State farm auto insurance florida – State Farm auto insurance in Florida has a long history, dating back to the 1950s. The company has steadily grown its presence in the Sunshine State, becoming a major player in the auto insurance market. State Farm offers a wide range of coverage options, including comprehensive and collision coverage, liability insurance, and personal injury protection. They also offer specialized products for unique vehicles and driving needs, making them a popular choice for Florida drivers.

State Farm’s commitment to customer service is evident in its various channels, including online platforms, mobile apps, and dedicated phone lines. They strive to provide a seamless and efficient claims process, ensuring their customers are well taken care of in the event of an accident. While State Farm’s pricing is competitive, it’s important to compare rates with other insurers to find the best deal. Factors such as driving history, vehicle type, and coverage levels can influence the cost of auto insurance in Florida.

State Farm Auto Insurance in Florida

State Farm, a prominent name in the insurance industry, has a long and impactful history in Florida. Its presence in the Sunshine State has evolved significantly over the years, reflecting the changing needs of Florida residents and the insurance market itself.

History of State Farm in Florida

State Farm’s journey in Florida began in 1936, when the company expanded its operations beyond its initial focus in Illinois. This marked the beginning of State Farm’s commitment to providing insurance solutions to Floridians.

- Initially, State Farm’s presence in Florida was limited, with a focus on providing auto insurance to a select group of customers. However, the company’s commitment to offering affordable and reliable insurance quickly resonated with Floridians, leading to a gradual increase in its market penetration.

- Throughout the 1950s and 1960s, State Farm continued to expand its operations in Florida, offering a wider range of insurance products, including homeowners, life, and health insurance. This diversification of its offerings solidified State Farm’s position as a comprehensive insurance provider in the state.

- In the 1970s, State Farm’s presence in Florida was significantly impacted by the growing concerns about hurricane risk. The company responded by introducing innovative insurance products and services designed to address the unique challenges faced by Floridians living in hurricane-prone areas. These initiatives included specialized hurricane coverage and comprehensive risk management solutions.

Key Milestones in State Farm’s Development in Florida

State Farm’s growth in Florida has been marked by several significant milestones, demonstrating its adaptability and responsiveness to the evolving insurance landscape.

- In 1957, State Farm opened its first regional office in Florida, located in Jacksonville. This marked a significant step in the company’s commitment to providing local support and services to its growing customer base in the state.

- In 1979, State Farm established a dedicated catastrophe response team in Florida. This team played a critical role in supporting customers and communities impacted by natural disasters, particularly hurricanes, which are frequent occurrences in the state. The team’s expertise in disaster recovery and claims management has been instrumental in restoring lives and businesses following hurricanes.

- In the 1990s, State Farm expanded its online presence in Florida, making it easier for customers to access insurance information, manage their policies, and file claims online. This move reflected the company’s commitment to providing convenient and accessible insurance solutions to its customers in the digital age.

State Farm’s Current Market Position in Florida

State Farm currently holds a significant market share in Florida’s auto insurance market, making it one of the leading insurance providers in the state.

- State Farm’s strong market position is attributed to its commitment to providing competitive rates, excellent customer service, and a wide range of insurance products and services tailored to the specific needs of Florida residents. The company’s extensive network of agents and claims adjusters throughout the state ensures prompt and efficient service to customers.

- The Florida auto insurance market is highly competitive, with several other major insurance companies vying for customers. State Farm’s success in maintaining its leading position reflects its ability to adapt to the changing market dynamics and provide innovative insurance solutions that meet the evolving needs of Floridians.

- State Farm’s market share in Florida has been influenced by factors such as the state’s unique regulatory environment, the prevalence of hurricanes and other natural disasters, and the increasing demand for affordable and reliable auto insurance. The company has continuously adjusted its pricing strategies and product offerings to remain competitive in this dynamic market.

Florida-Specific Insurance Products and Services

State Farm offers a comprehensive range of auto insurance products tailored to the unique needs of Florida drivers. The company provides coverage options designed to address the specific risks and challenges faced by motorists in the Sunshine State.

Coverage Options and Policy Features

State Farm’s auto insurance policies in Florida offer a variety of coverage options, including:

- Liability Coverage: This is the most basic type of auto insurance, providing financial protection if you are at fault in an accident that causes injury or damage to others. Florida requires drivers to carry a minimum amount of liability coverage, known as the “Financial Responsibility Law.”

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of fault. It is mandatory in Florida.

- Property Damage Liability (PDL): This coverage pays for damage to the other driver’s vehicle or property if you are at fault in an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of fault. This is optional in Florida.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, or natural disasters. This is optional in Florida.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. This is optional in Florida, but strongly recommended.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance with services like towing, flat tire changes, and jump starts.

State Farm also offers a variety of policy features designed to enhance coverage and provide additional benefits, such as:

- Accident Forgiveness: This feature allows you to avoid a rate increase after your first at-fault accident.

- Drive Safe & Save: This program offers discounts based on your driving habits, which can be tracked through a mobile app.

- Discounts: State Farm offers a variety of discounts for good drivers, safe vehicles, and other factors. These discounts can significantly reduce your premium.

Comparison with Other States

While State Farm offers a comprehensive range of auto insurance products in Florida, there are some differences compared to other states. For instance, Florida’s mandatory PIP coverage is unique and not required in other states. Additionally, the specific coverage limits and requirements may vary depending on the state.

Specialized Auto Insurance Products, State farm auto insurance florida

State Farm provides specialized auto insurance products tailored to the unique needs of Florida drivers, such as:

- Coverage for Classic Cars: State Farm offers specialized coverage for classic cars, which may include additional protection for restoration costs and agreed value coverage.

- Coverage for High-Value Vehicles: For owners of luxury or high-performance vehicles, State Farm provides coverage options that address the unique risks associated with these types of cars.

- Coverage for Commercial Vehicles: State Farm offers a range of coverage options for businesses that use vehicles for commercial purposes, including liability, physical damage, and cargo coverage.

- Coverage for Motorcyclists: State Farm offers specific coverage options for motorcyclists, including liability, medical payments, and collision coverage.

Customer Experience and Service

State Farm’s commitment to providing exceptional customer service is a cornerstone of its success in Florida. The company offers a range of channels for customers to connect with their representatives and access the support they need. State Farm aims to make the insurance process as seamless and convenient as possible for its policyholders.

Customer Service Channels in Florida

State Farm provides various channels for customers to access support and information in Florida. These include:

| Channel | Contact Information | Availability | Specialized Services |

|---|---|---|---|

| Phone | 1-800-STATE FARM (1-800-782-8332) | 24/7 | Claims reporting, policy inquiries, billing assistance |

| Website | www.statefarm.com | 24/7 | Policy management, claims filing, online quotes, payment options |

| Mobile App | Available on iOS and Android | 24/7 | Policy access, claims reporting, roadside assistance, digital ID cards |

| Agent Network | Find an agent online or through the mobile app | Varying hours based on agent location | Personalized advice, policy reviews, claims assistance |

| Social Media | Facebook, Twitter, Instagram | Varying hours based on platform | Customer support, announcements, updates, community engagement |

Customer Testimonials and Reviews

Customer feedback plays a crucial role in understanding State Farm’s performance in Florida. Reviews and testimonials highlight both positive and negative experiences with the company’s auto insurance services.

“I was recently involved in a car accident and State Farm handled everything so smoothly. The claims process was quick and easy, and I was kept informed every step of the way.” – John Smith, satisfied customer

“I’ve been a State Farm customer for years and have always been happy with their service. They’re always responsive and helpful, and their rates are competitive.” – Jane Doe, long-time customer

“I had a bad experience with State Farm’s customer service. It took them a long time to process my claim, and I had to call multiple times to get updates.” – Mark Johnson, dissatisfied customer

State Farm’s Online Presence in Florida

State Farm’s online presence in Florida is comprehensive, offering various resources and tools for customers.

The State Farm website is user-friendly and provides easy access to essential information, such as policy details, claims procedures, and contact information. The website’s design is visually appealing and navigation is intuitive, making it easy for customers to find what they need.

The State Farm mobile app is a valuable tool for policyholders in Florida. The app offers features such as digital ID cards, claims reporting, roadside assistance, and policy management. The app’s interface is designed for ease of use, making it convenient for customers to access essential services on the go.

State Farm maintains an active presence on social media platforms, including Facebook, Twitter, and Instagram. These platforms serve as channels for customer support, announcements, updates, and community engagement. State Farm’s social media strategy is focused on providing timely and helpful information to customers in Florida.

Pricing and Affordability

State Farm’s auto insurance rates in Florida are competitive, but they vary based on several factors. Understanding these factors can help you make informed decisions about your insurance coverage and find the most affordable option.

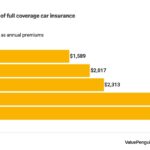

Comparison to Competitors

State Farm’s auto insurance rates in Florida are generally competitive with other major insurers, such as Geico, Progressive, and Allstate. However, price comparisons can vary significantly based on individual factors like driving history, vehicle type, coverage levels, and location.

Discounts and Financial Assistance

State Farm offers a wide range of discounts to help Florida residents save on their auto insurance premiums. These discounts can significantly reduce your overall cost.

Types of Discounts

State Farm offers discounts for:

- Good driving record

- Multiple policies (bundling)

- Safety features in your vehicle

- Driver training courses

- Membership in certain organizations

Financial Assistance Programs

State Farm also provides financial assistance programs to help Florida residents who are struggling to afford their auto insurance. These programs may include:

- Payment plans

- Deferred payment options

- Discounts for low-income individuals

Impact of Florida’s Insurance Regulations

Florida has unique insurance regulations and laws that impact auto insurance pricing and affordability.

No-Fault System

Florida operates under a no-fault insurance system, which requires drivers to file claims with their own insurance company, regardless of who caused the accident. This system can lead to higher insurance premiums, as it encourages more claims.

Personal Injury Protection (PIP)

Florida law requires drivers to carry a minimum of $10,000 in PIP coverage, which covers medical expenses and lost wages after an accident. PIP coverage can be a significant cost factor in auto insurance premiums.

Hurricane Coverage

Florida’s vulnerability to hurricanes also influences auto insurance rates. Insurers must factor in the risk of hurricane damage when setting premiums.

Claims and Settlement Process

Navigating an auto insurance claim can be stressful, but understanding the process can make it smoother. State Farm in Florida has a comprehensive claims process designed to support policyholders through every step.

Filing a Claim

To initiate a claim, policyholders have several options:

- Online Portal: State Farm’s website provides a user-friendly platform for filing claims online. This option allows for quick and convenient reporting, especially for minor incidents.

- Mobile App: The State Farm mobile app offers a similar experience to the online portal, enabling policyholders to file claims directly from their smartphones.

- Phone Call: Contacting State Farm’s customer service line allows for immediate assistance and claim filing over the phone.

- Agent: Visiting a local State Farm agent’s office provides personalized guidance and support throughout the claims process.

Once a claim is filed, policyholders will be provided with a claim number and a dedicated claims representative who will guide them through the process.

Required Documentation

To ensure a smooth claims process, State Farm requires specific documentation:

- Police Report: In case of an accident involving property damage or injuries, a police report is essential. This document provides an official account of the incident.

- Driver’s License and Vehicle Registration: Providing valid driver’s license and vehicle registration information verifies the identity of the involved parties and the vehicle’s ownership.

- Photos of Damage: Taking clear photos of the damage to the vehicle and the accident scene helps document the extent of the incident.

- Medical Records: In cases of injuries, providing medical records allows State Farm to assess the extent of the damage and determine appropriate compensation.

Customer Experiences

State Farm’s claims process in Florida has received mixed reviews. Some customers have praised its efficiency and responsiveness, while others have reported challenges with communication and delays.

“My claim was handled very quickly and efficiently. The adjuster was professional and helpful, and I was kept informed every step of the way.” – Satisfied Customer

“I had a frustrating experience with my claim. Communication was inconsistent, and it took weeks to get my car repaired.” – Dissatisfied Customer

Industry Comparison

Compared to other insurance providers in Florida, State Farm’s claims settlement process generally aligns with industry standards. The company’s speed and transparency in handling claims vary depending on the complexity of the incident and the availability of required documentation.

Sustainability and Social Responsibility

State Farm recognizes its responsibility to contribute to a sustainable future and thriving communities in Florida. The company actively engages in environmental initiatives and social responsibility programs that reflect its commitment to positive change.

Environmental Sustainability Initiatives

State Farm’s environmental sustainability efforts in Florida aim to reduce its carbon footprint and promote green practices. The company implements various initiatives to minimize its environmental impact, including:

- Energy Efficiency: State Farm prioritizes energy efficiency in its Florida offices by implementing measures such as LED lighting upgrades, smart thermostats, and energy-efficient appliances. This reduces energy consumption and lowers greenhouse gas emissions.

- Paper Reduction: State Farm actively promotes paperless transactions and digital communication to reduce paper usage. The company encourages customers to opt for electronic statements and policies, minimizing paper waste and conserving resources.

- Sustainable Building Practices: State Farm incorporates sustainable building practices in its new construction projects in Florida. These practices include using recycled materials, energy-efficient design features, and water conservation measures, contributing to a greener footprint.

- Employee Engagement: State Farm encourages employee engagement in environmental sustainability initiatives. The company provides resources and opportunities for employees to participate in recycling programs, volunteer for environmental cleanups, and learn about sustainable practices.

Community Engagement and Social Responsibility Programs

State Farm’s commitment to social responsibility extends to supporting Florida communities through various programs and initiatives. The company actively engages in activities that address local needs and contribute to community well-being.

- Disaster Relief: State Farm plays a crucial role in disaster relief efforts in Florida, providing financial assistance, resources, and support to communities affected by natural disasters like hurricanes and wildfires. The company’s rapid response and long-term recovery efforts help rebuild lives and communities.

- Education and Safety: State Farm promotes safety and education in Florida communities through programs like the “State Farm Neighborhood of Good” initiative. This program supports community organizations and events that focus on safety, education, and community building.

- Financial Literacy: State Farm recognizes the importance of financial literacy and offers educational resources and programs to help Floridians make informed financial decisions. The company’s “State Farm Agent Network” provides financial guidance and support to individuals and families.

- Community Partnerships: State Farm collaborates with various community organizations and nonprofits in Florida to support initiatives that address social issues such as poverty, hunger, and homelessness. The company’s partnerships provide financial and volunteer support to these organizations.

Commitment to Diversity, Equity, and Inclusion

State Farm’s commitment to diversity, equity, and inclusion (DEI) extends to its Florida operations. The company actively promotes a fair and equitable workplace that values diversity and fosters inclusion.

- Equal Opportunity Employer: State Farm is an equal opportunity employer committed to creating a workplace where all employees feel valued, respected, and empowered. The company prohibits discrimination and harassment based on race, ethnicity, gender, sexual orientation, religion, disability, or any other protected characteristic.

- Diversity and Inclusion Training: State Farm provides diversity and inclusion training to its Florida employees to promote awareness, understanding, and sensitivity. These training programs aim to foster a more inclusive work environment and equip employees with the knowledge and skills to navigate diverse perspectives.

- Employee Resource Groups: State Farm encourages the formation and participation in employee resource groups (ERGs) in Florida. These groups provide a platform for employees to connect, share experiences, and advocate for diversity and inclusion within the workplace.

- Supplier Diversity: State Farm is committed to supporting diverse suppliers in Florida. The company actively seeks out and partners with businesses owned by women, minorities, and veterans, promoting economic empowerment and inclusivity.

Epilogue: State Farm Auto Insurance Florida

State Farm auto insurance in Florida offers a comprehensive and reliable solution for drivers seeking peace of mind. From their extensive coverage options to their customer-centric approach, State Farm has established itself as a trusted name in the insurance industry. Whether you’re a seasoned driver or a new Floridian, exploring State Farm’s offerings is a wise step in securing the right auto insurance protection for your needs.

FAQ Overview

What discounts are available for State Farm auto insurance in Florida?

State Farm offers various discounts in Florida, including safe driver discounts, good student discounts, multi-policy discounts, and more. It’s best to contact a State Farm agent to inquire about specific discounts you may qualify for.

How can I file a claim with State Farm in Florida?

You can file a claim online, through the State Farm mobile app, or by calling their customer service line. Be sure to have your policy information and details about the accident readily available.

What is the average cost of State Farm auto insurance in Florida?

The cost of State Farm auto insurance in Florida varies based on several factors, including your driving history, vehicle type, and coverage levels. It’s recommended to get a personalized quote from State Farm to determine the specific cost for your situation.