State Farm auto insurance price is a key consideration for many drivers seeking affordable and reliable coverage. As one of the largest and most recognized insurers in the United States, State Farm offers a range of policies and features that cater to diverse needs and budgets. Understanding the factors that influence State Farm’s pricing can help you make informed decisions about your auto insurance.

This guide delves into the intricacies of State Farm’s auto insurance pricing, exploring the factors that impact your premiums, comparing State Farm’s rates to its competitors, and providing valuable tips for obtaining the best possible price. Whether you’re a new driver or a seasoned veteran, this information will empower you to navigate the world of auto insurance with confidence.

State Farm Auto Insurance Overview

State Farm is a leading provider of auto insurance in the United States, known for its comprehensive coverage options, competitive rates, and exceptional customer service. Founded in 1922, State Farm has a long history of serving the insurance needs of millions of Americans.

History and Market Position

State Farm was established in 1922 by George J. Mecherle in Bloomington, Illinois. The company began as a small mutual insurance company focused on providing auto insurance to farmers. Over the years, State Farm expanded its product offerings to include a wide range of insurance products, including home, life, health, and commercial insurance. Today, State Farm is the largest provider of auto insurance in the United States, with over 83 million policies in force.

Core Values and Mission Statement

State Farm’s core values are centered around customer satisfaction, integrity, and financial stability. The company’s mission statement emphasizes its commitment to providing “peace of mind through insurance and financial services.” These values are reflected in State Farm’s auto insurance policies, which are designed to protect policyholders from financial losses and provide them with peace of mind in the event of an accident.

Key Features and Benefits

State Farm’s auto insurance policies offer a variety of features and benefits, including:

- Comprehensive coverage options: State Farm offers a range of coverage options to meet the individual needs of its policyholders. These options include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP).

- Competitive rates: State Farm strives to provide competitive rates to its policyholders. The company offers a variety of discounts, such as safe driver discounts, good student discounts, and multi-policy discounts, to help policyholders save money on their premiums.

- Exceptional customer service: State Farm is known for its excellent customer service. The company has a network of agents and claims representatives available 24/7 to assist policyholders with their insurance needs. State Farm also offers a variety of online and mobile tools to make it easy for policyholders to manage their accounts and file claims.

- Financial stability: State Farm is a financially sound company with a strong track record of paying claims. The company has consistently received high ratings from independent financial rating agencies, such as A.M. Best and Standard & Poor’s, which demonstrates its financial strength and ability to meet its obligations to policyholders.

Factors Influencing State Farm Auto Insurance Prices

State Farm, being one of the largest auto insurance providers in the United States, employs a comprehensive rating system to determine individual insurance premiums. Several factors contribute to the final price you pay for your policy. These factors are categorized into various aspects of your profile, such as your driving history, the vehicle you drive, your location, the coverage you choose, and your eligibility for discounts.

Driving History

Your driving history is a significant factor in determining your auto insurance rates. State Farm, like other insurance providers, considers your past driving record, including any accidents, violations, and claims. A clean driving record with no accidents or violations usually results in lower premiums, while a history of accidents or traffic violations can lead to higher premiums.

Vehicle Type

The type of vehicle you drive is another crucial factor in calculating your insurance rates. State Farm considers factors like the vehicle’s make, model, year, safety features, and theft risk. For example, sports cars or luxury vehicles often have higher insurance premiums due to their higher repair costs and greater risk of theft. Conversely, older, less expensive vehicles with basic safety features may have lower premiums.

Location

Your location also plays a role in determining your auto insurance rates. State Farm considers factors like the population density, traffic congestion, crime rates, and weather conditions in your area. For instance, areas with higher crime rates or more frequent accidents may have higher insurance premiums.

Coverage Levels

The level of coverage you choose for your auto insurance policy directly impacts your premiums. State Farm offers various coverage options, such as liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Higher coverage levels, which offer more protection, generally come with higher premiums.

Discounts

State Farm offers a variety of discounts to help lower your insurance premiums. These discounts can be based on factors like your driving history, vehicle safety features, good student status, multiple policy discounts, and more.

State Farm’s Pricing Across Different States

State Farm’s auto insurance rates can vary significantly across different states due to various factors, including the state’s regulations, the cost of living, and the frequency of accidents. Here’s a table comparing average premiums for State Farm auto insurance in different states:

| State | Average Annual Premium | Potential Rate Variations |

|---|---|---|

| California | $2,000 | $1,500 – $2,500 |

| Florida | $1,800 | $1,300 – $2,300 |

| Texas | $1,600 | $1,100 – $2,100 |

| New York | $2,200 | $1,700 – $2,700 |

| Illinois | $1,900 | $1,400 – $2,400 |

Note: The average premiums and potential rate variations listed above are for illustrative purposes only and may vary depending on individual circumstances.

State Farm’s Rating System Compared to Other Providers

State Farm’s rating system is similar to other major auto insurance providers, considering factors like driving history, vehicle type, location, coverage levels, and discounts. However, State Farm may have its own proprietary algorithms and weighting factors that influence the final premium calculation. It’s important to note that State Farm’s rates may vary compared to other providers, and it’s always recommended to compare quotes from multiple insurers to find the best rates for your individual needs.

State Farm Auto Insurance Pricing Comparisons: State Farm Auto Insurance Price

It’s important to compare prices from different insurance companies before settling on a policy. State Farm is a well-known and reputable provider, but it’s crucial to see how its prices stack up against its competitors.

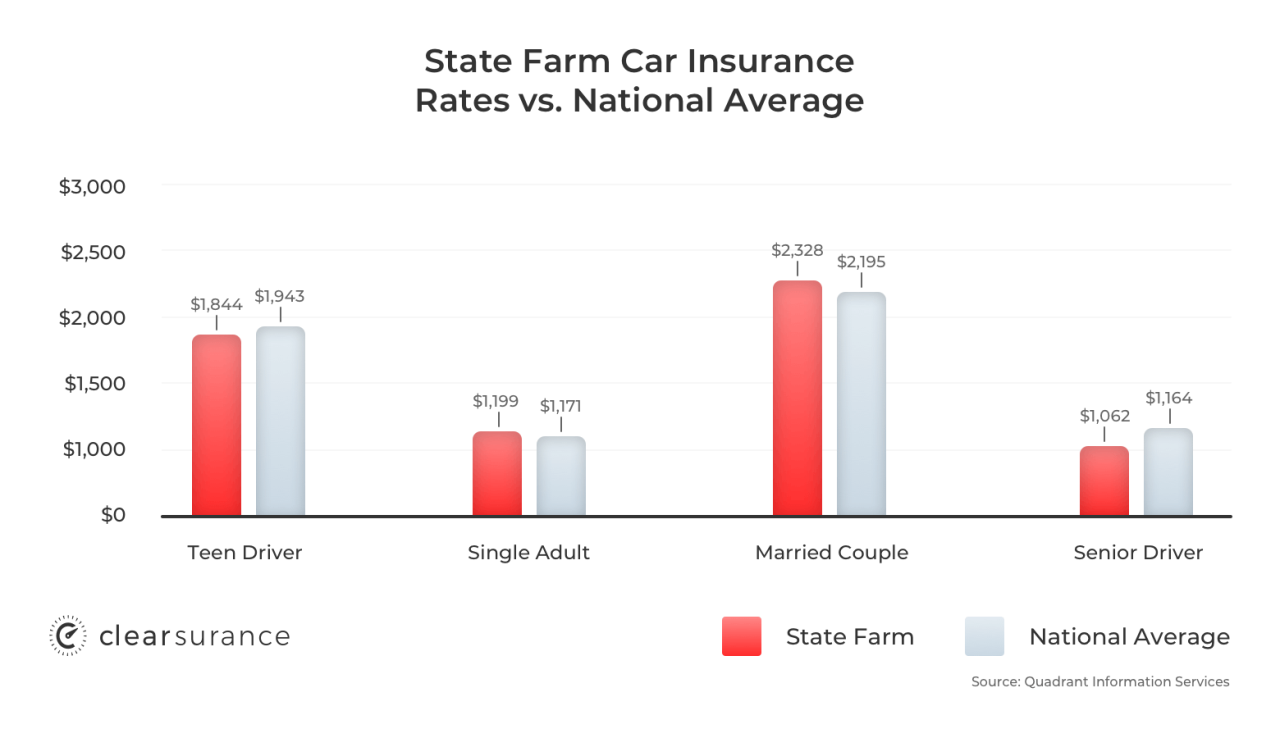

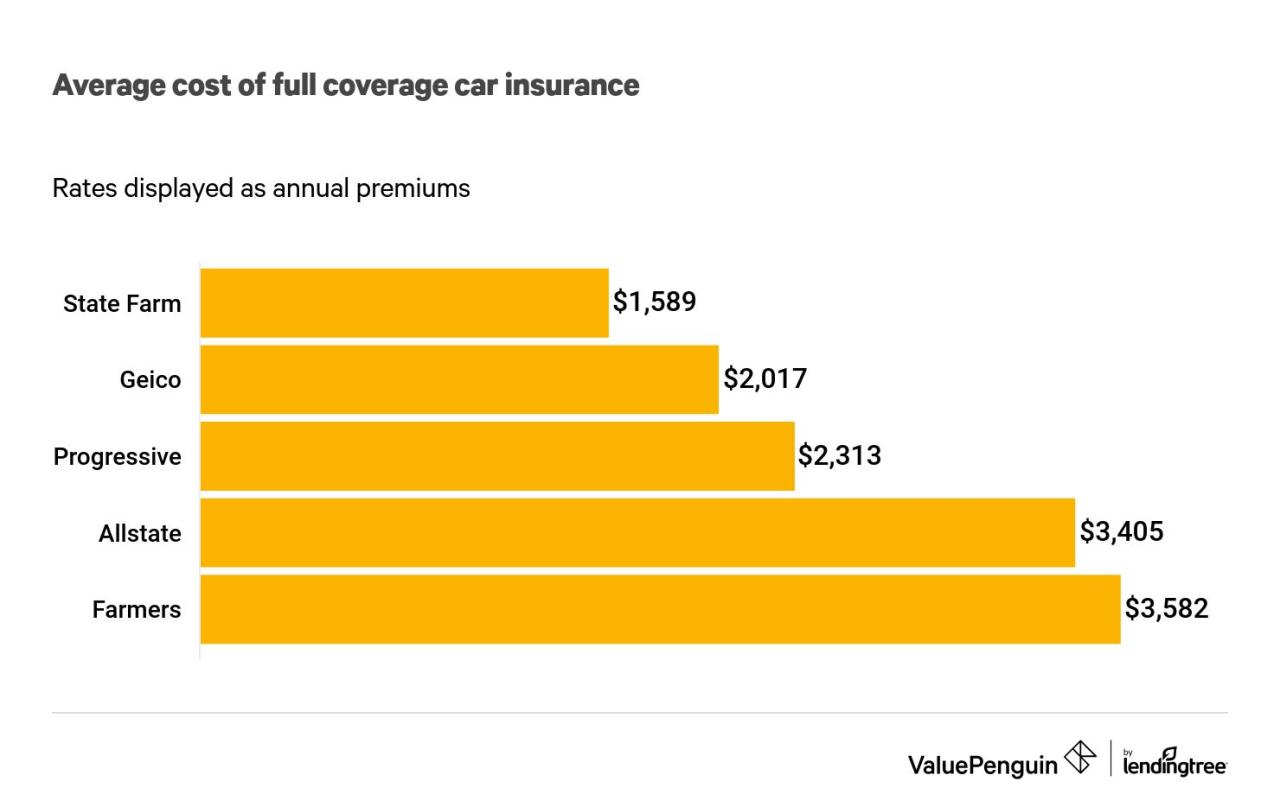

Comparison of Average Premiums

The average auto insurance premium varies depending on factors such as location, driving history, vehicle type, and coverage level. However, we can get a general idea of how State Farm’s prices compare to its top competitors by looking at average premiums for similar coverage levels.

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $1,500 |

| Geico | $1,400 |

| Progressive | $1,350 |

| Allstate | $1,600 |

Please note that these are just average premiums and your actual premium may vary. It’s always best to get personalized quotes from multiple insurance companies to compare prices and coverage options.

Advantages and Disadvantages of Choosing State Farm Based on Price

State Farm’s pricing can be competitive, but it’s not always the cheapest option. It’s important to consider the advantages and disadvantages of choosing State Farm based on price alone.

- Advantage: State Farm offers competitive prices, especially for certain demographics and coverage levels.

- Advantage: State Farm is a well-established and reputable insurance company with a strong financial rating.

- Disadvantage: State Farm’s prices may not always be the lowest compared to its competitors, particularly for drivers with a poor driving history or who live in high-risk areas.

- Disadvantage: State Farm’s coverage options and discounts may not be as extensive as those offered by some of its competitors.

State Farm’s Customer Experience and Value

State Farm is a well-established insurance provider with a reputation for its customer service. Understanding the factors that contribute to customer satisfaction and how they relate to pricing is crucial for making informed decisions about insurance.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into State Farm’s auto insurance pricing and overall customer service. Online platforms like Trustpilot, Google Reviews, and the Better Business Bureau offer a wealth of information. Reviews often highlight aspects such as:

- Pricing transparency: Customers appreciate clear explanations of how their premiums are calculated and the factors influencing them.

- Claims handling: The speed and efficiency of claims processing, along with the level of communication and support received, are critical factors in customer satisfaction.

- Customer support: Accessibility, responsiveness, and helpfulness of customer service representatives play a significant role in customer perception.

While positive reviews highlight State Farm’s strengths, negative reviews often point to areas for improvement, such as long wait times for claims processing, communication challenges, or perceived unfair pricing practices.

Impact of Claims Handling and Customer Support on Pricing Perception

State Farm’s claims handling process and customer support have a direct impact on how customers perceive their pricing.

- Efficient claims processing: Prompt and hassle-free claims handling can contribute to a positive customer experience, potentially leading to a perception of fair pricing.

- Excellent customer support: Responsive and helpful customer service representatives can build trust and loyalty, which can influence customers’ willingness to pay a premium for quality service.

- Negative experiences: Conversely, delays in claims processing, unhelpful customer service, or perceived unfair treatment can negatively impact customer perception and potentially lead to a belief that prices are too high.

Loyalty Programs and Incentives, State farm auto insurance price

State Farm offers loyalty programs and incentives to reward long-term customers and encourage continued business.

- Discounts: State Farm provides a range of discounts for good driving records, safety features, and bundling insurance policies.

- Rewards programs: These programs can offer cashback, points, or other benefits based on policyholder behavior, encouraging customers to maintain good driving habits and engage with State Farm’s services.

These programs can influence customer perception of pricing by offering tangible benefits for loyalty and good behavior. However, it’s important to note that the effectiveness of these programs in influencing pricing perception can vary depending on individual customer needs and preferences.

Tips for Obtaining the Best State Farm Auto Insurance Rate

Securing the most competitive auto insurance rate with State Farm involves a strategic approach. By understanding the various factors that influence your premium and taking advantage of available discounts, you can significantly reduce your overall costs.

State Farm Discounts

State Farm offers a wide range of discounts that can lower your premiums. Taking advantage of these discounts can significantly impact your overall insurance cost. Here are some of the most common discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits. Typically, drivers who haven’t been involved in accidents or received traffic violations for a specific period qualify.

- Safe Driver Discount: This discount is awarded to drivers who have completed a defensive driving course, showcasing their commitment to safe driving practices.

- Multi-Policy Discount: State Farm provides a discount when you bundle multiple insurance policies, such as auto, home, and renters insurance, under one account.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or GPS tracking systems, can lower your premiums.

- Good Student Discount: This discount is available to students who maintain a certain GPA, demonstrating their commitment to academic excellence and responsible behavior.

Comparing Quotes from Multiple Insurers

Before settling on a policy with State Farm, it’s crucial to compare quotes from other reputable insurance providers. This ensures you’re getting the most competitive rate and not missing out on potential savings.

“Shopping around for insurance can save you hundreds of dollars a year. Don’t be afraid to compare quotes from multiple companies to find the best deal.”

Other Tips for Lowering Your State Farm Auto Insurance Premiums

In addition to the discounts mentioned above, several other strategies can help you secure a lower premium.

- Increase Your Deductible: By raising your deductible, the amount you pay out-of-pocket in case of an accident, you can lower your monthly premium. This strategy is particularly beneficial for drivers with a clean driving record who are less likely to file claims.

- Choose a Safe Vehicle: Certain vehicle models are considered safer than others, which can translate into lower insurance premiums. Factors like safety ratings, anti-theft features, and overall reliability play a role in determining insurance costs.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations is crucial for keeping your insurance premiums low.

- Pay Your Premium in Full: Paying your premium in full can often result in a lower overall cost compared to making monthly payments.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs that track your driving habits, such as speed, braking, and mileage. By demonstrating safe and responsible driving practices, you can potentially earn discounts.

State Farm Auto Insurance Pricing Trends and Future Outlook

The auto insurance landscape is constantly evolving, driven by factors such as technological advancements, changing driver behavior, and economic conditions. These trends have a significant impact on State Farm’s pricing strategies and the future outlook for its rates.

The Role of Technology and Data Analytics in Shaping State Farm’s Pricing Strategies

Technology and data analytics are playing an increasingly important role in shaping State Farm’s pricing strategies. State Farm leverages advanced algorithms and data analysis to assess risk and personalize insurance rates. This includes factors like driving history, vehicle type, location, and even driving habits obtained through telematics devices.

State Farm uses data-driven insights to offer more accurate and personalized pricing, which benefits both the company and its customers.

By analyzing large datasets, State Farm can identify patterns and trends in driving behavior, allowing them to offer discounts to safer drivers and adjust premiums for those with higher risk profiles. This approach enables State Farm to remain competitive while ensuring fairness and transparency in its pricing.

Final Wrap-Up

In conclusion, State Farm auto insurance price is influenced by a variety of factors, including driving history, vehicle type, location, coverage levels, and discounts. While State Farm’s rates may be competitive in some areas, it’s essential to compare quotes from multiple insurers to ensure you’re getting the best value for your money. By understanding the factors that influence pricing and leveraging available discounts, you can secure affordable and comprehensive auto insurance coverage that meets your specific needs.

Essential Questionnaire

How can I get a free quote from State Farm?

You can get a free quote online, over the phone, or by visiting a State Farm agent in person.

What are some common discounts offered by State Farm?

State Farm offers a variety of discounts, including safe driver discounts, good student discounts, multi-policy discounts, and more.

What if I have a poor driving record?

If you have a poor driving record, your State Farm auto insurance rates will likely be higher. However, you can still get coverage, and there may be ways to improve your rate over time.

What are the different types of auto insurance coverage offered by State Farm?

State Farm offers a variety of auto insurance coverage options, including liability coverage, collision coverage, comprehensive coverage, and more.