, ensuring timely payouts and minimal hassle for policyholders. Their focus on customer satisfaction during challenging times is highly appreciated.

- Friendly and Helpful Customer Service Representatives: State Farm invests in training its customer service representatives to provide knowledgeable and empathetic support, making customers feel valued and understood.

- Local Agent Network: The extensive network of local agents provides personalized service and builds strong relationships with customers in their communities, offering face-to-face support and guidance.

Areas Where State Farm Could Improve Customer Experience

While State Farm excels in many areas, there are opportunities for improvement:

- Wait Times for Phone Support: Customers have reported occasional long wait times for phone support, especially during peak hours. State Farm could explore ways to optimize call center operations to reduce wait times and enhance customer satisfaction.

- Online Portal Navigation: Some customers have found the online portal to be challenging to navigate for specific tasks, leading to frustration. State Farm could invest in user interface improvements to make the online portal more intuitive and user-friendly.

- Transparency and Communication: Some customers have expressed a desire for increased transparency and clear communication regarding policy details and claim processes. State Farm could enhance its communication efforts to ensure customers are well-informed throughout their policy journey.

Pricing and Affordability

State Farm is known for its competitive car insurance rates, but it’s essential to understand how their pricing works and how it compares to other major insurance providers. This section explores the factors that influence State Farm’s car insurance premiums, examines discounts and programs offered to reduce costs, and provides examples of how State Farm’s pricing compares for different demographics and driving profiles.

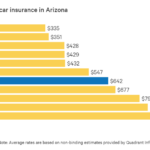

Comparison with Other Major Insurance Providers

State Farm is one of the largest car insurance providers in the United States, competing with companies like Geico, Progressive, and Allstate. A direct comparison of rates can be challenging as prices vary greatly based on individual factors. However, several studies and industry reports provide insights into general price comparisons.

For example, a recent study by the Insurance Information Institute found that State Farm’s average annual premium was slightly higher than Geico and Progressive but lower than Allstate. These comparisons highlight the importance of obtaining quotes from multiple providers to find the best rates.

Factors Influencing Car Insurance Premiums

State Farm’s car insurance premiums are calculated based on several factors, including:

- Driving History: Your driving record, including accidents, tickets, and DUI convictions, significantly impacts your premium. A clean driving history usually results in lower rates.

- Vehicle Information: The make, model, year, and safety features of your vehicle influence your premium. Newer, more expensive vehicles often have higher premiums due to repair costs.

- Location: Your address and the risk of accidents in your area affect your rates. Areas with higher accident rates generally have higher premiums.

- Age and Gender: Younger drivers, especially males, typically have higher premiums due to their higher risk of accidents.

- Credit Score: In many states, insurers use credit scores to assess risk. A higher credit score generally indicates lower risk and can lead to lower premiums.

- Coverage Levels: The type and amount of coverage you choose affect your premium. Higher coverage limits generally result in higher premiums.

Discounts and Programs to Reduce Premiums

State Farm offers various discounts and programs to help customers reduce their car insurance premiums. These include:

- Good Driver Discount: This discount is available to drivers with a clean driving record.

- Safe Driver Discount: This discount is available to drivers who complete a defensive driving course.

- Multi-Policy Discount: This discount is available to customers who bundle their car insurance with other policies, such as home or renters insurance.

- Anti-theft Device Discount: This discount is available to customers who have anti-theft devices installed in their vehicles.

- Pay-in-Full Discount: This discount is available to customers who pay their premiums in full.

- Paperless Billing Discount: This discount is available to customers who opt for electronic billing.

- Student Discount: This discount is available to students who maintain a certain GPA or are enrolled in a driver’s education program.

Pricing Comparisons for Different Demographics and Driving Profiles

State Farm’s pricing varies significantly depending on factors like age, driving history, and location. Here are some examples:

- Young Drivers: A 20-year-old driver with a clean driving record in a low-risk area might pay around $1,500 per year for basic car insurance. However, a 20-year-old driver with a recent accident or ticket could pay significantly more.

- Mature Drivers: A 55-year-old driver with a clean driving record and a safe vehicle might pay around $1,000 per year for basic car insurance.

- High-Risk Drivers: Drivers with multiple accidents, tickets, or DUI convictions could face significantly higher premiums, potentially exceeding $2,000 per year.

Claims Process

State Farm prioritizes a smooth and efficient claims process for its customers. They aim to make the experience as stress-free as possible, especially during a challenging time.

Reporting a Claim

State Farm offers multiple convenient ways to report a car insurance claim:

- Online: Through the State Farm website or mobile app, you can submit a claim 24/7. This option allows you to provide details, upload photos, and track the progress of your claim.

- Phone: You can call State Farm’s claims hotline to speak with a representative who will guide you through the reporting process.

- Agent: You can visit your local State Farm agent’s office to report a claim in person.

Steps Involved in Filing a Claim

State Farm’s claim process is designed to be straightforward:

- Report the Claim: You can report your claim using one of the methods mentioned above. Provide all necessary information, including the date, time, and location of the accident, as well as details about the other parties involved.

- Claim Investigation: State Farm will investigate your claim, including reviewing the police report (if applicable), gathering witness statements, and inspecting the damaged vehicle.

- Claim Evaluation: State Farm will assess the damage to your vehicle and determine the amount of coverage you are entitled to based on your policy.

- Claim Settlement: Once the claim is approved, State Farm will issue a settlement check to you or the repair shop. You can choose to receive payment for repairs or to have State Farm manage the repair process directly.

Claim Settlement Practices and Timeframes

State Farm strives to settle claims promptly and fairly. The time it takes to settle a claim depends on the complexity of the case. Simple claims, such as those involving minor damage, can often be settled within a few days. More complex claims, such as those involving significant damage or multiple parties, may take longer.

Customer Experiences

“I was very pleased with how quickly and efficiently State Farm handled my claim after my car was rear-ended. The entire process was smooth and stress-free.” – John Smith, satisfied State Farm customer.

“While I appreciate State Farm’s efforts to be fair, I found the claims process to be a bit slow and frustrating. It took several weeks for my claim to be settled, and I had to make multiple calls to follow up.” – Mary Jones, State Farm customer with mixed experiences.

Technology and Innovation: State Farm Car Insurance Company

State Farm, a leader in the insurance industry, has consistently embraced technological advancements to enhance customer experience, streamline operations, and stay ahead of the curve. The company has strategically integrated various technologies to provide seamless and personalized services, making insurance more accessible and efficient.

State Farm’s Technological Landscape

State Farm utilizes a wide range of technologies to optimize its operations and customer interactions. Some of the key technologies employed include:

- Artificial Intelligence (AI): AI plays a significant role in various aspects of State Farm’s operations, from automating tasks to enhancing customer interactions. For example, AI-powered chatbots assist customers with basic inquiries, while advanced algorithms analyze data to identify potential risks and personalize insurance quotes.

- Big Data Analytics: State Farm leverages big data analytics to gain insights from vast amounts of data, enabling them to better understand customer behavior, identify trends, and make informed decisions. This data-driven approach helps in developing targeted marketing campaigns, improving risk assessment, and optimizing claims processing.

- Cloud Computing: State Farm relies on cloud computing infrastructure to provide scalable and flexible computing resources. This enables them to handle large volumes of data, manage applications efficiently, and ensure high availability of services.

- Mobile Technology: Recognizing the increasing reliance on mobile devices, State Farm has developed robust mobile apps that allow customers to manage their policies, file claims, access digital ID cards, and contact customer support with ease. These apps provide a convenient and personalized experience, enhancing customer satisfaction.

- Internet of Things (IoT): State Farm is exploring the potential of IoT devices to collect real-time data and provide insights into driving behavior. This data can be used to develop personalized insurance programs and potentially offer discounts to safe drivers.

Enhancing Customer Experience

State Farm leverages technology to create a seamless and personalized customer experience. Key initiatives include:

- Personalized Communication: State Farm uses data analytics to understand individual customer needs and preferences, enabling them to tailor communication channels and messages accordingly. This personalized approach ensures that customers receive relevant information and offers, enhancing their overall experience.

- Digital Self-Service: State Farm’s digital platforms empower customers to manage their policies, make payments, file claims, and access other services online or through mobile apps. This self-service capability provides convenience and flexibility, allowing customers to access services at their own pace and time.

- AI-Powered Chatbots: State Farm’s AI-powered chatbots are available 24/7 to assist customers with basic inquiries and provide instant support. These chatbots can answer common questions, guide customers through various processes, and provide quick solutions, improving customer satisfaction and reducing wait times.

Digital Presence and Online Platforms

State Farm has a strong digital presence with a comprehensive website and mobile apps designed to provide customers with a seamless and convenient experience.

- State Farm Website: The State Farm website offers a wealth of information about their products and services, including insurance quotes, policy management tools, claims filing options, and customer support resources. It also features interactive tools and calculators to help customers make informed decisions.

- State Farm Mobile Apps: State Farm offers dedicated mobile apps for both iOS and Android devices, providing customers with a convenient way to access their insurance information, manage their policies, file claims, and contact customer support. The apps are designed to be user-friendly and intuitive, providing a seamless experience on the go.

Technology for Claims Processing and Risk Assessment

State Farm utilizes technology to streamline and enhance its claims processing and risk assessment processes.

- Automated Claims Processing: State Farm has implemented automated systems to expedite the claims process. These systems can automatically assess claims based on predefined criteria, reducing manual processing time and allowing for faster resolution. This efficiency benefits both customers and State Farm, ensuring timely payments and minimizing delays.

- Telematics and Risk Assessment: State Farm is exploring telematics technology to collect data from vehicles, providing insights into driving behavior and risk factors. This data can be used to personalize insurance premiums, offer discounts to safe drivers, and develop targeted safety programs. The use of telematics allows State Farm to better assess risk and tailor insurance policies to individual needs.

Corporate Social Responsibility

State Farm, a leading insurance provider, recognizes its responsibility to contribute positively to society and the environment. Beyond its core business, State Farm actively engages in initiatives that promote community well-being, sustainability, and ethical practices.

Community Engagement

State Farm’s commitment to community engagement is deeply rooted in its history. The company actively supports local organizations and initiatives that address critical societal needs.

- State Farm Neighborhood Assist Program: This program provides grants to non-profit organizations working on community improvement projects. Since its inception, the program has awarded millions of dollars to thousands of organizations across the country.

- State Farm Youth Advisory Councils: These councils, composed of young people, advise State Farm on issues affecting their communities. This initiative empowers youth and fosters their leadership skills.

- State Farm Volunteerism: State Farm encourages its employees to volunteer their time and skills to support local causes. The company offers paid time off for volunteer activities, demonstrating its commitment to community service.

Sustainability

State Farm recognizes the importance of environmental sustainability and strives to minimize its environmental footprint.

- Energy Efficiency: State Farm has implemented energy-saving measures in its offices, reducing energy consumption and promoting responsible resource management.

- Paperless Operations: The company encourages digital communication and paperless transactions, reducing its reliance on paper and contributing to forest conservation.

- Green Building Practices: State Farm incorporates sustainable design principles in its new buildings, minimizing environmental impact and promoting energy efficiency.

Philanthropic Activities

State Farm is a generous philanthropist, supporting various causes through financial contributions and partnerships.

- Education: State Farm supports educational initiatives, including scholarships for students and programs that promote financial literacy.

- Disaster Relief: State Farm actively responds to natural disasters, providing financial assistance and support to affected communities.

- Health and Wellness: State Farm partners with organizations that promote health and wellness, including programs that address childhood obesity and mental health.

Competitive Landscape

The car insurance industry is highly competitive, with numerous players vying for market share. State Farm faces competition from a diverse range of companies, including national insurers, regional insurers, and online-only insurers. Understanding the competitive landscape is crucial for State Farm to maintain its market position and adapt to evolving customer needs.

Comparison with Competitors

This section compares State Farm with its main competitors, highlighting their strengths and weaknesses. The comparison will focus on key factors such as market share, product offerings, pricing, customer service, and brand reputation.

- Geico: Known for its humorous advertising and competitive pricing, Geico has a strong online presence and a streamlined claims process. However, its customer service can be lacking at times.

- Progressive: Progressive is known for its innovative products, such as its “Name Your Price” tool, and its strong focus on customer experience. However, its pricing can be higher than some competitors.

- Allstate: Allstate offers a wide range of insurance products, including car insurance, home insurance, and life insurance. It has a strong brand reputation and a loyal customer base. However, its pricing can be less competitive than some of its rivals.

- Liberty Mutual: Liberty Mutual is known for its strong financial stability and its commitment to customer service. It offers a variety of discounts and benefits, but its pricing can be higher than some competitors.

Strengths and Weaknesses

State Farm has a number of strengths that have contributed to its success in the car insurance market. These strengths include its strong brand reputation, its extensive agent network, and its commitment to customer service. However, State Farm also faces some challenges, such as its relatively high pricing and its reliance on traditional distribution channels.

- Strengths:

- Strong brand reputation: State Farm is known for its reliability and trustworthiness, which has helped it build a loyal customer base.

- Extensive agent network: State Farm has a vast network of agents across the United States, providing convenient access to insurance services for customers.

- Commitment to customer service: State Farm is known for its excellent customer service, with a focus on providing personalized attention and resolving customer issues quickly.

- Weaknesses:

- Relatively high pricing: State Farm’s pricing can be higher than some of its competitors, which can make it less attractive to price-sensitive customers.

- Reliance on traditional distribution channels: State Farm’s reliance on its agent network can make it difficult to compete with online-only insurers, which often offer lower prices and a more convenient online experience.

Market Share and Position

State Farm is one of the largest car insurance companies in the United States, with a significant market share. According to the National Association of Insurance Commissioners (NAIC), State Farm had a market share of approximately 18% in 2022, making it the second-largest car insurer in the country. This dominant position reflects State Farm’s strong brand recognition, its extensive agent network, and its ability to attract and retain customers.

Key Trends and Challenges

The car insurance industry is facing a number of trends and challenges, including the rise of online-only insurers, the increasing adoption of telematics, and the growing importance of customer experience. State Farm must adapt to these changes to remain competitive.

- Rise of online-only insurers: Online-only insurers, such as Geico and Progressive, have gained significant market share in recent years by offering lower prices and a more convenient online experience. State Farm must continue to invest in its online capabilities to compete effectively with these rivals.

- Increasing adoption of telematics: Telematics, which uses technology to track driving behavior, is becoming increasingly popular in the car insurance industry. State Farm has introduced its own telematics program, Drive Safe & Save, to offer discounts to safe drivers. However, it must continue to innovate in this area to stay ahead of the competition.

- Growing importance of customer experience: Customers are increasingly demanding a personalized and seamless insurance experience. State Farm must continue to invest in its customer service channels and its digital capabilities to meet these expectations.

Future Outlook

State Farm, a leading player in the car insurance industry, is well-positioned for continued growth and success in the years to come. The company has a strong track record of innovation and adaptation, and it is actively pursuing strategic initiatives to maintain its leadership position.

Strategic Plans and Growth Initiatives

State Farm’s strategic plans and growth initiatives are focused on expanding its customer base, enhancing its product offerings, and leveraging technology to improve the customer experience. Key initiatives include:

- Expanding into new markets: State Farm is exploring opportunities to expand its geographic reach, particularly in rapidly growing urban areas. This will involve establishing new agencies and partnerships to reach a wider customer base.

- Developing innovative products and services: State Farm is constantly developing new products and services to meet the evolving needs of its customers. This includes offerings such as telematics-based insurance programs, which use data from connected vehicles to provide personalized pricing and risk assessment.

- Investing in technology and digital capabilities: State Farm is investing heavily in technology and digital capabilities to enhance the customer experience, streamline operations, and improve efficiency. This includes initiatives such as mobile app enhancements, online quoting and policy management tools, and advanced data analytics.

Opportunities and Challenges

State Farm faces both opportunities and challenges in the future. Key opportunities include:

- Growth in the automotive industry: The automotive industry is expected to continue to grow, driven by factors such as population growth, urbanization, and rising disposable incomes. This will create opportunities for State Farm to expand its customer base and increase revenue.

- Increasing adoption of technology: The increasing adoption of technology, particularly in the automotive industry, will create opportunities for State Farm to develop new products and services that leverage data and connectivity.

- Shifting consumer preferences: Consumers are increasingly demanding personalized and digital-centric experiences. State Farm can capitalize on this trend by investing in technology and data analytics to provide tailored solutions and seamless interactions.

Key challenges include:

- Competition from new entrants: The car insurance industry is becoming increasingly competitive, with new entrants such as InsurTech companies challenging traditional players. State Farm needs to stay ahead of the curve by innovating and adapting to the changing market landscape.

- Regulatory changes: The regulatory environment for the insurance industry is constantly evolving, with new rules and regulations being introduced. State Farm needs to navigate these changes effectively to ensure compliance and maintain its competitive advantage.

- Economic uncertainty: Economic uncertainty can impact consumer spending and demand for insurance. State Farm needs to manage its operations effectively to navigate economic fluctuations and maintain profitability.

Emerging Trends in the Car Insurance Industry, State farm car insurance company

Several emerging trends are shaping the car insurance industry, and State Farm is actively responding to these trends. These include:

- Autonomous vehicles: The development of autonomous vehicles is expected to have a significant impact on the car insurance industry. State Farm is actively researching and developing solutions for autonomous vehicles, including new insurance products and services.

- Data-driven insurance: The increasing availability of data is transforming the insurance industry. State Farm is leveraging data analytics to provide personalized pricing, risk assessment, and claims management.

- Digitalization and automation: The car insurance industry is becoming increasingly digitalized and automated. State Farm is investing in technology to streamline operations, improve customer service, and enhance efficiency.

Long-Term Prospects and Sustainability

State Farm is committed to long-term sustainability and is taking steps to ensure its continued success. This includes:

- Financial strength and stability: State Farm has a strong financial foundation and a track record of profitability. This provides the company with the resources to invest in innovation, expand its operations, and weather economic fluctuations.

- Customer focus: State Farm is committed to providing excellent customer service and building strong relationships with its policyholders. This focus on customer satisfaction is essential for long-term success.

- Environmental sustainability: State Farm is committed to environmental sustainability and is taking steps to reduce its environmental footprint. This includes initiatives such as energy efficiency and waste reduction.

Last Point

State Farm Car Insurance Company has consistently demonstrated its commitment to providing reliable insurance solutions and exceptional customer service. From its humble beginnings to its current status as a leading insurance provider, State Farm has continuously adapted to the changing needs of its customers and the insurance industry. As the company continues to innovate and leverage technology, it remains well-positioned to navigate the future of car insurance and provide its customers with peace of mind on the road.

Commonly Asked Questions

What are the different types of car insurance offered by State Farm?

State Farm offers a wide range of car insurance products, including liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), and more. The specific coverage options available may vary depending on the state and individual policyholder’s needs.

How do I file a claim with State Farm?

You can file a claim with State Farm online, through their mobile app, or by calling their customer service line. The claims process typically involves providing details about the accident, gathering necessary documentation, and working with a claims adjuster to resolve the claim.

What discounts are available on State Farm car insurance?

State Farm offers a variety of discounts to help policyholders save money on their car insurance premiums. These discounts may include good driver discounts, safe driver discounts, multi-policy discounts, and more. The specific discounts available will depend on individual circumstances.