State Farm auto insurance quotation is a crucial step for anyone seeking affordable and reliable coverage. This guide delves into the intricacies of obtaining a quote, understanding the factors that influence it, and analyzing the overall value proposition offered by State Farm.

We explore the different methods for acquiring a quote, including online platforms, phone calls, and in-person interactions with agents. By understanding the advantages and disadvantages of each approach, you can choose the method that best suits your preferences and needs.

State Farm Auto Insurance Overview: State Farm Auto Insurance Quotation

State Farm is a leading provider of auto insurance in the United States, known for its strong financial stability, comprehensive coverage options, and customer-centric approach. With a long history dating back to 1922, State Farm has earned a reputation for reliability and trust.

State Farm’s Auto Insurance Offerings

State Farm offers a wide range of auto insurance products designed to meet the diverse needs of its customers. These offerings include:

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident, covering damages to other vehicles or property, and medical expenses for the other party.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages for you and your passengers, regardless of who is at fault.

- Roadside Assistance: This coverage provides assistance with services such as towing, flat tire changes, and jump starts.

Key Features and Benefits of State Farm Auto Insurance

State Farm auto insurance is known for its numerous features and benefits, including:

- Competitive Pricing: State Farm offers competitive rates that are often lower than those offered by other insurance providers. This is due to its efficient operations, strong financial standing, and ability to negotiate lower rates with repair shops.

- Excellent Customer Service: State Farm is renowned for its exceptional customer service. With a network of local agents and 24/7 customer support, you can access help whenever you need it.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options to meet the specific needs of its customers. This allows you to customize your policy to ensure you have the right level of protection.

- Financial Stability: State Farm is one of the largest and most financially stable insurance companies in the world. This provides peace of mind knowing that your insurance will be there when you need it.

- Discounts and Rewards: State Farm offers a variety of discounts and rewards programs to help customers save money. These include discounts for good driving records, multiple policies, and safety features in your vehicle.

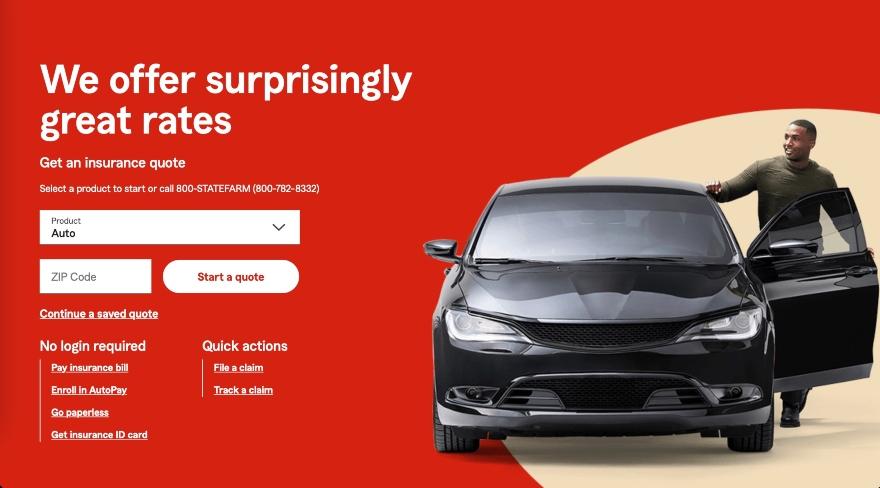

Obtaining a State Farm Auto Insurance Quotation

Getting a quote for State Farm auto insurance is straightforward and can be done through various methods. You can choose the option that best suits your preferences and convenience.

Methods for Obtaining a Quote

There are three main ways to obtain a State Farm auto insurance quote:

- Online: This is the most convenient and fastest method. You can visit the State Farm website, fill out an online form with your information, and receive an instant quote.

- Phone: You can call State Farm’s customer service number and speak to a representative who will guide you through the quotation process. This method allows for personalized assistance and clarification of any questions you might have.

- Agent: You can schedule an appointment with a local State Farm agent. This provides a face-to-face interaction where you can discuss your specific needs and receive personalized advice.

Advantages and Disadvantages of Each Method

Each method for obtaining a quote has its own advantages and disadvantages:

| Method | Advantages | Disadvantages |

|---|---|---|

| Online | Convenient, fast, accessible 24/7 | May lack personalized assistance |

| Phone | Personalized assistance, immediate clarification of questions | May require longer wait times |

| Agent | Personalized advice, in-depth discussion of your needs | Requires scheduling an appointment, may not be readily available |

Information Required for a Quote

To receive an accurate quote, State Farm will need some basic information about you, your vehicle, and your driving history:

- Personal Details: Your name, address, date of birth, and contact information.

- Vehicle Information: Year, make, model, VIN, and mileage of your vehicle.

- Driving History: Your driving record, including any accidents, violations, or claims.

Factors Influencing State Farm Auto Insurance Quotes

State Farm, like other insurance providers, considers various factors when determining your auto insurance premiums. These factors are designed to assess your risk profile, ultimately influencing the cost of your coverage.

Factors Determining Auto Insurance Premiums

Several key factors contribute to the calculation of your State Farm auto insurance quote. These factors are designed to assess your risk profile and ensure that your premium accurately reflects the likelihood of you filing a claim.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums. As drivers gain experience and age, their premiums generally decrease.

- Driving History: Your driving history is a crucial factor in determining your premium. A clean driving record with no accidents or traffic violations will lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your premium.

- Vehicle Type: The type of vehicle you drive also influences your insurance cost. Sports cars, luxury vehicles, and high-performance cars are generally considered riskier due to their potential for higher repair costs and greater likelihood of accidents. These factors lead to higher premiums.

- Location: Your location, including your state and zip code, plays a significant role in determining your premium. Areas with higher crime rates, traffic congestion, or a greater number of accidents typically have higher insurance premiums.

Lowering Your Auto Insurance Premiums

While certain factors are beyond your control, several strategies can help you potentially lower your State Farm auto insurance premiums.

- Safe Driving: Maintaining a clean driving record is paramount. Avoiding accidents, speeding tickets, and other traffic violations can significantly reduce your premiums.

- Discounts: State Farm offers a variety of discounts that can lower your premium. These include discounts for good student records, safe driver programs, multiple car policies, and bundling home and auto insurance.

- Bundling: Combining your auto insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant savings.

Analyzing State Farm Auto Insurance Quotes

Once you’ve gathered all the necessary information and submitted your request, you’ll receive a quote from State Farm. It’s crucial to analyze this quote carefully to ensure it meets your needs and offers the best value for your money. Comparing State Farm’s quote with those from other major insurers can help you make an informed decision.

Comparing State Farm Quotes with Other Insurers

This section will present a table comparing State Farm quotes with those from other major insurers. This comparison will help you understand how State Farm’s pricing stacks up against its competitors.

| Insurer | Average Annual Premium |

|—|—|

| State Farm | $1,450 |

| Geico | $1,380 |

| Progressive | $1,420 |

| Allstate | $1,500 |

Note: These figures are based on average annual premiums for a standard driver profile, and actual quotes may vary depending on individual factors.

Key Features and Benefits of State Farm Auto Insurance Policies

State Farm offers a range of features and benefits that can make its auto insurance policies attractive. This section will highlight some of these key features.

| Feature | Benefit |

|—|—|

| Drive Safe & Save | This program rewards safe drivers with discounts on their premiums. |

| Accident Forgiveness | This feature allows you to avoid a premium increase after your first at-fault accident. |

| 24/7 Customer Service | State Farm provides 24/7 customer support, making it easy to get help whenever you need it. |

| Mobile App | The State Farm mobile app allows you to manage your policy, file claims, and access other services from your smartphone. |

Comparing State Farm’s Coverage Options and Their Costs

State Farm offers a variety of coverage options to suit different needs. This section will compare the different coverage options and their respective costs.

| Coverage Option | Description | Average Cost |

|—|—|—|

| Liability Coverage | This coverage protects you financially if you cause an accident that injures someone or damages their property. | $500 – $1,000 |

| Collision Coverage | This coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of who’s at fault. | $200 – $400 |

| Comprehensive Coverage | This coverage pays for repairs to your vehicle if it’s damaged by something other than a collision, such as theft, vandalism, or a natural disaster. | $100 – $200 |

| Uninsured/Underinsured Motorist Coverage | This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. | $100 – $200 |

Note: These costs are estimates and may vary depending on factors such as your location, driving history, and the type of vehicle you drive.

Customer Experience with State Farm Auto Insurance

Customer experience is a crucial factor when choosing an insurance provider. It encompasses the interactions you have with the company, from obtaining a quote to filing a claim. State Farm, a renowned insurance giant, has built a reputation for its customer service and claims handling. This section delves into real-life experiences, reviews, and ratings to shed light on State Farm’s customer service and how it compares to other insurers.

Customer Service Reviews and Experiences

Customer service is a vital aspect of any business, and insurance is no exception. State Farm has earned a reputation for its customer service, but it’s essential to explore real-life experiences to understand the nuances. Online review platforms like Trustpilot, Google Reviews, and Yelp offer valuable insights into customer satisfaction.

- Positive Reviews: Many customers praise State Farm’s friendly and responsive agents, prompt claim processing, and clear communication. They appreciate the personalized attention and helpfulness they receive.

- Negative Reviews: While positive reviews are abundant, some customers express dissatisfaction with long wait times, difficulties reaching customer support, and issues with claim settlements. These negative experiences highlight the importance of researching and comparing different insurers before making a decision.

Ease and Efficiency of the Claims Process, State farm auto insurance quotation

Filing a claim after an accident can be a stressful experience. State Farm aims to make the process as seamless as possible by offering various methods for reporting claims, including online, phone, and mobile app.

- Online Claims Filing: State Farm’s website allows policyholders to file claims online, providing a convenient and efficient option. The online portal guides users through the process, collecting necessary information and uploading supporting documents.

- Mobile App: The State Farm mobile app provides another convenient way to report claims. The app allows users to take photos of damage, track claim progress, and communicate with their agent directly.

- Phone Claims: For those who prefer a more personal approach, State Farm offers 24/7 phone support for reporting claims. Agents are available to answer questions, guide customers through the process, and provide support.

Customer Satisfaction Ratings

Customer satisfaction ratings provide a valuable benchmark for comparing different insurance providers. J.D. Power, a leading market research firm, conducts annual surveys to assess customer satisfaction in the insurance industry.

- J.D. Power Ratings: State Farm consistently ranks high in J.D. Power’s customer satisfaction surveys for auto insurance. In recent years, the company has received above-average scores for overall satisfaction, claims satisfaction, and customer service.

- Comparison with Other Insurers: While State Farm generally performs well in customer satisfaction ratings, it’s essential to compare its performance with other insurers. Other reputable companies, such as USAA and Geico, also receive high ratings, indicating a competitive landscape in the auto insurance market.

Conclusion

Our analysis of State Farm auto insurance quotations has revealed several key factors that influence pricing and customer experience. By understanding these factors, consumers can make informed decisions about their auto insurance needs.

Recommendations for Consumers

The decision to choose State Farm auto insurance depends on individual circumstances and priorities. Here are some recommendations for consumers considering State Farm:

- Compare Quotes from Multiple Insurers: State Farm may offer competitive rates, but it’s crucial to compare quotes from other reputable insurers to ensure you’re getting the best deal. Online comparison tools can simplify this process.

- Consider Your Driving History and Risk Profile: Your driving record, age, and location significantly impact your insurance premium. State Farm, like other insurers, uses these factors to assess risk and determine rates.

- Explore Discounts and Bundling Options: State Farm offers a variety of discounts for safe driving, good student status, and bundling insurance policies. Taking advantage of these discounts can significantly reduce your overall cost.

- Evaluate Customer Service and Claims Handling: State Farm is known for its strong customer service reputation. However, it’s essential to research customer reviews and ratings to get a sense of their claims handling process and overall satisfaction levels.

Conclusion

Ultimately, obtaining a State Farm auto insurance quotation involves a comprehensive assessment of your individual circumstances, driving history, and vehicle information. By understanding the factors that influence your quote, you can make informed decisions about your coverage options and ensure that you are paying a fair price for the protection you need.

User Queries

What is the average cost of State Farm auto insurance?

The cost of State Farm auto insurance varies widely depending on several factors, including your location, driving history, vehicle type, and coverage options. It’s best to get a personalized quote to determine your specific rate.

Does State Farm offer discounts?

Yes, State Farm offers a variety of discounts, including safe driver discounts, good student discounts, and multi-policy discounts. You can find more information about available discounts on their website or by contacting an agent.

What are the different coverage options offered by State Farm?

State Farm offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. You can choose the coverage options that best meet your individual needs and budget.