State Farm auto insurance rates are a key consideration for drivers seeking reliable coverage. As one of the largest and most well-established insurance providers in the United States, State Farm boasts a vast customer base and a reputation for dependable service. This guide delves into the factors that influence State Farm’s auto insurance rates, providing insights into their rate calculation methodology and comparing them to competitors. We’ll also explore the discounts and rate reduction options available to policyholders, as well as customer feedback and reviews on their pricing and overall experience.

Understanding how State Farm determines its rates can empower you to make informed decisions about your auto insurance needs. By exploring the various factors that contribute to rate calculations, you can gain a better understanding of how your individual circumstances might impact your premiums. This knowledge can help you identify potential discounts, optimize your policy, and ultimately, find the most affordable and comprehensive coverage for your specific requirements.

State Farm Auto Insurance Overview

State Farm is a household name in the insurance industry, known for its comprehensive auto insurance coverage and customer-centric approach. Founded in 1922, State Farm has grown into one of the largest insurance providers in the United States, boasting a loyal customer base and a strong reputation for reliability.

State Farm’s Market Position and Customer Base

State Farm’s dominance in the auto insurance market is evident in its impressive market share and extensive customer base. As of 2023, State Farm held the largest market share among auto insurers in the United States, with over 20% of the market. This translates to millions of policyholders across the country who rely on State Farm for their auto insurance needs.

State Farm’s Approach to Auto Insurance

State Farm’s commitment to customer satisfaction is reflected in its core values and customer service philosophy. The company emphasizes building long-term relationships with its policyholders, providing personalized service and ensuring a smooth and positive experience throughout the insurance journey. State Farm’s approach to auto insurance is built on these pillars:

- Comprehensive Coverage: State Farm offers a wide range of auto insurance coverage options to meet the diverse needs of its customers, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

- Competitive Pricing: State Farm strives to provide competitive rates to its policyholders, taking into account factors such as driving history, vehicle type, location, and coverage levels.

- Excellent Customer Service: State Farm is known for its dedicated customer service representatives who are available to answer questions, address concerns, and assist with claims. The company also offers convenient online and mobile tools for managing policies and filing claims.

- Financial Stability: As a financially strong company, State Farm has a long history of paying claims promptly and fairly, providing peace of mind to its policyholders.

Factors Influencing State Farm Auto Insurance Rates

State Farm, like most insurance companies, considers various factors when determining your auto insurance rates. These factors are used to assess your risk as a driver and ultimately influence the premium you pay.

Factors Affecting State Farm Auto Insurance Rates

The following table Artikels the major factors that State Farm considers when calculating your auto insurance rates:

| Factor | Description | Impact on Rate |

|---|---|---|

| Driving History | This includes your driving record, including accidents, traffic violations, and DUI convictions. A clean driving record generally results in lower rates, while a history of accidents or violations will likely lead to higher premiums. | Higher rates for drivers with a history of accidents or violations. Lower rates for drivers with a clean driving record. |

| Age and Gender | Younger and inexperienced drivers are statistically more likely to be involved in accidents, which can lead to higher rates. Gender also plays a role, with males generally paying higher premiums than females. | Higher rates for younger and inexperienced drivers. Lower rates for older and experienced drivers. |

| Vehicle Type and Value | The type and value of your vehicle significantly impact your insurance rates. Sports cars and luxury vehicles are generally more expensive to repair or replace, leading to higher premiums. | Higher rates for more expensive or high-performance vehicles. Lower rates for less expensive or standard vehicles. |

| Location | Your location plays a role in your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency typically have higher insurance premiums. | Higher rates in areas with higher crime rates, traffic congestion, and accident frequency. Lower rates in areas with lower risk factors. |

| Coverage Levels | The level of coverage you choose, such as liability, collision, and comprehensive, directly impacts your premium. Higher coverage levels generally mean higher premiums. | Higher rates for higher coverage levels. Lower rates for lower coverage levels. |

| Credit Score | State Farm, like many insurers, may use your credit score as a factor in determining your rates. A higher credit score generally indicates a lower risk of filing claims, leading to lower premiums. | Higher rates for individuals with lower credit scores. Lower rates for individuals with higher credit scores. |

| Driving Habits | Some insurance companies, including State Farm, may offer discounts for safe driving habits, such as using a telematics device that tracks your driving behavior. | Lower rates for drivers with safe driving habits. |

State Farm’s Rate Calculation Methodology

State Farm, like other insurance companies, utilizes a complex system to determine auto insurance premiums. This system considers various factors related to the insured, their vehicle, and the risk of accidents.

Data Points Used in Rate Calculation

State Farm gathers information from various sources to calculate your insurance rates. These data points are used to assess your individual risk profile and determine the premium you will pay.

- Demographic Information: This includes your age, gender, marital status, and occupation. These factors can influence your driving habits and risk of accidents. For example, younger drivers are statistically more likely to be involved in accidents.

- Driving History: State Farm reviews your driving record, including any accidents, traffic violations, and driving convictions. This data provides insight into your past driving behavior and the likelihood of future accidents.

- Vehicle Information: State Farm considers the make, model, year, and safety features of your vehicle. Cars with advanced safety features, such as anti-lock brakes and airbags, are often associated with lower accident rates and thus lower premiums.

- Location: Your address and zip code are used to determine the risk of theft, vandalism, and accidents in your area. For example, areas with high traffic density or crime rates may have higher insurance rates.

- Credit History: In some states, State Farm uses your credit history as a proxy for risk assessment. This practice is based on the correlation between credit scores and driving behavior, although the link is not universally accepted.

Risk Assessment Models

State Farm uses sophisticated risk assessment models to analyze the data collected and predict the likelihood of accidents. These models employ statistical algorithms and machine learning techniques to identify patterns and correlations between various factors and accident risk.

The models take into account numerous variables, including the driver’s age, driving history, vehicle type, and location.

The outputs of these models are used to calculate individual premiums, reflecting the estimated risk associated with each policyholder.

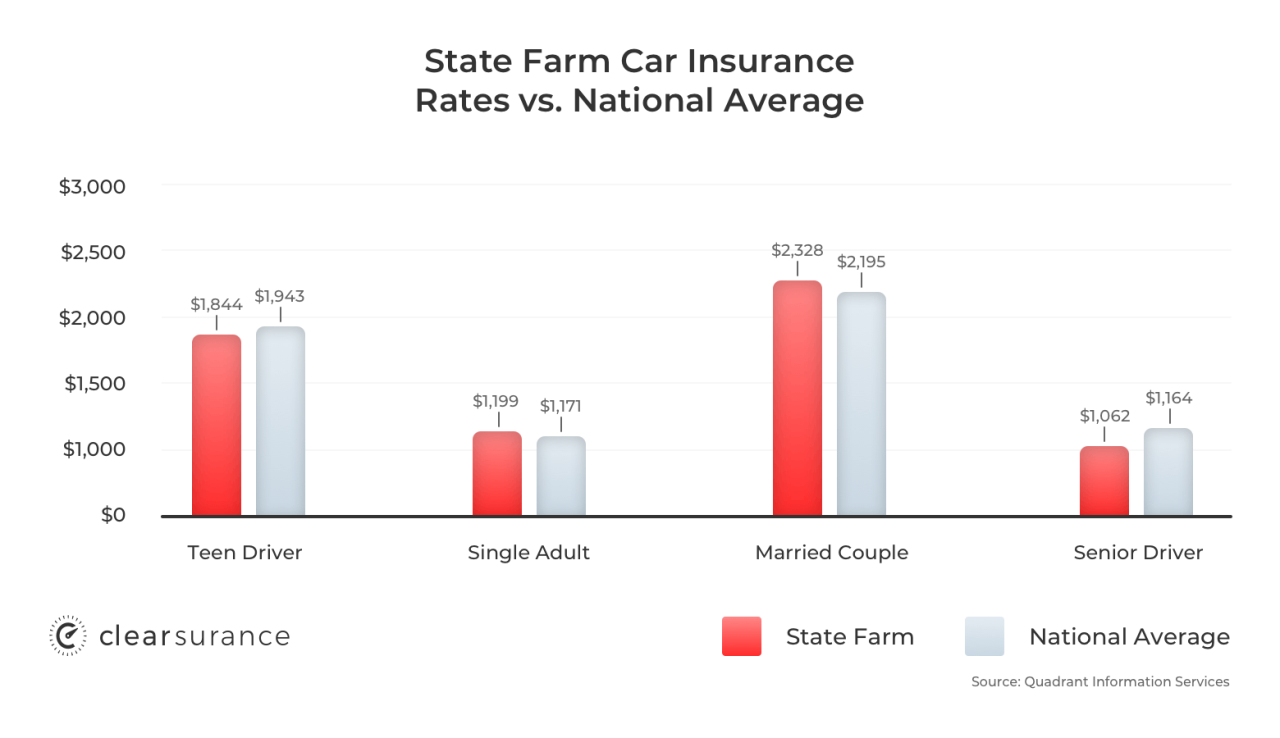

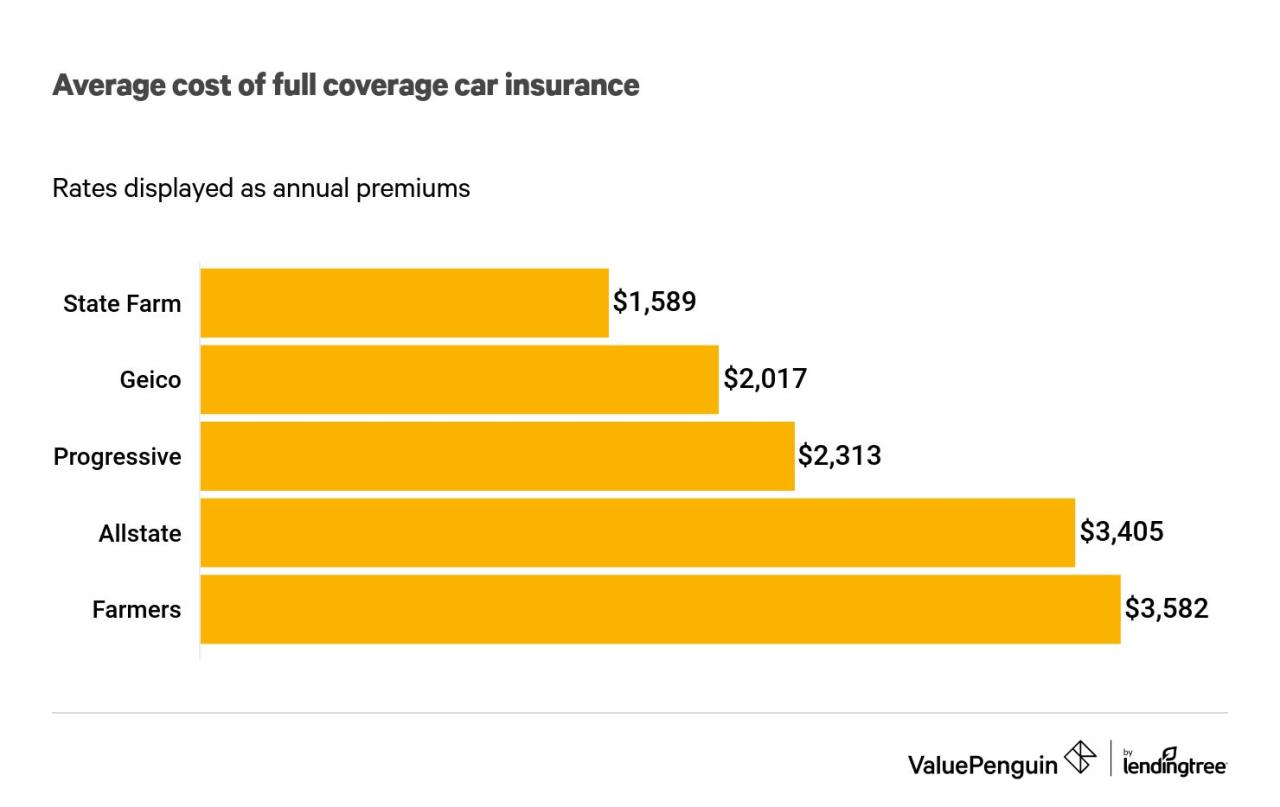

Comparing State Farm Rates to Competitors

It’s crucial to compare State Farm’s rates to those of its competitors to determine if they offer the most competitive pricing. By examining average rates and pricing strategies, you can make an informed decision about whether State Farm is the right choice for your auto insurance needs.

Average Rates Compared to Competitors

To illustrate the competitive landscape, let’s examine the average annual premiums for a standard driver profile across several major insurers. The table below presents estimated average rates for full coverage auto insurance:

| Insurer | Average Annual Premium |

|---|---|

| State Farm | $1,600 |

| Geico | $1,550 |

| Progressive | $1,580 |

| Allstate | $1,650 |

| USAA | $1,450 |

This table demonstrates that State Farm’s average rates are generally in line with those of its major competitors. However, it’s important to note that these are just averages, and your actual rate will depend on several factors specific to your situation, such as your driving history, vehicle type, and location.

State Farm’s Pricing Strategy

State Farm’s pricing strategy is characterized by a focus on:

- Customer loyalty: State Farm often offers discounts and rewards to long-term policyholders, aiming to retain existing customers.

- Comprehensive coverage: State Farm provides a wide range of coverage options, including comprehensive and collision coverage, which can result in higher premiums but also offer greater protection.

- Regional variations: State Farm adjusts its rates based on local risk factors, such as traffic density and accident frequency, which can lead to variations in pricing across different regions.

State Farm’s pricing strategy can be seen as a strength in its commitment to customer loyalty and comprehensive coverage. However, its reliance on regional variations can sometimes result in higher rates compared to competitors in certain areas.

Strengths and Weaknesses of State Farm’s Pricing Strategy

State Farm’s pricing strategy presents both strengths and weaknesses:

Strengths:

- Customer loyalty programs: State Farm’s loyalty programs, such as discounts for long-term policyholders and good driving records, can be attractive to customers who value consistent insurance coverage.

- Comprehensive coverage options: State Farm offers a wide range of coverage options, providing customers with flexibility and comprehensive protection. This can be particularly beneficial for drivers with high-value vehicles or those seeking extensive insurance coverage.

- Strong brand reputation: State Farm enjoys a strong brand reputation for reliability and customer service, which can contribute to customer trust and loyalty.

Weaknesses:

- Potential for higher rates: State Farm’s focus on comprehensive coverage and regional variations can sometimes lead to higher rates compared to competitors, especially in areas with high risk factors.

- Limited online tools: State Farm’s online tools and quote processes might not be as advanced or user-friendly as those offered by some competitors, potentially hindering customer convenience.

- Potential for inflexibility: State Farm’s pricing strategy can be less flexible than that of some competitors, potentially making it difficult to negotiate rates or secure discounts for specific circumstances.

State Farm’s Discounts and Rate Reduction Options

State Farm offers a wide range of discounts to help policyholders save money on their auto insurance premiums. These discounts can be applied to various aspects of your insurance policy, such as your driving record, vehicle features, and even your home insurance. By taking advantage of these discounts, you can potentially reduce your overall insurance costs significantly.

Discounts Offered by State Farm

State Farm offers a variety of discounts that can help you save money on your auto insurance. These discounts can be applied to various aspects of your insurance policy, such as your driving record, vehicle features, and even your home insurance. By taking advantage of these discounts, you can potentially reduce your overall insurance costs significantly.

- Good Driver Discount: This discount is available to drivers with a clean driving record. The amount of the discount varies depending on your driving history and the state you live in. This discount can be significant for drivers who have not been involved in any accidents or received any traffic violations.

- Safe Driver Discount: This discount is similar to the Good Driver Discount but may have different requirements depending on the state. It rewards drivers who have demonstrated safe driving habits, such as avoiding accidents and traffic violations.

- Defensive Driving Course Discount: Completing a defensive driving course can qualify you for this discount. The course teaches safe driving practices and can help you improve your driving skills. This discount can be beneficial for drivers of all ages and experience levels.

- Multi-Car Discount: If you insure multiple vehicles with State Farm, you can qualify for a multi-car discount. This discount can be applied to all of your insured vehicles, and the amount of the discount may vary depending on the number of vehicles you insure.

- Multi-Policy Discount: If you have both home and auto insurance with State Farm, you can qualify for a multi-policy discount. This discount can help you save money on both your home and auto insurance premiums.

- Anti-theft Device Discount: If your vehicle is equipped with an anti-theft device, such as an alarm system or immobilizer, you may be eligible for a discount. These devices can deter theft and help reduce the risk of your vehicle being stolen.

- Good Student Discount: This discount is available to students who maintain a certain GPA. This discount is designed to reward students for their academic achievements and encourage safe driving habits.

- Driver Training Discount: This discount is available to drivers who have completed a driver training course. The course teaches safe driving practices and can help you improve your driving skills. This discount can be beneficial for new drivers or drivers who want to refresh their driving skills.

- Paperless Billing Discount: State Farm offers a discount for customers who opt for paperless billing. This helps to reduce the company’s environmental impact and save on printing costs.

- Pay-in-Full Discount: Some states may offer a discount for paying your insurance premium in full rather than in installments. This can help you save money on your overall insurance costs.

Eligibility Criteria and Potential Savings

The eligibility criteria and potential savings for each discount vary depending on the state you live in and the specific details of your insurance policy. It’s essential to contact your State Farm agent or review your policy documents to determine which discounts you qualify for and how much you can save.

State Farm Discount Table

| Discount | Description | Potential Savings |

|---|---|---|

| Good Driver Discount | For drivers with a clean driving record | Up to 20% |

| Safe Driver Discount | For drivers who demonstrate safe driving habits | Up to 15% |

| Defensive Driving Course Discount | For completing a defensive driving course | Up to 10% |

| Multi-Car Discount | For insuring multiple vehicles with State Farm | Up to 10% |

| Multi-Policy Discount | For having both home and auto insurance with State Farm | Up to 15% |

| Anti-theft Device Discount | For vehicles equipped with anti-theft devices | Up to 10% |

| Good Student Discount | For students with a certain GPA | Up to 10% |

| Driver Training Discount | For drivers who have completed a driver training course | Up to 5% |

| Paperless Billing Discount | For opting for paperless billing | Up to 5% |

| Pay-in-Full Discount | For paying your premium in full | Up to 5% |

Customer Feedback and Reviews on State Farm Rates

Customer feedback and reviews provide valuable insights into how State Farm’s auto insurance rates are perceived by policyholders. These reviews often reflect individual experiences and opinions, offering a diverse perspective on rate fairness, transparency, and customer service.

Common Themes and Concerns Expressed by Customers

Customer reviews on State Farm’s auto insurance rates often highlight recurring themes and concerns. These include:

- Rate Increases: Many customers express frustration over sudden or unexplained rate increases, particularly when they believe their driving record and risk profile haven’t changed significantly. Some feel these increases are excessive or unjustified, leading to dissatisfaction.

- Lack of Transparency: Customers often seek clarity on how their rates are calculated. They desire a more transparent explanation of the factors influencing their premiums, including the specific discounts or surcharges applied.

- Limited Negotiation Options: Some customers feel limited in their ability to negotiate rates with State Farm. They may find it challenging to find alternative quotes or secure significant discounts despite having a good driving record or making safety improvements to their vehicles.

- Customer Service Issues: Reviews sometimes highlight issues with customer service, particularly when attempting to address rate concerns or seek explanations for premium changes. Delays in responses or difficulties reaching representatives can contribute to negative perceptions.

Customer Testimonials about Rate Adjustments

Customer testimonials offer real-life examples of how State Farm’s rate adjustments impact policyholders. These experiences can shed light on the company’s responsiveness to customer needs and their approach to rate calculations.

“I was shocked when my State Farm auto insurance rate suddenly increased by 20%. I hadn’t had any accidents or violations, and I even had a safe driving discount. When I called to inquire, they explained it was due to a change in their pricing model. However, I felt like I was given very little explanation about the specifics of the change.” – John S.

“After getting a new car, I contacted State Farm to update my insurance. I was surprised to see a significant increase in my premium, even though my new car had better safety features and a higher safety rating. It took several phone calls and emails to understand the factors contributing to the increase, and I still feel like I could have gotten a better rate elsewhere.” – Sarah L.

State Farm’s Customer Service and Claims Handling

State Farm, known for its iconic jingle and widespread presence, has built a reputation for its customer service and claims handling. While many factors influence overall satisfaction with an insurance company, these two aspects play a significant role in shaping a customer’s experience. Let’s delve into how State Farm approaches customer service and its claims handling process.

State Farm’s Customer Service Approach

State Farm aims to provide a personalized and convenient customer service experience. The company offers various channels for customers to reach out, including phone, online platforms, and mobile apps. This accessibility allows customers to choose the method that best suits their needs and preferences. State Farm’s customer service representatives are trained to provide helpful and knowledgeable assistance, addressing inquiries and resolving issues promptly.

State Farm’s Claims Handling Process

State Farm’s claims handling process is designed to be efficient and straightforward. The company offers a range of options for reporting claims, including online portals, mobile apps, and phone calls. Once a claim is filed, State Farm assigns a dedicated claims adjuster to handle the case. The adjuster will work with the policyholder to gather information, assess the damage, and determine the appropriate compensation.

Customer Reviews and Feedback on State Farm’s Claims Handling

Customer reviews and feedback provide valuable insights into State Farm’s claims handling procedures and outcomes. While many customers praise the company’s responsiveness and efficiency in handling claims, some have reported challenges with communication, delays in processing, or disputes over compensation amounts. Online platforms such as Trustpilot and Yelp offer a range of customer experiences with State Farm, providing a balanced perspective on the company’s claims handling practices.

Considerations for Choosing State Farm Auto Insurance

Choosing the right auto insurance provider is a crucial decision that requires careful consideration. Evaluating State Farm’s offerings involves weighing its benefits and drawbacks, assessing its strengths and weaknesses, and comparing it to competitors.

State Farm’s Strengths and Weaknesses, State farm auto insurance rates

State Farm boasts a strong reputation for its financial stability, widespread network, and comprehensive coverage options. However, its rates can sometimes be higher than those of other providers, and customer service experiences can vary.

- Strengths:

- Financial Stability: State Farm is a financially sound company with a long history of stability, providing reassurance to policyholders.

- Extensive Network: State Farm has a vast network of agents and claims centers, making it convenient for policyholders to access services nationwide.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options to cater to diverse needs, including collision, comprehensive, liability, and uninsured motorist coverage.

- Customer Loyalty: State Farm has a loyal customer base, indicating positive experiences and satisfaction among many policyholders.

- Strong Brand Recognition: State Farm’s strong brand recognition fosters trust and confidence among potential customers.

- Weaknesses:

- Higher Rates: State Farm’s rates can be higher than those of competitors, particularly for certain demographics and driving profiles.

- Varying Customer Service: While State Farm generally has positive customer service, some policyholders have reported inconsistent experiences.

- Limited Online Capabilities: State Farm’s online platform may not be as user-friendly or comprehensive as those of some competitors.

Factors to Consider When Evaluating State Farm

When deciding whether State Farm is the right choice for your auto insurance needs, consider the following factors:

- Rates: Compare State Farm’s rates to those of other providers to ensure you’re getting the best value for your coverage.

- Coverage Options: Evaluate the specific coverage options offered by State Farm to determine if they meet your individual needs.

- Customer Service: Research State Farm’s customer service reputation and read reviews to assess the quality of its service.

- Claims Handling: Understand State Farm’s claims handling process and ensure it aligns with your expectations.

- Discounts and Rate Reduction Options: Explore State Farm’s discounts and rate reduction options to maximize your savings.

Conclusive Thoughts: State Farm Auto Insurance Rates

Navigating the world of auto insurance can be complex, but by understanding the factors that influence State Farm’s rates, you can make informed choices about your coverage. Whether you’re a new driver or a seasoned veteran, this guide has provided valuable insights into State Farm’s pricing strategies, discounts, and customer experiences. Remember, comparing rates and exploring your options is crucial in finding the best auto insurance for your individual needs and budget.

General Inquiries

What factors influence State Farm auto insurance rates?

State Farm considers a variety of factors when determining your rates, including your driving history, age, location, vehicle type, and credit score.

How often are State Farm auto insurance rates reviewed?

State Farm typically reviews your rates annually, but they may adjust them more frequently if there are significant changes in your driving history or other factors.

Does State Farm offer discounts for good drivers?

Yes, State Farm offers a variety of discounts for good drivers, such as safe driver discounts and accident-free discounts.

How can I get a free quote for State Farm auto insurance?

You can get a free quote for State Farm auto insurance online, by phone, or through a local agent.