State Farm auto insurance rates are a crucial aspect for anyone considering this reputable provider. State Farm, known for its extensive history and commitment to customer service, offers a range of insurance products and services. However, understanding how their rates are determined is essential for making informed decisions.

Several factors influence State Farm’s auto insurance rates, including driving history, vehicle type, location, age, and credit score. Each factor plays a significant role in shaping the final premium. By analyzing these elements, individuals can gain a comprehensive understanding of how State Farm’s rating system operates.

State Farm Auto Insurance Overview

State Farm is a renowned name in the auto insurance industry, known for its reliability and customer-centric approach. With a rich history spanning over a century, State Farm has established itself as a trusted provider, offering a wide range of insurance products and services.

State Farm’s History and Reputation

Founded in 1922, State Farm began as a small insurance agency in Bloomington, Illinois. Over the years, the company has grown significantly, becoming one of the largest insurance providers in the United States. State Farm’s commitment to customer satisfaction has earned it a reputation for excellent service and strong financial stability. This commitment is reflected in their consistent high ratings from independent organizations like J.D. Power and A.M. Best.

State Farm’s Core Values and Mission Statement

State Farm’s core values are centered around integrity, customer focus, and financial strength. The company’s mission statement is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” These values and mission guide State Farm’s operations and ensure a customer-focused approach.

State Farm’s Key Insurance Products and Services

State Farm offers a comprehensive range of insurance products and services, including:

- Auto Insurance: This is State Farm’s flagship product, providing coverage for liability, collision, comprehensive, and other essential protections. State Farm also offers various discounts and features to help customers save on their premiums.

- Home Insurance: Protecting homeowners from a wide range of risks, including fire, theft, and natural disasters.

- Life Insurance: Offering various life insurance options to meet the financial needs of individuals and families.

- Health Insurance: Providing health insurance plans to individuals and families, with a focus on affordable and comprehensive coverage.

- Business Insurance: Tailored insurance solutions for businesses of all sizes, covering property, liability, and other risks.

- Financial Services: State Farm offers a range of financial services, including banking, investing, and retirement planning.

Factors Influencing State Farm Auto Insurance Rates

State Farm, like other insurance companies, uses a complex system to determine your auto insurance rates. The goal is to assess your risk and price your policy accordingly. Various factors influence the final cost of your insurance, and understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your State Farm auto insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher rates.

- Accidents: Each accident, regardless of fault, can increase your rates. The severity of the accident also matters, with more serious accidents resulting in higher rate increases.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can all raise your insurance premiums. The severity of the violation and the frequency of offenses will impact the increase.

- DUI/DWI: Driving under the influence of alcohol or drugs is a serious offense that can significantly increase your insurance rates. These offenses often lead to higher premiums for several years after the conviction.

Vehicle Type

The type of vehicle you drive is another important factor that State Farm considers when setting your rates. Certain vehicles are statistically more likely to be involved in accidents or to be more expensive to repair, leading to higher insurance premiums.

- Make and Model: Some car models are known for their safety features and lower repair costs, resulting in lower insurance rates. Conversely, vehicles with a history of safety issues or expensive parts may have higher rates.

- Vehicle Age: Newer vehicles often have more advanced safety features and are generally more expensive to repair, leading to higher insurance rates. Older vehicles, while often cheaper to insure, may lack safety features and have higher repair costs due to parts availability.

- Vehicle Value: The value of your vehicle is also considered. More expensive vehicles generally have higher insurance rates due to the higher cost of replacement or repair in the event of an accident.

Location

Where you live significantly impacts your State Farm auto insurance rates. Factors like population density, traffic volume, crime rates, and the frequency of accidents in your area all contribute to the overall risk assessment.

- Urban vs. Rural: Urban areas with heavy traffic and higher population density often have higher insurance rates due to the increased risk of accidents. Rural areas, with lower traffic volumes and fewer drivers, may have lower rates.

- Crime Rates: Areas with high crime rates can lead to increased theft and vandalism risks, resulting in higher insurance premiums.

- Weather Conditions: Regions with extreme weather conditions, such as hurricanes, tornadoes, or frequent snowstorms, can increase the risk of accidents and damage to vehicles, leading to higher insurance rates.

Age

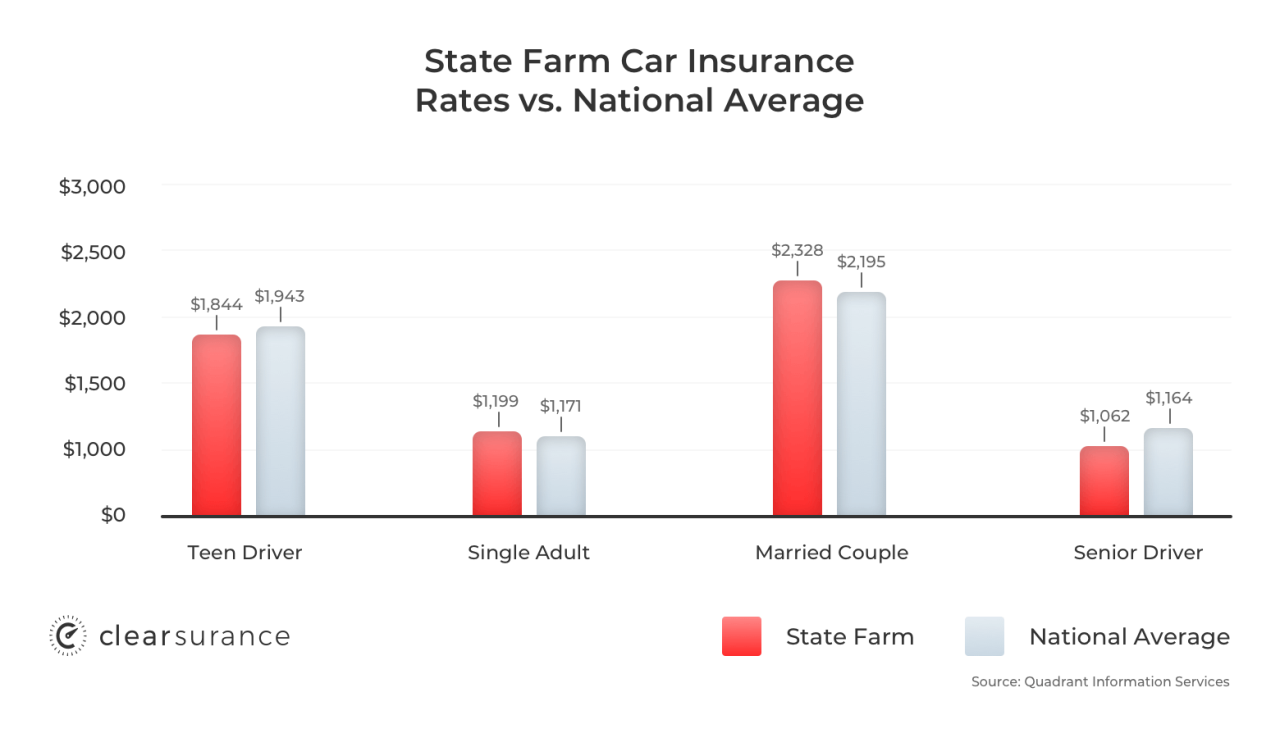

Your age is a factor in determining your State Farm auto insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As you age and gain more driving experience, your rates may decrease.

- Teen Drivers: Teen drivers have limited driving experience and are statistically more likely to be involved in accidents. This leads to higher insurance premiums for young drivers.

- Mature Drivers: Drivers over 65 may also face higher insurance premiums due to factors such as potential health issues or decreased reaction time.

Credit Score

In some states, State Farm may consider your credit score when determining your auto insurance rates. The rationale behind this is that individuals with good credit scores are generally more financially responsible and less likely to file claims.

- Credit Score Impact: A higher credit score can often lead to lower insurance premiums, while a lower credit score may result in higher rates.

- State Regulations: It’s important to note that the use of credit scores in insurance pricing is subject to state regulations. Not all states allow insurance companies to consider credit scores in determining rates.

State Farm Rate Comparison

State Farm is one of the largest auto insurance providers in the United States, known for its comprehensive coverage options and competitive rates. However, it’s essential to compare State Farm’s rates with other major insurance providers to determine if it offers the best value for your specific needs.

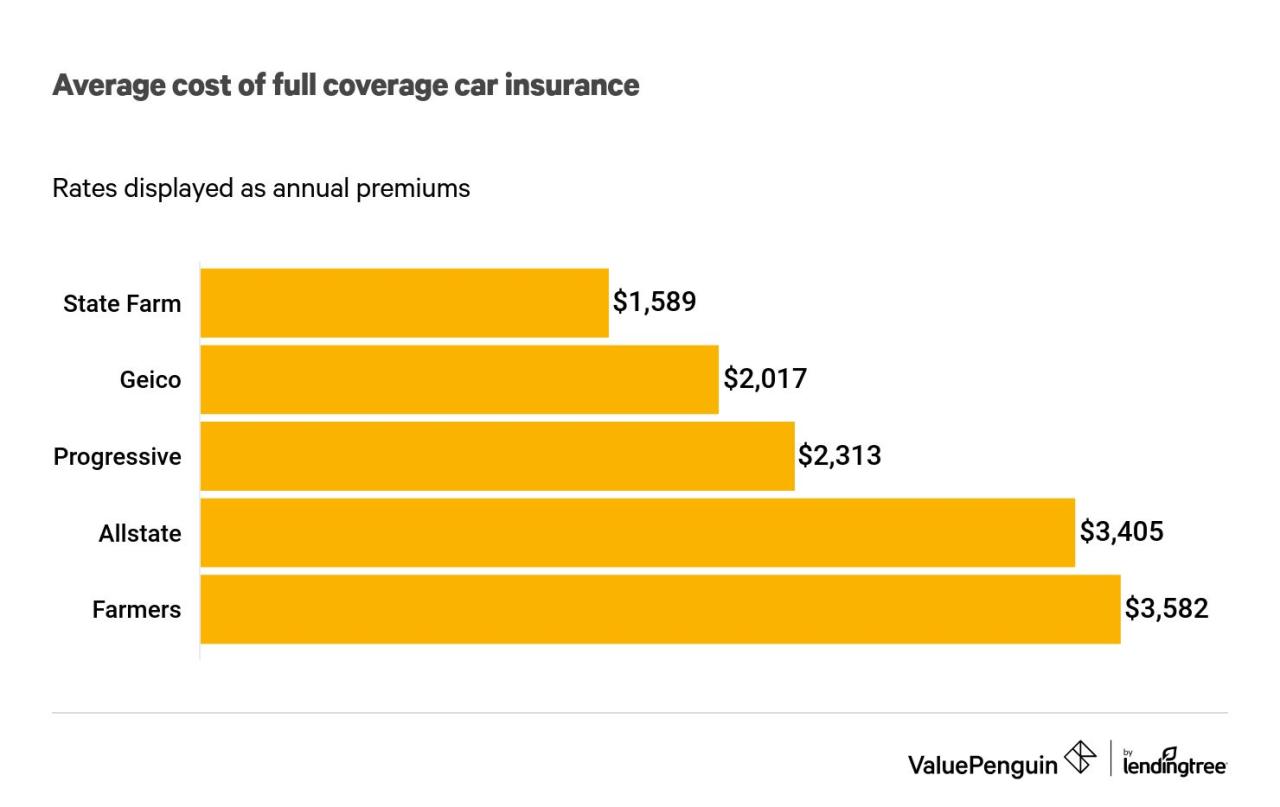

State Farm Rates Compared to Other Major Providers, State farm auto insurance rate

To get a clear picture of how State Farm’s rates stack up against its competitors, it’s essential to consider various factors, including your location, driving history, vehicle type, and coverage level. Several independent rating agencies, such as J.D. Power and Consumer Reports, conduct comprehensive studies to assess the overall customer satisfaction and pricing of different insurance providers.

For example, in a recent J.D. Power study, State Farm ranked above average in terms of customer satisfaction, while its rates were found to be slightly higher than the industry average.

State Farm Rates Across Different Geographic Regions

Auto insurance rates can vary significantly based on location, primarily due to factors like traffic density, accident rates, and the cost of car repairs.

For instance, State Farm’s rates may be higher in urban areas with heavy traffic and a higher frequency of accidents compared to rural areas with lower traffic volume.

State Farm Coverage Options and Corresponding Rates

State Farm offers a wide range of coverage options, each with its corresponding rate. The specific coverage options and their associated costs depend on factors such as your vehicle’s value, your driving history, and your chosen deductible.

Here’s a breakdown of some common State Farm coverage options and their potential impact on your rates:

- Liability Coverage: This coverage protects you financially if you’re responsible for an accident that causes injury or damage to others. Higher liability limits generally lead to higher premiums.

- Collision Coverage: This coverage covers repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured.

State Farm Discounts and Savings

State Farm offers a wide range of discounts to help policyholders save money on their auto insurance premiums. These discounts can significantly reduce your overall costs, making State Farm a competitive option for your insurance needs.

Discount Eligibility and Application

State Farm offers various discounts, each with specific eligibility criteria. To maximize your savings, it’s crucial to understand these criteria and ensure you qualify for all applicable discounts.

- Good Driver Discount: This discount is typically offered to drivers with a clean driving record, demonstrating responsible driving habits. It often rewards drivers who have not been involved in accidents or received traffic violations for a specified period.

- Safe Driver Discount: Similar to the good driver discount, this discount recognizes drivers with a history of safe driving. This may involve factors like avoiding accidents, traffic violations, and adhering to traffic laws.

- Multi-Policy Discount: State Farm provides discounts for bundling multiple insurance policies, such as auto, home, renters, or life insurance. This encourages customers to consolidate their insurance needs with State Farm, often resulting in significant cost savings.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can make it less appealing to thieves, potentially reducing the risk of theft. State Farm recognizes these efforts by offering discounts to policyholders with anti-theft devices.

- Defensive Driving Course Discount: Completing a defensive driving course demonstrates your commitment to safe driving practices. State Farm often offers discounts to policyholders who have successfully completed such courses.

- Good Student Discount: This discount rewards students with good academic performance. It encourages responsible behavior and academic excellence, recognizing the potential for safer driving habits among high-achieving students.

- Paperless Billing Discount: Opting for paperless billing is environmentally friendly and cost-effective for insurance companies. State Farm often offers discounts to policyholders who choose to receive their bills and communications electronically.

- Vehicle Safety Features Discount: State Farm may offer discounts for vehicles equipped with advanced safety features like anti-lock brakes, airbags, and electronic stability control. These features can enhance safety and potentially reduce the likelihood of accidents.

Maximizing Savings

To maximize your savings on State Farm auto insurance, it’s essential to take proactive steps:

- Review your driving record: Maintain a clean driving record by avoiding accidents and traffic violations. This will make you eligible for good driver and safe driver discounts.

- Bundle your insurance policies: Consider bundling your auto insurance with other policies like home or renters insurance. This can lead to significant savings through the multi-policy discount.

- Invest in safety features: Install anti-theft devices in your vehicle and ensure it has advanced safety features like airbags and anti-lock brakes. This can qualify you for additional discounts.

- Enroll in a defensive driving course: Completing a defensive driving course demonstrates your commitment to safe driving practices, potentially earning you a discount.

- Maintain good academic performance: If you’re a student, strive for good grades to qualify for the good student discount.

- Opt for paperless billing: Choose paperless billing to reduce environmental impact and potentially receive a discount from State Farm.

- Contact your agent: Reach out to your State Farm agent to discuss your specific situation and explore all available discounts. They can provide personalized advice and ensure you’re taking advantage of all eligible savings.

State Farm Customer Service and Claims Process

State Farm is known for its strong customer service reputation and commitment to providing a smooth claims process. They offer a variety of ways to reach out to their representatives, including phone, email, and online chat. This section explores State Farm’s customer service practices and the steps involved in filing a claim.

State Farm’s Customer Service Reputation

State Farm has consistently ranked highly in customer satisfaction surveys. They are known for their friendly and helpful representatives who are dedicated to resolving customer issues. State Farm also offers a range of resources to support customers, such as online tools and mobile apps, making it easy for customers to access information and manage their policies.

Filing a Claim with State Farm

State Farm offers multiple ways to file a claim, providing flexibility and convenience for policyholders. Here’s a breakdown of the process:

- Online Claim Filing: Customers can file a claim online through State Farm’s website, providing quick and convenient access.

- Mobile App Claim Filing: State Farm’s mobile app allows customers to file claims on the go, streamlining the process.

- Phone Claim Filing: Customers can call State Farm’s 24/7 customer service line to file a claim by phone, receiving immediate assistance from a representative.

State Farm’s Claim Handling Practices

State Farm is committed to providing fair and efficient claim handling. They aim to resolve claims promptly and fairly, ensuring that policyholders receive the compensation they are entitled to. State Farm utilizes a dedicated team of claims adjusters who are trained to investigate and assess claims thoroughly. The claims process typically involves the following steps:

- Initial Report: Once a claim is filed, a State Farm representative will contact the policyholder to gather initial information about the incident.

- Investigation: State Farm will investigate the claim, gathering evidence and assessing the extent of the damage or loss.

- Claim Assessment: Based on the investigation, State Farm will determine the amount of compensation the policyholder is eligible for.

- Payment: State Farm will issue payment to the policyholder for the approved claim amount.

“State Farm is committed to providing fair and efficient claim handling, ensuring that policyholders receive the compensation they are entitled to.”

State Farm Digital Tools and Resources

State Farm offers a comprehensive suite of digital tools and resources designed to simplify the insurance experience for its customers. These tools are accessible through the State Farm website and mobile app, providing convenient and efficient ways to manage policies, access information, and connect with customer support.

Online Quote Requests

State Farm’s website and mobile app allow customers to obtain personalized auto insurance quotes in a matter of minutes. This online quote process is user-friendly and eliminates the need for phone calls or in-person visits. Customers can easily input their vehicle information, driving history, and desired coverage levels to receive an instant quote. This empowers customers to compare different coverage options and find the best value for their needs.

Final Wrap-Up

Navigating the world of auto insurance can be complex, but understanding State Farm’s approach to rates is crucial for making informed choices. By considering factors like driving history, vehicle type, and location, individuals can gain insights into how their premiums are calculated. Moreover, exploring available discounts and utilizing digital tools can help maximize savings and enhance the overall insurance experience. Ultimately, State Farm’s commitment to customer service and comprehensive coverage options make it a valuable choice for many seeking reliable auto insurance.

FAQs: State Farm Auto Insurance Rate

How can I get a free quote from State Farm?

You can obtain a free quote online, over the phone, or by visiting a local State Farm agent.

What are some common discounts offered by State Farm?

State Farm offers a variety of discounts, including safe driver discounts, good student discounts, multi-policy discounts, and more.

What is State Farm’s claims process like?

You can file a claim online, over the phone, or through a State Farm agent. State Farm has a reputation for prompt and efficient claims handling.