State Farm auto insurance prices are a crucial factor for many drivers seeking affordable and reliable coverage. Understanding how State Farm determines these prices is essential for making informed decisions about your insurance needs. This guide explores the key factors influencing State Farm’s auto insurance pricing, including driving history, vehicle type, and location. We’ll also delve into State Farm’s quote process, discounts, and coverage options to help you navigate the world of auto insurance.

From understanding the intricacies of State Farm’s pricing model to exploring their discounts and coverage options, this guide aims to equip you with the knowledge necessary to make informed decisions about your auto insurance. Whether you’re a seasoned driver or a new car owner, this comprehensive overview will shed light on the factors that shape State Farm’s auto insurance prices.

State Farm’s Auto Insurance Pricing Factors: State Farm Auto Insurance Prices

State Farm, like other insurance companies, uses a complex pricing model to determine individual auto insurance premiums. This model considers a wide range of factors, both static and dynamic, to assess risk and determine the appropriate cost of coverage. Understanding these factors can help policyholders understand how their premiums are calculated and potentially find ways to lower them.

Factors Influencing State Farm’s Auto Insurance Prices, State farm auto insurance prices

State Farm’s pricing model considers several factors to determine the cost of auto insurance. These factors can be broadly categorized as:

- Driver-related factors: These factors focus on the individual’s driving history and risk profile. They include:

- Driving history: This includes factors like accidents, traffic violations, and driving record. A clean driving record generally leads to lower premiums, while a history of accidents or violations can significantly increase them. For instance, a driver with multiple speeding tickets or a DUI conviction will likely face higher premiums compared to someone with a clean record.

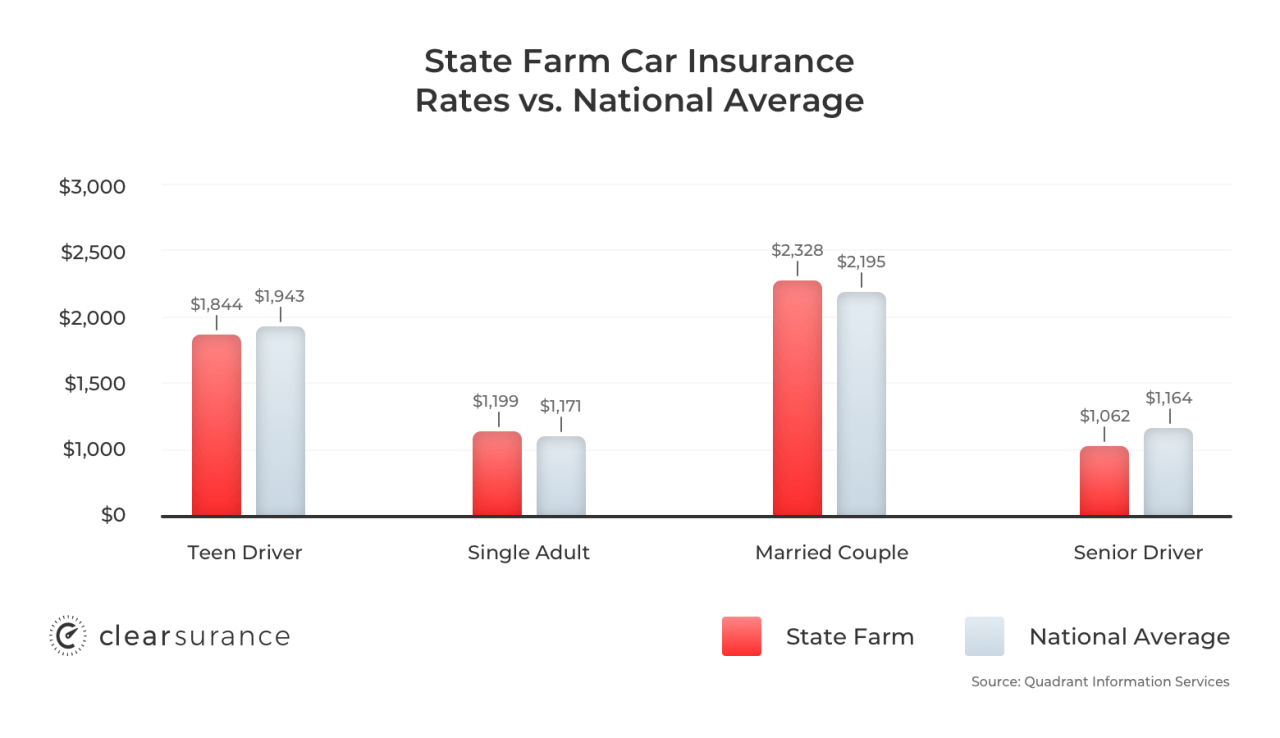

- Age and experience: Younger drivers, especially those with limited driving experience, are statistically more likely to be involved in accidents. As a result, they typically pay higher premiums. Conversely, older drivers with years of safe driving experience may qualify for discounts.

- Credit history: While controversial, State Farm, like many other insurers, uses credit history as a proxy for risk assessment. Individuals with good credit scores tend to be considered more responsible and less likely to file claims, resulting in lower premiums.

- Driving habits: State Farm may offer discounts for drivers who participate in telematics programs, which track driving habits like speed, braking, and mileage. By demonstrating safe driving practices, policyholders can potentially earn lower premiums.

- Vehicle-related factors: These factors relate to the insured vehicle and its characteristics, including:

- Vehicle type: The make, model, and year of the vehicle significantly influence premiums. Luxury cars or high-performance vehicles are generally more expensive to repair and replace, leading to higher insurance costs. Conversely, older, less expensive vehicles typically have lower premiums. For example, insuring a brand-new Tesla Model S will likely be more expensive than insuring a 10-year-old Honda Civic.

- Safety features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are considered safer and less likely to be involved in accidents. State Farm may offer discounts for vehicles with these features.

- Vehicle usage: The purpose and frequency of vehicle use can influence premiums. For example, a vehicle used primarily for commuting will likely have lower premiums than one used for long-distance travel or commercial purposes.

- Location-related factors: These factors relate to the geographical location of the insured driver, including:

- Location: The state, county, and even neighborhood where the vehicle is primarily driven can impact premiums. Areas with high traffic density, crime rates, or accident history may have higher insurance costs. For instance, drivers living in major metropolitan areas might face higher premiums compared to those residing in rural areas.

- Climate: Areas prone to severe weather conditions, such as hurricanes, tornadoes, or earthquakes, may have higher premiums due to the increased risk of damage to vehicles.

Understanding State Farm’s Rate Quotes

Getting an accurate auto insurance quote from State Farm is crucial for understanding your potential costs and making informed decisions. It’s a straightforward process, and State Farm provides several options to suit your preferences.

Getting an Accurate State Farm Auto Insurance Quote

To get a precise quote from State Farm, follow these steps:

- Gather your personal information, including your driver’s license, Social Security number, and contact details.

- Provide details about your vehicle, including the year, make, model, and vehicle identification number (VIN).

- Share your driving history, including any accidents, tickets, or violations.

- Specify your coverage preferences, such as liability limits, comprehensive and collision coverage, and any optional add-ons.

- Provide your address and the location where you primarily park your vehicle.

State Farm uses this information to calculate your insurance premium, taking into account your individual risk factors and coverage choices.

State Farm’s Online Quote Tools

State Farm offers convenient online quote tools that allow you to quickly get an estimated price for auto insurance. These tools are generally accurate, providing a good starting point for understanding your potential costs. However, it’s important to remember that online quotes are just estimates and may not reflect your final premium.

- State Farm’s online quote tools use a simplified algorithm based on basic information you provide.

- They may not consider all your individual risk factors, such as your driving history or specific coverage options.

- To get a more accurate quote, you can contact a State Farm agent directly, who can review your details thoroughly.

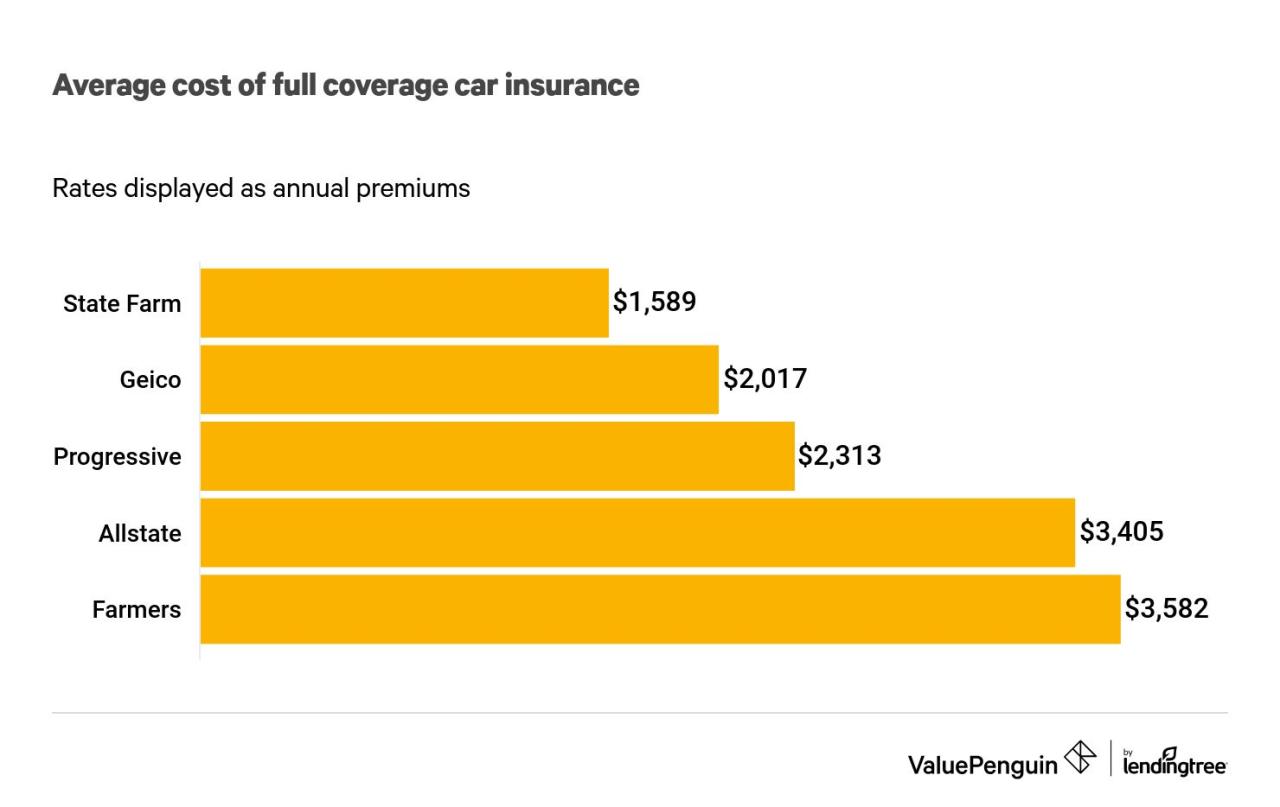

Comparison with Other Insurers

State Farm’s quote process is generally similar to other insurers. However, there are some key differences to consider:

- State Farm offers a variety of discounts, such as good driver discounts, safe driver discounts, and multi-policy discounts, which can significantly impact your final premium.

- State Farm’s online quote tools are generally user-friendly and provide a quick estimate of your potential costs.

- State Farm has a strong reputation for customer service and claims handling, which can be an important factor when choosing an insurer.

It’s always recommended to compare quotes from multiple insurers to find the best rates and coverage options that meet your individual needs.

State Farm’s Discounts and Savings Opportunities

State Farm offers a variety of discounts to help its customers save money on their auto insurance premiums. These discounts can be applied to your policy based on your individual circumstances and driving habits. By understanding these discounts and how to qualify for them, you can potentially significantly reduce your insurance costs.

State Farm’s Auto Insurance Discounts

State Farm offers a wide range of discounts, including:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, meaning no accidents or traffic violations. The amount of the discount can vary based on the length of time you have maintained a clean driving record.

- Safe Driver Discount: This discount is available to drivers who have completed a defensive driving course approved by State Farm. These courses teach safe driving techniques and can help reduce your risk of accidents, making you a more desirable customer for insurance companies.

- Multi-Policy Discount: If you bundle your auto insurance with other State Farm policies, such as homeowners, renters, or life insurance, you can receive a significant discount on your auto insurance premium.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as an alarm system or GPS tracking, can help deter theft and reduce your insurance costs.

- Defensive Driving Course Discount: State Farm rewards drivers who complete an approved defensive driving course, demonstrating their commitment to safe driving practices.

- Good Student Discount: Students who maintain a good academic record, typically a B average or higher, can qualify for this discount, recognizing their responsible behavior and lower risk profile.

- Accident-Free Discount: If you have been accident-free for a specified period, you may be eligible for a discount, reflecting your safe driving history.

- Loyalty Discount: State Farm rewards long-term customers with loyalty discounts, recognizing their continued business and trust in the company.

- Paperless Billing Discount: Choosing paperless billing for your policy can save you money and reduce your environmental impact, reflecting your environmentally conscious approach.

- Paid-in-Full Discount: Paying your auto insurance premium in full upfront can sometimes result in a discount, as it provides State Farm with a predictable revenue stream.

Maximizing Your Savings

- Review your policy regularly: Check your policy periodically to ensure you are still eligible for all applicable discounts. Your circumstances may change, such as getting married, moving, or adding a new driver to your policy.

- Ask about available discounts: Don’t hesitate to ask your State Farm agent about any discounts you may be eligible for. They can help you identify and apply for all the discounts that apply to your situation.

- Maintain a good driving record: This is the most important factor in determining your insurance premium. By avoiding accidents and traffic violations, you can significantly reduce your costs.

- Consider bundling your policies: Bundling your auto insurance with other State Farm policies can result in significant savings. This is one of the most common ways to lower your overall insurance costs.

- Install anti-theft devices: Installing anti-theft devices in your vehicle can make it less attractive to thieves and lower your insurance premium.

- Take a defensive driving course: Completing a defensive driving course can not only improve your driving skills but also earn you a discount on your insurance.

State Farm Discounts: Eligibility and Potential Savings

| Discount | Eligibility Criteria | Potential Savings |

|---|---|---|

| Good Driver Discount | Clean driving record (no accidents or violations) | Up to 20% |

| Safe Driver Discount | Completion of an approved defensive driving course | Up to 10% |

| Multi-Policy Discount | Bundling with other State Farm policies (home, renters, life) | Up to 15% |

| Anti-theft Device Discount | Installation of approved anti-theft devices | Up to 10% |

| Good Student Discount | Maintaining a good academic record (B average or higher) | Up to 10% |

| Accident-Free Discount | No accidents for a specified period | Up to 15% |

| Loyalty Discount | Long-term customer with State Farm | Up to 5% |

| Paperless Billing Discount | Choosing paperless billing for your policy | Up to 5% |

| Paid-in-Full Discount | Paying your premium in full upfront | Up to 5% |

State Farm’s Coverage Options and Their Impact on Prices

State Farm offers a variety of auto insurance coverage options to meet the diverse needs of its policyholders. Understanding these options and their impact on premiums is crucial for making informed decisions about your insurance coverage.

State Farm’s Auto Insurance Coverage Options

Here is a breakdown of State Farm’s common auto insurance coverage options, their descriptions, and typical price ranges:

| Coverage Type | Description | Typical Price Range |

|---|---|---|

| Liability Coverage | Covers damages to others’ property and injuries you cause in an accident. | $50 – $100 per month |

| Collision Coverage | Covers damages to your vehicle in an accident, regardless of fault. | $20 – $50 per month |

| Comprehensive Coverage | Covers damages to your vehicle from non-accident events like theft, vandalism, or natural disasters. | $15 – $40 per month |

| Uninsured/Underinsured Motorist Coverage | Protects you and your passengers if you’re hit by a driver without insurance or with insufficient coverage. | $10 – $30 per month |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. | $20 – $50 per month |

Comparing the Costs of Different Coverage Levels

The cost of your auto insurance policy is directly influenced by the coverage levels you choose. For example, increasing your liability limits will generally result in higher premiums. However, higher liability limits offer greater financial protection in the event of a serious accident. Similarly, choosing comprehensive and collision coverage will increase your premiums but provide protection against damages caused by non-accident events and accidents, respectively.

Scenario Illustrating Coverage Options Impact

Imagine you’re a young driver with a new car. You’re considering different coverage options and their impact on your insurance costs.

– Scenario 1: Minimal Coverage: You choose only the minimum required liability coverage, opting out of collision and comprehensive coverage. This will result in the lowest premiums but leave you financially vulnerable if your car is damaged in an accident or by a non-accident event.

– Scenario 2: Comprehensive Coverage: You opt for comprehensive and collision coverage, along with higher liability limits. This will provide greater financial protection but come with higher premiums.

By comparing these scenarios, you can see how different coverage choices can significantly affect the overall cost of your insurance.

Factors Influencing State Farm’s Pricing Across Different Regions

State Farm, like other major insurance companies, adjusts its auto insurance premiums based on a variety of factors, including regional variations in risk, state regulations, and local market conditions. This ensures that premiums are tailored to the specific risks and circumstances faced by drivers in different areas.

State Regulations and Local Risk Factors

State regulations play a significant role in shaping State Farm’s pricing strategy. Each state has its own set of laws and regulations governing auto insurance, including minimum coverage requirements, pricing practices, and the availability of certain discounts. For example, some states have stricter regulations regarding the use of credit scores in pricing, which can influence the overall cost of insurance.

Local risk factors, such as the frequency and severity of accidents, the density of traffic, and the prevalence of theft and vandalism, also impact premiums. Areas with higher rates of accidents or traffic congestion tend to have higher insurance premiums due to the increased likelihood of claims.

Average Premiums Across Different States and Regions

State Farm’s average premiums vary considerably across different states and regions. For example, the average annual premium for full coverage auto insurance in Texas is significantly higher than in Iowa. This difference can be attributed to a number of factors, including the higher density of population, greater traffic congestion, and higher accident rates in Texas.

Regional Differences in Factors Influencing Premiums

Regional differences in factors such as traffic density and accident rates can significantly influence premiums. For example, in urban areas with high traffic congestion, drivers are more likely to be involved in accidents. This increased risk is reflected in higher premiums. Similarly, areas with high rates of car theft or vandalism may have higher premiums due to the increased likelihood of claims.

For example, a recent study by the Insurance Information Institute found that the average annual premium for full coverage auto insurance in New York City was $2,372, while the average premium in rural areas of Iowa was $1,184. This difference can be attributed to a number of factors, including the higher density of population, greater traffic congestion, and higher accident rates in New York City.

Epilogue

In conclusion, State Farm auto insurance prices are influenced by a multitude of factors, including driving history, vehicle type, location, and coverage options. By understanding these factors and utilizing State Farm’s discounts and online quote tools, you can potentially secure competitive pricing for your auto insurance needs. Remember, careful consideration of your individual circumstances and a thorough understanding of State Farm’s offerings are key to finding the best coverage at the right price.

FAQ Insights

How can I get a free quote from State Farm?

You can get a free quote online, over the phone, or by visiting a local State Farm agent.

What factors affect my State Farm auto insurance premium?

Factors such as your driving history, vehicle type, location, coverage options, and credit score can influence your premium.

Does State Farm offer discounts for safe drivers?

Yes, State Farm offers discounts for safe drivers, such as the Safe Driver Discount and the Accident-Free Discount.

What are the different coverage options available from State Farm?

State Farm offers various coverage options, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

How can I contact State Farm for assistance?

You can contact State Farm by phone, email, or through their website.